What are limits

At each enterprise, employees of authorized departments set standards for the supply of materials in accordance with the specifics of production. Limits are drawn up on the basis of production programs; when compiling them, the consumption rate is taken into account, as well as the number of materials that remained unused in the previous period and are transferred to the next period of the year.

In some cases, by decision of authorized persons, the limits may change. This happens in the following cases:

- Changing the production program or exceeding the plan. In this case, the limit is reduced to reduce costs.

- Replacement of materials used. The limit is recalculated taking into account the specifics of the activity.

- Clarification of balances not used in the production process in the previous period. The supply limit is reduced to reduce the amount of unclaimed materials.

- Elimination of errors made during the limits process and identified later.

Materials may also be released in excess of the limit, for which permission must be obtained from an authorized employee. Release in excess of the planned limit can be used to cover excess consumption of materials, as well as to compensate for costs due to rejected products. In such cases, it is necessary to attach documentation confirming the detected defect. - SELECTION CARD

Who sets the limit

Setting a limit is the prerogative of the director of the company or persons authorized by a special order or order for this action (for example, the head of a department, site, workshop, etc.). The limit is calculated by analyzing the consumption of materials for production, production capacity and actual volumes.

Sometimes there is a need for above-limit consumption of materials. This is possible only with the special permission of the head of the enterprise in a strictly established manner, subject to compliance with certain requirements.

What is a limit-fence card

A limit-fence card is a primary accounting document of a cumulative nature, which serves as the basis for writing off MC from the warehouse of an enterprise to the workshops, to the sites of the same enterprise. The quantity of materials is written out based on their planned requirement.

The name and the form of the document itself were developed in the Soviet Union and have survived to this day. “Limit” means a type of restriction, “fence” - i.e. vacation, receipt - indicates that this is a strict reporting form.

A limit intake card is issued if there are limits on the supply of materials that will be used in the manufacture of own products, i.e. this is an internal document. It controls the work of warehouse employees, especially those who honestly perform their duties - it guarantees them protection from accusations and suspicions of theft.

What is it used for?

In order to carry out production activities, the structural divisions of the enterprise need to systematically consume MC for various purposes. The number of MCs is established due to the limits that are determined for each item.

MC limits, in turn, are formed from approved consumption standards per 1 unit. finished products, as well as according to the production volumes of these products according to the production programs of sites and workshops. Enterprise managers or other persons authorized by them are responsible for approving limits.

The movement of MC is documented using limit cards, which also serve as a supporting documentary basis for the release of MC from the warehouse to other structural divisions of the enterprise. In addition, the limit-fence card facilitates ongoing control over compliance with established limits on the consumption of goods and materials. Material is released only from the warehouse indicated in the limit-receipt card.

Thanks to the limit card, materials that were not used in production are accounted for (return). If it is necessary to release material in excess of the limit or replace the item specified on the card with another, then this occurs with the permission of the manager or authorized persons.

What is a limit-fence card?

Definition 1

A limit-fence card is an official document developed and approved by the Resolution of the State Statistics Committee of the Russian Federation, which is used to control the write-off of inventory items.

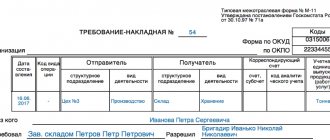

In other words, in each economic entity, subject to the systematic write-off of inventory items, a document such as a limit-fence card can be drawn up, which reflects information about the approved write-off limits. Such a card should be classified as primary accounting reporting; the document has the code “M-8”. The format of the limit-fence card is shown in Figure 1.

Figure 1. Limit-fence map of the enterprise. Author24 - online exchange of student work

Help with student work on the topic Limit-fence map

Coursework 450 ₽ Essay 270 ₽ Test paper 250 ₽

Get completed work or consultation with a specialist on your educational project Find out the cost

Note 1

It is worth noting that since 2013, the format of this document has not been regulated in the Russian Federation, and can be developed by the organization independently, but with the obligatory indication of all necessary details. In this case, the form of this document must be reflected in the accounting policy of the economic entity.

Filling out the limit and intake card

Limit intake cards are filled out to check the volume of materials issued, as well as to check compliance with the established limit standards. According to such a document, the remaining unused materials can be returned to warehouse storage. The document must be prepared by the procurement department or other division of the enterprise in three copies:

- The first is sent to the recipient along with the released materials.

- The second one must remain in stock.

- The third remains in the authorized service for subsequent monitoring.

The card must indicate the date of issue, as well as the quantity of materials issued. The fact of release is confirmed by the signatures of an authorized warehouse employee (storekeeper) and the recipient.

The enterprise has the right to reduce the amount of documentation; for this, the card is issued in form M-17. It reflects the same information, and the recipient signs the warehouse record card. The card must bear the signature of the person authorized to release materials to production. The card in form M-17 is filled out in a single copy.

Forms M-8, 117, 62

The main forms of a limit-fence card are rightfully considered:

- Form M-8 - refers to the primary even documentation of the unified standard intersectoral form, which was adopted by Resolution of the State Statistics Committee of the Russian Federation No. 71a in October 1997.

- Form 62 - refers to primary accounting documentation, which is intended directly for writing off trade and material assets from the company’s warehouses in workshops or areas. Today, the document is not used, since it is not compiled in a unified form in primary documentation albums. Based on Order No. 119n of the Ministry of Finance of the Russian Federation of December 2001, the unified form M-8 is considered to be the accounting documentation for the write-off of inventory items.

- Form 117. A distinctive feature is that this is a specialized form that was adopted by the USSR State Agricultural Industry in March 1987.

It is worth noting that the last form considered was until recently used in the agro-industrial complex, but today it is no longer valid, just like form 62.

Actions before formation

Initially, the planning department and supply must issue a limit card with a fixed limit in several copies for a calendar month, and in some cases for a quarter, half-year, or calendar year.

It must necessarily include monthly tear-off coupons for the actual provision of trade and material assets. As noted earlier, one part of the card remains in the warehouse, the second is transferred to the accounting department.

In addition, the established limits must be justified and approved by the immediate management of the company. If there is a need to increase them, it is necessary to formalize the corresponding requirement and justify this fact.

Part one

- First, at the top of the document you need to put its number in accordance with the internal document flow.

- Then, below, enter the name of the enterprise, as well as the OKPO code (All-Russian Classifier of Enterprises and Organizations - information can be taken from the constituent documents).

- Next, the first table includes the date of drawing up the limit-fence card, the code of the type of operation (provided that such a system is used), the sender and the recipient (names of structural divisions).

- The next step is to enter information about the accounting subaccount, the analytical accounting code for materials that are written off, and the unit of goods issued.

Part two

The second part of the document includes a table with details of the materials being issued.

- First, the characteristics : name, grade, size, brand of product, then in the “limit” cell the exact quantity of goods (this column can be filled out by an employee who calculates limits on the use of material assets, or by someone who is personally involved in issuing the limit). fence cards), then the serial number of the registration card in the warehouse card index.

- Next, fill in the item number (if available), how much was supplied (including returns), then there is information about units of measurement : the name of the unit of measurement of a given product or material (kilograms, meters, pieces, etc.), as well as its code in accordance with OKEI (All-Russian Classifier of Units of Measurement).

- Then enter the cost of the goods (per piece) and the total amount (excluding VAT).

- After this, the table contains lines for a specific issue of inventory items, in which you must enter the date , quantity , remaining limit (provided that not all of it has been selected) and the signature of the storekeeper.

The limit-fence card must be certified by employees who are directly responsible for issuing materials and goods from the company’s warehouse, indicating their positions and signatures with a transcript.

Limit fence card

The release of materials from warehouses to the organization's divisions is formalized using a limit card in form N M-8, a requirement-invoice in form N M-11 and an invoice in form N M-15. These forms are given in Resolution of the State Statistics Committee of Russia No. 71a, adopted on October 30, 1997. From January 1, 2013, they are not mandatory. An organization may approve its own forms. However, in this case, the latter must have mandatory details that are established by law (in particular, the Federal Law “On Accounting” dated December 6, 2011 N 402-FZ, Art. 9).

Limit and intake cards are used not only for the release of materials, but also for monitoring compliance with limits. Also, using this document, materials not used by departments can be returned to the warehouse.

The supply department or other authorized department issues limit cards, usually in two or three copies. One of them is transferred to the recipient (the department to which the materials are issued), the second to the warehouse, and the third (if any) remains with the service that issued the card for control.

In the first two copies of the card, the person responsible for issuing materials puts down the date of issue and the quantity of materials issued. The recipient and storekeeper confirm this information with their signatures.

In order to minimize the number of primary accounting documents, it is allowed to register the issue of materials using accounting cards in the M-17 form. In this case, the limit card is drawn up in one copy, the recipient signs for receipt on the warehouse registration cards, and the card is signed by the person who issued the materials.

Typically, these documents are drawn up for one month, but if materials are sold in small quantities, cards can be issued for a quarter.

If there are several warehouses, limit and intake cards are compiled for each warehouse separately. Only those materials can be issued from the warehouse and in the quantities indicated on the card.

After the limit is used up, the cards are sent to the accounting department for accounting.

Limit-fence card (form N M-8)

It is used in the presence of limits on the supply of materials to register the release of materials that are systematically consumed in the manufacture of products, as well as for ongoing monitoring of compliance with established limits on the supply of materials for production needs and is a supporting document for writing off material assets from the warehouse.

The limit intake card is issued in two copies for one name of material (item number). Before the beginning of the month, one copy is transferred to the structural unit - the consumer of materials, the second - to the warehouse.

The release of materials into production is carried out by the warehouse upon presentation by a representative of the structural unit of his copy of the limit card.

The storekeeper notes in both copies the date and quantity of materials issued, after which he displays the remainder of the limit according to the item number of the material. The limit and intake card is signed by the storekeeper, and the limit and intake card of the warehouse is signed by a representative of the structural unit.

To reduce the number of primary documents, where appropriate, it is recommended to register the issue of materials directly in materials accounting cards (Form N M-17). In this case, expenditure documents for the release of materials are not drawn up, and the operation itself is carried out on the basis of limit cards, issued in one copy, and accounting documents that have no significance. The vacation limit can also be indicated on the card itself. When receiving materials, the representative of the structural unit signs directly on the materials accounting cards, and the storekeeper signs on the limit-fence card.

According to the limit-fence card, records are also kept of materials not used in production (returns). In this case, no additional documents are drawn up.

Excessive supply of materials and replacement of some types of materials with others is allowed only with the permission of the head of the organization, chief engineer or persons authorized to do so.

The limit is changed by the same persons who are granted the right to set it.

The release of material assets is carried out from those warehouses that are indicated in the limit-fence map. The storekeeper notes the date and quantity of materials issued on the limit card, after which he displays the remainder of the limit for each item number of materials. The warehouse delivers limit-fence cards to the accounting department after the limit has been used.

A limit-fence card form with partially filled in details can be issued using computer technology.

At enterprises where material assets are often written out in production, a limit-fence card

. The procedure for filling out the card is simple, but you still need to know a few important nuances.

Forms of limit-fence cards

- The M-8 limit-fence card is the primary accounting document of the unified standard intersectoral form, which was approved on October 30, 1997. Resolution No. 71a of the State Statistics Committee of Russia.

- Limit-fence card (form 62) is a primary accounting document intended for writing off inventory and materials from the enterprise’s warehouses to its workshops or areas. This form is no longer used, because... it is not compiled according to a unified form in the albums of primary accounting documents. Following the order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119N, the primary accounting documentation for the consumption of medical supplies from the warehouses of an enterprise to its divisions is a limit-withdrawal card (standard interindustry form N M-8).

- Limit fence card, form 117 - this is a specialized form approved by the State Agricultural Industry of the USSR on March 20, 1987 N 281-4. Previously used in the agro-industrial complex, but also lost its effectiveness, like form 62.

Limit-fence card: sample filling

To release material assets from warehouses, you can use both independently developed fence card templates and standard forms:

- form M-8, which is a universal intersectoral template;

- the limit-receipt card of Form 62, which was created to reflect the procedure for writing off from a warehouse at a production department, can be taken as a basis;

- form M-28 - a limit-receipt card in construction, which is maintained throughout the entire construction cycle for one object (excessive supply of materials for it is not practiced; for this purpose, an invoice-request is additionally issued);

- form 117-APK. This option is one of the forms used only in certain areas. Limit-fence card form 117-APK is a specialized document intended for the agricultural industry. The template was put into circulation back in the USSR, but after the appearance of the inter-industry sample M-8 it was declared invalid (as was sample 62 of the form). The 117-APK limit fence map can be used as a basis when developing your own template.

The main thing is that in the end the document contains all the required details:

- data identifying the company that owns the material resources being issued;

- the recipient of the goods and materials must be indicated (department, workshop);

- date of registration of the form;

- limit size for specific materials;

- information certificate on products sold;

- signatures of the responsible persons (the employee who set the limit, the recipient and the storekeeper).

The seal is not a mandatory element, since the document is internal in nature. A collection card (form M-8) is issued separately for each storage location and for each type of material. If the limit is reached, the warehouse employee submits the completed card to the accounting service. The management of the enterprise is obliged to ensure the safety of the form for a period of five years.

The limit fence map consists of two blocks:

- The first part provides general background information. The number and date of the document, the details of the enterprise, the structural units involved in the movement of goods and materials, synthetic and analytical accounting accounts of valuables written off from the warehouse, and units of measurement are reflected here.

- The second block of the document contains data on the characteristics of inventory items, including their type, brand, and dimensions. The established limit for products and the nomenclature code of materials, the name of the unit of measurement with the OKEI code must be indicated. At the time of issuance of valuables, data is entered on the exact volume of products issued, returns, their cost and the amount of the batch issued excluding VAT.

Frequency of filling out the card

Typically, the limit and intake card is drawn up monthly, but if we are talking about small batches of materials, it can be filled out quarterly. If material arrives at the production site from several warehouses, then for each of them a card is issued personally - it indicates the quantity of materials issued, the date of receipt and the signature of an authorized person. After the materials are used up, the limit card is transferred to the enterprise accounting department for control.

A limit intake card is issued when the organization has approved a limit for the release of materials into production. They draw up a map for only one type of material. At each issue of materials, entries are made in the card about the amount of material issued and the balance of the limit. Materials are released according to the limit-fence card only from one warehouse indicated in the card.

Is it necessary to use limit cards?

The limit-fence card (form M-8) can be used by enterprises as an approximate sample, because Article 9 of the Federal Law dated 06.12.11 No. 402-FZ on “Accounting”, from 01.01.13, the requirements for the use of unified forms of primary accounting documentation were canceled.

Cards are necessarily used in enterprises where there are limits on the supply of materials, often in mass food production.

With the advent of automated accounting, the need for limit cards is gradually disappearing; this applies to non-standard, small-scale production. If the enterprise does not have internal regulations requirements regarding the form of accounting for MC consumption, then it can only be maintained in electronic form, without issuing a paper copy.

Sample limit-fence card

At the same time, subject to interchangeability, it is possible to enter several types, adding a specific type to the cards. The document is generated in several copies:

- one must be provided personally to the recipient of the materials or products;

- the second must be in the warehouse (meaning the sender).

After the established limit has been used in full, the storekeeper must transfer the documentation to the company’s accounting department.

Moreover, according to the established rules, cards must be transferred on a regular basis, once every 1 calendar month. It is recommended to transfer the limit card simultaneously with reports regarding the movement of materials or products (in strict accordance with the developed company schedule). The card in question must be stored according to the same rules as other internal documentation of the company - at least 5 years (a longer storage period is possible solely on the personal initiative of the company management).

I would like to note that long-term practice of using limit-fence cards has shown that there are no difficulties in the formation of this document, and therefore any problems due to its incorrect execution are extremely rare.

Initially, the planning department and supply must issue a limit card with a fixed limit in several copies for a calendar month, and in some cases for a quarter, half-year, or calendar year.

It must necessarily include monthly tear-off coupons for the actual provision of trade and material assets. As noted earlier, one part of the card remains in the warehouse, the second is transferred to the accounting department. In addition, the established limits must be justified and approved by the immediate management of the company.

If there is a need to increase them, it is necessary to formalize the corresponding requirement and justify this fact.

Due to the fact that the document in question can be generated in various forms, it is recommended that you familiarize yourself with the most popular domestic companies.

It is worth noting that the limit-fence card in form M-28a is formed according to the same rules as M-8. In fact, there are no differences between them.

Additionally, it is necessary to pay attention to the fact that in the process of entering all the necessary information into the document, it is prohibited to make any errors or typos, since in such a situation disagreements with regulatory authorities may arise.

Documents for downloading (free of charge) The release of construction materials for work that is carried out on one’s own is carried out on the basis of documents such as:

- Limit-fence cards (formed according to the form M-28, M-28a). The card means the release of materials for which

Fuel and lubricants issue record sheet

All enterprises whose activities are related to the provision of logistics services, and which have vehicles on their balance sheet, need a fuel and lubricants (fuels and lubricants) accounting sheet. This document fully displays when, to whom and in what volume the use of fuel or other fuels and lubricants was paid. For an accountant at a logistics company, this paper is one of the most frequently filled out.

On what basis is fuel provided?

The issuance of fuel and lubricants is carried out strictly if the driver has waybills. No receipts, certificates or statements can be the basis for the formation of a document. In order to verify the fact of presentation, the accountant (or any other person appointed financially responsible for fuel and lubricants) signs on the waybill, and the driver – on the statement.

Inspection authorities are usually interested in whether the taxpayer’s expenses are justified. In addition, it is necessary to prove that the consumption of fuels and lubricants is directly or indirectly related to the generation of income by a specific organization.

According to paragraph 1 of Art. 264 of the Tax Code of the Russian Federation, expenses associated with the purchase of gasoline, gas and other types of fuel and lubricants can be taken into account both in accounting and tax accounting.

What does the document look like and fill out?

The paper has three parts:

- Introduction, top. It indicates the serial number of the statement, the name of the organization itself, the brand, the name of the petroleum product issued, the date, and the full name of the person responsible for the issue.

- Middle part of the statement. It is presented as a table with columns to fill out. It must indicate: the model and number of the car, the number of waybills, the driver’s full name, his personnel number, how much fuel and lubricants was issued in liters in numbers and words.

Important point! The driver’s signature must appear directly in the table, in the last column, opposite the number of each waybill (if there are several of them).

Also mentioned in the tabular section are receipt coupons. If an organization issues gasoline through transport cards, then the presence of this column is not necessary.

- The final part of the paper. It is on the back and consists of the phrase “In total, according to statement number______ issued______.” Also at the end, the person who issues the document and the person who checks the information specified in the power of attorney signs. At the very end the seal of the organization is affixed.