Self-employment is a new experimental tax regime that allows for the legalization of private commercial activities. In 2021, the special regime is available to all regions of the Russian Federation, providing individuals with the opportunity to legally earn money and pay reduced taxes. Today there is a lot of talk about how easy it is to become self-employed, but in practice many questions arise: can a working person become self-employed, how is tax calculated, and many others, the answers to which are not obvious.

What are the advantages of self-employment?

The main advantage of self-employment for individual entrepreneurs is that you only need to pay for the months in which you had income. If there were no receipts to the current account, there will be no taxes either.

When payments are received from individuals, the tax will be 4% of income; if payments are received from companies and other individual entrepreneurs, then the tax will be 6%.

Here are some more advantages of self-employment:

There are no mandatory payments. Pension contributions are optional. If you want to insure yourself for sick leave or pension, you can voluntarily pay to the Pension Fund and the Social Insurance Fund.

No tax returns or reporting. Record sales through the “My Tax” service and send receipts to customers - the tax is calculated and charged automatically.

The IP status is maintained. There will be no need to renegotiate contracts, because only the tax regime changes. It is enough to warn the counterparty that you will now send checks for payments. Otherwise, the counterparty will not be able to pay its expenses.

Tax deduction - 10 thousand rubles. It's like a bonus or gift from the Federal Tax Service. It appears immediately after registration and reduces the tax rate to 3% for individuals and 4% for companies and individual entrepreneurs. It works like this: accrued taxes are deducted from the bonus until it ends. And only when 10 thousand rubles. will be spent, the standard rates of 4% and 6% will return, and taxes will have to be paid from your own funds.

Here's how the bonus works:

For example, Evgeniy is a lawyer. In May, he became self-employed and was awarded a tax bonus of 10 thousand rubles in the My Tax application. In June, Evgeniy consulted three companies and received 30 thousand rubles, so the tax amount will be: 30,000 × 4% = 1,200 rubles.

But Evgeniy does not need to pay tax from his own money, because 1,200 rubles will be written off from the bonus. Taxes will be deducted from the bonus until it expires. Let us remind you that the bonus is 10 thousand rubles.

If Evgeny had already spent the tax bonus in full, he would have paid: 30,000 × 6% = 1,800 rubles from his wallet.

This is how the tax office encourages the use of self-employment.

Which individual entrepreneurs can become self-employed

Individual entrepreneurs who:

1. They earn no more than 2.4 million rubles. in year.

2. They operate without employees on staff.

3. They work in a region where there is a self-employment regime.

Previously, the NAP regime worked in 23 regions - the list is in the law of December 15, 2019 No. 428-FZ. But from July 1, 2021, the remaining regions were allowed to introduce self-employment. You can see whether the NAP regime has appeared in your region on the websites of regional parliaments or in the special “Consultant” section.

Important. It doesn’t matter how much the individual entrepreneur earned before switching to NAP. Only the amount of income received in self-employed status is limited.

Permitted activities

Now the Tax Code of the Russian Federation provides for only 3 types of activities that a self-employed person can officially engage in.

These are activities such as:

- tutoring;

- cooking and cleaning (cook, housewife);

- caring for the sick, disabled and elderly (nurse).

Subjects of the Russian Federation may adopt regulations that supplement this list. At the beginning of 2021, according to regional laws, 4 entrepreneurs were registered.

How can a foreigner obtain a residence permit in the Russian Federation - what grounds will speed up the process?

It is planned that the provisions for the self-employed will be expanded to include photographers, translators, freelancers, taxi drivers, etc.

In total, legislators want to take into account 45 areas of activity at the federal level.

Who should not become self-employed

Professional income tax can be paid on any type of activity, except:

- Work under contracts of assignment, commission or agency agreements.

- Sales of goods with mandatory labeling or excise taxes.

- Sales of real estate and vehicles.

- Work under a simple partnership agreement.

- Courier delivery without online checkout.

- Extraction and sale of mineral resources.

- Resale of goods (retail industry).

If you are engaged in any of these types of activities, unfortunately, you cannot use self-employment mode. This is established by Federal Law No. 422-FZ.

Also, lawyers, notaries, arbitration managers, notaries and mediators cannot be self-employed.

Example. Evgeniy has registered as self-employed and provides legal services. To earn more, he decided to offer banking services to clients under an agency agreement. In May, Evgeniy brought three clients to the bank, the bank transferred 10 thousand rubles to his account.

Evgeniy entered the sale in the My Tax app and sent the check to the bank. And a week later he received a notification from the tax office that he no longer had self-employed status. This is because self-employed people are prohibited from representing others in business.

Fines for lack of a patent

Purchasing a patent will protect citizens from punishment for illegal business.

The penalties for not having a patent will be expressed as follows:

- in the form of penalties (up to 2 thousand rubles);

- through additional assessment of taxes and insurance premiums for the entire period of activity without registration, as well as penalties in the amount of 10% of income (at least 40 thousand rubles).

If a self-employed person has received large income without a patent, he may face the following:

- fine up to 300 thousand rubles;

- community service for up to 480 hours;

- arrest up to six months.

How can an individual entrepreneur switch to self-employment?

You can become self-employed in one day without visiting the tax office. To do this, just register in the “My Tax” application, which was developed by the Federal Tax Service. For Android you can download the application from Google Play, for iOS - from the Apple Store. There are three ways to register: through the taxpayer’s personal account, government services or using a passport.

Here's how to register in the "My Tax" application through your personal account or government services:

1. Select the items “Through the personal account of an individual” or “Through the State Services portal”.

2. Enter your login and password.

3. Select the region for doing business. This is not necessarily your subject: you can choose, for example, the region of registration of the main counterparty. 4. Come up with a 4-digit PIN code. You can also add quick login using your fingerprint or Face ID.

5. Enter the verification code from the SMS from the tax office. He confirms the registration.

This is what the application looks like inside:

If you do not have accounts in your personal account or for government services, you can register in the “My Tax” application using your passport:

1. Select the item “Registration using a Russian passport”.

2. Enter your phone number and select your region of business.

3. Scan your passport through your phone camera and confirm the data.

4. Take a photo placing your face in an oval outline.

5. Click the “Confirm” button, come up with a PIN code and wait for an SMS from the tax office.

If you register through your personal account or government services, the code will be sent within 1-2 hours. Registration using a passport takes longer: the tax office has the right to check the account up to 6 working days.

The last step is to choose the type of activity. But for some reason, not all types were added to the My Tax application. If you don’t find yours, select the “Other” option.

Legal consequences of obtaining a patent

Obtaining a patent for independent professional activity has its advantages and disadvantages.

Among the advantages, tax officials cite the following:

- simple procedure for assigning self-employed status;

- exemption from taxes and insurance premiums for the holiday period;

- there is no need to submit reports;

- absence of claims from regulatory authorities (including penalties);

- no need to use online cash registers;

- opportunity to advertise in the media.

In the future, it is possible that such rights will be extended to the self-employed:

- taking out a loan for business development;

- conclusion of civil contracts for the provision of services to individuals;

- inclusion of a period of self-employment in the length of service;

- resolving disputes in court as a self-employed person;

- participation in federal and regional programs to support small businesses.

However, all these benefits are not properly secured at the legislative level. And as a result, there is a lack of public confidence in the procedure for registering as self-employed.

The disadvantages include the following:

- insufficient development of the taxation and administration mechanism;

- temporary validity of the patent (from one to twelve months);

- self-employed citizens remain unwanted clients of credit institutions, since their income is almost impossible to confirm;

- it is difficult to prove the existence of work experience;

- sick leave is not paid, etc.

Despite the fact that in 2021 the President of the Russian Federation proposed to legalize the activities of self-employed citizens, and legislators began to develop the regulatory framework, there is still no clear understanding of the procedure for acquiring a patent for the self-employed. At the moment the patent is not issued, but this is planned to be done in the future. In 2021, citizens can only register as self-employed, but only if they meet the conditions set by the Federal Tax Service. So, for now, representatives of only three industries can register.

Vitaly Sazonov

Lawyer, author of articles on legal topics. Education: state educational institution of higher professional education "Moscow State Open University".

If you are self-employed, you need to abandon other tax regimes

Professional income tax cannot be combined with the simplified tax system, UTII, unified agricultural tax or patent. You must waive other tax regimes within 30 days. The transition to self-employment does not mean that other modes cease to apply. It's inconvenient, but true. If you register in the “My Tax” application, but do not refuse other modes, self-employment will be canceled.

To work only with NPD, you need to send an application to the tax office at the place of registration of the individual entrepreneur. Each tax regime has its own forms:

- Form No. 26.2-8 - for the simplified tax system.

- Form No. 26.1-7 - for Unified Agricultural Tax.

- Form No. UTII-4 - for UTII.

Important. If you have already issued a patent, you will not be able to immediately switch to self-employment. You will have to wait until the patent expires.

Possible reasons for refusal to issue a patent and its revocation

Grounds for refusal to issue a patent for self-employment:

- the person interested in the patent annually receives an income exceeding 1 million rubles;

- the citizen carries out activities that differ from those specified in the document;

- a citizen uses the labor of hired workers.

If citizens of the Russian Federation violated these requirements, the Federal Tax Service will have the right to cancel the issued document for self-employment. In addition, the self-employed may be held administratively liable.

A migrant who arrived in the Russian Federation from a country for which a visa-free regime has been established will also be able to obtain a patent.

In this case, cancellation of the permit is possible for the following reasons:

- age under 18 years;

- absence from the territory of the Russian Federation for more than six months or residence abroad;

- providing incorrect data;

- non-payment of patent costs;

- drug use or failure to provide medical certificates confirming the presence of dangerous diseases (including AIDS).

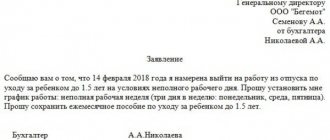

How to inform the tax office about the transition to self-employment

There are three ways to send an application to the tax office:

1. Through the personal account of the individual entrepreneur using an electronic signature.

2. Through electronic document management systems.

3. By registered mail.

Once the application has been submitted, sort out the required payments for the previous tax regime:

- submit a declaration for an incomplete year from January 1 to the day of transition to self-employment;

- pay contributions to the Social Insurance Fund and Pension Fund for the same period.

Example

. An entrepreneur-lawyer already familiar to us, Evgeniy, sent an application to renounce the simplified tax system on June 7. Now he needs to report for his work with the simplified tax system for the period from January 1 to June 6, 2021. Evgeniy only paid contributions to the Pension Fund, so he needs to calculate the payment for the same period using the simplified tax system and submit reports to the tax office.

How to keep records and pay taxes on NAP in self-employment

All reporting on NPD is the registration of each receipt in the application. As soon as the money arrives, you need to enter the sale into “My Tax” and send a check to the client. Receipts must be sent so that the client can include it in their expenses.

Here's how to enter a sale and generate a receipt in the My Tax app:

1. Click the “New Sale” button.

2. Write the name of the product or service and add the price.

3. Select the date of receipt of money.

4. Add information about the client. You need to select a status (individual or company). If a company or individual entrepreneur, you need to add the name and TIN.

5. Click the “Issue check” button and download it.

6. Send a check to the client in a convenient way: by email, social networks or instant messengers.

“My Tax” itself calculates how much taxes you need to pay. The application automatically sends a notification with the payment amount. Payment must be made by the 25th of the month in which the notice was received.

What to do if you earned more than 2.4 million rubles

If the calendar year has not yet ended, but the income has already exceeded 2.4 million rubles, self-employment automatically ends. The entrepreneur will have 20 calendar days to change the NAP to a different tax regime. To do this, you need to write an application and send it to the tax office at the place of registration.

Here are the application forms:

- Form No. 26.2-1 - for the simplified tax system.

- Form No. 26.1-1 - for Unified Agricultural Tax.

- Form No. UTII-2 - for UTII.

Important. In applications for the simplified tax system and unified agricultural tax, in the column “Taxpayer attribute code” you must indicate “3”. This way the tax office will understand that you are switching from a different tax regime.

If you didn’t write an application or didn’t meet the deadline within 20 days, something terrible will happen - the individual entrepreneur will automatically switch to the general taxation system. Then, on all income over 2.4 million rubles, you will have to pay 13% personal income tax.

For example, self-employed lawyer Evgeniy earned 3 million rubles from May to October 2020, but did not have time to apply for the simplified tax system. For 2.4 million he paid tax on professional income, and for the rest of the income - 600 thousand × 13% = 78 thousand rubles. And if Evgeniy had time to switch to the simplified tax system “Income”, he would have paid only 600 thousand × 6% = 36 thousand rubles. Twice smaller!

After individual entrepreneurs are transferred to the general system, they can switch back to self-employment or another tax regime only from January 1 of the next year. The application can be submitted in advance.

Self-employment mode helps entrepreneurs save on taxes and contributions. When there is no income, there is no need to pay the state anything.

Question answer

Will I have to pay taxes on all proceeds to my account or card?

No. You pay taxes only on the income for which you issue a check. The amount of self-employed income may be less than what you received into the account - if not all income is related to entrepreneurial activity. Or more - if you record income that you received in cash or on cards from other banks.

How to record a sale if I received payment in cash or to an account in another bank?

Enter the sale through the “Self-Employed” section in the same manner as for a regular sale. It is mandatory to deposit cash into your current account.

In the same way, you can issue checks for payments received to accounts in other banks.

Can I confirm my income if I want to get a mortgage or loan?

Yes. In the “Self-employment” section in your Delobank or SKB-Bank personal account, you can receive an electronic certificate of income for the current year. There is also a certificate confirming your self-employed status.

How to switch to self-employment at Delobank or SKB-Bank from another bank?

The same as with regular registration. In fact, you are simply connecting a new way of exchanging information with the tax office. At the same time, it is not necessary to disable access to the self-employed person’s personal account in another bank. For example, you can receive money into different accounts and register checks through different banks. But you only need to pay taxes through one bank, since the notification comes based on the total tax amount.