Conditions for using accelerated depreciation: list of situations

Accelerated depreciation is the transfer of the cost of an asset to the cost of production at an accelerated rate.

Since depreciation deductions are included in income tax expenses, tax legislation strictly regulates the issue of accelerated write-off of equipment depreciation costs.

When depreciating a fixed asset using the accelerated method, it is allowed to use one increasing factor from among the possible ones. The ban on the use of several coefficients was previously contained only in letters from the Ministry of Finance, but from 01/01/2014 it was legislatively enshrined in paragraph 5 of Art. 259.3 Tax Code of the Russian Federation and sub. "b" clause 8 of Art. 2, part 1 art. 6 of the Law “On Amendments to Parts One and Two of the Tax Code” dated September 30, 2013 No. 268-FZ.

The financial department believes that the taxpayer is obliged to indicate in the accounting policy which coefficient, out of all acceptable ones, will be used to calculate depreciation at an accelerated pace (letter of the Ministry of Finance of Russia dated September 14, 2012 No. 03-03-06/1/481).

How to determine the residual value of the leased asset when calculating property tax? The answer to this question is in ConsultantPlus. Learn the material by getting trial access to the system for free.

Find out what methods are used to calculate depreciation in tax accounting here.

Methods

Accelerated depreciation methods include the following:

- reducing balance;

- write-off of value based on the number of years of useful life;

- use of increasing coefficients.

The last method is the most common.

When applying the first method, the value of the property is measured, provided that the corresponding objects may be characterized by uneven returns throughout the entire period of application. It is relevant for products that quickly become obsolete.

The second method allows you to write off most of the cost of the operating system in the first years of operation of the object completely.

In what situations is it permissible to use accelerated depreciation?

List of situations that allow the use of accelerated depreciation rates:

- Conditions of aggressive environment. The use of a multiplying factor is reserved for fixed assets operated in highly aggressive environments. The coefficient increasing the depreciation rate is no more than 2.

- Conducting agricultural industrial activities provides for accelerated depreciation of all fixed assets (subclause 2, clause 1, article 259.3 of the Tax Code of the Russian Federation). The increasing coefficient for increasing the depreciation rate is no more than 2.

- The operation of an enterprise in an industrial-production or tourist-recreational zone gives the right to apply a coefficient within 2 for all fixed assets used in its activities (subclause 3, clause 1, article 259.3 of the Tax Code of the Russian Federation).

- Condition for OS energy efficiency. When legally determining the energy efficiency class of a fixed asset, the coefficient for objects with high efficiency is no more than 2.

NOTE! From 01/01/2018, increasing factor 2 is not applied to buildings with high energy efficiency (Subclause 2, Clause 1, Article 1 of the Law “On Amendments...” dated 09/30/2017 No. 286-FZ).

- If the fixed asset – the subject of the leasing agreement – is on the balance sheet of the lessor (lessee), a coefficient of 3 is applied.

See also “Depreciation of leased property from the lessee.”

- Use for offshore hydrocarbon production. Organizations that have a license for this activity and operators of offshore oil production have the right to accelerated depreciation of no more than 3 times. This benefit applies to equipment used to develop a new deposit (Clause 8, Article 2, Part 1, Article 6 of Law No. 268-FZ).

- From 01/01/2018, accelerated depreciation of 3 times is applied to water supply and sanitation assets according to the list approved by the Government of the Russian Federation.

An example of a calculation from ConsultantPlus: The organization acquired a fixed asset. The initial cost of the object is 1,260,000 rubles. Depreciation group - fourth, useful life - 84 months. Depreciation is calculated using the straight-line method. The monthly depreciation amount is RUB 15,000. (RUB 1,260,000 / 84 months). Taking into account the multiplying factor, monthly depreciation is equal to... View the calculation example in full.

For methods of calculating depreciation in accounting, see here.

The Tax Code does not prohibit the use of several coefficients for different groups of fixed assets. The criteria for applying the coefficients must be specified in the accounting policy of the enterprise.

Subsequently, additional amendments will be made to allow all enterprises to use a coefficient of no higher than 2 for fixed assets, including technological equipment, the list of which will be approved by the Government of the Russian Federation by 2021.

How modernization affects the use of accelerated depreciation, read the article “Modernization of an operating system does not cancel its accelerated depreciation .

Calculation formula

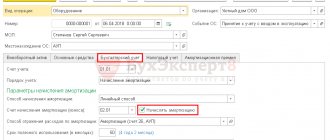

In accounting, this method is also called the reducing balance method, where the application is based on the residual value of the asset, the acceleration factor and the useful life itself.

The accelerated depreciation formula looks like this:

A = St / SPI * K,

where A is the amount of depreciation charges, t. rub.;

St – residual value of the asset at the beginning of the year, t. rub.;

SPI – time of use of the asset, years;

K – acceleration coefficient. The maximum value is 3. For small enterprises - no higher than 2.

Application of increasing coefficients for operating systems operating in an aggressive environment

The use of an increased depreciation rate is permissible when operating the OS in an aggressive environment, with increased shifts. The increase is no more than 2. The date of registration of the OS must be no later than 01/01/2014. The use of such a norm is prohibited for fixed assets of the 1st, 2nd and 3rd depreciation groups when using the non-linear method.

An aggressive environment is understood as natural or man-made environmental factors that accelerate the deterioration of fixed assets (paragraph 3, subparagraph 1, paragraph 1, article 259.3 of the Tax Code of the Russian Federation):

- climatic conditions of the Far North;

- contact of OS with explosive or toxic materials, etc.

According to officials, increasing coefficients can be used if the following requirements are met:

- the accompanying documentation does not indicate that they are intended to work in an aggressive environment;

- If there is such a mention, then you can use the benefit if the operating conditions do not correspond to those specified in the documents attached to the asset.

The Ministry of Finance believes that if the documents indicate the possibility of working in an aggressive environment, then the use of accelerated depreciation is not justified.

Judges, on the contrary, point out that the very fact of the presence of an aggressive environment is sufficient to apply increasing coefficients (Resolution of the Federal Antimonopoly Service of the Volga District dated February 13, 2014 No. A65-9516/2013).

The application of coefficients applies only to objects exposed to an aggressive environment. The remaining fixed assets of the enterprise, if they are under normal operating conditions, cannot be depreciated faster (letter of the Ministry of Finance of Russia dated October 14, 2009 No. 03-03-05/182, Federal Tax Service of Russia dated November 17, 2009 No. ShS-17-3 / [email protected] ).

Essence and concept

Accelerated depreciation is based on the principles of straight-line A. This means that all write-offs are equal, but their value is higher than in the case of straight-line depreciation. Fixed assets are calculated in a shorter period of time.

The essence of accelerated depreciation is as follows: entrepreneurs can shorten period A by applying increased rates. Of course, this is only possible after certain requirements are met, such as the use of fixed assets in conditions that indicate rapid consumption or in which rapid technological progress is observed.

It is preferable to use increased depreciation rates for buildings, vehicles and equipment subject to increased wear and tear. The legislation contains detailed instructions regarding the possibility of applying higher standards A.

Accelerated depreciation increases the amount of write-offs from fixed assets, while reducing the term A and the amount of taxes.

Accelerated depreciation of leased objects

Organizations that have a leasing object on their balance sheet can charge depreciation at an accelerated rate with a coefficient of no more than 3. The exception is objects of the 1st, 2nd and 3rd depreciation groups.

When the object of leasing is the entire enterprise as a single property complex, accelerated depreciation is accrued for all fixed assets, except those belonging to the 1st, 2nd and 3rd depreciation groups (letter of the Ministry of Finance of Russia dated September 24, 2007 No. 03-03-06/1/692).

Officials of the Russian Ministry of Finance indicate that the lessor has the right to continue accrual at an accelerated pace even if there is a change in the lessee (letter dated July 14, 2009 No. 03-03-06/1/463).

A new lessee can apply increasing values within 3 when receiving a leased object that was previously leased from another user. The new owner can independently set the size of the increase, without relying on past data (letter of the Ministry of Finance of Russia dated 09.09.2013 No. 03-03-06/1/37022).

If the leasing object is used under an agreement concluded earlier on January 1, 2002, then accelerated depreciation is charged on it according to the following rules (clause 3 of Article 259.3 of the Tax Code of the Russian Federation):

- accruals correspond to the method used at the time of transfer of property;

- accrual occurs using a coefficient of no more than 3;

- property depreciated in a non-linear manner should be separated into a separate subgroup.

When increasing factors cannot be applied, see the article “Leased fixed assets cannot be depreciated at an accelerated rate .

If you doubt whether you have correctly calculated depreciation using the accelerated method for leased property, use advice from ConsultantPlus experts. Get free trial access to the system and proceed to the calculation example.

Example

The transport company purchased an SUV that will transport expedition participants along with all the necessary equipment. Due to the purpose of this vehicle and the difficult operating conditions in which it will be used, it was decided to increase the depreciation rate using the maximum coefficient: 1.4. The initial cost of the car was 700 thousand rubles.

Calculation of monthly depreciation: 700 thousand rubles. X 20% x 1.4: 12 months = 16.33 thousand rubles.

In the case of traditional depreciation, the monthly write-off will be: 700 thousand rubles. X 20%: 12 months = 11.66 thousand rubles.

Depreciation of fixed assets involved in scientific and technical activities

Accelerated depreciation is provided for all enterprises in terms of the use of fixed assets for scientific and technical activities. The size of the coefficient should not exceed 3 (subclause 2, clause 2, article 259.3 of the Tax Code of the Russian Federation).

Scientific and technical activities are understood as activities aimed at obtaining new knowledge in any branch of science while ensuring the unity of science, technology and production. (Article 2 of the Law “On Science and State Scientific and Technical Policy” dated August 23, 1996 No. 127-FZ).

The Ministry of Finance notes that this category also includes research and development activities (letter dated August 28, 2009 No. 03-03-06/1/554).

Results

By writing off depreciation using the accelerated method, the taxpayer reduces the tax base for income tax. And since, according to Art. 252 of the Tax Code of the Russian Federation, all expenses must be economically justified and documented; the taxpayer should be very careful about the issue of writing off depreciation at an accelerated pace.

Sources:

- Tax Code of the Russian Federation

- PBU 6/01, approved. by order of the Ministry of Finance of Russia dated March 30, 2001 N 26n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.