How is the balance currency calculated?

The balance sheet currency can be calculated by balance sheet asset and liability.

- formula for calculating the balance sheet currency for an asset (calculated from the balance sheet data):

VB (by asset) = (Intangible assets + OS + DV + FV + ONA + Prvn) + (Z + VAT + DZ + FVl + DS + Proa)

Where:

- Intangible assets - the amount of intangible assets (line 1110)

- OS - residual value of fixed assets (including deduction of depreciation) (line 1150);

- DV - the amount of profitable investments in intangible assets (line 1160);

- FV - financial investments (line 1170);

- ONA - the amount of deferred tax assets (line 1180);

- Prvn - other non-current assets (line 1190);

- Z - the amount of the enterprise's reserves (line 1210);

- VAT - value added tax (line 1220);

- DZ - the amount of debt of debtors (line 1230);

- FVl - financial investments in current assets (line 1240);

- DS - the amount of cash in the cash register and in the current accounts of the enterprise (line 1250);

- Proa - the value of other current assets (line 1260).

Balance sheet currency elements

Thus, you can calculate the balance sheet currency of an enterprise for an asset using lines from the balance sheet:

VB (asset) = line 1110 + line 1150 + line 1160 + line 1170 + line 1180 + line 1190 + line 1210 + line 1220 + line 1230 + line 1240 + line 1250 + line .1260.

If the balance sheet has already calculated the totals of non-current assets (line 1100) and current assets (line 1200), then you can apply a simplified formula for calculating the balance sheet currency for an asset:

VB (by asset) = line 1100 + line 1200

The result should be the same in all cases.

- formula for calculating the balance sheet currency for liabilities (calculated from the balance sheet data):

VB (by liability) = p. 1310 + p. 1320 + p. 1340 + p. 1350 + p. 1360 + p. 1370 + p. 1410 + p. 1420 + p. 1430 + p. 1450 + p. 1510 + page 1520 + page 1530 + page 1540 + page 1550.

If the balance sheet has already calculated the totals of capital and reserves (line 1300), long-term liabilities (line 1400) and short-term liabilities (line 1500), then you can apply a simplified formula for calculating the balance sheet currency for liabilities:

VB (by liability) = line 1300 + line 1400 + line 1500

Note!

Balance sheet currency (by asset) = Balance sheet currency (by liability)

Balance sheet analysis in 10 minutes if you are not an accountant

Author:

Elena Pozdnyakova

Expert in the selection of accountants at Finver Agency

Purpose of analysis

partner’s financial statements: estimate the size of the counterparty company, make a forecast for the future and

answer the questions: how much is the partner’s business worth?

Does the partner have enough resources to secure the deal?

Will he be able to pay off his debts?

Let's start with Balance

, because it contains the most important information about the company, you can view the balance sheet on the CHEST BUSINESS portal in the card of the company being audited, in the “Financial reporting” tab.

I will give an algorithm on how to analyze the balance quickly and professionally.

But first, a little theory.

A balance sheet is a report on a company's assets and their sources as of a specific date.

The company's property is reflected in the "Asset" section, and sources: own and borrowed funds in the "Liability" section. The total amounts of these two sections are always equal to each other and are called “balance sheet currency”.

Balance sheet equality:

Asset = Liability

Any business transaction affects both assets and liabilities equally, therefore balance sheet equality is always preserved.

For example,

the founder deposited authorized capital in the amount of 100 thousand rubles into the current account

.

This operation will be reflected simultaneously in both an asset (money in the account) and a liability (own funds: authorized capital). The balance sheet currency is 100 thousand. Next, goods with deferred payment in the amount of 700 thousand were received at the warehouse.

We reflect the goods in the asset - 700 thousand, and in the liability account - accounts payable - 700 thousand. Now the balance sheet currency is 800 thousand.

We purchased a warehouse for a mortgage for 5000 thousand.

A fixed asset of 5000 thousand was added to the asset, a long-term loan was added to the liability - 5000 thousand. Thus, the balance sheet currency: 5800 thousand:

Asset 5800 = Liability 5800

Let's move on to financial analysis.

Step 1. Main balance equation.

Take the balance sheet of the company you are interested in as of the nearest reporting date and write down:

1) the total for the “ASSET” section is the value of all the company’s property;

2) the total for the “Equity” section from the “LIABILITIES” section is the cost of the company’s equity.

Liabilities can be calculated as the sum of the two remaining sections of “LIABILITIES”: Long-term liabilities + Short-term liabilities, or subtract the amount of equity from the balance sheet currency.

The drawn up equation shows with what funds, own or borrowed, the existing property was financed.

Let's analyze the absolute indicator. How much property does the company have? What amount was financed from your own funds? How much is financed by lenders?

Let's analyze relative indicators. If the balance sheet currency is taken as 100%, then what percentage of equity? borrowed?

Step 2. Structure of property and liabilities.

We go from general to specific and detail each indicator of our equation in accordance with the balance sheet data.

If you have questions during the process of analyzing the structure of balance sheet indicators, make notes in order to subsequently request clarifications and explanations from the counterparty.

We will divide the property into non-current assets and current assets

– these are the results for the corresponding sections of the balance sheet asset. The main criterion for dividing assets into current and non-current is their service life: non-current - more than a year, current - less.

We divide equity capital into authorized capital and accumulated profit (loss).

For the reporting of small enterprises, such detail is not provided, but the amount of authorized capital can be viewed in the counterparty card on the “FOR HONEST BUSINESS” portal.

Liabilities are divided into long-term and short-term

– these are the results for the liability sections.

Step 3. Check whether the main rule of financing is met

The essence of this rule is that

must be financed through long-term liabilities

Long-term assets include non-current assets, and long-term liabilities include all equity and long-term liabilities.

Compare these amounts. The total amount of long-term liabilities should be sufficient to cover non-current assets. If this is not the case, it means that the company is financing long-term assets at the expense of current debts (to suppliers, employees, the budget) and there is a possibility that the company will not be able to pay off its current debts on time.

If the main rule of financing is met, then it makes sense

assess the company's liquidity.

We compare current assets and short-term liabilities: what we will manage during the year and what we owe during the year. The difference between them is called net working capital. The higher this indicator, the higher the solvency.

Calculate the current ratio:

The recommended value is 2 and higher.

Step 4. Analyze the dynamics of indicators

After the main conclusions about the current state of affairs of the counterparty have been made, analyze the dynamics of significant indicators over several years

.

On the portal, data by year is presented in a single table, and this will be very convenient. Is there an upward or downward trend?

Have there been significant changes? This will help you

make a forecast

in order to understand what to expect from your counterparty in the near future.

We analyzed the balance sheet in three areas: structure, liquidity and dynamics of indicators. There are many more additional ratios and methods used by financial analysts, but the purpose of this article is to provide a method for quick express balance sheet analysis that can be applied by any portal user, regardless of special education.

Let checking contractors on the

FOR HONEST BUSINESS be easy and comfortable!

Especially for HONEST BUSINESS

Accountant recruitment expert

Editorial opinion may not reflect the views of the author.

Where is the balance sheet currency shown on the balance sheet?

In the balance sheet, the balance sheet currency is reflected in two places

1.On line 1600 “Balance” in the active part

Balance sheet currency in the asset balance sheet

2. On line 1700 “Balance” in the passive part of the balance sheet

Balance sheet currency in the liabilities side of the balance sheet

Thus, from the above example, you can see that the balance sheet currency at the end of the reporting period = 171,517 thousand rubles.

Results

The balance sheet currency is understood as the total total of the assets section and the total total of the liabilities section. The indicator is quite widely used in financial analysis. In addition, the size of the balance sheet currency is one of the criteria that determines whether an enterprise must conduct an audit.

Sources:

- Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n

- Federal Law of December 30, 2008 No. 307-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What does an increase in balance sheet currency mean?

An increase in the balance sheet currency can be either a positive or a negative factor. Let's take a closer look:

Changing the balance sheet currency using own and borrowed funds

As you can see in the balance sheet: line 1700 may increase due to changes in equity or borrowed funds.

- An increase in the balance sheet currency at the expense of own funds is a positive factor for the enterprise, because the enterprise will become more independent and independent.

- An increase in the balance sheet currency due to borrowed funds is a negative factor, because the enterprise will experience an increase in dependence on external creditors, as well as a decrease in the level of financial stability.

Cheat sheet on financial statements for 2021

Checking the accounting close for 2021

The preparation of accounting data for annual reporting ends with the “closing” of the year. This procedure must be repeated each time before the program fills out the reporting forms with the changed credentials. Checking the correctness of “closing” the year is as easy as shelling pears:

• you need to create a balance sheet (SAS) for 2018 with detail by subaccounts;

• at the end of the year there should be a zero balance on both the debit and credit of all your subaccounts opened to the accounts:

— 91 “Other income and expenses”;

— 99 “Profits and losses.”

There shouldn’t even be a penny balance left! The new accounting year should begin with a clean slate, that is, with zero results.

Let's move directly to the reporting forms. Let's start with their simplified versions.

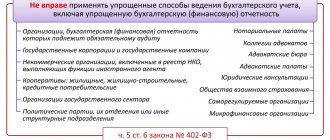

Commercial simplified reporting is limited to the balance sheet and income statement (SIR). They can be compiled by small businesses and non-profit organizations, whose reporting is not subject to mandatory audit under Part 5 of Art. 6 of the Law of December 6, 2011 No. 402-FZ.

Checking the simplified balance sheet indicators

Simplified accounting and reporting are simple because they do not involve any frills in the form of deviations from the standard chart of accounts, as well as specific assets, liabilities and transactions that require separate study. Everything is simple here - as in the joke about the main accounting principle: “Fixed assets are accounted for in the account “Fixed Assets,” etc.” Therefore, to check the simplified balance sheet items, we only need SALT for 2021 with an expanded account balance.

What is the balance sheet currency ratio?

The balance sheet currency ratio shows by how many coefficient points (or percentages) the value of assets or liabilities has changed compared to the previous period.

Formula for calculating the balance sheet currency ratio:

Kvb = (VB1 - VB0) * 100 / VB0

- Kvb - balance sheet currency ratio;

- ВБ1 — balance sheet currency in the reporting period;

- ВБ0 is the balance sheet currency in the base period.

An example of calculating the balance sheet currency ratio (based on the balance sheet presented above):

Kvb = (7598732 - 7640906) * 100 / 7640906 = -0.55

Thus, the balance sheet currency ratio showed that in the reporting period the balance sheet currency decreased by 0.55% relative to the base one.

Plot

Lesson three. Bank balance sheet currency. // Inna Sorokina, especially for Bankir.Ru.

There was such a story in my banking practice. This was a long time ago, in 1993, when the information and software of banks was carried out using the most manual methods. The bank where I worked had a large number of branches, and every morning we needed to collect the balance sheets of the branches in order to form a consolidated (single) balance sheet of the bank. When branches, for some reason, were late in providing such information until 10 am, we were forced to call them and ask: “Tell me your balance sheet currency,” in order to at least roughly estimate what would be in the bank’s unified balance sheet. One day, the young lady at the other end of the line asked me: “What currency do you need: dollars or rubles?”