Writing off fuel and lubricants as expenses is impossible without their documentary confirmation. The main document that performs this function is the waybill, but it is not the only way to record the costs incurred in accounting. Organizations that are not transport organizations can use other documents that meet the requirements of Federal Law 402 “On Accounting”. about in what cases it is possible to record fuel and lubricants WITHOUT waybills and how to do it correctly.

What are the required details of travel documents ?

In what cases is a waybill not needed?

Gasoline and other fuels and lubricants can be used not only for transport needs. For example, an organization uses a lawnmower to maintain its grounds. The unit is fueled with gasoline. Obviously, using a waybill to confirm its consumption is meaningless here. In such cases, use the technical documentation for the unit, which indicates the consumption rates of gasoline per hour of operation and oils (usually indicated per liter of fuel consumption).

Another option is to experimentally determine in the presence of a commission how much fuel and lubricants are actually burned per unit of time. These indicators and calculations are entered into the local NA, for example “Lawn mower performance indicators”. If the same territory is being cultivated, then its area is known and the amount of time required for mowing and gasoline consumption can be determined.

After the work is completed, on the basis of a work order or other supporting document, an act for writing off fuel and lubricants is drawn up. It indicates the area of the mowed area, the operating time of the unit, the name and quantity of gasoline consumed, its price and the cost charged to expenses. The act includes information that the established standards for fuel consumption are not exceeded, the expenses are justified and the gasoline is subject to write-off. The document is signed by the members of the commission and certified by the director.

Organizations that are not involved in transportation, but have official or industrial transport, can do accounting work without waybills (Ministry of Finance, document No. 03-03-06/1/354 dated 16/06/11):

- When using the GLONASS system or other similar control systems. The software allows you to make printouts - reports reflecting all indicators of the movement of the machine.

- If the route does not change, for example, the car is intended for daily transportation of workers. The number of trips, mileage, and gasoline consumption will be constant, therefore, write-offs can be applied according to approved fuel consumption standards. An organization can develop a document form that controls travel and gasoline consumption within a month on its own.

The write-off of fuel and lubricants is carried out on the basis of these documents by a write-off act.

By the way! Carriers can use tachographs, GLONASS, GPS systems as an auxiliary tool for monitoring fuel consumption.

Director's personal car

Other methods may also be used to write off gasoline for the director’s personal car. He is not relieved of the obligation to issue DPs, as well as to properly arrange business trips and other business trips. But in practice this requirement is not always met.

If any problems arise, the director can always explain the trips as personal goals, not work ones. Then, in order to accuse him of violating the law, the investigative authorities will have to prove that the trip was carried out directly as work functions.

The director of the LLC, being at the same time the founder, has the right to use all the methods described above to register the car. This is possible due to the fact that he also acts as an individual - that is, he is a director, an employee, and a representative of a legal entity.

Let's take a closer look at how to write off gasoline for the director's personal car. In this case, we will assume that it is on the balance sheet of the enterprise.

Nuances and problems

The refusal to use waybills to confirm expenses for fuel and lubricants is perceived ambiguously by regulatory authorities and judges. The Ministry of Finance in letter No. 03-03-06/1/354 allows this possibility and stipulates that the documents must be drawn up in accordance with the legislation of the Russian Federation. The Ministry of Finance does not establish the procedure for registering a primary report for fuel consumption. Mandatory document details are contained in Federal Law-402 “On Accounting”. Any document that meets its requirements and approved in the accounting policy (PBU1/2008 clause 4) can be used to confirm expenses. It follows from this that acts for the write-off of fuel and lubricants and documents confirming the operation of non-transport units using gasoline are sufficient grounds for write-off if they are correctly executed and approved by the organization as working.

As for transportation, judges have different opinions. Thus, the FAS ZSO in resolution No. Ф04-2219/11 in case No. А27-10300/2010 dated 05/17/11 concludes that waybills to confirm expenses are necessary in any case, since these documents indicate the actual operation of the car for production purposes.

At the same time, the Federal Antimonopoly Service of the North-West Zone in resolution No. F07-2241/12 in case No. A42-3168/2011 dated 12/04/12 states: a waybill is not the only document confirming that the costs of fuel and lubricants are economically justified. This position is also supported by the resolution of the 9th AAS No. 09AP-12355/12 of 06/09/12. Organizations whose main activity does not relate to transportation can do their work without waybills, both unified and independently developed .

An organization that does not use waybills may face the need to prove its case to regulatory and judicial authorities, especially regarding the issue of including fuel costs in income tax calculations.

How to recognize expenses for fuel and lubricants for tax purposes ?

Car rent

Renting out a personal car in order to later use it for business purposes is a common practice. This method provides the employee with a high level of guarantee of the safety of his car, provides additional remuneration and puts the vehicle on the company’s balance sheet, which significantly simplifies reporting.

But directors also note disadvantages in using a personal car rental. These include the following:

- You will have to pay personal income tax on rent.

- It is necessary to issue an insurance contract again.

- Additionally, you need to sign a lease agreement.

This issue is discussed in detail in Art. 643 Civil Code.

Cost calculation

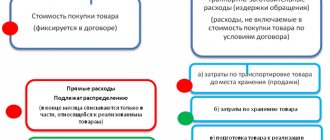

Calculation of the cost of consumed gasoline without waybills, as indicated above, can be done based on the actual consumption (based on the control system data contained in the reports), or according to the consumption standard, if the vehicle’s route is constant, or a unit is used that is filled with fuel and lubricants. Consumption indicators are most often assessed by the average cost of a unit of fuel. It is calculated as the sum of two cost indicators - the fuel balance and monthly income, divided by the sum of the balance and income of the same fuel in liters.

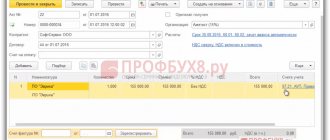

Example: Rassvet LLC, according to accounting data, has a balance of 25 liters of gasoline of a certain brand, at a price of 41 rubles. The current month's receipt amounted to 120 liters at a price of 39 rubles.

The cost of a unit of gasoline is:

- 25 * 41 = 1025.00 rub.

- 120 * 39 = 4680.00 rub.

- 1025 + 4680 = 5705.00 rub.

- 25 + 120 = 145 l.

- 5705 / 145 = 39.34 rubles.

Multiplying the unit cost by the fuel consumption actually determined by the control system, we obtain the costs.

Calculating the fuel consumption for the operation of units is also not difficult; they were discussed in detail above. Let's look at the example of accounting for fuel and lubricants without vouchers according to standards , if we are talking about permanent routes. The calculation standards and formulas adopted by the Ministry of Transport as recommendations (document AM-23-R dated March 14, 2008) can be used in this case.

Let us assume that transportation is carried out by bus, the basic rate of gasoline consumption for which is determined to be 15.2 liters per 100 km. A car driving along the same route increases its mileage by 50 km. Let's apply the formula from clause 2 of clause 8 of the Ministry of Transport norms AM-23-R: Qн = 0.01 * Hs * S * (1 + 0.01 x D) + Hot * T.

In addition to the consumption rate per 100 km (Hs) and mileage (S), the formula takes into account the operation of an independent heater (Hot - the rate of fuel consumption per hour, T is the time of its operation) and the correction factor D, usually in the form of an increase in fuel consumption in winter period. Recommended indicators related to winter time are contained in the appendices to the document of the Ministry of Transport. They are not used in the above calculation. Qn = 0.01 * 15.2 * 50 * (1 + 0.01) = 0.01 * 15.2 * 50 * 1.01= 0.01 * 760 * 1.01= 7.6*1, 01= 7.68 l.

Let's evaluate the fuel used at the average cost and include it in costs: 7.68 * 39.34 = 302.13 rubles. The bus transports workers of the main production, wiring: Dt 20 Kt 10/3 (sub-account “Fuel”) 302.13 rubles.

You can develop your own fuel consumption standards based on the results of control measurements by members of a commission created for this purpose and apply them in calculations.

How to take into account the influence of winter conditions when calculating standard fuel consumption ?

Disadvantages of a unified submarine

When using the unified form, the DP must fill out the “Place of departure and destination” item, as well as the remaining details of this form, since any details cannot be deleted. Therefore, it will be necessary to additionally check that among the destinations and departures there are no addresses that will allow the tax authorities to believe that the director’s use of the company car was for personal purposes.

If route information is not provided or the origin or destination indicates a non-business trip, the company will not be able to accept gasoline expenses. Moreover, in this situation, the employee receives income in kind (the cost of gasoline), from which the enterprise must calculate and transfer personal income tax to the budget, as well as pay insurance premiums. The adopted VAT may also be considered unreasonable by tax authorities.

Write-off order

An order for the write-off of fuel and lubricants is issued taking into account the write-off methodology adopted by the organization. If a decision is made to refuse waybills, the document must first reflect this fact. Here is a sample order reflecting the use of technical means of monitoring the operation of a vehicle, which were discussed above.

LLC "Rassvet"

ORDER No. 5

Moscow

June 1, 2021

On establishing a procedure for calculating volumes of fuel consumption

I ORDER: 1. From 06/01/2019, calculate the volumes of fuel consumption based on actual indicators, using the technical means specified in the appendix to the order. 2. In case of technical failures and breakdowns, calculations should be made according to the standards in accordance with the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r, taking into account the amendments that were current at the time of use of the document. 3. The engineering service ensures monitoring and timely repair of technical control equipment. 4. The deputy manager for economic affairs shall ensure control of the use of fuels and lubricants according to standards in the event of failures and breakdowns of technical control means.

Director of Rassvet LLC Krasnogorov M.P.

The following have been familiarized with the order:

chief engineer Martynov A.A. Deputy Director for Housekeeping O.I. Krivitsky chief accountant Mikhalkova T.V.

FILES

Using limits

The method consists in setting a specific fuel consumption limit at the enterprise. At the beginning of each month, employees receive gasoline coupons corresponding to the limits or one card issued by the gas station. When carrying out work activities, the employee uses the card as he sees fit. This means that in case of financial difficulties, you can use the card even for personal needs.

The disadvantage is that when the balance on the provided card runs out, you will have to pay off further expenses yourself. These conditions are included in the content of the employment contract and lease agreement, if one has been drawn up.

It is possible to request additional funds from the company’s balance sheet, but only for this it is necessary to confirm the validity of the limits. Excess payments are possible through an order from the enterprise administration, as well as through accounting documents.

Briefly

- Accounting for the write-off of fuel and lubricants is possible without using a waybill if the organization is not a carrier.

- In cases where fuel can be written off without taking into account mileage, mileage is a constant value, or modern technical systems for monitoring the use of fuel are used, the organization has the right to develop its own accounting forms, abandoning waybills.

- Having made such a decision, it is necessary to issue an order reflecting the new cost control mechanism in accordance with the legislation of the Russian Federation.