Individuals and legal entities are responsible for paying taxes and fees to budgets at various levels:

- stock;

- local;

- federal

The details along with the receipt are sent to the taxpayer by the local fiscal authorities. You can also find out the required combination of symbols using your Taxpayer Identification Number (TIN).

The payment document is filled out by the tax agent, who takes responsibility for entering budget classifier codes. Determining the direction of the payment depends on the correct formatting of the fields in this document. The contribution must be clearly recorded in the automated system so that the funds reach the recipient.

The tax office does not always have time to send a notification with a receipt. In this case, the payer can use a special online service to obtain data. On the Internet, the user will find government and tax portals that will help answer pressing questions.

How can I find out the details for paying transport tax?

If the receipt for payment of the transport tax did not arrive on time, then the user must independently take care of finding the details. You can pay the invoice without having the details at the local tax office. In this case, the payment will be processed using the TIN. You must take your document and passport with you. This is the easiest and most reliable way to avoid debt and fines. At the branch, the taxpayer will be able to write an application in a standardized form, and then receive a receipt indicating the details. After this, it will be possible to pay the debt not only at the branch, but also at the savings bank.

A convenient and quick way to find details is to search on the Internet. To obtain the necessary data, the user must visit the official portal of the Federal Tax Inspectorate. The initial information in this case will be the taxpayer identification number and the exact amount of transport tax. If you have this data, there is no need to use the details from the receipt.

The easiest way is to create your own account on the Federal Tax Service website in order to always have access to information on deadlines, debts and penalties. Using this service, you can almost completely get rid of grueling trips to the local fiscal authorities.

Details for preparing payment documents for taxpayers

Address and map

Schedule

Departments

Requisites

Transfer of tax payments by taxpayers of the Stary Oskol city district KBK: Budget classification code of the corresponding tax Current account: 40101810300000010002 Bank: GRKTs GU Bank of Russia for the Belgorod region BIC bank: 041403001 OKATO Stary Oskol: 14440000000 OKATO Stary Oskol district: 14252 000000 Recipient: UFK for the Belgorod region ( Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Belgorod region) INN: 3128001998 Checkpoint: 312801001

State fee for state registration of a legal entity and individual as an individual entrepreneur (or termination by an individual of activities as an individual entrepreneur) KBK: 182 1 0800 110 Current account: 40101810300000010002 Bank: GRKTs State Bank of Russia for the Belgorod region BIC bank: 041403001 OKATO Stary Oskol: 14440000000 Recipient: UFK for the Belgorod region (Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Belgorod region) INN: 3128001998 Checkpoint: 312801001

State fee for the re-issuance of a certificate of registration with the tax authority KBK: 182 10800 110 Current account: 40101810300000010002 Bank: GRKTs GU Bank of Russia Belgorod region BIC bank: 041403001 OKATO Belgorod: 14401000000 Recipient: UFC for Belgorod region (Inspectorate of the Federal Tax Service of Russia for Belgorod) Taxpayer Identification Number: 3123021768 Checkpoint: 312301001

Fee for providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Legal Entities KBK: 182 1 1300 130 Current account: 40101810300000010002 Bank: GRKTs GU Bank of Russia Belgorod Region BIC bank: 041403001 OKATO Belgorod: 14401000000 Recipient: UFK Belgorod region (IFTS of Russia in Belgorod) Taxpayer Identification Number: 3123021768 Checkpoint: 312301001

Fee for the provision of information contained in the Unified State Register of Russian Federation KBK: 182 1 1300 130 Current account: 40101810300000010002 Bank: GRKTs GU Bank of Russia of the Belgorod region BIC of the bank: 041403001 OKATO Belgorod: 14401000000 Recipient: UFK for the Belgorod region (I Federal Tax Service of Russia for Belgorod) INN: 3123021768 Checkpoint: 312301001

Fee for provision from the register of disqualified persons KBK: 182 11300 130 Current account: 40101810300000010002 Bank: GRKTs GU Bank of Russia of the Belgorod region BIC of the bank: 041403001 OKATO Belgorod: 14401000000 Recipient: UFK for the Belgorod region (IFTS of Russia for the city. Belgorod) Taxpayer Identification Number: 3123021768 Gearbox: 312301001

Monetary penalties (fines) for violation of the legislation on taxes and fees provided for in Art. 116,117,118, pp. 1 and 2 art. 120, art. art. 125,126,128,129,129.1,132,133,134,135,135.1 Tax Code (fine for violating the deadline for submitting information about opening (closing) an account (within seven working days), fine for violating the deadline for tax registration, fine for violating the deadline for submitting information about the liquidation (reorganization) of KBK: 182 1 1600 140 (in field 110 – “SA”) Current account: 40101810300000010002 Bank: GRKTs GU Bank of Russia of the Belgorod region BIC bank: 041403001 OKATO Stary Oskol: 14440000000 Recipient: UFK for the Belgorod region (Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Belgorod region) IN N : 3128001998 Gearbox: 312801001

Monetary penalties (fines) for administrative offenses in the field of taxes and fees, provided for by the Code of the Russian Federation on Administrative Offenses KBK: 182 1 1600 140 (in field 110 - “АШ”) Current account: 40101810300000010002 Bank: GRKTs GU Bank of Russia Belgorod Region BIC bank: 041403001 OKATO Stary Oskol: 14440000000 Recipient: UFK for the Belgorod region (Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for the Belgorod region) INN: 3128001998 Checkpoint: 312801001

Share a link to us

Found an error in the description? Write to us, we will definitely fix it

How can I find out the details for paying income tax?

Every entrepreneur and owner of an organization periodically receives a notification with a receipt from the tax office. You can make a payment based on a payment document in various ways, but modern Internet technologies simplify the procedure even more for the convenience and comfort of citizens.

The Federal Tax Service portal allows you not only to find out information on your current account, but also to pay debts and fines without leaving your home. To do this, the user must have a bank card that meets the standards of international payment systems (Visa, MasterCard).

By indicating the exact amount of payment, the taxpayer confirms the transaction. After conducting a financial transaction, the user can save an electronic version of the receipt or print the document so that it can be presented to the fiscal authorities in case of problems arising in the future.

3-2.07.00. Payment order (transfer of taxes and contributions). Requisites.

8 (499) 136-12-47

8 (499)

136-33-45

8 (499)

136-33-50

Skip to User Guide contents

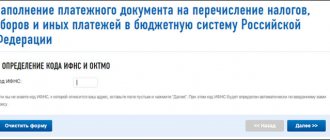

To autofill most document fields, you need to make (/check) the System settings (some information is duplicated in reference books):

- The form of the directory “Bank accounts” (Accounting → Bank → Bank accounts of the organization or Directories → Accounting) must contain details of all accounts of the enterprise opened with credit institutions

- The form of the directory “Organizations” must contain bank details of recipients of tax payments and contributions (Directories → Accounting → Organizations (counterparties) → Tax authorities)

- In the form “Setting up details for transferring taxes and contributions” (Accounting → Bank → Setting up details for transferring taxes and contributions) for each type of tax (contribution), you must fill in all fields of tax payment details (KBK, Name of recipient, OKTMO code, etc. )

- In the group of primary documents “Payment orders (transfer of taxes) in the reference book “Typical business transactions...” (Accounting → Operations), all settings must be made.

To display a list of tax payment orders, a standard PC journal form is used, however, the “Register based on” functionality is disabled in this form.

Rice. 1

When the bottom “Document” page is active, filling out the basic details on the “Payer” tabs is done in the same way as a regular PP. Filling in the payment details fields on the “Recipient” tab is also done automatically when selecting a value for the “Operation” field. The “Amount” field is filled in manually or using the Generate amount for period

— the balance from the Kt of the corresponding tax accrual account is transferred to the field, which is reflected by posting on the bottom page of the same name with the debit of this account.

When you select an operation to transfer personal income tax, the PP form changes - directly below the “Amount” field, a functionality appears that allows you to use payroll data - Fig. 2.

Rice. 2

By clicking the button, the “Select Statement” form is displayed on the screen - fig. 3, which contains a list of documents for the payment of wages and other payments in the month that was selected in the PP form.

Rice. 3

The PP will contain the amounts for the marked statements.

| It is worth noting that the System provides for the creation of only two types of statements: “Advance” and “Salary”. When creating statements for the payment of wages, vacation pay, etc., select the “Salary” type |

When selecting field values on the bottom “Tax Details” page, it is worth keeping in mind that the “Year” and “Month” fields appear in the interface only if the “Tax Period” field value is different from zero.

Rice. 4

Payment orders for taxes and fees provide for the possibility of indicating the checkpoint of a separate division when paying (transferring) tax for it by the parent organization. Once entered into the “KPP” field, the value is remembered by the System.

The “KBK” field has a built-in budget classification code constructor - Fig. 4a. When saving the document, the changed parts of the code for the selected operation are saved in the database: they are overwritten in the “Setting up details for transferring taxes and contributions” service.

Rice. 4a

| The buttons in the “KBK Designer” are intended to go to the Federal Tax Service website to select the appropriate part of the code. In the current version of the Taxpayer PRO PC, this service is inactive. |

If necessary, the postings can be adjusted on the corresponding bottom page of the form (Fig. 5):

Rice. 5

Until the bank statement on the execution of the order is received, it is stored in the System database in the “Draft” status.

Details of the tax inspectorates of Yekaterinburg, Berezovsky and Polevsky for paying taxes

Please provide new tax details for paying taxes in Yekaterinburg in connection with the merger of the Federal Tax Service.

Inspectorate of the Federal Tax Service of the Russian Federation for the Verkh-Isetsky district of Yekaterinburg Address:

620014, Ekaterinburg, st.

Khomyakova, 4 Help desk phone number: OKATO code

65401000000 – municipal formation of the city of Yekaterinburg

INN

6658040003

KPP

665801001

BIC

046577001

Account number

40101810500000010010

Bank:

GRKTs GU Bank of Russia for the Sverdlovsk region Ekater inburg

Name of recipient:

UFK for the Sverdlovsk region (Inspectorate of the Federal Tax Service of Russia for Verkh-Isetsky district of Yekaterinburg)

Tax authority code:

6658

Inspectorate of the Federal Tax Service of the Russian Federation for the Oktyabrsky district of Yekaterinburg

Recipient: Account

401 018 105 000 000 100 10

INN

6662024371

KPP

667201001 UFK for the Sverdlovsk region (Inspectorate of the Federal Tax Service of Russia for the Oktyabrsky district of Yekaterinburg)

Recipient bank:

GRKTs GU Bank of Russia for the Sverdlovsk region, Ekaterinburg

BIC

046577001

OKATO

65401000000

Tax authority code:

6672

Interdistrict Inspectorate of the Federal Tax Service of the Russian Federation No. 25 for the Sverdlovsk region

In connection with the reorganization of the Inspectorate of the Federal Tax Service of the Russian Federation for the Chkalovsky district of Yekaterinburg and the Inspectorate of the Federal Tax Service of the Russian Federation for the city of Polevsky by merging into the Interregional Inspectorate of the Federal Tax Service of the Russian Federation No. 25 for the Sverdlovsk Region from 01.09.2011.

details for paying taxes and fees have changed:

Recipient:

UFK for the Sverdlovsk region (MRI Federal Tax Service of Russia No. 25 for the Sverdlovsk region)

INN

6679000019

KPP

667901001

OKATO for taxpayers of the municipal municipality "Ekaterinburg city":

65401000000

OKATO for taxpayers of the Polevsky urban district:

654820 00000

Recipient bank:

GRKTs State Administration of the Bank of Russia for the Sverdlovsk Region

Budget account

40101810500000010010

BIC

046577001

Tax authority code:

6679

Interdistrict Inspectorate of the Federal Tax Service of the Russian Federation No. 24 for the Sverdlovsk region

In connection with the reorganization of the Federal Tax Service of the Russian Federation for the Zheleznodorozhny district of Yekaterinburg and the Federal Tax Service of the Russian Federation for the city of Berezovsky by merging into the Interregional Inspectorate of the Federal Tax Service of the Russian Federation No. 24 for the Sverdlovsk region from 01.09.2011.

The details for paying taxes and fees have changed:

Addresses:

Ekaterinburg, st.

Strelochnikov, 41; Berezovsky, st. Shilovskaya, 30 OKATO codes:

65401000000 – municipal formation of the city of

Yekaterinburg

65412000000 –

Berezovsky urban district Recipient

: UFK for the Sverdlovsk region (MRI Federal Tax Service of Russia No. 24 for the Sverdlovsk region)

INN

6678000016

KPP

667801001

Bank:

GRKTs GU Bank of Russia in the Sverdlovsk region, Yekaterinburg

Account

40101810500000010010

BIC

046577001

Tax authority code:

6678

Inspectorate of the Federal Tax Service of the Russian Federation Ordzhonikidze district of Yekaterinburg

Check

401 018 105 000 000 100 10 GRKTs GU Bank of Russia for the Sverdlovsk region

BIC

046577001

Recipient:

UFK for the Sverdlovsk region (Inspectorate of the Federal Tax Service of Russia for the Ordzhonikidze region)

TIN

6663021302

KPP

667301001

OKATO

654010 00000

Tax authority code:

6673

Inspectorate of the Federal Tax Service of the Russian Federation for the Leninsky district of Yekaterinburg

Recipient's name:

UFK for the Sverdlovsk region (Inspectorate of the Federal Tax Service of Russia for the Leninsky district of Yekaterinburg)

Account

40101810500000010010

Recipient bank:

GRKTs GU Bank of Russia for the Sverdlovsk region, Yekaterinburg

INN

6661009067

KPP

666101001

OKATO

65401000000

B IK

046577001

Tax authority code:

6671

Inspectorate of the Federal Tax Service of the Russian Federation for the Kirovsky district of Ekaterinburg

Recipient:

Inspectorate of the Federal Tax Service for the Kirovsky District of Yekaterinburg (IFTS of Russia for the Kirovsky District of Yekaterinburg)

TIN

6660010006

KPP

666001001

OKATO

65401000000

Tax authority code:

6670