On June 14, 2021, the State Duma adopted in the third (final) reading bill No. 1040802‑6 “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the transfer to tax authorities of powers to administer insurance contributions for compulsory pension, social and medical insurance " In addition to regulating the new powers of tax authorities to administer insurance premiums, this bill makes significant changes to Chapter. 26.2 Tax Code of the Russian Federation.

Increased the amount of income for the transition to the simplified tax system

Organizations and individual entrepreneurs can change their tax system to the simplified tax system. You can switch to the “simplified” system from the beginning of next year (clause 1 of Article 346.13 of the Tax Code of the Russian Federation). To switch to the simplified tax system, you must submit an application to the Federal Tax Service by December 31 in form No. 26.2-1, approved. by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/829. Also see “Moving from “imputation” to “simplified””.

However, it was previously provided that if an organization wants to switch to the simplified tax system from the new year, then its income for 9 months of the previous year should not exceed 45 million rubles excluding VAT, increased by the deflator coefficient (clause 1 of article 248, clause 2 of article 346.12 Tax Code of the Russian Federation).

For 2021, the deflator coefficient was determined as 1.329 (Order of the Ministry of Economic Development dated October 20, 2015 No. 772). Accordingly, if an organization wanted to switch to the simplified tax system from 2021, then its income for January – September 2021 should not exceed 59,805,000 rubles. (45,000,000 × 1.329).

In 2021, the situation is changing. The indicated limits have been increased. In paragraph 2 of Article 346.12 of the Tax Code of the Russian Federation, a fixed value is fixed - 112.5 million rubles. Therefore, organizations will be able to switch to the “simplified” system from 2021 if their income for 9 months of the previous year did not exceed 112.5 million rubles. Moreover, the deflator coefficient will be suspended until January 1, 2021. Accordingly, there is no need to apply a deflator to 112 million rubles.

The new limit (112.5 million rubles) can be applied from 2021. Accordingly, if an organization wishes to switch to the simplified tax system from 2018, then its income for January – September 2021 will not have to exceed 112.5 million rubles. It turns out that more organizations will be able to switch to the “simplified” system from 2021. Please keep in mind that individual entrepreneurs have the right not to take into account the restrictions on limits in order to switch to the simplified tax system. The increase in the said limit is provided for by Federal Law No. 401-FZ of November 30, 2016 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation.”

Income tax

Starting next year, the concept of economically justified costs will be introduced (clause 2 of article 130 of the Tax Code of 2017). According to our estimates, this is the most dramatic change in the Tax Code next year. Costs taken into account when taxing profits must be economically justified.

A list of expenses has been determined that, starting from 2021, cannot be included in taxation.

1. Expenses are not taken into account when calculating taxes if the fact of receipt of goods, performance of work, provision of services, or transfer of property rights is not established.

For example, organization “M” issued invoices to organization “P”. The purchase price of goods indicated therein is taken into account by “P” as part of expenses. VAT is accepted for deduction.

However, in fact, the movement of these goods from the warehouse of organization “M” to the warehouse “P” did not take place. This is confirmed by evidence collected by the tax authorities (for example, testimonies of drivers, information from the BelToll system that the goods declared in the invoices were moved in transport). Therefore, in 2017, organization “P” cannot take into account the costs of purchasing these goods (their purchase price) when calculating taxes.

Screenshot of a YouTube video

Essentially, this rule is still applied within the framework of Decree No. 488 dated October 23, 2012 “On certain measures to prevent illegal minimization of tax liabilities” by declaring documents accompanying the transaction to have no legal force. That is, a document can have legal force only if the business transaction described in it is actually completed.

2. You cannot include the amount of remuneration paid to an individual entrepreneur as an expense if he is an employee of the organization and these works (services) relate to his job responsibilities.

For example, an individual entrepreneur provided organization “I” with services for promoting goods. At the same time, the entrepreneur works at 0.25 times the salary as a sales manager in the same organization. His job responsibilities as a sales manager are identical to the terms of the service agreement concluded with this employee as an individual entrepreneur.

as payments for work and services provided for it are not included in taxation

- The performer of works/services is the founder of the company (payer) that ordered these works/services

- Or if the payer is the founder of the contractor from whom he orders the work/services. Moreover, the performance of such work/services falls under the responsibilities of an employee who is in an employment relationship with the payer

- Exception: joint stock companies

For example, the co-founder of M LLC, as an individual entrepreneur, entered into an agreement with M LLC for the provision of management services for this company. The individual entrepreneur is paid a monthly remuneration in the amount of 10,000 rubles.

The main feature of the expenses listed above is that they have an unrealistically high cost, several times higher than the costs of similar services on the market.

In addition, the work performed and services provided are included in the job responsibilities of a full-time employee who works at M LLC.

What to pay attention to.

At the same time, what “economically justified costs” are (by what criteria they are determined - Note “About business.” ) the legislator does not explain to us.

There are no comments on this topic from tax authorities yet. In my opinion, this criterion is of an evaluative nature, which will allow the tax authorities to express their subjective opinion and question the validity of accounting for certain costs for tax purposes.

And the taxpayer will be forced to be in the “defensive” position and prove that he is right. It is clear that the law is correct to combat tax evaders. But in the absence of an application mechanism, a lot of questions will arise for the Ministry of Taxation and “excesses” during tax audits.

The deadline for submitting a notification about the transition from UTII to the simplified tax system has been established

As we have already said, as a general rule, organizations and individual entrepreneurs switch to the simplified tax system from the beginning of the calendar year (clause 1 of article 346.13, clause 1 of article 346.19 of the Tax Code of the Russian Federation). However, special rules are provided for taxpayers switching to “simplified taxation” from another special regime – UTII. They can work for the simplified tax system from the beginning of the month in which the obligation to pay the “imputed” tax ceased (paragraph 2, paragraph 2, article 346.13 of the Tax Code of the Russian Federation). To make the transition to the simplified tax system, organizations and individual entrepreneurs need to submit to the tax authority a notification about the transition to the simplified tax system, the form of which is approved by Order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/829.

The deadline for submitting the said notification about the transition to the simplified tax system was not previously determined by tax legislation. Therefore, legislators made changes to paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation and stipulated that starting from 2021, a notification must be submitted no later than 30 calendar days from the date of termination of the obligation to pay UTII. Previously, the issue of the deadline for filing a notification was regulated only at the level of explanations from financiers (Letter of the Ministry of Finance of Russia dated September 12, 2012 No. 03-11-06/2/123). The amendment is provided for by Federal Law No. 401-FZ of November 30, 2016.

Increased the amount of income to maintain the right to the simplified tax system

The Tax Code of the Russian Federation provides that if, after the end of the reporting (tax) period, the income of an organization or businessman exceeds a certain amount, then it is impossible to continue to apply the simplified tax system (Letter of the Ministry of Finance of Russia dated July 1, 2013 No. 03-11-06/2/24984).

The maximum income limit in 2021 was previously specified in paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation in the amount of 60 million rubles. This amount was required to be increased annually by a deflator coefficient. For 2021, the coefficient was determined as 1.329 (Order of the Ministry of Economic Development of Russia dated October 20, 2015 No. 772). Using the coefficient, the maximum income limit under the simplified tax system in 2016 was RUB 79,740,000. (RUB 60,000,000 × 1.329).

From 2021, the maximum amount of income to maintain the right to “simplified” tax has increased to 150 million rubles. From 2021, you cannot receive more than this amount from business and remain on the simplified tax system. Therefore, companies or individual entrepreneurs need to ensure that their income for the first quarter, half of the year, 9 months, and 2021 does not exceed 150 million rubles. Otherwise, they will be deprived of the right to the simplified tax system from the beginning of the quarter in which income exceeds 150 million rubles. This is provided for by Federal Law No. 401-FZ of November 30, 2016.

Please note that the deflator coefficients have been suspended since 2017 until January 1, 2021. Therefore, 150 million rubles should not be indexed to coefficients from 2021.

If income in 2021 does not exceed 150 million rubles, then in 2021 it will be possible to continue to apply the simplified tax system without submitting any notifications to the tax office (clause 4.1 of article 346.13 of the Tax Code of the Russian Federation).

First (in 2021), legislators increased the income limit for 9 months from 45 to 90 million rubles, and the income limit for maintaining the right to the simplified tax system from 60 to 120 million rubles. We reported about this in the article “STS since 2017: how the limits on income and fixed assets will increase.” But then they changed their minds. And they increased the limits even more: to 112.5 and 150 million rubles, respectively.

For the simplified tax system, by order of the Ministry of Economic Development dated November 3, 2016 No. 698, a deflator coefficient of 1.425 was approved. However, this coefficient only misleads the “simplistic” people. There is no need to apply it in 2021. The fact is that the indexation of the income limit for the simplified tax system was suspended from 2021 to 2021 (clause 4 of article 5 of the Federal Law of July 3, 2016 No. 243-FZ). Therefore, in 2021, the income limit that allows you to remain on the simplified tax system should not be multiplied by a coefficient. From 2021, this limit will be equal to 150 million rubles.

Value added tax

The deadlines for accepting import VAT for deduction have been reduced . The period for accepting deduction (refund) of VAT amounts for goods imported by Belarusian importers into the territory of Belarus from outside the EAEU is extended to 2021.

However, according to the new rules, the deduction of “import” VAT will be carried out with a delay of 60 days. In 2021, this norm was 90 days (Decree No. 99 of February 26, 2015 “On the collection of value added tax”).

This norm is a “sore spot” for all importers. Let me remind you that Decree No. 99 provides that the deduction of “import” VAT is applied to imported goods released for free circulation in accordance with the declared customs procedure.

The date of release of goods for free circulation is indicated in column “C” of the customs declaration. You can deduct “customs” VAT in 2016 in the reporting period in which 90 calendar days of this date have expired.

In 2021, as I said above, this period will be reduced from 90 to 60 days.

For example. The company imports olives from Italy under a sales contract. On February 10, 2017, they were imported and “import” VAT was paid. Column “C” of the customs declaration for goods indicates the date of release of goods for free circulation - 02/11/2017.

The product was sold in Belarus through a retail chain on 02/21/2017.

Olive picking in Greece. Photo from the site grecheskieinteresnosti.blogspot.com.by

The deadline established by law for accepting import VAT for deduction, 60 days, falls on 04/11/2017 (the date from which this period begins to count: 02/12/2017). Thus, the amount of “import” VAT is subject to deduction in April 2021 and will be indicated in the VAT return for April-July (Q2 2017).

Electronic VAT invoices . In 2021, all work with invoices with incoming and outgoing VAT should be done only through ESCHF. Wherein:

- The general deadline for issuing/uploading electronic invoices to the portal created for working with ESChF has been changed. The deadline has been shifted from the previously established 5th to the 10th of the month following the month of shipment of taxable items (goods and (import) VAT; the deadlines have been changed from the 5th to the 10th of the month following the month of release of goods imported from far abroad

The limit on the residual value of fixed assets has been increased

In 2021, a company could apply the simplified tax system if the residual value of its fixed assets did not exceed 100 million rubles. This value is determined according to the accounting rules (clause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation). Also see “Accounting on the simplified tax system”.

Organizations both planning to apply the simplified tax system from the beginning of the new year and those already using the simplified system need to monitor the limit on residual value.

| The organization applies the simplified tax system | If, at the end of a reporting period (for example, a quarter or half a year), the residual value limit is exceeded, the organization will switch to OSN from the beginning of the quarter in which the excess occurred. |

| The organization plans to switch to the simplified tax system | To switch to the simplified tax system from the beginning of the new year, it is necessary that the limit on the residual value of fixed assets not be exceeded as of December 31 of the year preceding the start of application of the simplified tax system. |

From 2021, the maximum asset value limit has increased from 100 to 150 million rubles. Accordingly, from January 1, 2017, companies and individual entrepreneurs have the right to rely on the new maximum limit on the residual value of their fixed assets.

Keep in mind that individual entrepreneurs do not have the obligation to control the residual value of their assets when switching to the simplified tax system. But if an individual entrepreneur is already running a business using a “simplified” system, then he is obliged to monitor these indicators on an equal basis with organizations (letter of the Ministry of Finance of Russia dated January 20, 2016 No. 03-11-11/1656).

The procedure for recognizing expenses for taxes, fees and insurance premiums has been clarified

Organizations and individual entrepreneurs using the simplified tax system with the object of taxation “income minus expenses” have the right to reduce income by certain expenses when determining the tax base. Until 2021, it was envisaged that expenses incurred for paying taxes, fees and repaying debts on them could be written off as expenses (clause 3, clause 2, article 346.17 of the Tax Code of the Russian Federation). So, in particular, the costs can take into account:

- “input” and “import” VAT on purchased goods (works, services);

- other taxes (advance payments thereon) and fees paid in accordance with the legislation of the Russian Federation or additionally accrued as a result of an audit. For example - personal income tax, property tax, land tax, transport tax, state duty and trade tax. Starting from 2021, two important amendments have been made to this norm.

Amendment 1: Recognition of premium expenses

From 2021, insurance premiums come under the control of the Federal Tax Service and its inspectorates. See "Insurance premiums from 2021: overview of changes."

In 2021, insurance contributions (for example, pension, medical, or contributions for temporary disability and maternity) can be taken into account when calculating the simplified tax system. In subparagraph 3 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, legislators prescribed the procedure for recognizing expenses for the payment of insurance premiums and debts on them. Starting from 2021, expenses for taxes, fees and contributions must be recognized in the following order:

| Type of consumption | Procedure for recognizing expenses |

| Expenses for paying taxes, fees and insurance premiums. | Taken into account in the amount actually paid by the taxpayer. |

| Expenses to pay off debts for taxes and fees. | They are taken into account within the limits of actually repaid debts in those reporting (tax) periods when the taxpayer repays the specified debt. |

Amendment 2: recognition of expenses incurred by third parties

In 2021, taxes, fees and insurance premiums for organizations or individual entrepreneurs (including those using the simplified tax system) can be paid by third parties. Legislators made such an amendment to Article 45 of the Tax Code of the Russian Federation. Previously, it was provided that the taxpayer was obliged to fulfill the payment obligation independently. Also see “What will change in 2021: taxes, insurance premiums, benefits, reporting, accounting and online cash registers.”

It is possible that in 2021 a third-party organization, individual entrepreneur or individual will pay his taxes, fees or insurance premiums for the “simplified person”. Will it be possible to take such payments into account when calculating the “simplified” tax? No, starting from 2021, third party payments for taxes, fees and contributions cannot simply be attributed to expenses. However, in subparagraph 3 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, legislators provided that expenses can be recognized after repayment of the resulting debt to a third party. Let us explain the procedure for recognizing such expenses in the table.

| Type of consumption | Procedure for recognizing expenses |

| Payments by a third party in favor of the simplified person for taxes, fees and insurance premiums. | They are taken into account in the amount actually paid when the “simplified” person repays the debt to a third party that arose in connection with his payment of taxes, fees or insurance premiums. |

| Payments by a third party in favor of the simplified person to repay debts on taxes, fees and insurance premiums. | They are taken into account within the limits of the actually repaid debt in those reporting (tax) periods when the “simplified” repaid the debt to a third party, which arose in connection with the payment of arrears on taxes, fees and contributions. |

Thus, in order to take into account payments from third parties in expenses from 2021, it will be necessary to return to these persons the amounts they spent on paying taxes, fees and insurance premiums (or debts on them). This is provided for by Federal Law No. 401-FZ of November 30, 2016.

Tax return for simplified tax system in 2021

Submitting tax reporting to the simplified tax system consists of preparing and submitting a tax return to the simplified tax system. For individual entrepreneurs until April 30, 2021 and for LLCs until March 31, 2021.

In addition to the tax return for taxation under the simplified tax system, it is necessary to maintain a book of income and expenses (KUDiR).

The book is kept on a cash basis and do not forget that the simplified taxation system can be reduced by insurance premiums.

You can take into account the costs of an independent assessment

Since 2021, the Federal Law of July 3, 2016 No. 238-FZ “On independent assessment of qualifications” has come into force. See Independent Workforce Assessment: What You Need to Know.

From 2021, organizations and individual entrepreneurs using the simplified tax system with the object “income minus expenses” will be able to take into account the costs of an independent assessment of the qualifications of employees in expenses (clause 33, clause 1, article 346.16 of the Tax Code of the Russian Federation). For these purposes, the rules will be applied according to which the cost of such an independent assessment is taken into account in income tax expenses. That is, in particular, the organization and individual entrepreneur will have to have documents confirming an independent assessment. For more information about this, see “STS: accounting for the costs of an independent assessment of qualifications in 2021.”

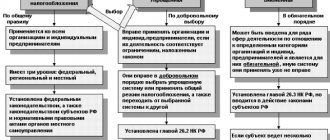

The essence of the tax system

This term refers to the procedure for monetary contributions that are levied in favor of the state from everyone receiving income. This means not only entrepreneurial activity; the payer is any entity - both an individual and a legal entity. What is important: a competent approach can help minimize the tax burden for a business.

Main elements of the taxation system:

It is important to know! A catalog of franchises has opened on our website! Go to catalog...

- object – any characteristic that imposes an obligation to pay tax (income, profit, etc.);

- base – the value of an object expressed in monetary terms;

- period – a time period within which the base is determined and a specific amount of tax payable is calculated;

- rate – the amount of charges;

- the procedure for calculating tax, as well as the form and timing of its payment.

In the Russian Federation today there are several tax regimes (or systems):

- General (OSNO, OSN). Can be used for subjects of different organizational and legal status. It is the most common and traditional. This is the heaviest tax burden, but at the same time it is beneficial for those entrepreneurs who cooperate with organizations that pay VAT (often “endess” counterparties refuse to work with those individual entrepreneurs or LLCs that are not payers of this type of tax).

- Unified tax on imputed income (UTII). Here the amount of payments is 15% of the estimated income fixed by law for certain types of activities.

- Unified Agricultural Tax (USAT). As the name suggests, it is used for producers of agricultural products. Does not apply to those who, if the type of activity corresponds, receives more than 30% of their income from processing products.

- Patent system. Can only be used by individual entrepreneurs.

- Simplified taxation system (STS). There are two varieties - “STS for income” and “STS for income minus expenses”.

All of the above (except OCH) can be called special modes. We need to dwell on the last, simplified one in more detail, because there are a number of advantages for small businesses.

We clarified the conditions for combining the simplified tax system with UTII or the patent system

Until 2021, it was stipulated that when combining the simplified tax system and UTII, it was necessary to keep separate records of income and expenses for each applicable tax regime. If it is impossible to organize such accounting, then when calculating the tax base, expenses must be distributed in proportion to the shares of income under different regimes (clause 8 of Article 346.18 of the Tax Code of the Russian Federation).

From 2021, exactly the same procedure will be used not only for UTII, but also in the case of combining the simplified tax system and the patent taxation system, which individual entrepreneurs can apply. At the same time, it is clarified that income and expenses under UTII and the patent system do not need to be taken into account when calculating the tax base under the simplified tax system. This is provided for by the new wording of paragraph 8 of Article 346.18 of the Tax Code of the Russian Federation. Thus, revenues from a patent or “imputed” single tax under the simplified tax system will not increase. These amendments to the Tax Code of the Russian Federation since 2017 are provided for by Federal Law No. 401-FZ dated November 30, 2016.

Clarification of tax rates

From 2021, changes are being made to clause 4 of Art.

346.20 “Tax rates” of the Tax Code of the Russian Federation. This norm refers to a tax rate of 0% for individual entrepreneurs registered for the first time after the entry into force of the relevant laws of the constituent entities of the Russian Federation and carrying out business activities in the production, social and (or) scientific spheres, as well as in the provision of consumer services to the population. The current version of the norm in question does not say what object of taxation we are talking about. The financiers explained that there are no restrictions on the application of a tax rate of 0% for taxpayers - individual entrepreneurs who were registered for the first time after the entry into force of the relevant laws of the constituent entities of the Russian Federation and who switched to the simplified tax system, depending on the object of taxation they have chosen (Letter dated 05.05.2016 No. 03‑11‑11/26185). Included in paragraph 4 of Art. 346.20 of the Tax Code of the Russian Federation, the amendments exclude any double interpretation of this norm.

It will also now be more correctly stated that during the period of validity of the tax rate of 0%, these individual entrepreneurs who have chosen the object of taxation in the form of income reduced by the amount of expenses do not pay the minimum tax provided for in paragraph 6 of Art. 346.18 Tax Code of the Russian Federation. This procedure was in effect previously.

We clarified how individual entrepreneurs can reduce the single tax on insurance premiums

Until 2021, individual entrepreneurs (IP) without employees using the simplified tax system with the object “income” had the right to reduce the amount of “simplified” tax (advance payments) on insurance contributions paid “for themselves” to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund in a fixed amount (clause 3.1 Article 346.21 of the Tax Code of the Russian Federation). However, the wording “at a fixed rate” has often caused controversy among the accounting community. The fact is that individual entrepreneurs’ insurance premiums “for themselves” are formed from two values:

- a fixed amount of contributions, which is calculated based on their income not exceeding 300,000 thousand rubles per year;

- the amount of contributions, which is calculated at 1% of income exceeding 300,000 rubles.

Some accountants believed that the amount of contributions from an income of more than 300,000 rubles is a variable value and cannot be called “fixed contributions.” Hence, disputes arose about whether the “simplified” tax could be reduced by such amounts of contributions.

From 2021, disputes in this regard should disappear, since the provisions of Article 430 of the Tax Code of the Russian Federation will clearly establish that the entire amount of individual entrepreneurs’ contributions “for themselves” is fixed. In paragraph six of clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation, which allows individual entrepreneurs to reduce the tax under the simplified tax system on insurance premiums “for themselves”, from 2021 it was prescribed that the single tax can be reduced for pension and medical contributions. The mention of “fixed size” has disappeared from this norm. Accordingly, the simplified tax system can be reduced by the entire amount of contributions that the individual entrepreneur transfers “for himself.” Also see “Insurance premiums of individual entrepreneurs “for themselves” in 2017: how much to pay to the Federal Tax Service.”

Simplified tax system and its features: studying the “material parts”

The following elements apply to the simplified taxation system:

- object – income or income reduced by expenses;

- the base in this case is income or income minus expenses expressed in monetary value;

- the tax period is calculated in a calendar year;

- the rates are variable - for the simplified tax system, income minus expenses is set at 5 to 15%, for the simplified tax system, income - from 1 to 6% (the minimum is preferential, applied depending on the regions and their tax policy).

The indisputable advantages of “simplified”:

- a real opportunity to minimize the tax burden;

- simplicity and ease of accounting, a small number of documents to process;

- a simple and understandable tax calculation algorithm that does not require specialist intervention or specific knowledge.

With all its loyalty to the payer, the “simplified” “income minus expenses” or the second version of the simplified tax system “income” have several nuances. The main thing is that not all subjects have the right to use these systems.

Developed a new form of income and expense accounting book

Starting from 2021, organizations and individual entrepreneurs on the simplified market must keep an updated book of income and expenses, approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n. The updated book has a new section V, in which taxpayers using the simplified tax system with the object “income” must show a trade fee that reduces tax under the simplified tax system. Previously, there were no special lines in the book for trade collection. In addition, starting from 2021, it will be necessary to affix a stamp in the book of accounting and expenses if the organization, in principle, has such a stamp. That is, the presence of a seal will become optional. Also, in column 4 “Income” of Section I of the book, there is no need to indicate the profit of controlled foreign companies. More information about this will appear in the order in which you fill out the book. You can familiarize yourself with the draft of the new book of accounting and expenses under the simplified tax system by following the link.

The updated book must be used from January 1, 2021. There is no need to redo the book of income and expenses that was kept in 2016. Order of the Ministry of Finance, which made changes to the book of accounting of income and expenses according to the simplified tax system - dated December 7, 2010 No. 227n. For more details, see “New form of book for accounting income and expenses under the simplified tax system from 2021: what has changed.”

Simplified taxation system for individual entrepreneurs in 2016-2017

For many individual entrepreneurs, the simplified tax system is the most profitable. There are a number of reasons why its use can make doing business much easier:

- The simplified tax system is an effective tax optimization tool.

- Advance payments are transferred throughout the year, but reporting is submitted only once, that is, filing a tax return for individual entrepreneurs in 2021 working on the “simplified tax” in 2021 must be made before April 30, 2021. Please note that you need to use the new sample forms, approved this spring (in 2016).

- No income tax is paid. For individual entrepreneurs, personal income tax is considered an analogue of income tax.

- No VAT is charged (except for import transactions).

Advice : sometimes, at the request of the counterparty, entrepreneurs use the simplified tax system to issue an invoice with allocated VAT. This is acceptable. But in this case, the seller will need to pay VAT in full on such revenue. But it will not be used to offset expenses and income (the rule is valid from 2021). Here you need to be careful about the deadlines for paying VAT.

- Allows you to recalculate the amount of accrued tax and insurance contributions, that is, subtract the latter, which are paid regularly throughout the year, from advance tax payments and reduce its amount by their amount. An individual entrepreneur without employees, who pays insurance and pension contributions for individual entrepreneurs for himself, can deduct their entire amount from the single tax. For those who have full-time staff and pay so-called “salary taxes” for employees (not entirely true from an accounting point of view, because these are insurance premiums), the deduction reaches 50% of the amount of the accrued single tax. You can also reduce the e/n by the amount of the paid trade fee.

- In a number of regions and for some types of activities, preferential rates are established that differ less from the standard ones.

- Allows the entrepreneur to choose the tax base (income or income minus expenses) at the discretion of the entrepreneur.

- No accounting records are kept. Tax reporting is carried out in a simplified format, the “Book of Income and Expenses Accounting” (KUDiR) is used here, and fixed assets are also recorded. Even the reporting of individual entrepreneurs on UTII with employees is more complicated than with the “simplified” version.

The listed features of the simplified tax system make it certainly the most profitable for small businesses. The exception is the absence of VAT, which limits the effectiveness of cooperation between individual entrepreneurs and large enterprises.

The BCC for the minimum tax under the simplified tax system has been abolished

From 2021, a separate BCC for the minimum tax paid by companies using the simplified tax system with the object “income minus expenses” has been abolished (Order of the Ministry of Finance of Russia dated June 20, 2016 No. 90n).

BCCs used in 2021 to pay the single tax, arrears and penalties under the simplified tax system will be used from 2021 also to pay the minimum tax. In connection with this change, the minimum tax for 2021 will need to be transferred to the KBK for the usual “simplified” tax - 18210501021011000110. See “KBK according to the simplified tax system in 2017”.

Note that previously for companies on the simplified tax system with the object “income minus expenses” there were two separate codes. This caused confusion. If a company mistakenly transferred advances to the minimum tax KBK, then inspectors assessed penalties. This, of course, was unfair. See “The BCC will be abolished for paying the minimum tax under the simplified tax system.”

Tax on income of foreign companies not operating through a permanent establishment

From 2021, the income of such organizations received from the provision of certain types of services will be taxed.

Intermediary services. For example, a Belarusian exporter, in order to enter new markets, attracts a foreign organization to provide services for finding potential buyers.

Today, the income of a foreign performing organization for such services is not designated as an object of taxation. But from 2017 they will be subject to income tax as intermediary services.

Those. When paying a foreign organization remuneration for these intermediary services, the Belarusian customer will have to calculate income tax.

Services for providing access to databases. In Belarusian legislation, these services are classified as data processing and information placement activities (code 63 110 “Data processing, provision of information placement services and related activities” according to the OKRB 005−2011 classifier).

Since the Belarusian company acts as a tax agent, it is according to our national legislation that the subject of the agreement and the object of taxation will be determined. Therefore, in order to eliminate questions from the tax authorities, it is necessary to clearly stipulate in the agreement with a foreign organization:

- Subject of the agreement

- What kind of data processing and information hosting services are provided?

- What do they include?

Elena Zhuger

Director and founder.

Certified auditor. Chairman of the Committee on Methodology and Audit of the Association of Auditing Organizations. Tax audit expert.

Conducts original seminars on accounting and taxation, author of articles on business topics.