Reasons for the need for a document

The legislation of the Russian Federation determines that the following categories can act as principals:

- Legal entities (in the role of the general director or directly the founder of the company).

- Individual.

- Individual entrepreneurs (businessmen).

A power of attorney is required for the temporary transfer of powers, in particular on issues related to the economic activities of the enterprise.

In some cases, such a document can be generated for an ordinary company employee immediately before he is sent on a business trip. Based on the duties and powers specified in the power of attorney, the employee can represent the interests of his company before business partners.

This document gives an ordinary employee the opportunity to sign contracts of a commercial nature, which in the future will form the basis of the activities of the entire company.

Authenticity of the signature: in what cases is it necessary?

Certification of the authenticity of a signature may be necessary for both individuals and legal entities in a variety of situations. You can certify the authenticity of a signature on almost any document you sign. Certification of the authenticity of signatures on documents is necessary if it is necessary to officially confirm that the document was signed by a certain person, both in cases expressly provided for by law and in other cases. In particular, it is common to testify to the authenticity of a signature in a situation where the signatory cannot personally confirm the signing of the document to the recipient of the document (when sending an application or other document by mail, with an authorized person, etc.).

For individuals, this service is relevant, in particular, when it comes to applications in inheritance cases (on acceptance of an inheritance, refusal of it, etc.), sent by mail or otherwise transmitted to a notary without the personal appearance of the applicant, when signed by the founder of the legal entity applications for registration of a legal entity upon creation (if the founder does not intend to personally submit this application to the Federal Tax Service of Russia) and in a number of other cases.

For legal entities, the need to certify the authenticity of a signature is an integral stage of activity. Thus, the authenticity of the signature is evidenced on applications and notifications to the Federal Tax Service of Russia in connection with the registration of legal entities (including changes in information about a legal entity, in its constituent documents, etc.), on bank cards (if they are not certified by the bank itself) and etc.

In accordance with the requirements of Articles 42 and 43 of the Fundamentals, a notary, before certifying the authenticity of a signature, is obliged to establish the identity of the citizen whose signature is being certified and to check the authority of the representative if a representative of an individual or legal entity has applied for this action. For these purposes, the notary checks the citizen’s identification documents (most often this is a passport; identification documents are presented only in the original), as well as documents certifying the authority of a representative of an individual or legal entity.

Documents required to certify the authenticity of signatures:

For a citizen (individual):

· passport or other identification document.

For a representative of an individual:

· passport or other identification document;

· document on the authority of the representative: birth certificate of a minor child under 14 years of age - for his parents; document appointing guardianship - for guardians; a power of attorney or another transaction containing a power of attorney - in most other cases.

For a representative of a Russian legal entity:

· passport or other identification document;

· the main constituent document (usually the charter) of the organization - the original, a copy certified by the tax authority, or a copy certified by a notary;

· extract from the register of legal entities (USRLE). It can also be received by the notary himself, if at the time of contacting him the service of the Federal Tax Service of Russia is working to provide electronic extracts from the Unified State Register of Legal Entities;

· protocol, decision or other document (in accordance with the provisions of the charter on the appointment of the sole executive body of the organization);

· an order for the appointment of a chief accountant, as well as other officials, whose signatures must be notarized;

· in case of certification of the authenticity of the signature of a representative of the management organization - similar documents of the management organization and the management agreement.

If the authenticity of the signature of a representative of a foreign legal entity is certified, the notary checks the authority of the representative based on the system of confirmation of authority that is adopted in the relevant state. Supporting documents may include various types of extracts from trade, commercial and other registers; certificates issued by competent authorities, minutes of meetings of bodies of legal entities, powers of attorney, contracts, etc.

By certifying the authenticity of a signature, a notary does not certify the facts stated in the document and the legality of its contents, but only confirms that the signature was made by a certain individual.

an official authorized by the state who has the right to perform notarial acts on behalf of the Russian Federation in the interests of Russian citizens and organizations (legal entities). written authority granted by one person to another person to complete a transaction with a third party actions of citizens and legal entities aimed at establishing, changing or termination of civil rights and obligations. an agreement of two or more persons to establish, change or terminate civil rights and obligations.

Situations requiring the formation of a power of attorney

- Drawing up documentation that in one way or another requires approval by the signature of the manager in his immediate absence.

- Receipt by an ordinary employee of an enterprise of a number of material assets.

- Signing documentation included in the general document flow of the company.

For example, drawing up a schedule of tax deductions, calculating wages for employees, and preparing financial statements.

The maximum permissible validity period of a power of attorney is thirty-six months. In the absence of a strictly specified period of validity of the document, the power of attorney will be considered valid for no more than one year from the time of its formation and approval.

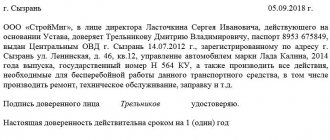

Example

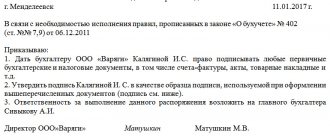

What will the order ultimately look like? Let's imagine that you need to allow your sales manager to sign invoices for you. You download a sample order and fill it out something like this:

“In order to ensure timely issuance of invoices for subsequent deliveries, I ORDER:

- From August 10, 2015, grant the right to sign invoices on paper for the manager and chief accountant - commercial director Ivan Ivanovich Ivanov.

- Legal adviser Marina Petrovna Petrova shall ensure the execution and issuance of a power of attorney for the right to sign invoices to the person specified in clause 1 of this order, valid until September 15, 2015.

- Responsibility for organizing the timely execution of invoices should be assigned to the chief accountant, Elena Egorovna Egorova.

- I reserve control over the execution of this order.”

Design rules

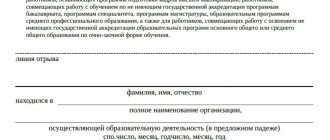

The execution of a power of attorney for the right to sign occurs in a certain form approved by current legislative acts.

According to the current legislative framework in Russia, both the general director of the enterprise and an authorized personnel employee of the company have the full right to draw up a power of attorney.

Each power of attorney allowing the use of the right to sign (for example, a power of attorney for the right to sign primary documents) is drawn up in simple written form.

In the vast majority of cases, the power of attorney is certified by a notary. In this case, the power of attorney must bear the seal and signature of the notary. The legislation in the Russian Federation does not require any additional procedures for confirming a power of attorney for the right to sign. Often, financial institutions may perform notarization.

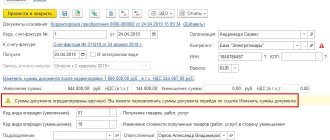

Signing of primary documentation is possible only if the following requirements are met:

- Title of the document;

- Presence of date, as well as place of composition;

- List of information about the authorized person and the principal himself;

- The presence of text containing data on granting the right to an authorized person to sign documentation of a certain nature;

- The time interval during which the power of attorney is considered valid;

- The presence of the signature of the principal, as well as the seal of the organization.

List of mandatory information about principals and trustees:

- Registration data;

- Identification code;

- Full name;

- Number in the Unified State Register of Legal Entities;

- Place of residence (registration address).

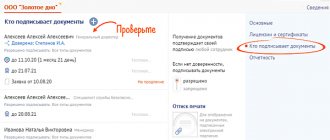

Sample power of attorney for the right to sign documents

The document transferring the right to sign can be formed exclusively on the letterhead of the power of attorney for the right to sign company documents. Approval by an authorized person of a completed document is possible only if the contents are complete and correctly compiled.

The document must accurately describe the powers that are temporarily transferred to the employee. In addition, it is possible to indicate the conditions and reasons on the basis of which the power of attorney was formed.

Recent changes in the legislative framework allow the process of transfer of powers in the absence of a stamp on the power of attorney. Previously, such a condition was mandatory, and therefore the signing of a power of attorney could only occur if there was a seal. But the current legislation of Russia clearly states the conditions under which the presence of a seal (in a power of attorney for the right to sign documents) is a prerequisite. Only in case of strict compliance with the above requirements, the power of attorney will be valid.

Who is given the right to sign?

You can only transfer signing rights to your employee. The task of signing documents cannot be delegated to third parties not related to the company. You can choose absolutely anyone – be it an executive director or a smart junior manager who is willing to take on additional duties and responsibilities.

The order can set the period during which the transferred right will be valid. If you are going away for a week or two (for example, you have finally decided to take a “vacation”), then it would be advisable to indicate this exact period. If you want to delegate the entire bureaucratic routine to someone completely and irrevocably, the clause with deadlines can be omitted.

Power of attorney form

Do you know what the Unified State Register of Legal Entities is and what it is needed for? Extract from the Unified State Register of Legal Entities online is a document that an individual entrepreneur may need. Why is it needed and how to get an extract via the Internet, read carefully.

Read about what reinvestments are and whether you can get high profits from them here.

This information may interest you https://businessmonster.ru/buhuchet/raschetyi/rentabelnost-produktsii-formula.html. Formulas and examples for calculating production profitability.

Termination: reasons

- Death or loss of ability to work of the principal.

- The decision by the top management of the company to terminate the authorized duties of a previously entrusted employee.

- Refusal of the trustee to act as the face of the company.

- Failure of a former fiduciary to fulfill previously assumed obligations. For example, loss of ability to work, dismissal or death.

Extension of a power of attorney is possible only after the expiration of a previously drawn up document, by re-issuance. Notarized confirmation of the document is required.