What kind of reporting is submitted for social contributions?

Calculation of insurance premiums (DAM) is mandatory reporting by payers.

Insurance premiums are paid for compulsory pension, medical, social insurance and insurance against industrial accidents. Currently, the payment of insurance premiums is controlled by the Federal Tax Service. Previously, these functions were performed by off-budget funds: the Pension Fund and the Social Insurance Fund. In case of failure to submit reports, a fine for failure to submit the RSV-1 was paid to the Pension Fund. In connection with the transfer of mandatory payments for social insurance, the payer has an obligation to provide the following reports:

| Report | Where is it provided? | Contents of the report | Frequency of provision | Deadline |

| RSV | Inspectorate of the Federal Tax Service | About accrued insurance premiums | Quarterly | Until the 30th day of the month following the reporting quarter |

| SZV-M | Pension Fund | Lists of working employees | Monthly | Until the 15th of the next month |

| SZV-STAZH | Information about employees' length of service | Annually | No later than March 1 of the following year | |

| 4-FSS | FSS RF | On the calculation and payment of contributions for injuries | Quarterly | On paper - until 20, electronically - until the 25th of the month following the reporting quarter |

Each regulatory body checks the accuracy of its reporting. For violations, a company is subject to a fine for failure to submit reports to the Pension Fund, the Federal Tax Service or the Social Insurance Fund, depending on the report.

Legislation on fines

According to Art. 423 and paragraph 7 of Art. 431 of the Tax Code of the Russian Federation, calculations for insurance premiums must be submitted based on the results of each quarter no later than the 30th day of the next month. If this moment falls on a holiday or day off, then the filing deadline is moved to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

If a company is late in filing the DAM for 2021, administrative liability is provided - a fine. It is equal to (clause 1 of article 119 of the Tax Code of the Russian Federation):

- 5% of the amount of insurance premiums not paid on time for each partial/full calendar month from the day determined for the submission of the DAM;

- in this case, the calculated fine cannot be more than 30% of this value;

- in this case, the amount of the fine cannot be less than 1 thousand rubles.

Accordingly, the penalty for delay in transferring the DAM to the tax office can be set either as a percentage of the amount or as a fixed amount - 1 thousand rubles.

Attention! According to clause 3.2 of Art. 76 of the Tax Code of the Russian Federation, the Federal Tax Service has the right to suspend operations on the company’s current account if it does not transfer the DAM within 10 days after the deadline for transferring this settlement.

Responsibility for failure to submit the RSV

After the transfer of administration of insurance premiums to the tax authorities, liability for violations in this area is regulated by tax legislation. The fine for failure to provide DAM is established by Article 119 of the Tax Code of the Russian Federation. It provides for the imposition of penalties on the offending company in the amount of 5% of the unpaid amount of social contributions calculated for payment in the overdue report. If the company paid everything on time, but submitted the DAM to the Federal Tax Service late, then it will have to pay the minimum fine for late submission of the DAM - 1000 rubles. (clause 2 of article 119 of the Tax Code of the Russian Federation).

In addition, if the payer is required to provide a report electronically, but submitted it on paper, then he will be fined 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation). In 2021, the threshold at which an organization is entitled to submit a report has been reduced to 10 people. All enterprises with a larger number of employees are required to submit reports electronically.

An example of how to calculate the fine for failure to submit the DAM in 2021

LLC "Company" with 30 employees provided the DAM for 2021 on 02/10/2020. The report was sent by mail in paper form. The amount payable for December was 300,000 rubles. and was transferred on the same day, that is, also late. Since the organization did not pay contributions on time and was late with the report, the fine will be 5% of the unpaid amount of social contributions. In addition, the organization is required to report electronically. For violating the delivery procedure, another fine in the amount of 200 rubles was applied to her.

The fine for RSV will be:

300,000 × 5% + 200 rub. = 15,200 rub.

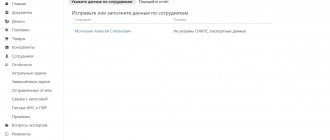

Subject: RSV 1 - not accepted, notification of clarification - for all employees

In response to the DAM, the Federal Tax Service may receive “Notifications of clarification” with the text “0400500003 Information on the specified persons does not correspond (is missing) to the information available to the tax authority. Unknown error type."

Hello! On the DAM for the 1st quarter of 2019, a response was received with error code 0400500003. For all employees, their information does not match. "Unknown error type." All our employees have been working with us for a long time, reports on them have been submitted several times. What to do about it?

What rules were previously established?

For periods before 01/01/2017, calculations of insurance premiums were provided to the Pension Fund. The fine for late submission of a report to the Pension Fund of the Russian Federation was established by Article 46 212-FZ and was calculated according to slightly different rules. The minimum fine payment was 1000 rubles. But it was clarified that its amount is calculated based on the amount of contributions accrued for payment for the last three months of the reporting period. As a result, the penalty rate was simplified and set at 5%.

Law 212-FZ provided for not only a fine for late submission of reports to the Pension Fund of the Russian Federation, but also liability for failure to comply with the procedure for submitting RSV-1. If the report was submitted in paper form when the electronic form was required, then a fine of 200 rubles was collected.

When there will be no fine if the deadline for submitting the RSV-1 is missed

The company added the code VRNETRUD to the information about the experience and sent the calculation again. But again we received a negative report, this time with other errors that were not there before. The program required payment for the third quarter, although they were reporting for the first. The accountant sent RSV-1 for the 1st quarter of 2021 again and again, but the program did not let it through. The company's chief accountant repeatedly appealed to the fund orally to explain the reasons for the errors, but the specialists refused to explain anything.

The company tried to submit RSV-1 via the Internet seven times in the 1st quarter of 2021, but the fund’s program constantly found errors in it and did not let it pass. As a result, the fund accepted the payment five days later than expected. For being late, the Pension Fund of Russia fined the company almost 7 million rubles and wrote off the amount for collection. The organization appealed the decision to the regional office, but the company was not supported there. There is only one option left - to go to court to prove that RSV-1 for the 1st quarter of 2021 was submitted on time.

What does the Pension Fund fine for?

In connection with the payment of insurance contributions for each person subject to compulsory pension insurance, the employer is obliged to submit reports to the Pension Fund:

- SZV-M - information about insured persons;

- SZV-STAZH - information about the length of service.

The Pension Fund's fine for late submission of a report is established by Article 17 of Law 27-FZ “On Personalized Accounting”. Penalties are provided in the amount of 500 rubles. for each person for whom information was not submitted or was submitted in error.

Penalty for late submission of insurance premium payments

- amounts of payments for reporting and billing periods (column 210);

- bases for calculating pension contributions within the limit (column 220);

- the amount of accrued pension contributions within the limit (column 240);

- total sums of these indicators (gr. 250 = gr. 210 + gr. 220 + gr. 240);

- bases for calculating pension contributions at an additional tariff for reporting and billing periods (column 280);

- amounts of accrued pension contributions according to additional tariffs (column 290);

- total amounts (gr. 300 = gr. 280 + gr. 290).

At the same time, the tax service clarified that calculations with technical errors regarding health insurance contributions will be accepted. Such errors in calculations cannot be grounds for refusal to take RSV.

What is the fine for late delivery of RSV 1 in 2021

From the 1st quarter of 2014, personalized accounting information must be submitted as part of the RSV-1 calculation. Previously, these were two different reports - RSV-1 and personal reporting, and separate fines were provided for failure to submit each of them.

Sharonova, leading expert Calculation in form RSV-1 for 2021, payers of contributions (organizations/individual entrepreneurs) had to submit to the Pension Fund of Russia branch at their place of registration (hereinafter referred to as Law No. 250-FZ); , (hereinafter referred to as Law No. 212-FZ): •or on paper no later than 02/15/2019. This opportunity was available only to those with the average number of employees for 9 months of 2021.

Who is renting RSV in 2021

Until 2015, reporting had to be done by persons who did not make any payments. Now this is the exclusive responsibility of the heads of peasant farms. Another important point is that RSV-2 must be provided even if the farm has no actual activity and no income.

- employees who have entered into fixed-term and open-ended employment contracts with the organization;

- contractors - individuals performing work on the basis of construction contracts or service agreements;

- general director, if he is the sole founder of the enterprise.

Comments fine for late submission of RSV for 2021

As for the remaining sections, dashes are placed in their lines, except for those cases where in the reporting period there were payments in favor of employees and the accrual of insurance contributions. Since the beginning of January 2021, all insurance and pension contributions have come under the control of territorial tax services. For reporting, starting from the first quarter of this year, a new unified form developed by the Federal Tax Service is provided. In this case, the RSV-1 form ceases to be valid. But it is worth noting that you need to report for payments for 2021 using the old established form. Blank form RSV-1 Rules for filling out In the form under consideration, only those sections in which any information can be indicated must be filled out. In other words, if the payer leaves one of the sections of the form blank, then the corresponding contributions should not be charged. Who submits the document The calculation of insurance premiums in question must be submitted to the control services and must be provided by all policyholders, which can be companies or entrepreneurs with permanent staff. In cases where during the reporting year the policyholder does not conduct active business and does not accrue financial benefits in favor of employees, he must still submit a report. For those entrepreneurs who did not hire new employees during the year and did not pay remuneration, submitting calculations in the RSV-1 form is not provided. The corresponding reporting form was approved on January 16, 2014 by Resolution No. 2. During 2018, the form did not change. It is worth recalling that the report must include a title page, as well as sections 1 and 2.1.

These rules, based on the general legal principles of justice, humanism and proportionality of responsibility for the committed act of its real social danger, have a universal meaning for all types of legal liability and are mandatory for both the legislator and law enforcement agencies, including the courts... Based on the constitutionally determined the obligation to extend the effect of such laws to previously committed acts is a mechanism for giving them retroactive force, and authorized bodies do not have the right to evade making jurisdictional decisions on the release of specific persons from liability and punishment or on mitigation of liability and punishment formalizing a change in the status of these persons. Dear readers, if you see an error or typo, help us fix it! To do this, highlight the error and press the “Ctrl” and “Enter” keys simultaneously.

Will there be a fine for being late with RSV-1 by one day?

— A fine is possible, but there are arguments to appeal it. Within four working days from the date of sending the calculation, the fund must send a negative or positive protocol. This follows from paragraph 7 of the Document Exchange Technology, approved. by order of the Board of the Pension Fund of October 11, 2007 No. 190r. The Foundation violated this deadline. If he had sent the protocol on time, the company would have had time to submit the corrected calculation before May 15. This means that the policyholder is not to blame for the delay.

We recommend reading: Until what age is a child considered a dependent?

— The fund has every reason to apply a fine under Article 46 of Law No. 212-FZ in the amount of 5 percent of the amount of contributions, but not less than 1,000 rubles. In fact, the company was late with submitting the calculation, since it sent the correct version only on the 16th. But according to the law, this had to be done no later than May 15. RSV-1 is now unified and includes not only individual information, but also the calculation of contributions. This means that the two-week period for correcting errors, defined in the order of the Ministry of Health and Social Development of Russia dated December 14, 2009 No. 987n, does not apply to him.

Why is there no response from the Federal Tax Service when sending the DAM for the 4th quarter of 2021

Recently, letters from authorities have been coming through TCS channels stating that there has been a delay in commissioning deadlines. And that all provided calculations will be accepted without violating deadlines, according to the date the report was sent

61 Region. The calculation of insurance premiums was sent on 01/10/19 - accepted on the same day, moreover, on the same day a notification was received that the taxpayer was summoned to provide explanations on the Calculation. SSC information sent 01/09/19 - notice of receipt 01/09/19, receipt of acceptance 01/15/19, notice of entry 01/20/19 Transport tax declaration sent 01/10/19 - notice of receipt 01/10/19, receipt of acceptance 01/19/19, notification of entry 01/22/19 VAT declaration sent 01/17/19 - notice of receipt 01/17/19, receipt receipt 01/29/19, notice of entry 01/29/19

RSV form for the 3rd quarter of 2021: new or old form

- employees with whom employment contracts have been concluded (fixed-term or without specifying a period);

- individuals with whom individual entrepreneurs or LLCs have entered into contract agreements or service agreements;

- director of the organization, if he is the sole founder of the enterprise.

Order of the Federal Tax Service No. ММВ-7-11/551 dated October 10, 2016 approved the form for calculating insurance premiums, which must be submitted by individual entrepreneurs, as well as organizations that are policyholders. This form is used starting from the submission of the DAM for the 1st quarter of 2021.

We recommend reading: List of documents for processing documents for an apartment with a mortgage