Accounting When issuing wages with finished products or goods, make the following entries: Debit 70 Credit 90-1

The main reasons for writing off a computer Let's consider the main reasons for writing off computer equipment. The main reason for equipment write-off

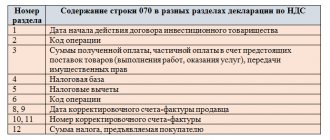

Purpose of line 070 in the VAT return From the huge mass of tax reports, the VAT return

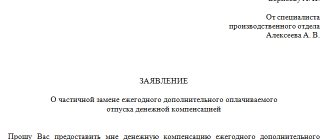

General concepts If the employee did not use the days provided for by law allotted to him for vacation, then

Home / Articles / How to withdraw the authorized capital during the liquidation of an LLC Published: 01/12/2018 Creating

List of works with a rate of 0% Transport services are subject to VAT at a rate of 0% for the reasons

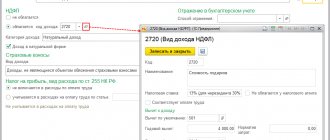

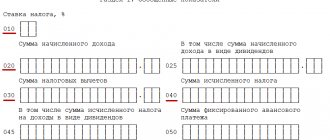

Personal income tax is a tax that citizens of the Russian Federation pay to the treasury on the income they receive. Employers are obliged

You know, Form 6-NDFL is a kind of experiment on the part of the Federal Tax Service on taxpayers.

Individual entrepreneurs are required to pay taxes and fees to the appropriate budgets, depending on the chosen

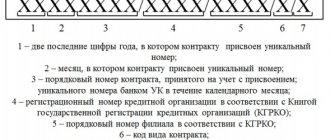

Currency control: what is the Criminal Code Until March 2021, instruction 138-I was in force, according to which