What should be in the VAT accounting policy

VAT accounting policies may include:

- description of synthetic and analytical VAT accounts used in the company;

- document flow technology for VAT accounting;

- a list of documents confirming the legality of VAT deductions and requirements for their execution, including forms (invoice, UPD, UKD, etc.);

- forms of used accounting certificates and calculations (for calculating tax deductions, VAT amounts to be restored, etc.);

- the order of numbering of invoices in the presence of separate divisions;

- formulas and algorithms for separate VAT accounting;

ConsultantPlus experts explained in detail how to describe the methodology for maintaining separate VAT accounting in the accounting policy. If you do not have access to the K+ system, get a trial online access for free.

- algorithm for confirming the legality of applying the zero VAT rate (responsible persons, list of documents submitted to tax authorities, etc.);

- list of persons authorized to sign invoices (UPD, UKD);

- list of responsible persons for processing and sending VAT returns via TCS;

- algorithms for preparing and signing documents related to VAT calculations (purchase books, sales books, etc.);

- other aspects (the procedure for filing and storing invoices and other documents related to the calculation of VAT).

Separate accounting of income and expenses - elements of accounting policy

In cases where it is necessary to keep separate records of income and expenses, two elements must be reflected in the accounting policy:

- separate accounting of income;

- separate accounting of expenses.

Separate accounting for these elements is needed for targeted revenues (clause 2 of Article 251 of the Tax Code of the Russian Federation), as well as for the purposes of calculating income tax, Unified Agricultural Tax, single tax under the simplified tax system and special tax system.

All business activities as a whole, and not individual types of activities, are transferred to the general, simplified and unified agricultural tax regime. Therefore, a company cannot combine the general regime, simplified taxation system, unified agricultural tax, as well as simplified taxation system and unified agricultural tax. But the patent regime, which is allowed for individual entrepreneurs, is applied to specific types of activities. Therefore, an entrepreneur using PSN can combine it with OSN, simplified tax system or unified agricultural tax.

Separate accounting of income can be kept on separate sub-accounts to accounts 90 “Revenue” and 91 “Other income”, as well as using special tax registers.

Expenses can also be taken into account by opening separate sub-accounts to account 90 “Revenue” or using special tax registers. And you can calculate them:

- in proportion to the share of income from activities for a specific type of activity in the total income for all types of activities (clause 9 of Article 274 of the Tax Code of the Russian Federation);

- in proportion to the shares of income received within each tax regime in the total amount of income for all types of activities.

What does a sample VAT accounting policy look like for 2021?

VAT does not belong to the category of mandatory tax payments paid by all firms and entrepreneurs without exception.

For example, if an individual entrepreneur or company applies a special regime and does not perform the duties of a tax agent for VAT, there is no need to pay attention to value added tax issues in the accounting policy.

Considering the specificity of working with VAT for different companies and entrepreneurs, information about the procedure, accounting methods, reporting and other VAT-related nuances can be formatted in different ways, for example:

- separate accounting policy - this option can be used by VAT taxpayers if there are numerous nuances in calculating this tax (complex structure of branches, working with foreign counterparties, combining taxation regimes, etc.);

- annex to the accounting policy - usually in this form the methodology for separate VAT accounting is drawn up, without which it is difficult to confirm the legality of tax deductions when carrying out activities subject to and non-taxable for VAT and in other cases;

Our section on separate VAT accounting will help you to correctly implement this method.

- a special chapter (section, subsection) of the accounting policy - if the obligation to pay VAT must be fulfilled due to the requirements of the Tax Code of the Russian Federation and standard accounting and settlement approaches are applied (there is no need for separate accounting of VAT, there are no benefits, etc.).

View a sample VAT accounting policy on our website:

Is it necessary to change the VAT accounting policy for 2021?

According to current legislation, changes to the company's accounting policy are made, including when regulations governing the calculation and payment of tax are changed.

Thus, from January 2021, the VAT rate in the Russian Federation was increased to 20%. In this regard, the taxpayer, in the order to change the accounting policy, should have specified the procedure for calculating tax, as well as the algorithm for accounting for transitional advances. Because Having received an advance in 2018 and calculating tax on it at a rate of 18/118, the taxpayer upon shipment in 2021 had to present the buyer with a tax calculated at a rate of 20%.

Read how to calculate VAT during the transition period here.

It is necessary to make changes to the accounting policies from 2021 (or from any new tax period 2020-2021) if:

- the company plans to carry out operations exempt from VAT (for example, issue loans to counterparties) - a separate VAT accounting methodology must be developed and included in the accounting policy;

We talked about how separate accounting for VAT is carried out - principles and methods - in this material.

- the current accounting policy details the specifics of tax calculation or VAT reporting, which will change from next year due to legislative innovations (for example, if the accounting policy specifies the applicable form of the VAT return and specifies the algorithm for filling it out, and the form of the VAT return changes);

Read about what other legislative innovations regarding VAT need to be taken into account in your accounting policies in our review of VAT changes.

A sample VAT accounting policy for 2021 is also available in ConsultantPlus. Get free demo access to K+ and learn the nuances of compiling this document.

Methods of maintaining tax accounting for VAT deductions

Organizations have the right to deduct the following amounts of VAT |*|:

* Information about what needs to be included in the calculation of the share to determine the amount of tax deductions for VAT is available for subscribers of the electronic “GB”

– VAT amounts presented to the payer when purchasing goods (work, services), property rights, regardless of the date of settlements for these objects;

– paid by the payer when importing goods into the territory of the Republic of Belarus. It is mandatory to reflect deductions in accounting and the purchase book if the payer maintains the purchase book.

The organization has the right during the tax period to provide in its accounting policy for maintaining a purchase book. In this case, it is carried out until the end of the tax period (clause 6 of article 107 of the Tax Code of the Republic of Belarus; hereinafter referred to as the Tax Code). If the payer maintains a purchase book, the VAT amounts reflected in it participate in the distribution of tax deductions (clause 24 of Article 107 of the Tax Code).

This norm may not be specified in the accounting policy. In this case, it is assumed by default that the organization does not maintain a purchase book. VAT amounts reflected in accounting records are accepted for deduction.

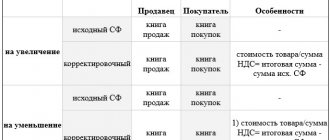

Methods for distributing tax deductions

When selling goods (works, services), property rights, tax deductions for which are made in a different order, the distribution of the total amount of tax deductions of the payer for the specified objects between these turnovers is carried out using two methods:

1) specific gravity method;

2) the method of separate accounting.

The use of one of these methods is carried out for at least 1 calendar year and is approved by the accounting policy of the organization. If there is no indication in the accounting policy of the applied method of distribution of tax deductions, all tax deductions are distributed using the specific weight method.

If the payer wants to distribute VAT tax deductions using the separate accounting method, this must be reflected in the tax part of the accounting policy. Accordingly, the accounting policy should indicate that when selling objects for which tax deductions are made in a different order, the distribution of the total amount of tax deductions is carried out using the method of separate accounting.

If the accounting policy does not reflect the method of distribution of tax deductions, the specific weight method is automatically applied.

VAT deductions from the previous tax period

If an organization distributes tax deductions using the specific weight method and the accounting policy does not stipulate that tax deductions from the previous tax period do not participate in the distribution, then tax deductions from the previous tax period are subject to distribution using the specific weight method in the manner established by the Tax Code (part four, clause 24, article 107 NK).

VAT deductions of the previous tax period on fixed assets and intangible assets

The payer has the right to make tax deductions from the previous tax period for fixed assets and intangible assets in the current tax period:

– distribute in the generally established manner (if there is turnover in the sale of goods (works, services), property rights, deductions for which are made in a different order);

– take for deduction in equal shares in each reporting period 1/12 (if the reporting period is a calendar month) or 1/4 (if the reporting period is a calendar quarter) (Clause 7, Article 107 of the Tax Code).

The procedure for deduction in equal shares chosen by the payer should be reflected in the accounting policy. It is not subject to change during the current tax period.

If the accounting policy does not indicate the applied method for distributing deductions from the previous year, then the specific weight method is used. Accordingly, if an organization has chosen the specific weight method to distribute deductions, it may not be indicated in the accounting policy.

Let's look at how accounting policies regarding VAT deductions are implemented in practice.

Situation. Distribution of tax deductions

The organization has the following turnover for the sale of goods at rates:

– 20% – 106,000.544 rubles;

– 10% – RUB 354,400.778;

– for transactions exempt from VAT – RUB 56,889.554.

As of January 1, 2021, the organization has amounts of VAT that were not accepted for deduction in the previous tax period - 15,886.258 rubles, incl. VAT on fixed assets – RUB 12,000,000.

For January 2021, VAT was charged on the acquisition of objects in the amount of RUB 38,457.226, incl. VAT on purchased fixed assets – RUB 2,554.223.

The organization submits VAT returns on a monthly basis.

Summary of Sec. I “Tax base” and the corresponding lines of the VAT return for January 2021 must be completed as follows:

The procedure for distributing tax deductions

Option 1. The accounting policy does not contain records about the chosen method of distribution of tax deductions.

1. Determine the deductions of the first stage.

First of all, VAT amounts on goods (work, services), property rights are deducted, with the exception of fixed assets and intangible assets, which are subject to deduction within the limits of VAT amounts calculated on the sale of goods (work, services), property rights (clause 25 of Art. 107 NK).

The amounts of VAT on goods (works, services) of the current year and the amounts of VAT on goods (works, services) not accepted for deduction in the previous tax period are subject to distribution, since the accounting policy does not contain information on the method of distribution of tax deductions of the previous year. Thus, the amount of VAT on goods (work, services) in the amount of RUB 39,789.261 is subject to distribution. ((38,457.226 – 2,554.223) + (15,886.258 – 12,000,000)).

The distribution of VAT on goods (works, services), property rights is reflected in table. 1.

Table 1

______________________

* Deduction of VAT attributable to sales turnover at a rate of 20% is made by the organization on an accrual basis within the limits of the calculated VAT amounts (part three of clause 5 of Article 103 of the Tax Code).

** VAT is deducted in full for goods on the sale of which VAT is levied at a rate of 10%; 9.09% (subclause 23.2, clause 23, article 107 of the Tax Code).

*** VAT amounts attributable to sales turnover exempt from VAT are not subject to deduction and are included in the organization’s costs taken into account when taxing profits (part one, clause 2, article 106, subclause 19.1, clause 19, article 107 of the Tax Code).

Thus, the amount to be deducted first is RUB 8,153,408.

2. We determine the deductions of the second stage.

Secondly, VAT amounts are deducted |*| for fixed assets and intangible assets, subject to deduction within the limits of VAT amounts calculated on the sale of goods (work, services), property rights. The specified amounts of VAT are deducted in an amount not exceeding the difference between the amount of VAT calculated on sales and the amounts of VAT deducted in the first place (clause 25 of Article 107 of the Tax Code). Since the accounting policy does not indicate the method of distribution of deductions for fixed assets of the previous year, these deductions are subject to distribution using the specific weight method in the current year.

* Information on how to avoid mistakes in the distribution of VAT deductions is available for subscribers of the electronic “GB”

Important! Determination of the amounts of VAT paid upon the acquisition and (or) import into the territory of the Republic of Belarus of fixed assets and intangible assets attributable to the turnover of the sale of goods (works, services), taxed at 0% rates; 10%, is made by multiplying the share of the amount of turnover on the sale of goods (works, services) subject to VAT at rates of 0%; 10%, in the total amount of turnover for the sale of goods (works, services), property rights on an accrual basis from the beginning of the year for the amount of VAT on fixed assets and intangible assets, reduced by the amount of VAT on fixed assets and intangible assets attributed to the increase in the cost of fixed assets and intangible assets (clause 7 of article 107 of the Tax Code).

The amount of VAT on fixed assets in the amount of RUB 14,554.223 is subject to distribution. (12,000,000 + 2,554,223). Its distribution is shown in table. 2.

table 2

VAT on sales is RUB 49,885.010, first-line deductions are RUB 8,153.408, second-line deductions should not exceed RUB 41,731.602. (49,885.010 – 8,153.408). The balance of VAT deductions on fixed assets after distribution is RUB 4,582,990. (14,554.223 – 9,971.233). Thus, the entire balance of deductions |*| for fixed assets in the amount of RUB 4,582,990. can be taken for deduction.

* Information on how to correctly distribute VAT tax deductions is available for subscribers of the electronic “GB”

3. Determination of third-order deductions.

In the third place, VAT amounts are deducted attributable to turnover on the sale of goods (works, services), property rights, subject to VAT at rates of 10%; 9.09%, regardless of the amount of VAT calculated on the sale (clause 25, article 107 of the Tax Code).

In this case, these are the amounts of VAT deductions on goods (work, services), attributable to sales turnover, taxed at a rate of 10%, in the amount of 27,259.992 rubles, as well as the amount of VAT deductions on fixed assets, attributable to sales turnover, subject to VAT at a rate of 10%, in the amount of RUB 9,971.233. Thus, in the third place, the amount of VAT of 37,231.225 rubles is accepted for deduction. (27,259.992 + 9,971.233).

The amount of tax deductions will be 49,967.623 rubles. (8,153.408 + 4,582.990 + 37,231.225).

Let's fill out the relevant sections of the VAT return:

Other information

The following entries must be made in accounting (see Table 3):

Table 3

Here is a fragment of the balance sheet for January 2016:

(The ending follows.)