Types of securities

In accounting, for the purposes of revaluation, securities are divided into:

- financial investments for which the current market value can be determined (securities listed (admitted for circulation) on the organized securities market);

- financial investments for which the current market value is not determined (securities that are not quoted (not admitted to circulation) on the organized securities market).

Depending on what type of security the security is, the rules for current revaluation and the reflection of its results will be different (revaluation (increase in value), markdown (decrease in value) or the formation of an impairment reserve).

This procedure follows from paragraphs 18–22 and section VI of PBU 19/02.

Listed securities

Quoted securities are accepted for accounting at their original cost. However, at the end of each year, the value of quoted shares must be reflected in accounting and financial statements at the current market value. To do this, you should adjust their assessment as of the previous reporting date, decreasing or increasing it. Revaluations can be done monthly or quarterly. The frequency of revaluation is fixed in the accounting policy of the organization (clause 7 of PBU 1/2008).

This procedure follows from paragraph 20 of PBU 19/02.

Do the revaluation on the basis of official data on quotes (clause 13 of PBU 19/02, letter of the Ministry of Finance of Russia dated March 21, 2005 No. 07-05-06/83). In this case, the organization must use all available sources of information on market prices, including data from foreign organized markets or trade organizers (letter of the Ministry of Finance of Russia dated January 29, 2014 No. 07-04-18/01).

Tip: information on prices (quotations) of securities can be found in the media (newspapers, magazines, Internet, etc.). This data is also provided by the trade organizer or intermediary through whom the securities were purchased.

If on the reporting date the organizer of trading in the securities market does not calculate the market price, then take the latest market price for the current market value of these securities (clause 24 of PBU 19/02 and letter of the Ministry of Finance of Russia dated March 21, 2005 No. 07-05- 06/83).

Reflect the results of the revaluation as a decrease or increase in the initial (book) value of securities and other expenses or income of the organization. To do this, reflect the difference between the new valuation of securities as of the reporting date and their previous valuation on account 58 “Financial investments” in correspondence with account 91 “Other income and expenses”. Make the following entries:

Debit 58 Credit 91-1 – reflects the revaluation of securities;

Debit 91-2 Credit 58 – reflects the markdown (impairment) of securities.

This procedure follows from paragraph 20 of PBU 19/02, paragraphs 7, 10.5 and 16 of PBU 9/99, paragraphs 11 and 14.4 of PBU 10/99 and the Instructions for the chart of accounts (accounts 58 and 91).

When calculating taxes, do not take into account the revaluation of listed securities, regardless of the tax regime that the organization applies.

For the general taxation regime, this is explained as follows.

When calculating income tax, the results of revaluation are not included either in income (subclause 24, clause 1, article 251 of the Tax Code of the Russian Federation), or in the expenses of the organization (clause 46, article 270 of the Tax Code of the Russian Federation).

The revaluation of securities does not affect the calculation of VAT, since in this case there is no object of taxation (clause 1 of Article 38 and Article 146 of the Tax Code of the Russian Federation).

The results of revaluation do not affect the calculation of the single tax under simplification for the following reasons.

When determining income (regardless of the object of taxation), the income mentioned in Article 251 of the Tax Code of the Russian Federation (subclause 1, clause 1.1, Article 346.15 of the Tax Code of the Russian Federation) is not taken into account. That is, in this case, the increase in the value of securities does not affect income during the simplification, since it is excluded from them on the basis of subparagraph 24 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

When determining expenses (in the case where an organization calculates tax on the difference between income and expenses), a decrease in the value of securities does not affect the tax base, since this type of expense is not mentioned in Article 346.16 of the Tax Code of the Russian Federation.

If an organization pays UTII or combines the general taxation regime and payment of UTII, reflect all transactions with securities (including revaluation) according to the rules of the general taxation system (clause 7 of article 346.26 and clause 9 of article 274 of the Tax Code of the Russian Federation) . This is due to the fact that certain types of activities are transferred to UTII, the list of which does not include transactions with securities (clause 2 of Article 346.26 of the Tax Code of the Russian Federation). Revaluation of securities is not taken into account when calculating income tax (subclause 24, clause 1, article 251 and clause 46, article 270 of the Tax Code of the Russian Federation) and VAT (clause 1, article 38 and article 146 of the Tax Code of the Russian Federation).

An example of how revaluation of listed securities at market value is reflected in accounting and taxation. The organization applies a general taxation system

As of September 30, the records of Torgovaya LLC (debit of account 58-1) included 10 shares of Proizvodstvennaya JSC. The book value of each share is 6,000 rubles.

According to Alpha's accounting policy, for accounting purposes, financial investments traded on the securities market are revalued quarterly.

When preparing financial statements for nine months, Hermes' accountant revalued these securities.

According to the trade organizer, the market price of shares as of September 30 was 6,395 rubles. per share.

The Hermes accountant reflected the revaluation in accounting as follows:

Debit 58-1 Credit 91-1 – 3950 rub. ((RUB 6,395 – RUB 6,000) × 10 pieces) – reflects the overvaluation of shares.

At the same time, the analytical accounting of Hermes reflects the additional valuation of each share in the amount of 395 rubles.

The revaluation of shares did not affect the calculation of income tax and VAT.

Example of invoice registration 58

engages in the sale of exotic plants. During the first quarter of this year, the company purchased shares worth 10 thousand dollars, and after that it issued a loan in the amount of 200 thousand rubles to a third-party organization supplying turf. At the end of the reporting period, the loan was returned to the current account. The accountant revalued the shares with an increase of 10% at the market rate and generated the following entries:

- Dt. 58.1 – Ct. 52 – 10,000 dollars – shares were purchased for foreign currency.

- Dt. 58.3 – Kt. 51 – 200,000 rubles – loan to a third-party company supplying turf.

- Dt. 91 – Kt. 58.1 – 1000 dollars – revaluation of shares with an increase of 10%.

- Dt. 51 – Kt. 58.3 – 220,000 rubles – loan repayment with interest.

Unlisted securities

Reflect unquoted securities in accounting and reporting at their original cost (clause 21 of PBU 19/02).

Exceptions to this rule are:

- debt securities whose original cost differs from their par value;

- securities for which a significant price reduction has been established.

Such financial investments in accounting and (or) reporting may be reflected at a cost different from the original (accounting value).

This procedure follows from paragraph 22 and section VI of PBU 19/02.

If the original cost of unquoted debt securities (for example, bills or unquoted bonds) differs from their par value, the entity may charge the difference to financial results (other income or expenses). This must be done evenly during the circulation period of the security, according to the income due on it, provided for when it was issued. This procedure is provided for in paragraph 22 and section V of PBU 19/02.

At the same time, make accounting entries similar to entries for the revaluation of quoted securities.

In particular, an organization can use this procedure to take into account the discount on a bill or the discount on a bond.

For tax purposes, adjustment of the value of debt securities towards par value according to rules similar to accounting is not provided (letter of the Ministry of Finance of Russia dated April 8, 2005 No. 03-03-01-04/1/175).

For more information about accounting and taxation of income in the form of discount on debt securities, see, for example, How to record interest (discount) on a bill.

Taxes and Law

In accordance with the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, financial investments are accepted for accounting at their original cost, which may subsequently change.

For the purposes of subsequent assessment, financial investments are divided into two groups:

— financial investments by which the current market value can be determined;

— financial investments for which the current market value is not determined.

Accordingly, we can distinguish two main types of adjustments that can change the initial cost of financial investments:

1) for financial investments with a determinable current market value;

2) for financial investments with an undeterminable current market value.

Currently, accounting does not provide for separate accounting of the initial cost of financial investments and the accumulated adjustments on them. However, the value of this information has increased, especially given the new requirements for the format of reporting information.

According to Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n “On Forms of Accounting Reports of Organizations,” organizations have the right to independently develop forms of explanations for the balance sheet and profit and loss statement. At the same time, the financial department in Appendix No. 3 to Order of the Ministry of Finance of Russia dated 07/02/2010 No. 66n “On the forms of financial statements of organizations” offers examples of the preparation of such explanations. In particular, in example 3.1 “Availability and movement of financial investments”, special columns are provided for disclosing information on accumulated adjustments to financial investments at the beginning and end of the period, as well as changes in these adjustments for the period.

Consequently, the need to provide information of this kind and the degree of detail are established at the legislative level. In this regard, the question arises: how to organize accounting of financial investments so that the generation of information about accumulated adjustments to financial investments is carried out with minimal labor costs? This issue is not only technical, but also methodological in nature.

By Order No. 160n dated November 25, 2011 “On the entry into force of International Financial Reporting Standards and Explanations of International Financial Reporting Standards on the territory of the Russian Federation,” the Russian Ministry of Finance officially notified the entry into force of International Financial Reporting Standards (IFRS) on the territory of the Russian Federation. The following standards are devoted to accounting and disclosure of information about financial investments, which impose new requirements for the disclosure of information about an organization’s financial instruments:

— IAS 32 “Financial instruments: presentation of information”;

— IAS 39 “Financial instruments: recognition and measurement”;

— IFRS 7 “Financial Instruments: Disclosures”.

In particular, according to PBU 19/02, the procedure for writing off the difference between the initial and par value of debt securities during their circulation period is voluntary, while IAS 39 indicates the direct obligation of the organization to reflect investments held to maturity at amortized cost, the determination of which is based on a methodology similar to Russian accounting.

IAS 39 requires adjustments to the fair value of an available-for-sale financial asset to be recognized in other comprehensive income until the financial asset is derecognized. On disposal of the asset, these accumulated adjustments must be eliminated from equity and recognized in profit or loss. In this regard, there is a need to generate and accumulate information about such adjustments for the purpose of their subsequent restoration at the time of disposal of the asset.

International Financial Reporting Standard (IFRS) 7 imposes specific disclosure requirements on changes in the fair value of financial instruments and the nature and extent of the risks to which an entity is exposed during the period and at the end of the reporting period by holding the financial instruments.

Thus, separate accounting of accumulated adjustments caused by changes in the current market value of financial investments will make it possible to assess the degree of market risk of owning these assets. Taking into account accumulated adjustments for financial investments for which it is impossible to determine the current market value will allow us to characterize the degree of credit risk. Information about accumulated adjustments caused by changes in exchange rates will be relevant in assessing the degree of exchange rate risk inherent in financial investments denominated in foreign currencies.

Consequently, the need to develop new methods of accounting for financial investments is obvious and is determined both by new requirements to meet the increased information needs of users of financial statements, and by the active introduction of IFRS into Russian accounting practice.

Let's consider the option of separate accounting of the initial cost of financial investments and their accumulated adjustments, as well as disclosure of information in the notes to the balance sheet.

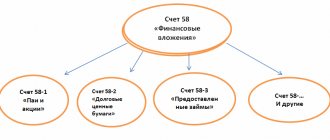

Adjustments to the value of financial investments that can be used to determine the current market value. Information on financial investments is accumulated in account 58 “Financial investments”. To decipher financial investments by groups and types, subaccounts are opened for this account:

— 58-1 “Units and shares”;

— 58-2 “Debt securities”;

— 58-3 “Loans provided”;

— 58-4 “Deposits under a simple partnership agreement”, etc.

In the organization's balance sheet, financial investments are reflected in two asset sections: non-current and current assets, based on the expected tenure. Based on this, we propose to introduce additional analytics for separate accounting of long-term and short-term financial investments. In the future, information on these analytical accounts will allow the formation of appropriate explanations for the balance sheet.

In deciphering long-term financial investments by groups and types, account 58 “Financial investments” is taken in the context of analytical subaccounts:

— 58-010 “Long-term shares and shares”;

— 58-020 “Long-term debt securities”;

— 58-030 “Long-term loans provided”;

— 58-040 “Deposits under a simple partnership agreement”, etc.

Decoding of short-term financial investments by groups and types is carried out in the context of the following analytical sub-accounts:

— 58-011 “Short-term shares and shares”;

— 58-021 “Short-term debt securities”;

— 58-031 “Short-term loans provided”, etc.

Financial investments for which the current market value can be determined usually include financial investments listed on the securities market, as well as other financial investments whose current value can be documented. They are reflected in the financial statements at the end of the reporting year at the current market value by adjusting their valuation as of the previous reporting date.

Consequently, the adjustment to the value of financial investments, by which the current market value can be determined, is the difference between the valuation of financial investments at the current market value as of the reporting date and their previous valuation.

This adjustment is made monthly or quarterly based on the organization’s accounting policies and is included in the financial results as other income or expenses.

Accounting for financial investments, by which the current market value can be determined, is kept in accounts 58-010 “Long-term shares and shares” and 58-011 “Short-term shares and shares.”

For these accounts, it is advisable to open an analytical account “Adjustments to the value of financial investments”, which will accumulate all information about accumulated adjustments due to changes in the current market value of such financial investments. Since the market value of financial investments can fluctuate both up and down, the balance in the adjustment account can be either a debit or a credit.

Data from these analytical accounts will be used to fill out explanations for reporting and subsequent analysis of the effectiveness of investing funds in financial investments.

Adjustments to the value of financial investments for which the current market value is not determined. Financial investments for which the current market value cannot be determined primarily include debt securities. This group also includes other financial investments that are not traded on the stock market and have no market value.

For financial investments for which the current market value is not determined, adjustments of two types are possible:

— adjustments in connection with the accrual of part of the difference between the original and nominal value of debt securities;

— adjustments in connection with the creation of a reserve for depreciation of financial investments.

Financial investments for which the current market value is not determined are reflected in the financial statements as of the reporting date at their historical cost less the amount of the reserve created for their depreciation.

At the same time, for debt securities, if their initial value differs from their par value, organizations can evenly write off part of the difference between the indicated values according to the income due on the securities.

To account for adjustments on debt securities to accounts 58-020 “Long-term debt securities” and 58-021 “Short-term debt securities”, it is advisable to open an analytical account “Adjustments to the value of financial investments”, which will accumulate all information on accumulated adjustments in connection with with the write-off of part of the difference between the original cost of a debt security and its par value.

In addition to this type of adjustments for financial investments for which the current market value cannot be determined, adjustments may occur due to exchange rate differences.

In particular, the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006) indicates that the recalculation of securities, with the exception of shares denominated in foreign currency, should be carried out not only on the date of the transaction, but also at the reporting date.

Consequently, the account “Adjustments to the value of financial investments” must also reflect exchange rate differences associated with the recalculation of the value of securities, other than shares, at the rate as of the reporting date.

In accordance with the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, financial investments are accepted for accounting at their original cost, which may subsequently change. For the purposes of subsequent assessment, financial investments are divided into two groups: - financial investments for which the current market value can be determined; - financial investments for which the current market value is not determined. Accordingly, two main types of adjustments can be distinguished that can change the initial value of financial investments: 1) for financial investments with a determinable current market value; 2) for financial investments with an indeterminable current market value. Currently, accounting does not provide for separate accounting of the initial cost of financial investments and the accumulated adjustments on them. However, the value of this information has increased, especially taking into account the new requirements for the format for presenting reporting information. According to Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n “On forms of financial statements of organizations,” organizations have the right to independently develop forms of explanations for the balance sheet and profit and loss statement. At the same time, the financial department in Appendix No. 3 to Order of the Ministry of Finance of Russia dated 07/02/2010 No. 66n “On the forms of financial statements of organizations” offers examples of the preparation of such explanations. In particular, in example 3.1 “Availability and movement of financial investments”, special columns are provided for disclosing information on accumulated adjustments to financial investments at the beginning and end of the period, as well as changes in these adjustments for the period. Consequently, the need to provide information of this kind and the degree of detail are established at the legislative level. In this regard, the question arises: how to organize accounting of financial investments so that the generation of information about accumulated adjustments to financial investments is carried out with minimal labor costs? This issue is not only technical, but also methodological in nature. By Order No. 160n dated November 25, 2011 “On the implementation of International Financial Reporting Standards and Explanations of International Financial Reporting Standards on the territory of the Russian Federation,” the Ministry of Finance of Russia officially notified the implementation of International Financial Reporting Standards reporting (IFRS) on the territory of the Russian Federation. The following standards are devoted to accounting and disclosure of information about financial investments, which impose new requirements for the disclosure of information about an organization’s financial instruments: - IAS 32 “Financial Instruments: Presentation of Information”; - IAS 39 “Financial Instruments: Recognition and Measurement” "; - IFRS 7 “Financial Instruments: Disclosure of Information”. In particular, according to PBU 19/02, the procedure for writing off the difference between the initial and par value of debt securities during their circulation period is voluntary, while IFRS ( IAS 39 indicates an entity's express obligation to record held-to-maturity investments at amortized cost, which is based on a methodology similar to Russian accounting. In accordance with IAS 39, adjustments to the fair value of an available-for-sale financial asset must be recognized in other comprehensive income until the financial asset is derecognised. On disposal of the asset, these accumulated adjustments must be eliminated from equity and recognized in profit or loss. In this regard, there is a need to generate and accumulate information about such adjustments for the purpose of their subsequent restoration at the time of disposal of the asset. International Financial Reporting Standard (IFRS) 7 puts forward special requirements for the disclosure of information about changes in the fair value of financial instruments, as well as the nature and amount risks to which the organization is exposed during the period and at the end of the reporting period in connection with the ownership of financial instruments. Thus, separate accounting of accumulated adjustments due to changes in the current market value of financial investments will allow assessing the degree of market risk of owning these assets. Taking into account accumulated adjustments for financial investments for which it is impossible to determine the current market value will allow us to characterize the degree of credit risk. Information about accumulated adjustments caused by changes in the exchange rate will be relevant when assessing the degree of currency risk inherent in financial investments denominated in foreign currencies. Consequently, the need to develop new methods of accounting for financial investments is obvious and is due to both new requirements to meet the increased information needs of users financial statements, and the active introduction of IFRS into Russian accounting practice. Let's consider the option of separate accounting of the initial cost of financial investments and their accumulated adjustments, as well as disclosure of information in the notes to the balance sheet. Adjustments to the value of financial investments, by which the current market value can be determined. Information on financial investments is accumulated in account 58 “Financial investments”. To decipher financial investments by groups, types, subaccounts are opened for this account: - 58-1 “Units and shares”; - 58-2 “Debt securities”; - 58-3 “Loans provided”; - 58-4 “Deposits for simple partnership agreement”, etc. In the organization’s balance sheet, financial investments are reflected in two sections of the asset: as part of non-current and current assets, based on the expected tenure. Based on this, we propose to introduce additional analytics for separate accounting of long-term and short-term financial investments. In the future, information on these analytical accounts will allow the formation of appropriate explanations for the balance sheet. In deciphering long-term financial investments by groups and types, account 58 “Financial investments” is taken in the context of analytical subaccounts: - 58-010 “Long-term shares and shares”; - 58- 020 “Long-term debt securities”; - 58-030 “Long-term loans provided”; - 58-040 “Deposits under a simple partnership agreement”, etc. Breakdown of short-term financial investments by groups and types is carried out in the context of the following analytical subaccounts: - 58- 011 “Short-term shares and shares”; - 58-021 “Short-term debt securities”; - 58-031 “Short-term loans provided”, etc. Financial investments for which the current market value can be determined, as a rule, include financial investments quoted on the securities market, as well as other financial investments, the current value of which can be documented. They are reflected in the financial statements at the end of the reporting year at the current market value by adjusting their valuation as of the previous reporting date. Consequently, the adjustment to the value of financial investments, by which the current market value can be determined, is the difference between the valuation of financial investments at the current market value to the reporting date and their previous assessment. The specified adjustment is made monthly or quarterly based on the accounting policy of the organization and is included in the financial results as part of other income or expenses. Accounting for financial investments, by which the current market value can be determined, is kept in accounts 58-010 “Long-term shares and shares" and 58-011 "Short-term shares and shares". For these accounts it is advisable to open an analytical account "Adjustments to the value of financial investments", which will accumulate all information about accumulated adjustments in connection with changes in the current market value of such financial investments. Since the market value of financial investments can fluctuate both up and down, the balance in the adjustment account can be either a debit or a credit. Data from these analytical accounts will be used to fill out explanations for the statements and subsequent analysis of the effectiveness of investing funds in financial investments. Example 1. In December 2009, the open joint-stock company (JSC) ANK Bashneft acquired 47.18% of the shares of JSC Ufaneftekhim from the joint-stock financial corporation (JSFC) Sistema for the amount of 13,047,106 thousand rubles. Shares of OJSC Ufaneftekhim are quoted on the stock exchange of the Russian Trading System and are reflected in the balance sheet at market value as of the reporting date. In June 2010, OJSC ANK Bashneft purchased another 7.75% of shares of OJSC Ufaneftekhim worth 2,950,773 thousand roubles. From the moment of the first purchase until June 2010, the market value of shares of OJSC Ufaneftekhim did not change significantly, however, in the second half of 2010, the current market value of shares of OJSC Ufaneftekhim increased and as of December 31, 2010 amounted to 25,639,606 thousand. rub., and on March 31, 2011, the current market value of the shares increased to 27,984,355 thousand rubles. The following entries must be made in the accounting records (Table 1). Table 1 Accounting records of JSC ANK Bashneft ————T——————-T———-T—————T—————¬¦ ¦ Contents ¦ Amount, ¦ ¦ ¦¦ Date ¦ business ¦ thousand rubles¦ Account debit ¦ Account credit ¦¦ ¦ transactions ¦ ¦ ¦ ¦+———-+——————-+———-+—————+——— ——+¦ 1 ¦ 2 ¦ 3 ¦ 4 ¦ 5 ¦+———-+——————-+———-+—————+—————+¦12/31/2009¦ Shares purchased ¦13 047 106¦ 58-010/ps ¦ 76 “Settlements ¦¦ ¦OJSC “Ufaneftekhim” ¦ ¦ “Long-term ¦ with different ¦¦ ¦ ¦ ¦ shares and shares” ¦ debtors ¦¦ ¦ ¦ ¦ ¦ and creditors" ¦+———-+——————-+———-+—————+—————+¦12/31/2009¦Paid for shares ¦13 047 106¦ 76 “Calculations ¦ 51 “ Settlement ¦¦ ¦OJSC "Ufaneftekhim" ¦ ¦ with different ¦ accounts" ¦¦ ¦ ¦ ¦ debtors ¦ ¦¦ ¦ ¦ ¦ and creditors"¦ ¦+———-+——————-+———- +—————+—————+¦01.06.2010¦Purchased ¦ 2,950,773¦ 58-010/ps ¦ 76 “Calculations ¦¦ ¦additional shares¦ ¦ “Long-term ¦ with different ¦¦ ¦OJSC “ Ufaneftekhim" ¦ ¦ shares and shares" ¦ debtors ¦¦ ¦ ¦ ¦ ¦ and creditors"¦+———-+——————-+———-+—————+————— +¦01.06.2010¦Paid shares ¦ 2,950,773¦ 76 “Settlements ¦ 51 “Settlements ¦¦ ¦OJSC “Ufaneftekhim” ¦ ¦ with different ¦ accounts” ¦¦ ¦ ¦ ¦ debtors ¦ ¦¦ ¦ ¦ ¦ and creditors" ¦ ¦+———-+——————-+———-+—————+—————+¦12/31/2010¦Produced ¦ 9 641 727¦ 58-010/corr ¦ 91 “Other ¦¦ ¦ overvaluation of shares ¦ ¦ “Long-term ¦ income ¦¦ ¦ JSC “Ufaneftekhim” ¦ ¦ shares and shares” ¦ and expenses" ¦+———-+——————-+———-+ —————+—————+¦31.03.2011¦Produced ¦ 2,344,749¦ 58-010/corr ¦ 91 “Other ¦¦ ¦overvaluation of shares ¦ ¦ “Long-term ¦ income ¦¦ ¦OJSC “Ufaneftekhim” ¦ ¦ shares and shares" ¦ and expenses" ¦L———-+——————-+———-+—————+—————- Adjustments to the value of financial investments for which the current market value is determined. Financial investments for which the current market value cannot be determined primarily include debt securities. This group also includes other financial investments that are not traded on the stock market and do not have a market value. For financial investments for which the current market value is not determined, two types of adjustments are possible: - adjustments due to the accrual of part of the difference between the original and nominal value for debt securities; - adjustments in connection with the creation of a reserve for depreciation of financial investments. Financial investments for which the current market value is not determined are reflected in the financial statements as of the reporting date at their original cost minus the amount of the created reserve for their depreciation. At the same time, debt securities, if their original value differs from their face value, organizations can write off evenly part of the difference between the indicated values according to the income due on the securities. To account for adjustments on debt securities to accounts 58-020 “Long-term debt securities” and 58- 021 “Short-term debt securities”, it is advisable to open an analytical account “Adjustments to the value of financial investments”, which will accumulate all information on accumulated adjustments in connection with the write-off of part of the difference between the initial cost of a debt security and its par value. In addition to this type of adjustments on financial investments , for which it is impossible to determine the current market value, adjustments may occur due to exchange rate differences. In particular, the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006) indicates that the recalculation of valuable securities, with the exception of shares denominated in foreign currency, must be made not only on the date of the transaction, but also on the reporting date. Consequently, the account “Adjustments to the value of financial investments” must also reflect exchange differences associated with the recalculation of the value of securities, except shares, at the exchange rate as of the reporting date.

Kulikova L.I., Goshunova A.V. Accounting for adjustments to the value of financial investments // International accounting. 2012. N 38. P. 2 - 12.

Impairment testing

At least once a year (as of December 31 of the current year) in accounting, check for impairment of securities (i.e., current liquidity - saleability) if there are signs of a decrease in their price. Such signs, in particular, include:

- the issuer is declared bankrupt or shows signs of bankruptcy;

- execution of a significant number of transactions in the securities market with similar securities at a price significantly lower than their book value;

- absence or significant reduction in income payments on securities (for example, dividends, interest, coupons, etc.) with a high probability of their further reduction.

To conduct the audit, determine the estimated value of a particular security and compare it with the book value of the security. Select (develop) the methodology by which the settlement price is determined yourself and establish it in the organization’s accounting policy (clause 7 of PBU 1/2008). For example, for this you can involve an independent appraiser or (for shares) use the method of the issuer's net asset value per share (per share of a certain type).

Such a test may reveal a sustained significant decline in the value of a security characterized by:

- at the reporting date and at the previous reporting date, the estimated value of the security is significantly lower than the accounting value;

- during the reporting year, the estimated value of the security changed significantly only downward;

- at the reporting date there is no indication that the estimated value of the security will increase in the future.

This procedure is established by paragraphs 37–38 of PBU 19/02.

For information on how to test for impairment of other financial investments, see Signs of impairment by type of financial investment (shares, shares in the authorized capital, loans issued).

Accounting entries to account 58

The PBU contains a list of transactions used to display all operations with account 58. Let's look at them in more detail in the table:

| Description | Dt. | Kt. |

| Securities purchased for foreign currency | 58.1 | |

| Bonds were paid from a current ruble account | 58.2 | 51 |

| Loan issued to a third party (materials) | 58.3 | |

| According to the deed of a simple partnership, the fixed asset was given away as a contribution to the authorized capital | 58.4 | 01 |

| Reflection of the difference between the initial and market value of bonds | 58.2 | 91 |

| The cost of purchased shares has been revised taking into account market indicators | 91 | 58.1 |

| Payment by bill | 51 | 58.2 |

| The previously issued loan was returned by bank transfer | 51 | 58.3 |

| The intangible asset transferred under a simple partnership agreement has been returned | 04 | 58.4 |