General information

Draws up a contract for a desk tax audit report from the Federal Tax Service. The preparation of the form is preceded by an analysis carried out by tax officials. A desk audit is carried out in several cases:

- if there is a discrepancy between the information specified in the declaration for a certain reporting period;

- if there are inconsistencies in the data in the reports presented for a certain period;

- when an application for tax relief is made;

- when filing a tax return for reimbursement from the budget or large deductions;

- when submitting reports containing information on the use of natural resources.

A document – an act of a desk tax audit – is drawn up during the inspection. On its basis, a decision is made on whether the taxpayer is subject to punishment for the tax offense he has committed. The form also contains information about the audit, based on which the taxpayer has the right to file an objection. A desk tax audit report sheet is generated only in cases of violation by the taxpayer of the established rules. It is delivered within five working days by mail or any other means.

Timing of the inspection and established procedure

The conduct of the required process, like other activities in the field of tax legal relations, is regulated by the Tax Code of the country, more precisely, by its article number 88.

Article 88. Desk tax audit

The audit begins immediately from the moment the taxpayer submits declaration forms and related documents to the tax office for verification. To initiate it, specialists do not need to obtain permission or a documented decision from the management of a particular service department or the tax payer who provided the data.

In addition, representatives of the tax system have no obligation to send taxpayers notifications stating that a desk audit has started.

The duration of the required process is 3 months from the moment the declaration is submitted for consideration to the tax office

If the inspection has already begun and during its implementation some inaccuracies, errors or any other discrepancy between the information submitted for processing and reality were discovered, inspectors are obliged to notify the citizen whose documents are being checked and provide him with the following two options for further developments:

- or come to the service department to give oral and written explanations for inaccuracies in the declaration;

- or provide a new declaration form, which plays the role of correcting an incorrect document.

We would like to draw your attention to the fact that additional submission of information or an invitation to receive clarification are situations that arise quite rarely. Usually, during a desk audit, all inaccuracies or points previously unclear to tax officials are clarified, and the work continues at full speed.

If there is a need to provide clarification, you can do the following.

- Appear in person at the tax office and, in the presence of employees involved in your case, draw up a written explanation. A very convenient option, since the inspectorate workers present during writing will help you indicate all the necessary clarifications and first explain in detail what the inaccuracies actually are.

- Send a written explanation via mail. To do this, you must write a registered letter as soon as you receive the requirements, since the maximum period for providing clarification is five working days.

- In addition to sending by post, clarifications can be sent using electronic communication channels, that is, using a scanner and the Internet, sending clarification to the e-mail of a specific tax office.

According to the law, you have the right to transfer data using any of the methods listed above. However, we recommend that you consult with the tax specialists involved in your case. Do what is convenient for both parties and establish friendly relations with your employees, which will certainly affect the degree of diligence in working with you.

If you do not have to give explanations, but enter corrective information using a new declaration form, you will have to fill it out again. According to the letter of the law, the tax service has the right to request a clarifying declaration and other accompanying documents in the following cases.

- if there was a statement of the amount of value added tax that needs to be reimbursed;

- when the declaration form states some benefits due to the taxpayer;

- if reporting is carried out on tax collections directly related to the use of natural resources;

- if the declaration form for collection from the profit of an organization or personal income tax was submitted for verification by a person participating in the investment partnership.

The right to receive additional information during a desk audit from tax officials extends not only to taxpayers providing documents. They can also obtain information of interest from other additional sources.

- First of all, the tax service has the right to clarify and supplement existing information with the help of taxpayers themselves, however, only in cases where such a right arises in accordance with legislative norms.

- Representatives of the tax inspectorate also have the right to demand the provision of information and additional documents from counterparties and other entities.

- In particularly complex cases, it is also possible to conduct interrogations of persons who are witnesses in a particular case.

- Another way to obtain additional information is to conduct an examination.

- If necessary, to clarify certain circumstances, tax officials may invite a professional translator or an expert in the desired field of activity to take part in the process.

- With the consent of the tax payer, service employees also have the right to inspect the submitted documentation and any items related to the case.

How to compose correctly

A sample desk tax audit report is drawn up on the basis of the Tax Code. Paragraph 4 of Article 100 specifies the basic requirements for the preparation of this type of documentation. So, according to this provision, the form must:

- Created in duplicate.

- Compiled according to an established template.

- Signed by the inspector and the taxpayer or his official representative.

- Be issued within 10 working days after completion of the inspection, in cases where violations were identified.

The structure of the form consists of three parts:

- Introductory. Information about the company and verification information are written here.

- Main. The facts of violation of the law are described in detail. The information in this block is written clearly and systematically.

- Final. The block contains information about the results of the inspection, describes the identified offenses, proposals for their elimination and punishment. The scheme of the desk tax audit report contains a number of appendices that present evidence of violations. As a rule, this section contains explanations, additions, certificates, calculations of discrepancies and other documentation drawn up by the inspector.

How to fill it out correctly

The template for the desk tax audit report is drawn up according to the approved sample in cases where the Federal Tax Service inspector has discovered errors in the taxpayer’s reporting documentation. The sample can be on electronic or paper media. At least 10 days are allotted for its preparation. The taxpayer is given 5 days to familiarize himself with the form.

The act is drawn up in Russian, usually in printed form. Abbreviations are permitted on the official sheet. It is worth noting that the first time you mention a company, you must indicate the name in full. Subsequently, it is allowed to shorten it.

Also, when filling out the template you must:

- Decipher monetary units of foreign currency and convert them into the corresponding equivalent in rubles. The exchange rate must correspond to the one set by the Central Bank.

- Enter dates in the format DD.MM.YYYY.

- Eliminate errors completely. In some cases, corrections are permitted. But they must be certified by the signatures of the inspector and the person being checked. An example of a desk tax audit report is filled out as a regular document. The first part contains the form number, the name of the enterprise (in full or abbreviated), and its details.

If the check is carried out in relation to an individual, then you will need to indicate:

- full initials;

- TIN.

In both cases, the inspector additionally indicates the place and time of the inspection. The first part contains information about the citizen: full name, documents that served as the basis for the inspection, period and list of activities carried out. The second part contains data confirming or refuting the fact of a violation, as well as facts mitigating the punishment for the offense. Please note that the information must be objective, reasonable and true.

The third part specifies penalties and their amount, as well as information about the inspector (full name, position).

Conducting an in-depth review

Conducting an in-depth audit involves requesting additional data from various entities to supplement existing information. Simply put, if confirmation of certain facts is needed or doubts about the veracity of any information are so strong, service employees have the opportunity to:

- receive photocopies of primary documentation;

- conduct a conversation with witnesses of a particular case;

- find out information of interest from counterparties;

- order an examination or obtain additional information in other available ways determined by law.

Why is an in-depth check needed?

The need for an in-depth audit arises in the following situations.

- If the tax payer has the right to use any benefits. Usually, information from outside is needed just to confirm the required information about the ownership of the right to receive government “indulgences” when paying taxes.

- If a value added tax refund was claimed on the return form, the tax office often insists on conducting an in-depth desk audit. The fact is that usually representatives of the entrepreneurial category avoid VAT refunds. Starting from 2015, it became possible to postpone value added tax deductions for three years, so that an in-depth desk audit was not carried out, and it was possible to avoid reimbursement.

- If inside the value added tax declaration form there are data on transactions performed that contradict other information obtained from the same form. Or there is a discrepancy between the information on the same transactions from the value added tax declaration form, which was provided for verification by another entity. Let's give an example. You and the company that is your counterparty simultaneously submit declarations for verification. In the same transaction in which both of you took part, the value added tax indicators according to the documentation proposed for verification turned out to be different. Previously, such a state of affairs would have required compensation, but now it is not required.

- If, after two years have passed from the last day on which the declaration was submitted, you submit for verification a declaration form with updated information, inside of which the indicator of losses received has increased or the amount of tax collection has been reduced. Of course, this state of affairs may seem far-fetched, and the tax service will want to find out how true the new data is.

- Most often, declarations drawn up for tax deductions related to the use of resources given to man by nature are subject to in-depth desk audits.

Note! If none of the above circumstances occur in your case, you have the right not to provide the tax service with additional information on completely legal grounds. However, if you are really clean and have the opportunity to explain yourself, it is better to do so so as not to aggravate the situation.

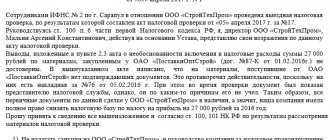

Sample of a desk tax audit report

The form cannot be drawn up in free form. The state has established a standard template, which can be downloaded on our website or the Federal Tax Service portal. The sheet is compiled only after verification. It lasts, as a rule, 3 months and is carried out on the basis of the declaration provided by the taxpayer.

To view an example of the form, you can view the desk tax audit report on our website. The sample completely follows the filling structure, which will allow you to get a general idea of the format and method of filling out the official paper.

How do experts determine when to initiate an inspection?

As we mentioned above, a desk audit is carried out “on the spot,” that is, within the Federal Tax Service, without implying any personal visits.

How do specialists decide to conduct an inspection?

Service specialists review declaration forms and other reporting documents filled with information relating to the activities carried out by the person:

- physical;

- legal.

All this data is verified for one purpose: to make sure whether the subject of tax legal relations has committed any illegal actions or simply whether he has not made banal errors when calculating the amount of the fee.

Such checks benefit not only the tax service, but also the payers themselves, at least because overpaid tax fees, the amounts of which are sometimes quite significant, are returned back.

A period of three months is given for the inspection. The countdown begins immediately from the moment the declaration document filled with information about the taxpayer is submitted for verification. If, during a desk audit, tax officials find inaccuracies or any errors among the declared information, and are unable to independently explain the discrepancies, the taxpayer will have to do this on his own. To do this, he will need to come directly to the tax service and give a written explanation or re-submit a clarifying declaration form.

According to the Tax Code of the Russian Federation, tax officials are required to carry out tax audits of declaration forms. However, within this main body of information regulating legal relations in the field of taxation, it is not stated who exactly and in what cases should be subjected to a desk audit. That is why, in fact, service employees not only have the responsibility to determine the reliability of knowledge, but also to determine the documents to be verified.

What to pay attention to

Let us remind you that the document is drawn up only after preliminary verification. In cases where the person being checked does not agree with the results of the check, he can file an objection. You have 1 month to prepare the form. The sheet is drawn up in written form. You can send it via email or submit it in person to the Federal Tax Service. The block of objections is compiled in free form. At the same time, it must clearly formulate points and protests of points with which the person being checked does not agree. If the decision made on the objection does not satisfy the citizen, he can file an appeal within 30 days.

Federal Tax Service employees must notify the taxpayer about the order in which the results of the audit are considered.

Events upon completion of the inspection: drawing up a report

So what begins to happen at the end of the inspection?

If tax specialists do not find any errors, contradictions or inconsistencies, then nothing else will happen.

When there are declared benefits within the declaration document or value added tax is presented for reimbursement from the state treasury, representatives of the tax service may insist on providing additional supporting documentation.

If some violations are identified, the tax inspectorate will begin drawing up a report upon completion of the audit. In total, specialists according to the law have ten days to carry out the required process. After their expiration, the service has five more days to deliver the paper to the payer.

After studying the act with violations, the payer has exactly 30 days to submit objections to the drawn up act. When the specified period given to the taxpayer ends, the head of a specific department of the tax service will make a decision to hold the person in question accountable for the offense committed. Since this decision rests with the manager, in some situations it is almost impossible to predict whether punishment will be imposed.