Taxation of movable property: history of the issue

From January 1, 2015, fixed assets included in depreciation groups 1 and 2 of the Classification of fixed assets approved by the Government of the Russian Federation ceased to be recognized as objects of taxation (subclause 8, clause 4, article 374 of the Tax Code of the Russian Federation).

At the same time, other objects of movable property are subject to taxation. Moreover, since 2015, such an object has also included property acquired after 01/01/2013, which was not subject to taxation until 2015. However, simultaneously with the exclusion from non-taxable property, it was included in the preferential property.

Thus, all movable property, except for objects of depreciation groups 1 and 2, from 2015, regardless of the date of registration as fixed assets, began to be regarded as subject to taxation. At the same time, property acquired after 01/01/2013 fell under the exemption.

Without having time to return: from this year the tax on movable property has been completely abolished

On January 1, 2019, amendments to the Tax Code of the Russian Federation came into force, which exclude movable property from taxation. Movable property includes, among other things, vehicles.

Let us remind you: from January 1, 2013 to December 31, 2017, a zero tax rate on movable property acquired after 2012, introduced by a federal decision, was in effect. As it was then assumed, the benefit should contribute to the modernization of production, vehicle fleet and other things subject to taxation.

However, from January 1 last year, the benefit was canceled . It is believed that the return of the tax was “pushed through” by the regions (receipts from it went not to the federal, but to the regional budgets), whose total debt to the Federation at that time exceeded 2 trillion. rubles _

The only thing: the marginal tax rate was limited to 1.1%. In 2019, according to plans, it should have been raised to 2.2%.

However, in June last year the Government advocated the complete abolition of the movable property tax. As First Deputy Prime Minister and Finance Minister Anton Siluanov emphasized then, this tax is burdensome for business and hinders the development and modernization of domestic enterprises.

Experts, in turn, believe that the decision to abolish the tax was made not so much out of concern for business, but out of the need to soften the “blow” from the VAT increase : the Government immediately started talking about eliminating the “fee” for the opportunity to own movable property after Dmitry Medvedev spoke in favor of increasing VAT to 20%.

Thus, in an interview with Regnum news agency, leading researcher at the Institute of Economics of the Russian Academy of Sciences, Aza Migranyan, noted that the abolition of the tax should be considered as “a balancing measure of state regulation, which somewhat smoothes out the negative effects of increasing other taxes.”

She also doubted that the absence of a tax on movable property would push transport companies to update and expand their fleet (the average age of a truck fleet, we recall, exceeds 19 years). According to Aza Migranyan, the policies of companies are primarily influenced by the economic situation in the country and the level of income.

Let us note that at the beginning of last year, sales of trucks, despite the “return” of the tax, showed unprecedented growth. Thus, in the first quarter, 43% more trucks were sold than in the first quarter of 2017.

In the second half of the year, however, the dynamics began to decline (in August, for example, sales dropped by 19% compared to 2017). However, to a greater extent this was caused not by the peculiarities of taxation, but by the increase in costs of carriers due to rising fuel prices : about 30% of the cost of their services is precisely “fuel costs”.

At the same time, with a one-and-a-half-fold increase in excise taxes from January 1, 2019, the situation in the fuel market continues to remain far from stable.

What movable property should be taxed in 2017

In accordance with paragraph 25 of Art. 381 of the Tax Code of the Russian Federation, movable property registered after 01/01/2013 is exempt from property tax (Clause 57, Article 1, Part 5, Article 9 of Law No. 366-FZ). This benefit does not apply to movable property accepted for accounting after:

- liquidation or reorganization of a legal entity;

- acquisition or transfer of property from related parties.

An exception to this list from 2021 is railway rolling stock produced after 01/01/2013.

To find out whether updating the constituent documents of a joint stock company affects the movable property benefit, read the material “Transformation of a JSC into a PJSC: what will happen to the property tax benefit?” .

Thus, in 2021, when calculating the average annual value of property in the tax base, one should take into account (subclause 8, clause 4, article 374, clause 25, article 381 of the Tax Code of the Russian Federation) the cost of movable property that is not included in depreciation groups 1 and 2 , but related to objects:

- registered as OS before 01/01/2013;

- registered as an OS later than 01/01/2013 after the liquidation or reorganization of a legal entity, as well as as a result of acquisition or transfer from related parties, except for railway rolling stock;

To learn about which BCCs should be used in 2017-2018 when making property tax payments, read the article “BCC for property tax in 2017-2018.”

For transport

As stated at the level of federal legislation, the rate of transport tax (TN) is regulated by regional authorities .

TN must be paid by citizens living throughout the country. All money raised from the tax ends up in the local budget.

All citizens of the Russian Federation who own cars and other vehicles must pay TN . This is stated in the three hundred and fifty-seventh article of the Tax Code of the Russian Federation. The same applies to companies with vehicles on their balance sheets.

Organizations have to independently calculate the amount of advance payment and the tax itself. This is done for individuals by employees of territorial tax authorities based on information about the state registration of the car.

TN is calculated based on the results of a certain period, which is called the tax period. The amount consists of the established rate, the base and the number of cars owned by the citizen . Companies calculate the difference between the TN itself and the amount of advances that were made during the tax period and determine the amount of tax.

For organizations, advance amounts are calculated after the end of the reporting period. This is 1/4 of the product of the current base and the rate, as stated in the three hundred and sixty-second article of the Tax Code of the Russian Federation.

What objects are subject to TN?

The objects for which the TN is valid are mentioned in the three hundred and fifty-eighth article of the Tax Code of the Russian Federation. In particular, you will have to pay for:

- automobile;

- motorbike;

- buses, self-propelled, tracked vehicles;

- boats, sailboats, cutters, helicopters, towed vessels, snowmobiles, airplanes and water or air transport.

Regardless of whether a citizen owns a car or an airplane, he must register the vehicle in accordance with the procedure provided for by law.

What do you not need to pay for?

Also, by law, you can not pay for some vehicles . We are talking about an impressive list that is required to be studied. So, you do not need to pay tax for:

- A rowing boat or motor boat, the engine power of which is no more than 5 hp.

- Passenger cars converted for disabled people, passenger cars with an engine no more powerful than 100 hp, purchased with the help of social security .

- River and sea vessels intended for fishing.

- Vessels that are the property of an organization or businessman engaged in transporting people or goods by water .

- Agricultural machinery owned by farms and used to produce products. This includes a variety of machines, ranging from tractors, combines, milk and livestock tankers, poultry carriers, fertilizers, maintenance, etc.

- Cars and other vehicles that belong to government authorities, for example, military, intelligence or law enforcement agencies .

- Vehicles stolen or stolen are wanted . In this case, you need to obtain a document that confirms the theft of a car or other vehicle.

- Aviation and medical helicopters, airplanes, as well as ships included in the international register, are stated in the three hundred and fifty-eighth article of the Tax Code of the Russian Federation.

Results

The issue of taxation of movable property has been resolved radically since January 1, 2019: there is no longer any need to pay tax on these assets.

In 2021, this issue was under the jurisdiction of regional authorities.

They had the right to completely exempt organizations from paying tax on movable property or establish reduced tax rates. Regions could establish benefits only for certain categories of taxpayers or for all organizations without exception. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Taxpayers and objects of taxation

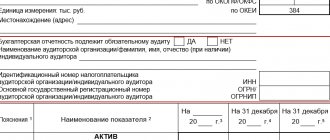

According to paragraph 1 of Art. 80 of the Tax Code of the Russian Federation, a tax return is submitted by each taxpayer for each tax payable by him.

Payers of property tax in accordance with Art. 373 of the Tax Code of the Russian Federation are organizations that have property recognized as an object of taxation in accordance with Art. 374 Tax Code of the Russian Federation .

Objects of taxation for Russian organizations are movable and immovable property (including property transferred for temporary possession, use, disposal, trust management, contributed to joint activities or received under a concession agreement), accounted for on the balance sheet as fixed assets in the manner established for accounting...

Accounting for property in the form of fixed assets

According to the accounting rules, fixed assets are recognized as assets that meet the criteria given in paragraph 4 of PBU 6/01 “Accounting for fixed assets” [1]. However, if the value of such assets is no more than 40,000 rubles, they can be included in the inventory (if this is provided for by the accounting policy - clause 5 of PBU 6/01 ).

For tax purposes, depreciable property is property with a useful life of more than 12 months and an original cost of more than 100,000 rubles. ( clause 1 of article 256 of the Tax Code of the Russian Federation ). An organization cannot change this rule by its accounting policy and set a lower cost threshold for recognizing property as depreciable. “Low value” objects are written off for tax purposes as part of material expenses ( clause 3, clause 1, article 254 of the Tax Code of the Russian Federation ).

In order to bring tax and accounting data closer together, write-offs can occur evenly, and it is this decision that is fixed in the accounting policy for tax purposes.

In paragraph 4 of Art. 374 of the Tax Code of the Russian Federation lists property that is not recognized as an object of taxation. This list includes land plots, nuclear installations, icebreakers, space installations, as well as fixed assets included in the first or second depreciation group in accordance with the Classification of fixed assets included in depreciation groups [2].

Consequently, if an organization’s balance sheet contains fixed assets (movable and (or) immovable), named as part of the objects of taxation, it is recognized as a payer of property tax and is obliged to submit a declaration (tax calculation for advance payments) for this tax.

The fact that, according to paragraph 25 of Art. 381 of the Tax Code of the Russian Federation in 2017, a preferential tax regime applies to movable fixed assets (regardless of their depreciation group), accepted on the balance sheet from January 1, 2013, does not mean that such objects are automatically excluded from the list of taxable objects.

Exclusion from the list of taxable objects and provision of benefits are not the same thing. These are different mechanisms for regulating the tax burden, provided for by various articles of the Tax Code.

So, by virtue of Art. 381.1 of the Tax Code of the Russian Federation from January 1, 2018, the tax benefit established by clause 25 of Art. 381 of the Tax Code of the Russian Federation , will be applied by taxpayers at the discretion of the constituent entities of the Russian Federation. It is likely that in some regions its validity will be extended, and in others terminated, however, in both cases, owners of movable property will be considered payers of property taxes who are required to submit tax reports for this tax.