The inclusion of “input” VAT in the amount of damage compensation costs entails the risk of disputes with the tax authorities. Let's take a closer look at the expert of the Legal Consulting Service GARANT, auditor, member of the AAS Mikhail Bulantsov.

initial situation

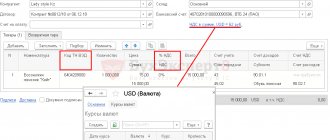

An organization on the general taxation system owns a gas station (gas station). While refueling a car belonging to a legal entity - the buyer, gasoline with an admixture of water was mistakenly filled, which caused damage to the car. The buyer made the claim orally. To restore the working condition, the following work was carried out: transporting the car to a service station, refueling the car, purchasing spare parts and paying the cost of repairs. Repairs and spare parts are presented to the organization's service station, including VAT.

Can an organization deduct VAT and reflect it in the purchase book? If not, will it be legal to include VAT in the amount of damage compensation costs?

It is advisable to specify in the contract the procedure for submitting a claim.

If the customer did not send the contractor a notice of recognition of the sanctions, then the date of recognition will be the date of receipt of the amount from the customer.

The opinions of the authors may not coincide with the point of view of the editors. All rights to the materials on the site are protected in accordance with the law, including copyright and related rights.

Thus, in the situation considered, the return of goods to the supplier should be considered as a sale. In this situation, the former buyer acts as the seller of the returned product, and the former supplier acts as the buyer of this product.

All trademarks and trade names are the property of their respective owners and are used herein for identification purposes only.

A closed list of situations in the event of which VAT amounts previously legally accepted for deduction are subject to restoration is established in clause 3 of Art. 170 Tax Code of the Russian Federation. Write-off of inventory items due to their loss, damage, shortage, defects among the cases listed in clause 3 of Art. 170 of the Tax Code of the Russian Federation, does not apply.

However, when interpreting the provisions of a contract, courts take into account the literal meaning of the words and expressions contained in it (Article 431 of the Civil Code of the Russian Federation).

Articles on the topic (click to view)

- Economic Crime Lawyer

- What to do next after you have bought a plot of land?

- Official rating of companies providing bankruptcy support for legal entities

- The bank has demanded full repayment of the loan, what should you do in such a situation?

- ROIS - Customs Register of Intellectual Property Objects

- Electronic trading platforms for bankruptcy

- The theory of consumer behavior suggests that the consumer strives

We are a construction organization that performed construction and installation work under the Contract. We signed KS-2 acts and KS-3 certificates with the customer on a monthly basis.

The work has been carried out since January 2014. until June 2015 We were paid for work on the basis of KS-2 and KS-3 minus the warranty deduction. As a result, a receivable was formed.

The security deposit must be paid 12 months after the final deed is signed.

However, Inina M.V. denies the fact of receiving wages from Lincoln LLC (interrogation protocol 12/34 dated October 15, 2008).

Submitting a buyer's complaint to a supplier - sample

The buyer, in accordance with the Civil Code of the Russian Federation, must notify the supplier of discrepancies in the quality and quantity of goods by sending a claim (clause 1 of Article 483 and clause 1 of Article 518 of the Civil Code of the Russian Federation). The claim must contain the following data (see sample):

- date and number of delivery and delivery note;

- name and quantity of low-quality goods in accordance with the supplier’s nomenclature;

- description of marriage and its reasons;

- data on the act of identifying discrepancies in quantity and quality;

- conclusion of the supplier’s commission or an independent expert.

In addition, the complaint must clearly indicate the buyer’s requirements for a defective product: return, replacement, discount, etc. An important issue is the amount of the claim and the rules for including VAT in it, as well as the accounting of claims by the supplier.

Claim to supplier with or without VAT?

Article 475 of the Civil Code of the Russian Federation states that in the event of detection of significant violations of product quality requirements that cannot be eliminated or their elimination entails disproportionate costs, as well as in other cases, the buyer has the right:

- demand a refund for paid goods;

- require replacement of a defective product.

When requesting a refund of the cost of a product, the question arises: does the buyer need to file a claim with or without VAT? In other words, should the claim requirement include the VAT amount?

There are two options to consider:

- 1. If the amount paid included VAT, then the claim must include VAT. The buyer has the right to demand a refund of the full price he paid for the defective product, including VAT;

- 2. If the amount paid did not include VAT, then the claim does not include VAT.

But it is worth considering that the situation is different for a non-resident. In the case of a non-resident supplier, VAT is not included in the amount paid. The VAT that is paid at customs when importing goods of inadequate quality should be compensated as losses (Article 15 of the Civil Code of the Russian Federation). Sometimes an agreement with a non-resident may stipulate that the terms of delivery are not regulated by the laws of the Russian Federation, then the actions will be different - in accordance with foreign legislation.

The VAT claim was submitted by the buyer to the simplified tax system

The buyer may not be a value added tax payer if working on a simplified basis. Is it necessary to allocate VAT when returning low-quality goods in such cases?

Since companies using the simplified tax system are exempt from paying value added tax, there is no need to allocate VAT in the return documents that are included in the package of documents along with the claim. An invoice is also not needed here. Payment of the VAT claim is made by the supplier along with deduction of input VAT on the return. The basis will be an adjustment invoice drawn up by the supplier.

However, if she issues an invoice, then she is required to pay VAT. Moreover, after this she will have to draw up an electronic VAT return.

Claims to the supplier without VAT - grounds

According to Article 146 of the Tax Code of the Russian Federation, an object that is subject to VAT is the sale of goods, services or work. If the claim does not relate to the quality (quantity) of the goods, then the amount of the claim to the supplier should not include VAT.

This could be damage to the buyer’s property during delivery of goods, failure to comply with safety regulations during work, etc. The amount of compensation for damage or penalties under the contract in the event of a violation of safety regulations is not subject to value added tax. The invoice will not be issued to the guilty organization.

The supplier must account for the payment of such a claim as non-operating expenses that are not directly related to the production and sale of goods and services.

The need to restore VAT amounts accepted for deduction

Violation by the client of this condition of the contract served as the basis for the forwarder to apply to the arbitration court with a claim to recover from the client the amount of losses not covered by penalties. The forwarder also included in the claim the amount of VAT presented to him by the contractor cleaning the wagons and the carrier who transported the wagons to the cleaning site.

Our general contractor company entered into a work agreement with the customer and the contractor. The contractor completed the work and signed the documents. According to the accounting department, entries Dt20.2 - Kt60.1 and Dt19 - Kt60.1 were made for a certain amount. Until the customers signed the acts, the work remained unfinished, and VAT was written off by posting Dt68 - Kt19 and entered into the purchase book.

Whether amounts are subject to VAT from the supplier. and also about the procedure for issuing invoices, the Ministry of Finance of Russia spoke to.

Making a claim with or without VAT

When analyzing the current account statement under the purpose of payment section, it was established that the current account received revenue for shipped products, work performed, and audit services provided under contracts concluded in 2006.

We, in turn, based on the claim, make entries Dt60.1 - Kt20.2 and Dt60.1 - Kt68 (the amount of VAT that was billed for reimbursement is now being accrued). How to do this correctly in the sales book? After all, there is no invoice for the issued VAT. And in general, are all these wiring done correctly? No money was transferred to the contractor for the work.

We, in turn, based on the claim, make entries Dt60.1 - Kt20.2 and Dt60.1 - Kt68 (the amount of VAT that was billed for reimbursement is now being accrued). How to do this correctly in the sales book? After all, there is no invoice for the issued VAT. And in general, are all these wiring done correctly? No money was transferred to the contractor for the work.

At the same time, the latest practice of the Presidium of the Supreme Arbitration Court of the Russian Federation is based on the fact that the lack of evidence of the amount of losses cannot serve as a basis for refusing compensation. The court cannot completely reject a claim for damages solely on the grounds that the amount of damages cannot be established with a reasonable degree of certainty.

Deducting VAT on a claim - is it possible?

Our company provided cargo transportation services by chartering a car for its client from a third-party organization. The recipient of the cargo recorded the shortfall and filed a claim with us, and we filed a claim with the contractor. Now I would like to reduce the amount of the transportation customer’s debt to us by the amount of this claim, and also accept VAT from it as a deduction. However, the customer counterparty refuses to issue an invoice for this amount. What should we do?

First of all, let us remember that in accordance with paragraph 2 of Article 171 of the Tax Code of the Russian Federation, only tax amounts presented to the taxpayer when purchasing goods (services, works, property rights) can be taken into account. The basis for this is an invoice - a document drawn up by the seller upon sale.

However, filing a claim does not constitute implementation. From the point of view of the counterparty who received the cargo, issuing an invoice for the amount of the claim would be a mistake, because there is no basis for this. As well as for your company to deduct the tax included in this amount. Officials of the Ministry of Finance in their letters and judges in their rulings have repeatedly explained that sanctions related to compensation for damage do not relate to sales and are not subject to VAT.

Thus, even if the counterparty issued you an invoice for the amount of the claim, it would still not be possible to deduct VAT on its basis. This amount, including the tax included in it, must be written off as non-operating expenses.

>Claim from the transport company

Can a legal person to reimpose the imposed fines on the culprit?

When deducting the amount of the fine from the employee’s salary, the provisions provided for in Art. 137 of the Labor Code of the Russian Federation restrictions (for more details, see Deductions from wages). If a month has already passed or the employee does not agree to voluntarily compensate for the damage, and the amount of such damage exceeds his average monthly earnings, he should go to court for compensation.

These circumstances indicate the absence of managerial and technical personnel and the impossibility of carrying out financial and economic activities. According to Art. 238 of the Labor Code of the Russian Federation, the employee is obliged to compensate the employer for direct actual damage caused to him.

For effective and safe interaction between supplier and buyer, it is necessary to organize the correct acceptance of goods. The goods must be accepted with careful checking in terms of quantity and quality, including the quality of the delivery itself (for example, temperature conditions).

Expert opinion

Kuzmin Ivan Timofeevich

Legal consultant with 6 years of experience. Specializes in the field of civil law. Member of the Bar Association.

If the buyer receives a low-quality (defective) product, the buyer must draw up a report indicating the identified defects. The statement of discrepancies for domestic goods is drawn up in the TORG-2 form, and for imported goods - in the TORG-3 form.

Compensation for damage caused is not recognized as sales, therefore it is not subject to VAT.

Inclusion of VAT in the claim amount

Current legislation does not contain restrictions regarding the inclusion of VAT in the calculation of the amount of losses itself, namely the prohibition on taking into account the amount of tax in the value of lost property when determining the amount of damage (see, for example, the decisions of the Eighteenth Arbitration Court of Appeal dated November 12, 2012 N 18AP-10470/12, Fifteenth Arbitration Court of Appeal dated 04/05/2012 N 15AP-2585/12, Ninth Arbitration Court of Appeal dated 06/24/2010 N 09AP-12587/2010).

The amount of loss in the form of VAT, if it is part of the price (cost) of the property subject to compensation, must be reimbursed in full by the counterparty responsible for these losses. This is precisely the position taken by some federal arbitration courts (resolutions of the Federal Arbitration Court of the Ural District dated 08/14/2012 N F09-6939/12, dated 06/28/2011 N F09-3136/11-S5, dated 04/08/2011 N F09-1173/11-S5, FAS North-Western District dated June 22, 2012 in case No. A56-44279/2011, dated February 22, 2011 in case No. A21-8004/2009).

At the same time, we draw attention to the conclusions contained in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 2852/13 in case No. A56-4550/2012. In it, the judges noted that losses in the form of expenses, including VAT, can be reimbursed to the victim if the latter proves that the tax amounts presented to him represent his uncompensated losses. According to the court, the existence of the right to deduct VAT amounts established by Art. 171 of the Tax Code of the Russian Federation, excludes a reduction in the property sphere of the person who suffered damage, and, accordingly, in this case excludes the application of Art. 15 Civil Code of the Russian Federation. The Presidium of the Supreme Arbitration Court of the Russian Federation concluded that a person who has the right to a deduction must know about its existence, must comply with all legal requirements to obtain it, and cannot shift the risk of non-receipt of the corresponding amounts to his counterparty, which in fact is an additional public liability for the latter. legal sanction for violation of a private law obligation.

Thus, an organization does not have the right to demand compensation for losses taking into account the amount of VAT if it has the right to deduct the amount of tax, which excludes a decrease in its property scope. That is, the reimbursement of the amount of VAT by the person who caused the damage and the receipt of a tax deduction from the budget, according to the court, leads to the unjust enrichment of the “victim” by receiving the tax twice - from the budget in the form of a tax deduction and from its counterparty in the form of compensation for damage.

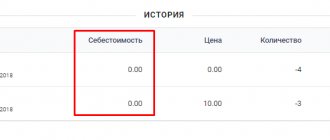

Since in the situation under consideration, VAT on inventories used in the production of products was previously accepted for deduction, and it is not required to restore it when writing off goods, we believe that VAT amounts should not be taken into account in determining the amount of the claim.

The burden of proving the existence of losses and their composition is placed on the victim (resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 N 2852/13, dated July 17, 2012 N 2683/12, dated April 24, 2012 N 16327/11, dated August 29, 2000 N 8926/99 ), and he, as we indicated earlier, on the basis of Art. 15 of the Civil Code of the Russian Federation has the right not only to compensation for the cost of lost goods, but also to compensation for lost profits.

If the tenant determines the amount of damages independently and the landlord agrees with it, then the parties do not need to go to court for judicial protection. Therefore, whether the losses caused are compensated, including VAT, or whether the loss is calculated from the cost of the lost goods excluding VAT, the parties determine independently. In the settlement document, the VAT amount is a separate line, based on clause 4 of Art. 168 of the Tax Code of the Russian Federation, there is no need to separate it, since compensation for losses is not subject to VAT.

Answer prepared by: Expert of the Legal Consulting Service GARANT, professional accountant Molchanov Valery

The answer has passed quality control

September 5, 2021

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

>Reflection of a claim from the Buyer in accounting

Taxation of damage compensation amount with VAT

According to paragraph 1 of Art. 146 of the Tax Code of the Russian Federation recognizes, in particular, transactions for the sale of goods (work, services) in the territory of the Russian Federation as subject to VAT.

The sale of goods, works or services is recognized as the transfer on a paid basis of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, and in cases provided for by the Tax Code of the Russian Federation, the transfer of ownership of goods, results of work performed works by one person for another person, provision of services by one person to another person - free of charge (clause 1 of Art.

39 of the Tax Code of the Russian Federation).

By virtue of paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the VAT tax base is increased by amounts received by the organization, provided that they are related to payment for goods (work, services) sold.

In this situation, the organization makes a claim to the lessor for compensation for losses incurred due to damage to the goods (finished products) located in the rented warehouse due to the fault of the lessor.

Compensation for damage caused to the organization is in no way connected with the sale and payment of goods (work, services), because in this case there is no transfer of ownership of the property on a compensated or gratuitous basis.

Since compensation for damage caused is also not related to payments for goods (work, services) sold, the amount of such compensation does not increase the VAT tax base.

Thus, there is no need to include the amount of compensation for loss in the VAT tax base.

In this regard, we believe that the amount of damage charged to the guilty party is not subject to VAT. Accordingly, an invoice is not issued to the guilty person (clauses 1, 3 of Article 168, clause 3 of Article 169 of the Tax Code of the Russian Federation).

Justification of the position

According to the general rule established by paragraph 1 of Art. 15 of the Civil Code of the Russian Federation, a person whose rights have been violated may demand full compensation for the losses caused to him. However, this rule is dispositive and provides that by law or the terms of a particular contract, the amount of damages subject to compensation may be limited to a certain limit. Clause 1 of Art. 1064 of the Civil Code of the Russian Federation establishes that damage caused to the property of a legal entity is subject to compensation in full by the person who caused the damage.

In this consultation, we do not consider the possibility of recognizing the Organization’s expenses for damage compensation for profit tax purposes (clause 13, clause 1, article 265 of the Tax Code of the Russian Federation), as well as documenting the relationship with the buyer regarding damage compensation, since this was not the subject of the question asked. . In the future, we proceed from the fact that the costs of compensating the buyer for the damage caused are subject to inclusion in the non-operating expenses of the Organization (letter of the Ministry of Finance of Russia dated September 20, 2010 N 03-03-06/1/597).

The obligation to pay a particular tax is directly related to the emergence of a corresponding object of taxation for the taxpayer (Clause 1, Article 38 of the Tax Code of the Russian Federation).

In accordance with paragraph 1 of Art. 146 of the Tax Code of the Russian Federation the objects of VAT taxation are:

- sale of goods (work, services) on the territory of Russia, as well as transfer of property rights, including gratuitous transfer of goods, gratuitous performance of work, provision of services;

- transfer of goods on the territory of Russia (performance of work, provision of services) for one’s own needs, if the costs for this cannot be taken into account for income tax purposes (that is, for purposes not related to commercial activities);

- carrying out construction and installation work for own consumption;

- import of goods into the customs territory of the Russian Federation and other territories under its jurisdiction.

By virtue of paragraph 1 of Art. 39 of the Tax Code of the Russian Federation, the sale of goods, work or services is recognized, accordingly, as the transfer on a paid basis (including the exchange of goods, work or services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person , and in cases provided for by the Tax Code of the Russian Federation, and free of charge.

According to paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the VAT tax base increases, including by amounts received for goods (work, services) sold or otherwise related to payment for goods (work, services) sold.

In the analyzed situation, the Organization (seller) compensates for damage caused to the property of its buyer. Consequently, the Organization does not sell goods (work, services), property rights to the buyer; does not transfer goods (work, services) for its own needs; does not carry out construction and installation work for his own consumption; and does not import goods into the customs territory of the Russian Federation. That is, compensation for damage is not subject to VAT taxation (clause 1 of Article 146 of the Tax Code of the Russian Federation).

Let us also pay attention to the decision of the Federal Tax Service dated January 31, 2012 No. 7. It, in particular, states that, based on clause 1 of Art. 39, pp. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, compensation for losses by its legal nature is not the sale of goods, work, or services.

Thus, the buyer should not charge VAT on the amount of compensation received for damage caused to the car.

In accordance with paragraph 1 of Art. 171 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the total amount of VAT calculated in accordance with Art. 166 of the Tax Code of the Russian Federation, as established by Art. 171 of the Tax Code of the Russian Federation, tax deductions.

An organization has the right to deduct “input” VAT if the following conditions are simultaneously met:

- purchased goods (work, services) are intended to carry out transactions subject to VAT (clause 2 of Article 171 of the Tax Code of the Russian Federation);

- goods (work, services) are accepted for accounting (clause 1 of article 172 of the Tax Code of the Russian Federation);

- there is a properly executed supplier invoice (in cases established by the Tax Code of the Russian Federation - other documents confirming the actual payment of tax amounts (clause 1 of Article 172 of the Tax Code of the Russian Federation).

In the case under consideration, the spare parts and car repair services purchased by the Organization at the service station were used in activities not subject to VAT - compensation for damage caused to the buyer’s property.

Thus, the Organization in the analyzed situation does not have the right to a tax deduction for the VAT charged to it.

According to paragraph 1 of Art. 170 of the Tax Code of the Russian Federation, VAT amounts presented to the taxpayer when purchasing goods (work, services), property rights or actually paid by him when importing goods into the Russian Federation, unless otherwise established by the provisions of Chapter 21 of the Tax Code of the Russian Federation, are not included in the expenses taken into account when calculating income tax organizations (personal income tax), except for the cases provided for in paragraphs. 2 and 2.1 art. 170 Tax Code of the Russian Federation.

These exceptions, in particular, include the acquisition of goods (work, services), property rights for the production and (or) sale (transfer) of goods (work, services), operations for the sale (transfer) of which are not recognized as sales in accordance with paragraph. 2 tbsp. 146 of the Tax Code of the Russian Federation, unless otherwise established by Chapter 21 of the Tax Code of the Russian Federation (clause 4, clause 2, article 170 of the Tax Code of the Russian Federation).

The list given in paragraph 2 of Art. 170 of the Tax Code of the Russian Federation, is exhaustive and is not subject to broad interpretation (letter from the Ministry of Finance of Russia dated 03/19/2012 N 03-03-06/4/20, Federal Tax Service of Russia for Moscow dated 05/20/2011 N 16-15 / [email protected] , dated 30.03.2005 N 19-11/ [email protected] , UMNS for Moscow dated 12.08.2004 N 26-12/52934, resolution of the Federal Antimonopoly Service of the North Caucasus District dated 15.12.2010 N A32-5103/2010-25/7 ). In all these situations, invoices received from sellers are not registered in the purchase book (clause “e”, clause 19 of the Rules for maintaining the purchase book).

At the same time, in Art. 170 of the Tax Code of the Russian Federation does not provide for the inclusion in the cost of goods (work, services) of VAT amounts for imposed sanctions, including compensation for damage. Therefore, in the situation under consideration, there is a high probability of tax disputes arising on the issue of accounting as expenses the amount of VAT on an expense recognized by the organization in the form of a fine (letter of the Federal Tax Service for Moscow dated March 30, 2005 N 20-12/20856).

In this regard, we believe that the inclusion of “input” VAT in the amount of damage compensation costs entails the risk of disputes with the tax authorities.

Unfortunately, we were unable to find official explanations or materials from judicial practice on situations similar to the one under consideration. Therefore, the position stated above is only our expert opinion.

In this regard, we recommend that you contact your tax authority or the Russian Ministry of Finance for official clarification regarding the possibility of recognizing “input” VAT as an expense for profit tax purposes in the analyzed situation.

Accounting and legal services

According to Art. 146 of the Tax Code of the Russian Federation, the object of VAT taxation is the sale of goods, works, and services. In addition, based on paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation, the tax base for VAT increases, in particular, by amounts associated with payment for goods sold (work, services).

The amount of the claim paid by the contractor for failure to comply with safety regulations is not related to the sale of goods (performance of work, provision of services), therefore VAT is not charged on it. In accounting, this operation is reflected by the following entries: Dt 91.02 Kt 76.02 - the claim is recognized Dt 76.02 Kt 51 - the amount of the claim is paid In tax accounting, the amount of the claim transferred to the counterparty is included in non-operating expenses in accordance with paragraphs.

13 clause 1 art.

265 Tax Code of the Russian Federation.

- demand a refund for paid goods;

- require replacement of a defective product.

When requesting a refund of the cost of a product, the question arises: does the buyer need to file a claim with or without VAT? In other words, should the claim requirement include the VAT amount? There are two options to consider:

- 1. If the amount paid included VAT, then the claim must include VAT. The buyer has the right to demand a refund of the full price he paid for the defective product, including VAT;

- 2.

Transport company claim

01.08.2011 N 03-07-11/207 Letter from the Ministry of Finance of the Russian Federation dated 01.08.2011 N 03-07-11/207

Question: LLC suffered damage from the carrier - damage to the goods. The goods invoice indicates the price of the goods including 18% VAT.

In accordance with paragraph 2 of Art. 796 of the Civil Code of the Russian Federation, damage caused during the transportation of cargo is compensated by the carrier in the event of a shortage of cargo in the amount of the cost of the missing (damaged) cargo. The carrier confirmed its agreement to compensate for damage in the amount of the cost of the goods according to the invoice, but excluding VAT.

By virtue of clause 59 of the Guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n, the actual cost of shortages and damage in excess of the norms of natural loss is taken into account as the debit of the claims settlement account and written off from the credit of the settlement account ( according to the supplier's personal account). When capitalizing missing materials received from suppliers and subject to payment by the buyer, the cost of materials, transportation and procurement costs and value added tax included in the actual cost of shortages and damage are reduced accordingly.

Is it legal for the carrier to reimburse the damage caused to the LLC based on the cost of the damaged goods excluding VAT?

Answer: MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

LETTER dated August 1, 2011 N 03-07-11/207

The Department of Tax and Customs Tariff Policy reviewed the letter on the legality of compensation by the carrier for damage associated with damage to goods purchased by the taxpayer, based on the cost of these goods excluding value added tax, and reports that the issues of determining the amount of compensation for damage are not regulated by the Tax Code of the Russian Federation.

At the same time, we inform you that in accordance with paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, amounts of value added tax presented to the taxpayer when purchasing goods (work, services), as well as property rights on the territory of the Russian Federation, or paid by the taxpayer when importing goods into the territory of the Russian Federation and other territories under its jurisdiction, are subject to deductions. , in the customs procedure of release for domestic consumption, temporary import and processing outside the customs territory or when importing goods moved across the border of the Russian Federation without customs clearance, in the case of using the specified goods (work, services), property rights to carry out transactions subject to tax Additional cost. In this regard, if it is impossible to use the above goods in activities subject to value added tax, the tax amounts on these goods are not deductible.

Deputy Director of the Department of Tax and Customs Tariff Policy S.V.RAZGULIN 08/01/2011

Here is what the auditor told me about this: I see no reason to reduce the amount of the VAT claim. You must be reimbursed for the full cost of the lost item. Example:

“A contract for the supply of goods was concluded with the condition that the goods be delivered to the buyer. The contract of carriage stipulates that in the event of loss of goods, the transport company will compensate the cost of the goods. The supplier and the transport company apply a common tax regime. During transportation, the transport company lost part of the goods. Should the transport company reimburse the supplier for the cost of the goods including VAT or without VAT?

Having considered the issue, we came to the following conclusion: In the case under consideration, in our opinion, the amount that was due to be paid for the lost goods by the buyer, including the tax charged to the buyer, is subject to compensation from the carrier. In this case, the owner of the lost goods does not charge VAT on the amount of the refund and does not issue an invoice to the carrier.

Rationale for the conclusion: According to paragraph 1 of Art. 15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount. Losses are understood as expenses that a person whose right has been violated has made or will have to make to restore the violated right, loss or damage to his property (real damage), as well as lost income that this person would have received under normal conditions of civil circulation if his right was not violated (lost profit) (clause 2 of article 15 of the Civil Code of the Russian Federation). In accordance with paragraph 2 of Art. 796 of the Civil Code of the Russian Federation, damage caused during the transportation of cargo or luggage is compensated by the carrier: - in case of loss or shortage of cargo or luggage - in the amount of the cost of the lost or missing cargo or luggage; - in case of damage (damage) to cargo or luggage - in the amount by which its value has decreased, and if it is impossible to restore the damaged cargo or luggage - in the amount of its value; - in case of loss of cargo or luggage handed over for transportation with a declaration of its value - in the amount of the declared value of the cargo or luggage. The cost of cargo or luggage is determined based on its price indicated in the seller's invoice or stipulated by the contract, and in the absence of an invoice or price indicated in the contract - based on the price that, under comparable circumstances, is usually charged for similar goods. Thus, in our opinion, compensation for the loss of goods is subject to an amount no less than the sum of the costs of purchasing the goods and other costs incurred by the owner of the lost goods under the supply contract. It should be taken into account that, since according to paragraph 2 of Art. 171 of the Tax Code of the Russian Federation, VAT amounts are subject to deduction only in the case of the acquisition of goods (work, services) for transactions recognized as subject to VAT, then the VAT amounts on lost property, previously legally accepted by the owner of the goods for deduction, are subject, in the opinion of the Russian Ministry of Finance, to restoration. Recovered VAT amounts are taken into account as part of other expenses associated with production and sales (letter of the Ministry of Finance of Russia dated July 20, 2009 N 03-03-06/1/480). In other words, the VAT amounts charged to the organization when purchasing lost goods are included in its expenses and must also be covered by the compensation received from the carrier. In the case under consideration, the contract of carriage establishes the amount of compensation for the loss of goods equal to its value. By the value of the lost goods we mean the amount that is (was) due to be paid by the buyer (including the tax charged to the buyer), since it is this amount that constitutes the lost income of the owner of the goods. Let us note that in similar situations, arbitration practice proceeds from the fact that the current legislation does not contain restrictions regarding the inclusion of VAT in the calculation of losses; the amount of damage is reasonably calculated taking into account VAT, which corresponds to the actual value of the lost cargo. Such conclusions are presented, for example, in the decisions of the Federal Antimonopoly Service of the Ural District dated June 28, 2011 N F09-3136/11 in case No. A76-20512/2010, dated November 3, 2010 N F09-8115/10-S5 in case N A76-3192/2010 -52-39, dated March 17, 2008 N F09-1666/08-C5, FAS Moscow District dated December 15, 2008 N KG-A40/10183-08. Thus, in the situation under consideration, VAT is not charged on top of the cost of the lost goods, but is part of this cost. Therefore, excluding VAT from the claim amount, in our opinion, does not comply with the law. Indirectly, this conclusion is confirmed by letters from the Ministry of Finance of Russia dated October 13, 2010 N 03-07-11/406 and dated October 7, 2008 N 03-03-06/4/67, in which the position is expressed that the disposal of property for reasons not related to the sale or gratuitous transfer (for example, in connection with loss, damage, battle, theft, natural disaster, etc.), based on the provisions of Art. 39 and 146 of the Tax Code of the Russian Federation, is not subject to VAT. In this regard, in case of compensation of damage by the guilty person in cash, VAT is not charged. In relation to the case under consideration, this means that the owner of the lost goods does not charge VAT for the amount of the refund and does not issue an invoice to the carrier.

When compensating for damage, the Court must compensate for damage including VAT

Judicial practice shows that when determining the amount of material damage to be recovered from the defendant in favor of the plaintiff, the court of first instance proceeded from the fact that material damage is subject to recovery without taking into account value added tax, since in this case actual damage is compensated, and the plaintiff materials for carrying out No construction or technical work was purchased and no repair work was carried out.

The panel of judges cannot agree with this conclusion of the court for the following reasons.

How to recover losses from a counterparty and correctly calculate taxes

A claim allows you to save not only time and effort on going to court, but also money on paying state fees. And the money from the culprit comes much earlier, which is also beneficial. Finally, the claim is important for tax accounting purposes, but more on that below.

So, we have decided that a claim is needed.

Let's see how to compose it correctly.

Expert opinion

Kuzmin Ivan Timofeevich

Legal consultant with 6 years of experience. Specializes in the field of civil law. Member of the Bar Association.

4. Circumstances of violation of duty. 5. Expenses that were incurred by the organization in connection with this (with reference to documents confirming these expenses).