- What is the need for a special assessment declaration?

- How often should I take it?

- What are the consequences if you don't file?

- Where to submit the declaration?

- Who has the right to submit a declaration under the SOUT?

- What to write in the document?

- Filling Features

- Do I need to submit an amended declaration?

- Sample of a blank declaration form for a special assessment of working conditions

- Sample of a completed declaration form for a special assessment of working conditions

- Sample cover letter to GIT

Each organization or individual entrepreneur who has hired employees through an employment contract has an obligation to regularly submit reports on special assessments. As a result of organizing the SOUT, a declaration is drawn up, which must be submitted to the territorial labor inspectorate. The procedure and features of this process will be disclosed in this article. The legal basis for the procedure is Federal Law No. 426 of December 28, 2013. Order of the Ministry of Labor of Russia No. 80n dated February 7, 2014 details the standard form of the declaration and the features of its content. The latest legislative amendments to the procedure for preparing and submitting a declaration under the SOUT were introduced in 2021 on the basis of Order of the Ministry of Labor No. 642n.

What is the need for a special assessment declaration?

The need to draw up a declaration on a special assessment of working conditions is mainly based on the interests of the organization itself. If acceptable working conditions are created for employees, the employer has the right to pay insurance premiums at a reduced rate. However, this only applies to positions without dangerous and harmful working conditions. And for specific types of work with a high level of injuries and health risks (for example, workers in mines and metallurgical industry enterprises), the legislator additionally established a tariff scale for insurance premiums of up to 8 percent.

Order of the Ministry of Labor No. 33n regulates in detail the methodology for calculating classes of working conditions.

By improving conditions in the workplace and increasing labor safety for employees, the organization can count on lowering the hazard class. An unscheduled SOUT will act as a legal basis for reducing the percentage of tariffs for insurance premiums. The legislation allows for a change from the third class (harmful conditions) to the first or second (permissible and optimal conditions), but it is impossible to lower the fourth class.

To properly monitor the implementation of labor protection requirements by employing organizations and individual entrepreneurs, Rostrud maintains a register of declarations of compliance of working conditions with state regulatory labor protection requirements. Received declaration information is entered into the register within 15 days. Anyone can view this information on the Rostrud website.

Filling Features

When filling out the document, you should be guided by the provisions set out in Letter of the Ministry of Labor dated June 23, 2014 No. 15-1/B-724.

Sample of filling out a declaration on SOUT in 2021, basic requirements:

- the full name of the employer and address are indicated in strict accordance with the statutory documents, while if information is submitted for workplaces located in a branch without forming a legal entity, the address is indicated not by the branch, but by the main division;

- the names of positions or works of employees whose places are declared are indicated from the special assessment card of this official place;

- the number of employees is also taken from the special assessment card (third section of the report);

- individual workplace numbers are taken from the first column of the list of official workplaces at which the special assessment was carried out (section 2 of the report);

- similar jobs are marked with the letter A, according to information from the fourth column of the list of section 2 of the report;

- In addition to the details of the expert’s opinion, it is necessary to indicate his last name and initials.

Sample of filling out the declaration of conformity of working conditions 2019

How often should I take it?

For filing a declaration, Order No. 80n of the Ministry of Labor defines a period of 30 working days, which begins from the moment the report is approved. To avoid penalties, it is recommended that you strictly adhere to these time limits. The territorial labor inspectorate considers the submitted data based on the results of the special labor inspection within 10 working days, then makes a decision on accepting the documents or refusing to accept them. If the form and content of the declaration does not comply with legal requirements, it is returned for revision.

A correctly drawn up special assessment declaration has legal force for 5 years. If no accident occurs at the specified workplaces or the employee does not suffer from an occupational disease, the validity of the declaration will automatically be extended for 5 years. There is no need to conduct a special assessment in this situation. But even a single fact of an accident at the workplace is grounds for canceling the declaration and assigning an unscheduled special safety assessment at this workplace.

Last news

The government has decided to introduce indefinite validity of SOUT declarations. Officials submitted a corresponding bill to the State Duma for consideration. Now this document is valid for 5 years from the date of entering information about the results of the special assessment into the information system for recording the results of the special assessment. If during this period an industrial accident occurs in the organization or an employee is diagnosed with an occupational disease, the declaration is terminated. If such situations do not arise, its validity is automatically extended for another 5 years, and the employer is required to conduct a second special inspection after 10 years. He does this at his own expense.

If the government amendments are approved, employing organizations will be able to save on special labor costs. The authors of the initiative note that the requirement to carry out a repeated labor safety assessment when working conditions have not changed and there are no violations is redundant. Its abolition will have a beneficial effect on the administration of labor protection requirements and the financial position of organizations.

Where to submit the declaration?

The declaration is submitted to the territorial labor inspectorate at the location of the organization. An employer can transfer reporting documentation in three ways:

- Personally, by visiting the administrative building of the territorial labor inspectorate;

- By mail with acknowledgment of delivery and a description of the contents;

- Via the Internet on the website of the Federal Service for Labor and Employment in the form of an electronic document confirmed by the digital signature of the head of the organization.

Submission rules

The order of the Ministry of Labor fixed the ways of sending a declaration on SOUT to the labor inspectorate (TI):

- submit a declaration in paper form when visiting the inspection;

- send the document by Russian Post. The letter is in registered form, be sure to include a receipt receipt and a list of the contents of the envelope;

- submit the SOUT declaration electronically on the labor inspectorate website;

- The form is signed with the digital signature of the company management before sending it.

Where to submit SOUT reports

Let's see where to submit the SOUT declaration. The document is sent to the TI at the place of registration of the company. During the special inspection, the workplaces of working employees in the company, including offices, are checked. The employer finds out how comfortable it is for employees to work, and if the conditions are recognized as comfortable, it acquires the right to pay contributions at low rates. During the special assessment, factors that negatively affect people are taken into account, and not aesthetic components. The expert assesses the level of noise, dust or lack of proper lighting. The color of the walls and the quality of window and door fittings are not taken into account. They measure the severity of labor, chemical and biological factors.

Assessments can be carried out by accredited persons. They have special equipment and skills. The company does not have the right to organize SOUT independently. The SOUT contractor is accredited, its accuracy is checked on the website of the Ministry of Labor. The appraiser's certificate is verified there.

The cost set by appraisers depends on the specifics of the company’s work and the total number of places. Traveling to sites outside the city is more expensive. When assessing manufacturing companies, additional measurements of the noise level and severity of technological processes are required, therefore, the cost increases. Also, the shorter the execution time, the higher the price.

Before the assessment activities, a list of places that are planned to be assessed is drawn up and signed by the commission. They create an order for the implementation of SOUT, draw up a schedule of activities. There is no special form for the schedule; it is compiled in any form according to the company’s internal document flow regulations. The schedule, list and order are stored in the accounting department.

Who should conduct a special assessment of working conditions in the organization? The document is provided by the company or its representative by proxy. The declaration on the special assessment of working conditions was introduced by order of the Ministry of Labor dated February 7, 2014 No. 80n. The company fills out and sends a declaration to the state labor inspectorate at its location within thirty days from the date of signing the special assessment report. TI reviews the report within ten working days and, if everything is filled out correctly, approves and registers it. If the declaration is filled out incorrectly, it is sent to the company with comments.

The declaration is not submitted:

- in places of workers included in the lists of the Cabinet of Ministers Resolution No. 10 of January 26, 1991;

- at work that allows you to receive an old-age insurance pension beyond the established deadlines;

- where a compensation package is provided for work with negative performance factors;

- where factors adversely affecting workers are recorded.

If no tragic cases or occupational diseases are recorded at the declared workplaces in the next five years, then the validity of the declaration will be extended for another five years. Consequently, companies are exempt from the SLA for a period of five years. When an accident is recorded, the company organizes a special assessment outside the plan, and the current declaration is canceled.

The materials of the SOUT report are valid 5 years after the inspection. The company organizes a special assessment for newly created jobs.

Form for an updated declaration on SOUT

The company's declaration is sent within thirty working days after the acceptance of the SOUT report. The declaration on the special assessment of working conditions and when it must be submitted is recorded in paragraph No. 5 of the procedure implemented by order of the Ministry of Labor and Social Protection of the Russian Federation dated February 7, 2014 No. 80n.

They enter data in accordance with the rules set out in the Letter of the Ministry of Labor dated June 23, 2014 No. 15-1/B-724. Conditions for filling: indicate the name of the company and location according to the constituent documents. In the data submitted for the places of workers in branches without creating a legal entity, the address data is recorded not for the branch, but for the head department. The names of professions are transferred from the special assessment card of the corresponding workplace. The number of workers is entered from the SOUT card, the numbers of work places are entered according to column No. 1 of the register of places where the assessment was carried out. Similar jobs are marked with the letter A according to the special assessment report. They enter the findings of the expert commission and the personal data of the inspector.

Sample declaration of SOUT 2019

Information is entered sequentially:

- position - according to the list approved by the company;

- numbers of work places - transferred from the SOUT report. They are written separated by commas, spaces separated by dashes;

- the number of workers performing work at these places.

Next, fill in the details of the completed expert report: its date and number in order.

Declaration of SOUT, sample of filling out 2021:

Since 2014, fines and sanctions for violations in the field of labor protection have been increased. For deviation from the deadlines for carrying out special assessments, officials will be fined in the amount of 5 to 10,000 rubles. Legal entities - from 60,000 to 80,000 rubles. with the suspension of the company. Based on the results of the assessment, other measures to support workers are determined (medical examinations, purchase of personal protective equipment, etc.). For violations of each of them - a fine of up to 200,000 rubles.

What to write in the document?

Requirements for the content of documents for a special assessment of working conditions are spelled out and enshrined in Order of the Ministry of Labor No. 80n and Letter of the Ministry of Labor No. 15-1/B-724. Thus, the mandatory details of the declaration are considered:

- full/abbreviated name of the organization, and if documentation is submitted by an individual entrepreneur, his full name;

- information about the head of the organization;

- the address of the organization specified in the charter;

- OGRN, TIN codes, etc.;

- total number of employees with individual workplace numbers;

- list of declared jobs;

- details of the expert opinion.

For some categories of jobs, a declaration is not submitted. These are:

- work that provides for early receipt of an old-age insurance pension;

- work that provides compensation payments and guarantees for dangerous and harmful working conditions;

- work where the results of the certification established dangerous/harmful working conditions.

Submission order

Where to submit the SOUT declaration

To the territorial body of the state labor inspectorate (where the enterprise is registered), or, more simply, GIT.

Who submits a declaration for a special assessment of working conditions

The employer or his authorized representative.

The form of the document is approved by Appendix No. 1 to Order of the Ministry of Labor dated 02/07/2014 No. 80n. Filled out and submitted by the employer to the state labor inspectorate (territorial body) in the manner set out in Appendix No. 2, within 30 days from the date of approval of the special assessment report.

The submission form can be:

- personal (visit the state inspection and submit documents on paper);

- in electronic form on the official website of the Federal Labor Service (in this case signed with an electronic digital signature);

- through Russian Post (the same as in person, but you don’t have to travel anywhere).

The labor inspectorate is obliged to check what is sent within ten working days, and if everything is filled out correctly, accept and register it.

If documents are filled out incorrectly or lack necessary information, they will be returned for revision.

The declaration is not submitted in relation to the following workplaces (even if the working conditions there are optimal or acceptable taking into account the personal and collective protective equipment used):

- who are included in the lists approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10, and work on which gives the right to early assignment of an old-age insurance pension;

- in which employees, upon entering work, are immediately provided with guarantees and compensation for working under harmful or dangerous working conditions;

- in which, based on the results of previously conducted workplace certifications, harmful and/or dangerous working conditions were established.

How often do you need to declare jobs?

If in the next five years an accident does not occur at the declared workplaces or the employee does not acquire an occupational disease (which must be established by a medical commission), the validity of the declaration is considered extended for the next five years, which gives the employer the right not to carry out special assessments for these workplaces during this period. period.

If an accident occurs or other reasons appear (the full list is listed in Article 17 of Law No. 426-FZ), the employer will have to organize an unscheduled special assessment, and the document will be canceled.

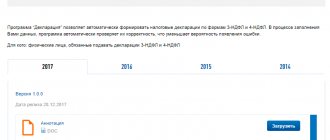

Declaration form for SOUT (adjusted declaration form)

Do I need to submit an amended declaration?

An updated declaration was necessary in 2021, when, with the introduction of a new procedure for conducting special assessments, the preparation of the declaration had to take into account jobs in the first and second class. Therefore, enterprises and individual entrepreneurs who had previously submitted their declarations to Rostrud had to provide additional information about work positions with optimal and acceptable conditions, documenting all this in an updated declaration. The deadline for filing an updated declaration was June 16, 2016. The new edition of the corresponding article of the Federal Law on Specialized Workplaces stipulates that information about working with optimal and permissible conditions should be provided in the text of the declaration of special assessment. Today there is no need to submit an updated declaration.

Make it before it's too late

Following the adoption by the State Duma in February 2021 of amendments to the Law “On the voluntary declaration by individuals of assets and bank accounts,” a capital amnesty began to operate in Russia on March 1, 2021. What is capital amnesty?

First of all, this is an opportunity to voluntarily declare your assets (real estate, vehicles, securities), controlled foreign companies and/or accounts in banks located outside the Russian Federation.

The key word here is “voluntary”. You and only you must decide whether to participate in the amnesty. However, this is a unique opportunity to bring your assets “out of the shadows” and avoid administrative, tax or even criminal liability.

It is no secret that many Russian citizens for many years adhered to the position “the less the state knows about me and my money, the better.” However, the situation around the world is changing rapidly. Already this fall, the first automatic exchange of information will take place between Russia and dozens of other countries (read more about this in my article “How will they know? or automatic exchange of information”), and the secret may become apparent.

The amnesty is valid for exactly one year: from March 1, 2021 to February 28, 2019. To take part in the amnesty, you need to fill out and submit a special declaration. Please note that a special declaration can only be submitted once. No additions, corrections or clarifying declarations are permitted. We can say that there is no room for error here.

Transaction monitoring reporting

| TNF code | Name of tax reporting | V | R | date |

| 000.10 | Export of goods (works, services) | 3 | 22 | 21.12.2020 |

| 000.20 | Import of goods (works, services) | 3 | 27 | 21.12.2020 |

Transaction monitoring reporting for 2021 (templates)

DEADLINE and FREQUENCY for submitting the declaration of special assessment of working conditions

The SOUT declaration must be submitted no later than 30 working days from the date on which the report on the special assessment of working conditions was approved. This is stated in paragraph 5 of the Procedure, approved by order of the Ministry of Labor of Russia dated February 7, 2014 No. 80n.

Note: Moreover, the deadline for approval of the report on a special assessment of working conditions is not established by Law of December 28, 2013 No. 426-FZ!

The submitted declaration of a special assessment of working conditions is valid for five years from the date on which the report on the special assessment of working conditions was approved. This means that you will not need to submit reports again for these five years.

Moreover, if no accidents at work or occupational diseases due to harmful and (or) dangerous production factors occur within five years, then the validity of the declaration is extended for another five years. That is, the employer will not have to resubmit the declaration after five years either.

But if, within five years from the date of approval of the report on a special assessment of working conditions, at least one employee is diagnosed with an occupational disease or an accident occurs at work due to harmful and (or) dangerous factors, then the declaration in relation to such a workplace is terminated. In this case, it is necessary to conduct an unscheduled special assessment of working conditions and, after approval of the report, submit the declaration again.

This procedure follows from the provisions of Article 11 of the Law of December 28, 2013 No. 426-FZ, paragraph 10 of the Procedure approved by Order of the Ministry of Labor of Russia of February 7, 2014 No. 80n.

SOUT: the employer was fined 60 thousand rubles for being late in filing a declaration of conformity

If the declaration of conformity of working conditions is sent to the labor inspectorate late, the organization may be fined up to 80,000 rubles based on paragraph 2 of Article 5.27.1 of the Administrative Code. This conclusion was reached by the Moscow City Court in decision dated November 26, 2018 No. 7-13339/2018.

The capital organization violated the 30-day deadline for submitting a declaration of compliance with working conditions. The delay was only five days. However, this did not stop the inspectors from fining the employer 60 thousand rubles in accordance with paragraph 2 of Article 5.27.1 of the Code of Administrative Offenses of the Russian Federation (violation of the procedure for conducting a special assessment). The mentioned paragraph provides for a warning or the imposition of an administrative fine:

- for officials - from 5 thousand to 10 thousand rubles;

- for individual entrepreneurs - from 5 thousand to 10 thousand rubles;

- for legal entities - from 60 thousand to 80 thousand rubles.

to menu

COMPOSITION and PROCEDURE for filling out the Declaration of Conformity of Working Conditions

Draw up the document based on the results of the first stage of a special assessment of working conditions - the so-called identification.

Reporting needs to be completed only for those workplaces where harmful and dangerous conditions were not established at this first stage. For declared jobs, the following stages of special assessment of working conditions are no longer necessary. This follows from paragraph 2 of the Procedure, approved by order of the Ministry of Labor of Russia dated February 7, 2014 No. 80n.

Sample declaration based on the results of a special labor assessment 2019

Download for free a sample declaration based on the results of a special labor assessment 2021.doc (Word)

to menu

At the top of the form, indicate the full name of the organization (last name, first name and patronymic of the entrepreneur).

Next, indicate the address where the organization is registered and located (the entrepreneur lives and works). If necessary, reflect two addresses: actual and legal.

In the same line, indicate the TIN and OGRN of the organization. If the declaration is submitted by an entrepreneur, indicate his TIN, if any.

Next, fill in the information about the jobs for which you are submitting the SOUT declaration:

• individual workplace numbers. These numbers are assigned by the commission when determining the list of jobs and indicate them in the report on the special assessment of working conditions. Individual numbers must contain no more than eight characters: from 1 to 99,999,999. Designate similar workplaces by number with the addition of a capital letter A. For example: 365A, 1245A. Include numbers of all workplaces similar to the workplace in which no hazardous or hazardous conditions have been identified;

• name of the profession or position of the employee employed at each specified workplace. Take the name from the All-Russian Classifier OK 016-94.

Note: If the name of a profession or position is not in the classifier, its name must correspond to the name of the position specified in the staffing table and the employment contract;

• number of employees employed at the workplace.

Please provide information about the organization conducting the special assessment of working conditions below:

• name of company;

• registration number in the register of organizations conducting a special assessment of working conditions;

• date and number of the expert report from the organization conducting the special assessment of working conditions.

This data can be obtained from the organization itself conducting a special assessment of working conditions, or viewed on the official website of the Russian Ministry of Labor.

At the bottom of the form, indicate the date of acceptance and expiration date of the declaration. The declaration is valid for five years from the date of approval of the report on the special assessment of working conditions. The expiration date of this period will be the expiration date of the declaration.

The completed declaration must be signed by the head of the organization (entrepreneur), indicate next to the signature his surname and initials and certified with a seal.

There is no need to fill out the back side of the declaration - it will be filled out by labor inspectorate specialists.

Note: This order follows from Appendices 1 and 2 of the Order to the menu

Tax statements

| TNF code | Name of tax reporting | V | R | date |

| 000.11 | Application for participation in an international group | 1 | 5 | 21.12.2020 |

| 000.12 | Cross-country reporting | 1 | 5 | 21.12.2020 |

| 001.00 | Tax application for suspension (extension, renewal) of tax reporting | 7 | 21 | 21.12.2020 |

| 002.00 | Tax application for extension of the deadline for submitting tax reports | 7 | 29 | 21.12.2020 |

| 003.01 | Notice of the applicable tax regime | 2 | 21 | 29.12.2020 |

| 007.00 | Tax application of a taxpayer (tax agent) for revocation of tax reporting | 8 | 25 | 21.12.2020 |

| 023.00 | Information from taxpayers on participation (control) in a controlled foreign company | 1 | 4 | 21.12.2020 |

| 024.00 | Tax application for a certificate of the amount of income received from sources in the Republic of Kazakhstan | 1 | 4 | 21.12.2020 |

| 000.25 | Information from persons engaged in forwarding, transportation, delivery of goods during electronic trading of goods | 1 | 4 | 29.12.2020 |

| 026.00 | Information submitted to the authorized body | 2 | 4 | 21.12.2020 |

| 027.00 | Tax application to confirm the authenticity of excess value added tax amounts | 1 | 3 | 21.12.2020 |

2021 Tax Applications (Templates)

Note 8

Filing a special declaration gives an individual the right to receive exemption from liability for the listed offenses.

However, if the “Plant” withdrew funds through “one-day” accounts for other needs, then the very fact of the “candid recognition” of the beneficiary with the mention of the “Plant” may prompt a tax audit and additional taxes to be assessed on unreasonable expenses. Accordingly, there will no longer be any grounds for releasing an individual from criminal liability for these amounts.

You will have to worry about whether it was worth trusting the special storage of declarations in the Federal Tax Service for 10 long years (Part 2 of Article 199 of the Criminal Code is a serious crime).

Now - Zavod LLC itself.

"Zavodik" committed a tax offense under Art. at least twice. 122 Tax Code:

- Understatement of the tax base due to the use of “oh, what counterparties”;

- Understatement of the tax base due to the payment of interest or royalties.

For dividends, as in the case of individuals. face, it will be Art. 123 of the Tax Code - failure to fulfill the duty of a tax agent.

Note 7

Filing a declaration quickly if such events begin after March 1, 2021 will not save you from liability.

But the complete triumph of impunity will not come. Responsibility can be avoided for a strictly limited list of crimes, administrative violations or violations of currency legislation. They are mainly related to tax evasion. But for corruption offenses and, most importantly, for offenses in connection with the illegal withdrawal of funds abroad (so-called legalization), no exemption is provided (see footnote No. 3).

And now the most unobvious part. Let's take a look at the diagram below. It shows one of the typical schemes for launching a model of using a foreign company in Russian business.

In order for a foreign company to receive dividends from its Russian partner (at a reduced tax rate), pay interest or royalties (reducing the income tax base), it must, accordingly, invest funds in the authorized capital of the Russian subsidiary, transfer funds on loan, or transfer the rights to use intellectual property (which must first be purchased). The question is, where did the “shelf” company, registered, for example, in Cyprus, get these funds? Right. At different times, they “settled” there through the withdrawal of funds from the donor business through “one-day” companies, which the Federal Tax Service has been fighting so hard for several years in close cooperation with the mega-regulator of the Central Bank.

Further, due to “passive” income from Russia, the foreign company made a profit. The game is worth the candle only if the taxation of such profits is significantly less than in Russia. In Cyprus, the tax rate is 12.5%, but, as a rule, due to the transfer of most of the profit to Offshores, taxation is even less.

This means that there are no grounds for exempting CFC profits from taxation in the Russian Federation.

If the profit of the CFC for 2015 was more than 50 million rubles, for 2021 - 30 million rubles. and for 2021 - more than 10 million rubles, the Russian beneficiary must pay 13% personal income tax in Russia. Filing a declaration within the framework of the capital amnesty will not save you from this obligation.

However, we are getting ahead of ourselves. Let's still list all the illegal actions presented in the diagram.

First, from the side of the beneficial owner as an individual...

- Tax evasion by LLC “Zavod” at the time of withdrawal of funds through one-day accounts (Article 199 of the Criminal Code);

- Tax evasion by LLC "Zavod" at the time of understating the income tax base at the time of withdrawal of funds in the form of interest and royalties (Article 199 of the Criminal Code)

- With dividends, perhaps it will be Art. 199.1 of the Criminal Code - failure to fulfill the duty of a tax agent due to failure to withhold tax at source in full (the tax rate on dividends is underestimated);

- Failure to pay personal income tax of 13% on undistributed profits of a CFC for 2015-2017, if its size exceeded the established limits.