What are the main tasks of an accountant?

In the production sector, there is a Regulation on the organization of accounting, because all accounting activities in production depend on its organization. In the same Regulations you can find questions about the functions and main tasks of accountants in an enterprise. Of course, they are not an axiom for accountants of different profiles, but nevertheless they make it possible to determine the tasks of an accountant. There are several such tasks:

- Make timely calculations of workers' wages, contributions to the pension fund, and accruals for sick leave.

- Monitor timely payments to tax and insurance companies.

- Select the most appropriate sources of funding for the organization.

- Finding ways to effectively use the financial resources of an enterprise.

What are the specific tasks of an accountant in an enterprise?

The duties of an accountant at an enterprise include:

- Carrying out accounting in accordance with all Regulations and legislation;

- The process of organizing the circulation of financial documents and providing other departments with the necessary information;

- Monitoring the correctness of documentation of concluded contracts;

- Systematic analysis of accounting and identification of available funds.

The concept, purpose and objectives of the professional activities of accountants and auditors.

The concept, purpose and objectives of the professional activities of accountants and auditors.

Currently, the role of an organization's accountant is increasing. The functions of an accountant are changing and the range of tasks facing him is expanding. From an accounting technical worker involved in registering facts of economic activity on accounting accounts, an accountant turns into a creative person; he ensures the formation and implementation of the organization’s accounting policy, necessary for the effective management of the organization’s economy.

Accounting activities

– this is the professional activity of an accountant in all its manifestations: accounting, reporting, formation of an organization’s accounting policy, control, analysis of reporting data, participation in professional organizations, etc.

The essence of accounting activities consists in the activities of the accounting service to collect, register, summarize information about all economic operations at the enterprise in specially designed accounting documents, as well as organize their movement, accounting and storage.

Main goals of accounting activities

– analysis, interpretation and use of economic information to identify trends in the development of the organization, select alternatives and make management decisions

The main objectives of accounting activities are

:

1. Formation of complete and reliable information about the activities of the organization and its property status, necessary for internal and external users of financial statements;

2. Providing information to monitor compliance with the legislation of the Russian Federation when the organization carries out business operations;

3. Prevention of negative results of the organization’s economic activities and identification of intra-economic reserves to ensure its financial stability.

Persons who have the profession of accountant can specialize in the following areas: 1) accounting, financial accounting, 2) accounting, management accounting, 3) tax accounting, 4) budget accounting, 5) accounting in banks, 6) accounting in insurance companies, 7) pedagogical and scientific- research activities independent accounting activities 9) auditing activities

independent accounting activities 9) auditing activities

Auditing is a business activity involving independent verification of used and financial statements of audited entities. The purpose of the audit was to express an independent opinion on the reliability of financial reporting and, accordingly, the procedure for maintaining used records of the Russian Federation.

Features of regulatory regulation of accounting in a market economy. The role of ethical standards.

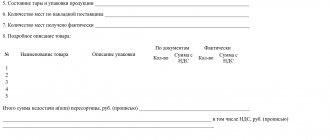

See Table

The professional activities of accountants, both in Russia and abroad, require regulation by various provisions, legislative acts, regulatory requirements and instructions. Such regulation is necessary not only in the work of an accountant, but also in his attitude to his professional activities, relationships with colleagues and superiors, that is, in the ethical aspects of this profession.

Ethics deals with the analysis of relationships between business partners from the standpoint of interpreting moral assessments of the reasons for success and failure in any activity, in particular in economic activity.

Ethical standards in the workplace differ significantly from generally accepted standards in everyday life. It was to consolidate ethical standards that the “Accountant Code of Ethics” was adopted, which obliges all professionals in this profession to follow certain rules in order to achieve the highest quality results of their work.

The relationship between accounting policies, professional judgment and professional ethics.

Accounting policies are the result of the accountant's professional judgment, since professional judgment acts as a tool for selecting the values of accounting policy parameters. Professional judgment plays an important role in the formation of reliable, complete, comparable information about the financial position, results of operations of the organization and in improving its accounting policies.

The formation of an accountant’s professional judgment depends on the influence of various factors, such as:

– accountant’s education

– qualification;

– knowledge of Russian legislation

– experience in a specific field

– availability of information,

– degree of freedom of decision-making

International professional associations of accountants and auditors.

See question 4

Areas of activity and structure of the International Federation of Accountants.

International Federation of Accountants (IFAC)

was created in 1977 to develop and strengthen the prestige of the accounting profession. The objectives of this organization are largely consistent with those of the IASB, but priority is given to the accounting profession itself. IFAC members are representatives of professional accounting organizations from more than 75 countries. Among them is the IPB of Russia.

Leading accounting organizations and associations of foreign countries.

See question 4

Requirements for members of the Institute of Professional Accountants of Russia.

General requirements for members of the IPB: honesty, objectivity, competence, confidentiality, etc.

a) honesty and objectivity in the performance of services: the basis for conclusions and recommendations of a member of the IPB can only be information, but not bias, conflict of interest or pressure exerted on him;

b) professional competence: constant improvement of one’s qualifications and the quality of one’s work, knowledge of regulations and the availability of the necessary practical skills, refusal to perform work and services that go beyond the area where this member of the IPB is a specialist;

c) confidentiality of information received in the performance of their official duties, without time limitation and regardless of whether the relationship of the IPB member with the employer continues or is terminated (except for cases expressly provided for by the legislation of the Russian Federation);

d) professional conduct: the need to maintain the reputation of the profession as a whole and to refrain from any conduct that could bring discredit to the accounting profession;

e) work in accordance with the standards of professional activity: performing one’s duties in accordance with the standards adopted in the field of one’s work, regardless of whether these standards are approved by government bodies or public organizations of which one is a member. The ethical requirements for a member of the IPB are not limited to those explicitly listed in the IPB Code. A member of the IPB is obliged to adhere to generally accepted moral rules and ethical standards in his actions and decisions, to live and work according to his conscience.)

Requirements for persons engaged in auditing activities.

Certification for the right to carry out auditing activities is a verification of the qualifications of individuals wishing to engage in auditing activities. It is carried out in the form of a qualifying exam. Persons who successfully pass the exam are issued an auditor qualification certificate. The validity period of the auditor qualification certificate is not limited; in order to be admitted to the exam, the applicant must have:

1) higher economic, legal education received in Russian educational institutions of higher professional education that have state accreditation, economic and (or) legal education received in an educational institution of a foreign state;

2) work experience in an economic or legal specialty for at least 3 years.

The procedure for certification for the right to carry out audit activities, the list of documents submitted along with the application for admission to certification, the number and types of certificates, and qualification exam programs are determined by the authorized federal body.

Qualifying exams are held over 3 days and consist of testing and written and oral work on exam cards.

Currently, the most important issues regarding the procedure for training and examinations are regulated by the Temporary Regulations on the system of certification, training and advanced training of auditors in the Russian Federation.

An auditor who has a qualification certificate must undergo training during each calendar year under advanced training programs approved by the authorized federal body.

When acting in the public interest, the auditor must comply with and comply with the requirements of professional ethics of the auditor.

The auditor must comply with the following basic principles of ethics:

a) honesty;

b) objectivity;

c) professional competence and due care;

d) confidentiality;

e) professional behavior.

14. Code of Ethics of the International Federation of Accountants and Code of Ethics of Accountants and Auditors of Russia.

The IFAC Code of Ethics consists of three parts:

• part A

The

General Application of the Code

describes the basic principles of professional ethics for professional accountants and provides a conceptual framework for the application of these principles. The conceptual framework reflects the methodology for applying basic ethical principles;

• Part B: Professional accountants in public practice

establishes rules intended to be applied by professional accountants operating in public practice;

• Part C “Professional accountants in business”

Establishes standards for use by professional accountants who are employed.

Parts B and C illustrate how the conceptual framework should be applied to specific situations. They provide: • examples of protective measures that can be taken to address threats to compliance with the fundamental principles; • Examples of situations in which no precautions are applicable and in which threatening activities or relationships should accordingly be avoided.

The Code of Ethics of Professional Accountants - members of the IPB of Russia is constantly being improved taking into account new international trends in the profession.

Target:

Establishes the basic rules of conduct for professional accountants - members of the IPB of Russia and defines the basic principles that must be observed by them when carrying out professional activities.

Scope: The IPA Russia Code of Ethics is intended for use by professional accountants in public practice and professional accountants in employment.

Disciplinary sanctions Violation of the fundamental ethical principles and rules of conduct established in the Code of Ethics of Professional Accountants - Members of the IPB of Russia entails the following disciplinary sanctions (listed in order of severity):

• remark;

• warning;

• suspension of membership in the Non-Profit Partnership “Institute of Professional Accountants of Russia” for a period of up to one year;

• exclusion from membership of the Non-Profit Partnership “Institute of Professional Accountants of Russia”.

Conclusion of an agreement for the provision of professional services. Conflict of interest. Second opinion.

Before entering into a relationship with a new client, a professional accountant in public practice should determine whether the client's selection may pose a threat to compliance with fundamental principles. A potential threat to integrity or professional conduct may, for example, arise if there are questionable characteristics of the client (its owners, management or activities). Questionable characteristics of the client (if known) are, for example: • participation of the client in illegal activities (legalization (laundering) of proceeds from crime); • reputation of a dishonest counterparty; • questionable practices in preparing accounting (financial) statements. A professional accountant in public practice must take reasonable steps to identify circumstances in which a conflict of interest may arise that may give rise to a risk of violation of fundamental principles. Second Opinion Situations where a professional accountant in public practice is asked to provide a second opinion on the application of accounting, auditing or other rules or principles in particular circumstances, or in relation to particular transactions of a company (or its name) who is not his client may lead to threats of violation of the fundamental principles. If the second opinion is not based on the same facts as those known to the professional accountant in public practice serving the client, or is based on inadequate evidence, there may be a risk of violation of the principle of professional competence and due care. When so requested, the professional accountant should evaluate the significance of such threats and, unless such threats are clearly insignificant, should consider and, as necessary, take precautions to eliminate the threat or reduce it to an acceptable level.

Potential conflicts. Preparation and presentation of information. Professional competence. Financial interest.

Professional accountants who are employed are involved in the preparation or reporting of information that may be publicly available or used within or outside the organization. Such information may include

• financial or management information (eg forecasts and budgets);

• financial statements;

• a discussion and analysis of management issues or a letter of representation signed by management that is part of the audit of the financial statements.

If the threat cannot be reduced to an acceptable level, the professional accountant is required to refrain from preparing information that, in the professional accountant's opinion, is or may be misleading. If the professional accountant knows that the misstatement is material or persistent, the professional accountant should consider informing the relevant authorities. The fundamental principles of professional competence and due care require that a professional accountant for hire undertake only those tasks for which he is qualified. A professional accountant must not mislead an employer as to his or her level of qualifications or practical experience, or neglect to seek professional advice or outside assistance when necessary.

A professional accountant should not manipulate information available to him or her for personal gain. Unless the threats are clearly insignificant, precautions must be considered and taken as necessary to eliminate them or reduce them to an acceptable level. Such measures may include:

• the rules and procedures of a committee, independent of the organization's management, to determine the amount and form of remuneration for senior managers;

• notification of any possible interests or plans to sell shares of those charged with management responsibilities in the organization, in accordance with any internal policies; • receiving, as necessary, consultations from direct management within the employing organization;

• obtaining advice, as necessary, from authorized persons of the employing organization or from relevant professional bodies;

• application of internal and external audit procedures;

• organizing timely training on ethics, legal restrictions and other regulations related to cases of possible insider trading (abuse of proprietary information for speculation in the stock market).

The concept, purpose and objectives of the professional activities of accountants and auditors.

Currently, the role of an organization's accountant is increasing. The functions of an accountant are changing and the range of tasks facing him is expanding. From an accounting technical worker involved in registering facts of economic activity on accounting accounts, an accountant turns into a creative person; he ensures the formation and implementation of the organization’s accounting policy, necessary for the effective management of the organization’s economy.

Accounting activities

– this is the professional activity of an accountant in all its manifestations: accounting, reporting, formation of an organization’s accounting policy, control, analysis of reporting data, participation in professional organizations, etc.

The essence of accounting activities consists in the activities of the accounting service to collect, register, summarize information about all economic operations at the enterprise in specially designed accounting documents, as well as organize their movement, accounting and storage.

Main goals of accounting activities

– analysis, interpretation and use of economic information to identify trends in the development of the organization, select alternatives and make management decisions

The main objectives of accounting activities are

:

1. Formation of complete and reliable information about the activities of the organization and its property status, necessary for internal and external users of financial statements;

2. Providing information to monitor compliance with the legislation of the Russian Federation when the organization carries out business operations;

3. Prevention of negative results of the organization’s economic activities and identification of intra-economic reserves to ensure its financial stability.

Persons who have the profession of accountant can specialize in the following areas: 1) accounting, financial accounting, 2) accounting, management accounting, 3) tax accounting, 4) budget accounting, 5) accounting in banks, 6) accounting in insurance companies, 7) pedagogical and scientific- research activities independent accounting activities 9) auditing activities

independent accounting activities 9) auditing activities

Auditing is a business activity involving independent verification of used and financial statements of audited entities. The purpose of the audit was to express an independent opinion on the reliability of financial reporting and, accordingly, the procedure for maintaining used records of the Russian Federation.

When is it possible and when is it impossible to do without a chief accountant?

The answer to this question is contained in Law No. 402-FZ. So, according to Art. 7, the obligation to employ a chief accountant rests exclusively with credit organizations. Other enterprises have the right not to hire a chief accountant, but to organize accounting in other ways:

- Entrust these functions to another employee. At the same time, the responsible employee of an enterprise that is obliged to apply legally approved professional standards (PJSC, non-state pension funds, insurance companies, budgetary institutions, etc.) must satisfy special conditions for admission to such work (higher education, length of service, absence of an outstanding criminal record).

- Outsource accounting. In this case, you need to make sure that the specialists of the outsourcing company (the person who independently provides such services) have the necessary qualifications.

- Entrust accounting to the manager. This option is available to most businesses under certain conditions. So, firstly, a company that has the right to keep records in a simplified form may have one head-chief accountant. We are talking about micro and small businesses, NGOs and participants in the Skolkovo project. Secondly, medium-sized enterprises, except housing complexes (housing cooperatives), credit cooperatives, microfinance organizations, bar and notary chambers and other organizations named in Part 5 of Art. 6 No. 402-FZ.

We would like to remind you that, in general, an enterprise is considered small if its staff does not exceed 100 people and its annual income is 800 million rubles. Medium - a business with up to 250 employees. and income not exceeding 2 billion rubles. per year (No. 209-FZ, regulation of the Government of the Russian Federation No. 265).

Thus, in the vast majority of cases, companies can function without a chief accountant. A reasonable question arises: if it is not necessary to have a chief accountant, then why are they in demand?

Drawing up a job description for an accountant

The upper right part of the document is reserved for approval by the head of the enterprise. Here you should enter his position, name of the organization, last name, first name, patronymic, and also leave a line for signature with mandatory decoding. Then the title of the document is written in the center of the line.

Main part of the instructions

In the first section entitled “General Provisions” you must enter which category of employees the storekeeper belongs to (specialist, worker, technical staff, etc.), then indicate on the basis of what order the accountant is appointed, to whom he reports and who replaces him, in if necessary (there is no need to write specific names here, it is enough to indicate the positions of authorized employees). The next step is to enter into the document the qualification requirements that the accountant must meet (specialization, education, additional professional training), as well as length of service and work experience, with which the employee can be allowed to perform work functions.

Further in the same section you need to list all the regulations, rules, orders with which the accountant must be familiar: standards and forms of documents accepted in the organization, rules for maintaining accounts and correspondence, organization of accounting document flow, rules on safety, labor protection and internal schedule, etc.

Second section

The second section, “Job responsibilities of an accountant,” relates directly to the functions that are assigned to an accountant. They may be different at different enterprises, but they should always be described in as much detail as possible. If there are several accountants in an enterprise and they have different functions, you must carefully ensure that there is no duplication in job responsibilities.

Third section

“Rights” section includes the powers that an accountant is given to effectively perform his work. Here you can separately indicate his right to interact with the organization’s management and other employees, as well as representatives of other structures if such a need arises. Rights must be spelled out in the same way as responsibilities - accurately and clearly.

Fourth section

“Responsibility” section establishes specific violations by the accountant, for which internal sanctions and penalties are provided. In one of the paragraphs, it is necessary to indicate that the applied measures comply with the framework of the law and the Labor Code of the Russian Federation.

Fifth section

The last section of the job description includes “Working conditions” - in particular, how they are determined (for example, internal labor regulations), as well as any features, if any.

Finally, the document must be agreed upon with the employee who is responsible for compliance with the rules and regulations prescribed in the accountant’s job description (this may be the immediate supervisor, the head of the human resources department, etc.). Here you need to enter his position, name of the organization, last name, first name, patronymic, as well as put a signature and be sure to decipher it.

Below you must provide information about the accountant :

- his last name, first name, patronymic (in full),

- Name of the organization,

- passport details,

- signature,

- date of familiarization with the document.

There is no need to put a stamp on the job description.

Who is the chief accountant, where is his place in the system

The answer to this question is in the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”:

- “Accounting is the formation of documented, systematized information about the objects provided for by this Federal Law, in accordance with the requirements established by this Federal Law, and the preparation of accounting (financial) statements on its basis.”

- Consequently, an accountant is a person who generates systematized and documented information about accounting objects, which are property, liabilities, business transactions, income, expenses and profit . These six objects are in the attention of the accountant, including the chief.

In the professional standard “Accountant” (approved by Order of the Ministry of Labor of Russia dated February 21, 2019 No. 103n):

- two professions are identified: accountant and chief accountant;

- job descriptions and requirements for the functionality of the profession are prescribed: what we should be able to do, what the employer means when he invites us to work and signs an employment contract with us.

The role of IFRS

The term "IFRS" stands for International Financial Reporting Standards. This set of rules can be called the world language of accounting. They specify how specific types of transactions and other events should be reported in the financial statements.

In some countries, IFRS has been adopted at the legislative level and is mandatory for use by all business entities. In the CIS countries, most national standards have already been developed in accordance with the requirements of IFRS, and this trend will only increase in the future.

Accountants of international companies that operate in their own country according to local rules should maintain two types of accounting in parallel . Local - for national services, international accounting (in accordance with IFRS) - for the head office and other interested users.

Those professionals who want to delve deeper into the topic of financial management may benefit from the corresponding course on the Laba training platform. The program comprehensively covers information from analysis of basic financial reports to planning the enterprise’s finances for the year.

What types of accounting are there, where to develop and grow?

- General accounting is carried out by 75% of all legal entities (accounting for limited liability companies, joint stock companies, large individual entrepreneurs, where accounting is taken seriously). This requires special professionalism. And if you want to achieve recognition in this type, then you need to be a great professional.

- Bank accounting has its own chart of accounts and a set of business operations of the bank that the bank’s chief accountant must know. The banking sector (credit institutions, microfinance organizations, etc.) is subordinate to the Central Bank, the chief accountant of the bank is approved by the Central Bank of the Russian Federation, without the approval procedure of the Central Bank, the chief accountant has no authority.

- Budget accounting is a budget chart of accounts and, accordingly, a budget type of accounting.

I'll share my experience

In the early 90s, at the beginning of the formation of the accounting that we see now, everyone dreamed of being bank accountants. It was fashionable, prestigious, financial. I didn’t escape this either: I was a bank accountant, which then really helped me broaden my horizons, because I understood the specifics of this type.

Until the mid-2000s, everyone wanted to be a bank accountant so they could work in banks.

- Today budget accountant is becoming fashionable because of stability and reliability. Of course, he earns several times less than a bank accountant, and slightly less than an accountant of a company in a general accounting system. But budget accounting now includes both the civil service and law enforcement agencies - everything related to the functioning of the state. And the budget accountant will always be in demand, will always be on horseback. Public finance accounting has been, is and will remain.

Decide what kind of accountant you want to be: general, banking or budget. Listen to yourself, take into account your previous experience, build a vector of development. A video from Kontur.School on how an accountant can build a professional development plan will help you with this.

Job specialization

The functional responsibilities of an accountant depend on the structure of the institution. If the enterprise is small, the specialist becomes a generalist. The job responsibilities of an accountant specialize in a manufacturing enterprise, which has a branched structure.

As a general rule, specialization occurs based on the categories of accounting objects:

The list is completed by the position of the chief accountant - the head of the financial service, who controls the activities and is responsible for their correctness.

Functions of the chief accountant. What does he do

Accounting hierarchy

- At the head is the chief accountant. He always reports only to the head of the enterprise (this is by law), not to the financial director (manager), and to the deputy for economics - only to the manager. The manager appoints the chief accountant to the position. Under the chief accountant, the entire hierarchy of the accounting world is formed by area accountants, cashiers and internal controllers.

The chief accountant is, first of all, the organizer of the work of the entire accounting service. We are not currently considering small companies where one person is in all faces and performs all functions. We are considering an organization with a small staff:

- in such an organization, the chief accountant reports to the head of the organization and controls the work of accountants in accounting areas on certain points.

- 70% of accounting is the work of two sections:

- The work of a “materialist” : accounting for materials, accounting for finished products - accounting for current assets.

- Payroll area.

If in these two areas you have people whose competencies you are confident in, then you are lucky. The chief accountant cannot delve into everything, but he signs the documents that are prepared for him by other accountants - his subordinates. We cannot check the payroll for each employee, because there may be 150 or more of them in the state, we can only take the statement, sign it and hope that the person who did the payroll is competent, honest, professional and that's it did the right thing.

Unfortunately, you physically cannot check everything; you need to trust people. You cannot check the write-off of materials, the sale of goods - all material reports, but you will sign these documents.

Correctly placing people, seating them depending on their level of knowledge and competencies - this is your knowledge of psychology, which you will have to demonstrate in your place.

- Separately - cashiers . These are the people who handle cash transactions. Nothing smells as good and sticks to your hands as cash. This is the most dangerous part of the job. In accordance with the professional standard of a cashier, appointment to the position of cashier is based on the recommendation of the chief accountant. That is, an application for a cashier job is first endorsed by the chief accountant, and then appointed to the position by the head of the organization. You must know the person who is in your place. There can only be a reliable, trusted person whom you trust, because he will take into account all the cash in your cash register. Control over cash discipline is also a function of the chief accountant.

- In addition, the internal controller (internal auditor) reports to the chief accountant. This person carries out internal verification of the correctness of accounting and, as a rule, the accuracy and timeliness of document flow. It helps to avoid serious fines from regulatory authorities. He's part of accounting. This is an area that receives the attention of the chief accountant.

We have looked at the hierarchical requirements, but what are the tasks of the chief accountant?

Accountant job description

The job description of an accountant is a document that defines the list of duties, rights and responsibilities of specialists in accounting departments.

APPROVED by: General Director of Supply Wholesale LLC Shirokov /I.A. Shirokov/ August 12, 2014

Accountant job description

I. General provisions

1.1. This document regulates the following parameters relating to the activities of an accountant: job functions and tasks, working conditions, rights, powers, responsibilities.

1.2. The hiring and dismissal of an accountant occurs through the issuance by the management of the organization of a corresponding order or instruction and is regulated by the legislation of the Russian Federation in the field of labor.

1.3. The accountant's immediate superior is the chief accountant of the organization.

1.4. During the absence of an accountant from the workplace, his functions are transferred to a person who has the necessary knowledge, skills and competence and is appointed in accordance with the procedure established by internal rules.

1.5. Requirements for an accountant: education of at least secondary specialized education, with work experience of at least two years, or higher professional education with work experience of at least six months.

1.6. The accountant must be familiar with:

- basics of civil and labor legislation of the Russian Federation;

- basics of economics and management;

- internal regulations, labor protection rules; fire safety and other types of security at the enterprise;

- internal regulations, instructions, orders and other documentation directly related to the activities of the accountant;

- organizing the company's accounting workflow;

- templates, samples and forms of various forms and documents accepted in the organization, as well as rules for their preparation, systematization and storage;

- ways and methods of accounting and tax accounting and reporting.

1.7. An accountant must have:

- skills in maintaining and preparing accounting and tax accounting and reporting;

- methods of economic analysis of the organization's work;

- plans and correspondence of accounting accounts.

- skills in working with computers and computing equipment, the Microsoft Office software package, specialized accounting services, as well as all office equipment.

II. Job responsibilities of an accountant

2.1. The duties and responsibilities of an accountant include:

- conducting financial and economic transactions, accounting for liabilities and property, including registration of the acquisition and sale of products, items, inventory, etc.;

- accounting for cash flows, as well as reflecting processes and operations related to the finances of the enterprise on the organization’s accounting accounts;

- working with cash;

- registration, acceptance and issuance, as well as control over the movement of primary accounting documentation (invoices, acts, invoices, etc.);

- working with banks in which the company's current accounts are opened, including submitting payment orders to the bank, requests and receipt of statements, etc.;

- development of forms of accounting documents for registration of various financial and economic transactions, in the absence of their officially approved, mandatory samples;

- working with the tax base, calculating taxes and transferring them to budgets of various levels;

- calculation and transfer of insurance contributions to extra-budgetary funds (PFR, Social Insurance Fund, Compulsory Medical Insurance Fund);

- calculation of salaries and other payments to employees of the organization, incl. social in nature (financial assistance, bonuses, sick leave, vacation pay, business trips, etc.);

- preparation of accounting and tax reporting;

- regularly informing the immediate supervisor about current processes in accounting, as well as timely reports of all non-standard, complex, controversial situations;

- participation in activities to inventory the property and financial condition of the enterprise;

- participation in audits, tax and other inspections initiated by both the management of the enterprise and supervisory authorities;

- timely familiarization with amendments made by law to the rules of accounting and tax accounting and reporting at enterprises, as well as their application in practice;

III. Rights

3.1. The organization's accountant has the following powers and rights:

- make to management reasoned and substantiated written proposals for improving and optimizing the work of both yourself and the enterprise as a whole;

- participate in meetings, planning meetings, meetings, discussions and other events directly related to his activities;

- improve your professional level, including attending courses, seminars, webinars, conferences, trainings, etc.;

- request documents (including archival ones), teaching aids and other materials needed to solve current issues and problems;

- make constructive proposals to eliminate violations, errors, and shortcomings identified during the work;

- sign documents within his competence;

- refuse to perform work functions if there is a threat to life or health.

IV. Responsibility

Disciplinary liability threatens the accountant for the following actions:

4.1. Neglect of performing labor duties, including complete evasion of them.

4.2. Malicious, regular violation of the internal rules established at the enterprise, work and rest regime, discipline, as well as violation of any types of safety and other regulatory regulations.

4.3. Failure to comply with orders and instructions issued by the organization’s management or immediate supervisor.

4.4. Causing (intentional or unintentional) material damage to the company.

4.5. Disclosure of confidential information about the organization.

4.6. All the above points strictly comply with the current legislation of the Russian Federation.

V. Working conditions

5.1. An accountant must obey the company’s internal rules, which detail the conditions of his work.

5.2. If necessary, the accountant may be sent on business trips.

AGREED Deputy Director for Economic Affairs LLC “Supplies Wholesale” Sterkhov /Sterkhov R.A./ August 12, 2014

Organizational structure of accounting

The structure of the accounting service depends on the type of activity, size of the organization, etc.

In modern conditions, three main types of organization of the accounting service structure have emerged: linear (hierarchical), vertical (line-staff) and functional (combined).

With a linear (hierarchical) organization of the accounting structure, all accounting employees receive tasks and report directly to the chief accountant. This accounting structure is used in small organizations.

With a vertical (line-staff) organization of the accounting apparatus, intermediate management links (departments, sectors, groups) are created, headed by senior accountants. Accounting employees receive assignments from senior accountants at relevant management levels and report directly to senior accountants.

This accounting structure model is used in medium and large organizations. In this case, the following departments can be created in the accounting structure:

- settlement, which records settlements with personnel for wages, social insurance authorities, suppliers, buyers and customers, etc.;

- material, which keeps records of the receipt and expenditure of inventories;

- cash, which takes into account cash transactions, transactions on bank accounts;

- production, which accounts for costs and output, calculates the cost of production, and prepares reports on costs and output;

- accounting of finished products, which accounts for finished products in warehouses and their sales;

- Taxation, which keeps records of tax payments and prepares tax returns;

- the general one, which carries out other operations and reflects them in the General Ledger, draws up accounting and statistical reporting.

In large organizations, in addition to the listed departments, there may be departments for accounting for capital investments, accounting for fixed assets, etc. In addition, the sectors of internal audit, management accounting, and tax accounting can be included in the accounting structure.

In a functional (combined) organization, special structural units of accounting are created in areas of accounting work that perform a closed cycle of work.

The rights of the chief accountant in this case are transferred to the heads of accounting departments within the established competence.

This structure of the accounting apparatus is used in large organizations and organizations in which responsibility centers have been created on the basis of the organization of intra-economic financial and economic relations.

When using any type of organization of the accounting structure, only well-established relationships with other services and divisions make it possible to obtain the necessary information to manage and ensure control over the economic and financial activities of the organization.

If necessary (large volume of work), the position of deputy chief accountant can be added to the accounting staff, through whom the interaction of the chief accountant with employees and their groups is carried out.

If there are more than two accountants, the accounting service must be formalized as a structural unit of the organization, headed by the chief accountant, who manages the accounting department.

Stereotypes about the work of an accountant

Most often, people imagine an accountant as a kind of bookkeeper, drowned in routine, monotonous work: paying bills, processing primary documentation, submitting reports. And so on endlessly in a circle. No amateur performances or non-standard tasks.

In fact, monotony can only be encountered at the beginning of a career. A young specialist really needs to get to grips with the work and understand the structure of the enterprise’s accounting department. Usually he is entrusted with the most “paper” work - processing the “primary”, entering it into the database, paying bills.

At higher positions (controller, senior accountant, deputy chief accountant, chief accountant), tasks arise that are more complex and interesting : optimization, planning, reporting, interaction with fiscal authorities, etc.

In modern realities, the very attitude towards an accountant in business has changed. This specialist is now perceived not as a “disturbance” to successful transactions, but rather as a financial and tax consultant, strategic director. Founders and executives listen to his opinion, and top management seeks advice before making any major transaction.

Main tasks of the chief accountant

- Organization of accounting of economic and financial activities . And not only the organization, there are the basics of management - management, the basics of psychology - you will have to deal with people with character, mood, and you must arrange them as successfully as possible in areas so that they work as efficiently as possible as accountants.

- Control over the preparation of financial statements. This is the main task of the entire accounting service under federal law. Nobody is interested in the process, everyone is only interested in the result, and the main task of the entire accounting service is to generate reliable information. We must put this result on the table of the manager, we are the ones. The chief accountant is responsible for this.

- Ensuring control over the timeliness, legality and correctness of documentation, ensuring its safety and archiving . If the document provides a place for the chief accountant’s signature (for example, in cash documents - in receipt and expenditure orders, that is, in the cash register), then this is necessary so that the chief accountant is aware and knows what is happening. That is why the cashier is appointed at his suggestion. Correct execution of documents is the responsibility and requirement of the chief accountant. No one has the right to refuse the chief accountant’s request for clarification of the accuracy or transfer of documents. It often happens that someone bought something and did not submit the primary documents to the accounting department. And we can’t work like that, so the chief accountant’s function is to organize the correct document flow. And if the signature of the chief accountant is required, but it is not there, then this document is invalid.

- Participation in economic analysis of economic and financial activities based on the results of accounting and reporting. This is a fashionable trend of late - the presence of the chief accountant in the manager’s office at all meetings and meetings when issues of economic and financial management are raised. Here the chief accountant’s word is fundamental: whether we will start this project or not, what it will give us - profit or loss. The chief accountant's last word before the general director's verdict is pronounced. If the chief accountant says that there will be no success and profit here, then the manager will give a negative answer in 90% of cases. Because the chief accountant is the most trained person in the organization from the point of view of financial accounting. And the leader listens to him.

There is a cheat sheet at the end of the article

“External” responsibility of the accountant to creditors

If, when a company goes bankrupt, creditors do not receive their funds in full, then they have the right to collect the remaining debt from those who managed the business.

The Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy”) defines the concept of “persons controlling the debtor” (KDL). The list of possible CDLs also includes the chief accountant (clause 3, clause 2, article 61.10 of law No. 127-FZ).

But in practice, of course, first of all, the company’s debts are collected from its owners and directors. The chief accountant may be “under attack” if, for example, his direct participation in “schemes” to withdraw assets before bankruptcy is proven.

But not all creditors wait until the bankruptcy procedure takes place. Tax officials sometimes try to collect debts to the budget from owners and other responsible persons of operating companies.

One of these cases reached the level of the Constitutional Court of the Russian Federation. Moreover, the culprit here was the specialist responsible for accounting. Employees of the Federal Tax Service tried to recover from the accountant of Temp LLC Akhmadeeva G.G. several million rubles of tax debt of the organization.

In general, the Constitutional Court of the Russian Federation protected the rights of responsible persons (Resolution No. 39-P dated December 8, 2017) and ruled that, in general, it is impossible to collect debts of operating companies from them. But if inspectors prove that the purpose of the company’s work was only to evade taxes, then the property of all persons controlling the organization may be at risk.

Separately, it is necessary to say about the responsibility of the company’s “top officials” to credit institutions. Banks often require a personal guarantee from management when issuing loans. Usually we are talking about business owners and directors, but sometimes the chief accountant can also be included in this list.

In case of bankruptcy, creditors can collect debts within 10 years after the violation (Article 61.14 of Law No. 127-FZ). In all other cases, the “standard” limitation period of three years applies.

Professional standards

A separate regulation has been approved for the position of “accountant” - the professional standard. Unlike the classification of positions by specialization, the professional standard does not provide for a similar division. Thus, officials identified only three categories in the professional accounting standard:

- Accountant. It is allowed to assign 1 or 2 categories to the specified position.

- Chief accountant or head of the accounting service.

- Head of Accounting and Financial Reporting Department.

The current standards are established by Order of the Ministry of Labor of Russia dated February 21, 2019 No. 103n. Moreover, the requirements regarding education and necessary work experience in the position held have been significantly tightened. For example, an employee with a higher education and at least five years of experience in accounting can be appointed to the position of head of the accounting service. If the chief accountant has secondary vocational education, then the required work experience increases to seven years.

Administrative and criminal liability of an accountant

It was said above that according to the law, the director is responsible for organizing accounting. Therefore, during inspections, it is usually “by default” that the blame for all violations is placed on him.

Cases when an accountant is punished are quite rare. Experts from the magazine “Glavbukh” in 2021 (No. 12) studied judicial practice. It turned out that over the previous three years, accountants acted as defendants in “tax” criminal cases in only 1.5% of cases.

But if the chief accountant is nevertheless brought to justice, then we are usually talking about violations in the field of accounting and taxes.

If the amount of distortion is small, then Art. 15.5, 15.6 and 15.11 Code of Administrative Offenses of the Russian Federation. For them, the maximum fine is 20 thousand rubles, and disqualification for up to 2 years is also possible.

If the arrears exceed the “limit” (5 million rubles for three years), then criminal sanctions may be applied (Articles 199 - 199.4 of the Criminal Code of the Russian Federation). To do this, inspectors must prove not only the fact and amount of the violation, but also the presence of intent.

Criminal sanctions for “tax” articles are much more serious than administrative ones. The fine can reach 2 million rubles, disqualification - 5 years, and a term of imprisonment - 7 years.

The statute of limitations for administrative cases for accounting violations is 2 years (Article 4.5 of the Code of Administrative Offenses of the Russian Federation).

In “tax” criminal cases, the period for bringing to justice varies from 2 to 10 years, depending on the severity of the crime (Article 78 of the Criminal Code of the Russian Federation).

Disadvantages of the profession of chief accountant

- Great responsibility: moral and material . When becoming an accountant, you must be prepared to accept responsibility.

- Mistakes made always result in penalties. Whether you yourself made a mistake in your tax return or report, or your employees made a mistake in the documents, you will be to blame.

- Guilty of all sins - it is the chief accountant who is the director’s right hand. Unfortunately, management will not figure out who exactly is to blame - the accountant will always be to blame. Know how to identify and track errors. Internal controllers will help you. Therefore, I say that moral responsibility to management will always be on you: for all failures in the financial part, for errors in the company’s accounting policies. Only later, behind the oak doors, you will figure out who is right and who is wrong.

- Processing large amounts of information . Be prepared to work with a large amount of information. It is purely physically impossible to keep this entire volume in your head (letters, briefings, laws, contracts, etc.), but knowing that such a document existed or did not exist, that this can be done or cannot be done, is something you will have to remember. All this information will be updated every time.

- Tracking changes in legislation - daily monitoring. No one will do this but you. This falls entirely on the chief accountant, because not a single employee at any site will monitor changes every day. You will have to look through a lot of documents to find one that suits you. Save them for yourself so that one day you can study and implement this in yourself.

“Internal” responsibility of the accountant to the organization

If the chief accountant commits violations of the company’s internal documents, then liability measures may be applied to him under the Labor Code of the Russian Federation.

Disciplinary liability, depending on the severity of the offense, can vary from reprimand to dismissal.

It should be noted that the chief accountant can be fired not only for violations, but also without explanation when the owners of the company change (clause 4 of article 81 of the Labor Code of the Russian Federation).

If the violations resulted in material damage (for example, you had to pay tax fines), then this amount can be recovered from the guilty employee.

In general, the chief accountant, like an “ordinary” specialist, bears financial responsibility only within the limits of average monthly earnings.

But the law provides for the possibility of concluding an agreement with him on full financial liability (Article 243 of the Labor Code of the Russian Federation).

You can recover damages under the Labor Code of the Russian Federation within a year after the violation.

After dismissal, it is more difficult to make claims against the chief accountant. Article 53.1 of the Civil Code of the Russian Federation allows for the recovery of damages from unfair actions only from those persons who directly managed the business. The chief accountant usually does not belong to them, unless, of course, he was a member of the board or the Board of Directors.

However, there is a situation when an accountant is responsible to the company precisely according to the general norms of the Civil Code of the Russian Federation. We are talking about a “freelance” specialist who works on the basis of a civil contract.

In this case, the organization can recover from the accountant not only “direct” losses, but also lost profits (of course, if it can prove this fact in court).

When recovering damages under the Civil Code of the Russian Federation, the statute of limitations is three years.

Tasks and job responsibilities of the chief accountant

The main tasks of the chief accountant are not limited to organizing the current activities of the company. A good specialist should always be on the lookout for effective ways of financial gain. First of all, methods for optimizing costs by predicting the tax consequences of upcoming transactions, applying benefits and special regimes, introducing automated accounting methods, reducing document flow, etc.

The chief accountant must:

- to perfectly navigate the branchiness of the current legislation;

- understand the internal regulations and instructions of the tax service;

- draw up all types of reporting, which should not only realistically reflect the current state of affairs in the company, but also not attract unnecessary attention and not cause criticism from Federal Tax Service inspectors;

- successfully pass tax and audit audits;

- participate in arbitration, labor and civil disputes;

- assist the financial services of the enterprise in the development of business plans and facilitate their implementation, and much more.

Is it difficult to find such a versatile pro? Definitely not easy!

This eliminates the problem of finding a suitable generalist and allows you to minimize the cost of paying for the services of narrow specialists (programmers, methodologists, auditors, lawyers, tax experts).

To professionally serve hundreds of clients, from small businesses to large organizations, our company has been maintaining business processes in the most efficient manner for many years. And today we are ready to offer our customers truly effective accounting, in which the ratio of useful results to expended resources will be optimal.

How to survive tax and audit audits

Perhaps, all newcomers are most worried about passing tax and audit inspections. But I hasten to reassure you: if an accountant does his job efficiently, draws up documents correctly and on time, then there is no reason to be afraid of the inspection authorities.

The Federal Tax Service checks the correctness of tax accounting: the correctness of the calculation of mandatory payments, the timeliness and accuracy of reporting.

An audit can have different purposes . For example, it can be ordered by the parent organization to ensure that its subsidiaries are accurately accounting in accordance with IFRS. The auditor will look at the documents that he needs to solve the task.

The work of an accountant must be organized so that at any time, to any request, he can provide an answer and supporting documents to both fiscal officials and auditors. That is, you need to be prepared for inspections by default .

The online course “Chief Accountant” will help you effectively organize accounting in any company. Not only to systematize accounting, tax and management reporting, but also to build coordinated work of the entire team. The course is taught by Olga Tuzhikova.

Problems of Ch. accountant of a small company (LLC, JSC)

Features of the work of a chief accountant in a small organization include:

- absolute interchangeability of accounting staff, the need to be able to do everything yourself;

- the possibility of reducing the volume of accounting work and reporting through the use of special regimes or the use of concessions provided by the SMP;

- little demand for accounting data for financial analysis purposes;

- no need for a large number of additional forms of internal reporting;

- lack of demand for audits;

- lack of close attention from inspection authorities, a relatively small number of requests for clarification.

Rights

The work of an accountant is responsible, requiring the ability to analyze data and process large volumes of information. To perform the functions of the position, the accountant has the following rights:

- get acquainted with the draft decisions of the head of the enterprise in terms of accounting;

- develop proposals for process improvement;

- inform management about identified violations;

- propose measures to eliminate and prevent violations;

- request the required information from departments;

- involve employees of other departments to perform assigned tasks.

Accounting courses from GCDPO

The City Center for Additional Professional Education conducts training courses for accountants. Our training center provides training and education for both novice accountants and chief accountants, accountants of public catering enterprises, as well as advanced training courses for accountants and training for professional accountants.

The GCDPO Training Center conducts accounting courses to study the main responsibilities and tasks for an accountant discussed in this article. These are accounting and taxation courses. You will learn how to maintain accounting records, prepare balance sheets and statements, as well as maintain tax records and prepare tax returns. Our training center provides graduates of these courses with assistance and assistance in finding employment as an assistant accountant and accountant in a small enterprise.

Our training center also conducts trade accounting courses, which will allow students to learn the rules and features of accounting in a trade organization. Students will consider trade as an accounting object, learn to use cash register equipment and become familiar with the features of export and import operations.

Accounting courses are taught by professional teachers, active accountants with extensive experience. The GCDPO training center constantly recruits students for accounting courses in morning, afternoon, evening training groups, as well as in weekend and intensive training groups. You can choose a time convenient for you.

Responsibility of the chief accountant of the organization for failure to complete tasks

The current accounting and tax legislation does not establish clear boundaries of responsibility for the manager and chief accountant. And although legal norms provide for financial, administrative and criminal liability for the chief accountant, in practice, the head of the company is more often subject to sanctions for offenses committed.

Financial responsibility of the chief accountant

Provided that internal personnel documentation, especially employment contracts and job descriptions, are correctly drawn up, the manager can avoid punishment. But, firstly, attempts to shift responsibility to the chief accountant are fraught with protracted legal proceedings, and, secondly, it is almost impossible to recover from an individual the damage caused to the enterprise in full. After all, even with a positive court decision in favor of the employer, the debtor is often unable to pay the required amount.

From this point of view, an accounting service agreement with a legal entity has distinct advantages. The terms of the agreement provide for compensation for fines resulting from the fault of the contractor. And in the event of material damage, the financial resources of the outsourcing company allow it to pay off its obligations to the client.

Rights, duties and responsibilities of the chief accountant

N.V. Yurgen, magazine “Topical Issues of Accounting and Taxation” No. 4-2004

The advent of market relations in our country has made it objectively necessary to reform the accounting and tax system. This, in turn, increased the role of the accounting service of each enterprise in general and the role of the chief accountant in particular. The financial well-being of each enterprise depends on the qualifications of the latter and his ability to quickly respond to changes in legislation. However, the place that the chief accountant occupies today in the management structure of each economic entity could not but affect the range of his rights and responsibilities, his responsibility for the decisions made. It’s one thing to be an accountant, on whom virtually nothing depended, and quite another to be a management accountant, practically the second person in the hierarchy of most enterprises, whose mistake can “put an end to” the results of the work of a large team.

This article will be devoted to the range of rights and responsibilities of the chief accountant, as well as measures of possible liability for violations related to his professional activities.

The position of chief accountant of an enterprise is a unity of at least three components that predetermine the range of his rights and responsibilities. Firstly, almost every chief accountant (except for those working under a civil contract) is an employee, that is, he is in an employment relationship with the employer. This circumstance predetermines the fact that the range of rights and responsibilities of the chief accountant structurally includes labor rights and responsibilities.

Secondly, the chief accountant is not just an employee of the enterprise, but also an official. This circumstance leaves a certain imprint on the legal capacity of the chief accountant, turning him into a possible subject of administrative and even criminal liability.

Thirdly, the chief accountant is not just an official of the organization, but an official with specific functions. In fact, he is the second person of the enterprise on financial issues. Moreover, as a result of his activities, he performs public functions. The latter circumstance explains that the main range of rights and responsibilities of the chief accountant are prescribed at the regulatory level.

Based on the above, we structure this article.

As noted above, the specificity of the legal status of the chief accountant lies in the fact that the range of his rights and responsibilities, the procedure for appointment to the position and dismissal from it are prescribed not only in labor, but also in accounting legislation.

In accordance with Art.

7 of Federal Law No. 129-FZ 1 chief accountant (accountant - in the absence of a chief accountant position on staff) is appointed to the position and dismissed by the head of the organization.

However, it should immediately be noted that the role that the chief accountant plays today in the management of an enterprise forms the basis for some restrictions on his rights. “The position obliges” - this saying is probably not perceived by many as discrimination against management employees. However, to be honest, those innovations that were introduced into the legal status of the chief accountant by the new Labor Code of the Russian Federation2 dated December 30, 2001 No. 197-FZ (hereinafter referred to as the Labor Code of the Russian Federation)

, make us think about what kind of chief accountant our economy needs today: independent or completely suppressed and powerless? An analysis of the provisions of labor legislation, which we will focus on below, allows us to answer in the affirmative, perhaps only with the second answer.

So, let's open the Labor Code of the Russian Federation

, according to which labor relations between employers and employees have been built since February 1, 2002.

The first article in which we find an indication of the position of chief accountant is Art.

59 of the Labor Code of the Russian Federation , dedicated to the possibility of concluding a fixed-term employment contract.

Let us recall that, as a general rule, the employer is obliged to conclude an open-ended employment contract with the employee. A fixed-term employment contract is concluded in cases where the employment relationship cannot be established for an indefinite period, taking into account the nature of the work to be done or the conditions for its implementation, unless otherwise provided by the code and other federal laws ( Article 58 of the Labor Code of the Russian Federation

).

In relation to the chief accountant, the law establishes precisely this “other”. In accordance with Art. 59 Labor Code of the Russian Federation

a fixed-term contract can be concluded at the initiative of the employer with managers, deputy managers and chief accountants of organizations, regardless of their legal forms and forms of ownership. Considering the fact that, as a general rule, a ban on the arbitrary conclusion of fixed-term employment contracts is considered in labor law as the protection of workers’ rights, this exception is essentially a restriction of the rights of these categories of workers, including the chief accountant. It should be noted that this circumstance can be a powerful lever of influence on the behavior of the chief accountant. It is no secret that this mechanism can be launched to get rid of an unwanted, and possibly overly honest and principled accountant. The possibility of dismissal from the job of the chief accountant upon expiration of the employment contract with virtually no explanation makes him defenseless and, probably, more accommodating to any manager. In our opinion, given the certain publicity of the functions of the chief accountant, such an approach by the legislator to his fate can hardly be considered justified.

Leafing through the Labor Code of the Russian Federation

further.

The gaze stops at St.

70 of the Labor Code of the Russian Federation , dedicated to the possibility of establishing a probationary period when concluding an employment contract. And here the chief accountant, along with other heads of organizations, did not go unnoticed. As a general rule, the trial period cannot exceed three months. However, for the chief accountant it has been extended to six. Of course, the position of chief accountant is key; a lot depends on his professionalism, and therefore the validity of such a step would seem obvious. However, all the concerns expressed above do not leave us here.

All of the above related to the conclusion of an employment contract with the chief accountant. Let's see how things go with his dismissal. We read paragraph 4 of Art. 81 Labor Code of the Russian Federation

: “the employment contract with the chief accountant can be terminated by the employer in the event of a change in the owner of the organization’s property.”

You can’t say anything - it’s a good reason... As a worthy reason for dismissing the chief accountant, the legislator sees the fact that this position is not held by a “protege of the property owner”, not “his own” accountant. “Care” for a dismissed specialist is limited to the payment by the new owner of compensation in the amount of at least three average monthly earnings ( Article 181 of the Labor Code of the Russian Federation

).

It should be noted that the new owner can dismiss the chief accountant under clause 4 of Art.

81 of the Labor Code of the Russian Federation for three months (

Article 75 of the Labor Code of the Russian Federation

).

Please note that in this case we are not talking about the low professionalism of the chief accountant or the mistakes he made under the previous owner. In the latter case, the chief accountant may be dismissed from work under clause 9 of Art. 81 Labor Code of the Russian Federation

, according to which he can be dismissed from work at the initiative of the employer if an unfounded decision is made that results in a violation of the safety of property or other damage to the property of the organization. Agree that given the contradictory nature of today's tax and accounting legislation, it is unlikely that anyone can rule out a possible mistake. In this connection, almost any chief accountant can be fired on this basis, especially since in this case we are talking about an isolated case.

If we add here the possibility of imposing full financial responsibility on the chief accountant, then the picture of the legal status of the chief accountant in the field of labor rights and obligations will be completely complete. In connection with the above, it seems that the well-known classical phrase “To be or not to be? That’s the question” for every applicant for the post of chief accountant today is filled with very real and unambiguous content.

When starting a conversation about the professional rights and responsibilities of the chief accountant, it is necessary to say a few general words.

The theory understands law as the measure of possible behavior of an authorized person. That is, the holder of the right can choose an option for possible behavior. When we talk about the rights of an accountant, we understand that we cannot say the same about them. The rights of the chief accountant carry with them a certain stamp of “responsibilities”. For example, the right of the chief accountant not to accept documents for accounting on transactions that contradict the law is, upon closer examination, his responsibility to ensure compliance of ongoing business transactions with the legislation of the Russian Federation (Clause 3 of Article 7 of the Accounting Law

). The same can be said about his other rights. Thus, the range of rights of the chief accountant, initially determined by the range of his duties, is only a condition that provides the opportunity for him to fulfill the latter.

So, the chief accountant of the organization:

- ensures compliance of ongoing business operations with the legislation of the Russian Federation ( clause 3 of Article 7 of the Law on Accounting

); - ensures control over the movement of property and the fulfillment of obligations ( Clause 3, Article 7 of the Accounting Law

); - forms the accounting policy of the enterprise ( clause 5 of PBU 1/98)3

; - signs the financial statements ( Clause 5, Article 13 of the Accounting Law

).

In accordance with paragraph 2 of Art.

7 of the Accounting Law, the chief accountant reports directly to the manager. This provision is a kind of organizational basis for the possibility of carrying out the functions assigned to it. This is due to the fact that the chief accountant has certain powers over all employees of the organization. In particular, in accordance with paragraph 3 of the above-mentioned article of the law on accounting, the requirements of the chief accountant for documenting business transactions and submitting the necessary documents to the accounting department are mandatory for all employees of the organization.

The chief accountant of the organization is the person responsible for maintaining accounting records in accordance with legal requirements and submitting complete and reliable financial statements. In this connection, the chief accountant is obliged to refuse to execute and prepare documents that do not comply with current legislation and violate contractual and financial discipline. However, the chief accountant reports to the head of the organization. In addition, in accordance with paragraph 1 of Art. 6 of the Accounting Law

The head of the enterprise bears responsibility for compliance with the law when carrying out business operations. In connection with the above, in order to differentiate powers between the manager and the chief accountant, the law resolves this conflict as follows. The head of the organization, in the event of disagreements between him and the chief accountant on a separate business transaction, has the right to issue a written order, which is executed by the chief accountant. However, the manager takes full responsibility for this operation.

In order to prevent transactions bypassing the chief accountant, the law contains a rule according to which, without the signature of the chief accountant, monetary and settlement documents, financial and credit obligations are considered invalid and should not be accepted for execution ( paragraph 3, paragraph 3, article 7 of the Accounting Law accounting

). This provision is important to ensure that the chief accountant can perform the duties assigned to him.

Thus, it should be noted that accounting legislation provides the chief accountant with the opportunity to fulfill his duties. However, taking into account what was said in the previous chapter, it seems very problematic for the chief accountant to adhere to principles in a dispute with the manager. The latter is unlikely to allow a subordinate to be next to him, forcing him to issue written orders and take full responsibility upon himself. As shown above, labor law provided enterprise managers with tools to free themselves from principled and objectionable chief accountants, thereby calling into question the reality of implementing the mechanisms laid down in accounting legislation.

Due to constant changes in accounting and tax legislation, the chief accountant is always at risk of possible errors, for which he may be held accountable.

The general grounds for the legal liability of the chief accountant are established in clause 2 of Art.

7 of the Accounting Law . Only it directly talks about the responsibility of the chief accountant. In accordance with this paragraph, the chief accountant is responsible for:

- accounting;

- formation of accounting policies;

- timely submission of complete and reliable financial statements.

It should be noted that this point evokes ambivalent feelings.

On the one hand, one cannot but recognize as a positive fact the fact that in this norm the list of possible grounds for bringing the chief accountant to legal liability is closed, that is, it cannot be arbitrarily expanded. From which we can conclude that the chief accountant cannot be held accountable for other violations in the field of accounting. However, these grounds are stated in such a way that almost any violation in the field of accounting can be summed up under their formulation. Moreover, the law contains a provision on responsibility, which does not directly name the chief accountant, but it is he who is thought to be. In this case we mean Art. 18 of the Accounting Law

, which talks about the possibility of bringing to justice the heads of organizations and other persons responsible for organizing and maintaining accounting records.

By “other persons” in this article we mean precisely the chief accountants of organizations. In it, as in Art.

7 of the Accounting Law , there are three grounds for prosecution, namely:

- evasion of accounting in the manner prescribed by law and regulations of the bodies regulating accounting;

- distortion of financial statements;

- failure to comply with deadlines for submitting financial statements.

This list is also formulated in such a way that almost any violation of accounting rules can be included in it. However, it must be said that the Accounting Law

establishes only hypothetical violations for which the chief accountant of an organization can be held legally liable.