To support companies operating in the field of information technology, Federal Law No. 265-FZ dated July 31, 2020 was adopted with amendments to the Tax Code of the Russian Federation. This is the so-called Law on Tax Maneuver in the IT Industry. Let's look at its main provisions and what it changes for IT companies regarding taxes and insurance premiums.

Also see:

- V. Putin’s new proposals in connection with coronavirus from June 23, 2020

- What is the transition period (transitional tax regime) under the simplified tax system from 2021

What taxes and fees will be reduced?

Income tax

Taxes are reduced only for companies that operate on a common tax system. For them, income tax will be reduced from 20 to 3%. Previously, 3% of contributions went to regional budgets, 17% to the federal budget. Now the tax will be transferred entirely to the federal budget.

If your company expects benefits, but operates on a simplified basis, write an application on form No. 26.2-3 with the date “January 1, 2021” and send it to the tax office at the place of registration. So you will switch to OSNO in the new year.

Insurance premiums

The second benefit is a reduction in insurance premiums. Here the taxation system does not matter: contributions are paid to both the OSNO and the simplified tax system. The general rate is reduced from 14 to 7.6%, and in terms of individual types of contributions, the changes are as follows:

- pension insurance - up to 6%;

- social insurance for maternity or illness, including foreign citizens - up to 1.5%;

- medical insurance - up to 0.1%.

Who will receive benefits?

Benefits on taxes and insurance premiums will be given to companies that are simultaneously included in the register of accredited organizations in the IT field and the register of Russian computer programs.

Register of accredited IT companies

IT companies that meet two criteria can become accredited:

1

the average number of full-time employees over the last year is at least 7 people;

2

90% of the income comes from deals with software that the company has developed.

Software deals include:

- sale of programs and their licensed copies, including on the Internet;

- transfer of exclusive rights to programs (for example, copyright or resale rights);

- provision of services for the development, modification, installation and testing of programs.

To obtain accreditation and be included in the state register, write an application and a certificate stating that your company works in the IT field. Documents can be brought to the office of the Ministry of Telecom and Mass Communications in person or sent by registered mail to the address: 125039, Moscow, Presnenskaya embankment, 10, building 2, IQ-quarter.

Register of Russian programs

Companies that meet the following requirements are included in the program register:

- a Russian legal entity, with the share of foreign organizations in the authorized capital not exceeding 50%;

- dividends of foreign founders - no more than 30% of the total amount;

- exclusive rights to the program include licensed components, open-source elements (i.e. free source codes of other programmers) and proprietary developments;

- programs are developed and supported in Russia;

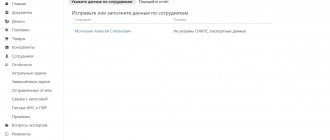

- programs do not violate laws on the protection of personal data and comply with FSTEC and FSB certificates.

To get into the program register, you need to register in the Unified Identification and Authentication System (USIA) and obtain an electronic signature. Then submit an application through the ESIA and attach copies of documents that confirm income and rights to the programs. The Ministry of Telecom and Mass Communications has posted instructions for registering with the Unified Identification of Authorities and submitting an application on its website.

You can obtain an electronic signature in the SberBusiness Internet bank. Delivery by the "Special Communications of Russia" service or pickup from a certification center in Moscow and St. Petersburg.

Tax benefits for IT companies: switch to a simplified tax system or stay on the OSN?

Most recently, the President announced a tax maneuver for IT companies. It was declared that it would support the industry thanks to serious tax benefits. And so, on July 31, 2020, amendments to the Tax Code were adopted. They will come into force on 01/01/2021. Tax regimes for IT companies are really changing. But are they becoming more profitable? What other options do IT companies have?

Says:

Nikolay Andreev,

Head of Tax Practice at Zartsyn and Partners Law Firm

In Russia, IT companies operate either on the simplified taxation system (STS) or on the general taxation system (GTS). Typically, the choice between these two regimes depends on the company's planned annual turnover, as well as on the volume of the company's expenses: under the general taxation system it is much easier to reduce the tax on the amount of expenses.

The tax maneuver will affect taxpayers on both the simplified tax system and the special tax system.

The most benefits are provided for companies on the OSN that have received the status of an accredited IT company:

- corporate income tax will be 3% instead of 20%;

- the VAT exemption for license agreements for software will remain if it is included in the register of domestic software;

- insurance premiums will be charged at a rate of 7.6% instead of 30%/15%.

For companies using the simplified tax system, the benefits are not so tangible - for them only the insurance premium rates will be reduced to 7.6%.

In this regard, it will be more profitable for some companies using the simplified tax system to switch to the special tax system. To do this, no later than a month before the end of the next year, you will need to submit a notification about the transition to the general taxation system. The notification must be sent to the territorial tax office, where the company submits tax reports.

The reform will not affect residents of special economic zones: they are subject to exactly the tax rates specified in the laws on the relevant economic zones. Even if a resident of a special economic zone acquires the status of an accredited IT company, tax rates will be the same as for other residents who are not accredited as an IT company.

Let's consider the options in more detail.

What changes are associated with the tax maneuver for IT companies?

The tax maneuver for IT companies is provided for by Federal Law No. 265-FZ of July 31, 2020 “On Amendments to Part Two of the Tax Code of the Russian Federation.”

Tax maneuver: the main thing

Insurance premiums are reduced to 7.6%

Corporate income tax is reduced from 20% to 3%

Wherein:

O (clause 6 of article 259 of the Tax Code of the Russian Federation)

The VAT benefit will only apply to software included in the Russian register of computer programs and databases

Insurance premiums. The general rate of insurance premiums for companies is 30%.

But for some categories of taxpayers, reduced rates apply. For example, a benefit is provided for small and medium-sized businesses - for wages within the minimum wage (12,130 rubles), insurance premiums are 30%, and for wages above the minimum wage - 15%. But this benefit is valid only until 2022. Therefore, those IT companies that enjoyed benefits on insurance premiums as an SME should take this into account and take a closer look at the status of an accredited IT company. Income tax. The income tax rate is also reduced significantly - from 20% to 3%. But at the same time Fr. What does it mean? Before the changes were made, there was a special benefit for IT companies on OSN. It was as follows. As a general rule, expenses cannot be included all at once when calculating the taxable base for income tax. This can only be done over a certain depreciation period. But for IT companies, instant depreciation was provided. That is, expenses, for example, on the purchase of computers, could be shown in one year. Thus, if the purchase was large, the organization’s profit tax could be reduced to almost zero. This benefit is now being cancelled.

VAT. Today, software license payments are completely exempt from VAT. After the tax maneuver, this benefit will apply only to Russian software included in the register.

In other words, the tax maneuver cannot be called unambiguously beneficial. It is possible that some companies working on OSN will consider switching to a simplified version.

What are the working conditions for the simplified tax system?

Within the framework of the simplified tax system, two rates are possible:

- 6% for net income,

- 15% for the “income minus expenses” model.

In this case, you do not need to pay VAT.

On a note

In some regions, the simplified tax rate is even lower. For example, in St. Petersburg, instead of 15%, the rate is 7%, and in the Voronezh region for an IT company, the preferential rate under the simplified tax system is not 6%, but 1%. Therefore, some companies may want to think about relocating to other Russian regions. But we must keep in mind that in practice such a move may lead to on-site tax audits.

There are a number of restrictions for using the simplified tax system, including:

- turnover up to 150 million rubles;

- the organization should not have branches;

- the organization is not a manufacturer of excisable goods, an organizer of gambling, or a pawnshop;

- number of employees up to 100 people;

- the residual value of depreciable fixed assets is less than 150 million rubles;

- the share of participation in the organization of other organizations is less than 25%;

- persons specified in paragraph 3 of Art. cannot apply the simplified tax system. 346.1 Tax Code of the Russian Federation.

For IT companies, as a rule, the decisive criterion is the first one – turnover up to 150 million rubles.

If a company does not meet the established criteria, it will have to operate on the general taxation system (GTS).

What are the working conditions at OSN?

As a general rule, the OSN includes:

- corporate income tax - 20%;

- VAT - 20%;

- insurance premiums - 30%.

Companies will be able to receive special tax benefits as part of the tax maneuver if:

• they have state accreditation in the Ministry of Telecom and Mass Communications as an IT company;

• they receive 90% of their income from the development and sale of software and several other related activities;

• average number of employees is at least 7 people.

There is also an interesting R&D benefit for companies on the OSN.

It allows the company that ordered the development work to calculate the costs of paying for it by applying an increasing factor of 1.5 (Article 262 of the Tax Code of the Russian Federation). That is, if a company entered into an agreement, for example, to develop a technology for the production of microcircuits, where the cost of the work was 100 thousand rubles, 150 thousand rubles can be included in corporate income tax expenses. In addition to development, expenses can also include the costs of research related to the use of technology, in particular, marketing research. In practice, this rule makes it possible to greatly reduce the tax base for income tax, bringing it to almost zero. But there is also a downside - recently, tax authorities are increasingly finding fault and demanding world-class developments. So it is important to monitor whether a particular contract is suitable for benefits and whether it is possible to reduce income tax with its help.

To qualify for the R&D benefit you must:

- have a primary R&D focus,

- start using the R&D results.

What conditions do Russian offshore companies offer for IT companies?

If you want to switch to OSN, but understand that questions may arise with VAT, it makes sense to think about Russian offshore companies - they are also special economic zones (SEZ).

The most popular SEZs and low-tax territories for IT companies:

Kazan IT Park

• Income tax 15.5% excluding tax maneuver • Property tax is almost zero – 0.1% • Insurance premiums vary from 14% to 20% (with state accreditation as an IT company) • Average headcount – 7 people

In general, the benefits here are similar to the general benefits for all IT companies, but the physical presence of at least several developers is also required, which is not suitable for all companies.

Kaliningrad SEZ

• Income tax 0% for a period of up to 10 years • Property tax 0% • Insurance premiums approximately 7.6%, because the rate is gradually increasing • The average number of employees does not matter • Accreditation as an IT company is not required

This SEZ is specifically for IT companies: OKVED 62 and 63 should be the main ones.

To become a resident of the Kaliningrad SEZ, you need to act as an investor - provide an investment project for 1 million rubles. You can also use this money to furnish your office. In addition, in addition to the investment project, the company must transfer at least part of its employees to Kaliningrad (according to unofficial data, 10 people are enough).

Skolkovo

• Income tax 0% • Exemption from VAT • Property tax 0% • Insurance premiums 14% • Reimbursement of import customs duties - VAT and customs duties

Nikolay Andreev recommends that companies operating on OSN take a closer look at Skolkovo resident status due to the complete exemption from VAT. However, one must take into account that insurance premiums for Skolkovo residents end up being higher than those of accredited IT companies.

Tags: IT companies depreciation benefits income tax tax tax maneuver NDSOSNOEZ programmer software resident USN company lawyer