What is it for?

Form SPV-2 “Information on the period of work of the insured person to establish a labor pension” contains personalized accounting information for the inter-reporting period.

It is provided to the Pension Fund to assign a pension to the insured person. The form was approved by Resolution of the Board of the Pension Fund of July 21, 2014 No. 237p (registered with the Ministry of Justice of Russia on August 7, 2014). Form SPV-2 contains information about the insured person, including those who have entered into a civil contract for benefits for which insurance premiums are calculated. The document is created based on the application of an employee who is about to retire.

Legislative framework of the Russian Federation

valid Editorial from 28.03.2012

detailed information

| Name of document | RESOLUTION of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 N 192p (as amended on March 28, 2012 with amendments that entered into force on April 22, 2012) “ON FORMS OF DOCUMENTS FOR INDIVIDUAL (PERSONALIZED) ACCOUNTING IN THE SYSTEM OF COMPULSORY PENSION INSURANCE AND IN INSTRUCTIONS FOR COMPLETING THEM" |

| Document type | resolution, instruction, classifier |

| Receiving authority | pf RF |

| Document Number | 192P |

| Acceptance date | 15.12.2006 |

| Revision date | 28.03.2012 |

| Registration number in the Ministry of Justice | 8392 |

| Date of registration with the Ministry of Justice | 23.10.2006 |

| Status | valid |

| Publication |

|

| Navigator | Notes |

RESOLUTION of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 N 192p (as amended on March 28, 2012 with amendments that entered into force on April 22, 2012) “ON FORMS OF DOCUMENTS FOR INDIVIDUAL (PERSONALIZED) ACCOUNTING IN THE SYSTEM OF COMPULSORY PENSION INSURANCE AND IN INSTRUCTIONS FOR COMPLETING THEM"

Form SPV-1 INFORMATION ON ACCRUED, PAID INSURANCE PREMIUMS FOR COMPULSORY PENSION INSURANCE AND INSURANCE EXPERIENCE OF THE INSURED PERSON FOR ESTABLISHING A LABOR PENSION

| Form SPV-1 | OKUD code | OKPO code |

INFORMATION ABOUT ACCRUED, PAID INSURANCE PREMIUMS FOR COMPULSORY PENSION INSURANCE AND INSURANCE EXPERIENCE OF THE INSURED PERSON FOR ESTABLISHING A LABOR PENSION

(as amended by Resolution of the Board of the Pension Fund of the Russian Federation dated June 23, 2010 N 152p)

| Policyholder details: | Information type | ||||

| Registration number in the Pension Fund of Russia | |||||

| Name (short) | [_] - original | ||||

| TIN | checkpoint | ||||

| Insured person category code | |||||

| Date of compilation on “__” _________ ____ year | [_] - corrective | ||||

| Date of submission to the Pension Fund "__" _____ ____ year | |||||

| Reporting period: | |||||

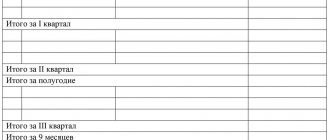

| I quarter [_] | I half of the year [_] | 9 months [_] | year: [___] | [_] - canceling | |

Calendar year _________

Reporting period 2010: I half of the year [_] year: [__]

Information about the insured person:

| Insurance number | Full Name | The amount of insurance contributions for the insurance part of the labor pension | The amount of insurance contributions for the funded part of the labor pension | ||

| accrued | paid | accrued | paid | ||

Work experience:

| N p/p | Start of period from (dd.mm.yyyy) | End of period (dd.mm.yyyy) | Territorial conditions (code) | Special working conditions (code) | Calculation of insurance period | Conditions for early assignment of a labor pension | ||

| base (code) | additional information | base (code) | additional information | |||||

| Name of the manager's position | Signature | Full name |

| date | M.P. |

What information is included in it?

The document contains the following information about the insured person:

- periods of work for the last three months from the beginning of the quarter in which the expected date of establishment of the labor pension falls, to the expected date of establishment of the labor pension;

- information on the calculation of insurance premiums for compulsory health insurance during the inter-reporting period;

- information on the calculation of insurance premiums at additional tariffs in relation to persons employed in work with harmful and dangerous working conditions specified in subparagraphs 1-18 of paragraph 1 of Article 27 of Federal Law No. 173-FZ.

For more information about calculating insurance premiums, see the berator. Install Berator for Windows

Filling out the SPV-2 form

The rules for filling out the SPV-2 form are given in the table:

| Props | Filling rules | Mandatory filling |

| Policyholder details: | ||

| Registration number in the Pension Fund of Russia | The number under which the employer is registered as a payer of insurance premiums is indicated, indicating the codes of the region and district according to the classification adopted by the Pension Fund of Russia | Required to fill out. The registration number of the Pension Fund is communicated to the employer by the territorial body of the Pension Fund. |

| Name | The short name of the organization is indicated | Required to fill out |

| TIN checkpoint | Indicate the taxpayer identification number and reason code for registration | Required to fill out |

| Insured person category code | Filled out in accordance with the parameter classifier of the same name (Appendix 1 to these Instructions) | Required to fill out |

| Compilation date on | The expected date of establishment of the labor pension is indicated. Fill in as follows: DD month name YYYY | Required to fill out |

| Date of submission to the Pension Fund | To be filled out as follows: DD name of the month YYYY. The date of receipt of documents by the territorial body of the Pension Fund of Russia is indicated. | To be completed by the territorial body of the Pension Fund of Russia |

| Reporting period | The period for which information is provided is indicated. Reporting periods are the first quarter, half a year, nine months of the calendar year, the calendar year, which are designated respectively as “3”, “6”, “9” and “0” | Required to fill out |

| Information about the insured person: | ||

| Last name, first name, patronymic (if available) | Similar to the details of the SZV-1 form of the same name | Required to fill out |

| Insurance number | Similar to the details of the SZV-1 form of the same name | Required to fill out |

| Information type | The “X” symbol indicates one of the following values: | Required to fill out |

| “original” - the form first submitted by the employer for the insured person; | If the original form submitted was returned to the employer due to errors, the original form will also be submitted in its place. | |

| “corrective” - a form submitted to change previously submitted information about the insured person; | If the original form contained information that did not correspond to reality, then the corrective form must contain the information in full, and not just the information being corrected. The information in the corrective form completely replaces the information in the original form. | |

| “oPeriod of work for the last three months of the reporting period” | ||

| Operating period for the last three months of the reporting period: | ||

| Start of period from (dd.mm.yyyy) | The dates must be within the period from the day following the end of the reporting period preceding the reporting period on which the expected date of establishment of the labor pension falls, to the expected date of establishment of the labor pension. Periods of administrative leave, temporary disability, rotational leave, etc. indicated using parameter classifier codes (Appendix 1) | Required to fill out |

| End of period (dd.mm.yyyy) | ||

| Territorial conditions (code) | Similar to the details of the SZV-1 form of the same name. If an employee performs work full-time during a part-time work week, periods of work are reflected based on the time actually worked. If the employee performs work part-time, the volume of work (share of the rate) in this period is reflected | Filled out when the insured person works in the regions of the Far North and equivalent areas, as well as in the exclusion zone, zone of residence with the right to resettlement, zone of residence with a preferential socio-economic status, zone of residence with the right of resettlement and the resettlement zone of the Chernobyl Nuclear Power Plant |

| Special working conditions (code) | Similar to the details of the SZV-1 form of the same name. | |

| Calculation of insurance period basis (code) | For insured persons employed in the work specified in subparagraphs 1 - 18 of paragraph 1 of Article 27 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation” (if the class of working conditions at the workplace for this work corresponded to a harmful and (or) dangerous class of working conditions established based on the results of a special assessment of working conditions), codes of special working conditions are indicated only in the case of accrual (payment) of insurance premiums at an additional rate. In the absence of accrual (payment) of insurance premiums at an additional tariff, codes of special working conditions are not indicated | |

| additional information | ||

| Conditions for early assignment of a labor pension | ||

| Base (code) additional information | ||

Form SPV-2 is accompanied by an inventory according to form ADV-6-1

“Inventory of documents submitted by the policyholder to the Pension Fund of the Russian Federation.”

Data on the number of documents of the SPV-2 form “Information on the period of work of the insured person for the establishment of a labor pension” included in the bundle is indicated in the line “Other incoming documents” of the table of the ADV-6-1 form.

Read more about the system of personnel documents in the berator. Install Berator for Windows

The best solution for an accountant

Berator is an electronic publication that will find the best solution for any accounting problem. For each specific topic there is everything you need: a detailed algorithm of actions and postings, examples from the practice of real companies and samples of filling out documents. Install Berator for Windows >>

If you have a question, ask it here >>

Personalized accounting. New form. For future retirees

(Resolution of the Board of the Pension Fund of June 23, 2010 No. 152p

“On amendments to the Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p”

)

The resolution puts into effect a new form SPV-1 “Information on accrued, paid insurance contributions for compulsory pension insurance and the insurance record of the insured person to establish the labor pensions"

.

Form SPV-1 is presented

to the territorial body of the Pension Fund of the Russian Federation by the policyholder (employer)

at the request of the insured person

, who has

the conditions for establishing a labor pension

.

Form SPV-1 contains information about the insured person

(including about a person who has entered into a civil law agreement, for which insurance premiums are charged in accordance with the legislation of the Russian Federation).

An insured person who pays their own insurance premiums

, can submit form SPV-1, containing the necessary information, to the territorial body of the Pension Fund of the Russian Federation

simultaneously with the application for the establishment of a labor pension

.

Form SPV-1 contains information as of the expected date

establishing a labor pension.

The completed SPV-1 form is certified by the signature of the head and the seal of the organization (with the exception of the SPV-1 form, submitted by the insured person who independently pays insurance premiums).

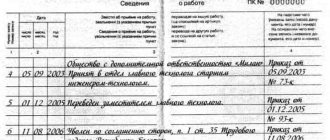

In the “Work Experience” section details

“Beginning of period”, “End of period”

are filled in as follows

: dates must be within the period

from the day

following the end of the reporting period preceding the reporting period on which the expected date of establishment of the labor pension falls,

to the expected date

of establishment of the labor pension.

Periods of “leave without pay” and “for temporary disability”

are indicated using parameter classifier codes.

To make it clear how to fill out these details, the Pension Fund provided examples

.

Example 1

The insured person has the right to receive a labor pension from September 18, 2010.

Example 2

The insured person has the right to receive a labor pension from 04/11/2011.

Section of the Classifier of Parameters “Calculable length of service

: additional information (for forms SZV-1, SZV-3) and Calculation of insurance experience: additional information (for forms SZV-4-1, SZV-4-2)”

is supplemented with the following codes

:

| ADMINISTR | Leave without pay | Art. 76 Labor Code “Leave without pay” | from 01/01/1996 to 31/12/2001 |

| Art. 128 of the Labor Code of the Russian Federation “Leave without pay” | from 01/01/2010 | ||

| VRNETRUD | Period of temporary disability | P.p. 2 p. 1 art. 11 of the Federal Law of the Russian Federation of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation” “Other periods counted in the insurance period” | from 01/01/2010 |

Details “Category code of the insured person”

is filled in in accordance with the parameter classifier of the same name.

Section “Category code of the insured person (in the form SZV-1

was used when filling out the details "Category code of the payer of insurance premiums")" of the Classifier of parameters used in the forms of documents for individual (personalized) accounting in the compulsory pension insurance system,

supplemented with codes of categories of the insured person

(tariff code for the payer of insurance premiums, etc.)

used when submission of information in SPV-1 forms

.

| Code | Name | Full name | Notes | Code expiration date |

| HP | HIRE/ WORKER | An employee of the policyholder, for whose payments and other remuneration insurance premiums are calculated | Indicated for all categories of employees whose payments and other remuneration are subject to insurance premiums paid by the policyholder | from 01/01/2010 |

| CX | AGRICULTURAL PRODUCERS | Worker of agricultural producers, folk art crafts, family (tribal) communities of indigenous peoples of the North, engaged in traditional economic sectors | Indicated for employees of agricultural producers who meet the criteria specified in Art. 346 of the Tax Code of the Russian Federation, organizations of folk artistic crafts and family (tribal) communities of indigenous peoples of the North (for insurance premium payers who apply a reduced rate of insurance premiums in accordance with clause 1, part 2, article 57 and clause 1, part 1, art. 58 of Law No. 212-FZ) | from 01/01/2010 to 31/12/2014 |

| OZOI | SPECIAL/ZONE/ ORGANIZATION/ DISABLED PERSONS | Employees of organizations and individual entrepreneurs, having resident status of technical innovation special economic zone and making payments to individuals working in the territory of the technology-innovative special economic zone | Indicated for employees of insurance premium payers who apply a reduced rate of insurance premiums in accordance with clause 2, part 2, art. 57 and paragraphs 2 and 4, part 1, art. 58 of Law No. 212-FZ | from 01/01/2010 to 31/12/2014 |

| Unified agricultural tax | SINGLE/Agricultural/TAX | Employees of organizations and individual entrepreneurs using the Unified Agricultural Tax | Indicated for employees of insurance premium payers who apply a reduced rate of insurance premiums in accordance with clause 3, part 2, art. 57 and paragraph 3, part 1, art. 58 of Law No. 212-FZ | from 01/01/2010 to 31/12/2014 |

| USEN | SIMPLIFIED/ SYSTEM/ SINGLE/ TAX | Employees of organizations and individual entrepreneurs using the simplified tax system and UTII (in relation to payments and other remuneration made to individuals in connection with conducting business activities subject to UTII) | Indicated for employees of insurance premium payers who apply a reduced rate of insurance premiums in accordance with clause 2, part 2, art. 57 of Law No. 212-FZ | from 01/01/2010 to 31/12/2010 |

| FL | INDIVIDUALS | Individual entrepreneurs, lawyers, notaries engaged in private practice | Indicated for payers of insurance premiums who do not make payments and other remuneration to individuals in accordance with clause 2, part 1, art. 5 of Law No. 212-FZ | from 01/01/2010 |