The book of income and expenses is a document that will help confirm the receipt and expenditure of money during the year if the Federal Tax Service has questions for you during the audit.

Typically, KUDiR is needed by the tax office during desk audits, when the inspector requests information from banks about the movement of money in your current account. If it does not correspond to the declaration, the tax office will send you a request to provide an explanation.

All entrepreneurs and organizations on the simplified tax system, as well as entrepreneurs on OSNO, PSN and Unified Agricultural Tax are required to maintain KUDiR. You need to hand over the book only after the tax office has requested it. Those who do not do this within 10 days will have to pay a fine.

In this article we will tell you in detail what to do with KUDiR using a simplified taxation system and where to find the book in Elbe.

How to maintain and print finished KUDiR

KUDiR can be maintained on paper and electronically, but the main thing is to enter data in chronological order. If you plan to record all business transactions by hand, print out the finished form at the beginning of the tax period. And if you want to keep records electronically, be sure to print out the completed book at the end of the reporting period. Otherwise it will not be considered valid.

Regardless of the maintenance format, the completed and verified KUDiR must be stitched, numbered, certified with the signature of the manager and seal, if any. Also, don’t forget to indicate the total number of pages on the last sheet. To do everything correctly, look at the photo instructions.

The procedure for working with KUDiR is established by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n, but it and other documents do not say how to correctly print a book and number its pages. Therefore, entrepreneurs usually turn to the generally accepted procedure: they use one-sided printing and start numbering from the title page, leaving it without a number.

It is important to print out the book with all sections, even those that do not need to be filled out on your tax system. All pages will also have to be numbered, even blank ones.

If you decide to take a vacation and have not made any financial transactions during the year, you still need to print out the KUDiR. Just fill out the title page and replace the numbers in the columns with zeros. The zero KUDiR must also be numbered, stitched and certified.

In order not to lose a single document and not look for errors before submitting reports, it is better to make entries in KUDiR regularly. It is more comfortable. But no one forbids you to enter all transactions retroactively at the end of the reporting period.

Blank book for accounting income and expenses

Submit reports in 3 clicks

Elba will calculate taxes and prepare business reports based on the simplified tax system and patent. It will also help you create invoices, acts and invoices.

Try 30 days free Gift for new entrepreneurs The promotion is valid for individual entrepreneurs under 3 months old

Accounting registers: essence, meaning and types

To account for and register business transactions, enterprises use accounting registers that vary in form, content, method of display and accumulation of information. The composition of the accounting registers maintained at a particular enterprise depends on the form of accounting adopted by the enterprise.

The word “register” in accounting refers to various types of tables in which data from primary documents is recorded.

Entries in accounting registers are based on information from carefully verified primary documents, which is why the registers themselves acquire evidentiary force when using their indicators to analyze the economic activities of an enterprise, when monitoring the state of funds and when identifying business results.

Accounting registers are data carriers of a certain form, built in accordance with the economic grouping of information about the assets, capital and liabilities of an economic entity.

They serve to display business transactions on accounting accounts.

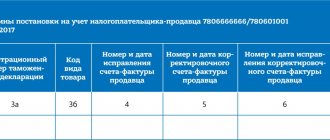

The classification of accounting registers is shown in the figure:

Chronological accounting registers are registers in which entries are made in chronological order, that is, in the order of operations (registration journals, cash book, etc.). Chronological books are usually called journals or diaries.

In systematic accounting registers, operations that are homogeneous in economic content are displayed in a certain sequence with a certain grouping (filling out data in the cash book within a day). Books of systematic recording are usually called Master books.

Combined registers are those in which entries are made simultaneously in chronological and systematic order (order journals, statements). Summary books are usually called balance sheets or turnover sheets.

Synthetic accounting registers are registers in which accounting is kept using synthetic accounts.

Analytical accounting registers are registers in which accounting is kept according to analytical accounts. Data is submitted to analytical accounting registers in natural, labor and monetary measurements. Analytical recording is a separate, detailed recording of changes that occur in any particular part of the balance sheet. During analytical registration, collective accounts of synthetic registration are subsequently divided into their component detailed or special accounts of the following orders.

Accounting books are sheets of paper specially lined up, which display data on the availability of economic assets, sources of their formation and economic processes according to synthetic and analytical accounts. For example, a cash book is designed to record the receipt and payment of cash from the cash register; the book of deposited amounts is intended for analytical accounting of unpaid (deposited) wages; the General Ledger provides information on balances and turnover on synthetic accounting accounts for the reporting period (monthly). Accounting books must certainly be laced, numbered, on the last page of the book the total number of pages must be indicated and certified with the signatures of the manager and chief accountant and the seal of the enterprise.

Cards are tables of a special shape and standard sizes, made on thick paper and intended for registering household assets (inventory cards for recording fixed assets, cards for storing materials, etc.). Store cards in file cabinets. When a card is opened in the accounting department, it is registered in a special journal, they are assigned a serial number that corresponds to their registration number in the journal. Registered cards are handed over to the financially responsible person against receipt. Cards are widely used for analytical accounting of an enterprise's inventory.

Summary sheets (statements) are separate tables of various formats with special graphics (magazines-orders, memorial orders, turnover sheets, etc.). They are used to maintain both synthetic and analytical accounting. Entries in separate statements are made on the basis of data from primary documents.

At the end of the reporting period (month, year) and the balance sheet has been compiled, books, cards and individual information are closed by calculating the totals for each account and recording the balance amount.

In one-way accounting registers they provide data on a business transaction, the amount of which is recorded as a debit or credit to the corresponding account. An example of a one-way accounting register is a cash book.

Bilateral accounting registers consist of two parts: in one part they provide data on debit turnover on the account, and in the second - on credit turnover on this account (materials warehouse card).

Multigraph accounting registers are registers in which one of the columns (most often debit) is divided into several. The General Ledger belongs to this type of accounting registers.

Chess registers are built on the principle of a chessboard. Entries in such registers are made in a cell located at the intersection of the column and row of the table, which correspond to the debit and credit turnover on the corresponding accounts.

Source: https://www.ekonom-buh.ru

What sections does KUDiR consist of?

KUDiR consists of a title page and five sections:

- Section I - for accounting of income and expenses.

- Section II - for calculating expenses for fixed assets and intangible assets.

- Section III is for calculating losses for past periods that reduce the tax base.

- Section IV - for accounting for expenses that reduce tax.

- Section V - for calculating the amount of the trade fee that reduces the tax.

Which sections you have to fill out depend on the object of taxation: “Income” or “Income minus expenses”. Let's take a closer look at the differences.

How to fill out KUDiR on the simplified tax system “Income”

On a simplified system with the “Income” object, you need to fill out sections I, IV and V.

Section I. Income and expenses

In this part, enter all business transactions in order, indicating the date and number of the primary document: payment order, sales receipt, act, invoice and others. Also write down the content of the transactions, and in column 4 indicate the amount of income.

Column 5 is usually not filled in. But if you received a subsidy to support small and medium-sized businesses, indicate the expenses that you paid with this money. You also need to display the subsidy in your income, but not at the same moment as you receive it. We spent part of the subsidy and added this amount immediately to income and expenses. We spent another portion and made entries again. And do this until you spend the subsidy completely.

Example of filling out Section I (display of subsidies)

Record income received only when money from the buyer is received at the cash register or in the bank account. Prepayment is also considered income, so it should also be entered in column 4. Even the prepayment returned to the buyer must be indicated in this column, only with a minus sign. There is no need to take the return into account as expenses and enter it in column 5, because it reduces taxable income.

Example of filling out Section I (return of prepayment)

Section IV. Tax-reducing expenses

In this section you need to enter those amounts by which your tax will later be reduced: insurance premiums for employees, contributions under voluntary personal insurance contracts and hospital benefits for the first three days of disability paid by the organization. Individual entrepreneurs must also indicate insurance premiums for themselves.

Record expenses as they are paid, and at the end of each quarter, add up the total in column 10 to compare the deduction with the limit and calculate the tax.

Example of filling out section IV. Tax-reducing expenses

Section V. Trade Fee Reducing Tax

In this section, add the trading fee amounts for each quarter. All taxpayers using the simplified tax system “Income” must fill it out, and not just those who are required to pay a trade tax.

If there is no trade tax in your region, indicate the reporting year, and put dashes in the indicators so that the tax inspector does not decide that you forgot to fill out the section.

If there is a trade fee in your region, indicate the serial number of the transaction, the date and number of the primary document, the period for which the payment was made, and the amount.

Example of filling out Section V. Amount of trading fee

How to fill out the KUDiR on the simplified tax system “Income minus expenses”

On a simplified system with the “Income minus expenses” object, you need to fill out sections I–III, as well as a certificate for section I based on the total amount of income and expenses.

Section I. Income and expenses

In this section, as in the simplified tax system “Income,” you need to enter all business transactions in chronological order, indicating the date and number of the primary document.

In column 4 show income, and in column 5 - expenses. Do not forget that you only need to enter those transactions that are taken into account when calculating the tax.

When accounting, it is important to understand at what point cash expenses become expenses. For example, if you purchased goods for resale, expenses can be entered into KUDiR only on the day when all three conditions are met:

- you received the goods from the supplier;

- you paid for this product;

- you have shipped the goods to the buyer.

And employee salary expenses can be taken into account after the employee receives the money in person or on a card.

More details about the procedure for determining income and expenses are written in Article 346.17 of the Tax Code.

Section II. Expenses on fixed assets and intangible assets

In this part, enter data on fixed assets that have already been put into operation. Distribute costs evenly across the quarters remaining until the end of the calendar year.

For example, if you bought office equipment for 200 thousand rubles in February, then distribute this amount by 50 thousand for each quarter. And if the purchase was made in August, that is, in the third quarter, you need to write off 100 thousand in the third and fourth quarters.

Enter the calculated amount for the current quarter from column 12 in column 5 of section I, indicating the last date of the quarter.

Columns 7, 8, 14 and 15 are filled in only if the fixed asset was purchased before the transition to the simplified system.

Example of filling out section II. Expenses on fixed assets and intangible assets

Section III. Losses from previous periods that reduce the tax base

If at the end of the year you earned less than you spent, you can transfer this loss to the following years. That is, reduce the tax base on it or part of it.

To do this you need to do the following:

- In line 010, reflect the amount of losses for previous periods that has not yet been taken into account, and in lines 020–110, write down the amounts by year.

- To line 120, transfer the tax base from line 040 of the certificate to section I.

- In line 130, indicate the loss that reduces the tax base of the current period.

- In line 140, enter the loss of the current period from line 041 of the certificate to section I.

- In line 150, enter the amount of the remaining loss, which can be written off in subsequent periods.

- On lines 160–250, break down the uncarried losses by year.

Example of filling out section III. The amount of losses for previous periods that reduces the tax base

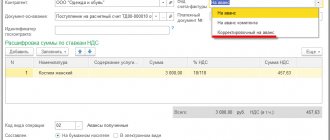

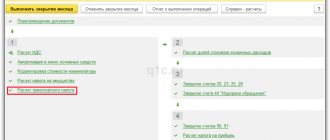

Quickly filling out the tabular part of a document

To quickly fill out new documents, a base-based input mechanism is used. When entering based on all possible details of the new document will be automatically filled in from the already entered document.

The tabular part of the document can be quickly filled in by selecting values from the directory. When registering a sale, the accountant can see the quantity and price of the selected inventory items (inventory).