Olesya Krumkach. Photo from personal archive About 3,000 employees of Belarusian companies buy lunches from the Bono food service every day in canteens or through delivery. This service was founded by a married couple - Olesya Krumkach and Denis Vnuchko. Six years ago, having tried themselves in the restaurant business, they preferred “homemade” cutlets to gourmet dishes, and began to prepare only lunches for offices. Olesya talks about how this business works in her story.

— My husband and I started in 2009 as co-owners of a restaurant, which, in addition to banquets, delivered lunches for a large IT company. It was thanks to this company that we learned that there was such a niche - corporate catering.

Our partner wanted to continue running the restaurant, and we became interested in a new direction. Unable to find a compromise, a year later my husband and I left management, selling the share to our partner. We found a cafe in the building where the administration of the Atlant-M holding was located, and began to work only at lunchtime.

MTS dining room. Photo from the personal archive of Olesya Krumkach

From a classic restaurant to simple lunches

There were no obvious major players in the market. There were many restaurants and cafes that offered lunch delivery to the office. Probably the biggest name in the lunch delivery market at that time was the Lido restaurant.

Very quickly we realized that we would not be able to cover costs with the incoming flow of customers, and the production facilities were idle. We decided to supplement them by preparing lunches for delivery. Thus, we immediately built our work focusing on lunch delivery, and now we see that classic restaurants entering the corporate catering sector inevitably face the following problems:

1. Personnel. A team of star chefs who perfectly prepares the evening menu and serves 50 checks per evening, cannot always, and most importantly wants to, prepare 100-300 lunches per morning.

2. Logistics. The staff needed a courier with a sanitary passport for the car, who tried to deliver lunches on time - and usually all existing customers immediately place an order from 12 to 13 o'clock.

3. Growth of the client base. For a small kitchen of a classic establishment, +100 lunches may be the “ceiling” of production capabilities, and the temptation to take on more orders is very high.

We received orders through word of mouth or looked for clients ourselves who, as we thought, might need corporate catering. Three years later, in 2013, we realized that we could no longer grow at the existing production site and we needed a new one.

Each client restructured our business processes

The next point after the small kitchen was the BSU canteen on the territory of the student village. This site was three times larger than the previous one - about 600 m². The World Hockey Championship became a test for the entire team: fans lived on the campus, it was a strategically important facility for the state. We did not get out of checks...

After the move, we formed a sales department, and it was a year of enormous growth. From the very beginning, we were lucky to work with large companies that had high internal standards and, accordingly, requirements for us. Over the course of a year, we launched Belarusbank, Olivaria, MTS, August-Bel, Bakko Instruments... Some companies found us on their own. The sales department is still the main tool for finding clients, accounting for 90% of the client base. After such growth, changes in the company are inevitable; each client dictated new rules:

1. gave us our own due diligence, sunday at their food outlet - every day. We were checked by their security service, accounting department... Now, starting to work with a large client, we ourselves offer to come to us and evaluate the production.

2. If you look at Olivaria, they are very systematic. It is very important for them that we plan our work and fulfill our promises on time. Relatively speaking, if we are planning a thematic menu in two weeks, then we are obliged to do so. This applies to all our relationships.

3. We learned customer focus from Atlant-M. Recently, the director decided to joke and told the production manager that we needed to take care of the nutrition of the beloved Labrador of one of our regular customers while he was away from the country. Without pausing, our employee asked if the dog had allergies and what meat was preferable.

4. With Bakko Instruments we began introducing the 5S system (an element of the lean production system) and launching a program for the continuous improvement of production processes and customer service.

Payment of compensation for food

Compensating for food is one of the easiest ways to feed an employee. After all, the company does not incur any additional expenses other than payment of compensation. In this case, you just need to fill out the documents correctly, then the amounts of compensation can be taken into account for profit tax purposes as part of labor costs.

Documentation requirements are usual: collective and employment agreements must contain references to the payment of compensation to employees. It is also necessary to establish the amount of compensation in local regulations.

If you have the above documents for the amount of compensation, you can reduce the base when calculating profit.

Personal income tax should be withheld from the compensation amount, since it is the employee’s income.

Also, insurance contributions to extra-budgetary funds must be calculated on the amounts paid.

When paying compensation to employees, you may be faced with the fact that employees, having received the money, will spend it at their own discretion, and not necessarily on food.

It is quite simple to prevent employees from using benefits intended to pay for food for other purposes - for example, by concluding a service agreement with a cafe located next to the company office. Payment for lunches is carried out using cards, to which the amount of compensation is credited.

For one cook - 100 lunches

Now the company has 98 people: cooks and waiters, general workers, administration: production manager, two deputies subordinate to her, technologist, accounting, HR, assistant director. Almost the entire management team has been with us for six years.

The differences between our staff and restaurant staff are colossal. This concerns the structure, the portrait of candidates. Chefs with experience working in restaurants don’t even last a week with us - it’s a completely different rhythm of work. They don’t have the opportunity to go out to smoke at a convenient time or “sit” on the phone. When chefs come to work, they clearly know: today they are preparing lunch for 3,000 people. We are not ready to pay for employee idleness in the workplace.

But our turnover of chefs is small, some have been with us for 6 years. I think because we select different types of people. Stability and income security are important to them. We have a five-day week, some work from 6 a.m. to 3 p.m., some work in the afternoon and go to their second place of employment. Salaries are average for the market and comparable to salaries in restaurants. There are a total of 30 chefs on staff.

The next group is the waiters on the serving line, there are about 30 of them.

Photo from the personal archive of Olesya Krumkach

The difficulty with this group is the turnover. Young mothers often take this position; it is important for them to pick up their children from kindergarten in the evening. There are also many graduates who come to us and then leave when they find a job in their specialty.

And the weakest point in the workforce is the laborers. I'm sure this is a problem in almost all catering establishments. The pace of work is very important to us, and not everyone can handle it. Also, very often there is a problem with alcohol among people applying for vacancies as general workers.

Equipment for eating areas

The place for eating is equipped in order to ensure normal working conditions (Article 223 of the Labor Code of the Russian Federation). Production premises must be isolated from sanitary, service and administrative premises, since eating in production premises is prohibited. This ban is caused by objective necessity. At production enterprises, eating food “without leaving the machine” is impossible due to the lack of appropriate sanitary and hygienic conditions. In office premises, lunch at work is also unacceptable in order to prevent the harmful consequences of a “business lunch”: traces of lunch on business papers, office equipment, persistent appetizing odors in the office atmosphere.

The standards for dining rooms are established in SNiP 2.09.04-87 “Administrative and domestic buildings”, approved by Decree of the USSR State Construction Committee dated December 30, 1987 No. 313. Thus, according to paragraphs 2.48 - 2.52 of SNiP 2.09.04-87, with the number of employees in For a shift of more than 200 people, the organization must have a canteen, and for a shift of up to 200 people, a canteen or a canteen-dispensing area. If the number of workers is less than 30 people per shift, instead of a canteen it is enough to equip a room for meals. In small organizations with a number of employees not exceeding 10 people per shift, instead of a room, it is allowed to allocate additional space in the locker room to install a table. In addition, the specified SNiP says how the room for eating should be equipped. So, it must have the appropriate equipment: a refrigerator, an electric oven, a cooler, an electric kettle, as well as kitchen furniture and utensils.

Income tax.

Tax legislation allows you to take into account the costs of ensuring normal working conditions for the purpose of calculating profits (subclause 7, clause 1, article 264 of the Tax Code of the Russian Federation). Therefore, the costs of purchasing the necessary equipment for the meal room, as well as repairs and utility bills, comply with the conditions specified in Article 252 of the Tax Code.

It should be noted that tax authorities sometimes try to increase the tax base for expenses associated with equipping the premises for eating. But their arguments are not supported by the judicial authorities; numerous arbitration practices have developed in favor of companies (resolution of the Federal Antimonopoly Service of the West Siberian District dated April 2, 2007 No. F04-1822/2007(32980-A27-40) in case No. A27-11993/2006- 2). Moreover, the arbitrators believe that the cost of purchasing utensils for the meal room, including disposable ones, also reduces the tax base (Resolution of the Federal Antimonopoly Service of the Moscow District dated August 19, 2009 No. KA-A40/7730-09 in case No. A40-69714/ 08-107-332).

Although the courts support companies in their desire to comply with labor legislation, it is better not to bring the matter to court. To do this, you should obtain documents justifying the purchase of the necessary equipment. Such documents may be memos, orders and acts that indicate the purpose of purchasing the property. The preamble of the manager’s order may sound like this: “In order to fulfill the obligation to provide workers with normal working conditions and provide premises for meals, I order...”

In addition, the employer’s obligation to provide employees with the opportunity to eat in a specially designated place should be enshrined in internal local regulations governing labor relations, for example, in internal labor regulations or a collective agreement.

VAT.

Incurring the costs of equipping the premises for eating, the company pays VAT. Since expenses are incurred within the framework of creating normal working conditions that are aimed at generating income, the company can accept VAT amounts for deduction (subclause 1, clause 1, article 171 of the Tax Code of the Russian Federation), provided that the company has invoices issued in accordance with the requirements of the law (clauses 1 and 2 of Article 169 of the Tax Code of the Russian Federation).

Personal income tax and insurance premiums.

There is no need to pay insurance premiums and personal income tax on the cost of expenses incurred, since the company does not make any payments to employees.

Example 1

Atlant LLC, as part of equipping the premises for meals, in May 2011 acquired the following property: a refrigerator worth 11,800 rubles, including VAT - 1,800 rubles, a microwave oven worth 2,360 rubles, including VAT - 360 rubles. , an electric kettle worth 472 rubles, including VAT - 72 rubles, a set of kitchen utensils worth 1180 rubles, including VAT - 180 rubles. The company has all the necessary primary documents and invoices.

Purchased equipment is not recognized as depreciable property for profit tax purposes in accordance with paragraph 1 of Article 256 of the Tax Code, therefore it is accepted for accounting as part of inventory and materials. The cost of acquired assets in the amount of 13,400 rubles. ((11,800 – 1800) + (2360 – 360) + (472 – 72) + (1180 – 180)) reduces the tax base for calculating profit at a time when transferring them into operation.

VAT on the cost of purchased property in the amount of RUB 2,412. (1800 + 360 + 72 + 180) is accepted for deduction.

How does a business organize meals for employees?

We are approached by IT, manufacturing, banking sector, construction, brewing companies: for example, in addition to those listed above, IBA, MTS, Dana Holding. We see that more and more companies are interested in corporate catering.

Everyone has different approaches to organizing and financing food. As a rule, the company has a person who oversees this issue. A few years ago, all it took was a call: “How much is lunch? Ok, bring it,” but now we still need to build a relationship with the company.

Photo from the personal archive of Olesya Krumkach

Sometimes we do renovations in canteens ourselves - this applies to companies with a staff of 1000 or more people. So, in the HTP there was a “bare” room for us, and we opened a cafe there from scratch (we don’t work there now). But still, more often we come to already equipped areas. As for delivery, we deliver lunches from 80 rubles, but if the client is on the courier’s route, then we make concessions and make delivery for orders of 30-40 rubles.

The volume and cost of lunches depends on the company’s social package. If the company subsidizes food, then we provide lunches to almost the entire staff. If the payment is partial, then the order is made by approximately 80% of the staff. And if employees pay for lunch themselves, then this is about 30%. The automated system on our website allows you to avoid turmoil in the office, when one person runs around the entire team and collects applications: employees can place orders themselves through the website. Let me give you an example: the average check at the canteens of Belarusbank and MTS is about 5 rubles.

Often our client immediately stipulates the average cost of lunch, which we must meet when creating a menu for him. For example, it is also possible to organize lunches for 3.5 rubles - it will be a simpler menu, consisting mainly of cutlets and pancakes. In some companies, the directorate eats separately; upon request, we create a menu for them at a completely different level.

Photo from bono.by

A spoon for mom, a spoon for dad

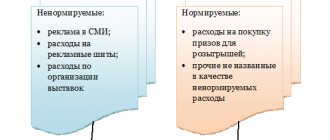

The most common option is to provide the opportunity to have lunch at the workplace. Moreover, they organize it differently depending on the finances and practical wishes of the organization:

- Payment of compensation.

- Payment for a cafe or canteen with which the organization has entered into an agreement (with deduction and without payment from employees).

- Delivery upon request.

- Own dining room.

- Purchase of ready-to-eat products: fruits, vegetables, dairy, meat products, semi-finished products.

More detailed information about paying for food with money is provided in the article at the link. I will dwell on the features of registration, accounting, payment of personal income tax and contributions.

First of all, monetary payment in any form must be stipulated by a collective or employment agreement, otherwise it will be impossible to accept it as expenses. On the other hand, if payments are personalized, the Pension Fund and the Federal Tax Service will really want to see the personal income tax and contributions paid from them. How to avoid this?

There are many other questions: how to set the amount of compensation: in the form of a specific amount or a constantly changing amount, if employees eat at a catering establishment with which the employer has entered into a service agreement, do they need to keep records for each person or just pay the total amount for lunches?

Let's look at the most common situations:

- The employee is given compensation in the form of a certain amount. He decides where he will have lunch or even can spend this money on his own needs; the employer has no control over costs. In this case, the payment amount is subject to personal income tax and insurance contributions, because, despite the social nature of the expenses, it is not known how the employee will manage the compensation, and it is also easy to determine to whom how much money was paid.

- The employee has lunch at a certain catering establishment, and the employer makes payments to the supplier at the end of the month. In this case, everyone is given a card (coupon, other personal document), which he presents at the checkout. Records are kept for each employee. This is where income in kind comes from. There are two possible ways of development of events:

- as in the first case, the amount spent on an employee will be subject to personal income tax and contributions;

- second – income is subject to personal income tax only.

Important! Insurance premiums calculated from payments, regardless of whether the payments themselves are accepted for accounting and included in the base for calculating the profit tax, are taken into account when calculating the tax base.

This depends on the specific situation and the company’s desire to challenge the claims of tax authorities and fund representatives in court in the future. For example, if the provision of food is not mandatory in accordance with the Labor Code (see, for example, Article 108 of the Labor Code of the Russian Federation), it means that it is provided by the organization on its own initiative, which means it relates to social benefits rather than wages. In this case, she should not be subject to contributions (the courts believe).

- D 91.2 K 73 – compensation (payment) is accrued if it is possible to attribute expenses to a specific individual.

- D 73 K 68 – personal income tax withheld.

- D 73 K 51 (50) – payment to employees is reflected.

If the amount of payment is correlated with the position, qualifications or time of work (experience), then contributions will have to be calculated: D 91.2 K 69.

Example: an organization has established that only employees who have worked for the company for more than six months, who do not have disciplinary sanctions and who comply with labor standards, receive paid meals.

- The organization pays the canteen, but no personalized records are kept. Employees show their ID (another document) at the checkout, confirming that they belong to a specific organization. At the end of the month, the total bill is paid without breakdown by individual.

- Delivery to workplaces. This option is suitable for hard-to-reach, remote workplaces, where food or groceries are delivered (not necessarily daily, for a week, for a month) due to the lack of a nearby cafe, or even just a store. Likewise for offices or sites from which it is simply inconvenient for people to leave for lunch (for example, from a construction site). In principle, there are no special differences from catering.

- The most expensive and difficult option is your own dining room: First, you will have to allocate a room for it, equipped in a certain way. Compliance with sanitary standards and safety regulations is required.

- Secondly, it is necessary to hire staff: kitchen workers, dishwashers, cashiers (if products are sold).

- Thirdly, in addition to the initial costs (equipment, utensils), there will be expenses for the purchase of products, salaries, deductions from them, medical examinations, and garbage removal. The bottom line is that not everyone can afford such a luxury.

In this case, it is impossible to determine who ate what amount, so it is impossible to calculate the taxable base.

Note! Sometimes the Federal Tax Service believes that an organization can divide the total payment into equal parts or distribute it in another way, but this is an ineffective and unfair way. Someone was sick, on vacation, on a business trip, did not go out to eat, and ate twice. In this case, there is no need to impose taxes and contributions on payment, despite the position of the authorities.

Regarding the deduction of the cost of lunches from wages. In this case, it turns out that the employer does not bear the costs, but organizes meals, for which the employee pays. There is no talk of receiving income, which means there is no need to withhold personal income tax.

The organization needs to charge VAT on the cost of food; in fact, the sale takes place. This position is confirmed by letters from the Ministry of Finance, however, there are other decisions (depending on the specific situation) justified by judicial practice. Plus - we accept VAT charged by catering for deduction if payment to employees is taxable.

The courts support taxpayers when disputes arise over the calculation of taxes and contributions on the cost of meals and other social benefits. Therefore, if claims or attempts at additional charges arise from government agencies, defend your interests in court - the chances of winning are high.

We take into account what is written in the organization’s LNA, the collective agreement, and in its absence, in the labor agreement, whether the cost of lunches is deducted from wages.

In recent years, many companies have recognized an attractive and least costly way of providing enterprise employees with access to a certain set of products. Usually these are fresh fruits, seasonal vegetables, yoghurts, dairy products, cold cuts, baked goods, as well as tea, coffee, and mineral water. Workers can enjoy stock from the refrigerator or drink a cup of coffee at any time of the day.

The purchase of products will be reflected in the following transactions:

- D 10 K 60(76) – products received from the supplier.

- D 91.2 K 10 - products are written off as other non-acceptable expenses.

Large organizations with a large number of employees, or business centers, install food vending machines in the corridors; a third-party company handles their maintenance. At the same time, the employer not only does not incur costs, but, on the contrary, makes a profit, because a payment is taken for renting the space for the machine.

True, you can’t get a full meal using vending machines - maximum carbonated drinks, chocolates or chips. If the vending machine is purchased and installed by the organization itself, then this will already be a sale.

Mandatory meals

So far we have been talking about the employer’s own initiative, but in accordance with the law, in some jobs food (special food) is provided necessarily, since it has a therapeutic and preventive purpose or is simply necessary:

- Allowance in kind for certain categories of workers. Usually these are those who are engaged in hazardous work. Can be replaced with compensation.

- Nutrition for athletes, as well as other workers employed in sports and recreational organizations, sports judges.

- Field allowance. Issued to “seasonal workers” - employees who participate in field work.

- Crew members of air, river, and sea vessels (except for the fishing fleet).

- Certain other employees as required by federal and industry law.

The cost of such food (within the limits of standards, if they are established) is not subject to personal income tax. But compensation, if it is not provided for by law, or excess allowance will have to be taxed.

Payments specified in Article 422 of the Tax Code of the Russian Federation are exempt from insurance premiums. There is the above allowance. At the same time, the nature of the work, harmfulness and provision of benefits are reflected in internal regulations, labor and collective agreements. In addition, harmful and dangerous conditions must be confirmed by a special assessment of working conditions.

Kitchen room equipment

Sometimes the employer organizes an area or room where staff heat up food they bring with them and have a snack during a break. At the same time, microwave ovens, kettles, and furniture are purchased at the expense of the organization. It is necessary to take into account the purchased equipment depending on the cost:

- Low-value items (“by default” in BU - less than 40,000, in NU - less than 100,000 rubles) are immediately written off as expenses. They will be accounted for on account 10 until they are put into operation, and after that it is recommended to reflect them on an off-balance sheet account to account for actual availability.

- More expensive ones should be registered as fixed assets and depreciation charged under OSNO or written off in equal parts during the tax period (STS).

The purchase of equipment and furniture will have to be justified. It would be good to stipulate in the regulations and contracts with employees that the employer undertakes to provide comfortable living conditions, food in the workplace, and also indicate additional reasons why this is required:

- 24/7 work (in shifts, at night).

- Accessibility (there are no catering outlets nearby).

- The ability not to leave the workplace (remote or hard-to-reach areas, work outside the city).

In this case, the costs of an office kitchen are reasonably included in expenses when calculating the base for both income tax and the single tax.

Note! Income tax costs include only food costs that are provided for by labor, collective agreements, local regulations, as well as those that are mandatory in accordance with the law (clause 25 of Article 270 of the Tax Code of the Russian Federation).

Another important point is cash receipts. There is no need to enter them when providing employees with food, either free of charge or when deducting money from their salaries. There are already many explanations from the Ministry of Finance on this matter.

About competition and customer requirements

By participating in tenders, we each time discover new names in this service market. To survive in difficult conditions, many establishments began to offer lunch delivery. But the attitude of companies to the choice of contractors has changed greatly over the past six years:

1. Previously, the client called the office, found out how much lunch would cost and said where delivery should begin tomorrow. Now the attitude is more scrupulous. Documents are requested, we accept entire commissions at production sites, which may include representatives of the security service, HR, and the person in charge of food service in the company.

To meet all requirements, we are ISO 2200 certified (food safety standard) and have taken up 5S (one of the elements of lean manufacturing).

2. The attitude towards the assortment of dishes is changing in favor of a healthy diet. There are more and more vegetarians.

3. Nowadays, only a few lunch delivery companies can afford to work only according to a standard collection of recipes. You need to surprise so that the client does not become bored with the assortment. So, we hold days of dishes made from seasonal products, days of dishes from different countries of the world, potato pancake fests...

Organization of Maslenitsa in the client’s office. Photo from bono.by

About the results

Now we have three main areas: organizing canteens, delivering lunches and confectionery production. There is also catering, but we do not highlight it as a separate area, although we constantly serve the events of our and third-party clients and have a warehouse of equipment, dishes, furniture and textiles. But 95% of the profit and labor costs are daily corporate catering.

The company's profitability is about 15%. We have about 30 clients, we serve about 3,000 people a day, about half of them at our locations. We have 5 canteens open, two of them with production bases where we prepare lunches for delivery. There is an automated system for receiving orders, its own transport, and warehouses. A CRM system allows you to record all contacts and “not lose” potential clients.

… and not only

If a canteen provides food not only to its employees, but also to third parties, then for profit tax purposes it is recognized as an object of service production (Article 275.1 of the Tax Code of the Russian Federation). In this case, the procedure for forming the tax base for income tax and accounting for losses is formed in a special way. Thus, a loss can be recognized for tax purposes if the following conditions are met:

- the cost of lunches sold corresponds to the cost of similar services provided by specialized organizations;

- the costs of maintaining a canteen do not exceed the usual costs of servicing similar facilities carried out by specialized organizations;

- the conditions for the provision of services do not differ significantly from the conditions provided by specialized organizations.

If at least one of the conditions is not met, then the loss received from the activities of the canteen can be carried forward for a period of no more than 10 years. Moreover, only the profit received from the activities of the canteen can be used to repay the loss.

Providing free or reduced-price food to employees means that one of the necessary conditions is not being met. Accordingly, losses from the activities of the canteen cannot be recognized.

To avoid the negative consequences of failing to account for losses, employees should be provided with lunch at market prices, just like other visitors. And instead of providing free lunches, workers should be compensated.

In the future we are planning...

My husband and I share responsibilities: Denis is a strategist, and I am responsible for the product, I write the menu myself for every week, and generate ideas for new dishes. He handles finances and sees everything much further and deeper than I do. The creation of a sales department was his idea. Frankly, I didn’t understand how you could offer lunches over the phone. In all six years in the family business, my husband and I have never had the desire to slam the door and go our separate ways. We don't have a "blanket pull". And I think that I wouldn’t want to build a business except outside the family.

We would like to see a corporate catering outsourcing market emerge. We want to convey to managers that we know many formats for how employees can get a nutritious lunch while in the office, rather than leaving it for a long time in search of food.

There are plans to expand into the regions. We are also interested in the public sector. We are making attempts to cooperate with large state-owned manufacturing companies, but even though local managers are quite progressive, the order to preserve jobs prevents them from making a decision. For them, it is not yet an argument that with a staff of 70 people we can do the same thing as 250 employees of their food service. But we see potential in reaching out to the public sector. I think they will sooner or later come to the conclusion that everyone should mind their own business.

Read also

- We tasted it to tears. How to line up in a seemingly “lost” place - the experience of the Döner King chain

- A cafe in a bank or a bank in a cafe - here is an example of successful co-branding

- Disposable tea strainer: 4 years of development, 2 designers and a patent. How a simple idea became a complex business