ASK VAT information system , implemented by the tax service to verify VAT returns, has been fully operational since the summer of 2015. Since then, taxpayers have received requests for explanations even more frequently. The program operates automatically and identifies inconsistencies without the participation of inspectors, selecting erroneous reporting forms for further verification based on certain criteria. Which declarations are at risk of coming to the attention of the automated Federal Tax Service system in the first place?

So, discrepancies in the VAT return can be of two types:

- internal , that is, inconsistencies in the control ratios of certain sections;

- discrepancies with counterparties .

Both attract the attention of the Federal Tax Service. True, the program will consider some of them significant and require explanations, while others, not so important, will simply be ignored.

Is it necessary to explain the discrepancy between VAT and income tax?

The company received a request to provide clarifications in the form approved in Appendix No. 1 to the order of the Federal Tax Service of Russia dated 05/08/15 No. ММВ-7-2 / [email protected] The reason for sending the request was a desk audit. The fiscal authorities requested clarification on the indicators reflected in individual lines of the balance sheet (Appendix No. 1 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). And they also demanded to attach documents confirming the reasons for the decrease in the “Financial Investments” indicator in the balance sheet asset.

But the Tax Code does not allow desk audits of financial statements! Controllers have the right to request documents and explanations on issues related to the calculation and payment of taxes (subclause 1, clause 1, article 31, articles 88, 93 of the Tax Code of the Russian Federation). And financial statements are necessary for users of these statements to make economic decisions (Part 1, Article 13 of Federal Law No. 402-FZ dated December 6, 2011).

In addition, the tax authorities monitor compliance with tax legislation (the regulations on the Federal Tax Service, approved by Decree of the Government of the Russian Federation dated September 30, 2004 No. 506), the Ministry of Finance of Russia is responsible for accounting reporting (Part 1 of Article 22 of the Federal Law dated December 6, 2011 No. 402-FZ, Decree Government of the Russian Federation dated June 30, 2004 No. 329). Therefore, in the request, the inspectorate may refer to a desk audit of a specific declaration and its indicators. And inspectors do not have the right to demand explanations and documents regarding financial statements. However, it is still worth responding to such a request from the inspection. A competent refusal to provide explanations will save the company from receiving a report on the discovery of facts indicating tax violations (Article 101.4 of the Tax Code of the Russian Federation), as well as from the need to further challenge this report. With my help, the organization prepared a letter refusing to comply with the inspection requirement. In response to a request for clarification, the company indicated that tax legislation does not provide for chambers in relation to accounting statements. At the same time, fiscal officials do not have the authority to control it.

There is no direct connection between “profit and VAT”

Almost every company received a requirement to provide explanations as part of a desk audit regarding VAT. Fiscal officials are often asked to explain the reasons for the discrepancies between the indicators that make up the revenue in the annual income tax return and the size of the tax bases reflected in the VAT returns for all four quarters of the reporting year. What documents are on the camera for personal income tax? It is illegal to demand >>>

In my case, the company received such a requirement as part of a desk audit of the VAT return for the fourth quarter of 2015. In addition, inspectors demanded to explain why the share of VAT deductions exceeds 89 percent. This is the permissible share of deductions used by companies to independently assess the risks of inclusion in the inspection plan (Appendix No. 2 to the order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected] hereinafter referred to as the Concept). In the third quarter of 2015, the share of deductions was 93 percent, in the fourth quarter of 2015 - 92 percent. The desk audit was carried out for the fourth quarter of 2015 - inspectors could only demand clarification for this period. In the letter, the company reminded fiscal officials that the tax period for VAT is a quarter (Article 163 of the Tax Code of the Russian Federation). However, difficulties arose in preparing the answer. It turned out that it is difficult to explain the specific reason for the discrepancies in the declarations. The fact is that the concept of “income” for profit tax purposes (Articles 248–251 of the Tax Code of the Russian Federation) and the concept of “tax base” for VAT purposes are not identical. Consequently, revenue for the purposes of calculating income tax and the tax base for VAT purposes may be different. The company carried out both transactions subject to VAT and transactions not subject to taxation (Article 149 of the Tax Code of the Russian Federation). Discrepancies in indicators can arise not only due to these nuances, but also due to the use of completely legal optimization methods. This, in particular, issuing invoices at a later date. This method is often used at the end of the year, when the company closes large contracts. She may receive significant revenue, and the amount of VAT payable will also increase. To this amount are added advances from buyers, from which it is also necessary to calculate VAT (clause 1 of Article 167 of the Tax Code of the Russian Federation). In this case, for goods (advances) shipped (received) in the last days of the reporting year, invoices are issued at the beginning of the next year. After all, the supplier must issue an invoice to the buyer within five days from the date of shipment or receipt of an advance payment (clause 3 of Article 168 of the Tax Code of the Russian Federation). This means that it is possible to postpone the payment of VAT from January 25, 2021 to April 25, 2016 (Clause 1 of Article 174 of the Tax Code of the Russian Federation). Of course, the last thing the organization wanted to do was explain such reasons for discrepancies in the controversial declarations. Therefore, the society decided to refuse this part of the requirement. The fact is that inspectors most often require clarification in connection with errors or contradictions in declarations (clause 3 of Article 88 of the Tax Code of the Russian Federation). And the company asked the tax authorities to indicate what these errors or contradictions were. We also asked the inspectors to provide a link to the regulatory legal act, which states that revenue for the purposes of calculating income tax must be equal to the VAT tax base. In the letter, the company emphasized that Chapters 21 and 25 of the Tax Code of the Russian Federation established different procedures for the formation of these indicators.

Discrepancy between income from sales under income tax and revenue under VAT - where to look for the error?

Published 11/29/2016 10:18 Author: Administrator Requests for clarification from tax authorities always come at the most inopportune moment. And sometimes the situation is further complicated by the fact that you do not understand what exactly the error is, how to correct it correctly, and will simple explanations be enough or is it necessary to provide clarifying reports? In this article, I want to talk to you about one of the most popular reasons for filing a claim: the discrepancy between income from sales under income tax and revenue under VAT.

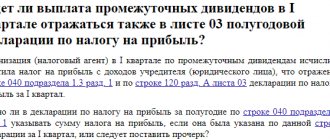

What exactly is the error in this case (and perhaps not an error, but more on that later) and how to see it with your own eyes? We open VAT and income tax returns for the periods specified in the request. It must be remembered that the income tax return is filled out on an accrual basis from the beginning of the year, but for VAT the tax period is a quarter. Therefore, if the Federal Tax Service has questions, for example, based on the results of a reporting campaign for 9 months, then for verification you will need to open an income tax return for this period and three VAT reports: for the first, second and third quarters. In the income tax report, pay attention to line 010 of Sheet 02 “Income from sales”.

We check the value of this line with the sum of lines 010 of Section 3 (column “Tax base in rubles”) of VAT returns for the specified period (in our case, for three quarters).

If your organization sells for export, then you must also add the tax base reflected in Section 4 of the VAT report. We also take into account transactions that are not subject to taxation and are included in Section 7. If, having collected the tax base for all sections of VAT returns for the required period, you do not receive the amount reflected in the income tax return, then we begin to understand the reasons for this phenomenon.

There may be several reasons:

1) An error actually crept into one of the declarations. For example, there is often a situation when, after sending the VAT report, data adjustments begin to prepare the income tax report. The documents are retransmitted, corrections are made, after which the amounts in the VAT return may also change, but the report has already been sent with the same data. In order to check the current situation in VAT accounting registers, you can create a new tax return for the quarter of interest and try to refill it, and then compare the data with the original report (under no circumstances try to refill the original report!). If the amounts have changed, we check their correctness and compare the new amounts with the income tax return. Errors in this case can be very different, we talked in detail about checking declarations using accounting data in 1C: Enterprise Accounting 8 in the video courses “VAT: from concept to declaration” and “Tax accounting and calculation of income tax.” In the event that erroneous information was transmitted, most likely it will be necessary to generate an updated declaration, especially if an adjustment must be made in the direction of increasing tax.

2) VAT was calculated on other income. If your organization received non-operating income subject to VAT during the tax period, then this fact will need to be written in the response to the request. This type of income is reflected in line 020 of Sheet 02 of the income tax return, but not all income reflected on this line is subject to VAT, so this situation is not transparent for the Federal Tax Service; explanations must be provided. For example, your organization issued penalties to the buyer, calculated VAT on the amount of the fine and reflected these amounts on account 91, i.e. as part of non-operating income.

There is no error in this case, there is no need to prepare an updated declaration, it is enough to provide an explanation in response to the request.

3) The organization received income from exchange rate differences in the tax period. If, at the end of the tax period, the organization received income from exchange rate differences, it will also have to provide explanations to the tax authority. The fact is that exchange rate differences are included in income for the purpose of calculating income tax, but are not subject to VAT, so a completely justified difference arises between the declaration figures.

4) A gratuitous transfer was carried out. In accordance with current legislation, a gratuitous transfer for VAT accounting purposes is recognized as the sale of goods (works, services). But in this case there is no taxable income for the purpose of calculating income tax, therefore, an understandable difference arises between the tax bases for VAT and income tax, for which it is necessary to provide explanations to the Federal Tax Service. Of course, there are many more rare situations that lead to a discrepancy between income from sales under income tax and revenue under value added tax. For example, targeted proceeds used for other purposes are recognized as income in tax accounting, but are not subject to VAT. But it is not possible to consider all the variety of options in one article, so I told you only about the most popular of them. And if you want to share your experience and write in the comments about a situation not mentioned in the article, then we will be very grateful to you, because this information can be useful to thousands of other Internet users who will look at our website in search of an answer to such an important question.

Author of the article: Olga Shulova

Let's be friends on Facebook

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Accountant 11/27/2020 6:11 pm I had this problem only because of returns and implementation adjustments. The income in the NP declaration has become less than the Revenue in the VAT declaration. After all, adjustments and returns are made through the purchase book, but the sales book is not changed, I understand correctly.

Quote

0 marina 09.12.2017 14:40 I quote Olga:

Good afternoon! My income from these declarations never matches and, in principle, it cannot match according to the Tax Code. And every year I write the same explanation to the tax office. Let me explain briefly. Revenue in the income tax return is determined based on the fact of shipment of goods (work, services). And we determine the revenue in the VAT return based on the fact of shipment + prepayment received.

DD! Tell me how to correctly formulate such a letter?

Quote 0 Irina1975 06/06/2017 01:58 Good afternoon, Olga. I quote Olga:

Good afternoon! My income from these declarations never matches and, in principle, it cannot match according to the Tax Code. And every year I write the same explanation to the tax office. Let me explain briefly. Revenue in the income tax return is determined based on the fact of shipment of goods (work, servants). And we determine the revenue in the VAT return based on the fact of shipment + prepayment received.

Good afternoon. And I have the same situation, the tax office asks for clarification, but here we have: “We determine revenue in the income tax return based on the fact of shipment of goods (work, from servants). And we determine the revenue in the VAT return based on the fact of shipment + prepayment received.” I just can’t figure out how to most succinctly formulate a response to the requirement. I would be grateful if you help Quote

And I have the same situation, the tax office asks for clarification, but here we have: “We determine revenue in the income tax return based on the fact of shipment of goods (work, from servants). And we determine the revenue in the VAT return based on the fact of shipment + prepayment received.” I just can’t figure out how to most succinctly formulate a response to the requirement. I would be grateful if you help Quote

-1 Olga Shulova 02/17/2017 14:57 Quote Olga:

You understood me correctly. And I am very grateful to you for your question. This year I will answer the tax office that these two indicators cannot be summed up. And so every year I sent the same letter to the tax office.

Thank you for sharing!

Perhaps someone will encounter the same situation and your comment will help them! Quote 0 Olga 02/17/2017 14:55 You understood me correctly. And I am very grateful to you for your question. This year I will answer the tax office that these two indicators cannot be summed up. And so every year I sent the same letter to the tax office.

Quote

+2 Olga Shulova 02/17/2017 14:46 I quote Olga:

Good afternoon! My income from these declarations never matches and, in principle, it cannot match according to the Tax Code. And every year I write the same explanation to the tax office. Let me explain briefly. Revenue in the income tax return is determined based on the fact of shipment of goods (work, services). And we determine the revenue in the VAT return based on the fact of shipment + prepayment received.

Hello!

But the VAT calculated on the prepayment received and the base for calculating this tax are in a different cell. Typically, the tax office reconciles lines generated only for sales income in two declarations (that is, line 010); prepayment is not taken into account for this reconciliation. Or did I misunderstand you? Quote +1 Olga 02/17/2017 1:13 pm Good afternoon! My income from these declarations never matches and, in principle, it cannot match according to the Tax Code. And every year I write the same explanation to the tax office. Let me explain briefly. Revenue in the income tax return is determined based on the fact of shipment of goods (work, servants). And we determine the revenue in the VAT return based on the fact of shipment + prepayment received.

Quote

Update list of comments

JComments

What are the VAT requirements?

After calculating data for 12 months, the company concluded that the share of deductions exceeds 89 percent. To find out what affects this indicator, we examined VAT returns in detail.

It turned out that the inspection included in the calculation the entire VAT, taking into account advances, both accrued for payment to the budget and declared for deduction. However, the Federal Tax Service of Russia believes that the share of VAT deductions should be calculated without taking into account accruals and deductions for advances (letter No. AS-4-2/12722 dated July 17, 2013). By recalculating the share of deductions, you can see how much the result will change if you take into account in the formula only the indicators of VAT accrued and presented on completed transactions and operations.

In our case, the recalculation gave an adjustment in the right direction. Without taking into account advance VAT, the share of deductions decreased by 2 percent and the deviation in the fourth quarter of 2015 was only 1 percent. Having recalculated the share of deductions due to VAT amounts from advances issued and received, the company came to the conclusion that prepayment amounts are the main reason influencing the level of the share of deductions. That is, activities related to sales in the billing period actually do not produce deviations in the share provided for by the Concept. The company sent these explanations, along with counter-calculations, to the inspectorate.

The procedure for writing an explanatory note

To date, there is no legislative regulation for the preparation of an “explanatory” form. Drawing up an explanation to the tax office about discrepancies in the declaration is carried out in any form. The main condition is to provide a clear answer to the question asked, and the history of the origin of inaccuracies in the declaration. In practice, two clarification options are used:

- The identified error is reflected in the explanatory note, but always with reference to the correct data;

- The presence of an error is refuted, explanations and relevant data are provided that confirm the inclusion of this information in the declaration. An example of this situation could be discrepancies in reconciliation between the enterprise and its counterparties.

Frequently asked question: VAT discrepancies associated with the discovery of an error in VAT calculation between the company data and the supplier. The occurrence of these discrepancies may be due to a number of reasons:

- The supplier's declaration does not contain information about the shipment of goods;

- The supplier of the goods is an intermediary.

The current legislation stipulates that when issuing an invoice on behalf of its customer, the intermediary is exempt from charging VAT; this function must be performed by the direct supplier. Thus, the presence of shortcomings may be due to the lack of appropriate actions on the part of the principal, failure to provide them with accounting logs or incorrect provision of them. In this case, it is necessary to additionally provide supporting documents: a letter from the counterparty, a commission agreement.

What are the income tax requirements?

Income tax requirements are often no less mysterious and even more time-consuming to explain than VAT. The company received a request as part of a desk audit of the income tax return for 2015 with a request to explain the discrepancies between the expenses reflected in the statement of financial results (Appendix No. 1 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n) and the expenses indicated in the income tax return. income tax. The inspectors also asked the question “why the tax base for 2015 did not change compared to the tax base for 9 months of 2015, despite a significant increase in revenue amounts.”

The approach to writing explanations on such issues depends on the desire and scrupulousness of the chief accountant. If the amount of expenses in tax accounting is less than in accounting, then we can limit ourselves to a short answer that the difference was formed due to expenses that are not accepted for tax purposes. The company itself decides whether to attach documents or not. After all, the inspectorate can demand documents in a camera room only in a limited number of cases.

The company explained that the increase in expenses occurred at the end of 2015 due to the creation of a reserve for doubtful debts in tax accounting. Because of this, a difference arose between accounting and tax accounting and the tax base for income tax did not increase significantly.

How to provide explanations when there is a discrepancy between the tax base for profit and VAT

Submitting reports to regulatory authorities is, of course, a responsible matter and requires careful preliminary checks. Therefore, checking the compliance of indicators in primary documents and reporting declarations is an important task. However, even the most thorough inspection does not guarantee that the inspectorate will not have questions for the taxpayer and will not require appropriate explanations. For example, the Federal Tax Service may request clarification on the discrepancy between the tax base for profit and VAT.

Taxpayers become aware of the existence of a discrepancy after receiving requests from tax authorities. According to paragraph 3 of Art. 88 of the Tax Code of the Russian Federation, the answer must be given within five days, otherwise the taxpayer faces a fine of 5 thousand rubles. If you do not respond to the inspection requirements again within a year, the fine will be 20 thousand rubles.

Let's look at the most common examples of such situations and tell you how to respond to tax requirements.

The organization receives interest on a cash loan

This does not affect the VAT tax base, but the very fact of receipt during the period of interest accrual is reflected in the VAT return. At the same time, amounts received from interest appear in the tax base for profits on the last day of each month.

What to answer in the explanation.

Please inform that there is no error in the declaration. Since non-operating income was reflected in profit (line 100 of Appendix 1 to Sheet 02), discrepancies arose. The amount of interest was not included in the VAT tax base in accordance with clause 3 of Art. 149 and paragraph 1 of Art. 146 of the Tax Code of the Russian Federation.

Use account statements 90.01 “Revenue” and 91.01 “Other income” as supporting documents.

Sales of goods, works and services exempt from taxation

Let's say an organization is engaged in the trade of medical goods, some of which are not subject to VAT. Their implementation does not affect the tax base, but it is reflected in the VAT return. Transactions on the sale of such goods are reflected in the income tax return after ownership passes from the seller to the buyer.

What to answer in the explanation.

There is no error in the declaration. It is necessary to clarify that the company sold medical products for a specific amount (its amount must be indicated in the explanation), which are not subject to value added tax and are reflected in section 7 of the VAT return. Income from the sale of these goods, according to clause 3 of Art. 271 of the Tax Code of the Russian Federation, was reflected in the income tax return (lines 010, 011, 012 of the appendix to sheet 02) after the transfer of ownership of the goods to the buyer.

For confirmation, you can use the purchase and sale agreement and registration certificates of medical devices.

Export operations

The accountant reflects export transactions in the VAT return in the period in which the entire package of documents necessary to confirm these transactions is collected. In profit reporting, the tax base appears at the moment when ownership passes from the seller to the buyer.

What to answer in the explanation.

Report that the company sold goods for export in a certain period for a specific amount (the sales period and the amount of revenue will need to be indicated). In accordance with paragraph 3 of Art. 271 of the Tax Code of the Russian Federation, operations for the export of goods were reflected in the income tax return (lines 010, 011, 012 of the appendix to sheet 02) after the transfer of ownership to the buyer. According to paragraph 9 of Art. 167 of the Tax Code of the Russian Federation, this operation was reflected in the VAT return after the complete package of documents was collected (here you will need to clarify the date of collection of the package of documents).

For confirmation, a purchase and sale agreement with specifications, as well as a bill of lading or an acceptance certificate are used.

The organization receives dividends and interest on deposits

When determining the base for calculating value added tax, dividends are not included. In addition, they are not reflected in the VAT return. The taxpayer reflects information about dividends in the tax return after receiving the money.

What to answer in the explanation. Report that your company received dividends (indicate the date of receipt and the amount of the dividends), and information about this was reflected in the VAT return (line 100 of Appendix 1 to Sheet 02) in accordance with paragraph 8 of Art. 250, paragraph 1, art. 271 Tax Code of the Russian Federation. Please clarify that on the basis of paragraph 1 of Art. 39, pp. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, dividends are not included in the calculation of the tax base for VAT and are not reflected in the declaration.

As supporting documents, use the decision to pay dividends, payment orders or cash documents for the payment of dividends.

There was a positive difference in the exchange rate

Let’s say an organization has entered into a supply agreement with a foreign partner with partial payment. The amount of VAT was charged on the foreign currency advance at the rate of the Central Bank of Russia on the date of shipment of the goods. When the subsequent payment was received, a positive exchange rate difference arose.

Positive exchange rate differences are not calculated or reflected in the value added tax return. But at the time of revaluation of liabilities, it is taken into account when the tax base for profits is formed.

What to answer in the explanation.

Please inform that there are no errors in the declaration. Please specify that the company has entered into an agreement for the supply of goods to a foreign partner with partial payment. The amount of value added tax was charged on the currency advance at the rate of the Central Bank of the Russian Federation, which was in effect at the time of shipment. In accordance with paragraph 8 of Art. 271 and paragraph 10 of Art. 272 of the Tax Code of the Russian Federation, the positive exchange rate difference that arose upon receipt of subsequent payment was included in non-operating income for income tax, and was also reflected in the declaration (line 100 of Appendix 1 to Sheet 2). The difference between the tax base for income tax and VAT arose because the amounts of exchange rate differences are not reflected in the VAT return.

To confirm, use the following statements:

- on account 62 for subaccounts “Settlements for advances received” and “Settlements for shipped goods”;

- under account 91.1 “Other income”.

Free transfer of goods, works, services or property rights

If a company transfers goods or provides services free of charge, the VAT tax base arises after these actions are completed. Since there was no tax base for the profit, the taxpayer does not reflect it in the declaration.

What to answer in the explanation.

Please inform that there are no errors in the declaration. Specify that your company transferred the goods to third parties free of charge (indicate the date of transfer and the amount of the cost of the goods). According to paragraph 1 of paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, this operation was reflected in the VAT return in the corresponding line of section 3 (010, 020 or 030 - depending on the tax rate) for the corresponding period. The tax base for profit did not arise and therefore was not reflected in the declaration (Article 249 and Article 250 of the Tax Code of the Russian Federation).

As supporting documents, use an extract from account 91.02 “Other expenses”, as well as an agreement according to which one party is obliged to provide the other party with something without receiving payment or other counter-provision.

Free receipt of goods, works or services

The tax base for VAT does not arise if the company receives goods free of charge from the counterparty, and therefore is not reflected by the taxpayer in the declaration. In an income tax return, income arises after the company receives the goods.

What to answer in the explanation.

Please inform that there are no errors in the declaration. Please specify that your company received the goods free of charge (you must indicate the period of receipt and the amount of the total cost of the goods), therefore this operation was reflected in the profit declaration (lines 100, 103 of Appendix 1 to sheet 02) in accordance with clause 8 of Art. 250 and pp. 1 clause 4 art. 271 Tax Code of the Russian Federation. Since the tax base for VAT did not arise, it was not reflected in the declaration.

To confirm, use account statement 98.2 “Gratuitous receipts”.

Carrying out construction and installation work for your own needs

Let's say a company is building a warehouse for itself. According to paragraphs. 3 p. 1 art. 146 of the Tax Code of the Russian Federation, income in this case arises when the tax base for VAT is formed. It is reflected in the declaration at the end of each quarter. In this case, the income does not fall into the income tax base and is not reflected in the declaration.

What to answer in the explanation.

Please inform that there are no errors in the declaration. Specify that your company is engaged in construction and installation work for its own consumption (indicate here the period in which the work took place). Based on paragraphs. 3 p. 1 art. 146 of the Tax Code of the Russian Federation, construction operations were reflected in the VAT return (line 060 of section 3) based on the results of each quarter. Since the tax base for profit did not arise, it was not reflected in the profit declaration.

Use account statements as supporting documents:

- 01 “Fixed assets”;

- 08.03 “Construction of fixed assets”.

Based on the results of the inventory, the surplus was capitalized

Identified surpluses are not included in the VAT tax base. The taxpayer does not reflect them in the declaration. In the income tax return, identified surpluses arise at the time the inventory is completed.

What to answer in the explanation.

Please inform that there are no errors in the declaration. Surplus inventory items that were identified as a result of the inventory were included in non-operating income (clause 20 of Article 250 of the Tax Code of the Russian Federation) and reflected in the income tax return (line 104 of Appendix 1 to Sheet 02). Based on paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, at the time of capitalization of the surplus object of taxation, VAT did not arise.

To confirm, use the act of the inventory commission and an extract from account 91 “Other income and expenses.”

Write-off of accounts payable after expiration of the statute of limitations

If a company has written off a debt to a counterparty after the expiration of the statute of limitations, the amount of the write-off does not require restoration in the value added tax return. It also does not fall into the tax base, but it must be included in non-operating income for income tax.

What to answer in the explanation.

Please inform that there are no errors in the declaration. The discrepancies arose due to non-operating income in the form of the amount of overdue accounts payable written off due to the expiration of the statute of limitations. This income was reflected in the income tax return (line 100 of Appendix 1 to Sheet 02). In accordance with paragraph 3 of Art. 149 and paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, this amount was included in the VAT tax base.

Use the following account statements as supporting documents:

- 90.01 “Revenue”

- 91.01 “Other income”.

Sales of recyclable materials by the VAT payer

Let’s say I sold ferrous metal to an address. Both organizations are VAT payers. Since Stroitel will use scrap metal in activities that are subject to VAT, it is this company that must charge the tax - as a tax agent.

will issue an invoice to the address with the note “VAT is calculated by the tax agent.” The buyer of scrap metal must reflect in the declaration all transactions that are associated with the calculation and deduction of VAT at the time of shipment of the goods. This operation is included in the seller’s VAT tax base. However, he is obliged to reflect it in his income tax return.

What to answer in the explanation.

Please report that your company sold recyclable materials using an invoice marked “VAT is calculated by the tax agent.” This operation is not reflected in the VAT return and, according to clause 8 of Art. 161 of the Tax Code of the Russian Federation, does not participate in the calculation of the tax base. Based on clause 3 of Art. 271 of the Tax Code of the Russian Federation, the sale of scrap metal is reflected in the income tax return (lines 010, 011, 012, 014 of Appendix 1 to Sheet 2).

As a supporting document, use an invoice marked “VAT is calculated by the tax agent.”

Important:

There are exceptions in which VAT is calculated by the seller and not the buyer. This happens if:

- in the contract and primary documents it is indicated about;

- the seller no longer has the right to apply the simplified tax system or UTII;

- the seller is no longer exempt from VAT;

- the VAT payer sold the goods to an individual without individual entrepreneur status;

- recyclable materials were sold by the VAT payer for export.

Return of goods

Let's imagine that a company discovers a defect in a purchased product. In this case, she transfers to the seller a statement of defects in the goods, as well as a return receipt. In this case, the seller issues an invoice for the reduction and registers this document in the purchase book.

The tax base in the VAT return is reflected by the buyer through the registration of an entry in the sales book. Since money returned for defective goods is not income, the transaction is not included in the income tax return.

What to answer in the explanation.

Please inform that there are no errors in the declaration. The company purchased a product that was found to be defective and returned it to the supplier. Funds returned by the supplier are not included in income. The cost of the item to be returned is not included in the costs. At the same time, value added tax was assessed on it.

The discrepancies arose due to the fact that there was no income for calculating income tax, and VAT was accrued on lines 010 (020) and columns 3 and 5 of section 3 of the value added tax declaration. After returning the goods, the contract between the company and the supplier was terminated, and a new contract was not concluded.

To confirm, use the statement of defects in the goods, the return delivery note and the adjustment invoice.

Important:

If the goods are returned to the supplier at the initiative of the company, when calculating income tax, it has taxable income, from which the cost of the returned goods can be deducted. Value added tax is charged on the proceeds from the return. Refunds are made at supplier prices, so for purposes of calculating income tax and VAT, the revenue will be the same.

Transfer of a fine, penalty or penalty from the buyer

If goods supplied under a contract are subject to VAT, then if the buyer violates his obligations, the supplier receives a penalty, fine or penalty from him. The money received by the company from the counterparty for violating the terms of the contract is not related to payment for the goods, and therefore is not subject to VAT. The payment of the penalty is not reflected in the value added tax return, but the amount received is included in the tax base for calculating income tax and is reflected in the return for this tax.

What to answer in the explanation.

Please inform that there is no error in the declaration. Based on clause 3 of Art. 250 and pp. 4 paragraphs 1 art. 271 of the Tax Code of the Russian Federation, the amount of the penalty received by the company from the counterparty for violating the terms of the contract was taken into account as part of non-operating income and reflected in the income tax return (line 100 of Appendix 1 to sheet 02. According to clarifications of the Ministry of Finance in letter dated March 4, 2013 No. 03 -07-15/6333, this transaction is not subject to VAT.

As supporting documents, use the supply agreement with the calculation of the penalty and an extract from account 91.01 “Other income”.

Restoring a previously created reserve

Let’s assume that the company’s reserve for doubtful debts at the end of the reporting period was less than the amount of the reserve balance. The difference in this case is included in non-operating income and is reflected in the income tax return (line 100 of Appendix 1 to Sheet 2). Restoration of a previously created reserve is not included in the VAT tax base and is not reflected in the declaration.

What to answer in the explanation. Please inform that there are no errors in the declaration. The amount of the reserve that was calculated as of the reporting date is less than the amount of the balance of the reserve from the previous reporting period. Based on clause 7 of Art. 250 and pp. 5 paragraph 4 art. 271 of the Tax Code of the Russian Federation, the difference is included in non-operating income on line 100 of Appendix 1 to sheet 02 of the income tax return. Restoration of a previously created reserve is not included in the VAT tax base and is not reflected in the declaration.

To confirm, use the statement of account 91 “Other income and expenses.”