What's happened?

The Ministry of Labor of Russia, by its order dated June 14, 2018 No. 385n, changed the Instructions for personalized accounting, approved by order of the Ministry of Labor dated December 21, 2016 No. 766n.

In the new edition, the document began to be applied on October 1, 2021, so employers must take into account all amendments when reporting for September 2018. After all, the SZV-M report (approved by resolution of the PFR Board No. 83p dated 02/01/2016) is monthly. The SZV-M report contains individual (personalized) accounting information for all employees of the organization, and all employers are required to submit it to the territorial body of the Pension Fund of Russia by the 15th day of the month following the reporting month. This means that the Pension Fund of Russia expects reports for September until October 15. But this time, those employers who report electronically via the Internet (such an obligation by law arises for those organizations that employ 25 or more people) will have to do this earlier. After all, they must not only send the reporting form to the Pension Fund, but also receive confirmation that the report has been accepted. This is the main amendment that officials made to the Instructions. This equally applies to reporting forms:

Starting from October 1, 2021, the Pension Fund of Russia branch, upon receipt of the SZV-M or SZV-STAZH form from the employer in electronic form, must respond with an electronic receipt confirming that the Pension Fund of Russia has accepted this report. Until such a receipt is received by the employer, the report is considered not accepted with all the ensuing consequences. This means that even if you send your reports on time, you can receive a fine for being late.

Bugs in SZV-M are now more dangerous

Over the eight months since the beginning of the year, fund employees found violations in the reporting of 38,567 companies in St. Petersburg and 3,974 organizations in the Leningrad region.

Fund employees found the most reporting violations in companies in the Central, Moskovsky and Nevsky districts of St. Petersburg. The most dangerous areas in the region are Vsevolozhsk, Gatchina and Vyborg. Fund employees explain the results by the fact that companies with high staff turnover operate in these areas. Therefore, organizations often make mistakes in the personal data of new employees.

Please note that from October 1, the Ministry of Labor has established new rules. Now the fund has the right to fine for supplementing the form, even if the company found the error on its own. Therefore, when you prepare SZV-M for October 2021, keep in mind that now it will be more difficult to cancel fines. See recommendations from experts and fund employees that will help you avoid mistakes in the report and avoid disputes>>

Useful documents for preparing SZV-M for October 2018

Current SZV-M form Filling out a report Download a sample Changes to SVZ-M New rules

How do you exchange documents with the Pension Fund now?

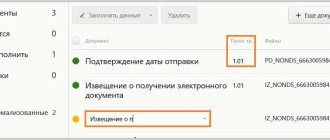

Now you need to send personalized reports to the Pension Fund of Russia using the following algorithm:

- The policyholder sends the SZV-M form to the Pension Fund;

- In response, the Pension Fund of Russia sends the policyholder a receipt for delivery of the statements.

- The Pension Fund of the Russian Federation sends a protocol for monitoring information to the policyholder (no later than the business day following the day the report is submitted).

- In response, the employer must send to the Pension Fund a receipt for delivery of the control protocol.

Obviously, all documents in this exchange must be signed with qualified electronic signatures of authorized persons (EDS). Please note that instead of one electronic document - the SZV-M form itself - now as many as 4 electronic documents take part in submitting reports.

New fine for SZV-M report (additional)

The SZV-M reporting form comes in three types. The policyholder indicates them when drawing up the report in the “Form Type” field. In particular, the report can be:

- The initial “output” is the initial data on employees for the reporting period.

- Additional “additional” - if necessary, supplement the information previously specified in the original report sent to the Pension Fund.

- О—if necessary, completely cancel the data previously specified in the report.

So, until now, policyholders could submit supplementary forms SZV-M (additional) even after the deadline for submitting the original report. In this case, they could avoid a penalty for errors if they forgot to indicate employees when filling out the initial version. Now, a fine can be avoided only if the supplementary SZV-M (additional) is sent to the Pension Fund before the deadline for submitting reports, that is, before the 15th day of the month following the reporting one. Consequently, errors in SZV-M have now become much more difficult to correct, and if one or more people are not included in the form, you can immediately tune in to the fine provided for errors. By the way, its amount is 500 rubles for each employee not included in the report or incorrectly indicated.

True, if all employees are listed, but an error was made in their data (full name, SNILS or INN), then at the request of the Pension Fund, it will be possible to clarify the data without a fine. Provided that the policyholder meets the 5 working days allotted to him for this.

Filling procedure

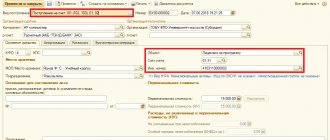

In the first section, information about the employer is filled in. You must enter the following information about the organization or individual entrepreneur who sent the report:

- Registration number assigned upon registration with the Pension Fund of Russia in accordance with Law 167-FZ.

- Name of the legal entity or full name of the individual entrepreneur.

- TIN.

- Checkpoint.

The second section is filled in the format: 00.0000. If the month number is unambiguous, you should put “0” in the first position in the provided field. In the November report, section 2 will look like this: 11.2018.

To indicate the type of form being sent, the following marks are made in the third section:

- “ISHD” is the original form originally submitted;

- “ADOP” – new data sent in addition to the original report already sent;

- “OTMN” – erroneous information contained in the original form, which is subject to exclusion.

The use of additional and canceling forms allows you to make adjustments, because a special corrective form is not provided. When it is necessary to clarify SZV-M, see the recommendations

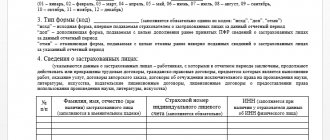

In the fourth section, you need to make a list of all insured persons, which indicates:

- Last name, first name and patronymic in full.

- SNILS.

- TIN.

It is best to determine the list of those who are to be included in the report using contracts. If the employee does not receive remuneration, but the employment contract with him has not been terminated, his data should be indicated in section 4. An employee may be on parental leave, educational leave, without pay. Lack of payments in the reporting period is not a basis for exclusion from SZV-M.

Filling out SZV M in a new way - from October 1

Related news

From October 1, 2018, new rules for filling out SZV M are in effect. Instructions for filling out SZV M reporting were updated by order of the Ministry of Labor of Russia No. 385n dated June 14, 2018.

The main change in terms of sending reports to SZV M. Now it is not enough just to send the report itself on time. It is necessary to wait for a positive protocol on his admission. In other words, if the report was sent before the deadline for submission, but was accepted after the deadline, then the report will be considered not submitted. This is stated in the Appendix to Order No. 385n. You can confirm receipt of the report with a receipt and protocol.

Also, according to the new rules for filling out the SZV M, it will become more difficult to challenge the fine for employees who, for some reason, were not included in the report. If the supplementary form SZV M is submitted after the reporting deadline, then the Pension Fund has every reason to consider the report not submitted, although the primary report was sent on time.

Clause 39 of the Instructions for filling out the SZV M also states that without the risk of receiving a fine, you can only correct errors in your full name, SNILS and INN. However, the period for such clarification is limited to 5 working days after receiving a refusal to accept or requests to make adjustments.

New rules for passing SZV-M from October 2021

Cm. "".

Let's assume that in the SZV-M for September 2021 you did not include one or more people in the report. If we talk about practice, previously the Pension Fund of the Russian Federation regarded this as an error and fined it for untimely provision of information. From October 1, 2021, the new edition of the Instructions for Personalized Accounting confirms that such fines are legal. From October 1, 2021, fines for submitting supplementary SZV-M reports were legalized. For each physicist, the fine is 500 rubles. Please note that only errors in already accepted information can be corrected without a fine.

For example, in full name or SNILS. In this case, the policyholder has the right to clarify the information himself or at the request of the fund within five working days, and this will exempt him from the fine for the error (clause 39 of the Instructions). But if you forgot to submit information for the physicist, then this is information for this insured person that was not submitted on time.

This has now been clarified in the Instructions.

For each “forgotten” insured person, the fund will fine you 500 rubles.

Who to report to the Pension Fund

In this report for October 2021, include all individuals with whom contracts were in force last October related to the payment of remuneration to them. We are talking about funds that are subject to pension insurance.

As you understand, we are talking not only about employment contracts, but also about civil law, copyright, licensing, etc.

If a company entered into a purchase and sale or rental agreement for property (cars, etc.) with an employee in October, then there is no need .

The main thing is the fact that the said contract with the individual was valid in October. Even if it was only 1 day. Whether there were payments under the contracts or not is irrelevant.

ATTENTION

there is no need to include the payee in the SZV-M .

Who should take SZV-M and when?

As you can see, this report does not make any calculations or reflect amounts - only the factual information necessary for the fund to allocate working pensioners.

- in the table, employees are added on or on, on leave at their own expense and paid.

- if an employee quits before the month of submission of the report, then data about him is no longer included in the reporting information, even if dismissal payments will be accrued in the month of submission;

- Regardless of payments in relation to employees and length of service, they are included in the document if they are subject to or;

It is important that from April 2021 it is necessary to submit the updated SZV-M form introduced by the Government in resolution 1077p.

New SZV-M report: who passes in 2021

Most accounting programs already include the function of generating such a report, so an accountant or HR officer only needs to press a couple of buttons and the SZV-M will be automatically generated and sent to the Pension Fund department.

This method of generation and transmission eliminates errors in filling out the SZV-M form, provided the initial data is entered correctly.

However, the data must be filled out correctly.

In total, the SZV-M report includes 4 sections. Section 1. Employer details. Here is a minimum set of company identifiers such as:

- INN/KPP.

- registration number in the Pension Fund of Russia;

- name of the organization (short);

? This is where all the information about the organization ends, no other information is required, and even the name of the employer is written short and not full.

Section 2. Reporting period. The month and year for which the form is submitted is indicated. Moreover, the name of the month is indicated in a digital code (May - 05, June - 06, etc.).

About the submission of SZM letters to the Pension Fund in 2021

Info Now employers will have to explain themselves. What's happened? The Federal Tax Service of Russia and the Pension Fund (PFR) issued a joint letter No. BS-4-11/, No. LCh-08-24/8824 dated 05/08/2019, which they sent for execution to their lower inspections and departments.

Officials are concerned about the situation in which a significant number of taxpayers have discrepancies between two types of reports:

- calculations for insurance premiums (DAM), which payers submit to the Federal Tax Service;

- reports in the SZV-STAZH form, which employers submit to the Pension Fund of Russia.

Although, according to the released control ratios, these types of reporting should complement each other, and the data in them should converge with each other, the Pension Fund of the Russian Federation verified the completeness of the submission by payers of insurance premiums of information on the insurance experience of insured persons using the SZV-STAZH form. It turned out that employers made many discrepancies.

SZV-M in 2021: form

Therefore, the Pension Fund of the Russian Federation did not even consider it necessary to provide in the said resolution the appropriate procedure for filling it out.

- individuals to include or not to include in the form.

- there is an obligation in principle to fill out and submit this report;

- TIN (if it is known to the policyholder).

- SNILS;

- FULL NAME. each insured person;

The main feature of filling out this form will be the year “2018”, which must be indicated in the second section of SZV-M: Also see.

“The procedure for submitting a completed SZV-M report to the Pension Fund has also been preserved: if the form contains 25 or more individuals, the policyholder is obliged to submit it via TKS as an electronic document, providing it with an enhanced qualified electronic signature (in one file without division!).

Submitting reports: instructions for filling out SZV-M

We fill in the month and year of the period for which we generate data about the insured persons.

- Form type. You must indicate what type you are creating. For reporting created for the first time, we indicate the type “output” - initial. For an adjustment that cancels incorrect information, use “cancel,” and one that supplements the data, use “add.”

- We indicate information about the insured persons in the context of each employee with whom an employment or civil contract has been concluded.

We write down the full last name, first name and patronymic (if any), fill out the SNILS and INN.

The prepared report must be signed by the head of the organization and certified with a seal.

You should also indicate the date of completion.

The current procedure for filling out the SZV-M allows for cases when you do not have to submit the document. For example, when the organization does not have a single registered employee, provided that the director or founder does not receive any payments and has not entered into an employment agreement.

Report on one founding director: to pass or not?

This situation is not that rare. In this case, the organization usually does not conduct activities and, naturally, the owner does not see the need to pay wages to himself.

Rostrud and the Pension Fund of the Russian Federation previously had completely different positions on this matter. The Pensions Authority has always insisted that the director is still an insured person and should be included in the report. In this case, the presence or absence of payments in his favor does not matter (letter of the Pension Fund of the Russian Federation dated May 6, 2016 N 08-22/6356).

SZV-M in 2021 - who is required to submit personalization

If the number is larger, then the form is sent electronically (the rules for submission are set out in the Resolution of the Pension Fund No. 1077p dated December 7, 2016). The report consists of 4 sections:

- “Insured details” - intended to indicate the name of the organization or full name of the individual entrepreneur, individual tax number, checkpoint (for LLC), registration number assigned by the Pension Fund of the Russian Federation upon registration.

- "Form type". Select one of the codes: “ref” - primary report, “additional” - supplementary, submitted when not all information is indicated in the primary report, “cancel” - contains erroneous information.

- "Information about insured persons." Fill out the table and enter information identifying employees.

- “Reporting period” - reflect the code of the reporting month and year.

Monthly before the 15th day of the month following the reporting month: Reporting month Deadline January February 15, 2021 February March 15, 2021

Procedure for providing SZV-M

We remind you that information about insured employees (SZV-M) is established by the form of Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p.

It is important to consider the number of employees for whom data is being submitted. If there are 25 or more employees, then the SZV-M must be sent in electronic form; in the opposite situation, it is enough to provide a report on paper. The current reporting format was approved by Resolution of the Pension Fund of December 7, 2016 No. 1077p. The organization needs to report both on employees working under an employment contract and on employees with whom a civil law contract has been concluded. Letter No. LCh-08-26/9856 of the Pension Fund of the Russian Federation dated July 13, 2016 introduced clarifications according to which the report also includes those employees who were not paid any remuneration during the reporting period.

SZV-M is a monthly reporting form, the deadline for submission of which is no later than the 15th day of the month following the reporting month. Letter No. 08-19/19045 of the Pension Fund dated December 28, 2016 clarifies that the deadline may be postponed if the deadline for submitting reports falls on a weekend or non-working day.

Materials from the newspaper “Progressive Accountant”

SZV-K: what is it and who is taking it in 2021 with an example of filling it out

Then it was also introduced to generalize information about work experience before 2002. Then human resources departments had to “raise” the work books of employees and inform the Pension Fund of Russia about the length of service of employees before 2002.

The compulsory pension insurance system introduced in 2002 provided for fundamentally new sources of financing pension payments - these are insurance premiums that are required to be paid by policyholders who use hired labor in their business activities or provide themselves with work. Since 2002, timely and complete payment of insurance premiums has made it possible for citizens to exercise their right to pension provision.

However, length of service before 2002 is also taken into account when assigning insurance pensions.

Why is the report submitted?

From 2021, the indexation of insurance pensions for working pensioners has been frozen. Moreover, after the retirement of the pensioner, all missed indexations should be taken into account when recalculating payments (Article 26.1 of Law No. 400-FZ dated December 28, 2013 “On Insurance Pensions”).

Therefore, starting from 2021, the monthly SZV-M form was introduced. All employers are required to provide it in accordance with clause 2.2 of Art. 11 of the Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the pension insurance system.”

Amendments to the Instructions on the procedure for maintaining personalized records

As for the first point of changes, now it is not enough for organizations to simply send and submit SZV-M to the fund. From October 1, it is also necessary to receive a notification from the Pension Fund about the acceptance of this report. This notification will represent a kind of receipt from the Pension Fund of Russia regarding receipt and acceptance of the report, but until the receipt is provided, the report is considered not accepted, and this entails penalties for failure to submit the SZV-M. Afterwards, the Pension Fund will send a data control protocol. As stipulated in the instructions, it is provided to the organization no later than the working day following the day the report is submitted. The policyholder must sign the protocol.

Another important change that policyholders need to take into account is the clarification of the conditions for exemption from fines for organizations when submitting a report. So, according to the previously existing procedure, the employer is exempt from the fine if updated information is submitted within five working days from the date when the fund body received a notification about the need to eliminate inaccuracies and discrepancies and if errors are detected and corrected by the employer before they are identified by the Pension Fund.

However, in practice, accountants were faced with the fact that when submitting the updated form SZV-M, which included employees who were not previously reflected in the original form of the report, they received a notification from the Pension Fund of the Russian Federation that a fine had been assessed. The fund's position was that expanding the list of employees does not correct an error in the information about the insured person. Such situations often led employers to challenge the fine in court, and quite often the court took the side of the insured.

Now amendments to the Instructions clarify and eliminate controversial provisions. It is now possible to avoid a fine if the following conditions are met:

- correctable errors must be made in relation to individuals included in the original SZV-M;

- errors must be detected and corrected independently or within 5 working days from the date of receipt of notification from the fund about their elimination.

Violation of these requirements entails a fine of 500 rubles.

for each insured person. The new edition of the Instruction on the procedure for maintaining personalized records dated December 21, 2016 No. 766n contains one more change. We are talking about the application of penalties if an error is identified and corrected by the organization itself. If the policyholder discovered and corrected an error before the Pension Fund learned about it, then there are no grounds for charging a fine (Part 3, Clause 39 of the Instructions). According to the order of the Ministry of Labor of the Russian Federation dated June 14, 2018 No. 385n, two conditions must be met in order to avoid sanctions:

- the organization itself discovered an error in the previously submitted information and corrected it before the Pension Fund learned about it;

- erroneous information was accepted by the Pension Fund.

Thus, the preparation and compilation of the SZV-M has not undergone significant changes. The Pension Fund of Russia, by order of June 14, 2021 No. 385, clarified a number of provisions of the instructions on maintaining personalized records in order to eliminate controversial and ambiguous provisions of the previously existing instructions.

Article

The new SZV-M form for November 2021 differs from the old one in electronic format; the form has not changed. Use the new format if reporting online.

How does the new SZV-M form for November 2021 differ from the old one?

Submit SZV-M for November in the new electronic format. The paper form has not changed. The form is still approved by Resolution of the Pension Fund Board of February 1, 2021 No. 83p.

To submit the November report, use the electronic format approved by the order of the Board of the Pension Fund of the Russian Federation dated August 31, 2021 No. 432r. This is important for those who submit SZV-M for November 2021 online.

Until November 1, companies could report using both the old and new formats. But after this date, the report will be accepted only in a new format (letter of the Pension Fund of the Russian Federation dated September 2, 2021 No. 15-26/12513).

In the updated format, the rules for checking SZV-M have become simpler. There are fewer errors due to which the fund will not accept SZV-M. For example, an extra space, period or hyphen no longer interferes with passing SZV-M. The fact that the TIN column contains only zeros will not be an obstacle. The table below shows the rules by which the Pension Fund now checks SZV-M.

How the fund will check SZV-M for November 2021 for errors

| Requirement | What error will occur if it is violated? |

| The file being checked must be a correctly filled XML document | 50 – the fund will not accept a report with such an error, you need to correct it and resubmit the SZV-M |

| The file being checked must comply with the XSD schema | |

| The electronic signature must be correct | |

| Element 'Registration number'. The number under which the policyholder is registered as a payer of insurance premiums is indicated, indicating the region and district codes according to the classification adopted by the Pension Fund of Russia | |

| The taxpayer identification number must be indicated in accordance with the Pension Fund data | |

| When providing information about insured persons with the form type 'initial' there should not be previously submitted information with the type 'initial' for the reporting period for which the information is provided | |

| The submission period for SZV-M must be no earlier than April 2016 | |

| For all types of SZV-M forms, the reporting period for which the form is submitted must be less than or equal to the month in which the audit is carried out | |

| The SNILS contained in the insurance certificate is indicated | 30 – the fund will accept the report, but partially (information on employees with such an error will not be accepted, they must be sent again) |

| The full name contained in the insurance certificate is indicated | |

| The status of the ILS in the 'Insured Persons' register as of the date of the document being checked should not be equal to the value of 'UPRZ' | |

| At least one of the elements 'Last Name' or 'First Name' must be specified | |

| The TIN check digits of an individual must be a number calculated using the algorithm for generating the TIN check number | 20 is a warning that does not prevent you from submitting a report |

| The TIN element of the insured person must be filled in |

How to solve common problems with SZV-M

How long does it take to correct errors so that there is no fine?

Inaccuracies must be corrected within two weeks after the negative protocol was received from the fund. This procedure follows from paragraph 41 of the Instruction, approved by order of the Ministry of Health and Social Development of December 14, 2009 No. 987n.

If the Pension Fund still issues a fine, it can be contested. Moreover, companies are reducing fines for SZV-M several times >>

An accountant is going on vacation, is it possible to submit the SZV-M early?

The Pension Fund will accept the report ahead of schedule. But for new employees you need to have time to get information before the 10th, otherwise the fund may issue a fine for incomplete information. In November you can submit a report for November, but not yet for December.

What to do if the fund requires a supplementary SZV-M due to an error in its program

The form with the code “supplementary” is submitted if you forgot to include one of the employees in the SZV-M or made a mistake in the report. You are not required to submit a supplementary form at the request of the fund. Let's say you decide to submit the form anyway. Attach to it an explanation that the original SZV-M was submitted on time and without errors. Confirm this with a receipt for sending the report and a letter from the special operator.

Should I submit SZV-M for November 2021 if the company has only a single founder?

Include the only founding employee in SZV-M if an employment contract was concluded with him. It doesn't matter whether he receives a reward or not. And, conversely, the owner must be shown in the report when there is remuneration, but no agreement.

There is no need to submit SZV-M for a founder without a contract and salary.

Sample of the new SZV-M form for November 2016

Important control points in the new SZV-M for November

Before submitting the new SZV-M form for November, check it against the control points.

Registration number. Indicate the same company number as in RSV-1. Do you report for the division on a separate balance sheet? Enter his number.

Company INN. It is better to carefully check this detail; due to an error, the report may not be accepted. But the error in the checkpoint for the report in the new format for November 2021 is no longer so dangerous.

Reporting period. Enter the code for the month for which you are reporting. For the November report, enter the code “11”.

SNILS. In the old format, SNILS was like this: ХХХ-ХХХ-ХХХ SS. There should be a space before the last two digits. In the new format SZV-M for November 2021, you can put either a space or a hyphen. It won't be a mistake.

Employee Taxpayer Identification Number. The fund may fine an employee for an error in the TIN. You can submit SZV-M without a TIN only if it is not in 2-NDFL either.