Examples to help you understand the dates and rates for personal income tax.

Personal income tax applies to most types of income of individuals. The list of these incomes includes payments received by employees of enterprises and organizations. Salaries, additional material remuneration (bonuses, bonuses, etc.), as well as sick leave payments, vacation pay and various compensations are subject to personal income tax. The tax is withheld and transferred by the tax agent. It is the employing organization.

General personal income tax

As a general rule, personal income tax is paid not at the expense of the employer, such as, for example, insurance premiums from employee salaries, but at the expense of the employee, by subtracting the tax from his income. The standard rate for residents of the Russian Federation for official employment is 13%, and for non-residents of the Russian Federation - 30% (with the exception of highly qualified specialists, for whom the personal income tax rate is 13%).

Important! The Russian Government plans to reduce in 2021. The personal income tax rate for non-residents is up to 13%.

The tax is initially withheld from the employee’s income and then transferred to the state budget. At the same time, transfer of personal income tax is possible only after the income is paid to the employee - issued in cash through the cash register or transferred to a bank account.

Violations of personal income tax legislation include the following important points:

- the employer assumes the burden of personal income tax, that is, transfers his own money, and not withheld from the individual’s income (if he transfers the tax before the payment of income);

- the employer shifts the responsibility of calculating and remitting tax to the employee himself. The company is a tax agent for personal income tax, and therefore it must directly calculate, withhold and transfer the tax to the state budget. The employee receives a salary or other income minus the amount of calculated and withheld tax.

The timing of personal income tax transfers depends on what type of income the employee receives. In some cases, the tax must be transferred no later than the next day after the payment of income, for example, payment for labor under an employment or civil service contract. In other cases, personal income tax must be transferred before the end of the month in which the income was paid, for example, for vacation pay or sick leave.

Basic interest rates

As a rule, the basic rate at which calculations are made is thirteen percent of the income received. For citizens of other countries, this figure is thirty percent.

There are other rates. For example, thirty-five percent is provided for the following income categories:

- prizes and winnings, the value/amount of which is more than four thousand rubles;

- money saved on interest on loans issued (with the exception of savings on housing loans (purchase and construction of residential premises)).

Fifteen percent of income tax is provided for income from equity participation in Russian enterprises by non-residents.

Previously, there was still a nine percent rate for income received from dividends. However, since the beginning of 2015, it has been increased to the most common - 13 percent.

Amounts not subject to personal income tax

According to Art. 217 of the Tax Code of the Russian Federation, some income received by individuals is not subject to personal income tax. Their list is very extensive, but the most common are, for example, the following:

- state benefits (except for temporary disability benefits), for example, for pregnancy and childbirth, child care up to 1.5 years;

- amounts for damages in connection with injury or damage to health;

- cash reimbursement for utilities or fuel;

- cost of food in kind;

- expenses for improving the professional level of an employee;

- costs for the employee to perform work duties, for example, travel expenses;

- daily daily allowance within 700 rubles. for business trips in Russia and within 2,500 rubles. for business trips abroad;

- severance pay, average monthly earnings within 3 average monthly earnings or 6 average monthly earnings (if the organization is located in the Far North and equivalent territories);

- financial assistance from the employer up to RUB 50,000. for each child at the birth or adoption of a baby;

- gifts or material assistance received from the employer - no more than 4,000 rubles;

- benefits in connection with the death of a close relative, etc.

Personal income tax: what changes are in effect from 2021?

03 Republic of Buryatia Publication date: 02/03/2020

Edition: Inform Polis online Topic: Personal income tax Source: https://www.infpol.ru/210246-ndfl-kakie-izmeneniya-deystvuyut-s-2020-goda/

Organizations , entrepreneurs and residents of Buryatia begin to pay taxes on personal income in a new way

Since 2021, personal income taxes (NDFL) have changed greatly and affected tax agents, individual entrepreneurs and ordinary citizens. We met with the head of the department of taxation of personal income and administration of insurance premiums of the Federal Tax Service of Russia for Buryatia Svetlana Truskova , and she spoke about the main innovations in personal income tax.

In one place

First, let's look at activities related to tax agents. Tax agents are considered organizations, employers and individual entrepreneurs who pay tax for the taxpayer. Essentially, it is an intermediary between the state and the taxpayer.

First of all, you need to know that the deadlines for submitting reports for 2-NDFL and 6-NDFL have been postponed from April 1 to March 1. But since March 1st falls on a holiday in 2021, the deadline is extended until March 2nd.

It should be noted that previously large organizations with several branches within one municipality submitted reports to different tax authorities according to their location. Now the taxpayer has the right to submit a notification to the tax authority and choose one tax authority that is convenient for him to submit the calculation.

— For example, an organization located in Ulan-Ude has two separate divisions, and previously, if one branch was located in the Oktyabrsky district and the other in Sovetsky, reports had to be submitted to both the first inspection and the second. Now an organization can take advantage of this right and choose the inspection where it is convenient to submit reports, explains Svetlana Truskova .

Employee reporting

In calculations of personal tax income and insurance premiums, a control ratio is provided, which identifies the payment of wages below the minimum wage (minimum wage) or the average monthly wage in the region. If the control ratios are violated, the tax authority may send requests for clarifications and explanations. To avoid tax control, you can always independently calculate the average monthly salary by type of economic activity. You just need to use the tax calculator in the “Transparent Business” section.

Those with ten or more employees now report personal income tax only electronically. The right to submit documents on paper was left to employers with fewer employees. Let us remind you that previously the threshold was up to 25 people.

The burden on citizens has been reduced

Russian organizations and individual entrepreneurs who make payments under agreements for the purchase and sale of securities concluded by them with individuals, starting from 2020, are also recognized as tax agents.

— If previously an individual sold securities to a legal entity, for example, an organization, then the responsibility fell on the individual. He was required to declare income and pay tax to the budget. Now the organization, having paid the income, is obliged to withhold tax and pay it to the budget. The burden on citizens has decreased, emphasizes Svetlana Truskova .

May not share income

The head of the department of personal income taxation noted that starting from this year, income from compensation payments is not subject to taxes.

— Income in the form of one-time compensation payments to medical workers, not exceeding 1 million rubles, the financial support of which is carried out in accordance with the rules attached to the relevant state program of the Russian Federation, approved by the Russian government, is not subject to personal income tax. Payments to teaching staff are also not taxed, she explained.

Combat veterans receiving monthly compensation payments are also exempt from taxes starting January 1.

New types of tax-free income have been introduced. For example, if a person has an overdue debt to a bank that is no longer collectible, and when it is written off, it will not be subject to personal tax.

Payments to parents who have disabled children are also now not subject to personal income tax. According to the law, they are given 4 additional days off. And these holidays are tax free.

Advance payment

For individual entrepreneurs, the principle of making advance payments is radically changing. Previously, advance payments were calculated based on their estimated income, now - based on their actual income.

— Previously, an individual entrepreneur, in the event of income from business activities, had to submit a declaration in Form 4-NDFL about the expected income. He had to determine such income himself. Based on this, the tax office calculated advance payments to the entrepreneur, which he transferred to the budget. Or advances were calculated on the basis of the 3-NDFL declaration for the previous tax period. Now all this is canceled. Starting from 2021, the entrepreneur is independently obliged to pay advance payments based on the income received for the reporting period for the quarter on the 25th,” says Svetlana Truskova.

Please note that advance payments must be paid no later than the 25th day of the first month following the reporting period.

Tax deduction for medicines

Tax changes will also affect ordinary residents of Buryatia. Thus, it has become possible to receive a social tax deduction for any prescribed medicines based on 2021 income.

— Previously, this rule sounded like this: for medicines received, one had the right to receive a deduction, but which were indicated in the list. Accordingly, many questions arose. This has been simplified and given the right to receive all medications, but there must be supporting documents. This is a recipe and a cash receipt,” reports the Office of the Federal Tax Service of Russia for Buryatia.

Property tax

Now, when selling property that was received as a gift, free of charge or partially paid, you can reduce the income received from the sale of such property by the amount of documented expenses in the form of amounts on which the tax was calculated and paid upon acquisition or receipt of such property.

When selling property received by inheritance or gift, you can take into account the costs of the testator or donor for the acquisition.

— If you are given an apartment by someone other than your relatives, then each of you is obliged to declare this income and calculate personal income tax on it and pay it to the budget. If you declare and sell property, the amount of income can be reduced by the amount that you have already declared and pay tax on this difference, explains Svetlana Truskova .

Another important change has been made, which should resolve controversial issues related to the sale of property. When receiving income from the sale of a share in real estate acquired with maternity capital funds. Previously, families with children buying an apartment with maternity capital were required to distribute the apartment into shares. However, when selling the apartment, they had to lose tens of thousands of rubles due to taxes on the sale of children's shares.

“Now the taxpayer has the right to reduce the amount of his taxable income by the amount of expenses for the acquisition of real estate in an amount proportional to the taxpayer’s specified share in the real estate property,” the department explains.

It should be noted that at the end of 2021, 36 billion rubles in taxes were collected in Buryatia. In 2021, even despite significant relaxations, the amount most likely will not decrease. The fact is that personal income tax concessions apply more to individuals, and the most impressive amounts are paid by tax agents who pay wages to employees.

Tax deductions

Tax deductions are amounts based on which the tax base is reduced. Tax deductions can be standard, social or property. Some of them can be obtained both through the employer and through the tax office, while others can only be obtained through the Federal Tax Service.

The most common is the standard deduction for children. As a rule, the right to receive them is associated with a minimum package of documents provided by the taxpayer. The deduction depends on how many children an individual has and who they are (parent, adoptive parent, guardian, etc.).

Social deductions are mainly received for expenses on education or treatment, both for yourself and for your immediate family. Property deductions are associated with the purchase of real estate - both in cash and by concluding a loan agreement.

The provision of almost all tax deductions is based on the fact that there is a specific limit, if exceeded, the taxpayer loses the right to use them. For example, for standard deductions for children, the limit is 350,000 rubles. total income for the period starting from the calendar year. For the property deduction when purchasing real estate, the deduction is 2 million rubles.

Personal income tax in 1C

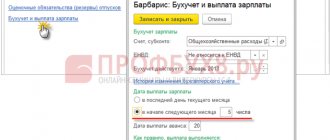

When calculating personal income tax in the 1C:ZUP program, you must make the following settings:

- check that standard deductions are applied on an accrual basis during the tax period;

- analyze whether the income codes are indicated correctly, since they will be reflected in personal income tax reporting;

- set up personal income tax taxation for each type of accrual and deduction.

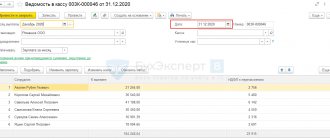

Personal income tax must be calculated for each amount of actually accrued income for each month separately. Tax is calculated by various documents depending on the type of income - vacation, sick leave, payroll, etc.

When closing the salary month, the document “Accrual of salaries and contributions” will reflect all amounts of income, deductions provided, as well as calculated and withheld taxes. This information is reflected in both accounting and tax accounting, that is, it ends up in the appropriate tax accounting registers.

Based on this information, reporting is generated to the Federal Tax Service, for example, certificates in form 2-NDFL or calculation of 6-NDFL. In the future, you can take advantage of the possibilities of transferring data directly from the program through the 1C: Reporting service, which is included in ITS PROF.

Overpayment of personal income tax

What to do if you paid too much? When an erroneous transfer of a larger tax amount occurs, the company itself can return the excess paid to its employee. This is possible when the tax period is not closed: the company must contact the inspectorate and report the incident.

When the period is closed, the employee must contact the inspectorate himself, bring documents confirming the overpayment, and also write a request for a refund.

To calculate the amount to be paid, you need to know the amount of tax. How to add personal income tax to your salary? The easiest way is to add up your salary and tax and calculate 13 percent. The amount of the transferred tax should be obtained. If it turns out to be much less, then perhaps a deduction was applied or an error was made in the transfer.