Returns of goods purchased in 2021 with 18% VAT are made in 2019 using adjustment invoices with 18% VAT. From January 2021, for the return of a consignment of goods or part thereof, accepted and not accepted for registration by buyers, adjustment invoices are issued for the cost of the returned goods.

VAT 20% applies to goods shipped from January 1, 2021. The same applies to services and works. When submitting adjustment and corrected invoices, the VAT rate that was in effect at the time of shipment of goods or provision of services is indicated. When returning, the amount of tax that was presented to the buyer and paid by the seller upon sale is deducted.

What it is?

If you look at any available business directory, you will see that VAT is a tax imposed on a company or an enterprise engaged in the production and sale of products or services.

VAT creates something like a buffer of additional market value of the goods produced by the company. It is calculated as the ratio between the original price of the purchased product and its new price at which the sale will be made.

Today the tax rate in the Russian Federation is eighteen percent for the vast majority of imported products. But some categories of goods are subject to a lower interest rate: only ten percent. For example, food, goods used in medicine. Products created in the country.

All categories of goods sent outside the Russian Federation (export) are not subject to tax. True, in a number of countries around the world, even exported goods may be subject to VAT. For example, in Hungary the VAT is twenty-seven percent, in Switzerland about eight percent, in Sweden all exported goods and services are subject to 25 percent taxes, in Thailand the VAT reaches seven percent.

Surely, you have come across the concept of “offer” or “offer agreement”. But not everyone has an idea of what this proposal represents. Public offer: what is it? Let’s understand the concept and find out what types of offers there are.

You will find information about what diversification is and examples of successful strategies here.

Are you familiar with the concept of reinvestment? Here you will find details about the procedure for reinvesting funds, as well as examples of the operation.

Tax rates

As stated above, the current taxation system in Russia for legal entities and individuals assumes the following VAT percentage rates:

- Zero rate . May apply to exporting companies. Confirmation with a full package of documents for export-oriented transactions is required.

- Ten percent . Used for the vast majority of children's and food products.

- Eighteen percent . The largest amount of VAT established for the vast majority of individual entrepreneurs and enterprises.

How did the transition period affect cash register owners?

From January 1, 2021, cash receipts must display the VAT rate of 20%. We needed software and a product accounting service. Cloud software and goods accounting service were updated automatically. There was no need to re-register the cash registers.

VAT refund and information in the receipt

- If the product was sold at a rate of 18%, and the buyer issues a return in 2021, then the receipt indicates the rate that was in effect at the time of shipment.

- If the seller received an advance payment or advance payment before January 1, 2021, then the rate in the check is indicated at 18%.

- If the buyer has made a full prepayment, then when shipping the goods in 2021, the seller may not issue a receipt. This rule is valid until July 1, 2021 and only applies to full prepayment. If the buyer contributed part of the amount, then VAT will be 20%.

Invoice: preparation

An invoice is one of the main documents in matters of VAT payment.

Such a document is extremely necessary in the process of filing a return for the deduction of accrued tax.

In the process of transferring property rights or selling certain products, tax is calculated by issuing an invoice.

For example, a buyer, upon receiving an invoice, must make all the necessary entries in his transaction book, thereby confirming the right to receive a tax deduction in the future. The amount of funds indicated in the invoice is taken into account when preparing and submitting a declaration to the tax service.

The procedure for drawing up this type of document by legal entities is prescribed in the letter of the Ministry of Finance dated May twenty-sixth, 2015 and Article 169 of the Tax Code of Russia. Only those companies and businessmen who have certain tax preferences do not have to issue an invoice.

What you should pay attention to

Confusion may arise in the process of checking addresses, because many enterprises indicate their actual location in the documentation, and not their legal address. Also, errors may be made in the process of issuing payment documentation numbers and in the company name.

How is a settlement reconciliation report drawn up?

In order to verify the settlement act, we do the following:

- Select the “Sale” menu.

- Click the “Add” button

(add a new document indicating the period). - We select a counterparty.

- We choose the currency and the contract

, which should be given special attention so that it is drawn up correctly. The directory determines the contract you need. - Go to the first tab and fill in

by clicking on the “Fill in according to organization data” cell. The document is automatically filled in. - At the bottom of the document,

if necessary, the “remainings” are filled in the cell. - When you click on the second tab

“According to the counterparty”, filling occurs automatically. - The third tab is responsible for accounting accounts

, the data of which will be indicated in the documentation. - After all the operations performed

, go to the “additional” tab, here a representative person from the organization is indicated, all personal data and signature are indicated.

How to calculate VAT? Example

How to calculate VAT payable? For a more complete understanding of what a tax such as VAT is, it is worth considering two simple examples.

First example

Let's say an entrepreneur opened a small store selling denim clothes.

However, to get started, he should find a wholesale supplier from whom he could purchase goods.

Let's say a supplier was found and fifty pairs of jeans were purchased from him for a total of ten thousand rubles (two hundred rubles for one pair of jeans).

In such a case, eighteen percent of the tax has already been included in the cost of the clothing, which the wholesale supplier will have to pay.

Two hundred rubles is 118 percent (or 1.18). The price of one pair of denim clothes excluding value added tax (from a wholesale supplier) is 169.5 rubles (the cost has been rounded for ease of calculation).

Consequently, thirty and a half rubles from each pair of jeans is the VAT paid by the entrepreneur, or 1,525 rubles for the entire batch of denim clothes. This amount will be taken into account as an “input” contribution.

When purchasing materials for their subsequent retail sale, an entrepreneur must prove that the cost of goods already includes VAT; in this case, this proof is an invoice, check or invoice with the corresponding tax lines. Accounting must be clear and transparent for the tax service.

Before the value of products ready for sale is generated, the entrepreneur should subtract the value added tax from the purchased goods - the amount of money deducted will serve as the basis for the subsequent calculation of the tax. After having already created the finished product, it is necessary to take into account the tax, namely eighteen percent.

Let’s say that an entrepreneur was able to sell jeans purchased from a wholesaler at a price of 1,000 rubles per piece.

In this case, after selling the entire batch, revenue in the amount of 50 thousand rubles will accrue.

This amount is similar to the previous 118 percent; in other words, the “outgoing” VAT base will be equal to:

- 50 thousand rubles / 1.18 = 42,373 rubles (100 percent);

- 50 thousand rubles – 42,373 = 7,627 rubles.

Ultimately, the entrepreneur will have to pay 7,627 – 1,525 = 6,102 rubles.

Second example

Clothing was purchased at a price of 2,000 rubles, and sold for 3,000 rubles. In this example, the amount of money required to pay value added tax can be calculated even more simply: the entire added value (one thousand rubles) is taken as 1.18 or 118 percent. Therefore, the VAT amount at eighteen percent will be:

- 1,000 / 1.18 = 847.5 rubles;

- 1,000 – 847.5 = 152.5 rubles.

If an identical number of goods were sold as purchased, then the VAT that must be paid can be calculated simply on the value added per unit of goods (the difference between the cost of purchase and sale).

Configuration 1C: Enterprise Accounting 3.0: Return of goods by buyer to seller

Content:

1. Changes in the return of goods by the buyer to the seller in 2019.

2. Return of purchased goods if shipment occurred in 2018 and return in 2021.

Changes in the return of goods by the buyer to the seller in 2021

By Decree of the Government of the Russian Federation of January 19, 2019 No. 15 “On amendments to Appendices No. 3 and 5 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137” the following changes are made:

Paragraph 1, paragraph 3 – excluded from the sales book: the buyer registers the document “Invoice”, which is issued to the seller upon “return of goods accepted for registration”.

In all cases of returning goods: full, partial, the buyer and the seller have one rule!

There is no more “reverse sale” of goods!

The buyer gives the basis document, for example, TORG-12, to his supplier without issuing an invoice. The supplier reflects the return on the basis of this document. Issues an adjustment invoice from the seller and transmits it to the buyer. The buyer records this adjustment invoice. The document “Return of goods from the buyer” remains only for the archive.

Return of purchased goods if shipment occurred in 2018, and return in 2021.

Let's consider this situation: the shipment of goods by the supplier occurred in 2021, and 1C returned the goods in 2021. The organization entered into a supply agreement with the buyer on OSNO.

12/24/2018 200 items were shipped. for a total amount of 30,000 (including VAT amount of 18 percent)

On 01/09/2019, low-quality goods were identified and returned to the supplier - 50 pcs. in the amount of 7,500 (including the amount of VAT 18 percent)

For the Seller: VAT deduction occurs in the period in which the documents for adjustment were made, i.e. in January 2021. Reflected in the purchase book and in the VAT return Section 3 page 120 and Section 8 page 180.

Procedure in the 1C:Accounting 3.0 configuration:

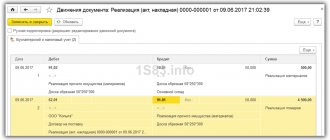

1. We make the document “Implementation (act, invoice).

After posting the document, the following accounting entries are entered into the accounting register:

on the debit of account 90.02.1 and the credit of account 41.01 - for the cost of written-off goods;

on the debit of account 62.01 and the credit of account 90.01.1 - for the sale value of goods;

on the debit of account 90.03 and the credit of account 68.02 - for the amount of accrued VAT.

A registration entry is made in the accumulation register “VAT Sales” to create a sales book.

2. Based on the document “Implementation (deed, invoice), we create the document “Adjustment of implementation.”

Type of operation – Adjustment by agreement of the parties.

Reflect the adjustment in all sections of accounting.

In the tabular section, in the “after change” line, we adjust the quantity.

Note! VAT 18%, since the sale took place in the previous period.

3. We issue the document “Adjustment Invoice”.

Advance offset – Automatically.

Last year's accounting is closed - the checkbox is unchecked.

Item of other income and expenses – Corrective entries for transactions of previous years.

After posting the document, the following accounting entries are entered into the accounting register 1C 8.3:

on the debit of account 90.02.1 and the credit of account 41.01 - REVERSE for the cost of written-off returned goods;

on the debit of account 62.01 and the credit of account 90.01.1 - REVERSE for the sale value of the returned goods;

on the debit of account 90.03 and the credit of account 19.03 - REVERSE for the amount of VAT accrued upon shipment of returned goods.

When issuing an adjustment invoice to the buyer to reduce the cost of goods (including in connection with clarification of their quantity), the seller accepts the difference in the amount of VAT for deduction in the tax period of adjustment. Therefore, as a result of posting the document “Adjustment of sales”, an entry is made in the accumulation register “VAT presented”.

4. Reflect “Creating purchase book entries” in 1C.

Specialist

Galina Nurlygayanova.

Tax refund - how to return VAT

A refund implies the use of a tax deduction, which is the amount of money by which the state allows you to reduce the tax required to be paid when selling goods or services.

According to the Russian legislative framework, enterprises and private entrepreneurs who use the general taxation system, but do not have any tax preferences and work with goods and services subject to the taxation system, can take advantage of the opportunity to refund VAT.

In the vast majority of cases, VAT is deductible, the amount of which is presented by the supplier of the service or product. A private businessman is able to reimburse the accrued tax if he performs the duties of a tax agent.

VAT refund process for a legal entity

- Providing tax documentation that specifies the amount of funds required for reimbursement.

- Conducting a chamber assessment by tax service employees. The verification is carried out within ninety calendar days from the date of submission of documentation.

- Making a final decision by the tax authority whether a VAT refund will be carried out or a refusal has been received.

In the overwhelming majority of cases, tax authorities, referring to the formal conditions of refusal, try to make a decision to refuse a tax refund. As a result, such a process often leads to courtroom proceedings.

VAT refund when purchasing a car

Is it possible to refund VAT on a car purchase? In the case of purchasing a new or used car, Russian legislation allows a portion of the tax paid to be returned exclusively to non-residents of the country, because they are not required to pay Russian taxes, such as residents of the Russian Federation.

Refund when buying an apartment or house

How to return VAT from the purchase of an apartment? Based on Article two hundred twenty of the Tax Code of Russia, an individual has the legal right to provide a tax deduction (property) in the amount of money that was spent on the construction or purchase of a house (apartment) on the territory of the state, in the amount of actual waste, but not more than a million Russian rubles.

A taxpayer can return tax from the purchase of a house or apartment with a mortgage from credit institutions located in the country. In particular, interest on a property loan is subject to reimbursement, not exceeding one million rubles.

If the company's activities are monitored incorrectly, a situation such as a cash gap may arise, which can lead to bankruptcy of the company. Determining the cash gap: tips for planning expenses to avoid business collapse.

Read about what franchising is in this material. Check out the history of this phenomenon. Pros and cons of starting a franchise business.

If the product's expiration date has expired

If you return an expired product, the product must be disposed of. Such goods can be written off as expenses only if they are prescribed for write-off by legal and regulatory authorities. In the absence of one, it is not recommended to write off as expenses.

Due to certain circumstances, there are situations when you need to return goods to the supplier. Depending on whether the goods being returned have been paid for or not, and whether the goods and materials have been accepted for accounting, accounting entries are made. It is also worth highlighting issues related to the return of high-quality and low-quality goods.

Civil law establishes cases when goods can be returned to the supplier. When returning goods of proper quality: it is issued in the form of a return sale. For this purpose, wiring is done

- Debit Credit 41.