How is debt payment carried out by a third party?

The debtor may entrust the fulfillment of contractual obligations to a third party, in accordance with Art. 313 of the Civil Code of the Russian Federation, unless the contract strictly stipulates that the debtor must personally fulfill the obligations.

The conditions for the participation of a third party must be documented. For this:

- The buyer sends a notice to the creditor indicating information about the third party who is subject to contractual obligations;

- The debtor sends a letter to the third party in which he describes the relevant contractual obligations.

All letters can be formatted in any form in accordance with the rules of a business letter, which details the details of the parties and complete information on calculations. The presence of written notifications allows you to avoid tax claims, since VAT and income tax have already been accrued and only the debt is paid.

How to make a debt adjustment when transferring debt, writing off debt and when offsetting advances in the 1C 8.3 program, read our article.

Justifications for payment of taxes by third parties

The Tax Code of the Russian Federation does not require concluding an agreement with third parties who make payments to the budget for taxpayers. To account for incoming insurance and tax payments, their civil grounds are not important (Letter of the Federal Tax Service dated September 26, 2021 No. ZN-3-22 / [email protected] ).

At the same time, legal entities need to reflect the movement of funds in current accounts in their financial statements. You can’t do without supporting documents here. The Federal Tax Service (hereinafter referred to as the Federal Tax Service) recommends that you be guided by the norms of civil legislation (Letter of the Federal Tax Service dated September 15, 2021 No. BS-4-21 / [email protected] ).

Individual entrepreneurs and other organizations can act as other persons when paying taxes, without being counterparties. In these cases, to determine the timing and procedure for paying taxes, a loan or assignment agreement is concluded.

This method of making tax payments does not contradict the norms of civil legislation. The Regional Office of the Federal Treasury cannot refuse to fulfill an obligation to a third party if it was imposed on him by the debtor (clause 1 of Article 313 of the Civil Code of the Russian Federation).

Under a loan agreement, another person transfers money to the taxpayer, who undertakes to return it in the same amount to the lender (clause 1 of Article 807 of the Civil Code of the Russian Federation). The text of the document specifies:

- loan disbursement period;

- method of providing a loan - transfer of funds to a third party;

- availability of interest on the loan.

In practice, when taxes, insurance premiums and fees are paid by a third party, an interest-free loan agreement is concluded. In this case, the amount saved on interest is considered income, and you need to pay tax on it.

Sample interest-free loan agreement.

In an agency agreement, where an individual entrepreneur or organization is the principal, and a third party is the attorney, it is important to provide for:

- deadlines for paying taxes, insurance premiums and fees;

- liability of a third party for their untimely inclusion in the budget;

- a method of returning money to a third party if the individual entrepreneur or organization did not have it or did not have enough at the time of payment. The principal is obliged to reimburse the attorney for expenses and provide funds for the execution of the order (Clause 2, Article 975 of the Civil Code of the Russian Federation).

The agency agreement does not have a unified form, but its provisions must comply with the norms of Chapter 49 of the Civil Code of the Russian Federation.

Sample gratuitous agency agreement.

According to the Civil Code of the Russian Federation, the principal is obliged to pay remuneration to the attorney, unless otherwise provided by the agency agreement (Clause 1, Article 972 of the Civil Code of the Russian Federation). But when taxes are paid by a third party, the text of the agreement can include a clause stating its gratuitous nature and the principal’s compensation for the attorney’s expenses for the fulfillment of obligations.

Tax authorities are attentive to the execution of gratuitous agency agreements and sometimes recognize them as gift agreements. Donation between legal entities and individual entrepreneurs is unacceptable.

Recognizing the payment of taxes under an agency agreement between legal entities or individual entrepreneurs as a gift entails the invalidity of the transaction. In this case, the provisions of Art. 166 - 168 of the Civil Code of the Russian Federation. Recognizing a transaction as invalid obliges each party to the contract to return to the other everything received under this transaction.

An interest-free loan entails problems: the recipient will have to pay personal income tax on the savings on interest on the loan. For tax authorities, the very fact of transferring something for free is a signal that they need to “dig” deeper and more carefully.

But a regular “interest-bearing” loan in this case is not much better. After all, it must be repaid later, and with interest. What should you give if the money went to pay taxes?

Thus, the loan will “freeze”, and the following options are possible:

- When checking, tax authorities recognize it as the recipient’s income with all the ensuing consequences in the form of additional taxes, fines, penalties, etc.;

- A debt forgiveness agreement will be concluded. But for the recipient of the loan, this will again be taxable income, perhaps without penalties.

That is, in this case it is better not to get involved with a loan at all.

A gratuitous agency agreement is also not the best option, because inspectors very carefully analyze all gratuitous transactions. In order not to create problems for yourself, it is better to conclude such an agreement, providing for a minimum payment.

— Dmitry Fedorov, more than 15 years of experience in the field of accounting and finance

In relations with a counterparty, you can limit yourself to a letter of request to make payments to the budget. It indicates the purpose of the payment and taxpayer identifiers. The letter can also be written to an individual.

Sample letter of request to a counterparty for payment of taxes

If the agreement concluded with the counterparty specifies a different procedure for payment for goods or services, the parties can sign an additional agreement. It indicates how much the counterparty contributes to the budget to pay what taxes, and not to the current account or cash register of an individual entrepreneur or organization. An agreement signed by both parties to the contract does not require a letter of request.

Sample additional agreement to the supply contract.

How to pay a debt by a third party in 1C 8.3

Let's look at an example:

TH COMFORT purchased goods from the supplier UYUT LLC for a total amount of RUB 84,842.00. incl. VAT 18% – RUB 12,942.00. The goods arrived on March 25, 2016. Before payment, the buyer receives a letter from the supplier in which he asks to repay the debt for the goods supplied to the third organization LLC "LETO" to adjust the debt.

Let's look at the solution of the example step by step in the 1C 8.3 Accounting program.

Step 1

Let's create a balance sheet for account 60 in the section Reports - Standard reports - Account balance sheet. According to the report, we see that the counterparty UYUT LLC has accounts payable in the amount of RUB 84,842.00:

Step 2

To transfer the amount – RUB 84,842.00. the third organization LLC "LETO" needs to create a Payment Order document and a Bank Statement document.

Let's create a Payment order document in the Bank and cash desk - Bank - Payment order section. In this document:

- In the line Type of operation we indicate Payment to supplier;

- In the line DDS Article we indicate Payment for goods, works, services, raw materials and other current assets;

- We fill out the remaining lines as shown in the figure:

Based on the Payment order document, we will create a Bank statement document in the Bank and cash desk section – Bank – Bank statements – Write-off:

Let's fill out the document:

- In the line Type of operation we indicate Payment to supplier;

- In the line Settlement account we indicate the account 60.01;

- In the line Advances account we indicate the account 60.02;

- In the Account line, indicate account 51;

- The data specified in the Payment Order document is automatically transferred:

Step 3

Let's create a balance sheet for account 60 in the section Reports - Standard reports - Account balance sheet. According to the report, we see that the counterparty Leto LLC has accumulated receivables in the amount of RUB 84,842.00:

Step 4

In order to offset the accounts receivable of LLC "LETO" against the accounts payable of LLC "UYUT" in 1C 8.3, you need to create a Debt Adjustment document.

So, let’s create a document Debt adjustment in the section Purchases – Settlements with counterparties – Debt adjustment. Let's fill out the document:

- In the line Type of transaction we indicate Advance offset;

- In the line Offset advance payment we indicate to the Supplier;

- In the line For debt we indicate Our organization to a third party;

- In the line Supplier (debtor) we indicate the counterparty LLC "LETO";

- In the line Third party (creditor) we indicate the counterparty, UYUT LLC;

- Fill out the Advances to supplier (accounts receivable) tab using the Fill in mutual settlement balances button:

- Fill in the Debt to a third party (accounts payable) tab using the Fill in mutual settlement balances button:

Let's process the document and generate postings. Based on the transactions received, we see that the accounts payable of the counterparty UYUT LLC were offset against the accounts receivable of the counterparty LETO LLC:

How in 1C 8.3 to carry out netting directly with a buyer or supplier or to carry out three-way netting, read the next article.

Step 5

Let's create a balance sheet for account 60 in the section Reports - Standard reports - Account balance sheet. According to the generated report, we see that there is no debt with the supplier UYUT LLC and the third party LETO LLC:

We recommend watching our seminar, which discusses popular tax schemes that attract the attention of tax authorities. This includes considering questionable transactions on taxpayer accounts; use in economic activities; use of fictitious intermediaries:

Give your rating to this article: (

1 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Procedure for paying taxes by other persons

Payment of taxes, insurance premiums and fees by a third party does not entail liability for him to the tax authorities and the budget of the Russian Federation. However, there are restrictions on making payments.

Do's and Don'ts

Other persons may pay for an individual entrepreneur and organization any fees, taxes, state duties, fines administered by the Federal Tax Service of the Russian Federation. Taxpayers make payments on their own when there is a direct indication of this in the law. For example, compulsory insurance against industrial accidents and occupational diseases. These insurance contributions are administered by the Social Insurance Fund of the Russian Federation, so the taxpayer pays them independently. There is an indication of this in paragraph 3 of Art. 2 of the Tax Code of the Russian Federation and clause 1.1 of Art. 22 of the Federal Law of July 24, 1998 No. 125-FZ (as amended on March 7, 2018).

When paying taxes, insurance premiums and fees by other persons, there are other restrictions:

- Another person cannot demand the return from the budget of funds that were contributed on behalf of the taxpayer;

- You cannot re-credit an overpayment of taxes from a third party in favor of an individual entrepreneur or organization. It can offset the amounts of overpaid taxes only in favor of its arrears and upcoming payments, or return it to itself upon a personal application;

- You cannot pay VAT on a specific business transaction related to the sale of goods and services to another person. Payment can only be made at the end of the tax period. If an individual entrepreneur buys a batch of fur hats worth 150,000 rubles from Firs-Group LLC, he will not be able to pay VAT for the seller on this transaction (Letter of the Ministry of Finance of the Russian Federation dated June 9, 2021 No. 03-02-07/1/37101).

When paying taxes by another person, you can:

- Pay off the arrears of an individual entrepreneur or legal entity for the past period, even before the amendments to Art. 45 Tax Code of the Russian Federation;

- Take into account the amount of payments made in the taxpayer’s expenses, but only after repayment of the debt to the person who paid for the taxpayer (clause 3, clause 2, article 346.17 of the Tax Code of the Russian Federation);

- Refund the amount of tax overpaid by another person. This can only be done by the taxpayer himself by contacting the tax authority at the place of registration.

When making tax payments for individual entrepreneurs and organizations, a third party does not need to confirm the origin of the funds.

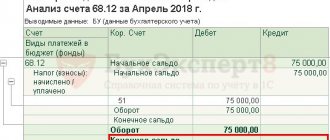

Reflection of payments from third parties in accounting

Payment of taxes by third parties, individual entrepreneurs and organizations, is reflected in accounting entries. The debit and credit accounts depend on the justification for the payments.

Posting if there are receivables from the counterparty

In writing, LLC “A” turns to the counterparty LLC “B” with a request to pay taxes to pay off the debt owed to it for the supply of goods. The tax payment is 10,251 rubles, the amount of debt is 10,000 rubles.

Posting of LLC "A" (taxpayer)

Entries in taxpayer accounting

Posting to LLC "B" (third party)

Postings in the accounting records of the counterparty

Posting when paying taxes by a third party under an interest-free loan agreement

If there were insufficient funds in the account of LLC “A”, its general director entered into an interest-free loan agreement with the counterparty LLC “N”. The loan amount of 15,550 rubles was provided to LLC “A” for a period of 10 months with the transfer of funds to the budget to pay taxes.

Posting of LLC "A" (taxpayer)

Entries in taxpayer accounting

Posting LLC "N" (third party)

Postings in third party accounting

An interest-free loan is not reflected in the debit of account 58.3, since it does not generate income. The movement of funds under the loan agreement is not taken into account as part of income and expenses (clause 10, clause 1, article 251 of the Tax Code of the Russian Federation). To record a long-term loan (for a period of more than 12 months) in the posting, use account 67 “Settlements for long-term loans and borrowings” instead of 66.

Posting when depositing own funds into a current account

LLC “A” does not have money in its current account to pay taxes, while a sufficient amount of 12,520 rubles is in the personal account of its founder. He deposits his own funds into the current account and pays taxes.

Postings in the accounting of LLC "A"

Amounts of taxes that a third party has paid for an entrepreneur are not considered income. They are not reflected in the income and expenses book (KUDiR) or the entrepreneur’s income book and are not subject to income tax.