Accountant for primary documentation: responsibilities and functions

Requirements for an accountant for primary documentation are criteria for selecting a specialist who deals with newly created and coming to the company accounting documents. The larger the enterprise, the wider the accounting staff. One deals with salaries, the other with budget payments, the third with inventory items... What does an accountant do with primary documentation? All newly received papers at the company pass through it. Let's look at this in detail.

Who can apply for the position of primary documentation accountant?

When selecting a specialist for the vacancy of an accountant based on primary documentation, the employer should pay attention to the following:

- the applicant has a diploma of education in the specialty “accounting, analysis and audit”;

- the applicant has a diploma of education in the specialty “economist” or “finance and credit” and a requalification document received upon completion of accounting courses;

- The applicant’s work experience is at least one year, as well as his experience working with primary documentation;

- the applicant’s knowledge of the regulatory legal framework of the Russian Federation on accounting issues;

- efficiency, communication skills, attentiveness, accuracy, perseverance, etc.;

- PC knowledge level - confident or advanced user.

The company's management has the right to independently supplement the list of requirements for the applicant depending on the specifics of the enterprise's activities, but all responsibilities must certainly be specified in the job description.

What kind of education is needed?

It is impossible to become an accountant without special education. To become a considered specialist and to efficiently perform your duties on primary documentation, you must have a special diploma. Where exactly can you get it?

You can study to become an accountant at economic universities. There are many faculties and specialties where one could master all the necessary information and scientific disciplines. There is another opportunity to get a diploma. This includes special courses that operate in almost any city in Russia (or another CIS country). They last much less time than studying at a higher educational institution. The duration of training here can be several months.

It is worth noting, however, that a university diploma is valued much more by employers. Thus, a person applying for a job can immediately receive the first or second professional category. Being a highly qualified specialist is truly prestigious, especially if it is an accountant for primary documentation. The duties and responsibilities, however, will be much higher for such a specialist.

Job description of an accountant for primary documentation

One of the personnel documentation documents is the job description. This local act plays a significant role in the organization of labor at any enterprise. It is possible to distribute responsibilities between accounting employees only with the help of it.

Top 3 articles that will be useful to every manager:

- How to choose a tax system to save on payments

- How to minimize taxes and not interest the tax authorities

- How to create an electronic signature quickly and easily

So, the job description of a primary documentation specialist must specify the service area and all the job duties that the employee will perform during the work process. It is also necessary to indicate the immediate supervisor, that is, the person who checks the results of work and controls the performance of duties. Most often this is the chief accountant or his assistant.

In addition, the job description of an accountant based on primary documentation must contain information about what he should be guided by in the process of work (regulatory framework, methodological material, recommendations, etc.). It is also necessary to indicate the skills, qualifications and theoretical knowledge that a specialist must have, because the quality of the work he performs directly depends on this. Another mandatory point is a description of the liability to which an employee may be held for poor performance or failure to fulfill duties.

What's happened?

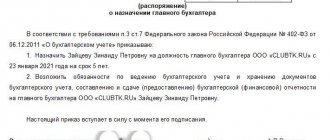

To date, the procedure for transferring cases to a new chief accountant upon dismissal of the previous chief accountant is not reflected in the current legislation. However, in order to reduce possible negative consequences, the organization must organize the transfer of affairs from the previous chief accountant to the new chief accountant. The procedure for transferring cases from the previous chief accountant to the new chief accountant occurs in several stages. When transferring cases from the previous chief accountant to the new chief accountant, the following algorithm should be followed:

- Step 1. Familiarization of the new chief accountant with the job description

- Step 2. Familiarization of the new chief accountant with the order to transfer affairs

- Step 3. Inventory of the organization’s property and liabilities

- Step 4. Checking the status of accounting and reporting

- Step 5. Acceptance - transfer of documents from the previous chief accountant to the new chief accountant

- Step 6. Obtaining clarification from the former chief accountant

- Step 7. Drawing up and signing the act of acceptance and transfer of cases

Job and functional responsibilities of an accountant for primary documentation

In order to competently prepare documentation, record it and work with the company’s clients, a primary specialist needs to know the following elements of the regulatory framework:

- the legislative framework of the Russian Federation regarding accounting, namely the main provisions of Federal Law No. 402 of December 6, 2011, accounting provisions;

- methodological recommendations, directions, instructions, comments and letters from authorized departments;

- standards and rules developed by the organization itself (accounting policies, charter, internal regulations, safety precautions, job descriptions, labor protection and any other working documents);

- rules for working with clients and counterparties;

- rules for conducting an inventory and generating a report on it;

- rules for working with PCs, software and hardware necessary for maintaining and recording primary documentation;

- rules for the formation of accounting entries and a chart of corresponding accounts;

- samples, blanks and forms of primary documentation and methods for their modification depending on the specifications of the enterprise and in accordance with the legislation of the Russian Federation;

- basic rules of office work.

A good specialist must have not only a large amount of knowledge, but also the ability to apply it in practice at the right time. In addition, one of the most important qualities of any accountant is attentiveness. After all, any mistake, even the most insignificant, can lead to irreversible consequences.

The work of an accountant with primary documentation involves a large number of responsibilities, and depending on the specifics of the enterprise’s activities, they may change, because management has the right to independently supplement them. But still, here is a list of responsibilities that is similar for all such specialists.

So, in the job description of a primary care specialist you can find the following points:

- Carrying out all business operations within the designated service area.

- Work with accompanying documents, their receipt, registration, accounting.

- Working with appropriate software, processing information and entering data into it.

- Development and addition of document forms, their execution - if necessary.

- Identification of violations in the primary document flow schedule and the procedure for submitting the necessary documents to the accounting department for its maintenance. Informing the manager about this.

- Participation in inventory taking. As a rule, this specialist becomes a member of the commission, provides the necessary archival data and generates a report based on the results of the inventory.

- Preparation of documents for submission to the archive.

In addition, the job description of a primary accountant can include the obligation to provide requested sets of documents by fiscal or other inspection authorities, analysis of information related to the work activity of this specialist, and many other functions at the discretion of management.

The first group of employee responsibilities

The presented specialist really has a huge number of responsibilities. It is unlikely that it will be possible to list them all in full. In addition, the functions of an accountant in different organizations can vary significantly or differ significantly. So, what does the employee’s job description prescribe? What exactly are the job responsibilities of an accountant?

- Functional responsibilities for conducting all types of financial transactions within the scope of one’s own qualifications.

- Processing of all existing documents (receipt, execution, certification and counting actions).

- Working with special programs and processing data using them.

- Development of new documentary forms, their execution and some other responsibilities.

All other employee functions will be discussed below.

Rights and responsibilities of an accountant regarding primary documentation

Any accountant works with inventory items, which only increases his share of responsibility.

Let's talk about the main types of sanctions imposed on a specialist for violations in the course of work:

- Disciplinary . This type of liability may arise for violation of labor discipline (absenteeism, tardiness, etc.). In this case, the employee can be punished with a fine, reprimand, deprivation of bonus, etc.

- Material . May occur in the event of damage to the organization's property. That is, what is considered here is a real decrease in property or deterioration in its condition. The fine in this case depends on the amount of damage; the employee is obliged to fully compensate for the damage.

- Administrative . Such liability may arise in case of failure to comply with the deadlines for submitting tax reports. Depending on the scale of the violation, a fine is imposed on the employee.

- Criminal . It provides for fines and imprisonment depending on the crime committed in the performance of work duties.

Primary accountant: pros and cons of the profession

Each profession is unique in its own way and has both pros and cons. This question is very subjective, because there are so many people, so many opinions. If someone likes concentrated work with numbers, then another likes surgery or cosmetology. It is quite difficult to highlight the advantages and disadvantages of working with the “primary”, but we will try to do it.

So, the disadvantages of this profession include:

- When applying for a job, the applicant must provide a large number of documents confirming his professional skills (educational diploma, certificates of completion of computer courses, advanced training courses, and many others).

- The average salary level for primary documentation accountants in the country is not too high, despite the complexity of this profession.

- Large amount of responsibilities.

The advantages of this profession include: demand (there are always not enough good specialists); comfortable working conditions (as a rule, accountants work in a bright and clean room); career prospects. And this is only a small part of the possible benefits. Surely every specialist will find many advantages for himself in this profession.

How to choose a good accountant video:

Specialist rights

It is obvious that Standard No. 1061n requires adjustments in terms of the right to send written demands to violating employees. So far, in most job descriptions drawn up on the basis of professional standards, the rights of an accountant according to the “primary” look like this:

Meanwhile, in paragraph 3.3 of the presented sample, it is quite possible to replace the word “request” with “require in writing”.