4.2 / 5 ( 4 voices)

Getting good business results is the goal of any business venture. To implement it, they attract the best specialists, create comfortable working conditions, and take measures to promptly restore health in case of temporary disability. These issues are fully resolved by concluding voluntary health insurance (VHI) contracts. What is VHI for employees and what benefits it provides is described in this article.

What is VHI

VHI provides insurance coverage for medical care that is not included in the basic and territorial compulsory health insurance (CHI) programs, and also provides compensation for accidents. Features of voluntary health insurance:

- The policyholders are represented by individuals and legal entities:

-private, when concluding a voluntary health insurance agreement to restore personal health or treat family members;

-legal, when applying for a corporate voluntary health insurance policy to restore the health of employees of an enterprise (organization).

- Insured persons in voluntary health insurance contracts can be employees of enterprises (including managers, founders), relatives, and the policyholder himself.

- The list of medical care, as well as the amount of insurance coverage, depends on the conditions stipulated in the insurance contract: the amount of insurance premiums, the procedure for paying them, the list of services, the number of insured persons, etc.

Medical care and other services (for example, rehabilitation) are provided to insured persons by medical institutions with which the insurance company has concluded VHI agreements.

Pros and cons of VHI

VHI opens up new opportunities for employees and employers. Firms thus show their concern for staff, increase their attractiveness and competitiveness, and create improved working conditions. This is an opportunity to attract highly qualified personnel. It is also beneficial for organizations to issue voluntary health insurance for employees from a financial point of view. By reducing profits, taxes are reduced.

Article on the topic: VHI after the probationary period - what is it

What does VHI give to employees? They receive the following benefits:

- the opportunity to be treated in private centers and receive quality care;

- buy medicines at a discount;

- undergo examination using modern precision equipment;

- take expensive tests for free;

- do not stand in queues;

- be treated at home;

- undergo rehabilitation in sanatoriums or specialized resort hospitals;

- to be treated in a hospital, being in a separate room with all the amenities;

- receive professional dental care;

- undergo medical examinations quickly.

Thanks to high-quality and correct treatment, the worker recovers faster and gets back to work, increasing the company’s profits.

Another advantage of insurance is VHI for relatives. The policy may extend to children and spouses. But such privileges for relatives require large expenses from the employer, so they are rarely included in the program. This option is mainly used for additional stimulation of valuable personnel.

The disadvantage of employee insurance is the fact that a person cannot choose an institution with which the insurance company does not cooperate.

What are the benefits of VHI for an organization?

Insurers offer corporate voluntary health insurance with packages of medical care and services that take into account the individual characteristics of enterprises. Small businesses can enter into collective insurance agreements even if they have two employees. The main benefits of introducing insurance include the following:

- creating comfortable conditions for the company’s employees and taking care of their health, which ultimately increases the motivational component of work, arouses respect for the company’s management and loyalty to management methods;

- enhances the image, increases the possibility of competition when recruiting employees with a high level of professional training among enterprises with a similar type of activity;

- reduction of the portion of profit subject to taxes.

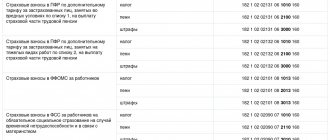

The obviousness of the first two statements is beyond doubt. In terms of gentle taxation, it should be taken into account that to enable mechanisms for reducing the fiscal burden, the following is necessary:

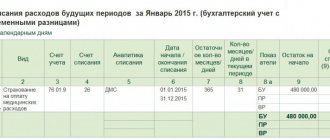

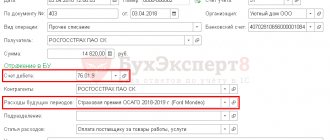

- a voluntary health insurance contract for company employees is concluded for a period of at least one year;

- inclusion in non-taxable expenses cannot exceed 6% of the total expenditure amount for wages, with the exception of freelance employees;

- accounting of payments for the provision of benefits is carried out depending on the payment of insurance premiums to insurers or employees aimed at medical care under a VHI agreement.

Businesses are not limited to choosing their preferred insurance company and the software products they offer.

What is the difference between VHI and compulsory medical insurance?

What does a VHI policy provide and how does it differ from standard compulsory medical insurance? Let's try to understand this issue by finding the maximum number of discrepancies between the poles.

The first and main difference is the initiative to sign the agreement. Compulsory medical insurance is a pole that is mandatory for acquisition by all citizens of the Russian Federation, as well as foreigners. Voluntary health insurance is purchased voluntarily; the initiator of receiving services of this kind is the policyholder himself.

An important difference is the financial side of the issue. Funds for the use of compulsory medical insurance are allocated by the state by collecting a fixed amount from the wages of all taxpayers. To finance voluntary health insurance, a person allocates personal funds.

These types of poles include a different range of services provided. The list of services provided by the compulsory medical insurance coupon is standard and the same for all categories of citizens. VHI services have many options. Depending on the client’s wishes, the insurance company offers several options for VHI policies.

To sign an insurance contract of the VHI type, the client must independently contact the company providing the relevant services. Insurance under the compulsory medical insurance coupon is provided to all persons, without exception, legally residing in our country. To obtain compulsory medical insurance, contacting an insurance company is not required, since registration of the policy is automatic.

Voluntary health insurance differs from compulsory medical insurance in the quality of services provided. Within the framework of compulsory medical insurance, medical care is provided on the basis of state medical institutions. VHI owners can count on receiving assistance in private centers, where the level of qualified medical care is much higher.

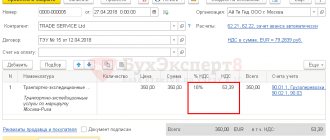

What is VHI for employees?

Voluntary health insurance for company employees makes it possible to receive guaranteed medical care in the amount of services and circumstances specified in the insurance contract between the management of the enterprise and the insurer. In 2021, employees will be given the opportunity to use commercial emergency medical care, conduct medical examinations using equipment and specialists from paid clinics. The list of medical insurance programs may include the following services not covered by compulsory medical insurance:

- Outpatient medical care, including special studies.

- Treatment with a doctor visiting the patient’s place of residence.

- Dental care using foreign-made materials, cosmetic interventions, if violations were received within the framework of insurance coverage.

- Services in specialized medical centers, as well as rehabilitation measures of a resort and sanatorium nature.

- Organization of immunoprophylactic measures.

- Collection and proper execution of medical documentation accompanying the patient.

Some companies, addressing issues of increasing motivation to work there, enter into voluntary health insurance agreements for relatives of employees (wife, children). Insured persons receive medical care regardless of their scheduled appointment with the attending doctor. At the same time, insurers fully provide practical assistance in the event of misunderstandings between the patient and the medical institution.

How to apply

VHI contracts are drawn up in insurance companies that have received a license for this type of activity, by directly contacting their office or using the electronic services of insurers. In the latter option, the client leaves a standardized request (telephone number, email address, personal data). After a short period of time, the insurer’s manager contacts him to clarify the special terms of the contract.

Concluding an insurance contract consists of several stages:

- Selecting an insurance program with conditions acceptable to an enterprise or individual. The programs are presented in several options:

- a set of basic conditions where advisory services, diagnostics, and general therapy are provided;

- expanded provision of insurance coverage with the provision of additional opportunities, for example, visiting a doctor outside of the scheduled queue, and others;

- a complete policy that provides the opportunity to receive any medical care in clinics in the Russian Federation, and under certain conditions – abroad. At the same time, insurance coverage covers expenses for sanatorium, resort services and others;

- combining individual conditions of various programs provides the policyholder with the opportunity to choose services in accordance with personal preferences.

- Studying the draft agreement, clarifying the provisions and signing. To avoid misunderstandings, you should carefully read the contract to eliminate the possibility of hidden conditions. If you identify the latter, or need to make additions to it, inform the insurer's representative. In many cases, they make the required changes.

- Payment of insurance premiums. Payment can be made in any way provided by law. Receiving fiscal confirmation of payment is mandatory.

When receiving the contract, you should pay attention to the start date of its validity and the period from which the insurance coverage begins to apply. In health insurance, it may be slightly later than the date of receipt of the policy.

Where to apply

There are a significant number of insurance companies operating in the insurance field of the Russian Federation that have the right to implement and support voluntary health insurance programs for employees of enterprises. Offers differ not only in the level of services provided, but also in pricing policy.

Contacting an insurance broker will help you understand the price-offer balance. He has information about all offers from insurers in the region, company ratings, customer reviews, and will also provide intermediary services when concluding an insurance contract. But if you decide to choose an insurer yourself, you should pay attention to the following tips:

- Large insurance companies have greater resources to provide medical care to clients. Their representative offices are represented in many regions of the country.

- there should be no doubt about the volume of the sum insured (the price of the full scope of services under the contract). Its significant reduction will not cover the costs in full, and the client will have to pay the difference in treatment from his own funds.

- the list of insured events included in the list must cover the main risks. Non-insured events should be kept to a minimum extent.

- the number of medical institutions with which the insurer has cooperation agreements should be maximum and multi-directional.

Before concluding a contract, it is advisable to read the reviews of people who have used the programs provided by the insurer. Visit medical facilities to ensure that care is being provided properly.

Cost of voluntary health insurance (TOP – 5 offers from insurers)

The criteria for evaluating insurance companies providing voluntary health insurance services are work experience, financial capabilities and their insurance offers. The survey showed that the following insurers and voluntary health insurance programs for employees enjoy the greatest respect from customers and are leaders in this area of insurance:

- "Alpha Insurance" Considerable experience, branches are located in almost all regions of Russia. They presented the following programs: “Formula of Health”, “Everything is Alright” and others.

- Tinkoff Insurance. It has an extensive network of sales and customer service offices. The scope of services provided includes the ability to purchase a policy online and order its preparation by phone. Employees of the 24-hour call center will provide any information related to insurance, including medical insurance.

- "Rosgosstrakh". The oldest company in the insurance market, the successor of the traditions of the USSR State Insurance. Has been involved in health insurance for at least ninety years. Offers a wide range of insurance products. Cooperation agreements have been concluded with more than 8 thousand medical institutions.

- "Ingosstrakh" It has been known in the insurance market since the end of the last century. Staff: thousands of employees, offices in all regions of Russia. In addition to standard voluntary health insurance, it offers insurance for health restoration after an accident. Provides legal support to clients.

- "Family doctor". A Moscow company providing voluntary health insurance services under contracts with leading clinics that have only modern equipment and highly qualified medical staff.

VHI subjects

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

What else to read:

- Accident and illness insurance

- Compulsory medical insurance: what it is, what services it includes, how to get it

- Plastic compulsory medical insurance policy: what is it and what does it come with?

+7 (495) 980-97-90(ext.589) Moscow,

Moscow region

+8 (812) 449-45-96(ext.928) St. Petersburg,

Leningrad region

+8 (800) 700-99-56 (ext. 590) Regions

(free call for all regions of Russia)

Insurance relations within the framework after signing the contract are regulated by the relevant regulations. Relationships of this type include several subjects:

- A client (policyholder) signing an agreement regarding the purchase of insurance services. The client is any individual (with full legal capacity) or legal entity. In some cases, a charitable foundation may act as the policyholder.

- The person for whom the insurance policy is issued. This is the party to the contract receiving insurance services. The policyholder and the insured person are often the same person, but it is possible to issue a policy for other entities.

- A company providing insurance services. A company engaged in the provision of insurance services on the basis of a license issued by the state.

- Medical institution. This could be a hospital, clinic or any other institution that is subordinate to the Ministry of Health. To provide insurance services legally, an appropriate agreement must be signed between the medical institution and the insurance company.