Why preparation is important

If the tax office comes for an on-site audit, she already knows what and where to look.

Selection methods have long been known to everyone. How to understand that the situation is escalating, and your business is being developed by the tax authorities, I will prepare a separate article.

So, the tax office has already carried out a comprehensive analysis of your activities, identified problematic issues, and even calculated a forecast amount, for which an on-site tax audit is coming to you. And the inspector’s task is to go to the place, look around and collect evidence that you are breaking the law.

But! If the verification comes, it means nothing has been proven yet. Inspectors go to collect evidence using the weak links of any business - employees and documents.

Your task is to survive this test with minimal losses.

Don’t give away too much and know what evidence was collected and in what ways. Be careful and very attentive!

To prove the correctness of your actions in court or at the pre-trial stage.

Convincing and fearless.

There will be no special warning

The tax office is not required to warn you that an audit is planned against the company.

In practice, the Federal Tax Service Inspectorate warns by telephone and calls the head of the Federal Tax Service Inspectorate to hand over the decision to conduct an inspection. Or uses a quick and cheap method of informing via TKS - through the taxpayer’s personal account.

The decision is considered received the next day from the day it is posted in your personal account. But the audit period begins to count precisely from the date the tax office makes its decision, and not from the date you receive it.

But sometimes an inspector can come suddenly, out of the blue. Present your official ID, hand over the decision and familiarize yourself with it.

It is important that with the decision to conduct an inspection, the inspector presents a request for the submission of documents, which you must comply with within 10 days.

If a very large volume of documents is requested, you have the right, the next day after receiving the request, to apply in writing to the head of the tax office for an extension of the deadline, indicating the reasons and the realistically possible deadline for submitting the documents.

Within 2 days, the head of the Federal Tax Service has the right to decide whether to extend the deadline or not. Right. But you don't have to. Depends on the weight of the reasons and your persuasiveness.

But don't be upset if they refuse. We already have 10 days!

And we are urgently working on preparing for the inspection!

What can the Federal Tax Service be guided by?

The selection criteria include the company’s performance indicators or those circumstances in the presence of which the taxpayer falls into the risk zone of committing a tax offense. If, for example, a company often changes its legal address or reflects constant losses in its reports for several years in a row, then this will be the basis for ordering an on-site inspection.

Please note that the Concept does not define the exact number of criteria that will become the basis for including an organization in the inspection plan.

Important!

The inspection may order an on-site inspection of an organization either in the complete absence of these criteria or in the presence of at least one of them.

The basis for the audit may also include information that was previously prepared by the tax base legalization commissions created under the Federal Tax Service. Additional criteria include the company’s participation in an ongoing regional investment project, which provides special tax benefits. Federal Tax Service employees may want to verify the legality of applying such benefits to project participants.

If your company has received a notification about an on-site inspection, then you should not panic and prepare all available documents. You should seek help from qualified lawyers in the field of such events. They will give advice, help collect the necessary documents and do everything possible to ensure that the company avoids tax sanctions based on the results of the audit.

ATTENTION!

Due to recent changes in legislation, the information in this article may be out of date!

Our lawyer will advise you free of charge - write in the form below.

Getting ready for inspection

Reality is the main thing

Even if the Federal Tax Service recognizes your counterparty as a “fly-by-night”, you must prove that the transaction with this counterparty was real! It is very important!

It is worth thinking through and memorizing all the details of the legend with all employees involved in the transaction:

- how they found the supplier, who found him, why him, how the terms were discussed, where the contract was concluded, what the director looks like if they met in person, etc.

- delivery of goods: how they were delivered, what kind of transport, who owns it, what driver, who accepted the goods, who handed them over, etc.

- unloading to the warehouse: where is the warehouse, owned/rented, storage conditions, sufficiency of warehouse space, how it was unloaded, by what force, who received it, etc.

Pay attention to the logic of actions, time intervals, deadlines and dates indicated in the documents. The lack of “common” sense of the deal, discrepancies in dates and unrealistic deadlines are often “scorched” on this.

Keep all documents related to correspondence with counterparties. Save emails too. But be careful. Prepare fragments and scans. So that there is no unnecessary information for inspectors.

Even if the tax authorities have identified certain signs of a “fly-by-night” in relation to your counterparty, your convincing position can change the course of the case. Your diligence and non-involvement in illegal actions can be confirmed by documents and clear answers to questions during interrogation as a witness. This applies to all your employees. This is what my article “For interrogation? - No problem!"

Notify your counterparties about the inspection and compare the documents again

Especially constant, with high speeds, or suspicious, in your opinion. Find out if they have had any checks. Any. Desk, visiting, counter. Were there interrogations? Did they ask about you? What questions were asked, what answers were given. Think over the legend taking into account the information received. It is possible that they will come to them too.

The first and second copies of your documents with your counterparties must be absolutely identical. All details must match, including signatures, seals, numbering, and dates. Check again. Replace fax copies with originals.

Prepare explanations for the location of your objects

Where are the office, warehouse, branches, separate divisions, production facilities located? Rights of use, purpose of use. So that when leaving the site, the inspector can easily find it. There should be no extraneous property, documents or uninformed people there.

Where to get checked

Of course, like any audit, an inspection by the Federal Tax Service slows down the company’s work. Therefore, think about where it is better to survive it: in the office or bring documents to the inspection.

In my opinion, it’s better to go to the inspection: the inspector will not surprise you with the suddenness of his questions: there will be time to prepare documents for requests, not answer questions without preparation, transfer all communication to paper: demand - response with documents attached, another demand - another response with attachment of documents.

Submit the required documents, but slowly and very carefully. Please remember that the review period is limited.

During the audit, some of my partners brought volumes of documents to the tax office that did not raise any questions, but loaded the inspector’s office: loan agreements, acts of transfer of bills, bank statements. My head is spinning, there are mountains of papers, but no evidence of violations has been found.

The purpose of an on-site inspection is that the inspector comes to you. But you can contact the head of the tax office with a request to conduct it at the inspectorate due to the lack of possibility of conducting an audit in the office. The main thing is to motivate your request well. The arguments must be substantial, since your request may be rejected.

You can start renovations in the premises, refer to the quarantine of workers, or create crowded conditions - move everyone into one room. The inspector has the right to verify on site that this is not possible and come for an inspection. He also does not want inconvenience and, perhaps, he will justify to his management the advisability of conducting an inspection at his workplace in the inspection.

But if they don’t agree with you, don’t be upset either! Host inspectors at your place.

What it is

On-site inspection is a control that is carried out at the enterprise of an individual or legal entity. The tax office goes to the payer’s enterprise, where they may find violations in the form of the organization’s failure to provide the required information or the production’s failure to pay taxes. There are penalties for this.

The activities of the event include a complete or selective analysis of the company’s work. The features of the first are the requirement of activity-based information, which selective assessment does not allow. There is also a desk method.

This term implies that the taxpayer is obliged to submit a declaration to the tax service, on the basis of which it is possible to check the period of operation of the enterprise, which does not exceed the completed schedule. The chief accountant is present during the inspection and prepares the documentation.

His assistants are allowed, but it is also possible to be accompanied by lawyers. The management of enterprises is concerned about what violations and shortcomings are revealed by the tax service and what the consequences are? The legislator provides for the imposition of penalties for non-payment of taxes. Typically, the sale of real estate does not occur.

Office preparation

Organize desks and safes

Take to your home other people's seals and stamps, flash drives, plastic cards, letterheads of other enterprises, including those already liquidated, and other incriminating items. Do not give the inspector a reason for unnecessary questions, unnecessary thoughts and additional research.

Take care of backups

Just in case. Inspectors use computer seizures in rare, acute cases. This may result in irreparable loss of valuable information. Therefore, it is better to transfer important work data to a remote server in advance.

Prepare your computer for the inspector

Delete all information in it except the accounting database for the audit period.

It is worth cleaning up the computers and other employees - removing unnecessary databases and dubious correspondence.

Be prepared to print tax registers or transcripts if required by the inspector.

You can also submit the requested information electronically.

Never place an inspector at your computer, do not enter your login and password, and exclude the slightest opportunity to “surf” your personal virtual world.

Prepare the inspector's workplace

Not exactly in the accounting department, where an emotional sales manager or a noisy driver can accidentally fly in. It's good if it's a separate room. Or a meeting room.

Prepare tea, coffee, sweets. Think about where and with whom the inspector will go for lunch. Offer a ride home after the end of the working day. There is no need to create an atmosphere of alienation. Attention and a kind joke will help defuse revision tension and constraint.

This may also be useful. It may happen that you invite an inspector fired from the tax office after an unsuccessful inspection to work as a tax consultant. Why escalate the situation in advance? You are confident in yourself. Be patient and endure the test with dignity. You don't need negativity. And a positive-minded inspector is capable of much. Exactly.

Instruct the secretary

The company secretary immediately notifies the manager and responsible employee of the inspection. The responsible employee must have a deputy in case of absence. Compose a short template for a letter to employees informing the secretary about the start of the inspection; a warning that you can communicate with inspectors only in the presence of a person in charge and as correctly as possible; a reminder about the rights of employees during inspection. Some companies include in the letter a request to remove documents from tables, lock cabinets, and log out of your computer account. In the event of a seizure, such actions will be useless, but are justified in case of inspection.

Separate room.

Designate a place for inspectors in advance. Inspectors are ordinary people who do their jobs and deserve to communicate within the bounds of business ethics. Offer them drinks and a Wi-Fi password while they wait for management and the responsible employee. If inspectors require original documents, then it is advisable to familiarize them with them centrally, that is, inside this room.

Staff briefing

All questions only through the coordinator

Designate your representative to interact with the inspector. This could be a tax lawyer, chief accountant or financial director. Understands the rules of conducting an audit and knows all the risks of the business. It is this person responsible for the inspection who will respond to requests for the production of documents, transfer them to the inspector, listen to questions and provide answers.

All additional actions of the inspector (inspections, seizures, inventories, interrogations) must also take place under his strict control.

Conduct training for the entire team

React to requests, persuasion, instructions of the inspector - only in one way - send to the coordinator. No answers without his consent. No amateur performances. This is right.

All employees without exception must immediately report any requests from the inspector, oral or written, for example, the delivery of a notice of summons for questioning, to the person responsible for the inspection.

Set yourself and your team on the right tone

Getting in the mood is very important. Consider communication with inspectors as a type of business negotiation.

There's no point in starting a little war with the inspector. But intimate conversations with inspectors in smoking rooms should also be excluded. This is one way of collecting information.

Consider allowing employees to temporarily work from home. Especially unreliable, fussy and talkative ones.

What is the question is the answer

Following former employees, tax officials often switch to those who work in the company. And although these people are already determined to defend their company in every possible way, interrogation is not the easiest test for them. “It’s very difficult to resist saying too much. It's all about the question itself. Most often, inspectors initially say in an accusatory manner: “Do you know that the company is engaged in counterfeiting?”, “Do you know that it is involved in working with fly-by-night products? Very few people in a situation of moral pressure will begin to justify their position and say that the organization does not engage in such fraud,” says lawyer Yulia Perova.

How can we help employees pass this test? The questioning of witnesses can be carried out both at the location of the tax authority and at the company’s office. Therefore, if “communication” with the organization’s staff is planned during the inspection, it is better to provide your premises for these purposes. This will reduce the impact of the event on the production process.

At the same time, it is worth morally preparing the team for the meeting with the inspectors, explaining that the witness should not talk in detail about the company’s activities, but answer the questions posed briefly and clearly, without lengthy explanations. The head of the company must take into account that most employees, if they find themselves in such a situation, will get confused and tell more than is required. Therefore, it is advisable to involve qualified lawyers in this procedure who can provide legal assistance, especially since this is not prohibited by the Tax Code.

The interrogation is accompanied by the drawing up of a protocol in which specific questions asked by the inspector and the answers of the witness are recorded. It is necessary to ensure that the content of the conversation is reflected correctly. To make sure of this, you should have the protocol read by a lawyer present. It is also wise to record the interrogation on a voice recorder and resort to this evidence if it turns out that the testimony of the inspector or witness is distorted in the protocol.

“In most cases, employees are expected to provide salary information. Often this information is at odds with reporting data. But it happens that interrogations reveal schemes by which a company evades taxes.

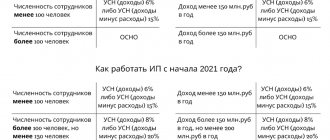

Thus, one of the elite hotels near Moscow organized the following system: the hotel itself, according to the Tax Code criteria, can only apply the traditional taxation system. The hotel registered another organization on the simplified tax system and transferred a significant part of the staff to this company. The companies entered into an agreement on the provision of services for cooking, cleaning, maintenance, repairs, etc. In this way, up to 10 percent of the wage fund was saved. The scheme worked for almost four years, until inspectorate specialists conducted a large-scale audit and interrogated almost two hundred employees. As a result, an additional 18 million rubles in taxes and penalties were assessed,” says lawyer, financial law specialist Alexey Zaitsev.

Any support is important

It is very useful to invite an auditor, or a tax consultant, or a lawyer. For legal, methodological and moral support. Such professional assistance is provided by various consulting firms. It is advisable, of course, to take care of this in advance and have it already verified. Among them there are many theorists who reason and verbally solve any problems, but in reality “haven’t smelled gunpowder”, and shrug their shoulders in the case of truly dangerous situations.

You should always remember about tax risks. It is worth preparing for this issue in advance. And some transactions from a security point of view, in a quiet operation mode, should be worked out in advance and discussed with consulting partners. Then, by the time of the inspection, you will have your own person, whose professionalism you trust, and he will not let you down. Such a fearless helper!

It’s just great if you have such a person on your staff!

But there remains a sediment

In addition to the employees themselves, tax authorities also send subpoenas to the contractors being audited.

To prove the illegality of deducting VAT and other costs, inspectors of field inspection departments enthusiastically look for managers and tell them on a piece of paper about how they managed the company. The hand of experienced taxpayer lawyers is felt here. In such cases, cases fall apart, and the decision to check is considered illegal,” says Alexey Zaitsev.

However, the inspectors target employees of all organizations with which the company being inspected entered into transactions. And, naturally, counterparties are not delighted with the attention of tax authorities to their business partners. These interrogations have the most painful impact on the company’s affairs, as they directly affect its market position, reputation and income.

Study the tax code

Questions regarding tax audits. Your rights. And responsibilities. Rights and responsibilities of the inspector. What he has the right to do and what not. What documents must the inspector present when performing control procedures and the procedure for carrying them out. What violations are allowed during inspection, interrogation, inventory, demand, seizure.

You have the right to list excesses and excesses and other violations on the part of the tax authorities in the complaint and, citing them, demand that the results of the audit be invalidated.

Supervise the inspection

PRACTICE ON WITNESSES

The inspection will be considered illegal if the witnesses are: • employees of the taxpayer (Resolution 9AAS dated 02.09.13 No. A40-85714/12, Resolution of the Federal Antimonopoly Service of the Moscow Region dated 03.12.2010 No. A40-6293/10-13-36);

• inspectorate employees (resolution of the FAS ZSO dated 02/09/2010 in case No. A75-6187/2009); • did not actually participate in the inspection, but only came up to sign the protocol (Resolution of the Federal Antimonopoly Service of the North-West District dated 02/07/2014 No. A66-3086/2013). Inspection of premises as part of an on-site inspection, unlike a desk inspection, does not require a special (separate) decision from the tax authority. In some cases, an inspection is mandatory (clause 6.5 of the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837), for example, if there are suspicions that the company is conducting activities that it did not declare in its constituent documents. The taxpayer himself, a specialist and an expert have the right to participate in the inspection. Inspectors should always be accompanied by a responsible officer to ensure that possible misconduct is recorded. During the inspection, inspectors can take photographs and videos, and make copies of documents. Inspectors have the right to get acquainted with documents that constitute a trade secret (clause 1 of Article 93, paragraph 2 of clause 3 of Article 102 of the Tax Code of the Russian Federation). If employees interfere with the inspection, this can be qualified as obstruction of the legitimate activities of an official with the consequence of administrative punishment under Part 1 of Art. 19.4, art. 19.7.6 Code of Administrative Offenses of the Russian Federation. In such cases, inspectors often return with reinforcements from law enforcement officers and carry out seizures.

Computer inspection.

If the computer remains turned on, nothing will prevent the inspector from inspecting the contents of the technical device. In one of the recent tax disputes, the judges came to the conclusion that actions to inspect computers are legal, reasonable and do not violate the rights of the taxpayer. Carrying out an inspection without studying the data contained in the computer does not meet the goals of its implementation; the computer itself as a technical device does not carry information (resolution of the Administrative District of the East Siberian District dated March 14, 2017 in case No. A19-916/2016).

Registration of inspection protocol.

Reflect each action and violation of the inspectors in detail in the inspection report, indicate your comments and observations. Tax officers are not required to provide a copy of the inspection report. The company will receive it along with the inspection report (Resolution of the AS of the East Siberian District dated March 14, 2017 No. A19-916/2016).

Uncover Your Hidden Tax Overpayments

Look for and involve auditors. Carry out in tax accounting transactions that you were afraid to declare as a reduction in the tax base. For three years . For example, due to the reporting of a loss or tax refund in a tax return.

Or because of discrepancies in the rules in letters from the Ministry of Finance and established judicial practice. Everyone definitely has such reserves.

Insist on their inclusion in the calculation. In objections to the inspection report, at the stage of pre-trial procedure, in a judicial dispute. There is a precedent when a tax audit ended not in arrears, but in a refund from the budget.

Check the legality of the seizure

EVIDENCE OF DESTRUCTION

• You must indicate: resolution of the Federal Antimonopoly Service of the Volga District dated June 25, 2014 in case No. A12-23096/2013);

• It is not necessary to indicate: resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated November 30, 2013 in case No. A31-13075/2012. The seizure is carried out on the basis of a reasoned decision. The template is provided by Order of the Federal Tax Service of Russia dated May 8, 2015 No. ММВ-7-2/ [email protected] The main motive for seizure is that the inspection has sufficient grounds to believe that the original documents can be destroyed, hidden, corrected or replaced. At the same time, the inspectors do not have enough copies at their disposal (clause 8 of Article 94 of the Tax Code of the Russian Federation). On the question of whether the tax authority is obliged to indicate in the seizure order evidence that there is a likelihood of destruction of documents or not, judicial practice is contradictory.