In this article we will understand the procedure for creating and opening a branch of any legal entity - LLC, individual entrepreneur and others. After all, if a business is developing well, then very soon you will need to open representative offices for it in order to expand, increase profits and try to reach new horizons. This is not difficult if you know how to open separate departments. To make this happen, you need to perform a small set of activities in order. We propose to consider the nuances of forming a package of documents, talk about deadlines and methods of submission. And it all starts with the directors deciding to form another office.

How to create a branch of an LLC: step-by-step instructions

In order to complete the task correctly and open up in yet another place without failure, it is worth having a rough plan of action before your eyes. The number of possible branches is not limited by law; the main thing is to register everything correctly. Each next one is easier to form than the previous ones. We suggest reviewing all upcoming surgeries. This will help avoid mistakes, proceedings with inspection authorities and time delays. There is a sequence that must be followed. Let's study it in more detail.

The decision to create a branch of the LLC

This is usually adopted by a general meeting of all participants. If there is only one member, then he has the right to independently decide and record this in the minutes.

It is important to properly prepare for the start of the meeting. First, you should choose the location wisely - this will also be indicated in the documents, so it’s worth deciding in advance. The same applies to the name of the future representative office. It is not necessary to use the main name of the organization, it can be different and completely different. The decision is made by the whole team.

Even before the collection, the Regulations must be drawn up and printed. It will contain all the important things. If you plan to make changes to the existing Charter of the company, it is recommended to draw up preliminary clauses in advance and draw up a draft of the new edition. It is also necessary to decide on a leader.

Everything must be accepted according to the majority principle. That is, it is important that at least ⅔ of the total number of those present vote. All significant moments are recorded in the protocol. This is an official document that must be presented when filing with the tax office.

What is needed to open branches and representative offices: who makes the decision

According to existing legislation, a protocol can only be drawn up on the basis of a majority. An independent business owner has the right to do this only if he is the only member of the management community.

In addition, the charter may establish a different procedure. For example, in accordance with it, the ability to open separate divisions can be delegated to the board of directors or another body, if it is collegial and executive.

Features of the procedure

To successfully complete registration, you need to complete several successive steps:

- Decide. We have already talked about this above. For this purpose, all founders with voting rights gather. It is considered that a branch will be opened if at least ⅔ of all participants vote for it.

- Prepare the position. It specifies the address at which the new office will be registered, its name, nuances, types of activities and geography, the sources from which it will be financed, the responsibilities of employees and their rights. It is separately indicated whether the unit will have its own current account.

- Select a leader. It is important to decide in advance on the vacancy of the future boss, think through his powers and indicate them in the general power of attorney.

- Record changes in the Charter, if any. We have already mentioned this too. It is advisable to prepare a draft updated version of the document, discuss all possible changes, and find out how the meeting participants feel about them.

- Fill out an application. When all the previous points have been completed, you need to draw up the appropriate paper. She will tell the inspection authorities about the upcoming changes.

- Prepare a package of documentation. They can be sent either personally to the Federal Tax Service or through specialists from other companies. There are many companies that offer the service of collecting and delivering information to the tax office. This is convenient for those who do not have time to go there themselves.

Documents for opening a branch of a legal entity in your own and another region

The list of required papers may change depending on whether changes are made to the Charter. At the moment, it is not necessary to modify it every time you register a new branch.

If nothing is changed in it, the list will look like this:

- application in form P14001;

- minutes of a community meeting or identification of a single participant;

- power of attorney and a notarized copy if the documents are carried by a representative or lawyer.

If the community decides that the Bylaws need to be changed, the list will be a little longer. In addition to the above forms, you should prepare:

- new edition in two copies;

- receipt for payment of state duty - a receipt is easily generated directly on the website (if everything was signed with an electronic signature, then you will not have to pay).

All files must be certified by a notary. This can only be done by the general director of the parent organization himself.

In addition, in some regions they additionally ask for a letter of guarantee if the enterprise will open at the applicant’s address. Or a lease (sublease) agreement if you plan to simply rent an office. Another question often arises from a Federal Tax Service specialist if a business owner plans to open in a residential building. Sometimes the company may be too noisy, so the consent of all residents will be required.

How to register a branch of a legal entity: submit documents

There are at least 4 ways to submit a package for review. Each organization can choose any one that suits it.

Main methods:

- personally submitted by the applicant;

- attorney with notarization;

- send by regular mail;

- electronic submission - a qualified digital signature will be useful; it is recommended to obtain it in advance.

It is important to take the papers to the department no later than 3 business days after making such a decision. They should be submitted at the location of the head office. Once the owner or participant has turned in the package, they will be given a receipt with a complete list of what was accepted, as well as the date when everything will be ready.

If everything will be sent by regular mail, then you need to remember to make an inventory of the attachments. The body undertakes to make changes to the Unified State Register of Legal Entities within 5 working days from the moment it was provided with everything necessary.

Submission to the Federal Tax Service

The head of the organization must submit a complete list to the tax office. The reviewer decides whether he agrees to the new unit and reports this. As we already said, all this is done where the head office is located.

Depending on the region, the Federal Tax Service may ask you to provide other files:

- regulations on the branch;

- papers that confirm the use of the address.

To use a particular home or property, business owners must have the appropriate permits. If the area is rented, then an agreement will be required, in the case where it is private property, then the owner’s consent will be required that he is ready to provide a place for work.

To ensure successful registration, we recommend that you consult with a tax specialist in advance. Sometimes it turns out that other documents are needed, so it is better to immediately find out what is needed for the official opening.

Entering data into the Unified State Register of Legal Entities

After 5 days from the moment when the company member brought the papers to the inspection body, the employee is obliged to make a decision. He double-checks everything that was brought to him, studies the legality and makes a decision. If all is well, it displays:

- registration sheet in the unified state register of legal entities;

- charter with a mark from the Federal Tax Service, if changes were made to it and it was submitted for verification.

Registration in Pension and social insurance

When owners think about how to open a branch of a company or LLC in another region, they do not have to decide how to contact the Pension Fund. At the moment, there is no need to specifically go there and make an appointment.

Now pension employees receive a message and, through information exchange, independently register new representative offices. You don’t have to go there or apply, everything happens automatically.

The FSS is required to submit documents within 30 days at the location where the separate unit is opened. That is, you need to contact the fund at an address that is close to the production site. This is especially important if there will be a lot of people working there or if the working conditions are not the safest.

How to register an LLC branch with the tax office in another city

If you plan to open an establishment in another region, then you need to be guided by Article 5 of 14 of the LLC Law. In accordance with it, it is allowed to open separate areas if they perform the same functions or part of them. It does not become an independent legal entity; all its activities will be based on the provisions that are established for society as a whole. It will be supervised by a designated supervisor. He coordinates all his actions with the head office, or acts according to instructions and a power of attorney.

According to this article, it is also important to timely reflect the update in the Unified State Register of Legal Entities. For this purpose, state registration is issued.

Reporting nuances

We looked at how to open a branch of a company, enterprise or other organization in another city, and now let's take a closer look at specific points.

If the enterprise previously enjoyed a special tax regime and was classified under the simplified tax system, then it will not be able to continue. You will have to switch to OSNO or another system.

On the accounting side, the firm has a choice. They can leave the balance general or allocate a personal one specifically for the unit. When there are few workers and production activity is low, there is no point in managing them separately. In this case, the head office determines special additional accounts for them.

If you plan to have a large subsidiary, then you should think about division. Then you will need to create your own accounting department. This is a rational step if the activity is large-scale and the number of employees is more than 10-50. But even then you will have to transfer financial statements to the main department in order to generate annual final documentation and send it to the tax office for verification.

General meeting of participants

It is organized to make any changes or discuss current affairs. For example, if it is necessary to rewrite certain provisions of the Charter or open a new office, everyone will have to gather. Here they can elect or re-elect a leader, or say something. After this, the director submits the recorded proposals to the inspection body.

This event is not necessary only if the owner of the business is the only employee. But even then he will have to create a protocol and sign it.

Open an account and separate the balance

The law did not specify the order in which the organization's work should look like. Therefore, everything remains at the discretion of the company. But it is worth noting that judicial practice usually recognizes these signs as mandatory. Therefore, for any division in which real activities are planned, you will have to open an account.

What to do with extra-budgetary funds

This is the last step to be taken before the new part of the company begins active work. You must register at the place where the representative office is located. It is important to remember that this is only necessary for branches that will have their own current account and balance. Another reason for going through the procedure is that management here independently calculates and issues wages to their employees.

To complete registration, you will have to prepare the following documents:

- application - it is prepared according to a sample that can be taken from the inspection body; it is also worth remembering that each fund can have its own form;

- notification according to which all activities have already been completed for the main company in connection with the legal entity;

- papers that were needed to create a new branch, as well as copies certified by a notary.

Since each such private or public fund is able to work according to its own rules, we advise you to contact them and get a list of what they will need to register. When all activities are completed, the department will be issued a certificate. It states that the open representative office is part of a large company, but it will pay insurance payments independently at its location.

Appointment of director

The department will be headed by a person appointed by the management of the head office or the general meeting. All actions that he needs to perform are based on job descriptions and instructions from superiors. He must also have a power of attorney, in accordance with which he begins his activities.

It can be changed at a general meeting. The reason could be any - the employee’s desire to quit, loss of confidence, or failure to cope with responsibilities. The main thing is that the council has a majority of participants who will make the right decision.

It is important to decide on the person who will occupy this post before the department begins work. He should be given a notarized power of attorney and told what his activities are. Information about who can appoint a new director, remove him and change his powers is contained in the Charter. An employment contract is signed between the head of the representative office and the director of the LLC personally.

If everything is done according to the rules, you will be able to avoid most problems and misunderstandings, avoid conflict situations and financial losses due to lost profits.

An organization can start working if it has commercial equipment, without which all processes become too long and cumbersome. To automate and optimize routine operations, you can take advantage of offers from Cleverence. In the catalog you will find various software options that will help solve your business problems faster and more efficiently.

CREATION OF A SEPARATE DIVISION THAT IS NOT A BRANCH OR REPRESENTATIVE

Creating a separate division that is not a branch or representative office is

somewhat simpler than opening a representative office or branch of the parent organization. The opening of a separate division is formalized by order of the head of the organization (except for cases where the head of the organization is deprived of the right to issue orders on the creation of separate divisions in accordance with the constituent documents of the organization).

The constituent documents of the company do not contain information about a separate division; therefore, when opening or closing a separate division, nothing needs to be included in the constituent documents.

It is necessary to take into account that a separate division should not be registered with the tax office if it is located on the territory of the same municipality as the organization itself. Read more…

The Tax Legislation of the Russian Federation provides a definition of a separate division, which is somewhat different from civil legislation.

Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month. (Article 11 of the Tax Code of the Russian Federation)

Registration of the branch with the tax office.

An organization that includes separate divisions located on the territory of the Russian Federation is obliged to register with the tax authority at the location of each of its separate divisions, if this organization is not registered with the tax authority at the location of this separate division on the grounds provided for this Code. (Clause 1 of Article 83 of the Tax Code of the Russian Federation) Prices for registering branches in St. Petersburg

Branch registration procedure

,

creating a representative office

of a company,

registering a branch with the tax office

requires such organizational procedures as a general meeting of participants (in relation to an LLC) or a general meeting of shareholders (in relation to a joint stock company).

To register a branch of an LLC

(as well as a joint-stock company), it is necessary to hold a general meeting of the company's participants, which makes a decision on the creation of a branch and amendments to the company's charter by a majority (at least 2/3) of votes of the total number of votes of participants (shareholders), if otherwise not provided by the charter.

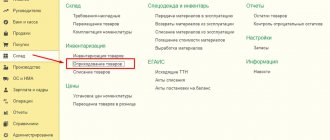

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions