How to fill out line 120 RSV 1

In line 120 of DAM 1, section 1, information about additionally accrued insurance premiums from the beginning of the billing period is reflected, and they are deciphered in section 4 of the current calculation of DAM-1. Previously, because of such filling in line 120 RSV, the fund could fine the company. There shouldn't be any controversy now

18.11.2015

Filling out line 120 RSV 1

If the company shows additionally accrued contributions in the current calculation of the RSV-1 line 120 of section 1, the fund will not fine it. The Pension Fund of Russia announced this decision in a letter dated November 20, 2014 No. NP-30-26/14991.

Due to errors found in previously submitted contribution reports, it is necessary to submit an updated calculation. And in order to avoid a fine for underestimating contributions, before submitting the adjustment, you must pay the additional accrued difference and late fees (Clause 1, Article 17 of the Federal Law of July 24, 2009 No. 212-FZ). But in practice, funds accept the updated PFR RSV-1 form only until the 1st day of the third calendar month following the reporting period (PFR letter dated June 25, 2014 No. HII-30-26/795I). And if the company did not make it within this deadline, then the errors will need to be corrected along with the next calculation. And reflect additional contributions in line 120 of section 1 of the calculation with a breakdown in section 4.

The Fund unequivocally responded in the commented letter that with such correction of errors there are no grounds for a fine. The main thing is to fulfill two conditions. Firstly, before submitting the calculation, you must pay additionally accrued contributions, which are reflected in line 120 of RSV 1 2015, as well as calculate and transfer penalties. Secondly, it is necessary to have time to correct the error before the fund discovers it.

Filling out line 120 RSV 1 in 2021

After January 1, 2021, information for nine months must be clarified in the calculation for 2015. To do this, fill out section 6 with the type of adjustment “Correcting” or “Cancelling”. And additionally accrued contributions are shown in line 120 of the RSV 1 of section 1 and are deciphered in section 4.

At the same time, before the company corrects the inaccuracies, the fund can order an inspection and detect the errors itself. Then a fine is not excluded. Therefore, if a company has underestimated contributions, then it is worth paying them as soon as an error is discovered, and the reporting can be corrected later. The fine is calculated only from arrears arising due to an understatement of the base. And if the insured has overpaid, then there is no basis for holding him liable (resolution of the Federal Arbitration Court of the West Siberian District dated February 14, 2014 No. A27-5748/2013).

Newspaper “Accounting. Taxes. Right"

Subscribe Post:

Filling out section 4 of the RSV-1 Pension Fund form

Columns 3 and 4. So, if in the reporting period the company accrued additional insurance premiums (based on inspection reports or independently identified an error that led to an underestimation of the amount of insurance premiums), it must show the additional accrual of insurance premiums on line 120 of the RSV-1 Pension Fund form:

- for the insurance part of the labor pension (column 3);

- the funded part of the labor pension (column 4).

Columns 5 and 6. These columns are filled in by individual categories of payers who pay insurance premiums at an additional rate. They indicate:

- in column 5 - the amount of contributions accrued in accordance with Part 1 of Art. 58.3 of Law N 212-FZ;

- in column 6 - from part 2 of Art. 58.3 of Law No. 212-FZ.

Additional charges in columns 5 and 6 are reflected only for 2013, since insurance premiums at additional rates of 4 and 2% on payments to employees with special working conditions who are entitled to early retirement have been paid by insurers only since 2013 (clause 1 and 2 Article 33.2 of the Federal Law of December 15, 2001 N 167-FZ “On Compulsory Pension Insurance in the Russian Federation”).

Column 3 of line 121 reflects the amounts of additionally accrued insurance premiums from amounts exceeding the maximum base for calculating insurance premiums. Insurance premiums for compulsory pension insurance for amounts exceeding the maximum base for calculating insurance premiums are paid by insurers applying the basic tariff (Article 58.2 of Law No. 212-FZ). They began paying insurance premiums at a rate of 10% in 2012 (Part 1, Article 58.2 of Law No. 212-FZ). Consequently, additional accrual of insurance premiums from amounts exceeding the maximum base value is possible only starting from 2012.

Let us remind you that insurance premiums paid at a rate of 10% are intended only to form the solidary part of the tariff of the insurance part of the labor pension.

Note. Policyholders applying reduced insurance premium rates are exempt from paying insurance premiums at a rate of 10%.

Columns 4, 5, 6 and 7 of line 121 are not filled out by policyholders under any circumstances (this is not provided for by the PFR RSV-1 calculation form itself).

If the payer of insurance premiums independently accrued additional insurance premiums for 2012, including at the 10% rate, he must reflect this amount in the calculation of the RSV-1 Pension Fund for the current reporting period:

- in column 3 lines 121;

- column 6 section. 4.

When additionally accruing insurance premiums for 2011 or 2010, line 121 is not filled in, since in these years policyholders did not accrue contributions at the additional 10% rate.

Note. Limit values of the base for calculating insurance premiums

The maximum value of the base for calculating insurance premiums, established by Part 4 of Art. 8 of Law N 212-FZ, is indexed annually (from January 1 of the corresponding year) taking into account the growth of average wages in the Russian Federation.

In 2012, the maximum value of the base was 512,000 rubles. (Resolution of the Government of the Russian Federation dated November 24, 2011 N 974), in 2013 it is equal to 568,000 rubles. (Resolution of the Government of the Russian Federation dated December 10, 2012 N 1276).

Column 2. Payers of insurance premiums who filled out line 120 of section. 1 of the RSV-1 Pension Fund form, must also be filled out in section. 4 “Amounts of additionally accrued insurance premiums from the beginning of the billing period” (paragraph 4, clause 3 and clause 29 of the Procedure). At the same time, as a basis for additional accrual of insurance premiums in column 2 of section. They will indicate 4 RSV-1 PFR forms:

- 1 - when additionally accruing insurance premiums based on inspection reports;

- 2 - with independent additional assessment of contributions.

Note. If the policyholder’s situation does not apply to either the first or the second case (for example, the requirement to pay arrears in contributions was not sent to him based on the results of an audit), fill out section. 4 is not needed.

Fill out section 4 is needed only when the amount of contributions is adjusted, but the base for their calculation does not change. If the basis for calculating insurance premiums has changed, an updated calculation must be submitted. Additional charges with a minus sign in Sect. 4 are not reflected.

Example 1. In November 2012, the payer of insurance premiums submitted to the Pension Fund an updated calculation in the form of RSV-1 Pension Fund for the first quarter of 2012. During a desk audit of this calculation, the Pension Fund came to the conclusion that the organization was unlawful in calculating insurance premiums for 2012. applied reduced tariffs, which led to an underestimation of insurance premiums.

Based on the results of the inspection, an act dated January 21, 2013 was drawn up and a decision was made on February 19, 2013 to hold the insured accountable for violating the legislation of the Russian Federation on insurance premiums. Based on the decision of the organization, additional insurance premiums were accrued for 2012. How to reflect the additional accrued amount of insurance premiums in the calculation using the RSV-1 Pension Fund form?

Solution. Since the decision to hold the policyholder liable was dated February 19, 2013 (the deadline for submitting the calculation in the RSV-1 Pension Fund form for 2012 expired on February 15, 2013), the policyholder must show the additional accrual of insurance premiums for 2012 in the calculation for the first quarter of 2013 .

In this case, the amount of insurance premiums is adjusted, but the base for their calculation does not change. Therefore, the payer of insurance premiums must reflect the additional accrued amount of insurance premiums:

- on line 120 “Additional insurance premiums accrued from the beginning of the billing period” section. 1;

- line 121 “including from amounts exceeding the maximum base for calculating insurance premiums” section. 1. The policyholder did not have the right to apply a reduced tariff in 2012; accordingly, he must pay additional insurance premiums at a rate of 10% for payments in excess of the maximum base for calculating insurance premiums;

- in Sect. 4 “Amounts of additionally accrued insurance premiums from the beginning of the billing period.”

Note. The base for calculating insurance premiums is determined as the amount of payments and other remunerations provided for in Part 1 of Art. 7 of Law N 212-FZ, accrued by payers of insurance premiums for the billing period in favor of individuals, with the exception of the amounts specified in Art. 9 of Law No. 212-FZ.

Columns 3 and 4 sections. 4 RSV-1 forms of the Pension Fund are intended to reflect the period for which insurance premiums were identified and accrued.

Column 5 shows the amount of additionally accrued insurance premiums for the insurance part (total), and column 6 shows the part that is additionally accrued at a rate of 10% (in 2012 - for payments exceeding RUB 512,000).

Column 7 reflects the amount of additionally accrued insurance premiums for the funded part.

Columns 8 and 9 are intended to indicate additional accrued insurance premiums at an additional rate for certain categories of insurance premium payers. Column 8 shows the amounts accrued in accordance with Part 1 of Art. 58.3 of Law N 212-FZ, and in column 9 - in accordance with Part 2 of the same article.

Column 10 indicates the amounts of additionally accrued insurance premiums for compulsory health insurance.

“9 months” is an app for pregnant women and more.

For a favorable pregnancy, you need three components: healthy parents, a healthy obstetrician-gynecologist and a healthy application on your tablet or smartphone.

Features of the “9 months” application:

- monitor changes in the pregnant woman’s body and fetal development

- know the rights of a pregnant woman

- read advice for the expectant mother

- export the report in PDF format to e-mail or view it in iBooks (relevant for purchasing the Diary)

- The Diary section allows you to create notes and photos, sort data into categories and set reminders (in-app purchase)

- the “Directory” section will answer questions related to health (in-app purchase)

- “Vitamins” will guide you through products rich in them (in-app purchase)

- the “names” section will help you choose a name (in-app purchase)

“9 Months” is one of the optimal applications for pregnant women, which has a simple interface. After individual settings (weight, height, date of last menstruation), you will find out the duration of pregnancy and the expected date of birth. There are two types of pregnancy timing calculations: obstetric and embryonic. Obstetric - calculated from the first day of the last menstruation, it is used by the doctor, assuming the date of birth. The embryonic gestation period is usually two weeks shorter than the obstetric period (coinciding with the ovulation period) and may correspond to the date of conception. In the “9 months” application, the Obstetric gestational age is calculated.

In the settings, be sure to indicate your weight and height. These parameters are necessary to assess the normal weight gain of the expectant mother. In the second tab, you can regularly enter data about new numbers on the scales and compare them with expected values.

But let's look at the core of the application - the diagram. She is like a flower of life with four petals: “child”, “advice”, “mother” and “rights”. The core is a simplified image of the fetus for a visual understanding of its development (by the way, it corresponds to the gestational age).

The pink petal “child” will tell you about the size and weight of the baby and clarify the stage of development of internal organs. Sunny “advice” will provide guidance on possible deviations in the pregnant woman’s well-being, draw attention to a timely visit to the doctor and explain the reason. The red petal “mother” will tell about changes in a woman’s body during pregnancy. Everything is described clearly and without unnecessary terminology. “Are you still feeling nauseous and tired? Great! This is a sign that your body is responding normally to the developing pregnancy.” The blue petal of “right” will reassure you with legislative excerpts on the rights of a pregnant woman.

There is another free section available - “weight and height”. This is a visual chart of fetal development by week. The App Store states that the user can create weight and height charts, but this turned out not to be the case. Should we regard this as an indicator of the instability of the heart rate of the “9 months” application? No. You do not build anything yourself, do not enter data on the size of the fetus after the ultrasound. You simply visually monitor the dynamics of the baby’s development.

The remaining sections of the application are paid. It’s up to you to decide how necessary each of them is, but the developers claim that it is “Diary” that gives special value to the application. “With the help of a diary, you can forever remember the story of the birth of a new life.”

review author: Anna Fedotova

Who submits the payment, when and on what form?

Absolutely all employers are required to submit calculations of insurance premiums:

- Companies, their branches and separate divisions (if these separate divisions independently calculate and pay contributions) “surrender” to the Federal Tax Service at the place of registration or business (clause 7 of Article 431 of the Tax Code of the Russian Federation).

- Individual entrepreneurs and self-employed people - to the inspectorate at the place of registration (registration).

If there were no accruals during the reporting period, you are required to submit a zero calculation by filling out the required sections and applications. This will allow tax authorities to distinguish those organizations that did not have accruals from those that forgot to submit calculations (for entrepreneurs, such an obligation is not established by law).

The deadline for submitting the DAM is set by the Tax Code of the Russian Federation on the 30th day of the month following the reporting quarter. Based on the results of 9 months of 2018, you must report no later than October 30. This is a working Tuesday, and therefore there will be no rescheduling.

If the DAM is submitted 10 days later than the established deadline, the tax authorities have the right to block the current account (clause 3.2 of Article 76 of the Tax Code of the Russian Federation). The same trouble threatens the policyholder who submitted the calculation on time, but with erroneous information: the tax authorities will not accept the report, and it will be considered not submitted.

The RSV form did not change in the 3rd quarter. The calculation is still submitted in the form approved. By order of the Federal Tax Service of October 10, 2016 N ММВ-7/11/551. Let's look at how to fill it out correctly.

Procedure for registration of DAM: general requirements

The report consists of 3 sections and 24 sheets, which display information about all insurance premiums, except for “accidental” ones. But you only need to fill out those that are mandatory and for which you have indicators.

Let's consider who should fill out which sheets when preparing reports for 9 months of 2021.

| Sheet | Is it necessary to fill out | Who fills it out |

| Title | Yes | All policyholders |

| Sheet “Information about an individual who is not an individual entrepreneur” | No | Only individuals who are not registered as entrepreneurs |

| Section 1 | Yes | All |

| Annex 1 | Yes | Subsections 1.1 and 1.2 - filled out by all policyholders, Subsections 1.3, 1.3.1., 1.3.2, 1.4 are completed only if there are payments of contributions for additional tariffs |

| Appendix 2 | Yes | All employers indicate information about insurance premiums in case of temporary disability and maternity |

| Annexes 3 and 4 | No | Fill out only those employers who paid sick leave benefits in the reporting period |

| Appendix 5 | No | Filled out by IT firms that have the right to apply reduced tariffs |

| Appendix 6 | No | They are drawn up by simplifiers who have the right to apply reduced tariffs in accordance with paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation |

| Appendix 7 | No | NPOs engaged in activities named in paragraphs. 7 clause 1 art. 427 of the Tax Code of the Russian Federation, which allows you to pay contributions at reduced rates |

| Appendix 8 | No | Businessmen apply for a patent, with the exception of those who work in catering, retail or rent out real estate |

| Appendix 9 | No | Designed for those employers who pay income to foreigners and/or persons temporarily staying in the Russian Federation |

| Appendix 10 | No | Issued only in relation to payments to students working in student teams under a GPC or labor agreement |

| Section 2 and Appendix 1 | No | Only heads of peasant farms in relation to contributions for themselves and members of the farm |

| Section 3 | Yes | Employers record pers. information on all hired persons |

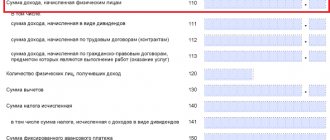

Filling out lines 120 and 121 of section 1 of the RSV-1 calculation of the Pension Fund of Russia (fragment)

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Additional insurance premiums accrued since the beginning of the billing period, total | 120 | 4908,00 | 636,75 | 0 | 0 | 962,65 |

| including from amounts exceeding the maximum base for calculating insurance premiums | 121 | 653,01 | X | X | X | X |

Sample 2

| N p/p | Grounds for additional assessment of insurance premiums | The period for which insurance premiums were identified and accrued | Amount of additionally accrued insurance premiums (RUB kopecks) | ||||||

| insurance contributions for compulsory pension insurance | insurance premiums for compulsory health insurance | ||||||||

| year | month | insurance part | accumulative part | at an additional rate for certain categories of insurance premium payers | |||||

| Total | including from amounts exceeding the maximum base for calculating insurance premiums | in accordance with Part 1 of Article 58.3 of the Federal Law of July 24, 2009 N 212-FZ | in accordance with Part 2 of Article 58.3 of the Federal Law of July 24, 2009 N 212-FZ | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 1 | 1 | 2011 | 2 | 3210,00 | 0 | 0 | 0 | 0 | 629,65 |

| 2 | 2 | 2012 | 10 | 1698,00 | 653,01 | 636,75 | 0 | 0 | 333,00 |

| Total accrued | 4908,00 | 653,01 | 636,75 | 0 | 0 | 962,65 |

If, according to an inspection report dated, for example, June 2013, the decision to hold the policyholder liable came into force in July 2013, additional accrued insurance premiums must be reflected in the PFR RSV-1 calculation for 9 months of 2013.

N.A. Yamanova

Scientific editor

magazine "Salary"

How to fill out section 1 and the required attachments to it

You should start filling out the calculation from Appendix 1 to Section 1, dedicated to contributions to the Pension Fund. It consists of subsections:

- mandatory to fill out - 1.1 and 1.2;

- filled in if there are indicators (calculation of contributions for additional tariffs) - 1.3 and 1.4.

Subsection 1.1 of Appendix 1 to Section 1

Let's consider a line-by-line algorithm for filling data.

| Line | What to indicate |

| 010 | Number of insured persons - total from the beginning of the year and monthly breakdown for the last quarter |

| 020 | Number of employees who received insurance premiums |

| 021 | Number of workers whose income exceeds the marginal base |

| 030 | The amount of employee income on which insurance premiums are calculated, from the beginning of the year, for 3 months and on a monthly basis. Don't forget to exclude non-taxable payments, for example, under a lease agreement |

| 040 | The amount of income not subject to insurance contributions, for example, compensation or hospital benefits. For a complete list of such income, see Art. 422 Tax Code of the Russian Federation |

| 050 | Difference between page 030 and 040 |

| 051 | An amount exceeding the maximum base for calculating contributions |

| 060 | The calculated amount of insurance premiums (multiplying the data on line 050 by 22%) |

| 061, 062 | Breakdown of the amount of assessed contributions, calculated from amounts not exceeding the maximum base and exceeding it |

Subsection 1.2 of Appendix 1 to Section 1

Fill out subsection 1.2 in the same way, but only for health insurance contributions. The subsection is required to be filled out, even if you apply a reduced tariff of 0%.

Appendix 2 to section 1

Social insurance contributions are calculated here. In this case, enter the appropriate code in page 001:

- 1 - if you work in the region where the Social Insurance pilot project is being conducted, i.e. if Social Insurance pays sick benefits directly to employees;

- 2 - if you calculate and pay benefits yourself, and pay with the Fund by offset.

Fill in lines 010-050 with the relevant information from subsection 1.1. Complete lines 051-054 only if you belong to the organizations listed there.

To fill out line 060, multiply the values of line 050 by the tariff of 2.9%. On page 070, indicate the amount of costs for paying benefits, and on page 080, the amounts reimbursed by Social Insurance. These lines are filled in only by those policyholders who indicated the value “2” on page 001.

If your company does not participate in the pilot project, then the amount of contributions can be reduced by the amount of benefits. Record these indicators on page 090.

The indicators on page 090 are always positive, even if contributions to the fund exceeded the amount of calculated insurance premiums. If the program automatically fills in a line with negative indicators, this will be considered an error and the calculation will have to be clarified (letter of the Federal Tax Service dated August 23, 2017 No. BS-4-11/16751).

To indicate negative values, put the value “2” in the “sign” field on page 090. If the amount of contributions is due, record the code “1”.

Section 1

Now you can fill out section 1. It contains the OKTMO code according to the territorial place of registration of your company, as well as budget classification codes (KBK) for the calculated amounts of insurance premiums. BCCs consist of 20 characters and should be checked especially carefully. After all, if a payment is submitted with incorrect codes, payments and charges will end up in different personal accounts. At the same time, an overpayment on one card and an underpayment on another will appear in the tax database, which threatens the accrual of penalties. To make adjustments, you will have to submit an amendment.

Check the codes for each type of insurance premium:

- pension insurance (PPI) - 182 1 0210 160;

- medical insurance (CHI) - 182 1 0213 160;

- social insurance (OSS) - 182 1 0210 160.

In this section, also indicate the amount of contributions by type of insurance for 9 months of 2021 and broken down by month. Check that negative values are not automatically transferred to pages 110-123.

On filling out calculations for insurance premiums, taking into account the costs of sick leave payments

To calculate the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, Appendix No. 2 to Section 1 of the calculation is intended.

The corresponding columns on line 080 of the application reflect the amounts of the payer's expenses for the payment of insurance coverage reimbursed by the territorial bodies of the FSS of the Russian Federation.

When filling out line 090 for each month of the reporting period in which the amount of expenses incurred did not exceed the amount of calculated insurance premiums, code “1” is indicated in the “attribute” column, and if expenses exceed the amount of calculated insurance premiums, the attribute “2” is set.

It is also indicated that if expenses exceed the amount of calculated insurance premiums as a whole for the last three months of the reporting period, column 4 of line 090 also reflects attribute “2”.

The procedure for transferring the specified data to section 1 of the calculation is reported:

Attention is drawn to the fact that in section 1 of the calculation, it is not allowed to simultaneously fill in line 110 “Amount of insurance premiums payable for the billing (reporting) period” and line 120 “Amount of excess expenses over calculated insurance premiums for the billing (reporting) period.”

Question: About filling out Appendix No. 2 to section. 1 Calculations for insurance premiums.

Answer:

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

THE FEDERAL TAX SERVICE

LETTER

dated April 9, 2021 N BS-4-11/ [email protected]

The Federal Tax Service reviewed the request dated March 19, 2018 regarding filling out Appendix No. 2 to Section 1 of the calculation of insurance premiums (hereinafter referred to as the calculation) and reports the following.

In accordance with the Procedure for filling out the calculation of insurance premiums, approved by order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11 / [email protected] (hereinafter referred to as the Procedure), Appendix No. 2 to Section 1 of the calculation is intended for calculating the amounts of insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity.

According to clause 11.14 of the Procedure on line 080 of Appendix No. 2 to Section 1 of the calculation of the amount of the payer’s expenses reimbursed by the territorial bodies of the Federal Social Insurance Fund of the Russian Federation for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity for periods starting from January 1, 2021, are reflected in the columns corresponding to the month in which the reimbursement was actually made.

At the same time, according to paragraph two of clause 11.15 of the Procedure, when filling out line 090 for each month of the reporting period in which the amount of expenses incurred did not exceed the amount of insurance premiums calculated by the payer, code “1” is indicated in the “attribute” column, and if expenses exceed the amount calculated insurance premiums are set to “2”.

If the costs incurred by the payer for the payment of insurance coverage exceed the amount of calculated insurance premiums as a whole for the last three months of the reporting period, column 4 of line 090 also displays attribute “2”.

Data from line 090 of Appendix No. 2 to section 1 of the calculation is reflected in section 1 of the calculation:

The mechanism for offsetting the amounts of expenses incurred towards the payment of insurance premiums in case of temporary disability and in connection with maternity is provided for in the structure of the calculation form and the Procedure for filling it out.

It should be taken into account that in accordance with clause 5.21 of the Procedure in section 1 of the calculation, it is not allowed to simultaneously fill in line 110 “Amount of insurance premiums payable for the billing (reporting) period” and line 120 “Amount of excess expenses over calculated insurance premiums for the billing (reporting) period” period".

Moreover, if the amount of expenses incurred by the payer for the payment of insurance coverage exceeded the amount of calculated insurance premiums, then the payer can offset the specified difference against upcoming payments for this type of compulsory insurance both within the reporting period and at its end.

Thus, the amounts of reimbursed expenses are reflected in the submitted calculation for the reporting period in relation to the month in which the territorial bodies of the Federal Insurance Service of the Russian Federation made the specified reimbursement, regardless of the period in which these expenses for the payment of insurance coverage were incurred.

Valid

state councilor

Russian Federation

2 classes

S.L.BONDARCHUK

Algorithm for filling out section 3

Here you should display individual information for each employee:

- FULL NAME;

- SNILS;

- TIN;

- day, month and year of birth;

- country of citizenship code, for Russians - 643;

- floor;

- details of the employee's identity document.

On pages 160-180, enter the value “1” if the employee is insured in the compulsory insurance system, or “2” if he is not insured.

Enter the value “1” even if you calculate insurance premiums at a 0% rate, since employees are insured in the insurance system.

On page 190, write down the month number. In the 3rd quarter it is July - 07, August - 08, September - 09.

On page 200, indicate the code of the insured person by selecting it from Appendix 8 to the procedure for filling out the calculation. For hired workers, this is the value of “HP”.

On pp. 210-240, record the amount of income accrued to the employee and the amount of insurance premiums for mandatory pension insurance.

If you recalculated payments to employees for previous periods, reflect all recalculations in the updated calculation. If you show them in the current calculation and section 3 includes negative values, then the pension fund specialists will not be able to post the information to individual accounts of individuals and the tax authorities will require you to submit an updated calculation.

You can fill out the RSV.

From theory to practice

Let us show the completion of lines 120 and 121 of section. 1 and sec. 4 RSV-1 Pension Fund forms as an example.

Example 2. In 2013, the Pension Fund conducted an on-site inspection of the correctness of calculation, completeness and timeliness of payment (transfer) by the organization of insurance contributions for compulsory pension and compulsory health insurance for the period from January 1, 2010 to December 31, 2012.

Based on its results, an act dated 03/04/2013 N 150023300001138 was drawn up and a decision dated 04/01/2013 N 015 023 12 RK 0001011 was drawn up to hold the organization accountable for violating the legislation of the Russian Federation on insurance premiums.

Note. A certificate of identification of arrears from the payer of insurance premiums (form 3-PFR) was approved by Order of the Ministry of Health and Social Development of Russia dated December 7, 2009 N 957n.

In accordance with this decision, the organization accrued additional insurance premiums for the first quarter of 2011 in the amount of 3839.65 rubles, including:

- 3210 rub. — for the insurance part of the labor pension;

- RUR 629.65 - for compulsory health insurance.

In addition, in March 2013, the Federal Social Insurance Fund of the Russian Federation did not accept benefits paid in October 2012. In connection with the restoration of benefit amounts, the organization accrued additional insurance contributions, including to the Pension Fund of the Russian Federation (2,987.76 rubles) and the Federal Compulsory Compulsory Medical Insurance Fund (333 rubles). .).

How to reflect the additional accrual of insurance premiums for both cases in the calculation using the PFR form RSV-1?

Solution. The organization must reflect the additional accrual of insurance premiums in the calculation for the first half of 2013 as shown in the samples on p. 34.

Sample 1

How to check the report

Before sending to the Federal Tax Service, check the RSV with form 6-NDFL. Tax officials will do the same during a desk audit. And if the values do not agree, they will ask for explanations about the reasons for the discrepancies.

For self-control, check the amount of income, excluding dividends, in 6-NDFL with the indicators on page 050 of subsection 1.1 to section 1 of the DAM form. According to the explanations of the tax authorities, the base subject to personal income tax must exceed or be equal to the base subject to insurance contributions. The formula that tax authorities rely on is given in the control ratios (CR) approved. by letter of the Federal Tax Service dated December 29, 2017 No. GD-4-11/27043

If the COPs do not agree, tax authorities may decide that the base in 6-NDFL is underestimated and the tax has not been paid in full.

But there are situations when income tax and contributions are recognized in different reporting periods, for example, if the payment is carryover.

Let's explain with an example.

The employee was paid vacation pay on Monday, October 1, and accrued on Friday, September 28. The amount of vacation pay should be included in page 050 of subsection 1.1 of section 1 of the DAM form for 9 months of 2018 (clause 1 of article 424 of the Tax Code of the Russian Federation).

In turn, the date of receipt of income in the form of vacation pay for the purpose of calculating personal income tax is the day of payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Since the tax was withheld already in the 4th quarter, the amount of vacation pay will fall into the annual 6-personal income tax.

If you have a similar situation and the tax authorities ask for clarification, write a letter that there is no error, since the payment for contributions was recognized in the 3rd quarter, and for personal income tax - in the 4th.

A similar situation arises with the payment of holiday, annual and quarterly bonuses. Contributions are calculated on the day the premium is calculated, and the date of payment does not matter (letter of the Ministry of Finance dated June 20, 2017 No. 03-15-06/38515).

But for personal income tax, the date of withholding tax on bonuses (except for monthly ones) is the day of payment to the employee (letter of the Federal Tax Service dated October 6, 2017 No. GD-4-11/20217). Therefore, if a bonus is assigned in the 3rd quarter and paid in the 4th, then it will appear in the reports in different periods.

The situation is different with the monthly bonus. It is recognized as income for personal income tax on the last day of the month (clause 2 of article 223 of the Tax Code of the Russian Federation). Therefore, even if it was paid in the 4th quarter, it should be recorded in the RSV and 6-NDFL for 9 months.

Payments to “physicists” under the GPC agreement are also recognized as transferable. For contributions, the date of accrual of remuneration is important, and for personal income tax - the day of payment. They may fall on different reporting periods and, therefore, be reflected in different reports.

The difference may also arise due to different approaches to calculating personal income tax and contributions.

For example:

| Type of income | Personal income tax | Contributions |

| Cash gifts | Personal income tax is calculated on amounts exceeding 4 thousand rubles. (Clause 28, Article 217 of the Tax Code of the Russian Federation) | Gifts for the purposes of calculating insurance premiums are not considered income, regardless of the amount, and are not reflected in the DAM (letter of the Ministry of Finance dated January 20, 2017 No. 03-15-06/2437) |

| Compensation for delayed wages | Not subject to personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation) | It’s safer to charge contributions: officials insist on this (letter from the Ministry of Finance dated March 21, 2017 No. 03-15-06/16239) |

If the tax authorities ask questions, in an explanatory letter write down a list of payments from which contributions and income tax were calculated differently. To exclude possible claims, we recommend providing a detailed justification with references to letters from officials and norms of the Tax Code of the Russian Federation.