Let's consider two situations to reflect losses of previous years in 1C Accounting 8.3:

- While working with the 1C 8.3 program, a loss arose for the current period, which must be transferred to the future.

- At the time of starting work with the 1C: Enterprise Accounting 3.0 program, it is necessary to reflect the presence of losses from previous years.

How should the loss of previous years be reflected in the program in both cases? How should the program behave in this case?

The occurrence of a loss while working in 1C

So, let's consider the first option: the loss in the period arose in the process of working with the 1C: Enterprise Accounting 3.0 program (note that this scheme also works for the previous edition of the 1C 8.3 Enterprise Accounting 2.0 program).

Based on the results of the activities of Moneta LLC in the fourth quarter of 2015, a loss was recorded in the amount of 235,593.27 rubles. In January 2021, a profit was made in the amount of 211,864.41 rubles.

Let's look at the results of document posting for December 2015:

As you know, we obtain the results of an organization’s financial activities as a result of automatic calculations using the Month Closing processing, which includes a list of necessary routine operations (menu Operations – Period Closing – Month Closing ).

As we can see, the resulting loss for December is recognized as a deferred tax asset. The financial result in postings for the month amounted to 245,762.71 rubles:

To see the financial result for the entire tax period, we will generate a reference calculation Calculation of income tax (menu Operations - Reference calculations - Accounting and tax accounting - Calculation of income tax ):

As can be seen from column 10 of the calculation certificate, the loss for the past 2015 amounted to 235,593.27 rubles.

“1C: Accounting 8” (rev. 3.0): how to reflect the repayment of a loss in accounting (+ video)?

The video was made in the program “1C: Accounting 8” version 3.0.58.26.

The net profit (loss) indicator is formed on balance sheet account 99 “Profits and losses” and represents the final financial result of the organization’s activities for the reporting period (Instructions for the use of the Chart of Accounts for accounting the financial and economic activities of an organization, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). The debit balance of account 99 at the end of the year indicates the presence of a net loss.

At the end of the reporting year, account 99 is closed. With the final entry of December, which is part of the accounting procedure - balance sheet reformation, the debit balance (the amount of net loss) is written off to the debit of account 84.02 “Loss to be covered.”

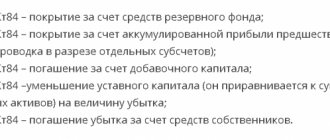

Already next year, based on the decision of the competent body (meeting of company participants), a decision is made on the sources of covering the loss. The loss can be covered by accumulated retained earnings in circulation (in correspondence with subaccount 84.03 “Retained earnings in circulation”), reserve funds (in correspondence with account 82 “Reserve capital”), etc.

In “1C: Accounting 8”, the specified operations are reflected in the Operation document (section Operations - Operations entered manually). Generated wiring:

Debit 84.03 Credit 84.02 - write-off of losses from retained earnings;

Debit 82 Credit 84.02 - write-off of losses from reserve capital.

See also:

How to reflect the distribution of profits received (+ video)

buh.ru

Transfer of losses from previous years to the current period in 1C 8.3

First of all, in order to see the entire amount of ONA received for losses in 2015, we will create a balance sheet for account 09:

To transfer the loss of 2015 to the current year 2021, we will create a new document Transactions entered manually (menu Transactions - Accounting - Transactions entered manually ) and fill it out as follows:

We will assign the balance of account 09 “Loss of the current period” to account 09 “Expenses of future periods”.

The second line in the Transactions entered manually document will transfer the 2015 loss to deferred expenses in tax accounting (accordingly, a temporary difference will arise for the same amount).

Let's check the balance sheet for account 09 to see if this operation was performed correctly:

As can be seen from the above report, the balance for the loss of the current period is zero, while our amount of IT is allocated to the expenses of future periods.

And we will pay special attention to filling out the analytics of account 97.21, namely the Expense of the future period ( the division is not filled in in the posting ). In our case, this is the Loss of 2015:

After filling out the Transaction entered manually has been completed, let us pay attention to the month-closing operation for December of the year resulting in a loss:

As we can see from the picture, the documents need to be re-issued within a month. In this case, you must skip the operation:

And re-perform the Balance Reformation operation.

Transfer of last year's losses when updating 1C ERP settings to the latest version

All of the above applies to new systems that do not provide information on losses for previous years, which remain after the system is updated from previous versions. But what to do if the system has already accounted for account 97.21 and the losses were closed manually?

In this case, after updating the settings, the balance will need to be manually assigned to the beginning of the current year from account 97.21 to account 97.11, using the “Operation (reg.)” document. Since after updating the settings, the directory of last year’s losses will be empty, you will need to manually prepare elements for those years for which there are unclosed losses, and when transferring from the account, fill out analytical account 97 yourself and correctly.

It is important not to forget the fact that the write-off of last year's losses (up to ten years) is not carried out automatically. In this case, a notification will appear about the presence of such amounts when closing regulated accounting for the last month of the year.

In order to write off last year's losses for a period of ten years or more from the current moment, you will need to use the document “Operation (reg.)”, starting from the decision made and filling out the following entries:

- Dt 91.02 PR – Kt 97.11 NU for a loss that is subject to write-off;

- Dt 91.02 VR – Kt 97.11 VR for a loss with a negative value that is subject to write-off.

Reflection of profit in the current period

Let me remind you that in January 2021 the organization made a profit of 211,864.41 rubles.

We will carry out the operation of closing the month for January 2021 in 1C 8.3. At the end of January, in 1C 8.3 we will generate a report on document postings. Write-off of losses from previous years:

And Calculation of income tax:

Reflection of losses in 1C:ERP, starting from version 2.4.2

Starting with version 2.4.2, in 1C:ERP it became possible to maintain the accounting we are interested in within the framework of tax accounting and reflect losses when generating an income tax return, without resorting to manual operations.

For these purposes, a new account 97.11 and a new directory of the same name were added to the system. In this case, the added directory is the only subaccount of the added account.

Typically, the directory of past losses is filled out automatically: as part of closing the year, before reforming the balance sheet, the system checks whether there is an entry in this directory with the year corresponding to the one being closed, and if not, it automatically adds a new element for the current year.

Fig. 2 Reflection of losses in 1C:ERP

Also, to take into account temporary differences in the losses under consideration, according to the requirements of PBU 18/02, the type of assets of the same name has been added to the list of types of tax assets/liabilities (ONA/ONO).

In general, the procedure for closing the month for organizations on the general taxation system (GTS) in terms of calculating and accounting for our losses looks like this:

- According to account 99.01.1 (Profits and losses from activities with OSN), the balance in tax accounting is determined.

- When the specified balance corresponds to a loss (account debit), then the amount of the loss is written off from 99.01.1 and transferred to account 97.11 (Dt 97.11 - Kt 99.01.1), while the NU amounts are filled in in the posting. On account 97.11 in the posting, the subconto of past losses is filled in with an element of the directory of the same name corresponding to the year being closed (if the element is missing, the system will create it).

- If in the organization for which the year is closed, the flag is set in the accounting policy, PBU 18/02 “Accounting for calculations of corporate income tax” is applied, then the amount of the transferred loss is recorded in “Amount Dt BP” and “Amount Kt BP” with a sign "minus". The balance in the debit of account 09 “Deferred tax assets” as of the closing date of the year in the sub-account “Loss of the current period” is transferred to the debit of account 09 in the sub-account “Losses of previous years” (entry Dt 09 “Losses of previous years” - Kt 09 “Loss of the current period” is formed "). The presence of a balance in account 09 “Deferred tax assets” in the subconto “Loss of the current period” at the end of the year and at the beginning of the current year is considered an error; it must be corrected and the year-end closing re-operation must be repeated.

If you still have questions about the procedure for closing a month in the system, contact our 1C 8 support specialists. We will be happy to help you!

Entering initial balances of losses from previous years

In a situation where you start working with the 1C 8.3 program, while having a balance of losses based on the results of previous years, the sequence of entering the initial balances will be as follows:

- Let's reflect the balances of the deferred tax asset at the beginning of the year (we use the same numbers as in the first section of the article, the date for entering the balances is December 31, 2015):

To create the document Entering initial balances for account 09, go to the Main menu – Initial balances – Assistant for entering balances:

- Let's reflect the balance on account 97.21 for last year's losses:

It should be noted that the balance for the loss of the previous year must be entered into the system in a document separate from the rest of the balances under the BPR.

At this point, the entry of initial balances for the purposes of accounting for losses of previous years can be considered complete. I will only say that in the case where losses need to be transferred over several years, this should be made in separate entries: separately for each year.

Account 84.02 - Loss to be covered

Subordinate to the account “Retained earnings (uncovered loss)” (84).

Account type: Active.

Description of the account “Loss to be covered”

Subaccount 84.02 was created to record the amounts of losses that are subject to coverage. Postings to subaccount 84.02 are made at the end of the reporting year when the balance sheet is reformed. The amount of losses is reflected in subaccount 84.02 from account 99 “Profits and losses”.

The amount of losses is taken into account in the account if the amount of expenses for the previous year exceeds the recorded income. By decision of the board, the amount of losses reflected in the account can be covered from the reserve fund, as well as by crediting the amount of accumulated retained earnings.

Postings to account “84.02”

By debit

| Debit | Credit | Content | Document |

| 84.02 | 000 | Entering opening balances: loss to be covered | Entering balances |

| 84.02 | 04.01 | Decrease in the value of an intangible asset as a result of revaluation | Operation |

| 84.02 | 99.01.1 | Write-off of net loss at the end of the year for activities not subject to UTII | Regular operation |

Articles on the topic

buhexpert8.ru

The RF Armed Forces will once again tell you how to correctly clarify losses from past periods

Recently, the active struggle of tax authorities with aggressive methods of tax optimization has begun to cause not only bewilderment, but also outright irritation, since in pursuit of indicators, tax authorities have long crossed the reasonable boundaries of acceptable behavior established by the Tax Code of the Russian Federation. The true goal of tax officials crossing reasonable boundaries of acceptable behavior in relation to taxpayers is to turn the latter into “powerless slaves of their masters.”

Today it is difficult to imagine how else tax officials can ruin a taxpayer’s life. To a person inexperienced in matters of communication with tax authorities, it may seem that things can’t get any worse. But, as reality shows, it can be even worse.

In the first ten days of April 2021, the Supreme Court of the Russian Federation will consider a taxpayer’s cassation appeal on the procedure for adjusting the tax base and tax amount when an error is identified and, in particular, will tell you how to correctly clarify losses from previous periods.

So, consider the following situation!

During a desk audit of the income tax return for 12 months of 2021, it was established that Euroizol LLC (hereinafter referred to as the taxpayer) on line 400 in Appendix 2 to sheet 02 “Adjustment of the tax base for identified errors (distortions) related to past tax periods that led to excessive payment of tax” reflects the amount of adjustment in the amount of 99,458 rubles.

During the analysis of documents available to the tax authority, it was established that line 400 in Appendix 2 to Sheet 02 “Adjustment of the tax base for identified errors (distortions) relating to previous tax periods that led to the excessive payment of tax in total” reflects the amount of adjustment in in the amount of RUB 99,458. by the counterparty LLC "TD Porfirit-Ural" (hereinafter referred to as the counterparty). According to the Unified State Register of Legal Entities, this organization was excluded from the Unified State Register of Legal Entities on January 11, 2016 on the basis of clause 2 of Art. 21.1 Federal Law dated 08.08.2001 No. 129-FZ.

By decision of the Federal Tax Service of Russia for the Zasviyazhsky district of Ulyanovsk (hereinafter referred to as the tax authority) dated August 21, 2019 No. 208, the taxpayer was held accountable for committing a tax offense in terms of additional accrual of arrears of income tax.

Dispute consideration:

Having disagreed with the decision of the tax authority, the taxpayer filed a petition in court to invalidate the decision of the tax authority to prosecute the person for committing a tax offense and to assess additional income tax arrears.

The position of the tax authority was that the basis for additional accrual of arrears for income tax was that the taxpayer reflected in the income tax return for 12 months of 2018 the amount of adjustment to the tax base and the amount of tax on errors that relate to previous tax periods . The tax authority considered that the adjustment should have been made by filing an amended tax return for 2016, and not by reducing the tax base and tax amount by reflecting additional expenses in the 2021 return.

The court of first instance (Case No. A72-18565/2019), having thoroughly understood the current situation, considered the decision of the tax authority to be contrary to the law and sided with the “good” (i.e., the taxpayer).

In making a decision in favor of the taxpayer, the court of first instance referred to the provisions of paragraph. 2 p. 1 art. 54 of the Tax Code of the Russian Federation and the corresponding provisions of paragraph 1 of Art. 81 of the Tax Code of the Russian Federation on the right of a taxpayer, upon discovering inaccurate information in the tax return submitted to the tax authority, as well as errors that do not lead to an underestimation of the amount of tax payable, to make the necessary changes to the tax return and submit an updated tax return to the tax authority

The court of first instance noted that the practice of applying paragraph. 2 p. 1 art. 54 of the Tax Code of the Russian Federation and clause 1 of Art. 81 of the Tax Code of the Russian Federation (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 09.09.2008 N 4894/08) “was based on the fact that expenses of previous tax periods can be declared by the taxpayer in the current tax period on the basis of subparagraph 1 of paragraph 1 of Article 265 of the Tax Code and only in the case when the period of occurrence of expenses is unknown , and in all other cases, expenses related to previous tax periods are subject to reflection in tax accounting in compliance with the requirements of Articles 54 and 272 of the Tax Code.”

However, when making a decision, the court of first instance took into account that “starting from 01/01/2009, in paragraph. 3 p. 1 art. 54 of the Tax Code (as amended by Federal Law No. 224-FZ of November 26, 2008) establishes the taxpayer’s right to recalculate the tax base and tax amount for the tax (reporting) period in which errors (distortions) were identified, if the errors (distortions) resulted in to excessive payment of tax."

The court of first instance indicated that “the meaning of this provision is that an error (distortion) in determining the tax base and the amount of tax, which led to excessive payment of tax, does not have negative consequences for the treasury. Accordingly, correction of such an error (distortion) not by filing an updated return for the previous tax period, but by reflecting the corrected information in the current tax return is considered acceptable.”

Also, the court of first instance Fr.

It should be noted here that the Ruling of the Supreme Court of the Russian Federation dated January 19, 2018 No. 305-KG17-14988 contains the position that “correction of an error (distortion) not by filing an updated return for the previous tax period, but by reflecting the corrected information in the current tax return is considered acceptable. It is assumed that by the time the error is corrected (filing a tax return), the three-year period for the return (offset) of the overpayment established by Article 78 of the Tax Code has not expired, taking into account that only during the specified period the taxpayer has the right to dispose of the corresponding amount of tax overpaid to the budget.”

It was this position of the Supreme Court of the Russian Federation that the court of first instance based its decision.

The appellate court overturned the decision of the first instance court and now sided with the “evil” (i.e., the tax authority).

In addition to the main position of the tax authority that the taxpayer knew the year of liquidation of the counterparty, the appellate court, in making its decision, took into account that the mistakes made did not lead to excessive payment of tax, since the taxpayer had previously declared a loss (according to the income tax return for 2021), thereby considering that there are no grounds for applying the provisions of paragraph 3, paragraph 1, article 54 of the Tax Code of the Russian Federation.

The appellate court, putting into practice a negative outcome for the taxpayer when considering the tax authority’s complaint against the decision of the court of first instance, indicated that “when assessing the possibility of applying the provisions of paragraph three of paragraph 1 of Article 54 of the Tax Code of the Russian Federation, it is necessary to establish the fact of the presence of an error as such, the impossibility of determining period of the error or that the error resulted in an overpayment of tax.”

The appellate court (taking into account the taxpayer’s position) indicated the following: “The taxpayer does not have the right to carry forward previously unaccounted losses of previous years to the current tax period before recalculating tax liabilities during the period of errors.” According to the court, it was necessary to take into account these losses at the time they occurred, that is, in 2021 (including the increased amount of losses due to the write-off of bad receivables).

The cassation court recognized the conclusions of the appellate court as corresponding to the circumstances of the dispute and based on the correct application of the law. The court did not take into account the current practice of interpreting the provisions of Art. 54 and art. 81 of the Tax Code of the Russian Federation, taking into account the features provided for in paragraph 3, clause 1, article 54 of the Tax Code of the Russian Federation, since, in the opinion of the court, they were adopted due to circumstances that are not identical to the present dispute.

The taxpayer filed a cassation appeal with the Supreme Court of the Russian Federation. According to the taxpayer, the court of first instance correctly noted the meaning of this provision, which is that an error (distortion) in determining the tax base and the amount of tax, which led to excessive payment of tax, does not have negative consequences for the treasury.

The Supreme Court of the Russian Federation agreed with the arguments of the taxpayer's cassation appeal and referred it for consideration at a court session of the Judicial Collegium for Economic Disputes. Attention was focused on the position set out in the decision of the trial court.

In addition, the ruling of the Supreme Court of the Russian Federation also states that “in support of its position, the company also refers to numerous clarifications of the Ministry of Finance of the Russian Federation on the application of controversial provisions of the Tax Code, in particular to letter dated 04/06/2020 N 03-03-06/2 /27064".

What can we expect from the Supreme Court of the Russian Federation:

The very fact that the case was transferred for consideration in a court session to the Judicial Collegium for Economic Disputes speaks volumes. Most likely, this case will be put to rest and the Supreme Court of the Russian Federation will adopt a new judicial act.

It can be assumed that the Supreme Court of the Russian Federation, when developing the appropriate legal position, will refer to the Determination of January 19, 2018 N 305-KG17-14988 and the Determination of January 21, 2019 N 308-KG18-14911.

With regard to the above-mentioned letter from the Ministry of Finance, it is appropriate to recall that this letter provides the following explanations: “An organization has the right to include in the tax base of the current reporting (tax) period the amount of an identified error (distortion), which led to the excessive payment of corporate income tax in the previous reporting (tax) period. ) period, only if a profit was made in the current reporting (tax) period.”

Although this letter does not speak of the taxpayer’s right to carry forward a loss from the past to the current period, the fact that this clarification of the Russian Ministry of Finance was mentioned most likely indicates the intention of the Supreme Court of the Russian Federation to formulate a universal position on the issue of adjusting the tax base and the amount of tax when an error is identified and how to correctly clarify losses from previous periods.

I would like to hope that the Supreme Court of the Russian Federation will take into account the positions formulated in other cases and focus its attention on the fact that if an error (distortion) in determining the tax base and the amount of tax does not have negative consequences for the treasury, then correcting such an error (distortion) not by filing an updated return for the previous tax period, but by reflecting the corrected information in the current tax return is acceptable.