From 2021, these preferential rates will be completely abolished and will remain only for charitable organizations on the simplified tax system and some non-profit organizations. “during 2021-2021, the rates of insurance contributions for compulsory pension insurance are set at 20.0 percent” (clause 3, clause 2, article 427 of the Tax Code). But we will follow the news, maybe they will extend it. In line ERSV 001 of Appendix 1 of Section 1, you must put tariff code 01. In column 200 of subsection 3.2.1 of Section 3 - codes of the categories of insured persons “NR”, “VZHNR”, “VPNR”. Appendices 6 and 8 to section 1 of the ERSV do not need to be submitted.

This list gives the right to apply preferential rates (20% instead of 30%) for insurance premiums for employees.

This benefit does not apply to the insurance (fixed) premiums of the individual entrepreneur himself.

Types of activities with reduced tariffs

Reduced tariffs in 2021 can only be applied to the following types of activities:

- domestic organizations operating in the field of information technology with tariffs of the Pension Fund - 8%, the Compulsory Medical Insurance Fund - 4%, the Social Insurance Fund - 2.0;

- organizations and enterprises from payments due to crew members of ships (except for naphthenic tankers) – at zero;

- non-profit enterprises on the simplified tax system with activities in the field of social services, scientific research, education, healthcare, libraries, museums, theaters and archives, amateur sports, as well as charitable organizations with Pension Fund tariffs of 20%, the rest - at zero;

- organizations participating in the Skolkovo project - Pension Fund 14%, the rest - zero;

- organizations and enterprises that have the status of participant in a free economic zone on the territory of the Crimean peninsula with tariffs - Pension Fund 6.0, Compulsory Medical Insurance Fund - 0.1; FSS – 1.5;

- those engaged in activities related to the production and sale of animated and audiovisual products - at the rates of the Pension Fund of the Russian Federation 6.0, the Compulsory Medical Insurance Fund - 0.1; FSS – 1.5.

The right of “simplers” to reduced insurance premium rates

Organizations and individual entrepreneurs using the simplified tax system can apply reduced tariffs if they are engaged in certain types of activities. To do this, two basic conditions must be met:

- income from this type of activity constitutes at least 70 percent of the total amount of all receipts for the reporting period (that is, from the beginning of the year);

- the total amount of income does not exceed 79,000,000 rubles.

This is stated in subparagraph 5 of paragraph 1, subparagraph 3 of paragraph 2, paragraphs 3 and 6 of Article 427 of the Tax Code of the Russian Federation.

Conditions of use

Not every individual entrepreneur can work according to the simplified tax system. The Tax Code contains a number of prohibitions and special provisions that allow you to filter the list of organizations that are given such an opportunity. You can find out more about the conditions in Article 346.12 of the Tax Code.

It is important! All individual entrepreneurs who previously used the general payment mode or UTII can switch to this mode of payment of fees.

One of the most important conditions is the amount of income that an individual entrepreneur received for a particular period. This period is considered from January to September of the current year. Income from activities received by the entrepreneur must be less than or equal to the amount of 112 million rubles.

The possibility of switching to the simplified tax system depends on the income level of the individual entrepreneur

If the amount of income received exceeds the specified indicator, then the simplified taxation system cannot be applied to this business.

But, in addition to this condition, there are two more equally important requirements that apply to individual entrepreneurs. They are covered in paragraph 3 of Article 346.12 of the Tax Code:

- The value of fixed assets in the balance should not exceed the amount of 150 million rubles. If the residual value is higher, the individual entrepreneur is deprived of the privilege to use the simplified tax system.

- The second condition is that the number of employees should not exceed 100 people. Only those employees who carry out their activities under an employment or civil contract are considered.

If an individual entrepreneur meets all of the above requirements, he can come to the tax office and write an application to switch to the simplified tax system. However, if at least one of the criteria does not fall within the requirements established by the Tax Code, then the entrepreneur will have to either adjust his business to the requirements for the entire next year, or accept the fact that he will not be able to work according to the “simplified” approach.

The decision to switch to the simplified tax system is made exclusively by the entrepreneur himself.

The transition to the simplified tax system also, in fact, does not entail any difficulties. The actions come down to the following list:

- You must notify the inspectorate of your decision. For this purpose, a notification application is drawn up in a special form number 26. 2-1. In this document, the individual entrepreneur indicates his income or income minus expenses. It is better to fill it out on a computer or by hand, but in block letters. This is necessary so that the inspection officer can familiarize himself with the information presented. The bank is filled out independently, with the help of accounting specialists or lawyers.

- A package of documents is collected, which indicates the income received, as well as the date of registration of the business in the form of an individual entrepreneur.

- All documents are submitted for review to the inspectorate, where after 30 calendar days registration is carried out in the simplified tax system form.

The tax authority cannot oblige individual entrepreneurs to switch to the simplified tax system, since such a transition is carried out only on a voluntary basis and at the request of the businessman himself.

What has changed since November 27, 2021

On November 27, 2021, Federal Law No. 335-FZ dated November 27, 2017 came into force. In this regard, the names of preferential types of activities now coincide with the names of the structural units of OKVED 2. And now there is no need to use transition keys between the classifiers OKVED1 and OKVED2.

The new list of preferential types of activities eliminates the problem of discrepancies between individual codes according to OKVED 1 and OKVED 2. Thus, in particular, previously it was unclear whether organizations and individual entrepreneurs could apply reduced tariffs for the following types of activities:

- activities of travel agencies and tour operators;

- computer equipment management;

- repair of machinery and equipment, repair of electrical equipment.

These types of activities are included in the new list. This means you can definitely apply the benefit!

New list and new codes

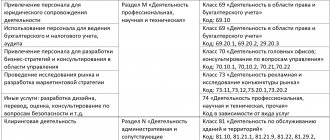

Let's assume that the company's type of activity code begins with the numbers from the left column of the new list of preferential types of activities according to the simplified tax system. If so, you can pay insurance premiums at reduced rates, which means you can apply a reduced rate (subject to other requirements). Here is a table with the new OKVED2, valid from November 27, 2017:

| OKVED code 2 | Name of the grouping of activities from the list given in the Tax Code |

| 10 | Food production |

| 11.07 | Production of soft drinks, production of mineral waters and other bottled drinking waters |

| 13 | Textile production |

| 14 | Manufacture of wearing apparel |

| 15 | Production of leather and leather products |

| 16 | Wood processing and production of wood and cork products, except furniture, production of straw products and wicker materials |

| 17 | Production of paper and paper products |

| 20 | Production of chemicals and chemical products |

| 21 | Production of medicines and materials used for medical purposes |

| 22 | Production of rubber and plastic products |

| 23 | Production of other non-metallic mineral products |

| 24.33 | Production of profiles using cold stamping or bending |

| 24.34 | Wire production using cold drawing method |

| 25 | Production of finished metal products, except machinery and equipment |

| 26 | Production of computers, electronic and optical products |

| 27 | Electrical Equipment Manufacturing |

| 28 | Production of machinery and equipment not included in other categories |

| 29 | Production of motor vehicles, trailers and semi-trailers |

| 30 | Manufacture of other vehicles and equipment |

| 31 | Furniture manufacture |

| 32.2 | Production of musical instruments |

| 32.3 | Production of sporting goods |

| 32.4 | Production of games and toys |

| 32.5 | Production of medical instruments and equipment |

| 32.9 | Production of products not included in other groups |

| 33 | Repair and installation of machinery and equipment |

| 37 | Wastewater collection and treatment |

| 38 | Collection, processing and disposal of waste, processing of secondary raw materials |

| 41 | Building |

| 42 | Construction of engineering structures |

| 43 | Specialized construction works |

| 45.2 | Vehicle maintenance and repair |

| 47.73 | Retail trade of medicines in specialized stores (pharmacies) |

| 47.74 | Retail trade of products used for medical purposes, orthopedic products in specialized stores |

| 49 | Activities of land and pipeline transport |

| 50 | Water transport activities |

| 51 | Air and space transport activities |

| 52 | Warehousing and auxiliary transport activities |

| 53 | Postal and courier activities |

| 59.1 | Production of films, videos and television programs |

| 60 | Activities in the field of television and radio broadcasting |

| 61 | Activities in the field of telecommunications |

| 62 | Computer software development, consulting services in the field and other related services |

| 63 | Activities in the field of information technology |

| 68.32 | Real estate management on a fee or contract basis |

| 72 | Research and development |

| 75 | Veterinary activities |

| 79 | Activities of travel agencies and other organizations providing services in the field of tourism |

| 81 | Maintenance activities for buildings and grounds |

| 85 | Education |

| 86 | Health activities |

| 87 | Residential care activities |

| 88 | Providing social services without providing accommodation |

| 90.04 | Activities of cultural and art institutions |

| 91 | Activities of libraries, archives, museums and other cultural facilities |

| 93.11 | Activities of sports facilities |

| 93.12 | Activities of sports clubs |

| 93.13 | Activities of fitness centers |

| 93.19 | Other activities in the field of sports |

| 95 | Repair of computers, personal and household items |

| 96 | Activities providing other personal services |

If you find an error, please select a piece of text and press Ctrl+Enter.

What qualifier should be used to determine preferential activities?

Please note: The right to reduced rates of insurance premiums for insurance premium payers using the simplified tax system, the main type of economic activity classified in accordance with OKVED, which is named in paragraphs. 5 p. 1 art. 427 of the Tax Code of the Russian Federation, is confirmed by filling out Appendix 6 “Calculation of compliance with the conditions for applying the reduced tariff of insurance premiums by payers specified in paragraphs. 5 p. 1 art. 427 of the Tax Code of the Russian Federation” to section. 1 calculation (Letter of the Federal Tax Service of the Russian Federation dated October 25, 2017 No. GD-4-11/). Let us remind you that the calculation form for insurance premiums is currently in effect, approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/

OKVED codes for the purposes of applying reduced contribution rates

To apply the benefit, enterprises do not have to submit an application and supporting documents. Taxpayers using the simplified tax system fill out Appendix 6 of Section 1 of the calculation of contributions. Application of reduced rates of insurance premiums by “simplified” travel agents Author: Dzhabazyan E.

L., expert of the magazine Conditions for applying reduced tariffs. Reduced rates of insurance premiums are established for organizations and individual entrepreneurs using the simplified tax system, the main type of economic activity of which is one of the types of activities specified in paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation. For your information: The main type of economic activity is qualified on the basis of activity codes in accordance with OKVED.

According to paragraphs. 3 p. 2 art.

Filling out a book of income and expenses during tax holidays

Maintaining a book of income and expenses (KUDiR) is the responsibility of taxpayers using the simplified tax system. However, tax holidays do not relieve the entrepreneur from this obligation. Information from KUDiR can be used to track the limit values for income received, since if they are exceeded, the entrepreneur will need to recalculate and pay tax on a general basis.

If inspectors establish the fact of incorrect or inaccurate maintenance of KUDiR, then the taxpayer will have to pay a fine of 10,000 rubles .

During tax holidays, an entrepreneur using the simplified tax system is not exempt from submitting annual declarations. When filling out, the rate used is 0%.

At the same time, individual entrepreneurs on PSN may not send reports to the Federal Tax Service and not pay taxes during the tax holiday period.

Preferential types of activities

- Benefit on insurance premiums in 2021

- New preferential types of activities for tax purposes 2017-2018

- Online magazine for accountants

- Lists of OKVED codes for reduced insurance premium rates in 2018 with a simplified tax system

- Ipc-zvezda.ru

- Usn benefits: rate of 20% instead of 30% of insurance premiums.

- Application of reduced rates of insurance premiums by “simplified” travel agents

- Conditions for applying reduced tariffs.

- On the application of reduced tariffs after the transition to new OKVED codes.

- How to apply preferential rates under the simplified tax system

- The content of the article

- Conditions for providing preferential rates under the simplified tax system

Reduced rates of insurance premiums under the simplified tax system. Some firms and entrepreneurs using the simplified tax system that have employees can charge insurance premiums at reduced rates (clause 3, clause 2, article 427 of the Tax Code of the Russian Federation).

Conditions

- At least 70% according to preferential OKVED

. The share of the company’s activities in this type must be at least 70%, but how this data will be checked is not specified in the law. - When switching to OKVED2, the benefit is not lost

.

Whether the activities of an organization or individual entrepreneur on the simplified tax system are classified as preferential activities is determined by the main OKVED code. However, when switching to OKVED2, the right to the benefit should not be lost (letter of the Ministry of Finance dated October 25, 2017 No. GD-4-11/21578). - Income for the year up to 79 million

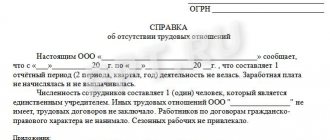

. To apply these tariffs, from January 1, 2021, there is a limit - income up to 79 million rubles / year (subclause 3, clause 2, article 427 of the Tax Code of the Russian Federation). If this limit is exceeded, all insurance premiums paid will need to be recalculated from the beginning of the year and paid at a rate of 30%. - If the income is 0 rubles, then the benefit cannot be applied

. If there is a complete lack of income, the reduced tariff cannot be applied (letter of the Ministry of Labor dated July 2, 2014 No. 17-4/B-295), but you can start applying it from the middle of the year if you have a share of such income of over 70% - The benefit can begin to be applied from the middle of the year

. If an organization did not have sufficient preferential income at the beginning of the year (70%), and then it appeared, then it has the right to recalculate contributions at a preferential rate (letter of the Ministry of Finance dated October 13, 2017 No. 03-15-07/66964)

(letter of the Federal Tax Service of Russia dated October 25, 2021 No. GD-4-11/21611).

Preferential types of activities on the usn

OSNO, simplified tax system, UTII (20% (or 12% for preferential ones on the simplified tax system) for insurance 6% for the funded part; if 1966 and older, if older - all for insurance), FFOMS 3.1% for OSNO, simplified tax system, UTII, TFOMS 2.0% for OSNO, simplified tax system, UTII. Total 34% (or 26% for preferential ones on the simplified tax system) Preferential OKVED Production: food products; mineral waters and other non-alcoholic drinks; textile and clothing; leather, leather goods and footwear production; wood products and wood processing; chemical; rubber and plastic products; other non-metallic mineral products; finished metal products; machinery and equipment; electrical, electronic and optical equipment; vehicles and equipment; furniture; sporting goods; games and toys; musical instruments; cellulose, wood pulp, paper, cardboard and products made from them; various products not included in other groups.

New preferential types of activities under the simplified tax system: list for 2017-2018

The new list of preferential types of activities eliminates the problem of discrepancies between individual codes according to OKVED 1 and OKVED 2. Thus, in particular, previously it was unclear whether organizations and individual entrepreneurs could apply reduced tariffs for the following types of activities:

- activities of travel agencies and tour operators;

- computer equipment management;

- repair of machinery and equipment, repair of electrical equipment.

These types of activities are included in the new list. This means you can definitely apply the benefit! The new edition of the amendments applies to the period starting from January 1, 2017.

Therefore, if an organization transferred insurance premiums at the usual rate during 2021, then it should submit updated calculations of contributions to the Federal Tax Service, as well as applications for offset (refund) of overpaid payments.

Advantages of using "simplified"

Today, the simplified tax system is the most common tax regime for individual entrepreneurs. This regime allows you to pay taxes and fees in a special manner, and also facilitates the process of keeping records both in the accounting and tax spheres. This approach greatly simplifies the life of small and medium-sized businesses.

Many individual entrepreneurs choose a simplified tax system

There are also other advantages that incline entrepreneurs to switch to a simple fee payment regime.

- The entrepreneur avoids the need to submit his financial statements to the Federal Tax Service on a quarterly basis. This approach significantly saves time and money on accountant services.

- The entrepreneur gets the opportunity to independently choose the object of taxation. It is important to consider that income should be 6%, and profit minus expenses should be 15%.

- Three taxes, which had to be paid separately and had to be reported for each, are being replaced with one single one.

- The volume of the tax base itself is reduced by the amount of funds and all tangible and intangible assets of the entrepreneur simultaneously at the time of their commissioning.

- New tax period frameworks are being established. Now the Tax Code decides that reporting must be submitted once a calendar year. At this moment the declaration is submitted.

- A simplified way to maintain accounting and tax records.

It is important! Entrepreneurs who have chosen a simple fee payment regime receive another bonus. They avoid paying personal income tax in the field of business activities. This approach allows you to get greater profits at the end of the year.

An undeniable advantage of the simplified tax system is that an individual entrepreneur can either immediately choose a similar mode of payment of fees or switch to it, having previously used a different mode. It is very comfortable.

The transition procedure itself, after submitting documents to the inspectorate, lasts only one calendar month, which will have virtually no effect on the level of income and the business as a whole. The legislator thought through the issue of transition in such a way as to minimize the losses of individual entrepreneurs at the time of registration. And this is another positive point.

The advantages of a simple fee payment regime are obvious. Therefore, every day an increasing number of small business representatives seek to test for themselves this opportunity provided by the state as part of the support of businessmen.

List of okved preferential codes

New tax calculation under the simplified tax system List of preferential activities for the simplified tax system 2021 Declaration under the simplified tax system Organizations and individual entrepreneurs submit a declaration under the simplified tax system this year for the last time. The Ministry of Finance has begun developing a draft law to simplify reporting for small businesses. The President gave this instruction in his message to the Federal Assembly. He asked to cancel reporting for those who use online cash registers. After all, all information on purchase and sale is received by the Federal Tax Service in real time. It will be necessary to simply calculate the taxes payable and reporting will then be superfluous. Therefore, companies and individual entrepreneurs may be submitting a declaration under the simplified tax system in 2021 for the last time.

Recipients and validity period of individual entrepreneur tax holidays

Tax holidays for individual entrepreneurs were introduced in 2015. Initially, it was assumed that this measure of support for Russian entrepreneurs would be temporary, but it proved to be quite effective, so officials decided to extend the duration of the benefit. It is currently known that tax holidays for individual entrepreneurs will be valid until 2023 .

Newly registered individual entrepreneurs who have chosen the USN or PSN as their taxation system can take advantage of the right. The following tax holiday periods are provided:

- under the simplified tax system - the maximum period is set at 2 calendar years (when registering in the middle of the year, the rest of the current year and the next one are taken into account)

- with PSN – the validity period of 2 patents (if the first patent is issued for 12 months, and the second for 6, then the tax holiday will last 18 months)

Usn news

The tax department came to the same conclusion in Letter No. BS-4-11/12091 dated June 23, 2017. Similar arguments of the Federal Tax Service are contained in Letter No. SA-4-11/15343 dated August 4, 2017, however, in relation to a “simplified” person with a different type of activity. As we can see, the initial position of the controllers regarding the “simplified” workers, whose new activity codes did not meet the requirements of Art.

427 of the Tax Code of the Russian Federation was as follows: reduced tariffs cannot be applied. However, recently there has been a different tendency to recognize the conformity of the type of activity of an organization according to OKVED 2 with the type of activity established in paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation. Please note: Is it necessary to submit an updated calculation of insurance premiums? Taking into account the uncertainty when applying reduced insurance premium rates, “simplified” travel agencies could either pay premiums “in full” or pay at a reduced rate.

What qualifier should be used to determine preferential activities?

To do this, it is necessary that this type of activity brings them at least 70% of all income received (clause 5, clause 1, clause 3, clause 2, clause 6, Article 427 of the Tax Code of the Russian Federation). Reduced insurance premium rates in 2021 for the simplified tax system

- the share of income from preferential activities in the amount of all income is at least 70%;

- maintain a preferential treatment (see table below);

- annual income does not exceed 79 million rubles.

From the beginning of the billing (reporting) period, in which the company no longer meets the necessary conditions, it loses the right to apply reduced tariffs. And the amount of contributions will have to be restored and paid.

Termination of preferential rates

All employing companies, regardless of the legal form or method of income taxation, pay insurance premiums if they make payments under employment or civil law contracts with hired workers.

An individual entrepreneur pays contributions on two grounds:

- fixed amounts of contributions - for yourself;

- at standard rates - from the income that the individual entrepreneur pays to employees.

| Insurance type | At what rate | Maximum base value for calculating insurance premiums in 2017 (RUB) | Maximum base value for calculating insurance premiums in 2018 (RUB) | |

| Until the base limit is exceeded | After exceeding the limit base | |||

| Pension insurance | 22% | 10% | 876 000 | 1 021 000 |

| Health insurance | 5,1% | — | — | |

| In cases of temporary disability | 2,9% | 0% | 755 000 | 815 000 |

Let's consider the types of activities for which a benefit is provided under the simplified tax system when calculating insurance premiums.

Benefits on mandatory insurance premium rates for some firms and entrepreneurs using the simplified tax system are valid until the end of 2021. The reduced rates are:

- on pension contributions - 20%"

- for social contributions for disability and maternity – 0%;

- for medical contributions – 0%.

If an organization (IP) loses the mandatory condition for applying the benefit, then insurance premiums are calculated at general rates. For example, the agreement for the implementation of tourist and recreational activities in the tourist and recreational special economic zone was terminated.

Important! If the subject is on a patent taxation system, then reduced rates can only be applied to payments to employees engaged in patent activities, and not to the entire state.

The transition to OSNO is a mandatory condition for the termination of benefits. The general rates for calculating insurance coverage should be applied from the 1st day of the month following the month in which the mandatory condition for receiving the benefit was lost.