New personalized accounting

New consolidated reporting to the Pension Fund is provided in accordance with Resolution of the Pension Fund Board of January 16, 2014 No. 2p.

Changes:

- Since 2014, a new form RSV-1 has been introduced, but there will be no separate SZV forms! Individual information will now be an appendix to the RSV-1 form.

- The distribution of insurance premiums between the insurance and savings parts will be carried out by the Pension Fund itself.

- The distribution of insurance premiums among insured persons will be carried out by the Pension Fund itself in proportion to the accrued contributions.

- One form will be submitted per person, which allows for the possibility of specifying several insurance premium rate codes. GPC agreements will now be a separate column in the information about the amount of payments section, and not a separate form.

- To indicate periods of inter-shift rest, transfer to light work, periods of study, transfers at the initiative of the employer, etc. The classifier of additional information codes for calculating length of service is being significantly expanded.

- New sections related to early non-state provision are appearing.

- Payments under the additional tariff will need to be further distributed by class of working conditions, depending on the results of a special assessment of working conditions.

- There will still be two BCCs, but the BCC of the funded part of the pension will be used only if the organization accrues additional contributions for the period 2010-2013. For the period starting from 2014, you will have to pay the insurance part to the KBK.

Changes in pension reporting in 2014

Based on materials from the webinar “New reporting rules in 2014.” Presenter: Elena Gennadievna Kulakova, expert at SKB Kontur.

So, from April 1, reporting to the pension fund will change significantly. First of all, the changes will affect the RSV-1 form:

1. It will contain data on employees,

2. Insurance contributions to the Pension Fund in 2014 will no longer be divided into two parts (insurance and savings). The pension fund itself will distribute the payment among employees.

Normative base

- Federal Law No. 333 of December 2, 2013

- Decree of the Government of the Russian Federation of November 30, 2013 on the maximum value of the base on which insurance premiums are calculated. In 2014 it was 624 thousand rubles.

- Federal Law No. 333 of December 2, 2013:

- He made changes to 212-FZ on insurance premiums: the application of reduced tariffs was extended for those who use the simplified tax system (their types of activities are listed in clause 8, part 1 of article 5), for pharmacies, non-profit, charitable LLCs and individual entrepreneurs using patent tax system. The reduced tariff can be applied until 2018.

- Changes were also made to Article 58.2: the general tariff was extended in the amount of 22% from the maximum value of the base and 10% above the maximum value: for those who apply the basic tariff.

- 351-FZ amended the law on compulsory Pension Insurance (167-FZ) and the law on personalized accounting (27-FZ).

- 421-FZ made changes, for example, to 212-FZ and 167-FZ.

Insurance premiums in 2014

For all insured persons born in 1967 and younger, there is now no mandatory savings part. It will remain for those who enter into an agreement with the non-state Pension Fund until December 31, 2015 and submit an application in which they wish to maintain the funded part in the amount of 6%. At the same time, policyholders will not divide contributions accrued to the Pension Fund into insurance and savings parts.

Accrued contributions are transferred in one settlement document to the KBK, intended for accounting for the insurance part. And by the 15th day of the second month following the end of the reporting period, policyholders will need to submit reports to the Pension Fund in the form RSV-1.

If there is no application from the insured person, then the Pension Fund will take into account 16% of the insurance part on the individual personal account and divide it into two parts. If there is an application, then 10% will be taken into account for the insurance part, and 6% of the actual payment for the savings part. That is, if the policyholder has not paid the premium in full, then the amount for the funded part will be calculated taking into account the payment ratio, in proportion to the amount that should be taken into account for the funded part. Then these funds will be transferred to a non-state pension fund or to a management company chosen by the insured person.

Reporting to the Pension Fund in several steps

In Kontur.Accounting, reporting is generated automatically based on the data you enter.

Try it

New form RSV-1

All changes made to the legislation were taken into account when developing the reporting form. The new RSV-1 was approved on January 16, 2014 by resolution of the PF Board No. 2P, which was published in the Rossiyskaya Gazeta on January 21, and came into force 10 days later.

Title page

Here, first of all, the coding of reporting periods has changed.

- Last year the reporting period was indicated by two numbers, and now by one. 3 is the first quarter, 6 is half a year, 9 is nine months, 0 is a year. Last year the year was represented by the number 12.

- We fill in a new field - “adjustment type” if we submit a corrective calculation. Its meanings can be as follows: 1, if the correction is made in terms of payment of insurance premiums, 2, if the corrections are related to the calculation of contributions to the Pension Fund, 3, if the corrections are made in connection with the recalculation of contributions for compulsory health insurance, or details are corrected that are not affect individual information.

- There are fewer insurer details. There is no need to indicate OGRN or OGRNIP for individual entrepreneurs, now there is no OKATO (OKTMO) and there is no need to fill out the registration address. In the details of the number of insured persons, it is now necessary to indicate only the number of persons for whom Section 6 is completed.

Section 1

Here the changes affected contributions to the Pension Fund and the columns were divided. Contributions to the Pension Fund starting from 2014 are indicated in a separate column, and separate columns are reserved for contributions for 2010-2013.

Please note: if at the end of 2013 there was an overpayment for the insurance portion, then this amount must be reflected in column 3 so that the amount will be offset in 2014, when the balance at the end of the reporting period will be calculated. If there is a debt for the insurance part for 2013, then it is reflected in column 4: where the insurance part for 2010-2013 is reflected. The cumulative part, positive or negative, is indicated in column 5.

Section 2.1.

Here you still need to fill out as many tariffs as were applied during the reporting period. There are fewer lines because... there is no division by age group: everyone is reflected on one line.

Line 206 reflects contributions in amounts exceeding the limit. The line is filled in only by those who apply the basic tariff and indicates 01, 52 or 53 tariff code. For those who do not charge 10% above the limit, this line is not filled in.

- We fill in line 207 if there are non-zero amounts in lines 205, 206, or both.

- Line 208 cannot be zero if line 203 contains non-zero amounts.

What should you pay attention to when filling out sections 2.1? If the codes are indicated in section 2.1, then section 3 is additionally filled in. For a tariff with code 03, subsection 3.1 or 3.2 is additionally filled in. This applies to public organizations of disabled people or those whose authorized capital consists of contributions from public organizations of disabled people.

For those organizations that apply the basic tariff, but have disabled employees and they are charged contributions at reduced rates, now section 3.1 does not need to be filled out. But keep in mind that if you filled out the table with code 03, then section 6 must contain information about insured persons with code OOI. If this is a public organization of disabled people, then section 3.1 is filled out, and then in section 6 all information must be with the code OIO.

For IT companies that indicate code 06 in section 2.1, fill out section 3.3. The numbering of section codes in section 3 has changed due to the fact that the list of disabled people has been cancelled. For media with code 09, subsection 3.4 is completed. For those who enter code 07, subsection 3.5 is additionally completed. And for those who put code 12 in section 2.1, subsection 3.6 is filled in.

Section 2.5.

This is a new section that replaced inventory ADV-6-2. Data on packs of information is displayed here. Subsection 2.5.1 contains data on packs of initial information, which in turn are formed into packs of 200 documents. Column 2 reflects data on the base that does not exceed the limit value. Column 3 reflects the contributions themselves. The base must be equal to the sum for all sections 6, in column 5 lines, which reflect the amounts for the last three months, and in column 3, contributions in the “total” line must be equal to the sum of all values from subsection 6.5 for all insured persons.

For the first quarter, the number of insured persons in all packs must be equal to the number of insured persons that you indicate on the title page. For subsequent periods these values may differ.

Subsection 2.5.2 reflects data on batches of corrective information. If you made a recalculation in the first quarter, for example, for 2010-2013, then you must create the correcting SZV-6-1 or 6-2, or SZV-6-4, if this is 2013. The packs will be attached to the calculation, and data on them will need to be reflected in section 2.5.2.

In the first quarter, we cannot submit any adjustments for 2014, so the periods in columns 2 and 3 can only be indicated within the range of 2010-2013. Moreover, the reporting period is indicated in accordance with the rules that were in force for that period, and not the codes that we use for 2014. The data on additional assessed contributions are reflected in columns 5 and 6, which are reserved for 2010-2013. And in subsequent periods, when there is a need to adjust the data for the first quarter of 2014 in the second or third, we will fill out column 4, which is reserved for additional accruals for 2014, and indicate the period that is being adjusted.

Section 4

The number of columns here has also increased due to the fact that 2014 and previous years are divided. If we charge additional amounts, we must indicate the reasons for the additional charge. In addition to the codes that were used in previous years, one more code has been added.

- Code 1 indicates the basis if additional charges were made based on desk audit reports;

- Code 2 - if additional charges were made based on on-site inspection reports;

- Code 3 - additional charges made independently, if you discovered an error, recalculated and added additional contributions.

Column 2 is required. The month and year for which the additional accrual was made is indicated; in the first quarter, you can indicate values only in columns 8, 9, 10 for 2010-2013. To reflect additional accrued contributions under Part 2.1 of Article 58.3, column 13 has been added. If we indicate additional accrued amounts in it, then in column 3 we indicate the grounds for this additional accrual. The codes correspond to the codes that we use in section 2.4: 1 - according to subparagraph 1 of paragraph 1 of Article 27 173-FZ, and 2 - according to subparagraphs 2-18.

Section 6

Here we indicate data on periods of work and amounts of payments for the last 3 months. We fill them out for the insured person, regardless of what contract he worked under: an employment contract or a civil service contract. Column 5 indicates the total amount of payments (the basis for calculating contributions), and column 6 indicates the amount under the GPC agreement.

The amount of payments exceeding the base limit is now indicated for all categories. In the SZV 6.4 form it was indicated only for the category of NR and accompanying VPNR, VZHNR.

In this case, the amount in column 4 must be equal to or greater than the amount in columns 5 and 7: if we add the amount within 624 thousand and the amount indicated in column 7, which exceeds the limit, then it must be either less than or equal to that amount , which we indicated in column 4. And the amount under the GPC agreement cannot be more than the base for calculating insurance premiums. If the insured person has more than one category, then new rows are added to this table, which are numbered next. Those. if there is one category, then from 400 to 403 lines, if the second category is from 410 to 413, etc.

Reporting to the Pension Fund without errors

Kontur.Accounting will tell you which fields are filled in incorrectly and provide links to legislation

Try it

For each category, the corresponding payments for these months are indicated. In section 6.5 , where accrued contributions are reflected, the amount consists of contributions for all tariffs. For example, we multiply the base for the HP category by 22%, the base for the OIO category by 21%, then we add these amounts and the result (the total amount of contributions accrued for the insured person) is reflected in section 6.5. The cumulative total in column 5, which reflects the base not exceeding the limit on lines 400 and 410, should not exceed 624,000.

In subsection 6.4, for individual entrepreneurs who use the patent taxation system, using code 16 when filling out section 2.1, the category of the insured person has changed. Now they must indicate the category of PNED (VZhED and VPED if they have foreigners). The remaining categories have not changed and correspond to the same tariff codes.

Subsection 6.6 is completed if any adjustments have been made for the insured person for previous periods. If subsection 6.6 is completed, then the calculation must be accompanied by forms correcting for the required period. The period for which the adjustment was made is indicated in the same subsection. In the first quarter, you can only adjust the years 2010-2013; in columns 4 and 5 we indicate the amount of additional contributions, that is, the difference between the original form that was submitted earlier and the corrective form that we are submitting now. In subsequent periods, when there are adjustments for 2014, we will indicate the corresponding period and fill out column 3, reserved for contributions for the fourteenth year.

Subsection 6.7 is provided for information on payments for which contributions are calculated at additional tariffs. Subsection 6.8 reflects periods of work for the last three months.

Another change when filling out the length of service for those situations where an employee works under both an employment contract and a GPC agreement. In this case, we allocate the amount under the civil contract in subsection 6.4 in column 6, and in the table with work periods they are reflected in separate entries. In this case, the periods may overlap, that is, the start date of the second record of experience may be less than the end date of the first record, but in one of these lines you must indicate either the AGREEMENT code or the NEOPLDOG code (when payment under the GPC agreement has not been made ), or the code NEOPLAVT (under the author's agreement).

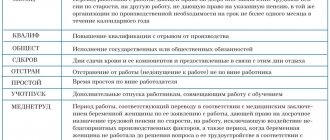

When filling out information about periods of work, new codes are now applied that have been added to the classifier for filling out information about length of service:

- A MONTH is the period when an employee is transferred from a job that is more harmful or dangerous to a job that does not give the right to early retirement for a period of no more than one month;

- QUALIFICATION - period of advanced training;

- SOCIETY - performance of state or public duties;

- SDKROV – the period of blood donation by donors and days of rest in connection with blood donation;

- SUSPENSION is removal from work through no fault of the employee;

- SIMPLE - period of inactivity;

- UCHOTVUSK - study leave;

- MEDNETRUD - the period of transfer of a pregnant woman from harmful work to non-harmful work;

- NEOPLDOG - work under a civil contract for which payment has not yet been made;

- NEOPLAVT - works under an author's contract.

What should you pay attention to when filling out calculations? Now there are no different forms, but within the calculation itself it is necessary to reflect the correspondence between its sections. When filling out the first section, it must be taken into account that the amount in lines 111-114 (where accrued contributions are reflected) in column 3 must be correlated with the amount in lines 205 and 206 from subsection 2.1. In column 6, the amount should be equal to the sum of lines 224 from subsection 2.2 and the lines that reflect contributions accrued for additional tariffs in section 2.4 with base code 1. And in column 7 it should be equal to the sum of lines 234 from subsection 2.3 and lines in which reflect contributions accrued at additional tariffs from subsection 2.4 with base code 2. Line 120, as before, must correspond to the line “Total additional accrued” in section 4.

In subsection 2, line 200 (where payments and rewards are reflected in full), the amount must be equal to the amounts reflected in column 4 in subsection 6.4 for all sections 6, that is, for all insured persons. On line 203, all columns must be equal to the sum of the lines in column 7 of subsection 6.4 of all sections 6 (these are amounts exceeding the maximum base value). On line 204, the amount in the corresponding columns (4-6) must be equal to the “Total” line in column 2 from subsection 2.5.1, that is, the base that is reflected in section 2.5.1 for all packs of individual information. And on line 205, the amount for columns 4 - 6, which reflects data for the last 3 months, must be equal to the amount for all sections 6.5 from section 6.

New report on form 4-FSS

Order of the Ministry of Labor of Russia No. 94 dated February 11, 2014 amended appendices No. 1 and 2 to the order of the Ministry of Labor and Social Protection of the Russian Federation dated March 19, 2013 No. 107n “On approval of the form of calculation for accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage and the Procedure for filling it out.”

Changes:

- the “OKATO code” field on the title page has been eliminated;

- Table 3 “Calculation of the base for calculating insurance premiums” has been changed;

- added table 4.5 “Information necessary for the application of the reduced tariff of insurance premiums by the payers of insurance premiums specified in paragraph 14 of part 1 of article 58 of the Federal Law of July 24, 2009 N 212-FZ”;

- table 10 “Information on the results of certification of workplaces for working conditions and mandatory preliminary and periodic medical examinations of workers at the beginning of the year” was changed;

- The filling order has been changed.

New deadlines for paying taxes and insurance premiums

Payers of UTII must submit tax returns and pay taxes quarterly. Deadline for submitting the UTII declaration for the 4th quarter of 2014: no later than January 20, 2015.

Extending the deadline for submitting reports does not affect the extension of the deadline for paying taxes (advance tax payments), even in cases where payment of taxes depends on the deadline for submitting the report.

For the payment of VAT and agency personal income tax, the government did not postpone the payment deadline and did not provide for an installment plan.

In addition, the forms and number of reports change quite often. You can check the list of reports for the organization on the statistics website - you only need an INN.

Legislative norms

Regulatory regulation of financial statements in 2014 is carried out according to almost the same documents as in previous years:

- Civil, Tax and Administrative Codes of the Russian Federation;

- Resolutions and Decrees of the Government, Orders, Regulations and recommendations of the Ministry of Finance of the Russian Federation.

And also according to the internal acts of the enterprise.

On January 1, 2014, the new Law “On Accounting” No. 402 dated December 6, 2011 came into force - it is its norms that should be followed when preparing reports in 2014.

Deadlines for submitting 3 personal income taxes in 2020

The accountant's calendar is designed for legal entities, individuals, and individual entrepreneurs. It contains the most important and widely used information on the deadlines for payment and submission of declarations, reports and information on taxes, fees and payments established by federal legislation, which are regular and of the same type.

But other Crimean and Sevastopol organizations and entrepreneurs will have to take care of the timely submission of this report. It can be prepared in paper form only if the number of individuals who received income from the tax agent during the tax period was less than 10 people. They report to the Federal Tax Service of the Russian Federation at their place of registration/residence no later than April 30, 2020 (based on the results of the previous tax period). Similar deadlines are established for submitting 3-NDFL for individual entrepreneurs and persons engaged in private practice.

Deadlines for submitting reports in 2014. Submitting reports for 2013

Accounting reports tell what the company has on its balance sheet and how it has performed. Tax inspectors compare financial statements with tax statements, for example, with an annual income tax return or a VAT return.

If an enterprise/organization and other companies of various organizational and legal forms use hired labor in their activities, they are tax agents in relation to their employees.

The form is intended solely for reporting the absence or incorrect information on the website of the Federal Tax Service of Russia and does not imply feedback. The information is sent to the editor of the website of the Federal Tax Service of Russia for information.

If an enterprise/organization and other companies of various organizational and legal forms use hired labor in their activities, they are tax agents in relation to their employees.

The form is intended solely for reporting the absence or incorrect information on the website of the Federal Tax Service of Russia and does not imply feedback. The information is sent to the editor of the website of the Federal Tax Service of Russia for information.

During 2014, organizations and individual entrepreneurs in Crimea and Sevastopol switched to Russian legislation, according to which it is necessary to calculate and pay personal income tax. As with other taxes, personal income tax must be reported - for now it is required to do this at the end of the year. Crimeans will need to carry out this procedure for the first time. How to properly prepare a personal income tax report?

Accountant calendar 2021 reporting deadlines

The program is used for the preparation by taxpayers of ALL forms of tax and accounting documents, documents used in accounting for taxpayers, when submitted to the tax authorities. In Russia they love everything new. The same applies to the deadlines for submitting tax and accounting reports. They change.

Organizations and individual entrepreneurs can receive a subsidy of 12,130 rubles for each employee if jobs are saved during the spread of coronavirus infection. Click on the image to enlarge. Who will receive a subsidy for employees?

A table is provided with a list of individual entrepreneurs' reports and the deadlines for their submission to the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund in 2021, for 2021, and individual entrepreneur declaration forms.

Accounting statements for small businesses are the Balance Sheet and Income Statement.

Insurance contributions to the funds must be paid monthly no later than the 15th day of the month following the month in which contributions are calculated. If the payment deadline falls on a weekend or holiday, the deadline is considered to be the next working day following it. In order to develop the enterprise in the future, management develops and approves a financial plan, which is a detailed diagram of the functioning of the organization and its development for the future...

At the same time, we draw your attention to the extension of the deadline established by the Tax Code of the Russian Federation for taxpayers to submit annual accounting (financial) statements to the tax authorities for three months, provided for in paragraph two of paragraph 3 of the Decree of the Government of the Russian Federation dated April 2, 2021.

If your reporting is subject to mandatory audit, then you must also submit an audit report to the statistical authorities. But the deadline for submitting it is different - no later than 10 working days from the day following the date of signing the audit report (but no later than December 31 of the year following the reporting one).

Income tax is imposed on all income of individuals received on the territory of the Russian Federation.

Altai Territory, Amur Region, Arkhangelsk Region, Astrakhan Region, Belgorod Region, Vladimir Region, Volgograd Region, Vologda Region,

For simplicity, I conditionally divide all reports into four types: tax, accounting, employee reports and statistical.

We, ONLINE REPORTING LLC, guarantee the confidentiality of the information we receive. The processing of personal data is carried out for the purpose of effective execution of orders, contracts and other obligations accepted by ONLINE REPORTING LLC as binding on you.

Law No. 325-FZ changed the deadlines for submitting reports in Form 2-NDFL. They must be taken into account when submitting documents for 2019.

In the field “in the Federal Tax Service (code)”, enter the four-digit code of the tax authority in which the tax agent is registered with the tax authorities: for example, in Simferopol - 9102, Yalta - 9103, Gagarinsky district of Sevastopol - 9201, etc. When filling out data on the individual Questions may arise from paragraph 2.3 “Taxpayer status”.

The government provided businesses with a deferment on taxes and insurance premiums, extended the moratorium on tax audits, and also postponed the deadline for submitting declarations. All indicators, except for tax, are reflected in the Certificate in rubles and kopecks, and the tax itself is only in rubles.

Submission of additional tax reporting

You need to download the reports downloaded from the accounting program that you want to send to the regulatory authority. If this is not possible, then add reporting in any format or data for it. If it is necessary to fill out zero declarations, instead of reporting, you must attach the details of the organization. When uploading more than 10 files, pre-pack them into an archive. Choose a convenient payment method for electronic reporting services. Payment details will be sent to you immediately after receiving your application.

Up-to-date information on the deadlines for submitting reports for the 4th quarter of 2014 to tax and extra-budgetary funds, as well as a reminder about the deadlines for paying taxes and fees.

We remind you that “simplified” are exempt from VAT (there are restrictions), income tax (there are restrictions), and property tax. And simplified entrepreneurs are also exempt from personal income tax (in terms of income from “simplified” activities).

Deadlines for submitting reports and paying taxes for the 4th quarter (annual) 2014

Only timely payment by legal entities of taxes and insurance premiums for the past 2014 will allow them to avoid additional expenses in the form of penalties or fines.

Property tax reporting for the 1st quarter? Did you cancel the submission of advance payments and leave the annual declaration? Not all individual entrepreneurs and organizations receive deferments in the payment of taxes and contributions, but only those who are included in the register of SMEs and are employed in the most affected industries from the list (approved by Decree of the Government of the Russian Federation dated 04/03/2020 No. 434 and dated 04/10/2020 No. 479) .

From January 1, 2021, quarterly (with cumulative total) and annual personal income tax reporting in Form 6-NDFL was introduced for tax agents. The report on Form 6-NDFL at the end of the quarter must be submitted no later than the last day of the month following the quarter, and at the end of the year - no later than April 1 of the following year.