How to select OKVED codes for individual entrepreneurs

The OKVED classifier is a reference book containing several sections. In it, each type of business activity corresponds to an individual code. There are several portals that automatically select OKVED codes. But a citizen can do this on his own. You must proceed as follows:

- Find in the directory the section that corresponds to the field of activity of the future individual entrepreneur. For example, “Wholesale and retail trade”, “Construction”, “Transportation and storage”.

- Go to this section and step by step go down to the specific type of activity that the businessman plans to engage in.

Retail trade through an agent: who will apply UTII?

agent

on behalf and at the expense of the principal, then the rights and obligations arise directly from the

principal . goods. The Company plans to sell the above goods in a retail network in Krasnodar through an agent. The agent will act on his own behalf at the expense of the principal.

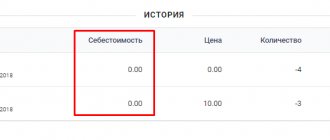

The agent will declare the type of economic activity “Other retail trade in non-specialized stores”, which is provided for by OKVED code 52.12. It is also planned that the agent will sell other goods (tights, toys, chocolate, chewing gum), which, under supply agreements, will be purchased by the LLC and transferred to the agent for sale.

Will the LLC be the payer of UTII, or will the agent be recognized as the payer of UTII in this situation?

In the above situation, is it necessary for an LLC to declare OKVED codes related to the retail trade of the above goods?

In case of commencement of certain types of activities in accordance with part one of Art. 8 of Federal Law No. 294-FZ of December 26, 2008, is it necessary for an LLC to notify Rospotrebnadzor, or should only the agent send this notification?

Having considered the issue, we came to the following conclusion :

In this situation, the UTII payer will be recognized as an agent organization, which, in turn, is obliged to notify Rospotrebnadzor of the start of retail trade activities.

Since the principal does not carry out retail trade in the situation under consideration, we believe that the principal organization does not need to notify Rosportebnadzor and open the corresponding economic activity codes.

Rationale for the conclusion:

Under a retail purchase and sale agreement, the seller, engaged in business activities of selling goods at retail, undertakes to transfer to the buyer goods intended for personal, family, home or other use not related to business activities (Clause 1, Article 492 of the Civil Code of the Russian Federation). In addition, by virtue of Art. 2 of the Civil Code of the Russian Federation, entrepreneurial activity of a subject is understood as independent activity carried out at its own risk, aimed at systematically obtaining profit from the use of property, sale of goods, performance of work or provision of services by persons registered in this capacity in the manner prescribed by law.

The taxation system in the form of a single tax on imputed tax (hereinafter referred to as the single tax, UTII) can be introduced only in relation to the types of business activities provided for in paragraph 2 of Art. 346.26 Tax Code of the Russian Federation. The list of these types of business activities is closed and is not subject to broad interpretation. At the same time, by regulatory legal acts of representative bodies of municipal districts and city districts, the types of business activities in respect of which a single tax is introduced can be established only within the limits of this list. On the territory of Krasnodar, the UTII system was introduced by the Decision of the City Duma of September 2, 2005 No. 72 “On a single tax on imputed income for certain types of activities.”

It should be noted that from January 1, 2013, the transition to UTII will become voluntary and will be of a notification nature (clause 22, article 2 of the Federal Law of June 25, 2012 No. 94-FZ). That is, from January 1, 2013, taxpayers carrying out, in particular, business activities in the field of retail trade, will have the right to independently choose the taxation regime for business activities: a general taxation regime, a simplified taxation system, a taxation system in the form of a single tax on imputed income for certain types activities (letters of the Ministry of Finance of Russia dated August 15, 2012 No. 03-11-11/243, dated August 30, 2012 No. 03-11-06/3/65, dated August 17, 2012 No. 03-11-11/ 249).

In the situation under consideration, the company plans to enter into an agency agreement with a legal entity, while the agent will sell the goods on his own behalf, but at the expense of the principal under retail sales contracts. In such a situation, the following must be considered.

According to Art. 1005 of the Civil Code of the Russian Federation, the parties to an agency agreement are the principal and the agent. Under this agreement, the agent may, at the expense of the principal, perform legal and other actions both on his own behalf and on behalf of the principal. The rights and obligations of the parties to an agency agreement regarding transactions made by the agent with third parties depend on on whose behalf the agent acts.

If a transaction with a third party is made by an agent on behalf and at the expense of the principal, then the rights and obligations arise directly from the principal. If a transaction with a third party is made by an agent on his own behalf and at the expense of the principal, then the agent acquires rights and becomes obligated. Moreover, this condition is decisive when deciding whether to classify retail trade as a business activity for the purpose of applying the taxation system in the form of UTII. Consequently, the agent will be recognized as the single tax payer in this situation.

Thus, in the letter of the Ministry of Finance of Russia dated March 12, 2010 No. 03-11-06/3/31, the following was stated. When transactions are carried out by an agent in accordance with the terms of the agreement on his own behalf and at the expense of the principal through a trade organization object owned (used by the agent) by the agent on legal grounds, then such activity of the agent relates to retail trade, and the agent himself is the payer of UTII. Taxation of the principal's income in this situation should be carried out within the framework of the general taxation system or the simplified taxation system. Similar clarifications are presented in the letter of the Federal Tax Service of Russia for the Irkutsk region dated February 29, 2012 No. 16-26/ [email protected]

In addition, financiers believe that agents selling goods on their own behalf are subject to transfer to the taxation system in the form of UTII, even if the retail facilities belong to the principal and are leased to the agent (letters of the Ministry of Finance of Russia dated January 22, 2009 No. 03 -11-06/3/06, dated November 27, 2008 No. 03-11-04/3/533, dated July 5, 2007 No. 03-11-04/3/252).

At the same time, regarding the need for the company to notify the supervisory authorities, we inform you that by law such requirements are imposed on legal entities and individual entrepreneurs planning to carry out certain types of business activities, that is, to those persons who will actually carry out the activities (in the situation under consideration, retail trade will be carried out by an agent ).

So, in accordance with part one of Art. 8 of the Federal Law of December 26, 2008 No. 294-FZ “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control” (hereinafter referred to as Law No. 294-FZ), legal entities and individual entrepreneurs are required to notify at the beginning of the implementation of certain types of business activities, the state control (supervision) body (bodies) authorized in the relevant field of activity.

Rules for submitting notifications about the beginning of certain types of business activities and accounting for these notifications (hereinafter referred to as the Rules), the form of such notification, as well as a specific list of works and services as part of certain types of business activities, about the beginning of which a legal entity or individual entrepreneur submits a notification, approved by Decree of the Government of the Russian Federation of July 16, 2009 No. 584 “On the notification procedure for the start of certain types of business activities” (hereinafter referred to as Resolution No. 584).

A notification about the start of certain types of business activities is submitted by a legal entity or an individual entrepreneur to the authorized federal executive body after state registration and registration with the tax authority before the actual performance of work or provision of services (Part 5 of Article 8 of Law No. 294-FZ) .

Notification of the commencement of certain types of business activities is submitted by legal entities and individual entrepreneurs performing work and services in accordance with the list of works and services approved by the Government of the Russian Federation, which also includes retail trade (clause 4, part 2, article 8 of Law No. 294 -FZ).

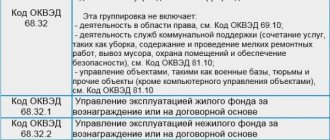

In the situation under consideration, the agent will declare the type of economic activity “Other retail trade in non-specialized stores”, which is provided for by code 52.12 of the All-Russian Classifier of Economic Activities, which is classified as activity in the field of retail trade (code 52).

Activities related to the specified code are provided for in clause 13 (IV. Retail trade of Appendix No. 1) of the List of works and services as part of certain types of business activities, the beginning of which a legal entity or individual entrepreneur submits a notification approved by Resolution No. 584.

In accordance with clause 3 of the Rules, the applicant intending to perform the work (provision of services) specified in clause 1-18, 22-47, 56-64 of the list of works and services, with the exception of activities in the territory subject to service by the Federal Medical and Biological Agency, submits a notification to the Federal Service for Surveillance in the Sphere of Consumer Rights Protection and Human Welfare (its territorial body ).

Therefore, notification of the start of retail trade to the Federal Service for Surveillance on Consumer Rights Protection and Human Welfare must be sent to the agent organization.

Failure to provide such notification is an administrative offense for which the organization and its officials may be brought to administrative liability under Art. 19.7 Code of Administrative Offenses of the Russian Federation.

The procedure for calculating the main type of economic activity of economic entities (hereinafter referred to as OVD) on the basis of the All-Russian Classifier of Types of Economic Activities (OKVED) for the formation of consolidated official statistical information by the territorial bodies of Rosstat and organizations under its jurisdiction is established by the Methodological Guidelines for calculating the main type of economic activity of economic entities based on the All-Russian Classifier of Types of Economic Activities (OKVED) for the generation of consolidated official statistical information (approved by order of the Federal State Statistics Service dated October 1, 2007 No. 150, hereinafter referred to as the Guidelines).

Thus, in section 4 “Specific rules for determining the main type of economic activity of organizations classified in section G of OKVED” of the Methodological Instructions the following is said.

Retail trade is included in a separate class 52, which has six subclasses for various types of retail trade and one additional subclass for the repair of personal and household goods. Retail commission trade is not distinguished separately, but is classified as part of the corresponding subclass, class 52.

The subclasses that include wholesale trade include all organizations whose principal economic activity is primarily the resale of goods on their own behalf to retailers, industrial or other consumers, and other wholesalers.

Class 52 covers retail trade of all types of goods other than those included in class 50. The subclasses that include retail trade include all organizations whose economic activity consists primarily of selling goods to the public (for their own account or on commission).

Since in this case the sale of goods to the public is carried out by an agent organization, OKVED code 52.12 “Other retail trade in non-specialized stores” is declared by the agent organization. In our opinion, the principal organization engaged in wholesale trade has no obligation to declare a code corresponding to this type of activity.

Post:

Comments

Principles for selecting OKVED codes

By law, OKVED encodings are selected with a detail of at least four characters. For example, the code code 47.11 is “Retail trade primarily in food products, including drinks, and tobacco products in non-specialized stores.”

If a generalized group of activities is suitable for a businessman, all codes included in it do not need to be listed. But if it is necessary to make details, the code below is selected - in the form of five or six characters. For example, 47.11.3 - “Retail trade activities with a large assortment of goods with a predominance of food products in non-specialized stores.”

Below is a list of OKVED codes for the most common types of activities of private entrepreneurs in Russia

Retail sale of food products:

- 47.11 — Retail trade primarily in food products, including drinks, and tobacco products in non-specialized stores.

- 47.19 — Other retail trade in non-specialized stores.

Retail outlets opened online:

- 47.91 — Retail trade by mail or via the Internet.

- 47.91.1 - Retail sale of goods through postal services.

- 47.91.2 - Retail trade carried out through the Internet.

- 47.91.3 — Sales of goods through virtual auctions.

Transportation of various goods:

- 49.41 — Organization of activities of freight-type road transport.

- 52.29 - Other auxiliary activities related to cargo transportation.

- 53.20.3 - Work of the courier service.

- 52.21.2 - Auxiliary activities related to road transport.

Organization of passenger transportation:

- 49.32 — Taxi work.

Opening of restaurants or cafes:

- 56.10 — Operating a restaurant and providing services for the delivery of prepared meals to the population.

- 56.30 - Serving drinks;

- 56.29 — Activities of public catering establishments for other types of catering.

Hairdressers and beauty salons:

- 96.02 — Provision of services by hairdressing and beauty salons.

- 96.04 — Physical education and health work.

- 96.09 — Provision of other individual services not included in other groups.

Licenses, taxes and OKVED

A formal approach to specifying codes leads to difficulties in obtaining permits.

For example, the registration form contains the main code 47.73 Retail sale of medicines in specialized stores (pharmacies). A decision is made to obtain a license to produce medicines. The production of medicines, OKVED code 21.20, is a licensed activity (Federal Law No. 99-FZ of May 4, 2011). The licensing authority will refuse a license if code 21.20 is missing.

Entrepreneurs enjoy tax preferences according to the main OKVED code.

Entrepreneurs on the simplified taxation system (STS), by decision of the local authorities, are given a zero rate if the OKVED codes correspond to the production, social, and scientific spheres (Article 346.20 of the Tax Code of the Russian Federation).

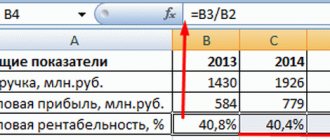

How the codes and the choice of taxation mode are related can be seen in the example.

An entrepreneur plans to sell books. To trade books in the store, the code is 47.61. Code 47.91 applies to selling books online. Books are sold online using the simplified tax system. Selling books in a store is allowed under the simplified tax system and UTII (Unified Tax on Imputed Income).

Table: tax regime and OKVED code

| Kind of activity | OKVED code | Decoding the code | Tax regime |

| Selling books in a store | 47.61 | Retail sale of books in a specialized store | USN, UTII (Unified tax on imputed income) |

| Selling books online | 47.91 | Retail trade by mail or via the Internet information and communication network | simplified tax system |

How many OKVED codes can you choose for an individual entrepreneur?

The legislation does not limit the maximum number of OKVED codes that a private entrepreneur can take for himself. But it is not recommended to specify too much. Optimally - no more than 20 pieces.

It is recommended to select encodings exclusively for those types of activities that a private businessman plans to engage in in the near future. If there are several OKVED codes, one of them can be specified as the main activity code, the rest as additional ones.

After registering an individual entrepreneur with the tax authorities, you can add encodings or remove unnecessary ones. This is done for free.

PSN in 2021

According to the edition of part two of the Tax Code of the Russian Federation, which was in force until December 31, 2020, in 2021, PSN was allowed to be used in retail trade through stationary retail chain facilities with a floor area of no more than 50 square meters for each of them. These are shops, pavilions and other separate premises for commercial purposes.

Healthy

PSN and transfer of rights to the program under a license agreement

PSN could also be used when trading through objects that do not have trading floors, for example, vending machines, kiosks, tents, fairs, as well as objects of a non-stationary network (peddling - by hand, tray, baskets and carts, and peddling - auto shop, auto shop, tonar, trailer).

What happens if the selected OKVED diverges from real activities

A private businessman does not have to work under every OKVED code specified when registering with the tax office. The list of OKVED codes included in the Unified State Register of Individual Entrepreneurs is a list of types of activities that an entrepreneur can engage in now or will engage in in the future.

If an individual entrepreneur has a business for which the OKVED code is not included in the Unified State Register of Individual Entrepreneurs, it’s okay, there is no penalty for this. However, the Code of Administrative Offenses of the Russian Federation provides for liability for failure to provide information about a legal entity or individual entrepreneur to the Federal Tax Service. This is fraught with a fine of 5,000 to 10,000 rubles, according to clause 4 of Art. 14.25 Code of Administrative Offenses of the Russian Federation.

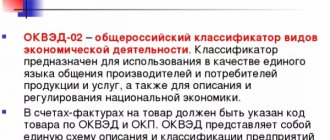

OKVED: what it contains and where it is used

OKVED (All-Russian Classifier of Types of Economic Activities) contains code designations for economic sectors. In 2018, OK 029–2014, or OKVED 2, is in force. In the classifier, economic areas such as manufacturing, agriculture, construction, real estate transactions and others are represented by codes. The encoding is adopted in statistics to reflect information about each economic unit and is used for management purposes.

A business representative, indicating the economic sectors in the registration form, becomes a participant in the process of systematization and collection of information by classes and codes.

The class is characterized by common characteristics, and grouping into classes occurs on the basis of a single methodological approach. Classification allows:

- collect statistical indicators of each business representative;

- present indicators by economic sector and tax regime;

- summarize information at the state level and by region.

Video: in simple words about classification

Step-by-step action plan for changing OKVED codes for individual entrepreneurs

- Fill out the title page and sheets “E” and “G” in the application form P24001. On the first page of sheet “E” you should indicate the codes that are added, and on the second - those that are deleted.

- Number and print only completed application sheets.

- On sheet “F”, enter the surname, first name and patronymic of the individual entrepreneur by hand. Do not sign the application - the signature must be affixed at the time of submission of the application.

- Take the application to the tax office and present your passport. The application can be sent by mail or submitted through a representative by proxy. But the application will have to be certified by a notary.