Around the world, in high value-added services, the most common pricing model is one based on calculating the volume of forecast work over time multiplied by a man-hour rate.

In Russia, this model is also used quite often, and in the digital sphere it has found the greatest distribution among production services. Not long ago, a separate rating of production companies was even published indicating the standard hour rates. However, in agencies involved in contextual/targeted advertising in Russia, pricing of services has traditionally been based on the percentage of the budget allocated to advertising platforms.

In the first half of 2015, we conducted a study of the online agency market in Western Europe and were surprised that medium-sized companies (with 30-100 employees) often do not use a percentage of the budget as the main pricing methodology when selling Google AdWords management and related services .

Most jobs are normalized by time, and their cost estimates depend on the man-hour rate. However, when performance indicators are achieved, agencies take a percentage of the budget in the form of a bonus.

Solving the problem of increasing operational efficiency, we estimate the cost of work for clients both according to the percentage of budget model and the Time&Material model, analyzing the cost and cost to the client of each specialist of the company.

This model can be effectively used in two cases:

- offering agency services that do not include expenses for advertising platforms, for example, analytics;

- serving clients with medium and small budgets, when traditional income in the form of a percentage of the budget in advertising platforms does not cover the full amount of work.

In this publication, we will share the methodology and pitfalls when calculating the cost of a standard hour for an agency employee.

You no longer need to search and call every digital agency.

Create a competition on workspace.ru - receive proposals from CMS Magazine participants on price and terms. It's free and takes 5 minutes. There are 15,617 digital agencies in the catalog ready to help you - choose and save up to 30%. Create a competition →

First, let's describe the modeled agency.

Specialization - performance marketing: contextual, targeted advertising, remarketing, web analytics, possibly SEO, SMM, CPA resale, classic media.

Staff: from 15 people. The agency has a dedicated department for working with clients (account department, client service, hereinafter referred to as the “commercial department”) and there is a department/departments with specialists who conduct advertising campaigns (hereinafter referred to as the “production department”). The financial service, lawyers, HR, CEO, IT department and others are united under the concept of “administration department”.

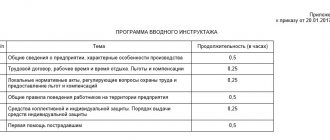

To estimate the cost of a standard hour, we fill out the table below. The example shows the cost of an hour for a contextual advertising specialist. This cost will be taken into account in the future when calculating the cost of services performed by a context specialist:

- creating an advertising campaign;

- monthly maintenance, report preparation;

- optimization and more.

Comments on the calculation of each parameter are given after the table.

| Annual salary fund of an employee (context specialist) | 600,000 rubles |

| Employee monthly income after taxes | 33,410 rubles = 600,000 / 12 / 1.302 * 0.87 |

| Working days per year | 247 |

| Vacation (28 calendar days = 20 working days) | 20 |

| Day-off (sick leave, administrative) | 3 |

| Paid working days | 224 = 247 — 20 — 3 |

| Working hours per day | 6 |

| Client billable time ratio | 0,7 |

| Billable time per client per day | 4,2 = 6 * 0,7 |

| Client billable hours per year | 941 = 224 * 4,2 |

| Cost of a production employee's working hour for the employing company | 638 rubles per hour = 600,000 / 941 |

| Share of costs for production employees | 45% |

| Cost of an employee's working hour for an agency | 1,418 rubles per hour excluding VAT = 638 / 0.45 |

| Planned operating profitability (EBITDA/Gross Profit) | 20% |

| Cost of an employee's working hour for a client | 1,773 rubles per hour excluding VAT = 1,418 / (100%-20%) |

You no longer need to search and call every digital agency

Create a competition on workspace.ru - receive proposals from CMS Magazine participants on price and terms. It's free and takes 5 minutes. There are 15,617 digital agencies in the catalog ready to help you - choose and save up to 30%. Create a competition →

To calculate the cost of a standard hour, we will use data on how much time an employee spends on solving client problems, and what expenses the agency bears for the employee.

1Calculation of the actual number of working days

With a five-day workweek in 2015, there were 247 working days. It is necessary to subtract vacation from them (28 calendar days are most often equal to 20 working days). You also need to take into account that the employer pays for the first three days of sick leave.

Many companies in our market are tolerant of situations where employees, due to poor health, remain to work at home or do not go to work for one or two days. In our experience, on average, an agency pays three additional day-offs per year.

Accordingly, we have 224 working days a year.

2Calculate the actual number of billable hours for clients

The table above shows that there are six hours in a working day. "How so? There are eight of them,” you might be surprised. In practice, I personally have rarely encountered a situation where employees spent exactly eight hours during the working day on work tasks and where the introduction of strict discipline led to increased productivity.

In addition, the legislation of the Russian Federation and the requirements of SanPiN introduce restrictions - when constantly working at a computer, a work shift cannot exceed six hours. The remaining two hours can theoretically be used for meetings, exchange of experience, training, but for calculations it is more effective to proceed from realistic data.

You also need to take into account the factor of paid and unpaid time by the client. The client does not want to pay for time:

- when preparing commercial proposals, calculating media plans;

- which specialists spend on correcting errors caused by them;

- when an agency wants to exceed the client's expectations and performs work beyond what was ordered.

In our experience, the client pays 70% of the total working time that specialists spend working with him.

Accordingly, the number of paid working hours per year: 224 * 6 * 70% = 941 hours.

To determine the cost of a standard hour, it remains to divide the employee’s annual wage fund (payroll) by the 941 hours received. When calculating the annual payroll, it is important not to forget income tax (13%), unified social tax (in the case of a general or traditional taxation scheme, this is 30%) and contributions to the Social Insurance Fund (0.2%).

If an employee receives after paying taxes, for example, 33,410 rubles, then the annual wage fund for his work will be: 12 months * 33,410 rubles. per month / 0.87 * 1.302 = 600,000 rubles.

Thus, the cost of a man-hour for a production employee is: 600,000 rubles / 941 hours = 638 rubles/hour.

At the beginning of the calculations, we indicated information about three departments - commercial, production and administrative. It's time to remember them when calculating the cost of a man-hour for a company.

When servicing a client, if a production specialist spent one hour of work, then account managers, accounting, an office manager, and so on spent some time, the company also paid a lot of administrative expenses - for office rent, communications, and so on. Taking into account everyone’s time and all expenses is extremely problematic, but it is possible and necessary to take into account the share of indirect costs when calculating the cost per hour of an employee.

The easiest way to do this is to look at the data and understand what share of operating expenses the wage fund of production departments takes up. In production companies this figure is usually 70%; in agencies it is usually lower. Let's take 45% (market indicator) as an example.

Then the cost per person-hour of a production employee for an agency will be equal to: 638 rubles per hour / 0.45 = 1,418 rubles.

Many companies make the mistake of carrying out this operation, or rather, not carrying it out. That is, they do not take into account administrative and selling expenses when calculating the cost of a production employee. As an alternative, you can offer to bill the account manager’s time separately to clients, and there are such examples on the market.

Note that 1,418 rubles per hour is the price without VAT, and profitability at this price is zero. If we want to work with a profitability of 20% of gross profit, then the price per hour for the client will be equal to: 1,418 / 0.8 = 1,773 rubles excluding VAT.

1,773 rubles excluding VAT - the resulting cost of a man-hour in a performance agency for a client with an employee income of 33,410 rubles per month, subject to payment of all taxes and a payroll share of production employees of 43%.

Time-based wage system

In this case, the employee’s earnings directly depend on the time worked; there is a fixed price per unit of time. The unit of time can be a fully worked month (then the monthly salary is calculated) or a shift or hour worked (then the tariff rate is set for the shift or hour).

Salary

If an employee works on a 40-hour schedule, then usually the main type of accrual is salary. In this case, the amount that is paid to the employee for a fully worked month is established. If an employee has not worked in full for a month, then calculations are made in proportion to the time worked.

The form for calculating salary for the current month is as follows: the base salary amount established for a fully worked month is divided by the standard working time for this month and multiplied by the time actually worked.

There is one peculiarity here. Since the amount of salary for a fully worked month is the same in each month, and the standard working time according to the production calendar may differ, the amount of salary for one day is different.

Example:

The employee decided to take two days of vacation at his own expense.

Let's see how his earnings will differ in May and July 2021.

In May, the standard working time is 19 working days, the salary for a full month is 30,000 rubles. Worked out - 17 working days.

Salary for time worked - 30,000 / 19 × 17 = 26,842.11 rubles.

In July, the standard working time is 22 days, 20 days worked. Salary for time worked - 30,000 / 23 × 21 = 27,272.73 rubles.

It turns out that the cost of 1 day in May is higher than in July, and if an employee takes two days at his own expense, it is more profitable in July than in May.

Payroll calculation is convenient to use if employees work according to a standard work schedule. In this case, they are guaranteed a salary for each month of work.

Description of the general settings algorithm

To implement such a calculation in the program, you must make the following settings:

- Create an auxiliary accrual type with the following settings:

- on the Basic , indicate: purpose - Income in kind ;

- accrued - Monthly ;

- formula: CalculationBase / TimeInDaysHours;

- uncheck the Include in payroll checkbox ;

- on the Calculation Base , indicate all charges from which you want to calculate the cost of the day/hour;

- on the Time Tracking , specify the types of time for which you plan to collect employee time worked;

- On the Taxes, contributions, accounting tab, indicate that the type of accrual is not subject to personal income tax and contributions. Assign this type of accrual to an employee as planned. This type of accrual, in fact, will not accrue anything; it is only required to calculate the cost of a day/hour in the document Calculation of salaries and contributions .

- The value calculated using this type of accrual can be used when calculating the standard type of accrual Payment for work on holidays and weekends . The formula for this type of accrual must be changed to the following: TimeInDaysHours * CalculationBase * 2 On the Calculation Base , indicate the type of accrual created in the first step.

Payment according to the tariff rate

Salary calculation can also be used for those employees who work on a shift schedule, but this will raise many more questions for both the accountant and the employees. It is better to use a tariff rate set per shift or per hour. Let's compare these calculations.

Example 1. Calculation based on the tariff rate per shift:

Let's imagine a store that is open from 10 am to 10 pm, the work schedule of the salespeople in it is 2 every 2, the work shift lasts 10 hours. For one employee, the first working day in June falls on the first day, for the second, on the third. There are only 30 days in a month, the first employee is scheduled to work 16 shifts per month, and the second - 14. If the tariff rate is set per shift or per hour, we can calculate the monthly payment in accordance with it. Let’s say a shift costs 1,300 rubles.

For the first employee: 16 shifts × 1,300 rubles = 20,800 rubles.

For the second employee: 14 shifts × 1,300 rubles = 18,200 rubles.

This calculation is simple and clear. Let's see what the calculation will be if you use salary payment during a shift schedule.

Example 2. Salary calculation for a shift schedule

Let’s imagine the same store and the same employees, but now they have a monthly salary of 30,000 rubles instead of a shift or an hour. This is where the difficulty arises in determining working hours. To calculate the amount of salary per month, we will take the actual time worked from the employee’s schedule, but it is not clear where to get the norm. This is not described in the legislation and there are different options that do not contradict the laws. You can determine the standard working time based on the employees' schedule, on the standard calendar for a 5-day 40-hour week, or on the average for the year.

Option 1. The time limit is determined according to the employee’s schedule, for each it is different, because different number of shifts.

If both worked all the shifts, then both will receive the same salary, because they worked all the days on schedule.

- 30 000 / 16 × 16 = 30 000

- 30 000 / 14 × 14 = 30 000

This calculation option raises questions from workers: after all, one employee worked 16 shifts, and the other worked 14. And their salary is the same.

Let’s assume that the first employee took two days off at her own expense, and instead of 16 shifts, she worked 14. It turns out that the employees’ hours worked are the same, but the first will receive less salary, because it will be calculated in proportion to the amount worked, taking into account the norm, and their norm is different:

- 30,000 / 16 ×14 = 26,250 rubles.

- 30,000 / 14 × 14 = 30,000 rubles.

Option 2. It happens that the standard working time is determined not according to the employee’s schedule, but according to the production standard calendar. In this case, another difficulty arises. Since the norms are different in different months, employees do not understand why this or that amount was obtained. Let’s take July 2021; according to the production calendar, the norm for a forty-hour work week is 176 hours. Both employees worked less than the norm, and one will receive 27,272.73 rubles, and the other - 23,863.64 rubles.

- 30,000 / 176 × 160 = 27,272.73 rubles.

- 30,000 / 176 × 140 = 23,863.64 rubles.

Let's look at the same situation in another month, for example, in February 2021. According to the production calendar, the norm is 151 hours. In this case, with the same work schedule, one employee will overwork the norm and receive 31,788.08 rubles, and the second will work less than the norm and will receive 27,814.57 rubles. Both may have questions about the calculation.

- 30,000 / 151 × 160 = 31,788.08 rubles.

- 30,000 / 151 × 140 = 27,814.57 rubles.

Option 3. Determining the standard time according to the production calendar, but on average for the year. To do this, you need to multiply the employee’s salary by 12 months and divide by the number of hours per year according to the standard calendar. In our case, the rate per hour in 2021 is 182.56 rubles (30,000 rubles × 12 months / 1,972 hours). This calculation is more or less understandable and is close to the tariff rate, because here the rate per hour is known, which does not change throughout the year. But then it will be more convenient for the employee if we write down the rate per hour in the employment contract, rather than the salary per month. An employee must understand how exactly and what his salary consists of.

So, for those employees who work on a shift or staggered schedule, it is more convenient to make calculations if the tariff rate is set per shift or per hour.

HOW TO CALCULATE THE PRICE OF AN EMPLOYEE'S LIFE: FINANCING OCCUPATIONAL SAFETY

Director of SRG-ECO Nikolay Sachkov told the editors of the magazine “Occupational Safety and Fire Safety” why calculate the costs per employee, what to pay attention to and what approach to choose.

Sachkov Nikolay

Director of SRG-ECO

Main points:

- Employee Life: PRICE and VALUE

- Cost of expenses per employee

- How does ISO 45001 implement the economics of saving a worker's life?

Human life is, of course, priceless. However, if you look at the issue from an economic point of view, it cannot help but note that the employer bears certain costs for its employees.

It is not difficult to calculate the real costs per employee; you just need to add up wages, taxes, insurance premiums, office depreciation, security, comfortable working conditions and other expense items.

At first glance, calculating the cost of living may seem cynical, but this measure is necessary. For example, the state evaluates life in order to understand what compensation to award to the families of the deceased and what budget to allocate for road safety and health care. It also helps enterprises determine payments to victims of accidents at work and determine the amount of budgeting for labor protection.

Below (Table No. 1) is an example of calculating costs for two workers in diametrically opposed professions (an accountant and a welder), including for security.

Table No. 1

What happens when an employee is injured?

To calculate damages, you can also use a simple tool for adding up all the costs: finding a new employee, replacing an employee during sick leave, fines from the state, production downtime, company reputation, and so on.

EXAMPLE

On March 1, the welder suffers a visual injury and goes on sick leave.

In production:

• 24 hours downtime to investigate the accident and search for a new welder (in terms of the number of working days we get - 24 ÷ 12 = 2);

• the need to pay sick leave for a month. In terms of money, the loss for the owner with a welder’s salary of 20,000 rubles amounted to downtime in the amount of 22,000 rubles for one employee (20,000 ÷ 20 × 2 + 20,000 (sick leave)).

Employers also often forget to count additional expenses:

• to search for a new welder (HR department);

• additional compensation for treatment (above and beyond insurance);

• fines for unscheduled inspections (the average fine for each inspection is about 100,000 rubles);

• necessary additional measures after an accident (knowledge testing, risk assessment and assessment of working conditions, etc.);

• Reduced productivity due to depressed morale of witnesses to the incident.

This approach is possible, but not effective in terms of zero injury goals. This is due to the fact that in practice the cost per employee can be significantly lower than, for example, the overhaul of an emergency workshop.

Thus, in order to calculate the “price of life” of an employee, it is necessary to use not quantitative indicators, but qualitative ones: that is, move from PRICE to VALUE.

For a complete understanding, let's imagine a situation: a short circuit occurred in your apartment, which led to an accident with your loved ones. In this situation, will you be engaged in calculating the economic benefits of measures that could prevent this incident - replacing wiring, renovating an apartment, etc.? - Most likely no.

The value of your loved one’s life is beyond question – it is extremely high, which is why you are implementing all the necessary measures to save this life.

Returning to production issues, it should be noted that in modern management systems, the company culture and, in particular, the safety culture is built on the principle of corporate values - common to all employees.

But not a single management system sets itself the goal of calculating the cost of living of an employee. However, for example, the ISO 45001 system has defined its goal to preserve the life and health of every employee, contractor, partner - everyone associated with the company's activities.

So, if senior management recognizes the extremely high value of their employees, then the issue of financing labor protection will be based on the real risks for people who exist in the company, and not on its losses in the event of death or injury to employees.

To identify real dangers, it is not enough to take only measures to ensure normal working conditions established in Article 163 of the Labor Code of the Russian Federation.

It is necessary to look deeper and take a risk-based approach.

The algorithm for switching to a risk-based approach consists of several stages:

- Conduct regular hazard identification and risk assessment

- Based on the risk assessment, identify significant/unacceptable risks

- Make an action plan to eliminate them: set clear goals and objectives in the field of safety

- Allocate the necessary resources to achieve the objectives

- Implement motivational programs and procedures for working personnel to find and eliminate incidents that could lead to an accident

- Compile a list, from a risk assessment point of view, of the most dangerous operations applicable to all branches, and develop clear procedures for performing these operations and plans for their implementation

- Assign responsibility for the implementation and further operation of these procedures to all branch managers

- Conduct a meeting on a weekly regular basis on the implementation of these procedures in compliance with the deadlines established in the implementation plan

- Develop KPIs in the field of industrial safety for all employees 10. Establish clear rules and the highest responsibility for managers if unacceptable risks are ignored when planning work.

- Establish clear rules and the highest responsibility for managers if unacceptable risks are ignored when planning work

Speaking about the assessment of professional risks, it is necessary to emphasize once again that this procedure should not be carried out once at a certain period of time, but on an ongoing basis. If you have not previously assessed risks in a company, we recommend that you first seek the services of a specialized organization. Specialists will be able to most accurately identify all risks in the workplace and draw up a plan of corrective measures to reduce them.

If you have not previously assessed risks in a company, we recommend that you first seek the services of a specialized organization. Specialists will be able to most accurately identify all risks in the workplace and draw up a plan of corrective measures to reduce them.

Thanks to extensive expert experience, the SRG-ECO company has developed its own methodology for assessing profit margins, which is based on the specifics of the activities of each enterprise. This allows you to complete projects of any complexity.

In addition, you can seek help from SRG-ECO specialists at any stage, including before and after work, which will further facilitate the effective use of the results of the procedure.

Piece wage system

Piece payment does not depend on the time worked and is applied to employees whose work results can be assessed in qualitative material indicators.

At the same time, the salary does not depend on the time worked, but working time must be kept track of: you need to fill out a timesheet. And when working at night, such employees are paid at increased rates.

Nowadays, in small enterprises, such a system is often used to pay those who work from home (freelancers) or part-time, with a flexible schedule. How to properly register such employees? The organization must keep time records, and freelancers must not work more than 40 hours a week. The company cannot control this on its own. But you can issue an order obliging the employee to fill out a time sheet, and make an entry in the employment contract stating that he determines the working hours and work schedule independently. At the same time, he should not work more than the norm for the production calendar.

Let us give two examples of such calculations.

Example 1. Piece payment for quantity

The daily quota of baked cakes from a confectionery employee is 5 pieces. The daily rate for the tariff is 1,500 rubles. In one month, the employee baked 94 cakes.

Payment for 1 cake will be: 1,500 rubles / 5 cakes = 300 rubles per piece.

In this case, the monthly earnings of a confectioner will be: 300 rubles × 94 cakes = 28,200 rubles.

Example 2. Piecework payment according to time standard

The bakery employee has a set time limit for baking one cake - 96 minutes. The hourly tariff rate is 187.5 rubles. The pastry chef baked 110 cakes in a month.

Piece payment will be: 187.5 × 96 minutes / 60 = 300 rubles/cake.

Monthly earnings will be: 300 × 110 = 33,000 rubles.

Bonus (commission) wage system

This payment system is usually used for employees on whose work the company’s revenue directly depends. For example, for sales managers, sellers. With such a system, there is usually a small constant part (calculated based on work time), and there is a bonus part, which depends on the revenue in each specific month or on the total amount of issued/paid invoices for a particular sales manager.

We examined the main remuneration systems in their purest form. In practice, these systems are usually found with additions and changes, for example, time-bonus or piece-progressive. Employers themselves develop a payment system depending on the needs of their organization. The main thing is that employees are familiar with local regulations that describe the payment system, and understand what indicators their salary depends on and what parts it consists of.