In this article, Professor M.L. Pyatov continues to acquaint readers with the provisions of the new law “On Accounting” dated December 6, 2011 No. 402-FZ. The material is devoted to the procedure for compiling and presenting primary accounting documentation as the basis for accounting records and maintaining accounting registers, determined by the new Federal Law.

In the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as the Law of 2011), as well as in the version of the Federal Law of November 21, 1996 No. 129-FZ (hereinafter referred to as the Law of 1996), issues related to the procedure compilation and presentation of primary accounting documents as the basis for entries in accounting accounts are determined by special article 9 “Primary accounting documents”. However, the provisions of the 2011 Law in this area contain significant innovations that should be noted.

Is it possible to have an account without a primary document?

Paragraph 1 of Article 9 of the 1996 Law established that “all business transactions carried out by an organization must be documented with supporting documents. These documents serve as primary accounting documents on the basis of which accounting is conducted.”

The provisions of the 2011 Law contain a slightly different wording: “every fact of economic life is subject to registration with a primary accounting document” (Clause 1, Article 9).

Does this mean that the primary document is no longer considered by the Law as the only “basis for accounting”? It is difficult to give a definite answer to this question. Formally, rather, yes, because the law states that “every fact of economic life” must be documented as a primary accounting document, and according to Article 5 of the 2011 Law, facts of economic life are not the only objects of accounting.

Methods for displaying information in registers

Information in registers can be reflected in various methods. The method chosen will be called the accounting registration technique. If information is entered into the table on the basis of documentation, this will be called posting an operation.

Recording can be done using these methods:

- Linear positional principle. In this option, debit and credit turnovers form a single line. This is a convenient method for keeping records of settlements. It makes it easy to track the status of all types of debts. Such a record allows you to combine data from detailed and generalized accounting.

- Chess principle. The amount for the completed action is recorded in one step both in debit and credit. This method is clear. The records are detailed as they reveal the composition of the correspondence. The chess principle is relevant when creating multiple registers, including order journals.

Recording methods are determined depending on the needs of the company and the characteristics of the information entered.

Unified forms of primary documents

Paragraph 2 of Article 9 of the 1996 Law established that “primary accounting documents are accepted for accounting if they are drawn up in the form contained in the albums of unified forms of primary accounting documentation.” As an exception to this general rule, there was a rule according to which “documents, the form of which is not provided for in these albums, must contain the following mandatory details: a) the name of the document; b) date of preparation of the document; c) the name of the organization on whose behalf the document was drawn up; d) content of the business transaction; e) measures of business transactions in physical and monetary terms; f) the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution; g) personal signatures of these persons.” “In order to implement the provisions of the Federal Law “On Accounting” of 1996, the Government of the Russian Federation issued Resolution No. 835 dated 07/08/1997 “On Primary Accounting Documents” (hereinafter referred to as the Resolution), in which the State Committee of the Russian Federation on Statistics was assigned “the functions of development and approval of albums of unified forms of primary accounting documentation and their electronic versions” (clause 1 of the Resolution).

Also, the State Committee of the Russian Federation on Statistics was ordered to “ensure, through territorial statistical bodies, starting from January 1, 1998, the provision of albums of unified forms of primary accounting documentation and their electronic versions to users on a contractual basis, while observing the principle of competition” (clause 4 of the Resolution).

In pursuance of the Decree of the Government of the Russian Federation dated 07/08/1997 No. 835, the State Committee of the Russian Federation on Statistics and the Ministry of Finance of Russia issued a joint Resolution (respectively, dated 05/29/1998 No. 57a and dated 06/18/1998 No. 27n), which approved the Procedure for the phased introduction in organizations independently on the form of ownership of those operating on the territory of the Russian Federation, unified forms of primary accounting documentation (hereinafter referred to as the Procedure).

According to this Procedure, from January 1, 1999, primary accounting documents had to be accepted for accounting “if they are compiled according to unified forms approved by the State Statistics Committee of Russia in 1997-1998. in agreement with the Ministry of Finance of Russia, the Ministry of Economy of Russia and other interested federal executive authorities for the following sections of accounting: accounting for agricultural products and raw materials; on accounting of labor and its payment; on accounting of fixed assets and intangible assets; on materials accounting; on accounting for low-value and wear-and-tear items; on accounting of work in capital construction; on accounting for the operation of construction machines and mechanisms; on accounting of work in road transport; on recording inventory results; on accounting of cash transactions; on accounting of trade transactions". According to paragraph 5 of this Procedure, the provision of unified forms of primary accounting documentation and their electronic versions to users of albums was to be carried out by territorial bodies of state statistics, starting from January 1, 1998, on a contractual basis.

The 2011 law repeals this provision. Paragraph 2 of Article 9 only defines the mandatory details of primary documents. According to the Law, “the mandatory details of the primary accounting document are:

1) name of the document;

2) date of preparation of the document;

3) the name of the economic entity that compiled the document;

4) the content of the fact of economic life;

5) the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

6) the name of the position of the person (persons) who completed the transaction, operation and who is responsible (responsible) for the correctness of its execution, or the name of the position of the person (persons) responsible for the accuracy of the execution of the event;

7) signatures of the persons provided for in paragraph 6 of this part, indicating their surnames and initials or other details necessary to identify these persons.”

The composition of the mandatory details of the primary document has been preserved, but here you should pay attention to the wording of the 2011 Law regarding the details reflecting the meter of the fact of economic life.

If the 1996 Law spoke about “measurements of a business transaction in physical and monetary terms,” then the 2011 Law indicates “the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement.” Thus, according to the new Law of 2011, the primary document may not contain the monetary measurement of the business fact reflected in the accounting.

According to paragraph 4 of the 2011 Law, “the forms of primary accounting documents are approved by the head of the economic entity upon the recommendation of the official charged with maintaining accounting records. The forms of primary accounting documents for public sector organizations are established in accordance with the budget legislation of the Russian Federation.”

Primary document carriers

Let us recall that paragraph 7 of Article 9 of the 1996 Law determined the provision according to which “primary and consolidated accounting documents can be compiled on paper and computer media. In the latter case, the organization is obliged to produce, at its own expense, copies of such documents on paper for other participants in business transactions, as well as at the request of the authorities exercising control in accordance with the legislation of the Russian Federation, the court and the prosecutor’s office.” This requirement of the Law has changed both in form and content, in particular with the introduction of the requirement for an electronic signature.

According to paragraph 5 of Article 9 of the 2011 Law: “The primary accounting document is drawn up on paper and (or) in the form of an electronic document signed with an electronic signature.” At the same time, paragraph 6 of Article 9 of the 2011 Law establishes that “if the legislation of the Russian Federation or an agreement provides for the submission of a primary accounting document to another person or to a government body on paper, the economic entity is obliged, at the request of another person or government body, at its own expense make hard copies of the primary accounting document compiled in the form of an electronic document.” Here the reader’s attention should be drawn to the existence of a special Federal Law dated 04/06/2011 No. 63-FZ “On Electronic Signatures”, Article 2 of which defines an electronic signature as “information in electronic form that is attached to other information in electronic form (signed information) or is otherwise associated with such information and which is used for the specific person signing the information.”

This Law “regulates relations in the field of the use of electronic signatures when making civil transactions... when performing other legally significant actions” (Article 1) and, in particular, defines:

- the procedure for legal regulation of relations in the field of using electronic signatures;

- principles of using an electronic signature;

- types of electronic signatures;

- conditions for recognizing electronic documents signed with an electronic signature as equivalent to paper documents, etc.

Corrections in primary documents

The 1996 Law, while defining the procedure for corrections in primary documents, actually contained provisions related to other areas of legislation (regulation of banking activities, etc.).

Let us recall that paragraph 5 of Article 9 of the 1996 Law established that “corrections to cash and banking documents are not allowed. Corrections can be made to other primary accounting documents only by agreement with the participants in business transactions, which must be confirmed by the signatures of the same persons who signed the documents, indicating the date of the corrections.” According to paragraph 7 of Article 9 of the 2011 Law, “corrections are allowed in the primary accounting document, unless otherwise established by federal laws or regulations of state accounting regulatory bodies. The correction... must contain the date of the correction, as well as the signatures of the persons who compiled the document... indicating their surnames and initials or other details necessary to identify these persons.”

Seizure of primary documents

The provisions of the Law on the possible seizure of primary accounting documents have also become more consistent with the framework of accounting legislation, without repeating the norms of tax, administrative, criminal and other areas of law.

Paragraph 8 of Article 9 of the 1996 Law established that “primary accounting documents can be seized only by the bodies of inquiry, preliminary investigation and prosecutor’s office, courts, tax inspectorates and internal affairs bodies on the basis of their decisions in accordance with the legislation of the Russian Federation,” and the “chief accountant or another official of the organization has the right, with the permission and in the presence of representatives of the authorities conducting the seizure of documents, to make copies of them indicating the reason and date of seizure.”

The 2011 law on this matter states the following: “If, in accordance with the legislation of the Russian Federation, primary accounting documents, including in the form of an electronic document, are seized, copies of the seized documents, made in the manner established by the legislation of the Russian Federation, are included in the documents accounting".

The procedure for recording business transactions

All information entered into accounting registers must be reflected correctly and in full. If a mechanical or mathematical error is made in a document, it is corrected in a certain way:

- additional accounting entries are prepared;

- the entry is reversed;

- the entry is corrected.

If an error was made in the register not related to the correspondence of accounts and total amounts, then it can be corrected by correcting the entry. To do this, an incorrect entry is crossed out with one thin line, and the correct information is indicated next to it. At the bottom of the document, the entry “corrected to believe” is indicated, followed by a date and signature. This method of correcting data is used in accounting certificates and explanatory notes to the balance sheet. If there was an error in the register, an error was made in the correspondence of accounts, then the “red reversal” method must be applied. This method is as follows:

- The accounting employee uses red ink to duplicate the erroneous correspondence, and then uses blue ink to indicate the correct entry.

If the amount was incorrectly indicated in the register, but the posting was correct, then you can use the additional posting method to correct it. When applying this method, unaccounted data should be reflected in the same correspondence.

Procedure for maintaining accounting registers

The 2011 Law, in terms of the rules relating to the preparation and presentation of primary documents, contains, like the 1996 Law, a special article 10 “Accounting registers”. Clauses 1 and 2 of Article 10 of the 2011 Law reproduce the classic rules for organizing the system of accounting registers, according to which “data contained in primary accounting documents are subject to timely registration and accumulation in accounting registers” (clause 1), and “omissions or withdrawals when registering accounting items in accounting registers” (clause 2). The further provisions of section 10 of the 2011 Law contain significant changes that should be noted.

We will not maintain tax registers

The advent of 2002 marked the most unpleasant news for accountants. From this time on, they must additionally “pull” the tax accounting of the enterprise. In theory, it is needed to correctly calculate income tax. For this purpose, special forms are designed, where all the necessary information is entered.

Nevertheless, many continue to calculate the tax directly in the declaration, using available tools: a calculator and drafts. Of course, the accountant does not use any accounting registers. Oddly enough, this behavior is quite reasonable and, in a sense, rational.

Registers and policies

Let's start with the well-known. All fundamental points regarding tax accounting are laid down in Article 313 of the Tax Code. Let us carefully read one important paragraph: “... if the accounting registers contain insufficient information to determine the tax base... the taxpayer has the right to independently supplement the applicable accounting registers with additional details, thereby forming tax accounting registers, or maintain independent tax accounting registers.” Did you notice the word “right”? That is, the main tax document of the country does not oblige the preparation of tax forms. Their information is for guidance only. But this is a theory.

What happens in practice? Employees of the Ministry of Taxation are trying to punish “objectionable” companies. They are charged with “gross violation of the rules for accounting for income and expenses and objects of taxation” (Article 120 of the Tax Code of the Russian Federation) or “failure to provide the tax authority with information necessary for the implementation of tax control” (Article 126 of the Tax Code of the Russian Federation). In reality, it is not possible to fine a company...

Responsibility will come later

First, let’s figure out why Article 120 of the code “doesn’t work.” The fact is that the lack of tax accounting registers is not among the gross violations defined by this article. It only talks about the absence of accounting registers, and not tax ones. Therefore, Article 120 of the Tax Code cannot be applied. Indicative in this matter will be the resolution of the Federal Antimonopoly Service of the North-Western District dated November 26, 2003 in case No. A05-4805/03-269/11.

Example 1

The tax inspectorate conducted an on-site audit of Bonadea LLC. The controllers found that in 2000 and 2001 the company did not keep tax cards for recording income and personal income tax in Form No. 1-NDFL. They considered that the company was grossly violating the rules for accounting for income and expenses, and demanded a fine of 15,000 rubles. on the basis of paragraph 2 of Article 120 of the Tax Code.

The company ignored this requirement, and the tax authorities went to court. However, the arbitrators did not support the inspectors. The arguments in favor of Bonadea were as follows.

According to Article 120 of the Tax Code, a gross violation means the absence of primary documents, invoices or accounting registers. And Form No. 1-NDFL is a tax accounting register designed for the correct calculation of this tax. Therefore, their absence is not a gross violation.

Note that, although Form No. 1-NDFL is not a register for accounting for income tax, the arguments of the judges are also applicable in our situation.

The officials themselves admit that they made a mistake. Thus, when adopting Chapter 25 of the Tax Code, they “forgot” to provide for penalties for the lack of tax registers. This was, in particular, stated by the Deputy Head of the Department of Profit Taxation of the Ministry of Taxation, Elena Popova, at a press conference dedicated to the payment of this tax. “At the moment we have no liability for failure to maintain tax records. Sometimes a situation arises that a taxpayer may refuse to maintain tax accounting registers, although Article 313 of the Tax Code states that the taxpayer is obliged to independently maintain registers on the basis of which he forms a tax return. However, if he refuses to keep such records, we cannot take any measures,” this is literally how the official described the situation.

True, now the Ministry of Taxation is trying to correct this situation. To do this, they have already prepared the necessary amendments to the code. Ms. Popova shared some details of what accountants will have to face: “We are focused on Article 120 of the code, which provides for sanctions for gross violations of accounting rules, we would like to supplement them with sanctions for failure to maintain tax records.”

Of course, it is not a fact that these amendments will be adopted. But in any case, they will begin to operate no earlier than next year. Until then, inspectors will have to put up with the current state of affairs.

Who needs documents

Now let's turn our attention to Article 126 of the Tax Code. Let's say that during the audit the inspectors demanded the necessary tax registers, but you did not provide them. Sometimes in such situations they automatically assessed a fine of 50 rubles for each form not submitted.

If the same thing happens to your organization, there is no need to rush to pay it. The fact is that the tax authorities cannot justify the amount of the accrued fine. After all, the Tax Code does not allow them to establish mandatory forms of tax accounting documents (Article 313 of the Tax Code of the Russian Federation). This means that controllers simply will not be able to determine the exact number of certain tax registers that they need to submit. All this is confirmed by arbitration.

Example 2

During the on-site audit, the tax inspectorate sent Provintsiya LLC a request to provide tax accounting registers for depreciation of fixed assets. This requirement turned out to be unfulfilled. Then the inspectors, referring to paragraph 1 of Article 126 of the Tax Code, offered the businessman to pay a fine of 450 rubles. When calculating this amount, employees of the Ministry of Taxes assumed that the organization should have one register per month. The “province” refused to pay, and the case was considered in court.

The court of first instance refused to collect the fine. The inspectors tried to challenge this decision and filed a cassation appeal. However, this time too the referees sided with the Province. They pointed out the following. Tax accounting registers are needed, but the merchant has the right to determine their form independently. In this regard, it is impossible to determine the number of documents that the company was required to submit. And then it follows: “... the tax inspectorate did not justify the amount of the fine collected on the basis of paragraph 1 of Article 126 of the Tax Code. Under such circumstances, the cassation instance does not find any grounds for canceling the court decision” (see the decision of the Federal Antimonopoly Service of the North-Western District dated February 2, 2004 in case No. A13-6442/03-21).

Let’s summarize: as you can see, there are no legal grounds for holding employees of the Ministry of Taxation accountable for the lack of tax records. Therefore, you can (of course, if you wish) reduce all tax accounting in your company to drawing up an accounting policy for tax purposes. This document is really necessary for work, if only because it determines the method of calculating VAT (“on payment” or “on shipment”) and income tax (cash method or accrual method). Although the absence of an accounting policy threatens the company with a symbolic fine of 50 rubles (Clause 1 of Article 126 of the Tax Code of the Russian Federation). In addition, the manager or chief accountant of the company may also be fined. For them, the fine will be from 300 to 500 rubles (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Well, you can safely ignore all the demands of officials that relate to income tax registers, at least until the end of this year.

I. Shmelev, PB expert

Double entry accounting

First of all, it is the provisions of the new law on the procedure for organizing the system of accounting registers that now contain an indication that organizations must maintain accounting records using the double entry method.

In the 1996 Law, this instruction contained paragraph 4 of Article 8, which established that “the organization maintains accounting records of property, liabilities and business transactions by double entry on interrelated accounting accounts included in the working chart of accounts.”

Paragraph 3 of Article 10 of the 2011 Law determines that “accounting is carried out through double entry in the accounting accounts, unless otherwise established by federal standards.” This is not only a change in the place of this rule in the text of the Law, but also the introduction into it of the possibility of defining exceptions for this rule by federal accounting standards.

However, the change in the position of this norm in the structure of the Law is also important, since its placement in Article 10 emphasizes the role of accounting accounts as a grouping feature that organizes the system of accounting registers.

Mandatory details of accounting registers

Paragraph 2 of Article 10 of the 1996 Law established that “business transactions must be reflected in the accounting registers in chronological order and grouped into the appropriate accounting accounts.” The 2011 Law abolishes the chronological sequence as the only possible option for organizing records in accounts, as indicated by one of the mandatory details of accounting registers defined by the Law - a norm that appeared in the Law for the first time.

According to paragraph 4 of Article 10 of the 2011 Law, “the mandatory details of the accounting register are:

1) name of the register;

2) the name of the economic entity that compiled the register;

3) the start and end date of maintaining the register and (or) the period for which the register was compiled;

4) chronological and (or) systematic grouping of accounting objects;

5) the monetary measurement of accounting objects indicating the unit of measurement;

6) names of positions of persons responsible for maintaining the register;

7) signatures of the persons responsible for maintaining the register, indicating their surnames and initials or other details necessary to identify these persons.”

By analogy with the definitions regarding primary documents, paragraph 5 of Article 10 of the Law establishes that “the forms of accounting registers are approved by the head of an economic entity upon the recommendation of the official charged with maintaining accounting records. Forms of accounting registers for public sector organizations are established in accordance with the budget legislation of the Russian Federation.”

Accounting registers in 1C

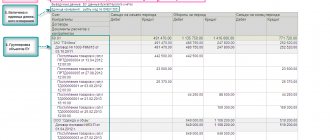

Let's look at the accounting registers that are used in the 1C: Enterprise Accounting 8 program, ed. 3.0. For this purpose, standard reports are provided, which are located in the “Reports”

and

“Calculation references”

in the

“Operations”

.

To set up the display of the position and signature of responsible persons in these registers, you must first go to the “Main”

–

“Organizations”

–

“Signatures”

–

“Responsible for preparing reports”

.

Next, you need to select those responsible in the fields “Accounting registers”

,

“Tax registers”

and

“Statistical reporting”

.

To set the dates from which the signature of the responsible person will be displayed in the accounting registers, follow the link “History”

.

Accounting registers and trade secrets

The 1996 Law contained a special rule indicating the following: “The contents of accounting registers and internal accounting reports are a trade secret” (clause 4 of article 10).

The 2011 law does not contain this provision, which naturally raises the question of maintaining the status of a trade secret of an economic entity for the contents of accounting registers.

Here, as in the cases of correction of legal provisions discussed above regarding the removal of irrational repetitions from normative legal acts of other areas of current law, we should use the general provisions of the Federal Law of July 29, 2004 No. 98-FZ “On Trade Secrets” (hereinafter referred to as the Law “ About trade secrets").

Article 3 of this Law defines a trade secret as “a regime of confidentiality of information that allows its owner, under existing or possible circumstances, to increase income, avoid unjustified expenses, maintain a position in the market for goods, works, services, or obtain other commercial benefits.”

At the same time, the Law establishes that information constituting a trade secret (trade secret) is “information of any nature (production, technical, economic, organizational and others), including the results of intellectual activity in the scientific and technical field, as well as information about methods of carrying out professional activities that have actual or potential commercial value due to their unknownness to third parties, to which third parties do not have free access legally and in respect of which the owner of such information has introduced a trade secret regime.”

The Law also specifically defines the concepts of the owner of information constituting a trade secret, access to such information, its transfer and provision, and disclosure of information of this type.

According to Article 3 of the Law “On Trade Secrets”:

“the owner of information constituting a trade secret is a person who legally possesses information constituting a trade secret, has limited access to this information and has established a trade secret regime in relation to it;

access to information constituting a trade secret - familiarization of certain persons with information constituting a trade secret, with the consent of its owner or on another legal basis, subject to maintaining the confidentiality of this information;

transfer of information constituting a trade secret - transfer of information constituting a trade secret and recorded on a tangible medium, by its owner to the counterparty on the basis of an agreement to the extent and on the terms provided for by the agreement, including the condition that the counterparty takes measures established by the agreement to protect its confidentiality;

provision of information constituting a trade secret - the transfer of information constituting a trade secret and recorded on a tangible medium by its owner to government bodies, other government bodies, local government bodies in order to perform their functions;

disclosure of information constituting a trade secret - an action or inaction as a result of which information constituting a trade secret, in any possible form (oral, written, other form, including using technical means), becomes known to third parties without the consent of the owner of such information or contrary to an employment or civil law contract.”

According to Article 5 of the Law “On Trade Secrets”, “a trade secret regime cannot be established by persons engaged in business activities in relation to... information... the mandatory disclosure of which or the inadmissibility of restricting access to which is established by other federal laws.”

Paragraph 11 of Article 13 of the 2011 Law determines that “a trade secret regime cannot be established in relation to accounting (financial) statements.” In this case, the composition of the accounting (financial) statements is established by Article 14 of the 2011 Law, according to which “the annual accounting (financial) statements, except for the cases established by this Federal Law, consist of a balance sheet, a statement of financial results and appendices thereto” (p. . 1). “The annual accounting (financial) statements of a non-profit organization, with the exception of cases established by this Federal Law and other federal laws, consist of a balance sheet, a report on the intended use of funds and appendices thereto” (clause 2). “The composition of interim accounting (financial) statements, with the exception of cases established by this Federal Law, is established by federal standards” (clause 3). “The composition of the accounting (financial) statements of public sector organizations is established in accordance with the budget legislation of the Russian Federation” (clause 4). “The composition of the accounting (financial) statements of the Central Bank of the Russian Federation is established by Federal Law of July 10, 2002 No. 86-FZ “On the Central Bank of the Russian Federation (Bank of Russia)” (clause 5).

Thus, in accordance with the Law “On Trade Secrets”, an organization can establish a trade secret regime in relation to the contents of its accounting registers.

Carriers of accounting registers

The provisions of the Law regarding the media of accounting registers have also undergone certain changes.

Let us recall that the 1996 Law established that “accounting registers are maintained in special books (magazines), on separate sheets and cards, in the form of machine diagrams obtained using computer technology, as well as on magnetic tapes, disks, floppy disks and other computer media "(Clause 1, Article 10).

In accordance with Article 10 of the 2011 Law, “the accounting register is compiled on paper and (or) in the form of an electronic document signed with an electronic signature” (clause 6). “If the legislation of the Russian Federation or an agreement provides for the presentation of the accounting register to another person or to a state body on paper, an economic entity is obliged, at the request of another person or government body, to make at its own expense on paper copies of the accounting register compiled in the form electronic document" (clause 7).

It is obvious that this change in the text of the Law only brought the latter into greater compliance with the realities of our time.

Classification

Accounting registers are tables compiled in a special form. They are needed to record the organization’s actions (settlements, receipts, etc.) on the accounting accounts. They are divided into types according to the following characteristics:

- By appointment. Based on this feature, tables are divided into three types. Information is entered into chronological tables as they arise, but they are not systematized. Information is entered into systematic registers based on the accounts on which it is posted. The data from these two tables are related. There are also forms in which generalized and systematic recording is performed. They will be combined. For example, such a table is considered to be “Journal-Home”.

- On working with information. Based on this feature, tables are divided into integrated and differentiated. In the first, the data is integrated, and in the second, it is separated.

- By appearance. The shape of the tables can be completely different. For example, these are cards, books. The first are forms in the form of a table, the second are a bound document with lacing. A blank sheet is a table placed on a form. This is a cross between a card and a book. Each form requires special storage. For example, cards are placed in file cabinets, and loose sheets are placed in folders. Registers must be maintained for these forms. They are needed to prevent theft and substitution. If a document is lost, it can be easily restored based on the registry data.

- By content. There are synthetic and analytical tables. In the first option, information is recorded in a generalized form in monetary terms. Data is entered based on synthetic accounts. The general ledger is considered to be the general ledger. In analytical registers, data is recorded in accounts with the appropriate name. That is, detailed information is reflected. Most companies use complex forms that combine two types of accounting (general and detailed).

What are the rules and examples of filling out accounting registers?

How are accounting registers used in the simplified method of accounting ?

Let's take a closer look at the classification of tables depending on their type:

- Contractual. These cards are single-sided in shape. On one side there are columns “Credit” and “Debit”. This arrangement of information allows you to quickly compare data and analyze the status of various operations.

- Inventory. Such cards are needed to record the valuables that the enterprise has. They have these columns: income, expenditure and balance. They are divided into columns. The document contains a stock standard that allows you to determine the discrepancy between the actual amount of funds that the company has and the required amount.

- Multi-columnar. Needed to record transactions performed in the company.

Important! All information posted in registers must be reliable. The person who compiled and signed the documents is responsible for the accuracy of the information.

Illegal adjustments cannot be made to the registers. The system must be protected from unauthorized patches. If a previously introduced error needs to be corrected, a special procedure is initiated. It is necessary to justify the adjustment and also confirm it with a signature. The date the corrections were made must also be indicated. The relevant rules are stipulated in Article 10 of Federal Law No. 402 of December 6, 2011 “On Accounting”. The same Federal Law states that information from registers is recognized as a trade secret. If any persons disclose the data in question, liability will be imposed.