The value of account 26 in accounting Active account. 26 is used in accounting for enterprises of any industry

Definition 1 A tax return is a document (both written and electronic

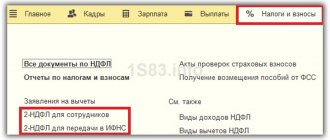

Help 2-NDFL is multifunctional and can be used at another place of work, in banks, the Federal Tax Service

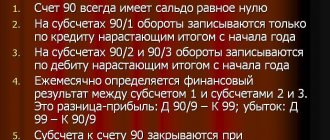

Accounting account 90 is an active-passive “Sales” account, used to reflect information related

STS (simplified taxation system) is a special type of tax regime that is valid throughout

How to keep records of building materials The specificity of working with building materials is that

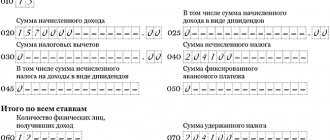

Income tax is imposed on the income of individuals received not only in cash, but also in

Article 161 of the Tax Code of the Russian Federation states: When selling goods (works, services), the place of sale of which is

We have until April 30 to submit a new 6-NDFL report. It is rented out by all organizations and

01/25/2016 34 550 23 Reading time: 7 min. Rating: Author: Konstantin Bely