Note 1

The main purpose of the existence of any commercial organization is to obtain the maximum level of income, which is measured in cash equivalent.

To start the existence of any business entity, borrowed or equity capital is required. Cash is an investment in the future assets of the enterprise. With the start of business, the initial capital undergoes many transformations, the result of which is the receipt of profit, or cash. This cycle is continuous, and its effectiveness directly affects the profitability and profitability of the organization.

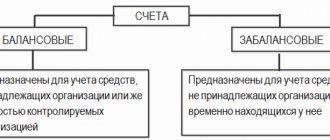

Figure 1. Types of funds. Author24 - online exchange of student work

Finished works on a similar topic

- Course work Funds of the organization 460 rubles.

- Abstract Funds of the organization 260 rubles.

- Test work Funds of the organization 230 rubles.

Receive completed work or specialist advice on your educational project Find out the cost

What do different types of cash flows provide to an organization?

Cash flow (CF) is a continuous process of movement of cash and non-cash money. All types of economic and financial activities of a company are accompanied by income and costs.

The economic activity of each organization is inextricably linked with the inflow and outflow of funds, the receipt of various payments and payments that are distributed over time.

Different types of cash flows of an organization are combined into a single financial flow, which is an independent object of the resource management system. The strategy of distribution and synchronization of various DPs plays a critical role in the economic development of an enterprise. Financial management is reflected in the final result of activities; it is impossible to ensure the effective operation of an enterprise in the conditions of the modern market. Every year new companies appear on the consumer market. But why do some of them successfully develop and increase profits, while others go bankrupt?

A properly organized financial resource management system and the use of modern methods of distributing funds make it possible to optimize not only the company’s economic activities, but also to ensure profitable investments, create conditions for economic well-being and prosperity, achieve set goals and achieve high performance.

Effective management of various types of cash flows of an organization ensures:

- Financial balance, stability and profitability of the enterprise, which depend on the uniformity of movement and the level of synchronization in volume and time of different types of cash flows. The higher the level of synchronization, the faster strategic goals are realized and the more intensively the company develops.

- Rational use of the company's financial resources, which allows reducing credit dependence and minimizing the enterprise's need for borrowed funds.

- Reducing the risk of insolvency when an organization cannot meet its financial obligations on time and in the required quantities.

Synchronizing the flow of money is a critical part of the company's anti-crisis plan. The imbalance of various types of cash flows of an organization increases the risk of insolvency and bankruptcy of even a successful enterprise.

Competent and effective financial management helps to generate additional profits and increase the assets of the enterprise. It is necessary to include even temporarily free residual funds into circulation and continuously increase investment resources.

With a high level of synchronization of income and expenses in volume and time, the company’s real need for the current and insurance balance of funds is reduced. This management strategy is aimed at reducing the reserves of investment resources that are formed in the process of real investment.

Competent financial management helps to open new sources of profit. Effective management of various types of cash flows allows you to generate additional resources for investment (investments) - placement of capital in order to make a profit.

Borrowed

Most often, enterprises need additional current assets; this is due to a long production cycle, receivables not repaid in a timely manner, force majeure, etc. In this case, the owners of the company decide to attract an asset such as someone else’s money. Depending on the volume, terms and fees for their use, there are several loan options. Assets in joint stock companies are attracted by additional issue of securities, municipal and federal enterprises are financed from the budget, subsidiaries use the resources of the parent company. Organizations of any legal form of ownership can attract funds from a bank or other credit institution as a loan. In this case, the source of money received and accrued interest under the agreement are reflected in the liability side of the balance sheet, and the funds received are included in assets. By agreement with the lending party, funds can be transferred to a current account, to the cash desk of an enterprise, or transferred as monetary documents, securities, or debt obligations of third parties (assignment agreement).

Main types of cash flows of an organization

Types of cash flows of an organization by direction of movement:

- Positive cash flow (PDF) or cash inflow is the amount that flows into the organization’s account from all types of transactions.

- Negative cash flow or cash outflow is the amount of payments for all types of transactions.

- A single comprehensive object of financial management – RAP and EDP. These two types of cash flows of an organization are closely interrelated. A reduction in one type of financial flow over a certain period of time leads to disruption of synchronization and a reduction in the flow of the second type.

Types of cash flows of an organization by management levels

(financial responsibility centers, projects, activities):

- DP for financial services of the enterprise as a whole.

- DP for financial services of individual structural divisions and central financial districts (financial responsibility centers) of the company.

- DP for individual financial transactions that are subject to independent management.

Effective financial management allows you to analyze and timely assess the most vulnerable areas of fund management in order to immediately plan and take appropriate anti-crisis measures.

Types of cash flows of the organization by type of activity:

- DP for current activities. It includes income from all completed sales, advances received from customers, payments from auxiliary operations, settlements with suppliers, payroll, and tax deductions.

- DP on investment activities. This includes all types of financial transactions related to the purchase of property and the sale of long-term assets.

- DP on financial activities. Combines various credit receipts, loans, repayment of interest on loans, payment of dividends on securities (shares, bills).

Types of cash flows of an organization in relation to the company:

- Internal (IDP) – movement of money within the enterprise.

- External (VDP) – the movement of financial resources between an enterprise and its counterparties (suppliers, customers).

Types of cash flows of an organization by calculation method:

- Cumulative (ADP) – the entire amount of receipts or payments of funds for a period of time at intervals.

- Net (NPP) – the difference between positive (PDP) and negative (NPD) flows for a period of time by intervals.

Net DP is of great importance for determining the market value and financial position of the enterprise; it determines the performance of the company.

NPV can be calculated for the enterprise as a whole and for individual financial responsibility centers (FRC). The calculation is performed using the formula:

Amount of NDP for the period = Amount of DDP (funds received) for the period – Amount of DDP (funds paid) for the period.

The amount of NPV affects the size of the company's financial assets. The NPV indicator can be either positive or negative.

Types of cash flows of an organization by level of balance:

- Balanced (SDP) can be calculated for the enterprise as a whole, for a separate center of financial responsibility, for a specific operation.

The balance between individual types of cash flows of an organization for a period is calculated using the following formula:

Amount of DDP = Amount of DDP + Provided increase in the amount of cash reserves.

- Unbalanced (NDP) is a deficit or surplus (excess) total financial flow. In case of insufficient funds or excess of income over expenses, the balance is not ensured.

Types of cash flows of an organization by time period:

- Short-term (KDP) - the calculation is made for a certain period, from the beginning of receipt of payments to the end, but not more than 1 year.

- Long-term (LTD) - calculated over a period of more than 1 year, from the beginning of receipt of payments until the end of a certain period.

Short-term DP refers to the current and partly to the financing activities, and long-term DP refers to the investment and partly to the financing activities of the company. For example, these could be long-term loans or loans. Calculations of KDP and DDP are used for individual operations of the enterprise.

Types of cash flows of an organization by importance in the formation of financial results:

- Priority (PDP) is a high level of NPV or net profit of the enterprise, for example, from the sale of goods.

- Secondary (VDP) - has an insignificant volume, therefore it does not significantly affect the financial results of the company (for example, the issuance of accountable funds).

Types of cash flows of an organization using the time estimation method:

- Current (TDP) – the indicator is compared with the value at the current time.

- Future (FDP) - the indicator is compared with the cost at a certain future point in time.

Most often, classification according to the time estimation method is used when determining the future profit of an enterprise - discounting.

In accordance with international financial accounting standards, an organization's cash flows are divided by type of economic activity:

- DP for operating activities - payments to suppliers of raw materials, deductions for the services of third-party contractors.

- DP for investment activities - payments and receipts when investing.

- DP for financial activities - payments and receipts related to attracting equity or other funds, obtaining long-term or short-term loans and borrowings.

The above classification is necessary for accounting, effective planning and analysis of the continuous cash flow of the enterprise. Competent financial management is based on a standard financial accounting system.

Definition

An enterprise's cash is the most liquid share of its current assets. The source of their formation depends on the legal form of the organization and the type of its activity. With all the variety of placements, funds are reflected only in the asset balance sheet of the enterprise. Relationships with government tax authorities, counterparties (suppliers and buyers), extra-budgetary funds, company employees, its partners, owners and founders are based on monetary payments. The reliability and solvency of an organization depends on the correct redistribution of financial flows and the availability of a certain free volume of its own monetary assets.

Other important types of cash flows for an organization

In addition to the above financial accounting classification system, there are other, equally important types of cash flows of an organization:

- Excess (IDP) - the amount of financial receipts exceeds the company's spending needs. The presence of financial excess indicates insufficiently effective planning and use of enterprise resources. Excessive DP indicates lost profits for the company, since money depreciates as a result of inflation.

- Deficit (DS) - means that incoming funds are not enough to fully meet the company's needs. A shortage of funds leads to a deterioration in the financial position of the enterprise, its economic development slows down, and the consequences can be critical.

- Discrete (DCF) - income or costs of a company associated with the performance of single transactions in a certain period, for example, the acquisition of an intangible asset or gratuitous receipts.

- Regular (RDP) – income or expenses of an enterprise associated with constantly carried out business operations over time periods.

Regular DP of a company can be uniform or uneven. This is due to the frequency of receipt of financial resources as a result of the company’s business operations.

The considered types of cash flows of an organization may differ only within a certain period of time. With a minimum period of time, all financial flows will be discrete, and over a long period they can be considered regular.

Top 3 articles that will be useful to every manager:

- Financial control at the enterprise

- Net profitability of the enterprise

- How to build a company's financial structure

Equivalents

Part of its own current assets that are not currently involved in production processes can be transferred by the organization into monetary documents (quickly sold), securities (bills, shares, options, bonds), placed in deposit accounts, invested in other companies (including including subsidiaries). In this case, funds may lose some of their liquidity due to the period of cashing out, but at the same time they will retain (in some cases increase) their original value. Storage of equivalents of current assets is regulated by internal documents of the enterprise. The most common and safest method is to place them in a safe deposit box, while the most liquid ones can be stored in the organization’s cash desk.

Analysis of various types of cash flows of an organization

Here we should consider in detail why we need an analysis of the movement of various types of cash flows of an organization (CAF). Well-organized financial accounting of the moments and values of inflows (IAP) and outflows (ODP) of funds at an enterprise makes it possible to determine the financial stability and profit of the company. This type of analysis is also called operational, since the calculations take into account income and costs from operating (current) activities.

Analysis of the inflows and outflows of an enterprise's funds is an important part of financial management, since it is on its basis that a strategic development plan for the company is drawn up, taking into account the self-financing capabilities of the enterprise, its financial potential and profitability.

Increasing financial resources directly affects the economic well-being of the enterprise. Without generating a stable profit, it is impossible to cover the company's debt obligations. Financial shortages usually lead to a crisis. An excess of available funds usually indicates an unprofitable enterprise.

The company's unprofitability is due to two main factors - inflation and missed investment opportunities. An enterprise can receive additional income from profitable investment of excess funds. Analysis of the movement of various types of cash flows of an organization allows us to identify its actual financial position.

Analysis of aggregate indicators of inflows and outflows of funds is the most important characteristic of the stability and sustainability of a company. Only the analytical method makes it possible to determine the effectiveness of financial management and identify the financial potential of an enterprise.

To analyze the financial condition of the company (to calculate the ADP), it is necessary to calculate the outflow (ODP) and inflow (APP) of funds for the period of time for which the loan, credit or loan was taken out. For example, when borrowing funds for 1 year, the analysis (ADP) is done on an annual basis. If the loan term is up to 90 days, then an analytical calculation (ADP) is made for the quarter.

Elements of financial inflow for the period:

- A company's profit earned in one specific period.

- Depreciation accrued over one specific period.

- Release of financial resources from: inventories, accounts receivable, fixed assets, other assets.

- Increase in accounts payable.

- Growth of other liabilities.

- Increase in share capital.

- Issuance of new loans.

Elements of financial outflow for the period:

- Payments: taxes, interest, dividends, fines and penalties.

- Additional investments in: inventories, accounts receivable, other assets, fixed assets.

- Reducing accounts payable.

- Reduction of other liabilities.

- Outflow of share capital.

- Repayment of loans.

An indicator of a company's total cash flow (TCF) is the difference between the inflow (TCF) and outflow (TCF) of funds. Any changes in the financial reserves of the enterprise, accounts receivable and payable, other assets and liabilities, fixed assets in one way or another affect the cash flow indicator. To determine the real degree of such influence, it is necessary to compare the indicators of residual funds for various items of inventories, debtors, and creditors at the beginning and end of a certain time period.

If an increase in the balance of financial reserves, debtors and other assets for a specific period is detected, then the final result of the calculation is recorded with a “-” sign and indicates an outflow of money. A decrease in the balance of funds is recorded with a “+” sign and indicates an influx of capital. An increase in creditors and other liabilities is considered as an inflow of funds, and a decrease in them is an outflow with a “-” sign.

When analyzing the movement of various types of cash flows of an organization, it is necessary to take into account some features in determining the inflow and outflow of funds. This is due to changes in fixed assets. When performing calculations, one should take into account not only the increase or decrease in the value of their balance over a certain time period, but also the final indicator of the sale of part of fixed assets for a specific period. If the sales price exceeds the book value, this indicates an influx of funds. If the balance sheet value exceeds the selling price, then we are talking about an outflow.

The inflow or outflow of funds due to changes in the value of fixed assets is calculated using the formula:

Inflow (outflow) of funds due to changes in the value of fixed assets = Cost of fixed assets at the end of the period - Cost of fixed assets at the beginning of the period + Results of sales of fixed assets during the period.

The indirect analytical method of ADP is based on grouping the elements of inflow and outflow of funds into areas of management, which in turn are divided into blocks:

- enterprise profit management;

- inventory and settlement management;

- management of financial obligations;

- tax and investment management;

- management of the ratio of equity capital and loans.

ADP by direct analytical method is performed as follows:

Total Cash Flow (Net Cash) = Increase (decrease) in cash from operating activities + Increase (decrease) in cash from investing activities + Increase (decrease) in cash from financing activities.

Calculation of the first term:

Revenue and sales - Payments to suppliers and personnel + Interest received - Interest paid - Taxes.

Calculation of the second term of the total cash flow:

Proceeds from the sale of fixed assets - Capital investments.

Calculation of the third term:

Loans received - Repayment of debt obligations + Issue of bonds + Issue of shares - Payment of dividends.

To perform an ADP, it is necessary to have data for at least three past years. If an enterprise has a stable excess of inflows over outflows of funds, then it can be considered financially stable and creditworthy. Even a short-term excess of outflows over inflows, as well as all fluctuations in the value of the total DP, indicate insufficient stability and low creditworthiness of the company.

If the amount of outflow systematically exceeds the amount of inflow, then the enterprise is characterized as uncreditworthy. A positive total DP (inflows exceed outflows) indicates the size of the tolerable loan that a firm can obtain.

Analysis of different types of cash flows of an organization allows us to determine the weak link of financial management. For example, the cause of outflow may be insufficiently thought-out management of financial reserves, settlements (debtors and creditors), and financial payments (taxes, interest, dividends).

Identifying deficiencies in capital management is necessary for the correct development of lending terms, which will be reflected in the loan agreement. For example, if the main reason for the outflow of finance is the excessive diversion of funds into payments, then maintaining the turnover of accounts receivable during the entire period of using the loan at a certain level can become a favorable condition for lending.

If the reason for the outflow was an insufficient share capital ratio, then the main condition for lending can be considered compliance with a certain standard level of the financial leverage ratio (leverage) - management of the company's assets and liabilities in order to make a profit.

It is more convenient to analyze the inflow and outflow of funds using a report on the flow of funds. In accordance with the international standard IAS7, “Report on changes in financial position” (put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated December 28, 2015 N 217n) is the main source of information for analysis (ADP). It is compiled not according to the sources and directions of movement of funds, but according to the areas of activity of the organization - operating (current), investment and financial.

When drawing up a statement of cash flows and changes in the financial position of the enterprise, the indicators of cash received by the organization as a result of its activities are determined:

- operating room (current);

- investment;

- financial.

Balance sheet and income statement data are used to generate the cash flow statement.

Cash

A limited portion of the organization's monetary assets may be present in the cash register. The sources of cash receipts are proceeds from sales, withdrawal of part of the assets from the company’s accounts, return of subaccounts, etc. Also, some of the most liquid monetary documents and securities that will be used in the near future can be stored in the company’s safe. For each business entity, the volume of these current assets is regulated by internal documents and current needs. Cash is most often used for emergency needs, travel expenses, wages, compensation and vacation payments. Some contractual obligations due to small volumes or conditions of the counterparty may be covered by the required amount of cash on a specific date. The amount of money in the cash register may exceed the permissible level for three days, then the unused cash is deposited into the current account. Amounts of wages not paid on time are deposited, and unsold monetary documents are transferred to a bank safe. To work with cash and monetary documents, the cash register premises are equipped taking into account security requirements, and the cashier or the accountant appointed by the order bears full responsibility for material assets.

Consumption

As a result of the functioning of the enterprise, regardless of the type of activity and legal form, there is an outflow of part of the funds. Its main directions are:

- payment of wages to employees;

- tax payments to budgets of various levels and extra-budgetary funds;

- acquisition of current and non-current assets, intangible assets (payment to suppliers);

- rental, leasing payments;

- repayment of loans, loans received;

- payments to owners, founders;

- purchase of securities, investments in subsidiaries;

- amounts issued on account;

- payment of penalties, claims from buyers, tax authorities, etc.;

- loans provided.

The outflow of part of monetary assets is associated with the current, financial and investment activities of the enterprise. In this case, expenses related to the main area of work are mandatory.

Documentation

To reflect the movement of funds in each account, approved register forms are provided. Documents must contain a number of mandatory details and be signed by responsible persons who are appointed by internal order of the enterprise. To record cash at the cash desk, the following documents are used:

- receipt order;

- withdrawal slip;

- cash book;

- journal PKO and RKO (registration and numbering);

- cash receipts (when using cash register machines).

When moving non-cash assets, using special and foreign currency bank accounts, the following documents are used:

- payment order;

- payment request;

- announcement for cash contribution;

- bank statement for a current (special, foreign currency) account;

- checks;

- letters of credit.

Cash documents and transfers in transit include the following cash equivalents:

- stamps;

- securities;

- paid, but not issued travel documents (railway, air tickets);

- vouchers, etc.

The general requirement for monetary documents is the absence of corrections, the presence of appropriate signatures and seals, and the correct completion of all necessary details. If the completed form does not comply, it is considered invalid, and accordingly, the operation to transfer funds is not carried out.

Admission

When creating any enterprise, its main (current) line of activity is determined, as a result of which it will receive income (PBU 9/99). Sales of manufactured products, purchased goods, work performed, services provided are the main source of the formation of the money supply. At the same time, the company can make a profit from investment and financial activities. The main channels for increasing the monetary assets of any enterprise are:

- revenue from customers when selling products;

- proceeds from the sale of non-current and current assets;

- gratuitous receipts from owners and third parties;

- special-purpose financing;

- compensation for material damage caused;

- return of accountable amounts;

- received loans, loans, credits;

- sale of securities;

- returns from suppliers (advance payments, penalties);

- interest on loans provided to other organizations;

- issue (release) of securities (for a joint stock company).