Can an organization, in the case of acquiring fixed assets that were used from a legal entity, determine the depreciation rate for this property independently? The Russian Ministry of Finance answers that it can.

Recently, an issue was considered affecting the procedure for calculating depreciation on a purchased building that was already in use from another organization. In a letter dated May 21, 2013 No. 03-03-06/1/17911, financial department specialists explain that in the event of the acquisition of used fixed assets from legal entities, the organization has the right to determine the depreciation rate for this property independently, taking into account the requirements of paragraph 7 Article 258 of the Tax Code and Classification of fixed assets. In other words, the useful life can be determined as established by the previous owner, reduced by the number of months of operation. Is it safe to put this into practice?

Let's figure it out.

Depreciable property

Depreciation is the gradual transfer of the cost of fixed assets to the cost of products (works, services). Property with a useful life of more than 12 months and an original cost of more than 40,000 rubles is recognized as depreciable.

Depreciable items for profit tax purposes include property, results of intellectual activity and other intellectual property owned by the company. It is important that the company uses all of the above property to generate income; then its cost will be repaid by calculating depreciation (clause 1 of article 256 of the Tax Code of the Russian Federation). According to paragraph 1 of Article 258 of the Tax Code, depreciable property is distributed among depreciation groups in accordance with its useful life.

Depreciation of fixed assets (calculation example)

Let us detail what has been said with an example. Let’s say the standard service life of a pie oven is 5 years. Initially, the stove was purchased for 50 thousand rubles. Consequently, depreciation charges for this fixed asset per year are: 50,000 rubles. / 5 years = 10,000 rubles/year.

This is a calculation of basic depreciation, without taking into account inflation (what is that?).

If you need to calculate the joint stock company for a specific object for a month, then the joint stock company for the year needs to be divided by 12. In our example, depreciation charges for the month are equal to: 10,000 / 12 = 833.33 (rub.).

This amount must be taken into account when calculating the cost of products produced per month at this bakery (i.e., “invest” it in the cost).

Let’s say a bakery baked 30 thousand pies a month with a cost (excluding joint stock company) = 10 rubles. If we take into account the depreciation of equipment, then the cost of all pies baked in a month will increase by 833.33 rubles. This means that the cost of 1 pie will be equal to 10.03 rubles.

The difference is small, but taking into account that 3 kopecks will be added for each pie for 5 years, then by the end of the standard service life an amount will “accumulate” equal to the purchase price of the pie oven.

I’ll tell you a little later how depreciation charges are accumulated.

As a rule, in an enterprise, all fixed assets are grouped according to certain characteristics, and depreciation charges are not calculated for each object, but are established by group.

In 2002, the Government of the Russian Federation approved a special classifier in which all fixed assets are divided into groups based on their service life. You can view this classifier at the link: https://www.consultant.ru/document/cons_doc_LAW_34710/.

Useful life

Such a variety of property, the characteristics of which fit the definition of depreciable, cannot have one useful life.

Useful life is the period during which an item of fixed assets or an item of intangible assets serves to fulfill the objectives of the company.

According to the Tax Code, the company has the right to determine the useful life independently. This must be done on the date the depreciable property is put into operation. At the same time, independent determination of the useful life should not contradict the requirements of Article 258 of the Tax Code and the Classification of Fixed Assets (clause 1 of Article 258 of the Tax Code of the Russian Federation).

Paradox

The paradox of depreciation is that for many years all accountants considered it as an extended write-off (decapitalization) of previously incurred expenses. Many people still think so today. However, all economists and, following them, some accountants began to view it as a kind of markup on the cost (or, what is the same, a part of it), which allows them to accumulate a fund for the reimbursement of liquidated fixed assets.

The economists' belief that depreciation is income reached its highest point in the USSR. Since it was included in both the planned and actual costs, for this formal reason it was decided to re-depreciate fixed assets, i.e. the amount of accrued depreciation turns out to be greater than the cost of the funds themselves. This supposedly ensured, contrary to K. Marx, the comparability of the cost of finished products produced in different reporting periods. But in fact the strength lay in another argument. Treating depreciation as income, the treasury withdrew a significant portion of working capital into the budget under this pretext. At the same time, we saw that the amount of depreciation accrued on the liability is significantly higher than the cash security that it has in the asset.

It follows that this was no longer depreciation, but in essence what would later be called payment for funds. In modern conditions this is impossible, but then all enterprises were financially branches of the State Bank.

Procedure for calculating depreciation

Depreciation in accounting should begin to be calculated from the month following the month in which you classified the property as fixed assets. Subsequently, depreciation is calculated monthly. Starting from the first day of the month following the month when the fixed asset is fully depreciated or written off the balance sheet, depreciation is stopped. The residual value of a fully depreciated fixed asset is zero, since the amount of accrued depreciation on this object is compared with its original cost.

In tax accounting, depreciation is also accrued from the month following the date when the object was put into operation. The date of state registration in this case does not matter.

For your information

According to the Tax Code, a company has the right to set its own useful life. This must be done on the date the depreciable property is put into operation. At the same time, independent determination of the useful life should not contradict the requirements of Article 258 of the Tax Code and the Classification of Fixed Assets (clause 1 of Article 258 of the Tax Code of the Russian Federation).

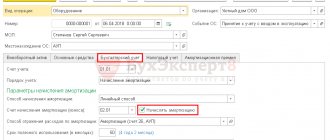

In accounting, depreciation is reflected in the credit of account 02 “Depreciation of fixed assets” and the debit of cost accounting accounts. The wiring looks like this:

DEBIT 08 (20, 23, 25, 26, 29, 44) CREDIT 02

- depreciation of fixed assets has been accrued. In accounting, there are four methods for calculating depreciation on fixed assets:

- linear method;

- reducing balance method;

- method of writing off cost by the sum of numbers of years of useful life;

- method of writing off cost in proportion to the volume of products (works) produced.

There are only two depreciation methods in tax accounting: linear and nonlinear.

To approximate accounting and tax accounting, organizations often choose the linear method of calculating depreciation of fixed assets.

It consists of evenly accruing depreciation over the entire useful life of the fixed asset. Example 1

In June 2013, an organization bought a machine worth RUB 120,000.

(excluding VAT). The useful life of the machine is five years. In the accounting policy, the accountant chose the straight-line depreciation method for both accounting and tax accounting. When using the straight-line depreciation method, the accountant will annually write off 1/5 of the cost of the purchased machine. To determine the annual depreciation rate, you need to divide 100% by five years, we get 20%. The annual depreciation amount will be: 120,000 rubles. X 20% = 24,000 rubles. The monthly depreciation amount will be equal to: 24,000 rubles. : 12 months = 2000 rubles/month. Every month, starting from July 2013, the accountant will make the following entry: DEBIT 20 CREDIT 02

– 2000 rubles.

– depreciation of the machine was accrued for the reporting month.

The nuances of recognizing depreciation expenses

Obviously, depreciation charges are not the main expense item for any enterprise, including a construction company. However, these amounts are quite large, so their exclusion by inspectors from expenses that reduce taxable profit leads to additional financial costs in the form of the obligation to pay arrears, penalties and sanctions. The desire of the enterprise to avoid such unnecessary expenses is understandable.

This article combines answers to questions about the legality of writing off accrued depreciation as part of tax expenses and will certainly help the accountant navigate ambiguous situations. Converted equipment

Let's start directly with a case from the life of a taxpayer. The company purchased, on the basis of a supply agreement, two complexes for mechanical pruning of limbs, equipped with specialized attachments (harvester heads) mounted on the basis of Hitachi self-propelled machines. When determining the useful life, the organization was guided by the fact that in the Classification of fixed assets [1], machines for cutting forests, uprooting, collecting and loading stumps are included in the third depreciation group “Property with a useful life of more than 3 years up to 5 years inclusive” (see. code 14 2941204). Therefore, the accountant calculated depreciation based on a useful life of 60 months.

Inspectors pointed out that depreciation amounts were overstated and accrued arrears not only for income tax, but also for property tax. According to the Federal Tax Service, the enterprise should have classified delimbing complexes into the fifth depreciation group (code 14 2924152 “Single-bucket excavators”) with a useful life of 7–10 years, since in the passports of self-propelled machines in the line “Name and brand of machine” it is indicated “HITACHI” ZX230 Excavator".

The court declared the inspection's decision invalid, noting that for the purpose of calculating depreciation, the enterprise correctly accounted for fixed assets as machines for cutting forests, uprooting, collecting and loading stumps, and not as excavators (see Resolution of the Federal Antimonopoly Service of the North-West District dated October 5, 2007 No. A26-8862/ 2006-28 ).

It should be noted that in this case, the conversion of self-propelled vehicles was carried out before they were put into operation. Otherwise, the provisions of paragraph 1 of Art. 256 Tax Code of the Russian Federation :

– the taxpayer has the right to increase the useful life of a fixed asset after the date of its commissioning, if after its reconstruction, modernization or technical re-equipment there was an increase in the useful life. In this case, an increase in this period can be carried out within the time limits established for the depreciation group in which this fixed asset was previously included;

– if as a result of reconstruction, modernization or technical re-equipment of an object there is no increase in its useful life, the taxpayer charges depreciation based on the remaining useful life.

Thus, the organization does not have the right to change the depreciation group by re-equipping (modernizing) a previously operated facility.

Newly found equipment

The question of the legality of charging depreciation on fixed assets identified during the inventory remains unresolved. For a long time, officials insisted that such property is recognized for income tax purposes as received free of charge. For example, this point of view was expressed in Letter of the Ministry of Finance of Russia dated June 20, 2005 No. 03-03-04/1/7 . First, financiers reminded in it that the value of property identified as a result of inventory is included in non-operating income ( clause 20 of Article 250 of the Tax Code of the Russian Federation ), taking into account the provisions of Art. 40 of the Tax Code of the Russian Federation , that is, at the market price ( clause 5 of Article 274 of the Tax Code of the Russian Federation ).

The letter further states that the fixed assets identified as a result of the inventory for profit tax purposes are received free of charge and by virtue of Art. 257 of the Tax Code of the Russian Federation, their initial cost is determined as the amount at which such property is valued in accordance with clause 8 of Art. 250 of the Tax Code of the Russian Federation , that is, the market price reflected in non-operating income. In other words, the said letter gave taxpayers the green light to reduce taxable profit by the amount of accrued depreciation. That is, it turned out that income from the capitalization of such objects was taken into account for tax purposes at a time, and expenses were recognized gradually, through depreciation.

However, then, as often happens, the Ministry of Finance changed its position on this issue. Thus, in letters dated February 15, 2008 No. 03-03-06/1/97 and No. 03-03-06/1/98 and dated January 25, 2008 No. 03-03-06/1/47 , the following was explained to taxpayers: since when If, as a result of the inventory of fixed assets, there is no transferring party, such fixed assets for profit tax purposes are not recognized as received free of charge . The procedure for determining the initial cost of fixed assets identified during an inventory, as well as the possibility of depreciation of such fixed assets, is not established by the Code. At the same time, as in letters previously issued by the department, officials draw attention to the need to pay income tax on the market price of this property.

A similar opinion was repeatedly expressed when answering questions from organizations orally. Officials state that the taxpayer did not incur real costs for the acquisition of such objects, therefore, their original cost is zero, and there is no basis for calculating depreciation.

So, it is obvious that an organization that has reduced its profit by depreciation amounts on newly identified fixed assets will inevitably face claims from tax inspectors. In this regard, I wonder who the referees support in controversial situations?

The judges of the FAS VSO in the Resolution of August 11, 2006 No. A33-26560/04-S3-F02-3935/06-S1, A33-26560/04-S3-F02-4272/06-S1 indicated the legality of depreciation calculation (including for profit tax purposes) for objects identified during the inventory. Moreover, the court decision drew attention to the fact that, as in the general case, depreciation begins on the 1st day of the month following the month in which the facility was put into operation.

The arbitrators of the same district, in Resolution No. A33-8921/06-F02-1794/07 , noted that when determining the value of depreciable property identified as surplus during inventory, the provisions of paragraph 1 of Art. 257 of the Tax Code of the Russian Federation concerning the determination of the value of fixed assets received free of charge. On this basis, the FAS VSO recognized that the lower court’s conclusions about the enterprise’s overestimation of expenses that reduce the tax base when calculating income tax by the amount of depreciation charges on surplus fixed assets identified as a result of the inventory are based on an incorrect interpretation of the rules of substantive law.

At the same time, in the Resolution of the FAS ZSO dated November 30, 2006 No. F04-2872/2006(28639-A27-40), F04-2872/2006(28570-A27-40), the decision was not made in favor of the taxpayer. True, the arbitrators did not deny the possibility of reducing the tax base by the amount of depreciation from the cost of surplus identified fixed assets. The fact is that the organization was unable to justify the cost of these objects and, accordingly, the amount of accrued depreciation, taking into account the provisions of Art. 40 , 250 , 252 , 257 , 259 Tax Code of the Russian Federation . Only this became the basis for holding the enterprise accountable, accruing tax arrears and penalties.

Failure to carry out activities ≠ failure to receive income

In this section of the article, we will try to answer the question of whether the tax base for the purposes of calculating income tax is reduced by the amounts of depreciation accrued during periods when the enterprise does not have sales revenue. Let's start with Letter of the Federal Tax Service for Moscow dated November 12, 2007 No. 20-12/107022 . So, the organization that sent the request to the department asked: is it possible to take into account depreciation amounts (which are both direct and indirect expenses) in expenses for profit tax purposes during periods when it does not sell products and, accordingly, has no income? The capital's tax authorities responded: depreciation, which, according to the organization's accounting policy, is classified as direct expenses, can be taken into account for profit tax purposes only if products are sold in the cost of which it is included. Accordingly, if an organization does not conduct activities aimed at generating income, then depreciation, related to both direct and indirect expenses, is not taken into account when forming the tax base.

It is no coincidence that the author highlighted two phrases above. The attentive reader, obviously, noticed how cleverly officials replaced the concepts, identifying periods of the organization’s activity in which there was no sales with the complete absence (non-realization) of commercial activities.

Tax authorities are certainly right that an organization that does not really carry out any commercial activities (including preparation for production and/or sales) has no reason to take into account expenses (including depreciation) when determining the tax base. But that’s not what the taxpayer was asking about! In our opinion, the company should have responded something like this: direct expenses (including depreciation) can be recognized for profit tax purposes only in the period (month) in which revenue is reflected in taxable income. In this case, indirect expenses (including amounts of accrued depreciation) in the absence of revenue are recognized as losses, which will reduce the income received later[2]. In other words, the organization can write off depreciation amounts (not classified as direct expenses) monthly as tax expenses.

As audit practice shows, when conducting inspections, inspectors often exclude the amount of accrued depreciation from tax expenses, citing the lack of income from activities. In this regard, we will give examples of court decisions that are positive for taxpayers in order to show readers what arguments can convince judges.

In the situation that became the subject of consideration in A56-33529/2006 of the Federal Antimonopoly Service of the North-West District dated April 24, 2007 , tax authorities pointed out the unlawful inclusion of computer depreciation amounts in expenses associated with production and sales accepted for tax purposes. According to the tax authority, the organization's production activities began only in June, so expenses incurred before this month cannot be considered economically justified.

The company explained that during the disputed period it carried out activities to prepare for the production of double-glazed windows and suspended ceilings, and entered into contracts for the supply of relevant production equipment. Despite the fact that the first delivery of equipment under these contracts was made in June, this does not mean that the costs are not related to the business activities of the organization.

The judges supported the taxpayer, noting the following: within the meaning of Art. 252 of the Tax Code of the Russian Federation, the economic justification of expenses incurred by a taxpayer is determined not by the actual receipt of income in a specific tax (reporting) period, but by the focus of such expenses on generating income, that is, their conditionality by the economic activity of the taxpayer. Moreover, the arbitrators emphasized that the legality of recognizing expenses for tax purposes is not excluded in the event of a loss as a result of financial activities for the reporting (tax) period.

Another example is FAS PO Resolution No. A65-9440/2007-SA2-11 . The dispute arose regarding the amounts of depreciation accrued on fixed assets leased with the right to purchase. The tax authority insisted that failure to receive income from leased property deprives the organization of the right to include depreciation amounts as expenses. However, this time too the taxpayer won.

The court proceeded from the fact that, in pursuance of the said agreement, the property was transferred to the tenant under an acceptance certificate. The agreement provided for the provision of the tenant making monthly rental payments, which indicates the use of the property for the purpose of making a profit. The subsequent termination of the specified lease agreement as unfulfilled due to the fact that, due to objective reasons, the tenant was not able to transfer rental payments under the agreement, does not deprive the lessor of the right to include the amount of depreciation in expenses, since the property was actually leased and was leased.

The actual receipt of income is not a condition for recognizing depreciation amounts for the purpose of calculating income tax. Tax legislation provides for the possibility of incurring losses from the activities of an enterprise, and since the taxpayer’s activities, both in general and in relation to the disputed property, were aimed at generating income, he lawfully classified the accrued depreciation as expenses. Therefore, the decision of the tax authority is illegal.

Let us cite another resolution - FAS MO dated September 13, 2007 No. KA-A40/9170-07 . The inspectorate assessed additional income tax, considering it unlawful to recognize as expenses depreciation amounts for a non-residential building acquired by an organization during periods of no income from leasing it.

The arbitrators pointed out that from the definition of depreciable property ( clause 1 of Article 256 of the Tax Code of the Russian Federation ) it does not follow that it should be constantly used to generate income. The tax period for income tax is a calendar year. In other words, the income must be received during the tax period. The grounds on which fixed assets are excluded from depreciable property are given in paragraph 3 of Art. 256 of the Tax Code of the Russian Federation (transferred by decision of the organization’s management to conservation for a period of more than 3 months or undergoing reconstruction and modernization for a period of more than 12 months). The situation in question is not named there. Therefore, after the building was put into operation, the organization had no reason not to charge depreciation on the disputed object. As a result, the court recognized the argument of the Federal Tax Service that the taxpayer did not have the right to charge depreciation during periods when the building was not rented out and did not generate income, erroneous and contrary to the law.

Temporary downtime

When deciding the legality of calculating depreciation in those periods when an item of fixed assets is not used in the activities of the enterprise, it is necessary to rely on the above-mentioned paragraph 3 of Art. 256 Tax Code of the Russian Federation . Therefore, if objects temporarily not used in the production activities of an enterprise are not mothballed, then depreciation on them can be included in tax expenses.

Note that Ch. 25 “Profit Tax” of the Tax Code of the Russian Federation does not oblige an organization to transfer idle facilities to conservation. In this case, the position of the arbitrators of the FAS NWO, formulated in Resolution No. A56-9865/2007 . So, during the on-site audit, the tax authority came to the conclusion that the enterprise unlawfully included in tax expenses depreciation charges for idle fixed assets. As follows from the documents presented in the case file, these fixed assets were used by the organization periodically and for a short time. In particular, the installation for the production of phenol-formaldehyde resins was operated for 3 months; distillate production plant – 1 month; mastic production plant – 9 months; isopenol production plant – 10 months. The tax authority qualified the disputed amount of depreciation as an expense on property not used to generate income, and assessed arrears of income tax, penalties and a fine.

As a counter-argument, the company presented long-term contracts for the processing of raw materials (on a toll basis) and invoices for its receipt, confirming the irregular nature of deliveries.

The arbitrators agreed that:

– the rhythm of supply of customer-supplied raw materials depends not on the taxpayer, but on the customers;

– in the presence of existing long-term contracts, the enterprise could not make a decision on mothballing production equipment;

– conservation and re-preservation of objects requires considerable time, as well as significant financial costs, therefore the organization considered it economically inexpedient to preserve the controversial equipment during the period of its temporary non-use.

The court indicated that in accordance with the provisions of Chapter. 25 “Income Tax” of the Tax Code of the Russian Federation , a fixed asset that is not used by the taxpayer due to downtime is removed from the depreciable property and is not taken into account when calculating depreciation only if it is transferred by decision of the organization’s management to conservation for a period of more than 3 months. At the same time, expenses in the form of depreciation of non-operating fixed assets that are temporarily idle, recognized as justified and being part of the organization’s production cycle, meet the criteria of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation and reduce the tax base when calculating income tax. Taking into account the fact that the list of fixed assets excluded from depreciable property established by clause 3 of Art. 256 of the Tax Code of the Russian Federation is exhaustive and cannot be interpreted broadly; the Federal Antimonopoly Service of the North-West District declared the decision of the Federal Tax Service invalid.

Conclusions useful for taxpayers are also contained in letters from the Ministry of Finance. In particular, from Letter No. 03-03-06/1/645 , it follows that financiers consider it possible to take into account as expenses the amount of depreciation accrued for a full month in relation to machinery and equipment used during the month from 10 to 40 % of time, subject to confirmation of the economic feasibility of such an operating mode. In Letter No. 03-03-04/1/367 , it was reported that expenses in the form of depreciation charges for a non-operating facility that is temporarily idle, recognized as justified and part of the organization’s production cycle, are reduced the tax base for income tax. At the same time, in Letter No. 03-03-01-04/1/236 , the Ministry of Finance explained that downtime, for example, caused by the repair of fixed assets or arising due to the seasonal nature of the activity, is justified. Downtime of an organization can also be recognized as justified. the production cycle of which includes the preparatory phase (see also Letter of the Ministry of Taxes and Taxes of Russia dated September 27, 2004 No. 02-5-11/162 ).

It is clear that, pursuing the goal of replenishing the country’s budget by any means, tax authorities always strive to prove that the downtime of depreciable property is unreasonable and is not due to the technological features of the production of the enterprise being inspected. Therefore, arguments in favor of the legality of reducing an organization’s taxable profit need to be prepared in advance.

At the same time, taking into account the fact that we are talking about a production cycle, the preparation of a written justification for downtime should be entrusted to “technicians”. It is these specialists who are able to find and correctly use the necessary terms and arguments, which will be very difficult for tax specialists who do not have technical training to refute, and the Federal Tax Service Inspectorate most likely will not conduct an examination with the involvement of qualified specialists. For example, in a dispute considered by the FAS UO in Resolution No. F09-7349/07-S3 , the enterprise was able to convince the court that the temporary suspension of the operation of oil and water wells is due to the production process and is mandatory and economically justified, therefore, depreciation on disputed objects was taken into account for tax purposes legally.

Let us cite another interesting court decision - Resolution of the Federal Antimonopoly Service of the Moscow Region dated December 17, 2007 No. KA-A40/12829-07 . The Federal Tax Service insisted that in the absence of waybills, it was impossible to reduce profits by depreciation amounts, since passenger cars were not used in production activities. The organization argued the opposite and presented, in support of its position, copies of powers of attorney issued to the general director and the security guard for the right to drive vehicles. The arbitrators pointed out that the inspection did not provide evidence of the non-use of cars in the company’s activities, and in Ch. 25 “Income Tax” of the Tax Code of the Russian Federation, the legality of including accrued depreciation in expenses does not depend on the availability of waybills.

We will not list all the judicial acts adopted in favor of taxpayers. We believe that these examples were able to convince readers of the possibility of proving the legitimacy of tax savings. Let us remind you once again that the decisive argument in this case is the justification of the economic feasibility of temporary non-operation of objects and the ineffectiveness of carrying out conservation work. Considering the variety of types of economic activity and specific features of production, it is impossible to give recommendations, as they say, for all occasions to all taxpayers. Only production workers can help an accountant in this matter.

Backup equipment

First of all, we note that in this section we will analyze the possibility of calculating depreciation on property put into operation , but located in stock (reserve) and used in production only during the period of failure of the main objects. Let's start with Letter No. 03-03-04/4/114 , in which the Ministry of Finance confirmed that depreciation on equipment in stock and used only during periods of breakdown of similar equipment is taken into account for the purpose of calculating income tax.

However, local tax authorities often take the opposite position. As a result, inspectors and taxpayers meet in courtrooms.

Arbitrators usually find it illegal to accrue tax arrears and penalties and to hold organizations accountable. Let us confirm what has been said with examples from judicial practice. During the audit (see Resolution of the Federal Antimonopoly Service of the North-West District dated March 21, 2007 No. A26-12006/2005-25 ), the tax authorities established that in one of the workshops of the inspected enterprise there are 11 unused pumps, the depreciation amounts for which are included in expenses for profit tax purposes. It is obvious that the fact of non-operation of the property in this case was established during an inspection of the premises and territory of the enterprise, since the resolution also contains the inspector’s opinion about the violation of the conditions for storing backup pumps (in the open air), as well as about the impossibility of using them in the future.

The arbitrators stated the following:

– non-use of reserve pumps until inspection does not change their purpose and does not deprive the organization of the right to calculate depreciation;

– the storage of 11 pumps for a workshop in which 120 pumps operate simultaneously is provided for by technical regulations to ensure a continuous production cycle in the event of an accident. A similar position is set out in letters from the Ministry of Finance of Russia dated 05/06/2005 No. 03-03-01-04/1/236 and the Ministry of Taxes of Russia dated 09/27/2004 No. 02-5-11/162 ;

– the inspection’s opinion about the unsuitability of the disputed pumps for operation due to violation of their storage conditions is based on assumptions and is not confirmed by expert opinions or relevant examinations.

As a result, the enterprise won. Thus, by showing some ingenuity and ingenuity when preparing documents, an organization can save on income tax.

“Unusual” operating conditions

Clause 7 of Art. 259 of the Tax Code of the Russian Federation allows the taxpayer to apply an increasing coefficient (not higher than 2) to the basic depreciation rate in relation to fixed assets used for work in conditions of extended shifts. The Ministry of Finance, explaining the application of this norm, has repeatedly emphasized (see, for example, Letter No. 03-03-04/1/521 ) that in order to use a special coefficient, it is necessary that the operating conditions of depreciable fixed assets differ from the usual conditions of their use . Since the useful life in the Classification of fixed assets is established based on the normal operation of equipment in two shifts, the right to apply an increasing depreciation rate arises only when facilities operate in three shifts or around the clock ( Letter of the Ministry of Finance of Russia dated October 19, 2007 No. 03-03-06/1/ 727 ).

It is obvious (and officials remind us of this in their letters) that the enterprise must confirm the operation of the depreciable property in a multi-shift mode. It is the supporting documents that tax inspectors usually find fault with. The fact is that the specific list of such documents in Art. 259 of the Tax Code of the Russian Federation is not provided for, therefore tax authorities, at their discretion, can require a variety of documents, and if any papers are missing, they can charge arrears. Faced with such a situation, an enterprise may go to court. As arbitration practice shows, judges accept a variety of evidence of the operation of fixed assets in three shifts and around the clock. The only condition that must is that the possibility of applying an increasing coefficient must be enshrined in the accounting policy for tax purposes. In addition to the accounting policy, the case materials may include an order from the head of the organization to work in a multi-shift mode, a list of fixed assets (indicating their inventory numbers) directly used in the production process in such special operating conditions, time sheets, etc. If the documents are are drawn up correctly, then victory in court will be on the side of the taxpayer (see, for example, decisions of the Ninth Arbitration Court of Appeal dated October 23, 2007 No. 09AP-9569/2007-AK , FAS TsO dated December 25, 2007 No. A68-3553/06-247/ 18 ).

At the same time, before defending your position, you should make sure that the application of the increasing coefficient is legal. Otherwise, wasting time and money on legal defense will be useless. Thus, the Resolution of the Federal Antimonopoly Service NWO dated December 18, 2007 No. A05-3300/2007 considered the following situation. The tax authority pointed out the illegality of using a special coefficient when determining depreciation amounts for cars and minibuses, since the company did not confirm their use in conditions of extended shifts. The main evidence of the enterprise were copies of waybills. However, the judges, having analyzed the documents, noted that the indicated copies of waybills do not confirm the use of fixed assets in an extended shift mode, since it follows from them that the cars were operated in two shifts or in excess of this mode by one hour. The organization did not provide any other evidence that the disputed fixed assets were used in three shifts or around the clock, and therefore lost the case.

From the editor . It is obvious that within the framework of one article it is impossible to consider all the ambiguous situations associated with the recognition of accrued depreciation amounts as part of tax expenses. It is inevitable that some difficult moments were left behind the scenes. Send your questions, suggestions and wishes on this and other topics that interest you to the following address. You can also contact the editor through the magazine’s website (https://stroi.avbn.ru), using the “Letter to the Editor” section.

[1] Approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1.

[2] A similar position is presented in Letter of the Ministry of Finance of Russia dated March 6, 2008 No. 03-03-06/1/153.

Shock absorption groups

Depending on the useful life, depreciable property is combined into the following groups (clause 3 of Article 258 of the Tax Code of the Russian Federation):

- No. 1 – all short-lived property with a useful life from 1 year to 2 years inclusive;

- No. 2 – property with a useful life of over 2 years up to 3 years inclusive;

- No. 3 – property with a useful life of over 3 years up to 5 years inclusive;

- No. 4 – property with a useful life of over 5 years up to 7 years inclusive;

- No. 5 – property with a useful life of over 7 years up to 10 years inclusive;

- No. 6 – property with a useful life of over 10 years up to 15 years inclusive;

- No. 7 – property with a useful life of over 15 years up to 20 years inclusive;

- No. 8 – property with a useful life of over 20 years up to 25 years inclusive;

- No. 9 – property with a useful life of over 25 years up to 30 years inclusive;

- No. 10 – property with a useful life of over 30 years.

How to calculate depreciation using residual value

To calculate deductions, the residual value can be used:

- when additional equipment or completion, reconstruction, modernization or, possibly, partial liquidation are carried out, which entail a change in the standard indicators initially taken as a basis, and also cause an extension of the useful life;

- when an object is registered with depreciation already accrued. The calculation of depreciation is carried out taking into account the residual value, as well as the rate of depreciation charges, which are calculated based on the useful life that remains for a particular asset at the time of accounting.

What is depreciation

Let's figure out what depreciation is, how to calculate it and use it to optimize your business. The term “depreciation” itself (translated from the Latin “amortisatio”) means nothing more than “repayment”. Regulatory documents of the state regulator - the Ministry of Finance of the Russian Federation indicate that the cost of fixed assets is repaid through depreciation. In other words, depreciation is a gradual transfer of the cost of fixed assets to the cost price (work, services, products). Previously, this type of accounting was applicable only to commercial organizations, but now depreciation for non-profit companies is calculated in the general manner.

Depreciation of fixed assets is, at a minimum, order in the reporting, and at a maximum – minimal losses and economically profitable operation of the business. The types of depreciation are different for accounting (AC) and tax accounting (TA), which we will discuss further.

Depreciation of fixed assets for tax and accounting - Differences

As we have already said, depreciation is used in both tax and accounting. But what's the difference?

The key is the cost of the OS. For accounting, at least 40 thousand rubles, for tax accounting – 100 thousand rubles. Also, the depreciation period in tax accounting depends on SPI and depreciation group.

The meaning of depreciation

Savicheva Olga

Corporate accountant, practicing economist

Ask a Question

The meaning of depreciation is the monthly inclusion of part of the PS in the cost of production. The need for depreciation is to obtain enough funds in revenue to “update” OSes that have served their purpose. It turns out that the price should ultimately cover all expenses, including depreciation. It must be monitored on a monthly basis and counted as expenses. Accounting for depreciation allows you to distribute the cost of assets to all goods, work, products that the company plans to produce, and provide OS assistance to the company.

What is accumulated depreciation

Accumulated depreciation and residual value are closely related:

OS = NS - NA, which means NA = NS - OS

The residual value, which is determined by this formula, is also called the historical cost of fixed assets.

Accumulated depreciation

Savicheva Olga

Corporate accountant, practicing economist

Ask a Question

At the end of each month, the company revaluates fixed assets and determines their residual value to determine liquidation or replacement value. The accumulation of accumulated depreciation on any property is also recorded every month in the reporting documentation of the organization, and the calculation procedure depends on the type of object, features of use and depreciation method.

Depreciation and amortization

It is important to distinguish both at the theoretical and practical level between the concepts of depreciation and wear. Wear and tear is, first of all, the loss of an OS object’s original properties. Depreciation is, as we have repeatedly pointed out, the process of transferring the value of an fixed asset to other accounting objects for the purpose of subsequent reproduction of the fixed asset. In other words, wear characterizes the physical side, depreciation characterizes the economic side.

The rate of deterioration of fixed assets is influenced by such factors as the quality of workmanship, the presence or absence of protection from external influences, the nature of the technological process, the intensity of operation of the facility, as well as the qualifications of the personnel servicing it.

Example: physical wear and tear of a building is the loss of its original qualities by the materials from which the building is constructed. And the obsolescence of a building is a gradual (over time) deviation of the main operational indicators from the current level of technical requirements for the operation of buildings.

Currently, the refusal to account for depreciation of fixed assets in favor of accounting for depreciation is one of the fundamental differences between the modern accounting concept and the pre-reform one. Of course, ideally, wear and tear should be identical, but in practice this is almost impossible. Therefore, it is so important for accounting to distinguish between these two concepts.

It is important to distinguish between wear and depreciation