Organizational property tax is one of the mandatory OSNO taxes for legal entities (including foreign ones). IP

, in turn, pay property tax like individuals (more details here).

Note

: the property tax of organizations is a regional tax introduced by the laws of the constituent entities of the Russian Federation. Regional authorities can independently set the tax rate (within the limits established by the Tax Code of the Russian Federation), the procedure and terms of payment, benefits, and features of calculating the tax base.

How to find out whether you need to calculate advances and fill out a report

Whether or not your company will file a settlement at the end of the 1st quarter of 2018 can be found out from the corresponding regional legal acts. If you are required to submit it, we recommend that you:

- Familiarize yourself with the tax calculation form and the rules for filling it out, approved by order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/

- Study in detail the latest edition of the regional legal acts on property tax ─ after all, since 2021, most regions have adjusted “property” laws in connection with the abolition of the federal exemption for “movables”.

DEADLINE FOR CALCULATION OF ADVANCE PAYMENT FOR PROPERTY TAX FOR THE 1st QUARTER OF 2021 – NO LATER THAN MAY 3, 2021

Reporting on property tax of organizations

At the end of each quarter, the organization must submit advance payments to the Federal Tax Service no later than 30 days

from the end of the quarter.

The tax return is submitted at the end of the year by March 30

next year.

Note

: calculations for advances and a tax return are submitted separately for each property located at the location of the organization, outside its location, separately for the property of separate divisions allocated to a separate balance sheet - to all Federal Tax Service Inspectors on the territory of which the specified property is located.

Note

: taxpayers classified as the largest ones submit declarations at their place of registration.

Technology for calculating advances and preparing reports

First you need to collect information:

- on the cadastral value of a real estate asset on the company’s balance sheet as of 01/01/2018 (if it is included in the list under clause 1 of Article 378.2 of the Tax Code of the Russian Federation);

- on the cadastral value of residential premises not taken into account on the balance sheet as fixed assets (clause 12 of Article 378.2 of the Tax Code of the Russian Federation);

- on the residual value (according to accounting data) of the company’s other assets (to calculate the average value of assets for the 1st quarter of 2018).

- Property tax rate ─ 2.2%. The maximum tax rate on “movable property” cannot exceed 1.1% (clause 3.3 of Article 380 of the Tax Code of the Russian Federation). For Sevastopol and Crimea ─ 1%. This rate is used to calculate the tax advance on movable assets (Clause 25, Article 381 of the Tax Code of the Russian Federation):

- belonging to 3-10 depreciation groups;

- registered from 01/01/2013;

- received by the company not from related parties and not as a result of reorganization or liquidation.

IMPORTANT! The maximum rate is applied only if regional authorities have not provided reduced rates or benefits. The calculation of advances does not include the cost of property included in depreciation groups 1 or 2 (subclause 8, clause 4, article 374 of the Tax Code of the Russian Federation). The maximum property tax rate based on the cadastral value cannot exceed 2% (clause 1.1 of Article 380 of the Tax Code of the Russian Federation), but regional authorities have the opportunity to reduce it.

Having collected the information, calculate the advances separately:

- Based on the cadastral value of the property:

APk = ¼ x KSI x SNks,

where APk is an advance payment calculated from the cadastral value;

CSI ─ cadastral value of property;

SNks ─ tax rate (for real estate with a base in the form of cadastral value).

- Based on the average value of property for the reporting period:

APsr = ¼ x SSA x CHsr,

where APsr is an advance payment calculated from the average value of assets;

ACA ─ average value of assets for the quarter;

СНср ─ tax rate (for assets, the base for which is calculated in the form of their average value for the reporting period).

Now let’s try to calculate APk, APsr and the total amount of “property” obligations.

Objects of taxation in 2021

Law of the Russian Federation of December 9, 1991 No. 2003-I was replaced by Chapter 32 of the Tax Code of the Russian Federation. The changes affected taxation objects. An individual who has the right to property must pay tax (Article 400 of the Tax Code).

Let us recall that previously the list of taxes included:

- apartments;

- residential buildings;

- rooms in a communal apartment;

- garages.

Now this list has been replenished with new objects (Article 401 of the Tax Code of the Russian Federation):

- parking space;

- unfinished;

- buildings, as well as dachas (other structures), which are located on the land plot;

- several buildings united technologically and physically in a document that defines your ownership (Article 133.1 of the Civil Code of the Russian Federation) - a single real estate complex.

- houses and residential buildings located on land plots provided for personal subsidiary plots, dacha farming, vegetable gardening, horticulture, individual housing construction (as amended by Federal Law No. 401-FZ of November 30, 2016).

Example of calculating advances

The assets of Allegro LLC are geographically located in the Republic of Tatarstan. On its balance sheet there is a trading office (cadastral value of 45,433,190 rubles) and other assets.

Specialists of Allegro LLC, whose responsibilities include calculating property tax and preparing reports on it, studied the laws of the Republic of Tatarstan dated December 22, 2017 No. 97-ZRT, dated November 28, 2003 No. 49-ZRT and found out that:

- The authorities did not provide for a reduced rate for movable property tax ─ the calculation will have to be based on the maximum statutory maximum of 1.1%;

- Allegro LLC was not included in the list of beneficiaries (completely exempt from property tax);

- The company does not have property taxed at a reduced rate (for example, the value of assets intended for investment activities, etc. is taxed at a rate of 0.1% in the Republic of Tatarstan);

- the property tax rate (calculated based on the average value of assets) is set at 2.2%;

- for assets whose base is taxed at cadastral value, a 2% rate is applied in 2021.

Allegro LLC was formed in 2021, and on its balance sheet, in addition to the trading office (real estate subject to property tax based on cadastral value), only movable assets of various depreciation groups are listed (they are taxed in 2021 based on regional legislation at rate 1, 1%).

According to accounting data, the residual value of movable assets (the tax on which is determined based on the average value for the reporting period):

- as of 01/01/2018: RUB 12,467,132.

- as of 02/01/2018: RUB 11,786,020.

- as of 03/01/2018: RUB 11,255,609.

- as of 04/01/2018: RUB 10,897,665.

Calculation of “property” liabilities of Allegro LLC for the 1st quarter of 2018:

- Determination of average asset value:

SSA = (12,467,132 + 11,786,020 + 11,255,609 + 10,897,665) / 4 = 11,601,607 rub.

- Calculation of advance payments (AP):

AP = APk + APsr = ¼ x (KSI x SNx + SSI x SNsr)

AP = ¼ x (45,433,190 x 2% + 11,601,607 x 1.1%) = 259,070 rub.

Allegro LLC will report on advances to the Federal Tax Service in electronic form ─ clause 3 of Art. 80 of the Tax Code of the Russian Federation (the average number of employees of the company for 2021 exceeds 100 people).

According to the Law of the Republic of Tajikistan No. 49-ZRT, 1 month and 5 days from the end of the quarter are allotted for the transfer of the advance on property tax ─ taking into account transfers, the final reporting date for the 1st quarter of 2021 falls on 05/07/2018.

Next, we will dwell on the nuances of preparing a report on advances for property tax.

This might also be useful:

- Changes in the field of insurance premiums in 2021

- Deadline for submitting 2-NDFL in 2021 for 2021

- How to calculate the simplified tax system?

- New KBK for 2021

- What taxes does the individual entrepreneur pay?

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Title page

Let us briefly recall the basic rules for its design. If you have experience filling out tax calculations and declarations, you can prepare this sheet by analogy with them. With the exception of certain nuances, which we will now talk about.

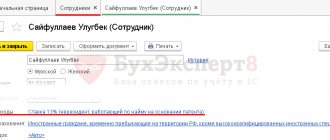

Difficulties can be caused by various codes ─ the top part of the sheet is most saturated with them. The figure below deciphers individual codes that cause difficulty when filling out the field:

There are several more fields on the title page, which we will discuss separately ─ the requirements for filling them out differ for different tax returns and calculations. These fields include “Contact phone number” and “Date”:

These fields are not significant (they do not reflect such important calculation indicators as the advance amount, benefit code, etc.), however, the legally established rules for filling out this document should not be ignored.

Providing tax benefits will be simplified

From January 1, 2021, changes regarding property taxation will come into force. To receive a property tax benefit, an individual will only need to submit a corresponding application to the tax office. Tax authorities will request all other necessary documents from other government agencies.

Current

An individual has the right to submit documents confirming the right to the benefit. A new application form has already been developed. But if the citizen has not done this, the tax authority, based on the information specified in the application, independently requests information from the authorities, organizations, and officials who have this information. If such information does not exist, the tax authority is obliged to inform the taxpayer about the failure to receive information upon request and about the need for the taxpayer to submit supporting documents to the tax authority.

Paper and electronic formats of the application “On the provision of tax benefits for transport tax, land tax, personal property tax,” as well as the rules for filling them out, have already been developed. The draft order that plans to approve them is posted on the official website of the draft legal acts.

If documents confirming the taxpayer’s right to a tax benefit are not available from the tax authority, including those not submitted by the taxpayer independently, the tax authority, based on the information specified in the taxpayer’s application for a tax benefit, requests information confirming the taxpayer’s right to a tax benefit from bodies, organizations, officials who have this information.

A citizen applying for a benefit will need to indicate all the details of the document - the grounds for drawing up an application (for example, a pensioner’s card, a veteran’s card, etc.). Namely: full name of the document, full name of the body (organization) that issued the document; date of issue, validity period, series and number.

A person who has received a request from the tax inspectorate to provide information confirming the taxpayer’s right to a benefit fulfills it within seven days from the date of receipt or, within the same period, reports the reasons for non-fulfillment of the request.

The inspectorate, within three days from the date of receipt of the specified message, is obliged to inform the taxpayer about the failure to receive, upon request, information confirming the right of this taxpayer to a tax benefit.

Section 2

Most companies calculate their “property” liabilities in this section. It includes all the necessary information for calculating advances: about the residual value of assets, benefit codes, details of the relevant regional regulatory legal acts, etc.

See below for recommendations for filling out this section:

The lines provided for the tax benefit code (130, 160, 190) consist of two parts. If in the first part you indicate the benefit code, the second part of the line must contain a link to the subclause, subclause and article of the regional law (which describes the corresponding benefit):

This is what line 130 may look like if your benefit is established in sub. 11.5 clause 7 art. 5 regional legal acts.

The information specified in this section is confirmed by the signature of an authorized person of the company (manager or representative by proxy) indicating the date of signing.

Land tax

Changes in the cadastral value of a plot due to:

- changes in the type of its permitted use;

- transfer of a plot from one category of land to another

organizations and entrepreneurs will have to take into account when determining the tax base from the date of entering into the Unified State Register of Information, which is the basis for determining the cadastral value of this site (clause 1 of Article 391 of the Tax Code of the Russian Federation).

In relation to such a plot, land tax and advance payments on it will need to be calculated taking into account the ownership coefficient. It is calculated as the ratio of the number of full months during which the site was owned by the organization to the number of months in the tax (reporting) period (clauses 7, 7.1 of Article 396 of the Tax Code of the Russian Federation).