This article discusses hazardous working conditions class 3.1, as well as 3.2 and 3.3. From it you can learn about the required workers' compensation and the features of its provision.

A mandatory condition for the work of enterprises and organizations is a special assessment of working conditions. It allows you to identify harmful factors in production and determine the severity of damage that is caused to employees during the performance of their work duties. The results obtained are systematized, compared with current hygienic standards and relate to a particular class of work. In this article we will take a closer look at working conditions class 3.1, 3.2 and 3.3, what this means.

Features of working in hazardous working conditions

Harmful working conditions are considered to be those that can lead to occupational disease, and dangerous - to injury. In the workplace, health can be affected by high levels of noise, dust, vibration, radiation, poor lighting, high or low temperature, etc. There are many harmful and dangerous production factors, they can be physical, chemical, biological, psychophysiological.

The extent to which workplaces are harmful and (or) dangerous is determined based on the results of a special assessment of working conditions (SOUT). Employers are required to conduct it once every 5 years. All jobs of employees who work for individual entrepreneurs or organizations under employment contracts are assessed, with the exception of homeworkers and remote workers. There are conditions under which a special assessment is carried out even before the expiration of five years, for example:

- introduced new equipment that significantly changed the production process;

- a new workplace was introduced and the employee began his duties there, including after the opening of an organization or individual entrepreneur;

- moved the workplace to another room, etc.

In these cases, an unscheduled special assessment must be carried out within 12 months after the changes.

If, during the implementation of the special labor assessment, you have identified workplaces with harmful and (or) dangerous working conditions, you are obliged to provide additional payments, guarantees and compensations provided for by law to the employees employed there. The specific list of benefits for “harmful workers” depends on the class and subclass of working conditions assigned based on the results of a special assessment. For example, for working in harmful working conditions of the 3rd or 4th degree or dangerous conditions, employees are entitled to:

- shortened working hours - no more than 36 hours per week;

- increased wages - at least 4% of the rate or salary established for work under normal working conditions;

- at least 7 calendar days of annual additional paid leave .

Guarantees and compensation are enshrined in Art. 92, 117 and 147 of the Labor Code of the Russian Federation , but the employer can independently supplement them.

There are professions, positions and industries that by default require working in harmful or difficult conditions, even when a special assessment has not yet been carried out. For example, if they are listed in List No. 1 and List No. 2, approved by Resolution of the Cabinet of Ministers of the USSR No. 10 of January 26, 1991.

Special working conditions

27 No. 173-FZ

27-11GR, 27-11VP1127-1212AIRPLANE, SPETSAV, SPASAV, UCHLET, VYSHSPIL, NORMAPR, NORMSP, REAKTIVN, LETRAB, ITSISP, ITSMAV, INSPEKT1327-141427-151527-SP (28-SP - until 2011) 16| Code of special working conditions | Subclause 1 of Art. 27 No. 173-FZ |

| 27-1 | 1 |

| 27-2 | 2 |

| 27-3 | 3 |

| 27-4 | 4 |

| 27-5 | 5 |

| 27-6 | 6 |

| 27-7 | 7 |

| 27-8 | 8 |

| 27-9 | 9 |

| 27-10 | 10 |

| 27-OS (28-OS - until 2011) | 17 |

| 27-PZh (28-PZh – until 2011) | 18 |

- Contributions are paid to finance pension supplements in the coal industry or flight crew members, i.e. in the settings for calculating insurance premiums (Figure 2), the flag “Using the labor of those employed in mining operations for coal and shale extraction” or “Using the labor of flight crew members” is set.

However, regardless of whether these characteristics have already been indicated in the staffing table or information about the position, the indicator itself for the imposition of additional contributions to the position should be entered independently; it is not automatically entered when updating.

To decide whether a particular position should be subject to additional contributions, as well as which of the two additional contribution rates to choose, you can analyze the previously filled in values of the “Bases of length of service” for the position and the “working conditions” indicated in the staffing table "

| Sign of imposition of additional contributions, established in the information about the position | The basis of length of service specified for the position | Working conditions specified in the staffing table |

| Work with hazardous working conditions, subparagraph 1 of paragraph 1 of Article 27 of the Law “On Labor Pensions in the Russian Federation” Figure 3 | Not specified | |

| Work with difficult working conditions, subparagraphs 2 - 18 of paragraph 1 of Article 27 of the Law “On Labor Pensions in the Russian Federation” Figure 4 | 27-11GR 27-11VP 27-12 AIRPLANE SPETSAV SPASAV UCHET VYSSHPIL NORMAPR NORMSP REACTIVE LETRAB ITSISP ITSMAV INSPEKT 27-14 27-15 27(28)-SP | 27-2 27-3 27-4 27-5 27-6 27-7 27-8 27-9 27-10 27(28)-OS 27(28)-RV |

| Not specified Figure 5 Note. It is also not indicated for all positions in which work is not related to the right to early assignment of a labor pension | 27(28). | 28-SEV |

Please note that if the same position appears in the staffing table in different departments, and for one of such positions special working conditions are indicated from those listed in lines 1-2 of the table (i.e. for this position, the attribute of additional contributions should be set ), and for the other are not indicated, then you should highlight separate elements for these jobs in the “Positions” directory and indicate for them different signs of additional contributions.

Thus, to calculate additional contributions, it is only necessary to set the appropriate attribute for “harmful” positions. Contribution rates do not need to be configured; they are filled in automatically in the “technological” information register “Contribution rates for those employed in jobs with early retirement”

Figure 6

https://www.youtube.com/watch?v=upload

When calculating insurance premiums using the document “Calculation of insurance premiums”, all employee income is recorded indicating the relationship to the assessment of additional contributions (with the exception of the document “Piece work order for work performed”, which itself registers its income for the purposes of calculating insurance premiums).

Figure 7

Insurance premiums are calculated taking into account the value of this characteristic. Additional contributions are placed in a separate column depending on their type.

Figure 8

Separate accounting of “harmful” and “heavy” additional contributions is associated with their separate payment (each type has its own BCC). The document “Calculations for insurance premiums” registers the payment of accrued additional contributions.

Figure 9

In accounting, accrued additional contributions are recorded in subaccounts 69.02.5 and 69.02.6

Figure 10

In the document “Adjustment of accounting for personal income tax, insurance contributions and unified social tax” it is possible to indicate the ratio of income to taxation with additional contributions, as well as the amount of accrued additional contributions

Figure 11

Changes have also been made to analytical reporting. The report “Analysis of accrued taxes and contributions” implements an additional option “PFR, contributions for employees with early retirement” for the analysis of additional contributions

Figure 12

An additional section has been added to the “Insurance Contributions Accounting Card” report, shown for employees who have been accrued additional contributions

Figure 13

Changes to the regulated reporting of contributions will be made as the relevant regulations are published.

Please note:

- If the organization pays contributions to finance additional pension payments in the coal industry or flight crew members, i.e. in the settings for calculating insurance premiums, the flag “Uses the labor of those employed in mining operations for coal and shale extraction” or “Uses the labor of flight crew members” is set, and the corresponding flags are set in the job information, then these contributions will continue to be calculated regardless of the “new” additional contributions

Figure 14

- Additional insurance premiums are registered without dividing into UTII and non-UTII parts

Let us recall that the rates for compulsory social insurance against industrial accidents and occupational diseases are established by Federal Law dated December 22, 2005 No. 179-FZ and are annually “extended” by separate Federal Laws (for example, for 2012 by Federal Law dated November 30.

2011 No. 356-FZ). Law No. 179-FZ provides, in particular, for the payment of only 60% of the established tariffs in relation to accruals made to employees who are disabled people of groups I, II and III. However, according to the text of the law, this “benefit” applies only to “organizations of any organizational and legal forms”; accordingly, it does not apply to policyholders who are individual entrepreneurs.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

Now this injustice has been eliminated - Federal Law No. 228-FZ dated December 3, 2012, by which tariffs are “extended” for 2013, includes Article 2, allowing individual entrepreneurs to pay only 60% of the established tariffs in relation to accruals made to disabled employees Groups I, II and III.

In accordance with this change in version 2.5.59, when calculating insurance premiums for employees of an individual entrepreneur who are identified as disabled, the corresponding “benefit” will be applied.

Figure 15

In accordance with Part.

2 tbsp. 10 of the Federal Law of December 3, 2012 No. 216-FZ, the indexation of state benefits for citizens with children provided for in Article 4.2 of the Federal Law of May 19, 1995 No. 81-FZ was carried out, from January 1, 2013 by 5.5%.

Also in accordance with the Decree of the Government of the Russian Federation of October 12, 2010 No. 813 and Part 1 of Art. 1 of Law No. 216-FZ, the maximum amount of social benefits for funerals provided for by Federal Law No. 8-FZ of January 12, 1996 was indexed.

New benefits and restrictions are set automatically when upgrading to version 2.5.59.

Figure 16

Please note that since 2011, the maximum amount of benefits for child care up to one and a half years is not limited, and the maximum amount is limited to the earnings on the basis of which the benefits are calculated. No recalculation of such previously recorded benefits is required.

The maximum value of the base for calculating insurance premiums has been increased in accordance with Decree of the Government of the Russian Federation of December 10, 2012 No. 1276

https://www.youtube.com/watch?v=https:tv.youtube.com

Figure 17

In accordance with Federal Law dated December 3, 2012 No. 232-FZ, from January 1, 2013, the minimum wage (minimum wage) was established in the amount of 5,205 rubles. per month. Let us remind you that this value in the program is used exclusively for calculating benefits. If accruals with arbitrary formulas are used, in which your own minimum wage indicator appears (for example, “Additional payment to the minimum wage”), then the new value of the indicator, if necessary, should be entered independently.

In what cases do you need to pay contributions to the Pension Fund for “harmfulness”

For payments to “harmful workers,” the employer is obliged to charge pension insurance contributions at general (or reduced) rates and at additional rates (Article 428 of the Tax Code of the Russian Federation).

But this applies only to certain types of work that give the right to an early pension:

- from clause 1, part 1, art. 30 of Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions” (List No. 1);

- from clauses 2–18, part 1, art. 30 of Law No. 400-FZ (List No. 2).

If the employee is not engaged in the work specified in paragraphs 1–18 of Part 1 of Art. 30 of Law No. 400-FZ, insurance premiums for additional tariffs do not need to be charged, and it does not matter that his working conditions were recognized as harmful or dangerous by a special assessment. This has been repeatedly confirmed by the Ministry of Finance, in particular, by letter No. 03-15-06/74288 dated September 27, 2019.

Contributions to the Pension Fund of the Russian Federation at additional rates must also be calculated in relation to “harmful workers” who already receive a preferential old-age pension, but continue to work in harmful and (or) dangerous working conditions.

Special working conditions: codes, decoding

In addition to the 2 codes discussed above, the table contains a fairly large number of others. They also break down positions (specialties) into separate categories.

There are 13 codes in total, including those discussed. They all start with “27”, and then they are assigned either a digital (1 to 10) or an alphabetic code (OS, PZ). The only code starting with 28 is 28-SEV, it includes residents of the Far North and areas equivalent to them, engaged in fishing, reindeer herding, as well as hunters.

The table contains not only current codes, but also those that have already been canceled, and the period of their application is indicated. This is necessary to identify work when analyzing reporting from old periods.

Next, we will briefly consider the characteristics of each code.

27-3 It is used for women working in agriculture on tractors, as well as in other sectors of the economy on loading and unloading mechanisms, or as drivers on construction and road machines. That is, all work performed by women using large mechanisms is classified in this category.

27-4. Again, it defines women's labor in heavy or intensive work in the textile industry.

27-5 Railway transport and metro workers who carry out direct transportation and their organization, as well as heavy truck drivers in mines, mines, and quarries.

27-6 Field work during expeditions, geological and geodetic (topographic) survey work, prospecting work.

27-7 Works on logging and timber rafting, as well as related ones.

27-8 Machine operators in ports.

27-9 Sailors of river and sea fleets.

27-10 Drivers of urban ground transport.

https://www.youtube.com/watch?v=ytcreatorsru

27-OS Labor of convicts in places of deprivation of liberty.

27-PZh Labor as part of fire brigades.

28-NEV Permanent residents of the Far North engaged in reindeer herding, fishing and other trades.

Codes indicating special working conditions for an employee are noted in column 5 of subsection 6.8 “Special working conditions (code)”. And if there are no special conditions, then the column is simply left empty. Thus, column 5 needs to be filled out only if contributions at additional tariffs were calculated from the employee’s payments (clause 37.6 of the Procedure for filling out the RSV-1).

For RSV-1, there are quite a few working conditions codes and they are all listed in Appendix No. 2 to the Procedure for filling out RSV-1 (table “Special working conditions”). An excerpt from the code table is given below.

Decoding working conditions codes

| Code | Work performed by the employee |

| Working conditions code "27-1" | Underground work, work with hazardous working conditions and in hot shops (clause 1, part 1, article 30 of the Law of December 28, 2013 N 400-FZ) |

| Code of special working conditions “27-2” | Work with difficult working conditions ( |

When hiring an employee, it is necessary to determine whether it is harmful or dangerous. To do this, you should familiarize yourself with the list of types of work in List No. 1 and List No. 2 (approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10)

On January 1, 2014, a new procedure appeared for the employer - “Special assessment of working conditions” (put into effect by Federal Law No. 426-FZ of December 28, 2013). Such an assessment represents a whole range of activities and is carried out by the employer together with a specialized organization.

It is important for us that as a result of a special assessment of working conditions, classes and subclasses of working conditions are established, on the basis of which, in turn, the additional tariff of contributions to the Pension Fund is determined.

Today we will discuss an issue related to the formation of regulated reporting, namely the formation of individual information SZV-6-4 in the Pension Fund of the Russian Federation. Let's look at an example of how to set up 1C ZUP to automatically create separate packs of SZV for employees working in special working conditions. The necessary settings will be made in the personnel records section of the program and include two stages:

- Indicate the code for special working conditions (for example 27-2) in the staffing table;

- Specify the list position code (for example, 23200000-19756) in the “Positions” directory.

Now let's take a closer look at an example. The organization employs an employee - Ivan Ivanovich Ivanov, who from 02/01/2013 is transferred to the position of Electric Welder. To do this, we will enter the document “Personnel transfer of the organization.”

Working as an Electric Welder involves difficult working conditions.

The position Electric Welder is also on the list of professions and positions with harmful and difficult working conditions, employment in which entitles one to a preferential pension. Therefore, in addition to the special conditions code, it is necessary to ensure automatic completion of the “List Item Code” field (for an electric welder it is equal to 23200000-19756). To do this, you need to fill in the “List Position Code” field in the Organization Positions directory for the corresponding positions.

The field is filled in from the directory “Professions and positions of preferential pension provision”. By default, this directory does not contain elements, so we need to add the element we need. This can be conveniently done by selecting from the built-in classifier. You need to click on “Selection from list No. 1” or “Selection from list No. 2”, find a profession in the list and double-click on the found line to open the form for recording a new element. In this example, we are interested in the profession that is in the second list:

- from 01/01/2013 to 01/31/2013 when he worked in a regular position as an Electrician;

- from 02/01/2013 to 03/31/2013 in the preferential position of Electric Welder;

— thirdly, the fields Special working conditions code and List item code were automatically filled in.

Everything turned out the way we planned. These settings will save a lot of time in the case of a large number of employees working on preferential terms.

I wish you success! See you on the blog pages.

To be the first to know about new blog posts via e-mail or join our groups on social networks, where all articles are also regularly published.

| Codes of special working conditions: table | ||

| Code | Full name | Code expiration date |

| ZP12A | Underground work, work in hazardous working conditions and in hot shops | from 01/01/1996 to 31/12/2001 |

| 42762 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12B | Work with difficult working conditions | from 01/01/1996 to 31/12/2001 |

| 42793 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12V | Work (women) as tractor drivers in agriculture and other sectors of the national economy, as well as drivers of construction, road and loading and unloading machines | from 01/01/1996 to 31/12/2001 |

| 42821 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12G | Labor (women) in the textile industry in work with increased intensity and severity | from 01/01/1996 to 31/12/2001 |

| 42852 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12D | Work as workers of locomotive crews and workers of certain categories who directly organize transportation and ensure traffic safety on railway transport and the subway, as well as truck drivers directly in the technological process in mines, mines, open-pit mines and ore quarries for the removal of coal, shale, ores, rocks | from 01/01/1996 to 31/12/2001 |

| 42882 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12E | Work in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, prospecting, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey work | from 01/01/1996 to 31/12/2001 |

| 42913 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12ZH | Work in logging and timber rafting, including maintenance of machinery and equipment | from 01/01/1996 to 31/12/2001 |

| 42943 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| 3P123 | Work as machine operators (docker-mechanizers) of complex teams during loading and unloading operations in ports | from 01/01/1996 to 31/12/2001 |

| 42974 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12I | Work as a crew member on ships of the sea, river fleet and fishing industry fleet (with the exception of port ships constantly operating in the port water area, service and auxiliary ships and crew ships, suburban and intracity ships) | from 01/01/1996 to 31/12/2001 |

| 43005 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12K | Work as drivers of buses, trolleybuses, trams on regular city passenger routes | from 01/01/1996 to 31/12/2001 |

| 43035 | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12L | Working as a rescuer in professional emergency rescue services, professional emergency rescue teams and participation in emergency response | from 01/01/1996 to 31/12/2001 |

| ZP12M | Working with convicts as workers and employees of institutions executing criminal penalties in the form of imprisonment | from 01/01/1996 to 31/12/2001 |

| 28-OS | from 01/01/2002 to 12/31/2008 | |

| 27-OS | from 01/01/2009 to 31/12/2014 | |

| from 01/01/2015 | ||

| ZP12O | Work in positions of the State Fire Service of the Ministry of Internal Affairs of Russia (fire protection of the Ministry of Internal Affairs of Russia, firefighting and emergency rescue services | from 01/01/1996 to 31/12/2001 |

| 28-PZh | Ministry of Internal Affairs of Russia and emergency rescue services of the Ministry of Emergency Situations of Russia) | from 01/01/2002 to 12/31/2008 |

| 27-PZh | from 01/01/2009 to 31/12/2014 | |

| from 01/01/2015 | ||

| SEV26 | Reindeer herders, fishermen, commercial hunters who live permanently in the Far North and equivalent areas | from 01/01/1996 to 31/12/2001 |

| 28-SEV | from 01/01/2002 to 31/12/2014 | |

| from 01/01/2015 | ||

Additional tariff rates for insurance contributions to the Pension Fund in 2021

If there has not yet been a special assessment, insurance premiums for “pests” must be calculated according to general additional tariffs:

- 9% - for employees from clause 1, part 1, art. 30 of Law No. 400-FZ of December 28, 2013 (List No. 1);

- 6% - for employees from clauses 2–18 of Part 1 of Art. 30 of Law No. 400-FZ (List No. 2).

If a special assessment has been carried out, the tariff will depend on the assigned subclass of working conditions.

Additional tariff rates based on the results of SOUT

How to calculate contributions according to additional tariffs

Tariffs that need to be applied based on the results of the special assessment begin to apply from the date its results are entered into the federal state information system (Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”). The appraising company must notify you of this no later than three working days after entering the information.

For the month in which the information appeared in the FSIS SOUT, additional tariffs based on the results of the special assessment are calculated not from all payments, but from the day the information appears in the system until the end of the month.

For payments to employees from paragraphs 1–18 of Part 1 of Art. 30 of Law No. 400-FZ, accrued before this date, contributions for “harmfulness” are calculated at general rates - 6% or 9%.

If the results of the special assessment contain information that cannot be disclosed (state or other secret protected by law), additional tariffs can be applied from the date of approval of the special assessment report.

Additional contributions must be calculated like regular insurance contributions to the Pension Fund - for all taxable payments separately for each employee, from the beginning of the calendar year to the end of each month on an accrual basis. But there are also peculiarities.

- If regular insurance premiums have limits on the annual salary limit, above which premiums are reduced, additional premiums are calculated equally on all amounts.

- The application of additional tariffs depends on the period in which payments were accrued, and not for which they were accrued. For example, in 2021, an employee was awarded a bonus based on the results of last year. In the month of accrual, he is engaged in harmful and dangerous work. The bonus must be included in the base for calculating contributions “for harmfulness”, even if the employee worked under normal conditions for the entire last year for which the bonus was issued.

- The accrual of additional tariffs does not depend on the operating mode. If an employee is employed in harmful and difficult conditions for less than 80% of the working time, this period is not included in the preferential period for early retirement. But additional tariff contributions still need to be calculated.

- They also need to be calculated in cases where the “harmmaker” was absent due to illness, business trip, vacation (annual paid, child care, maternity leave) and other periods that are included in the preferential length of service. In such cases, the employee is considered to be employed in work that gives the right to early retirement.

- During the month, the “harmful worker” can be employed alternately in the work indicated in both List No. 1 and List No. 2. Then additional contributions must be calculated at different rates. If the enterprise does not keep separate records of payments, contributions for additional tariffs must be calculated proportionally - the actual days worked for each type of work are divided by the total number of calendar days of the month and multiplied by payments for the month and the corresponding tariff.

- If an employee was employed in both hazardous and normal working conditions during the month, then additional tariffs should be calculated only on payments for the time actually worked in hazardous conditions. They are calculated in the same way as in the previous situation (if there is no separate accounting of payments).

- Periods when the “harmmaker” is on leave without pay or on study leave are not counted toward the length of service for early retirement. And here the Pension Fund and the Ministry of Finance disagree on whether additional contributions should be accrued. The position of the Pension Fund of the Russian Federation is not to accrue, since the employee was not employed in work with special working conditions. The Ministry of Finance believes that payments for this period are subject to additional contributions in full. It’s safer to charge them anyway. Thus, the Ministry of Labor, in letter No. 17-3/B-256 dated June 17, 2021, explained that the base for calculating contributions for additional tariffs does not depend on the periods included or not included in the preferential period. This position is confirmed by judicial practice.

Basic codes for calculating length of service in 2021

Selecting the required code for columns 8 (according to territorial conditions), 9 (for special conditions), 10 (for special periods included in the length of service) and 12 (for conditions giving the right to early retirement) does not present any particular difficulties, since each of these the graph corresponds to its own single table.

Including the table in the appendix, the codes for column 10 SZV-STAZH “Calculation of insurance experience, basis (code)” are clearly interpreted, for which there are no explanations in the text of the procedure for filling out the form. From the table dedicated to them, it becomes clear that work periods require reflection here:

- in seasonally operating industries (SEASON);

- in the field (FIELD);

- in places of deprivation of liberty (PEC 104);

- under water (DIVER);

- in special medical institutions (LEPRO).

The tables relating to the above columns can be viewed in full on our website:

- to column 8 - codes of territorial conditions used when filling out the forms “Information on the insurance experience of insured persons (SZV-STAZH) ...”;

- to column 9 - codes of special working conditions used when filling out the forms “Information on the insurance experience of insured persons (SZV-STAZH) ...”;

- to column 10 - codes “Calculation of insurance experience: basis”, used when filling out the forms “Information on the insurance experience of insured persons (SZV-STAZH) ...”;

- to column 12 - codes “Conditions for early assignment of an insurance pension: basis”, used when filling out the forms “Information on the insurance experience of insured persons (SZV-STAZH) ...”.

The total number of tables corresponding to absence period codes reaches three. What is the reason for such a number of tables, each of which, unlike, for example, those related to columns 9 and 12, is not voluminous? Why aren't they combined into one?

This decision is explained by the fact that two of them relate to employees (registered both under an employment contract and under GPC agreements) and should be used when drawing up SZV-STAZH. Their division into different tables is caused by the indication in one of them of periods of absence included in the length of service, and in the other - those not included in it.

To learn about the conditions under which periods of absence are included in the insurance period, read the material “What is the insurance period for a pension.”

The third table is devoted to the periods taken into account in the length of service of self-employed persons who, during these periods, are not able to pay insurance premiums for themselves. Since self-employed persons do not submit reports on their work experience, the absence codes indicated in this table in SZV-STAZH are not used.

Thus, to fill out column 11, codes will have to be selected based on their meanings contained in two tables in the appendix to the procedure for filling out forms, approved by Resolution of the Pension Fund Board No. 507p.

See also the Checklist for filling out the SZV-STAZH.

When and how to pay

Additional tariff premiums are transferred within the same time frame as for regular insurance premiums - no later than the 15th day of the month following the month in which they were accrued. If the last day of payment is a weekend or non-working day, it is postponed to the next working day.

When making a payment for additional insurance contributions to the Pension Fund for hazardous working conditions in 2021, special budget classification codes (BCC) are used. They will be different depending on what types of work the “harmmakers” are engaged in and whether a special assessment was carried out.

If additional tariffs are established based on the results of the SOUT, then for List No. 1 use KBK 182 1 02 02131 06 1020 160, and for List No. 2 - KBK 182 1 02 02132 06 1020 160. If the SOUT was not carried out, then for List No. 1 use KBK 182 1 0210 160, and for List No. 2 - KBK 182 1 02 02132 06 1010 160.

What do absence codes reflect?

What is the composition of the codes included in the tables intended for column 11? The periods taken into account in the length of service include, for example:

- leave (regular, educational, to care for a child up to one and a half years old, without pay within the duration determined by the Labor Code of the Russian Federation);

- sick leave (including those issued in connection with pregnancy and childbirth);

- periods when work is impossible due to production technology or reasons beyond the control of the employee;

- periods of work under GPC agreements.

With regard to the latter periods, it should be noted that they may have different codes depending on whether payment was made for work performed under the contract.

Among those not taken into account in the length of service are, for example, maternity leave for up to three years and without pay beyond the duration determined by the Labor Code of the Russian Federation, as well as other unpaid periods.

Complete lists of codes contained in the tables used when filling out column 11 are also available for download on our website:

- codes “Calculation of insurance experience: additional information” used when filling out the forms “Information on the insurance experience of insured persons (SZV-STAZH) ...”;

- codes “Calculation of insurance experience: additional information (periods not included in the insurance experience)”, used when filling out the forms “Information on the insurance experience of insured persons (SZV-STAZH) ...”.

What happens if you don’t pay fees for “pests”

For non-payment or incomplete payment, a fine of 20% of the unpaid amount of insurance premiums is provided (clause 1 of Article 122 of the Tax Code of the Russian Federation). Penalties are applied if the payer:

- erroneously underestimated the basis for calculating insurance premiums;

- incorrectly calculated contributions (for example, applied a reduced tariff);

- committed other unlawful actions (inactions).

The fine will increase to 40% of the unpaid amount if all this was done intentionally (Clause 3 of Article 122 of the Tax Code of the Russian Federation).

What kind of reporting to submit?

Information about additional contributions for payments to “pests” is included in several reports.

Calculation of insurance premiums

The DAM is submitted to the tax office, organizations - at their location, and individual entrepreneurs - at their place of residence.

The amounts of payments for which additional tariff contributions are calculated, and the contributions themselves must be reflected:

- in subsection 1.3.2 or 1.3.2 of appendix No. 1 to section 1;

- in subsection 3.2.2 of section 3, which reflects information on a specific employee.

Using the special service “My Business” you can generate a free calculation of insurance premiums.

SZV-STAZH and ODV-1

These forms are submitted as a set to the territorial office of the Pension Fund at the place of registration.

Codes of working conditions that give the right to early assignment of a pension are indicated in column 9 of the SZV-STAZH report . The codes are taken from the classifier of the Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018. For example, the working conditions of an electric welder for manual welding, which is included in List No. 1, are marked with code 27-1.

If special working conditions are indicated in the SZV-STAZH form, then section 5 must be completed in EDV-1.

Using the special service “My Business” you can generate a free calculation of insurance premiums.

4-FSS

In the report for social insurance, on the title page, fill in the number of workers employed in work with harmful and (or) hazardous production factors and Table 5.

What data goes into SZV-STAZH

SZV-STAZH is a form of annual reporting on the length of service of employees, used starting with the report for 2021 (Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p).

The need for its appearance was caused by the abolition of the previously used quarterly form RSV-1, which was submitted to the Pension Fund of the Russian Federation and contained information on the calculation and payment of insurance premiums for compulsory health insurance, as well as information on length of service. Since 2021, control over the calculation and payment of contributions has passed to the tax authorities; quarterly reports began to be submitted there, combining data on accruals for all insurance premiums transferred to the jurisdiction of the Federal Tax Service (OSI, compulsory medical insurance, compulsory social insurance, except for contributions for injuries). This reporting also includes a section with information about accrual of payments to compulsory pension insurance made in relation to the income of each employee personally.

However, information about the length of service was not included in the new reports submitted to the Federal Tax Service as it is not related to the calculation and payment of contributions. Control over data on length of service remained with the Pension Fund of Russia, but the submission of information about it became annual. It is for this annual reporting that a new reporting form (SZV-STAZH) was introduced.

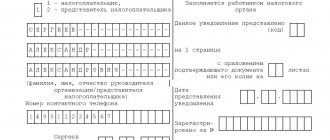

The form reflects information about the policyholder (name, registration number, TIN, KPP), the type of information submitted (initial, supplementary, intended for calculating a pension) and the year for which the report is submitted. To enter basic information (about the length of service of employees), there is a table reflecting the information:

- about full name and SNILS of employees (columns 2–5);

- the period of their work for the reporting year (columns 6–7);

- working conditions and periods specially taken into account in the length of service (columns 8–13);

- the fact of dismissal on December 31 of the reporting year (column 14).

Under the table there are sections for marks indicating the fact of accrual and payment of contributions, which are required to be filled out only when submitting information about the length of service for calculating a pension.