When paying taxes, a citizen may overpay. The excess amount is reflected in the personal account of the fee payer on the Federal Tax Service website. The article talks about what an overpayment is in a taxpayer’s personal account and how to deal with it.

The personal account of a fee payer is an interactive office of a Russian citizen. Here an individual has the right to control tax income and expenses, find answers to legal and tax-related questions. The service provides the service of sending declarations and paying fees directly on the portal. It is possible to pay the accrued amount online only if the resident has an electronic signature.

How to find out about an overpayment

An excess tax amount means that a citizen or tax agent contributed money to the tax budget in excess of the accrued tax amount. A resident can find out about an overpayment:

- from tax inspectorate employees during a personal visit to the service;

- through a tax agent: if the tax authorities discover an excess amount during the calculation, then within 10 days after the money is transferred to the Federal Tax Service budget, the payer will receive a letter notifying about the overpayment;

- in your personal account on the nalog.ru portal.

It is more convenient to view the amount of overpaid funds in the payer’s personal account. On the main page of the site, an individual will first see unpaid taxes and debts. To clarify whether there is an overpaid fee, a citizen needs to look at the information in the taxpayer’s personal account. The overpayment is reflected in the My taxes tab above the Income information line. It is impossible to return the extra money right away, as you need to wait for approval from the tax office.

We recommend watching video instructions on how to manage overpayments in your taxpayer’s personal account.

Methods of paying taxes in your personal account

If it is necessary to pay a tax or debt, a citizen has the right to use the service. The service for paying funds and sending a report is provided by the service free of charge. Service employees offer two methods of paying the fee:

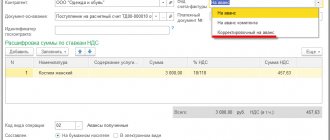

- "Pay taxes" service. Here, the resident has the right to pay not only fees, but also insurance contributions and state duties. The program allows you to deposit funds for yourself and third parties. Algorithm for using the “Pay Taxes” service to pay funds:

- Agree to the processing of personal data by clicking the checkbox in the appropriate box and clicking on the “Next” button.

- Select the type of fee: tax on property of individuals, land, transport, personal income tax, unified, insurance contributions to the Pension Fund of the Russian Federation, compulsory medical insurance, VNIM. In the example, we will choose personal income tax.

- Determine the personal income tax category: according to form 3-NDFL or by foreign workers who work in Russia. Let's choose - 3-NDFL.

- Selecting the type of payment: fee, penalty, fine - direct fee (tax).

- Enter the amount and click “Next”.

- Fill in the details of the Federal Tax Service and the payer. In the information about the payer, the TIN is required to be filled out when making electronic payments on the Federal Tax Service website. If you do not complete the field, you will only be able to print the completed payment slip.

- Click on the red button labeled “Pay.”

- Select payment type. When paying via personal account, select a card or banking organization.

- If the “card” option is selected, then in the window that appears, agree to the processing of information by clicking the checkbox and clicking “Pay”. Then enter the card details and click on the “Pay XXXX rubles” button, where the amount is indicated instead of X. If a bank is selected, the service automatically takes you to the bank’s page, where you need to enter your personal account login and confirm the operation.

- On the State Services website. Instructions for payment through the State Services portal:

- Log in to your personal account on the Federal Tax Service portal.

- Fill out the payment using the method above.

- In the last paragraph, when choosing the type of payment, click on the button using the organization’s website and select Public Services. Then the program will automatically transfer to the State Services website, where, using the account or card details, the resident has the right to deposit the tax amount.

- Through the My Taxes tab:

- Open the My taxes tab on the main page.

- Select the fee you need to pay and click on this line.

- Select a payment method: by bank card, through the credit company’s website, or create a payment order. Let's choose a bank card.

- Agree to the processing of information by checking the box. Then you need to click on the “Pay” button.

- Enter your card details and click pay.

When choosing a payment method through the website of a specialized company, the program will take you to the company’s page, where you also need to fill in the details and click a button with the appropriate text.

Reasons for overpayment of taxes

When an overpayment occurs, the citizen worries where it came from. Three main reasons for the appearance of excess funds:

- Incorrect amount in the declaration. An extra zero and when recalculating the tax authorities will find an extra amount. But the money will be debited from the account and will be in the form of an overpayment.

- When making advance funds, when the resident makes an advance payment for the fee. By the end of the year the total amount may be less.

- In case of late payment of personal income tax, since the amount for this tax is written off automatically upon delay. It turns out that the Federal Tax Service employees wrote off the funds on time, but the payer did not know about it and paid the money a second time. It turned out to be double payment. Thus, an overpayment of personal income tax appeared in the taxpayer’s personal account.

But the extra amount will not remain in the tax authorities’ budget; the money still belongs to the citizen.

Overpaid or overcharged?

There are two concepts: excessively overpaid and excessively collected amount. It's easy to distinguish them. In the first case, the payer himself is to blame. He could have made a mistake in drawing up the receipt, made an extra advance payment or made a double payment. In the second case, the tax service is to blame for incorrectly calculating the amount. Or the traffic police received incorrect information about the vehicle.

How to reduce transport tax?

What can you do about overpayments and payments?

According to paragraphs. 1, 6 tbsp. 78 of the Tax Code of the Russian Federation, the payer has the right to return excess funds or offset the money towards the payment of another fee or transfer it to a future tax period. If you transfer money to the next year to pay the next accrued amount, you do not need to fill out 3-NDFL. You just need to send an application for this to the tax authority at the place of registration.

A citizen also has the right to apply for a deduction for treatment, training, purchase or sale of movable and immovable property. In this case, the citizen is returned a portion of the funds spent, in the amount of 13%. But before that, the declaration will be subject to desk review.

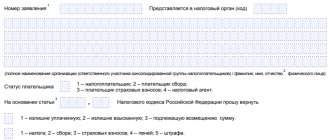

How to fill

First of all, we note that applying for a credit is required separately for each type of tax, fee or contribution. It is not possible to combine fiscal payments in one document.

If an organization is registered with several Federal Tax Service Inspectors at once, for example, it has several branches or separate divisions, then the document should be submitted exactly to the inspection department where the overpayment of taxes occurred.

Instructions for filling:

- In the header of the document we indicate the TIN and KPP of the taxpayer-applicant.

- The application number is a serial number for the current year.

- Payer status: for an organization it is either “1” - taxpayer, or “4” - tax agent.

- Enter the article of the Tax Code of the Russian Federation, in accordance with which we carry out the offset. Indicate the article number in the field: “176” - for VAT credit, “203” - for excise tax and “78” - for other fiscal payments (taxes, fees, contributions).

- Select the type of payment from the list provided. For example, to offset income tax, select “1”, to offset VAT penalties, select “4”.

- Then we determine the period or specific date for which the overpaid amount was generated. For example, for January 2021 - MS.01.2019, for the 1st quarter of 2021 - KV.01.2019, for the 1st half of the year - PL.01.2019, for the year - GD.00.2019. We indicate a specific date if the law establishes the exact date for filing a declaration or paying a tax. For example, 03/28/2019 to pay income tax.

- OKTMO - the code corresponds to the code of the place where the taxpayer is registered.

- Indicate the BCC corresponding to the tax, fee, contribution for which the overpayment was detected.

- On the second sheet of the document, indicate the overpaid amount in rubles and kopecks. Then determine what the payment should be redirected to: “1” - for arrears, “2” - for future periods. Specify the tax period to be offset against future payments.

- Enter OKTMO at the place where the payment was made.

- BCC of the tax, fee, contribution against which the offset is made.

- The last page (section “Information about an individual who is not an individual entrepreneur”) is not filled out by institutions.

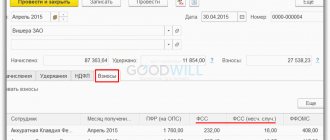

Desk inspection

A desk audit is an audit of the package of documents and the 3-NDFL declaration that the payer sent to the inspectorate. According to paragraph 2 of Art. 88 of the Tax Code of the Russian Federation, monitoring lasts up to 90 days by employees of the Federal Tax Service. In practice, the check ends earlier. But if during this time the tax authorities discover an error, they will notify you about it earlier and send a form for correction.

An individual has the right to check the progress of the verification in his personal account on the Federal Tax Service website. Step-by-step instructions for tracking camera monitoring:

- After sending the papers for audit, the submitted declarations will be displayed on the main page in the Messages from the tax authority tab. The one according to which the resident expects a refund will also be visible here.

- In the line “Desk audit status” you can see the following: “Registered”, “Started”, “In progress”. And if the status is “Completed”, the desk check is over. If there are no other notifications from the service, it means that the procedure was successful and no errors were detected.

When monitoring is completed, you can begin processing a refund of overpaid money.

Tax refund credit

Refund to the taxpayer of the amount of overpaid or overcharged tax if he has arrears on other taxes of the corresponding type or arrears on the corresponding penalties, as well as fines subject to collection, is made only after the amount of overpaid tax is offset against the repayment of the arrears (debt).

This offset occurs according to the rules of Article 78 of the Tax Code of the Russian Federation. In the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57 “On some issues arising when arbitration courts apply part one of the Tax Code of the Russian Federation”, in order to uniformly resolve judicial disputes related to the application of the provisions of the Tax Code of the Russian Federation, some issues related to offset or return of amounts overpaid (collected). Thus, the Plenum of the Supreme Arbitration Court of the Russian Federation in paragraph 32 of Resolution No. 57 indicated that offset is a special form of forced collection of taxes; it should be subject to the general provisions of the Tax Code of the Russian Federation, which determine the timing of the exercise by tax authorities of the right to forced collection of taxes, penalties, and fines.

In this regard, overpaid (collected) amounts of penalties cannot be offset on the initiative of the tax authority in the following situations:

- offset of overpaid (collected) amounts of penalties cannot be made by the tax authority to repay the debt, the possibility of forced collection of which has been lost;

- The tax authority cannot offset penalties against debt repayment, which, by virtue of the provisions of Article 45 of the Tax Code of the Russian Federation, is subject to collection in court.

The Plenum of the Supreme Arbitration Court of the Russian Federation came to the conclusion that a taxpayer can file a claim in court for a refund or offset of overpaid tax only if the tax authority refused to satisfy the said application or if the taxpayer did not receive a response within the prescribed period.

Similar conclusions are contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 26, 2011 N 18180/10 in case N A19-7006/09-18-32. The features of offset or return of overpaid amounts of penalties by a tax agent are explained in paragraph 34 of Resolution No. 57. According to paragraph 14 of Article 78 of the Tax Code of the Russian Federation, the rules for offset or return of overpaid amounts of tax, fee, and penalties defined by this article apply to tax agents. In this regard, as the Plenum of the Supreme Arbitration Court of the Russian Federation explained, if, when considering a dispute, the court determines that the amounts excessively transferred by the tax agent to the budget do not exceed the amounts withheld from the taxpayer, the decision to offset or return these amounts in favor of the tax agent can only be made by the court in two cases:

- if the return to the taxpayer of amounts excessively withheld from him by the tax agent is assigned by law to the latter;

- if, at the request of the taxpayer or on his own initiative, the tax agent paid the taxpayer the amount of tax that was unreasonably withheld from him.

The tax authority can find out about the amount of tax overly withheld by the tax agent from an application submitted by the tax agent in accordance with paragraph 1 of Article 231 of the Tax Code of the Russian Federation for the return of the amount of tax overly withheld and transferred to the budget system of the Russian Federation, or as a result of an on-site tax audit of this organization (tax office). agent).

The tax authority may obtain information that the tax agent paid the taxpayer the amount of personal income tax that was unreasonably withheld from him as a result of an on-site tax audit of the organization. The specified information can also be obtained directly from the taxpayer (including a tax return in Form 3-NDFL) or at the initiative of the tax authority in the manner provided for in Article 93.1 of the Tax Code of the Russian Federation “Request for documents (information) about the taxpayer, payer of fees and tax agent or information about specific transactions"). Paragraph 35 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 57 states that the rules established by Articles 78 and 79 of the Tax Code of the Russian Federation on the mandatory offset of overpaid (collected) amounts of penalties towards debt repayment apply exclusively to cases of refund of overpaid (collected) tax by the tax authority in an administrative manner and are not subject to application in the execution of judicial acts providing for the return to the taxpayer from the budget of overpaid (collected) amounts of taxes, penalties, and fines.

Thus, the decision of the arbitration court to return to the taxpayer the overpaid (collected) amounts of penalties is subject to unconditional execution by the tax authority. The tax authority does not have the right to independently offset this amount towards repayment of existing debt. Explanations regarding the moment of fulfillment of the obligation to return the relevant amounts to the taxpayer by transferring them by bank transfer to the account specified by the recipient are contained in paragraph 36 of Resolution No. 57.

The Plenum of the Supreme Arbitration Court indicated that it is necessary to be guided by the general rules, according to which the payer is recognized as having fulfilled his obligation from the moment the corresponding amount is received by the bank indicated by its recipient. Consequently, the tax authority is considered to have fulfilled the obligation to return this amount to the taxpayer only from the moment the amount of the penalty to be returned is received by the bank indicated to the taxpayer.

When to refund overpaid tax

If the payer decides to return the funds to a personal account or card, you need to fill out the appropriate application. The application can be submitted on the portal in your personal account in two ways:

- Fill out 3-NDFL through the service. After sending the declaration, you are immediately asked to write an application.

- Use the “Manage overpayment” service. The service is provided in the Life Situations tab, where the overpayment is processed in a couple of steps.

Is it worth writing a statement?

After the citizen has sent the 3-NDFL form to the Federal Tax Service, a window will open asking you to fill out the application. But at this moment it is not advisable to fill out the form, since the amount has not yet been approved by the tax authorities. The fact is that during recalculation or during a desk audit, an error may be discovered and the refund will be refused. But when the desk audit is completed, you can fill out an application and send it to the tax authority. It is also worth remembering that after submitting an application, funds will not be received immediately. There are deadlines for tax authorities to review them.

For combat veterans

Veterans of military operations (during the Great Patriotic War, in Afghanistan, in Chechnya, in Syria, etc.) are also entitled to receive benefits when paying taxes. Overpayment may arise as a result of ignorance or erroneous actions of the veteran himself or service employees.

How to return transport tax in 2021 to a combat veteran? The procedure does not differ from the standard one for individuals. You need to write an application and provide a package of documents to the regional tax office. The package must also include a combat veteran ID card. The certificate must be in the form established by the state.

Overpayment refund method

To find money that was paid in excess of the amount, you need to go to the My Taxes tab. Here the payer will see that the amount in the overpayment tab has appeared in the tax office’s personal account. The tab is located above the information about the profit of the owner of the interactive account. To clarify whether the amount is ready for compensation, you need to click directly on this overpayment. If a window opens where the “Dispose” button is active at the bottom of the line, then you can issue a refund.

The “Manage overpayment” tab allows you to quickly process funds for refund. To reimburse excess funds you need:

- Click on the Life Situations button and select the button in the left corner that says “Dispose of overpayment.”

- In the window that appears, the amount that the citizen has the right to return will appear, and at the bottom there is a “Confirm” button, which you need to click.

- In the tab that opens, fill in the details: BIC of the bank in which the account is opened and to which the card belongs, the full name of the bank, account number. If a BIC is entered, the program will automatically indicate the full name of the bank. Then click on the “Confirm” button.

- In the new window, check the correctness of the information: name of the Federal Tax Service, code, OKTMO, amount, bank BIC, account number. Then save the application in .pdf format by clicking on the button of the same name to the right of this block.

- Enter the electronic signature password in the bottom line and click Send application.

Now a notification will appear on the screen indicating that the application has been sent.

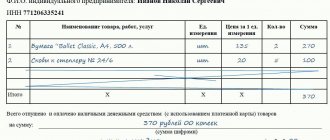

What documents are needed for return

If the client has evidence of excess fees and does not have debts in other areas, then there should be no problems with the return of transport tax from individuals. You need to go to the inspection with a package of documents:

- passport;

- TIN;

- Act of reconciliation;

- car passport;

- vehicle registration documents.

You may also need some certificates from the State Traffic Inspectorate. You also need to fill out an application. It is drawn up in free form, but must necessarily contain the full name, passport data and TIN number of the applicant, the amount of the overpayment, and the account number to which the amount can be returned.

Transport tax – will there be changes?

What to do if the tax office does not return funds

According to Art. 78 of the Tax Code of the Russian Federation, the Federal Tax Service is obliged to return funds that are approved after the completion of the desk audit. But if the tax authorities do not return the amounts, then there are reasons for this. For example:

- The desk check has not been completed and the funds have not yet been approved for return.

- Availability of debts on other fees. In this case, the extra money will be used to pay off the debt.

But if there are no errors, the monitoring period has passed, and there are no notifications about errors, then the citizen has the right to go to court with a complaint against the Federal Tax Service.

Legislation

Many categories are eligible to receive transportation benefits. This is supported by the legislation of the Russian Federation with amendments for the regions.

- Article 357 of the Tax Code of the Russian Federation states: a citizen whose vehicle is registered and recognized as an object of taxation can receive a transport tax.

- The application form for compensation is established by letter of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21/897.

- The average cost of a passenger car was calculated and determined by order of the Ministry of Industry and Trade of the Russian Federation dated February 28, 2014 No. 316.

- The deadlines for paying duties on movable property are established by the Tax Code of the Russian Federation, Art. 52.

- Article 78 of the Tax Code allows the taxpayer to return overpaid funds.

For reference! If a citizen has a debt to pay other taxes (land taxes, etc.), then he will be denied compensation, and the money will be used to pay off the debt.