According to Article 254 of the Tax Code, material costs include acquisition costs:

- materials and raw materials used in the production of goods (works, services) and for other production needs;

- components and semi-finished products subject to further processing;

- materials for packaging of goods sold (containers);

- fuel, water and energy of all types, heating of buildings for industrial needs;

- works and services of a production nature performed by third parties or structural divisions of the company (for example, transportation costs);

- property that is not depreciable, that is, the cost of which is less than 40,000 rubles. or the useful life of which is less than one year (clause 1 of Article 257 of the Tax Code of the Russian Federation);

- tools, production equipment, laboratory equipment, workwear, safety footwear, etc. The cost of this property is included in material costs in full as it is put into operation. And from January 1, 2015, firms received the right to write off the cost of this property over more than one reporting period, independently determining the procedure for recognizing the corresponding material expenses, taking into account the period of use of the property or other economically feasible indicators.

The list of material expenses contained in Article 254 of the Tax Code is not exhaustive. Material costs may also include other documented costs that are directly related to the production and sales process.

Cost of material costs

To understand how much material expenses can be included in a company’s tax costs, you must first determine their initial cost. At this cost, material expenses that have a tangible form (materials, raw materials, fuels and lubricants, etc.) are credited to account 10 “Materials” in accounting.

The cost of material costs is determined based on the actual costs of their acquisition.

The cost of material costs in the form of work and services of a production nature is written off in accounting to expense accounts (20, 25, 26, 44) immediately after the service (work) has been provided to you.

The most difficult thing is to determine the cost of purchased inventories. These are materials, raw materials, semi-finished products, components, goods. In some situations, their tax and accounting value may differ. If there are such differences, you will either have to take them into account in separate tax registers, or supplement the accounting registers with the information necessary to calculate taxable profit.

Analytics of enterprise performance efficiency

The following criteria are taken into account here:

- The ratio of costs and profit received - here the income from the sale of finished products is taken into account based on each ruble spent on its production;

- Material intensity - the ratio of material costs for each unit of production;

- Material productivity - calculated by dividing the cost by the materials and resources spent for production;

- Cost ratio - demonstrates the dynamics or decrease in production volumes and the profitability of the use of material costs.

What equates to material costs

The following are equated to material expenses (clause 7 of Article 254 of the Tax Code of the Russian Federation):

- expenses for land reclamation and other environmental measures;

- losses from shortages (damage) during storage and transportation of inventories that arose in connection with a decrease in the weight (quantity) of goods, within the limits of natural loss norms approved in the manner established by the Government of the Russian Federation;

- expenses for mining and preparatory work during mining, for operational stripping work in quarries and cutting work during underground mining within the mining allotment of mining enterprises;

- technological losses during production and (or) transportation. At the same time, in order to include them in material expenses, the taxpayer can independently determine the standards for the generation of irrevocable waste for each specific type of raw material used in production. These standards can be established, in particular:

- technological maps;

- process estimates;

- other similar internal documents that are developed by specialists who control the technological process and approved by authorized persons of the organization (see letter of the Ministry of Finance of Russia dated July 5, 2013 No. 03-03-05/26008).

Types of material costs

Such expenses are classified according to several criteria. Let's look at each of the groups in more detail.

Direct

This category includes all material costs directly involved in the production of finished products. For example, this includes the purchase of materials and payment of employees.

Variables

This is a type of cost, the value of which directly depends on the volume of products produced. This item of material costs can be considered direct costs, but there is one feature. Variable costs disappear when production is suspended.

This may include:

- Energy consumption;

- Bonus payments to workers for fulfilling the plan;

- Costs for transportation of raw materials and finished products.

Indirect

These are costs that are not directly involved in the production of products, but contribute to the production process or sales of products. For example, here you can include the costs of advertising, rent of office space, and salaries of business personnel.

Refundable

This includes the remains of resources that participated in the production process, but are unsuitable for further use for their intended purpose. Essentially, this is industrial waste that can be used after recycling. Return expenses do not include inventories transferred to branches of the enterprise for further use and by-products obtained as a result of main production.

Read also: Tax risks

Natural decline

Natural loss of inventory is a decrease in the mass of goods (quantitative change in inventory) while maintaining its quality within the requirements (standards) established by regulatory legal acts, which occurred as a result of natural changes in the biological or physico-chemical properties of goods.

Natural loss does not include:

- technological losses;

- losses from marriage;

- losses of inventory items during their storage and transportation associated with violation of standards, technical and technological conditions, technical operation rules, damage to containers, imperfect means of protecting goods from loss and the condition of technological equipment;

- loss of inventory during repair or maintenance of technological equipment used for storage and transportation, during intra-warehouse operations;

- emergency losses.

Ways to reduce material costs

Such expenses usually amount to 50-60% of the cost of finished products.

Therefore, all manufacturing companies are interested in reducing such costs. During the operation of such enterprises in market conditions, a certain strategy was developed aimed at reducing production costs. These include the following decisions:

- Introduction of modern technologies aimed at waste-free production;

- Use of innovative materials;

- Optimization of production processes;

- Encouraging employees to use enterprise resources more carefully;

- Do not neglect scientific research in the manufacturing industry;

- Effective use of production waste.

The assessment of the efficiency of using material costs is determined by the method of substituting economic indicators. Let's assume that a company is engaged in the production of woodworking machines. Component parts are also produced by the structural division of this company. However, among competitors, such parts are 30% cheaper. In such a situation, it is more profitable to liquidate an unprofitable structural division and buy components from other manufacturers. Transport costs are also taken into account according to a similar scheme.

In addition, material costs for production can be reduced by reducing the number of defects and increasing the volume of products.

Accounting for expenses when selling goods for tax accounting purposes

Taxpayers who use the simplified tax system “income-expenses” recognize expenses after they are actually paid (clause 2 of article 346.17 of the Tax Code of the Russian Federation).

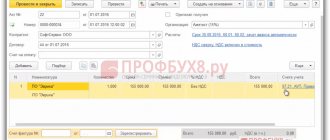

The cost of goods purchased for sale can be taken into account in expenses only if the conditions are simultaneously met (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation):

- goods must be paid to the supplier;

- the goods must be sold to the buyer.

The sale of goods means that ownership of them has passed to the buyer. As a rule, this happens after the transfer of the goods, regardless of receipt of payment (clause 1, article 39 of the Tax Code of the Russian Federation, clause 1, article 223 of the Civil Code of the Russian Federation).

All your expenses for the purchase of goods must be confirmed by primary documents: invoice or UPD, payment documents (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Let's give an example of accounting for the cost of goods sold in expenses.

Example 1. In January I bought 100 pieces of general notebooks for the amount of 2,000 rubles. (without VAT). In January, 20 notebooks were sold.

The purchase price of goods sold in January was:

2,000 rub. / 100×20 = 400 rub.

This amount is 400 rubles. you can take into account expenses for January when calculating the “simplified” tax.

You can write off the cost of goods as expenses using one of the valuation methods (clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation, clause 36 of FSBU 5/2019):

- by unit cost;

- at average cost;

- at the cost of the first in time of acquisition (FIFO).

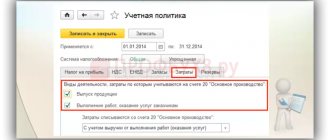

The chosen method of assessment for tax and accounting purposes must be fixed in the accounting policies of the organization. As a rule, the same valuation method is chosen in order to bring NU and BU as close as possible.

Please note that “input” VAT is taken into account separately from the cost of goods . At the same time, you can take into account VAT in expenses only in that part that relates to goods sold (clause 8, clause 1, article 346.16, clause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation). Let us give an example of accounting for the part of the “input” VAT attributable to goods sold in expenses.

Example 2. Let's take the basic data from the previous example. I bought 100 pieces in January. general notebooks in the amount of 2,400 rubles. (including VAT 400 rub.).

In January, 20 units were sold. notebooks, i.e. Only a fifth of them were sold:

20 pcs. / 100 pieces. x 100% = 20%

In this case, VAT can only be taken into account in the amount of 80 rubles. (RUB 400 x 20%).

Accounting for transition period expenses when selling goods

As noted above, it is possible to take into account the cost of goods purchased for sale in expenses only if the conditions are simultaneously met: the goods must be paid to the supplier and sold to the buyer. Therefore, expenses for the purchase of goods for sale incurred during the period of application of UTII can be taken into account after the transition as they are sold. In Letter No. SD-4-3/ [email protected] dated November 20, 2020, tax officials explained the procedure for accounting for transition period expenses.

There are only four possible situations that may arise during the transition period. For clarity, we present the procedure for accounting for expenses in Table 2.

Table 2. Accounting for expenses - transition from UTII to the simplified tax system “income-expenses”

To confirm expenses, there must be primary and payment documents: invoices, acceptance certificates, UPD, payment orders, etc. (Clause 1 of Article 252 of the Tax Code of the Russian Federation).

Classification of costs included in the cost of production

An enterprise incurs a wide variety of costs in order to produce and sell products. These costs vary in their economic purpose; roles performed in the production process; place of origin; depending on changes in production volumes. This necessitates their grouping according to certain classification criteria.

1) Grouping of costs based on their economic homogeneity

The purpose of this grouping is to determine the full cost of the entire volume of production, analyze the cost structure. The document in which such grouping is carried out is called a production cost estimate. The estimate includes the costs of all workshops, areas, departments, and services.

In the estimate, costs are grouped according to the following economic elements:

- a) material costs;

- b) labor costs;

- c) contributions for social needs;

- d) depreciation of fixed assets and intangible assets;

- d) other costs.

Material costs include the following subelements:

- raw materials and materials;

- purchased components and semi-finished products, works and services of a production nature performed by a third party;

- fuel from the side;

- energy from the outside.

Raw materials costs include:

Example: in the communications industry, products are communications services, the production of which does not require raw materials and supplies; these costs are not included in the cost price. However, to carry out the production process, enterprises need operating materials, spare parts, tools, devices, and special clothing.

The costs of “Purchased components and semi-finished products, work and services of a production nature performed by a third party” include the cost:

- purchased components and semi-finished products that are subject to further installation or additional processing at this enterprise;

- works and services of a production nature performed by third-party enterprises or production facilities and farms not related to the main type of activity, as well as entrepreneurs without forming a legal entity.

Production work includes:

- performance of individual operations for the manufacture of products, processing of raw materials and materials, repair of fixed production assets, transport services of third-party organizations for the transportation of goods within the enterprise;

- costs of research and development work associated with the preparation and development of new types of products and technological processes.

“Fuel from outside” costs include the cost of all types of fuel purchased from outside , spent on:

- technological purposes, production of all types of energy (electric, thermal, compressed air, cold, etc.),

- heating of industrial buildings,

- transport work performed by enterprise transport.

“External Energy” costs include the cost of purchased energy of all types (electric, thermal, compressed air, cold, etc.) spent on technological, energy, propulsion and other production and economic needs of the enterprise.

The element “Labor expenses” reflects

- wage payments calculated on the basis of piece rates, tariff rates and official salaries established depending on the results of work;

- incentive and compensation payments, including compensation for wages in connection with price increases and wage indexation;

- bonus systems for workers, managers, specialists and other employees for production results, other conditions of remuneration in accordance with the forms and systems of remuneration used at the enterprise.

Please note: the composition of the wage fund related to the cost of production was discussed in the article “Labor income of enterprise employees.”

The element “Deductions for social needs” reflects mandatory contributions at the rates established by law to the social protection fund, as well as the enterprise’s expenses for compulsory medical insurance of certain categories of employees in accordance with the law.

The element “Depreciation of fixed assets and intangible assets” reflects the amount of depreciation charges for the complete restoration of fixed assets and intangible assets, calculated on the basis of the book value and depreciation rates, methods and rules, including accelerated depreciation of their active part, as well as indexation of depreciation charges produced in accordance with the law.

In this case, the accrual of depreciation on fixed assets and intangible assets ceases after the expiration of the standard service life, subject to the full transfer of their entire cost to production costs.

The methodology for calculating depreciation charges was discussed in the relevant articles.

The “Other expenses” element includes:

- emergency tax to eliminate the consequences of the Chernobyl disaster;

- contributions to the centralized innovation fund;

- land tax;

- environmental tax;

- interest payment:

- for short-term bank loans (except for interest on overdue and deferred loans and loans received to compensate for the lack of own working capital, the acquisition of fixed assets and intangible assets);

- for long-term loans to replenish working capital;

- on bills within the established payment terms;

- for short-term loans from other legal entities and individuals;

- for the acquisition of material resources (carrying out work, providing services by third-party enterprises) on credit provided by the supplier of material resources (producer of works, services);

- other services related to servicing enterprises;

- rent, in the case of renting individual objects of fixed production assets, expenses for leasing operations;

- payment for work on product certification;

- travel expenses;

- payment to third-party organizations for fire and security guards, including payment for work on the construction of fire alarm systems at existing facilities;

- payment for communication services and computer centers;

- payment to third parties for training and retraining of personnel;

- payment for consulting, information and audit services performed by relevant organizations;

- compensation for wear and tear (depreciation) of personal vehicles, equipment, tools and devices used for the needs of the enterprise by agreement in accordance with the law;

- other costs included in the cost of products (works, services) that are not related to the previously listed cost elements;

- contributions to the repair fund and the reserve for future costs of repairing fixed production assets.

2) Grouping of costs according to the method of attribution to cost

According to the method of attribution to the cost of production, costs are divided into 2 groups:

- direct costs;

- indirect costs.

Direct costs are those costs that can be immediately, directly attributed to the cost of a specific product or service.

These include purchased raw materials, basic materials; semi-finished products, fuel and energy for technological needs, wages of the main production workers, accruals on the wages of these workers: for social needs, compulsory medical insurance for certain categories of workers.

If an enterprise produces several types of products, then some expenses cannot be immediately attributed to the cost of specific products or services. These are indirect costs .

3) Grouping costs depending on production volume

Depending on the change in the volume of production, the following types of costs are distinguished:

- variables;

- fixed (conditionally fixed) expenses.

Variable costs change in proportion to changes in production volume.

These include the costs of raw materials, materials, fuel and electricity for technological needs, wages of piece workers.

Fixed (conditionally fixed) costs either do not change or change slightly due to changes in production volume.

These include fuel costs for heating buildings, other utilities, electricity for lighting premises, wages of temporary workers, administrative and management personnel, depreciation, etc.

4) Grouping costs in other ways

Depending on the period of occurrence and attribution to cost:

- current period expenses;

- Future expenses.

According to the degree of feasibility:

- productive expenses;

- non-productive expenses (losses) are expenses associated with the manufacture of defective products and the subsequent correction of defects.

Subscribe to our newsletter and receive guaranteed discounts on education, including business courses! People often read with this material: articles in the Business Directory section on the Aspect portal

Source: https://ta-aspect.by/klassifikaciya-zatrat-sebestoimosti

Accounting for income from the sale of goods purchased for sale

All taxpayers using the simplified tax system record income using the cash method, i.e. take into account income on the date of receipt (clause 1 of Article 346.17).

By virtue of this rule, all funds received during the period of application of UTII are not taken into account in the tax base of the “simplified” tax . This also applies to advances received before the transition, which you closed (or will close) by delivering goods already under the simplified tax system. Therefore, you do not need to include in your “simplified” tax income payment for goods that you put on UTII if it was received after the transition (clause 1 of article 39, clause 1 of article 346.17 of the Tax Code of the Russian Federation).

And it is necessary to include payment for goods in income if both payment and sale took place under the simplified tax system (Letter of the Federal Tax Service of Russia No. SD-4-3 / [email protected] dated November 20, 2020). For clarity, we present the procedure for accounting for income during the transition period in Table 1.

Table 1. Income accounting - transition from UTII to simplified tax system

All of the above about income is true for the objects of taxation under the simplified tax system: “income” and “income-expenses”.

Let us remind you that on the “profitable” simplified tax system no expenses are taken into account, incl. material costs and expenses for the purchase of goods.

You can track sales, conduct analytics, and replenish warehouse stocks on time with the free online service MyWarehouse . The service has more than 100 ready-made integrations, allows you to connect cash registers, print price tags, invoices, acts, invoices, UPD, and keep records of labeled goods.

Try MySklad for free

In order to understand the accounting for transition period expenses, let us first consider the general accounting procedure.