It is difficult to overestimate the commercial role of advertising, and therefore the economic efficiency of the funds spent on it.

However, this expense item turns out to be the most controversial from a taxation point of view (income tax base). Not every phenomenon considered by ordinary people to be advertising is such from a legal point of view. In addition, you need to take into account an important criterion for the legality of accounting for expenses for tax purposes - the normalization of expenses.

Let's consider how the concept of the norm for advertising expenses is reflected in accounting and tax accounting.

Question: The LLC plans to enter into an agreement with a legal entity-executor to carry out work on the production and application of advertising banners on the external sides of urban ground transport (trams) to advertise manufactured products in order to increase their sales. In response to a request to the tax authority about the existing maximum amount for accounting expenses for this type of advertising expenses, the LLC received a response that the maximum amount is 1% of sales revenue, since trams are not a means of stable territorial placement. However, LLC believes that this type of advertising expenses is taken into account in the amount actually incurred. Is the LLC's position justified? View answer

What is the difference between standardized and non-standardized advertising expenses?

Advertising expenses, which are taken into account for tax purposes, are divided into two groups:

- non-standardized expenses, that is, those that can be taken into account completely;

- standardized expenses, that is, those for which there is a recognition procedure.

Tax Code of the Russian Federation in paragraph 4 of Art. 264 contains a more detailed classification.

Judges' opinion

In this case, the position of the judges is of particular interest: the first two courts rejected the taxpayer and made decisions in favor of the tax authority, agreeing with its arguments, namely that: -

organizations that broadcast advertising videos in store sales areas as means mass media are not registered; did not have media network status;

— the Indoor TV system, through which services are provided for the distribution of advertising through a media rental network in the trading floors of retail store chains, is a broadcasting system that operates using software installed on a computer. A media rental network is not an information and telecommunications system, since access to this system can only be carried out by the person in whose control such a system is located, while access to an information and telecommunications network must be provided to an unlimited circle of people or to a circle limited by the owner of such a network persons through the use of technical means.

And only the cassation court examined the case on its merits and overturned the decisions of its colleagues. It was stated that in Chap. 25 of the Tax Code of the Russian Federation there are no provisions that would allow us to conclude that the will of the legislator is aimed at limiting the possibility of recognizing for tax purposes expenses for the distribution of advertising materials only due to the fact that the place of their placement is not stationary objects, but their internal premises. Such a distinction does not make sense from the point of view of economic justification, which leads to unequal taxation of taxpayers.

And in this case, the court referred to the above-mentioned Determination of the Supreme Court of the Russian Federation No. 305-ES19-4394, noting the peculiarities of taking into account the provisions of the Law on Advertising for tax purposes.

It was also emphasized that the disputed expenses of the entrepreneur represent the costs of paying for the production and rental of advertising videos in the sales areas of a certain retail chain. The economic justification of product advertising costs incurred by an entrepreneur interested in increasing sales volumes due to increased consumer demand was not disputed by the tax authority. The fact that the relevant monitors were located directly on the sales floor and not outside the stores cannot deprive the taxpayer of the right to fully accept the relevant expenses for tax purposes.

The cassation court considered that the courts of the two first instances incorrectly interpreted and applied paragraph 4 of Art. 264 of the Tax Code of the Russian Federation, which led to erroneous conclusions about the absence of grounds for the entrepreneur to accept disputed expenses in the amount of actual expenses incurred.

Non-standard advertising expenses

It is allowed to include the following types of advertising expenses in the full amount of actual expenses:

- advertising that is placed through the media (television, radio, print, Internet);

- outdoor advertising (illuminated, billboards, stands, etc.);

Expenses on outdoor advertising are taken into account according to special rules. Which one? ConsultantPlus experts spoke about them:

Get free access to K+ and find out all the details on outdoor advertising.

- advertising carried out through participation in exhibitions, fairs, as well as through the design of shop windows, expositions, showrooms and sample rooms;

- production of advertising catalogs and brochures containing information about products, goods, services or work offered by the company, or about itself;

- deliberate reduction in price (markdown) of goods that have lost their quality during exhibition.

Is it possible for income tax purposes to include as advertising expenses for adhesive tape with the organization’s logo used to package goods? The answer to this question was given by 3rd Class Advisor to the State Civil Service of the Russian Federation Razgulin S.V. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

There are some clarifications in the non-standardized part. The Ministry of Finance of Russia, using the provisions of paragraph. 4 p. 4 art. 264 of the Tax Code of the Russian Federation, included leaflets, booklets, leaflets and flyers among brochures and catalogues. The ministry’s specialists reflected their position in letters from the Ministry of Finance of Russia dated August 12, 2016 No. 03-03-06/1/42279, dated October 12, 2012 No. 03-03-06/1/544, dated November 2, 2011 No. 03-03-06/ 3/11 and dated 10.20.2011 No. 03-03-06/2/157. That is, the costs of producing such materials can be taken into account as part of non-standardized expenses.

Entertainment expenses

Situation: when calculating income tax, is it possible to include in entertainment expenses the costs of purchasing flowers for representatives of counterparties to decorate the place of negotiations?

No you can not.

The list of entertainment expenses taken into account when taxing profits is given in paragraph 2 of Article 264 of the Tax Code of the Russian Federation (subparagraph 22 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation). It does not provide for the cost of purchasing flowers for representatives of counterparties to decorate the meeting place. Therefore, do not take these expenses into account when calculating your income tax. A similar conclusion was made in letters of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/176, Federal Tax Service of Russia for Moscow dated January 22, 2004 No. 26-08/4777.

Some arbitration courts support this point of view (see, for example, the resolution of the FAS of the Volga-Vyatka District dated March 15, 2006 No. A29-1822/2005a). They justify their position by the fact that the costs of purchasing flowers are not determined by business customs that must be observed when organizing meetings of business partners. This means that they are not economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Advice : there are arguments that allow organizations to recognize expenses for the purchase of flowers for representatives of counterparties when calculating income tax. They are as follows.

An organization has the right to take into account expenses aimed at generating income when calculating income tax. In this case, expenses must be economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation). Expenses for purchasing flowers for business meetings are aimed at establishing contacts with potential clients (partners) of the organization. Therefore, such expenses can be considered economically justified. This conclusion is contained in the resolutions of the Federal Antimonopoly Service of the West Siberian District dated May 11, 2006 No. F04-2610/2006(22165-A46-40), the Northwestern District dated November 3, 2005 No. A56-9369/2005, the Volga District dated February 1, 2005 No. A57-1209/04-16. And in the resolution of September 3, 2010 No. KA-A40/10128-10, the FAS Moscow District indicated that the list of entertainment expenses is open. Therefore, within the limits of the standard, an organization can include in their composition the costs of purchasing flowers for official receptions.

Situation: when calculating income tax, is it possible to include in entertainment expenses the costs of purchasing tea and tableware intended for use during official meetings with the organization’s business partners?

Yes, you can.

Entertainment expenses, in particular, include the costs of holding official receptions for representatives of other organizations (business partners). An official reception means organizing a breakfast, lunch or other similar event. The location of the reception does not matter, so the organization can arrange it both on its territory and outside it. This follows from the provisions of paragraph 2 of Article 264 of the Tax Code of the Russian Federation.

A specific list of costs for conducting an appointment is not established by law. Consequently, these can be any economically justified and documented expenses directly related to the organization of such a reception (clause 1 of Article 252, clause 2 of Article 264 of the Tax Code of the Russian Federation).

Obviously, when holding a reception (breakfast, lunch) on its territory, an organization cannot do without tea and tableware. But in order to include the costs of purchasing tableware as entertainment expenses, you need to prove the connection between these costs and the entertainment events.

You can confirm the costs of purchasing utensils with cash and sales receipts. And the entertainment nature of expenses can be justified by an order (instruction) of the head of the organization, an estimate, as well as a report on entertainment expenses. The report must be accompanied by primary documents for each item included in the report (invoices, sales receipts, etc.). Similar clarifications are contained in letters of the Ministry of Finance of Russia dated April 10, 2014 No. 03-03-RZ/16288, dated March 22, 2010 No. 03-03-06/4/26 and dated November 13, 2007 No. 03-03- 06/1/807.

If the dishes are reusable, the costs of purchasing them do not count as entertainment expenses. The cost of such utensils can be included in material costs on the basis of subparagraph 3 of paragraph 1 of Article 254 of the Tax Code of the Russian Federation. But for this you will have to prove that it is constantly used in the economic activities of the organization.

In arbitration practice, there are decisions that confirm the legality of including the costs of purchasing reusable tableware as entertainment expenses (see, for example, Resolution of the Federal Antimonopoly Service of the North-Western District dated June 9, 2008 No. A05-12045/2007). However, relying on the opinion of individual courts when writing off such costs is risky.

Situation: when calculating income tax, is it possible to include in entertainment expenses the costs of holding a corporate evening (organization anniversary)? The organization pays for the rent of the banquet hall, services for organizing the event, food, etc.

No you can not.

Representation expenses of an organization include the following expenses:

- for an official reception and (or) service (including a buffet) for representatives of other organizations, as well as officials of the organization itself;

- for transport support for delivery to the venue of the representative event and (or) meeting of the governing body and back;

- to pay for the services of translators (not on staff of the organization) during entertainment events.

Entertainment expenses do not include expenses for organizing entertainment, recreation, prevention or treatment of diseases.

Such rules are established by paragraph 2 of Article 264 of the Tax Code of the Russian Federation.

Therefore, the costs of holding a corporate party (company anniversary) are not considered entertainment expenses. Such expenses cannot be considered as advertising expenses. Similar explanations are contained in the letter of the Ministry of Finance of Russia dated September 11, 2006 No. 03-03-04/2/206.

Advice : if an organization is ready for a dispute with the tax office, it can include the costs of holding a corporate evening as part of entertainment expenses. But for this you need to fulfill several conditions.

Firstly, the organizational documents need to clearly indicate the purpose of such an event. For example, in an order for an event, it is better to indicate that a corporate evening is held to summarize the organization’s work, maintain cooperation with business partners, and demonstrate to them the company’s achievements and prospects for its development. At the same time, the rules of the evening should provide time for negotiations (presentations), familiarization with new products, inspection of exhibitions, etc.

Secondly, you need to invite representatives of other organizations (at least the largest business partners) to the holiday and record the fact of their presence in the report on entertainment expenses.

Thirdly, the costs of holding a corporate evening must be confirmed with primary documents. For information on what documents should be prepared and how to do this, see What documents should be prepared in order to safely recognize entertainment expenses.

Fourthly, the amount of expenses for holding the holiday together with other entertainment expenses must fit within the established standard (4 percent of labor costs for the reporting (tax) period).

If the above requirements are met, the organization has a chance to defend its position in court. In arbitration practice, there are examples of court decisions in which it is recognized as legitimate to write off expenses associated with the organization and conduct of corporate events as entertainment expenses (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated November 30, 2009 No. VAS-15476/09, the resolution of the Federal Antimonopoly Service of the Ural District dated January 19, 2012 No. F09-9140/11, Northwestern District dated July 30, 2009 No. A56-17976/2008).

Standardized advertising expenses

In an amount not exceeding 1% of the amount of sales proceeds (calculated in accordance with Article 249 of the Tax Code of the Russian Federation), the following types of expenses should be included in expenses:

- expenses for the production or purchase of prizes that are awarded during drawings during mass advertising campaigns;

- other advertising expenses.

The above list has one interesting feature. The fact is that the list of non-standardized expenses is closed and does not allow additions, while standard advertising expenses are not limited, and this list is always open.

For this reason, any expenses that bear signs of advertising expenses can be taken into account in expenses, even if they are not listed in the Tax Code. They will simply fall into the category of “standardized advertising costs.” Confirmation of this thesis can be found in the resolutions of the Federal Antimonopoly Service of the Moscow District dated March 21, 2012 No. A40-54372/11-91-234 and dated March 14, 2012 No. A40-63461/11-99-280.

An example is this type of advertising, such as promotional and informational materials delivered in the form of bulk and unaddressed mail. The costs of paying for courier or postal services can be attributed to advertising costs, and, in accordance with the provisions of paragraph. 5 paragraph 4 art. 264 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated January 12, 2007 No. 03-03-04/1/1, these will be standardized advertising expenses.

Hosting an event

Some companies conduct training seminars, general education lectures and consultations to convey information, certain theories and practices. Such events, as a rule, are aimed at improving the skills of employees in certain areas. Some companies organize seminars with free attendance for everyone; As a rule, such seminars are held in the interests of promoting new products. In both cases, the organizing companies spend money.

Firstly, to place information about the event on various network resources, city posters, booklets, flyers, brochures and other advertising products. The company has the right to take such expenses into account as part of other expenses on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. Judicial practice confirms this approach. The Federal Antimonopoly Service of the Moscow District, in its resolution dated January 10, 2007, January 17, 2007 No. KA-A41/12981-06, indicated that the costs associated with the production of advertising products and their full sale are classified as “other expenses.”

Secondly, there are the costs of organizing the seminar. Payment for the services of lecturers, their travel to the venue, and hotel accommodation. The procedure for accounting for the cost of paying for a lecturer’s services depends on the following factors.

note

20–25% of free seminar participants become potential clients of the organizing company.

1. Is the lecturer an employee of the company organizing the seminar, the topic of which is of an advertising nature. Thus, if a lecturer is on the staff of a company, then his salary when calculating income tax is taken into account as part of labor costs (Article 255 of the Tax Code of the Russian Federation).

2. If a company invites a lecturer to conduct a seminar who is not an individual entrepreneur and, accordingly, not part of the company’s staff, then the costs of paying the cost of his services are taken into account as part of the cost of remunerating specialists who are not on the company’s staff (clause 21 Article 255 of the Tax Code of the Russian Federation).

These are also the costs of providing handouts to event visitors, spending on souvenirs, renting a hall, audio, video and lighting equipment, buffet tables and lunches. Thus, the company has the right to take into account disputed costs when calculating income tax. Moreover, in full - as part of other expenses on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

When to apply the provisions of international agreements

In business practice, there are circumstances in which an international agreement on the avoidance of double taxation determines the accounting of advertising expenses on other principles that differ from those provided for by the Tax Code of the Russian Federation. In such cases, according to Art. 7 of the Tax Code of the Russian Federation, contractual provisions should be adhered to.

In particular, the agreement between the Russian Federation and Germany provides that advertising expenses incurred by a Russian organization with the participation of a company from Germany are allowed to be taken into account when calculating income tax in full. There is only one condition: the amount of such a deduction cannot exceed the amount of expenses of independent companies under similar operating conditions.

Confirmation of this statement can be found in letters from the Ministry of Finance of Russia dated 03/05/2014 No. 03-08-RZ/9491, dated 03/01/2013 No. 03-08-05/6124 and dated 01/11/2013 No. 03-08-05. The authors of the letters explain that if the above conditions are met, even normalized advertising costs can be taken into account in full. This principle must be observed regardless of the size of the German company’s share.

When there are no clear signs of advertising

In 2012, the Supreme Arbitration Court of the Russian Federation indicated that the placement of certain information that obviously evokes an association in the consumer with a certain product, with the goal of attracting attention to the object of advertising, should be considered as advertising.

To attract attention and maintain interest in a product, an image of part of the information about the product (including the trademark) is sufficient (clause 2 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 8, 2012 No. 58 (hereinafter referred to as Resolution No. 58)). Meanwhile, the association, as a rule, is subjective and may arise for some consumers, but not for others. To this, the Supreme Arbitration Court of the Russian Federation responded that in each specific case, the determination of the presence or absence of an “obvious association” and, accordingly, signs of advertising in the posted information is made by the court at its discretion and inner conviction.

Courts of previous instances consider advertising and include the following as information that obviously evokes an association with the object of advertising:

- image of the product on a wall panel attached to the facade of the building, without mentioning the name of the company and the address of its location (regulatory Federal Antimonopoly Service dated January 17, 2013 No. F06-10288/12);

- an image of a glass container in the form of a bottle with two filled glasses, without indicating the type of alcoholic beverage (associated specifically with alcoholic beverages, and not with other drinks) (regulatory Federal Antimonopoly Service of the North-West District dated August 20, 2009 No. A26-1568/2009);

- posters placed in subway cars with the phrase “Need money “One and a half lemons” for personal purposes” and indicating the name of the organization (the expression “One and a half lemons” causes an association among an indefinite circle of people - consumers of advertising - with the amount of money - the size of the loan) (post. Ninth AAS dated October 29, 2012 No. 09 AP-29613/2012, 09 AP-30597/2012).

It turns out that even if the banner does not directly mention the object of advertising, but the information posted clearly establishes a connection with the product, company or trademark, judges and the Federal Antimonopoly Service of Russia will most likely recognize this banner as an advertisement.

To avoid an unnecessary dispute with controllers about whether the posted information causes an obvious association with a product (company, trademark) or not, indicate the individualizing characteristics of your company (name, trademark, product image, etc.). In 2008, in a similar situation, the company managed to defend advertising costs for publishing New Year greetings to city residents in the newspaper. During the inspection, inspectors excluded these costs from the income tax base. In their opinion, the congratulation did not contain advertising information. However, the judges pointed out that newspaper readers are an “indefinite circle of people” for the organization, and publication in the media helps to improve the company’s reputation (registered by the Federal Antimonopoly Service of the Eastern Military District dated February 26, 2008 No. A29-2355/2007). It is possible to place congratulations on the banner with a photograph of the director or other person associated with the activities of a particular company. Inspectors may try to exclude such expenses from the income tax base. In 2007, the court considered a similar dispute. The company included in the calculation of the income tax base as advertising expenses for services for placing articles about its general director in the historical almanac. The inspectors recognized the content of the publication as not related to advertising within the meaning of the provisions of the Advertising Law. However, the company, with its argument that the article would be of interest to consumers, proved that the publication costs are advertising (regulatory Federal Antimonopoly Service dated January 19, 2007 No. F09-4979/06-S3). At the same time, the article mentioned the name of the company. Based on judicial practice, I recommend that in addition to placing a photo of the director on the banner, you should use a trademark, company name, or anything else that allows you to identify the company in your congratulations. Otherwise, it will be difficult to prove in court that the person in the photo is strongly associated with the work of the company.

Advertising costs are included in other expenses

In accordance with sub. 28 clause 1 art. 264 of the Tax Code of the Russian Federation, advertising expenses should be included in other expenses that are associated with production and sales. Moreover, according to paragraph 1 of Art. 318 of the Tax Code of the Russian Federation are indirect. Depending on the accrual method, the moment at which such expenses are recognized will differ:

- If a legal entity uses the accrual method of accounting, then advertising expenses should be classified as other expenses in the reporting or tax period in which they were incurred. The moment of actual payment (in any form) does not matter here (clause 1 of Article 272 of the Tax Code of the Russian Federation).

- If the cash method is used, then advertising expenses should be recognized after the actual payment is made (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Separately, it is worth pointing out that if advertising costs are due to payment for the services of third-party companies, then they can be taken into account in 2 different ways:

- at the time of presentation of documents on the basis of which calculations should be made (invoice and certificate of completion of work);

- on the last day of the reporting or tax period.

Both options are legal in accordance with clause 7.3 of Art. 272 of the Tax Code of the Russian Federation, which is confirmed in the letter of the Ministry of Finance of Russia dated March 29, 2010 No. 03-03-06/1/201.

Tax consequences

Disputes with inspectors regarding the advertising nature of expenses arise when printed materials (flyers, booklets, brochures) are sent by mail. For example, in the letter of the Federal Tax Service for the city of Moscow dated March 16, 2005 No. 20 08/16391 “On advertising expenses”, the opinion is stated that the distribution of catalogs with information about goods by direct mailing to a database of potential clients (individuals) is not advertising. At the same time, expenses associated with the gratuitous transfer of catalogs are not taken into account for profit tax purposes on the basis of paragraph 16 of Article 270 of the Tax Code of the Russian Federation. If the dissemination of information is limited to a certain circle of people, then these expenses cannot be classified as advertising. This position is confirmed by Resolution of the Federal Antimonopoly Service of the North-Western District dated June 1, 2005 No. A05 16465/04 10. In accordance with it, advertising expenses for holding the opening ceremony of a new building and the cost of purchasing equipment for the business needs of the hotel with the hotel logo and telephone number are not recognized. and address.

note

The director's order may indicate that the distribution of goods will be carried out to increase the number of concluded contracts, the volume of supplies and, accordingly, the profit of the organization. An additional advantage will be the company’s internal documents, which document these operations as an integral part of the marketing policy that contributes to the growth of the company’s profits.

The tax consequences largely depend on how this transaction is processed. For example, the director’s order states that the distribution of goods will be carried out to increase the number of concluded contracts, the volume of supplies and, accordingly, the profit of the organization. An additional advantage will be the company’s internal documents, which formalize these operations as an integral part of the marketing policy that contributes to the growth of the company’s profits.

Standardized advertising expenses: calculation of the maximum amount

As already noted, recognition of standardized advertising expenses in the reporting period is possible only in an amount that does not exceed 1% of sales revenue, determined, in turn, in accordance with Art. 249 of the Tax Code of the Russian Federation.

In paragraph 1 of this article there is a rule that requires the inclusion of proceeds from sales as income. However, in accordance with paragraph. 2 clause 1.2 art. 248 of the Tax Code of the Russian Federation, when determining the final amount of income, it is necessary to subtract from the received proceeds all amounts of taxes that are presented to the buyer. This refers to VAT and excise taxes.

That is, the maximum amount of standardized advertising expenses is calculated from the amount of sales revenue minus the amount of VAT and excise taxes. Confirmation of this thesis can be found in the letter of the Ministry of Finance of Russia dated 06/07/2005 No. 03-03-01-04/1/310.

Example

The organization received revenue from the sale of services in the amount of 530,000 rubles in the reporting period. (including VAT). First, let's determine the amount of VAT that is included in the revenue:

530,000 rub. × 20/120 = 88,333 rub.

Then let's find the difference:

530,000 rub. – 88,333 rub. = 441,667 rub.

Now, finally, let’s determine the amount of the maximum amount of advertising expenses:

RUB 441,667 × 1% = 4417 rub.

Within the limits of this amount, it is permissible to include advertising costs in expenses.

If you have access to K+, check whether you have determined the standard correctly. If you don’t have access, get free trial access to the system and go to the Ready Solution.

To learn how this limit is calculated under the simplified tax system, read the material “How to take into account advertising costs under the simplified tax system.”

VAT deduction on advertising materials that do not meet the characteristics of the product

If the transferred advertising material is not a product (for example, your organization distributes catalogs, advertising brochures), VAT is not required (regardless of the cost). Is it possible to deduct VAT on such materials?

The Ministry of Finance of the Russian Federation, in letter No. 03-07-11/75489 dated December 23, 2015, believes that this is impossible. The department’s logic is simple: in this case, the condition for the deduction that the deduction is possible only if the goods are used in transactions subject to VAT is not met. According to officials, if the transfer of brochures and other advertising materials does not create an object of VAT taxation, then the deduction for them is not applicable.

Strange logic, because brochures, etc. transmitted for the purpose of advertising products or company activities. And transactions within the framework of such activities are subject to VAT.

Fortunately, the Supreme Court of the Russian Federation, in its Ruling dated December 13, 2019 No. 301-ES19-14748, confirmed the illegality of the tax authorities’ position on this issue. Therefore, the deduction of “input” VAT on such materials is legal. However, keep in mind that during an audit, tax authorities may try to declare it illegal. Accordingly, be prepared to defend your deduction, possibly in court.

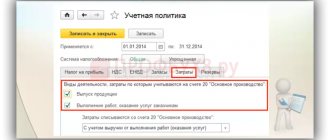

How are advertising expenses reflected in accounting and reporting?

In accounting, advertising expenses are expenses for ordinary activities that are reflected as part of business expenses. Sub-paragraph is aimed at such reflection. 5 and 7 of the accounting regulations “Expenses of the organization” PBU 10/99 (approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

As for the chart of accounts, it is recommended to reflect such expenses in the debit of account 44 “Sale expenses” (instructions for using the Chart of Accounts for accounting financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). For accounting purposes they do not have a standardized nature.

The amount of advertising expenses in the income tax return is always reflected in one place, regardless of the method used to determine income and expenses. This amount forms the data indicated in line 040 of Appendix 2 to sheet 02 of the declaration (approved by order of the Federal Tax Service of Russia on October 19, 2016 No. ММВ-7-3 / [email protected] ).

The RF Armed Forces put an end to the dispute

The senior arbitrators indicated: in Ch.

25 of the Tax Code of the Russian Federation there are no provisions that would allow us to conclude that the will of the legislator is aimed at limiting the possibility of recognizing for tax purposes expenses for the distribution of advertising materials only due to the fact that the place of their placement is not stationary objects (for example, bus stop pavilions public transport), and vehicles (trams, trolleybuses, buses, etc.). This kind of differentiation in the possibility of deducting costs does not have a reasonable economic basis and, accordingly, leads to unequal taxation of business entities. Referring to the provisions of the Law on Advertising to justify the opposite conclusion, the courts did not take into account that it does not contain a definition of the concept of “outdoor advertising”, which could be used for taxation on the basis of paragraph 1 of Art. 11 of the Tax Code of the Russian Federation.

Articles 19 and 20 of the Advertising Law establish only certain features of the distribution of advertising. Moreover, taking into account the fact that this law does not relate to acts of legislation on taxes and fees and has other purposes of legal regulation, the differences established in it in the composition of the restrictions in force when distributing advertising using stationary advertising structures and using vehicles should not be considered as relevant for profit taxation, in the absence of the direct will of the legislator.

At the same time, the tax authority did not dispute the economic justification of the costs of advertising confectionery products incurred by the company as its manufacturer, interested in increasing sales volumes due to increased consumer demand.

Consequently, the court of first instance came to the essentially correct conclusion that the tax authority had no legal grounds for sending the company a demand for payment of arrears of income tax.

How to correctly take into account advertising expenses when increasing profits in the tax period

The tax base for profit during the tax period is determined on an accrual basis (clause 7 of Article 274 of the Tax Code of the Russian Federation). Naturally, due to the gradual increase in the amount of revenue, the maximum amount of standardized advertising expenses will also increase, which can be taken into account when calculating the tax.

The letter of the Ministry of Finance of Russia dated November 6, 2009 No. 03-07-11/285 states that excess advertising expenses that could not be taken into account in the past reporting period can be taken into account during the calendar year in subsequent reporting periods (clause 44 of Art. 270 of the Tax Code of the Russian Federation).

In accounting, in such circumstances, a deductible temporary difference is formed, which is a deferred tax asset equal to the amount of excess advertising expenses (clauses 8–11, 14, 17 of the accounting regulations “Accounting for income tax calculations” PBU 18/02, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

Example

Circumstances:

, engaged in trade, spent 21,000 rubles on the production of prizes, which were then raffled off during the advertising campaign. (including VAT 3,500 rubles) The company is exempt from having to pay VAT in accordance with Art. 145 Tax Code of the Russian Federation.

Sigma's revenue by quarter was:

- for the 1st quarter - RUB 1,590,000;

- for half a year - 2,380,000 rubles.

Reflection in accounting:

According to paragraph 2 of Art. 285 of the Tax Code of the Russian Federation for income tax, reporting periods are considered to be 1 quarter, 6 months and 9 months.

If there were no other advertising expenses in the specified periods, the calculation of the maximum amount of normalized advertising expenses will look as follows.

- In the 1st quarter, since the amount of revenue is RUB 1,590,000:

- maximum amount of advertising expenses: RUB 1,590,000. × 1% = 15,900 rub.;

- the amount of advertising expenses that can be recognized in this reporting period is also equal to 15,900 (since it is less than the entire amount of expenses of RUB 21,000).

- maximum amount of advertising expenses: RUB 2,380,000. × 1% = 23,800 rub.;

- It will still be possible to admit: 21,000 rubles. – 15,900 rub. = 5,100 rub.

But it would be possible to write off a larger amount of advertising costs as expenses if their cost were higher. For the half year, this value was: 23,800 – 21,000 = 2,800 rubles.

In accounting, the above transactions will be reflected as follows:

Dt 10/6 Kt 60 – prizes in the amount of 21,000 rubles were capitalized. (VAT is included in their price, since the company operates without VAT);

Dt 44 Kt 10/6 – the cost of prizes (21,000 rubles) was written off as expenses.

In addition, at the end of the first quarter on March 31, you need to make the following posting:

Dt 09 Kt 68 - a recognized and deferred tax asset of 1020 rubles is reflected. ([21,000 – 15,900] × 20%).

And based on the results of the six months of June 30 of the current year, the following entries are drawn up:

Dt 68 Kt 09 - the deferred tax asset is written off in the amount of 1020 rubles.

- 7.1. Public promise of reward

- 7.2. Public competition

- 7.3. Incentive lottery

- 7.4. Tax accounting for the distribution of prizes during promotions

7. DISTRIBUTION OF PRIZES DURING ADVERTISING PROMOTIONS

Among the huge variety of ways to interest a buyer in your goods or services, the most popular is the distribution of prizes during special promotions. It is most often called a competition, raffle, game, quiz, and less often - a lottery.

According to current legislation, prize distribution can be carried out in the following forms:

• public promise of reward (Chapter 56 of the Civil Code of the Russian Federation);

• public competition (Chapter 57 of the Civil Code of the Russian Federation);

• incentive lottery (Federal Law of November 11, 2003 No. 138-FZ “On Lotteries” (hereinafter referred to as the Law on Lotteries)).

Despite the fact that such promotions are directly related to encouraging potential buyers to purchase the relevant goods, the legal relations of the organization - the seller and recipients of prizes in the form of goods, souvenirs or banknotes are regulated by the Law on Advertising only from the point of view of disseminating information about the ongoing promotion and the reliability of its conditions.

For example, in paragraph 15, part 3, art. 5 of the Law on Advertising states that advertising is considered unreliable if it contains untrue information about the rules and terms of an incentive lottery, competition, game or other similar event, including the deadline for accepting applications for participation in it, the number of prizes or winnings according to its results, timing, place and procedure for their receipt, as well as the source of information about such an event.

An advertisement announcing the holding of an incentive lottery, competition, game or other similar event, the condition for participation in which is the purchase of a specific product (hereinafter referred to as the incentive event), must indicate:

1) the timing of such an event;

2) the source of information about the organizer of such an event, the rules for holding it, the number of prizes or winnings based on the results of such an event, the timing, place and procedure for receiving them (Article 9 of the Law on Advertising).

In Art. 21 of the Russian Advertising Code, developed on the basis of the International Code of Advertising Activities of the International Chamber of Commerce (ICC) and adopted by the Advertising Council of the Russian Federation, also establishes that in advertising of goods and services using games with prizes that stimulate sales, it is necessary to indicate: the main dates of the event , including indication of the closing date for accepting applications for participation and/or deadlines for issuing prizes; name of the organizing company and/or advertiser; a publicly available source where participants in the promotion can obtain information about the actual address of the organizing company and/or advertiser, not limited to indicating the PO box, about the full rules of the game and prizes, including which party (player or organizer) pays taxes on prizes, and also about possible additional conditions, costs associated with participation in the game, receipt and use of the prize.

Otherwise, the legal relationship between the company organizing such promotions and the recipients of prizes (i.e., buyers of goods) is regulated by civil law.

7.1. Public promise of reward

A person who has publicly announced the payment of a monetary reward or the issuance of another reward (payment of a reward) to someone who performs the lawful action specified in the announcement within the period specified in it, is obliged to pay the promised reward to anyone who performed the corresponding action, in particular, found the lost item or reported the person who announced the award, the necessary information (Part 1 of Article 1055 of the Civil Code of the Russian Federation).

Example

Chain of stores "Perekrestok"

Take part in the prize draw as part of the Ice Age 3 promotion.

– Collect the complete collection of magnets on the Ice Age 3 magnetic disk for free. The cost of a board for magnets is 99 rubles.

– Take a photo with a board filled with magnets.

– Send a letter with contact information about yourself (full name, contact phone number) and a photo during the period from 07/20/2009 to 08/24/2009 to the post office box: Moscow, 11123, post office box “Ice Age-3”.

The first 600 participants of the Promotion who sent letters will receive a prize.

We will inform you about the place and time of the award ceremony by phone.

Hurry up! The characters of the cartoon "Ice Age 3" are waiting for you!

Details on the website www.perekrestok.ru

Ice Age 3. Age of Dinosaurs. TM&(S) 2009

Twentieth Century Fox Film Corporation. All rights reserved.

Implementation of the norms of Part 1 of Art. 1055 of the Civil Code of the Russian Federation in practice often leads to disputes being considered in arbitration court, in connection with which FAS ruling

Moscow District dated

February 16, 2009 No. KG-A40/13416-08

in case No.

A40-45865/08-93-121.

The essence of the dispute boils down to the following:

07/13/2008 when contributed by individual entrepreneur V.V. Vasilyev payment for cellular radiotelephone communication services in the amount of 350 rubles, MTS OJSC to the subscriber number of IP Vasiliev V.V. Along with notification of the received payment, an SMS message with the following content was sent: prize 170,000 rubles. Send YES to 1525.

After the individual entrepreneur sent an SMS message with the text YES to the specified number, he received a message from the defendant with the following content: Select the desired prize: 1) 170,000 rubles; 2) LCDtbLG; 3)DUOS.

According to the individual entrepreneur, MTS OJSC, which sent an SMS message to his subscriber number, made a public promise of a reward in the form of a prize in the amount of 170,000 rubles, which was not paid to him and which the individual entrepreneur insists on collecting.

Resolving the dispute, the courts of the first and appellate instances came to the conclusion that there was no reason to believe that there was a public promise on the part of MTS OJSC to pay the reward, and the claims were rejected.

The cassation judges find these conclusions of the courts of first and appellate instances to be justified and consistent with the materials of the case.

So, in accordance with Art. 1055 of the Civil Code of the Russian Federation, a person who publicly announced the payment of a monetary reward or the issuance of another reward (payment of a reward) to someone who performs a lawful action specified in the announcement within the period specified in it, is obliged to pay the promised reward to anyone who performed the corresponding action, in particular, found the lost item or provided the person who announced the reward with the necessary information.

Such a promise must meet the following conditions: it must be public, that is, addressed to an indefinite number of persons; a reward is established for performing a lawful action; the announcement must make it possible to identify the person who promised the reward.

Meanwhile, as can be seen from the content of the SMS message sent by MTS OJSC to the subscriber number of an individual entrepreneur, it does not contain a promise to pay a monetary reward for performing any actions.

The individual entrepreneur’s reference to the fact that MTS OJSC promised to pay a reward when sending an SMS message with the text YES to number 1525 is not accepted by the judicial panel, since this does not follow from the content of the said message.

Please note: in the announcement of a public promise of a reward, only the necessary action that must be performed and the deadline established for this are indicated (Part 1 of Article 1055 of the Civil Code). And at the same time, there is no such feature as competitiveness, which is necessarily inherent in a public competition (Part 1 of Article 1055, Part 4 of Article 1057 of the Civil Code of the Russian Federation).

7.2. Public competition

A person who publicly announced the payment of a monetary reward or the issuance of another reward (payment of an award) for the best performance of work or achievement of other results (public competition) must pay (give out) the stipulated reward to the one who, in accordance with the terms of the competition, is recognized as its winner ( Part 1 of Article 1057 of the Civil Code of the Russian Federation).

Example

Competition "Chef's Secret Weapon"

The online store of dishes and kitchen utensils is giving all participants in the “Chef's Secret Weapon” competition 50 bonuses for participation! And 20 Club members who answer all questions correctly will receive useful prizes from!

Dates of the competition: August 6-31, 2009.

The results of the competition will be announced by September 7, 2009.

Organizer of the competition: Online store.

Competition questions are posted on the website www. 4cook. ru.

According to Part 4 of Art. 1057 of the Civil Code of the Russian Federation should include among the conditions that must be contained in an announcement of a public competition, at least the essence of the task, the criteria and procedure for assessing the results of work or other achievements, the place, deadline and procedure for their presentation, the size and form of the award, etc. This means that a public competition has such a mandatory feature as competitiveness.

7.3. Incentive lottery

A lottery is a game that is held in accordance with an agreement and in which one party (the lottery organizer) draws the lottery prize fund, and the second party (the lottery participant) receives the right to win if it is declared a winner in accordance with the terms of the lottery. The agreement between the lottery organizer and the lottery participant is concluded on a voluntary basis and is formalized by issuing a lottery ticket, receipt, other document or other method provided for by the conditions of the lottery (Part 1 of Article 2 of the Law on Lotteries).

Example

The supermarket chain "Avoska" is holding a stimulating lottery "Skorozub seeds - to Avoska!"

To become a participant in the incentive lottery, you must reside in the Russian Federation and complete the following actions:

purchase during the period from! July to 3! July 2009 in the supermarket chain “Avoska” at least 1 pack of “Skorozub” seeds 80 grams;

send the organizer an application for participation in the lottery as follows: take a check from the cashier confirming the purchase of “Skorozub” seeds 80 grams, write on the back of it your last name, first name, patronymic and contact phone number and put the check in a special box installed in the Avoska supermarket "

The prize fund includes: 50 neck wallets, 30 T-shirts, 20 boxes of “Skorozub” seeds, 10 alarm clocks, 5 electric kettles, 3 food processors, 1 TV.

Consumers who have purchased at least one pack of Skorozub seeds and whose total receipt amount is at least 300 rubles can participate in the drawing of all prizes.

Consumers who have purchased at least 1 pack of Skorozub seeds and whose total receipt amount is less than 300 rubles participate in the drawing for all prizes except for a TV and food processors.

Details on the website www.avoska.ru.

Of the listed promotions, the most complex is the lottery, both from the point of view of legal registration and from the point of view of implementation technique.

A distinctive feature of a lottery from forms of distribution of prizes in the form of a public promise of a reward and a public competition is the mandatory presence of a drawing of the prize fund, i.e. a procedure carried out by the organizer of the lottery or on his behalf by the operator of the lottery using lottery equipment, based on the principle of random determination of winnings, with through which the winning lottery participants are determined and the winnings to be paid, transferred or provided to these participants (Article 2 of the Law on Lotteries).

Legal relations between the organization and recipients of prizes are not regulated by the Law on Advertising, since they are not conditioned by the dissemination in any way, in any form and using any means, of information about the object of advertising, which is addressed to an indefinite number of persons and is aimed at attracting attention to the object of advertising, forming or maintaining interest in it and its promotion on the market (Part 1 of Article 3 of the Law on Advertising).

From the point of view of civil law, the conduct of such an advertising campaign, when there is an accident of receiving specific goods or banknotes in packaging along with the purchased goods (the subject of the purchase and sale agreement), falls under the concept of conducting games, and the activities of the organization - under the holding of lotteries and other games, based on risk (Article 1063 of the Civil Code of the Russian Federation).

Accordingly, the relationship between the organizers of lotteries and other risk-based games and the participants in the games (who become buyers of goods) is based on an independent type of contract. In cases provided for by the rules of organizing games, the agreement between the organizer and the participant of the games is formalized by issuing a lottery ticket, receipt or other document, as well as in another way. Persons who, in accordance with the conditions of a lottery, sweepstakes or other games, are recognized as winners must be paid by the organizer of the games the winnings in the amount, form (cash or in kind) and within the period stipulated by the conditions of the games.

In accordance with Art. 1062 of the Civil Code of the Russian Federation, the rights of lottery participants are not protected by law, except in the case of failure by the organizer to fulfill the obligation to pay winnings.

The activities of conducting lotteries are regulated by the Law on Lotteries, in accordance with Art. 20 in which the payment, transfer or provision of winnings is carried out in accordance with the terms of the lottery, i.e. the inclusion of pre-announced souvenirs or banknotes in the packaging of retail goods does not contradict the requirements of the law, provided that other requirements of the law are met.

The lottery option under consideration refers to incentive lotteries

– lotteries, the right to participate in which is not associated with paying a fee (for example, purchasing a lottery ticket) and the prize fund of which is formed at the expense of the lottery organizer (in this case, the manufacturer or seller of the relevant product) (Part 3, Article 3 of the Law on lotteries).

In our opinion, a broader definition of an incentive lottery could be as follows: an incentive lottery is a risk-based game that is played in accordance with an agreement concluded in a manner determined by the organizer. In accordance with the agreement, one party (the lottery organizer) draws the lottery prize fund, and the second party (the lottery participant) receives the right to win if it is declared a winner in accordance with the terms of the game. The right to participate in the game is not associated with payment of a fee, and the prize fund is formed at the expense of the organizer. To put it simply, it is a game in which the organizer sets the rules and provides prizes, and the participant follows the rules and, without paying a fee, receives a non-guaranteed opportunity to receive a prize, and this opportunity depends on chance.

Thus, the mandatory features of a stimulating lottery come down to the following:

1) the participant does not pay a participation fee (the accompanying purchase of goods is not a participation fee, since the purpose of selling the goods is to make a profit as part of ordinary activities);

2) the prize fund is formed at the expense of the organizer;

3) an agreement is concluded between the organizer and the participant in the manner determined by the organizer, according to which the organizer draws prizes, and the participant acquires the right to a prize if he is recognized as a winner in accordance with the terms of the lottery;

4) the participant in the drawing takes a risk, is exposed to chance, the result of the drawing cannot be predetermined (risk factor).

According to Part 8 of Art. 6 of the Law on Lotteries there is no need to obtain permission to conduct such a lottery. That is, the right to conduct an incentive lottery arises if a notification about holding an incentive lottery is sent to the federal executive body authorized by the Government of the Russian Federation, the authorized executive body of a constituent entity of the Russian Federation or the authorized local government body (Part 1 of Article 7 of the Law on Lotteries).

Based on clause 2 of the Government of the Russian Federation of July 5, 2004 No. 338 “On measures to implement the Federal Law “On Lotteries”, as well as the Government of the Russian Federation of September 30, 2004 No. 506 “On approval of the Regulations on the Federal Tax Service”, the Federal Tax Service of Russia is an authorized federal executive body that carries out the functions of reviewing notifications of incentive lotteries, maintaining the state register of lotteries, and monitoring the conduct of lotteries.

The notification for holding an incentive lottery should indicate the period, method, territory of its holding and the organizer of such a lottery, as well as the name of the product (service) with the sale of which the promotion is directly related.

The list of documents that must be attached to the notification is provided in Part 2 of Art. 7 of the Law on Lotteries.

The Moscow Government Decree No. 430-PP dated June 14, 2005 “On the regulation of lottery activities in the city of Moscow” establishes the rules for conducting a city incentive lottery. They determine the procedure for holding an incentive lottery on the territory of Moscow and include the right or prohibition to conduct an incentive lottery, entering information about incentive lotteries held on the territory of Moscow into the state register of city lotteries, checking the compliance of lotteries with their conditions and the legislation of the Russian Federation (letter Federal Tax Service of Russia for Moscow dated October 5, 2005 No. 18–11/1/71052).

The duration of the incentive lottery cannot exceed 12 months. The territory where the incentive lottery is held, in accordance with its terms, is the territory in which the relevant goods are sold.

In the case under consideration, the agreement to participate in the lottery is concluded through the purchase of goods in retail trade and is a public agreement of adhesion.

According to Part 1 of Art. 16 of the Law on Lotteries, the agreement between the organizer and the participant of the incentive lottery is free of charge. An offer to participate must be accompanied by a statement of the conditions of the lottery. Such an offer can be applied to the packaging of a specific product or placed in another way that allows, without special knowledge, to establish a connection between a specific product and the ongoing incentive lottery.

When the incentive lottery is terminated, its organizer is obliged to publish a message in the media about the termination of the incentive lottery or otherwise publicly notify about such termination.

Violation of the requirements of the Law on Lotteries, including failure to notify the authorized body about the holding of an incentive lottery, is subject to administrative legislation, in particular, Art. 14.27 of the Code of Administrative Offenses of the Russian Federation, and may entail the imposition of a fine on officials in the amount of 4,000 to 20,000 rubles; for legal entities – from 50,000 to 500,000 rubles.

7.4. Tax accounting for the distribution of prizes during promotions

For profit tax purposes, it is important to consider the issuance of prizes during advertising campaigns (competitions, sweepstakes, games, quizzes, lotteries) as advertising expenses, i.e. it is necessary to determine in which cases holding promotions with the issuance of prizes in any of the considered forms is promotions of an advertising nature.

According to Part 1 of Art. 3 of the Law on Advertising, advertising is information disseminated in any way, in any form and using any means, addressed to an indefinite number of persons and aimed at attracting attention to the object of advertising, generating or maintaining interest in it and promoting it on the market.

In accordance with Art. 2 of the Federal Law of July 27, 2006 No. 149-FZ “On Information, Information Technologies and Information Protection” the concept of “information” is information (messages, data) regardless of the form of their presentation, and the dissemination of information is actions aimed at obtaining information by an unknown circle of persons or transfer of information to an indefinite circle of persons.

To the organization's expenses on advertising for the purposes of Ch. 25 of the Tax Code of the Russian Federation includes, in particular, the taxpayer’s expenses for the acquisition (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns, as well as expenses for other types of advertising not specified in paragraph. 2–4 of this paragraph, carried out by him during the reporting (tax) period, are recognized for tax purposes in an amount not exceeding 1% of the proceeds from sales, determined in accordance with Art. 249 of the Tax Code of the Russian Federation (paragraph 5, clause 4, article 264 of the Tax Code of the Russian Federation).

Regarding the incentive lottery, everything is simple. The costs of running it, in any case, are classified as advertising, since the main purpose of holding such a lottery is to stimulate consumers of a particular product or service by disseminating information about them. In this case, the condition regarding the advertising nature of the information is met. Expenses for holding incentive lotteries are standardized advertising expenses and should not exceed 1% of sales revenue (subclause 28 p. 1

Art.

264, para. 5 paragraph 4 art. 264 of the Tax Code of the Russian Federation) subject to the requirements of paragraph 1

of Art. 252 of the Tax Code of the Russian Federation.

Expenses for holding actions in the form of a public promise of a reward or in the form of a public competition, which are of an advertising nature, can also be recognized for the purposes of calculating income tax as part of standardized advertising expenses (subclause 28, paragraph 1, article 264, paragraph 5, paragraph 4 Article 264 of the Tax Code of the Russian Federation) subject to the requirements of paragraph. 1

Art. 252 of the Tax Code of the Russian Federation. Moreover, with regard to the public competition there is a peculiarity: according to Part 3 of Art. 1057 of the Civil Code of the Russian Federation, a public competition can be open (when the offer of the organizer of the competition to take part in it is addressed to everyone by means of an announcement in the press or other media) or closed (when the offer to take part in the competition is sent to a certain circle of persons at the choice of the organizer of the competition). That is, if the competition is closed, it cannot be an advertising campaign, since it is not intended for everyone. And this directly contradicts one of the conditions that make up the concept of advertising - it must be addressed to an indefinite circle of people (Part 1 of Article 3 of the Advertising Law).

Table of contents

Results

Advertising expenses can be taken into account in full when calculating profits if they are included in the list from clause 4 of Art. 264 Tax Code of the Russian Federation. If there are no advertising costs incurred, they are taken into account in an amount equal to 1% of revenue.

In accounting, advertising costs are written off in full. If the amount of standardized costs is more than 1% of revenue, temporary differences arise between tax and accounting accounting.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Taxpayer position

The disputed costs were the costs of the services of counterparties in the production of advertising materials, namely banners - advertising structures depicting the products of the taxpayer (society), which were later placed on trolleybuses in Novosibirsk.

The banner placement service was paid separately. The Company accounted for these banners in off-balance sheet account 013 “Low-value items with a useful life of more than 12 months.” According to the taxpayer, Art. 19 of the Law on Advertising" establishes that the distribution of outdoor advertising is carried out by the owner of advertising products, who is an advertiser. This norm does not define outdoor advertising. Based on this, the company may not standardize the costs of producing advertising materials in accordance with clause 4 of Art. 264 and paragraphs. 49 clause 1 art. 264 of the Tax Code of the Russian Federation as other costs for product promotion.

The taxpayer believes that he could use these banners to place equipment, balloons, aerostats and other technical means of stable territorial placement on any surface, mounted and located on external walls, roofs and other structural elements of buildings, structures, structures or outside them, and as well as public transport stops.

Marketing policy of the company

Separately, we would like to note such a local regulatory act.

As the name suggests, this is the main document that guides the company in its activities when promoting new goods (works or services) to the market, as well as to maintain customer interest in goods (works, services) already existing on the market. The marketing policy defines specific programs and types of marketing activities for which funding will be allocated, and establishes criteria by which the effectiveness of the activities carried out will be determined.

In our practice, we are faced with the fact that controllers, without particularly delving into the nature of the event, often believe that the company did not need to carry out marketing activities at all.

In this case, the marketing policy will help to justify to the auditors that the expenses incurred are economically feasible and necessary for the development of the company and, accordingly, are justified and have a business purpose.

Thus, if your company’s budget for marketing activities is significant, we strongly recommend that you develop and approve this local regulation at the senior management level.