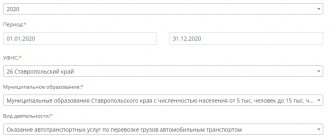

List of works with a rate of 0%

Transport services

VAT

at a rate of 0% on the grounds listed in clause 1 of Art. 164 Tax Code of the Russian Federation:

- location of loading/unloading points outside the territory of Russia (this condition applies to all types of transport: sea, river, air, rail and road);

- transportation of natural resources (oil, gas) in Russia and abroad;

- transport services for goods in transit;

- cargo and passenger transportation with points of departure and destination outside the country;

- turnover from commuter trains (until December 2016);

- air transportation from the territory of Crimea and Sevastopol until December 31, 2015.

For services provided outside the territory of Russia, legislation establishes requirements for the submission of documents (copies) confirming the right to a zero rate:

- contracts certifying the terms of the transaction;

- a certified list or the shipping documents themselves;

- customs documents or their signed list.

The specified package must be submitted to the tax authorities no later than 180 days from the date of passage of transport documents through customs, this is stated in paragraph 9 of Art. 165 Tax Code of the Russian Federation. If there is no confirmation of the right to a zero rate, the taxpayer will have to pay VAT at the usual rate of 18%.

Payment for cargo transportation with or without VAT

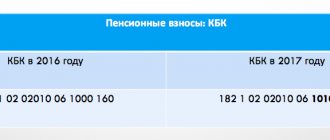

The VAT rate for individual entrepreneurs (individual entrepreneurs) and organizations can be calculated at rates of 0.10 or 20%. The application of a specific rate depends on what cargo is transported, by what transport, from where, what destination, etc.

For example, international transportation, as well as outside the Russian Federation with landing in Russia, and transit operations may be subject to a zero tariff. The right to apply zero percent must be confirmed by submitting documentation. Sometimes you can refuse to use this tariff. A rate of 20% is used in cases where it is not possible to apply a zero percentage or a tariff of 10%.

To confirm the availability of benefits, you need to submit documents. Their list may vary depending on the type of operation. If international transportation was carried out, a contract for the provision of services and transport documents will be required. If the transportation involved an aircraft with landing in the Russian Federation and subsequent departure, a register of transportation documents is needed.

When performing a transit operation, you need a contract for the provision of services, TD, and shipping documents. If you submit documentation late, you will need to pay a fee of 20%.

When do you need to pay 10% of the cost of transport work?

For Russian air carriers in the period from 04/07/2015 to 12/31/2017, a preferential VAT regime of 10% was established. It was introduced by paragraphs. 1 and 6 tbsp. 3 Federal Law “On Amendments to Ch. 21 Tax Code of the Russian Federation" dated 04/06/2015 No. 83-FZ.

For air traffic with Sevastopol and the territory of Crimea, in terms of VAT, transport services

had an even stronger relaxation - a 0% rate. However, it was in force from 03/18/2014 to 12/31/2015. Starting this year, this region is subject to a 10% tax rate.

Consignment note

Along with the TN, a consignment note (Bill of Lading) is used. A standard form is provided for the consignment note (form 1-T). It was approved by Rosstat Resolution No. 78 of November 28, 1997.

This invoice is issued if the selling organization must deliver goods to the buyer’s warehouse.

TTN consists of two sections:

- commodity, which serves to write off inventory items from shippers and capitalize them from consignees;

- transport, which determines the relationship between shippers - customers of vehicles and organizations - owners of vehicles and serves to account for transport work and payments for cargo transportation services.

The product section is filled out by the seller (shipper). The transport section is filled out by the seller and a representative of the transport organization.

Cases of application of the standard rate of 18%

With the exception of the above situations, paragraph 3 of Art. 164 of the Tax Code of the Russian Federation obliges all taxpayers, when using the main tax collection system, to impose VAT on transport services

at the rate of 18%.

With regard to transportation for foreign companies that do not have branches in Russia, but transport goods from points of departure and destination on its territory, domestic carriers are required to pay tax at the usual rate of 18% (subclause 4.1, clause 1, article 148 of the Tax Code of the Russian Federation). Foreign carriers providing services to domestic companies within the country pay tax under the same conditions.

IMPORTANT! In such situations, an enterprise using the services of foreign companies acts as a tax agent. The basis for this is that the place where the service is provided will be determined by the customer, and accordingly, taxes must be transferred to the budget of the Russian Federation.

Transportation can be carried out either as part of a regular sales contract or as the subject of a separate transaction for an intermediary company. The subtlety is that it is impossible to deduct VAT from such transactions if it is paid in full by the buyer of the product. As a substantiation of this point of view, one can cite the letter of the Ministry of Finance of Russia dated 02/06/2013 No. 03-07-11/2568. The intermediary uses only the amount of his remuneration as a tax base (letter of the Ministry of Finance of Russia dated December 29, 2012 No. 03-07-15/161).

When carrying out intermediary operations in the field of freight and passenger transport, the seller is also a service provider, and therefore he must issue a separate invoice not only for his own product sold, but also for the transport work performed. Moreover, in line 2 of the specified document, he must write down as the service provider the transport company that actually provides it, and not the name of his company. This is clearly stated in the rules for filling out invoices.

Even if, when fulfilling an intermediary contract, an enterprise acting on a simplified taxation system acts as an agent, it is still responsible for calculating and transferring VAT to the budget.

Intermediary activities of the forwarder

When a freight forwarder engages third parties to perform work, such work is of an intermediary nature. Therefore, the work of the forwarder in such cases is regulated by the rules on commission and agency relations. Freight forwarders have the right to issue clients the necessary documents, including invoices with an allocated VAT amount.

In order to confirm the intermediary nature of forwarding activities, the following conditions must be met:

- Drawing up an agreement that indicates on whose behalf subsequent contracts for the transportation of goods are concluded - on behalf of the client himself or the forwarder. Separately, it is worth specifying the expected amount of remuneration for the services offered. Independently taking on additional functions without notifying the client may not be considered an intermediary activity.

- In addition to the contract, it is necessary to have forwarding documents, such as: an order to the forwarder indicating the fulfillment of conditions and work within the framework of the transportation of goods, a receipt confirming the fact of acceptance and transfer of goods, warehouse records for the shipment of goods.

Which transport services are exempt from VAT?

As it says sub. 5 clause 1.1 art. 148 of the Tax Code of the Russian Federation, if the point of departure and the point of acceptance of cargo is located outside the territory of Russia, transportation operations are not subject to taxation and are not included in the VAT calculation base. In Art. 149 of the Tax Code of the Russian Federation, a similar benefit applies to the transportation of passengers by public transport.

The VAT benefit fully applies to carriers under simplified tax regimes. So, in Art. 346.11 of the Tax Code of the Russian Federation clearly states that there is no obligation for payers of the simplified tax system to calculate and pay VAT. In such a situation, transport services of entrepreneurs and companies are not subject to taxation.

Subject to compliance with the requirements of sub. 5 p. 2 art. 346.26 of the Tax Code of the Russian Federation, namely, if they own no more than 20 units of equipment, carriers are allowed to calculate and pay a single tax on imputed income. By selling UTII, the company is also exempt from obligations to pay VAT.

Working as an individual entrepreneur with VAT: pros and cons

An entrepreneur has the right to independently establish the optimal taxation regime for his activities. Often individual entrepreneurs use special regimes, for example, simplified taxation system, PSN and UTII, which allow them not to pay value added taxes. However, in some cases, a fee has to be paid, or the individual entrepreneur must work for OSNO, if the use of special regimes is prohibited.

The rate for this payment may vary depending on what transactions are carried out. If an entrepreneur works for OSNO, he must keep a book of purchases and sales. Payments are settled every quarter. A person must file their taxes on time.

There are some pros and cons of working with VAT. Main advantages for individual entrepreneurs:

- Possibility of cooperation with large contractors.

- Possibility of tax deduction.

The main disadvantage of working with this fee on OSNO is the complex calculation. But if you work without this payment, the businessman becomes less competitive, and there is a risk that potential partners will refuse to work together. Entrepreneurs on OSNO are often more thoroughly checked by tax authorities.

***

The list of works performed by transport companies is quite wide. The tax rate and the availability of the object of taxation largely depend on where the consumer of the service is located (outside or on the territory of the Russian Federation).

When providing transport services, it is possible to use tax rates of 0, 10 and 18%. The use of a rate other than 18%, or a complete exemption from the calculation and payment of tax, must be documented by the enterprise.

Similar articles

- In what cases are educational services not subject to VAT?

- Features of taxation of consulting services VAT

- VAT rates on food products - list of products

- UTII: cargo transportation and transport services in 2021

- Provision of transport services OKVED

TN or TTN?

Can only a TTN be a document confirming transportation?

The Ministry of Finance believes that issuing a TTN alone is not enough. The basis is paragraph 2 of Article 785 of the Civil Code of the Russian Federation, which states that the TN is the appropriate document confirming the conclusion of a transportation agreement (see, for example, letter of the Ministry of Finance dated April 30, 2013 No. 03-03-06/1/15213).

As for the VAT deduction on purchased goods, one tax mark is also clearly not enough; you will need a tax bill or another primary document, for example, a TORG-12 invoice.

However, if you have a properly executed waybill (TN) and consignment note (TORG-12) for documentary evidence of expenses in the form of the cost of the goods sold (purchased) and the costs of its delivery, the consignment note may not be required at all (see letter from the Federal Tax Service of Russia on Moscow dated September 27, 2011 No. 16-15 / [email protected] ).

How to issue an invoice from an individual entrepreneur to a legal entity

An entrepreneur should create a form for payment to a legal entity if the contract does not contain enough materials about the transaction:

- volume of shipped products (services);

- their price;

- period of fulfillment of obligations under the contract.

Sometimes the parties indicate in the agreement the general principles of the transaction. Formation of a form for mutual settlements is mandatory. If money needs to be transferred to the manufacturer urgently, then an invoice is issued and the contract is signed later.

How to issue an invoice from an individual entrepreneur to an individual

How to issue an invoice from an individual entrepreneur for payment? Business owners can provide services and sell goods to ordinary citizens who are not registered as business entities. The payment form is sent to the individual. The document must contain the buyer's full name and address information.

An individual can pay for goods (services) supplied at a bank branch by transferring money to the supplier. The online banking functionality will help you send funds to the manufacturer of products (services) from any convenient location.

Example of an account for an individual

Purpose and contents of the account

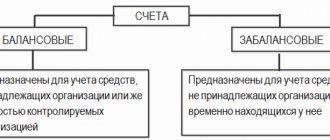

An invoice is the basis for payment for products or services provided by an entrepreneur or legal entity. The form contains details for transferring money to the seller. The payment document can be issued to a partner with whom a contractual relationship has been concluded or without one.

Sample payment form

The document must contain the following materials:

- information about the seller (name of individual entrepreneur, address, individual tax number, checkpoint);

- information about the buyer (name of individual entrepreneur, organization, address information, tax number, checkpoint);

- shipped products and services, their quantitative characteristics, price;

- amount to be paid;

- bank account details of the supplier for transferring money;

- date of creation of the form.