Deduction

How and on what form is the SZV-M submitted? The SZV-M form is the most frequently filled out report,

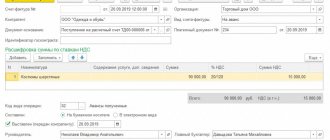

Deduction of VAT from the seller upon receipt of an advance payment In accordance with the terms of the concluded agreement, the buyer

Let's consider the features of reflecting in 1C received materials intended for operations not subject to VAT. For example

Program "Declaration 2012" for filling out 3-NDFL for 2012 Program "Declaration 2012", version 1.2.0

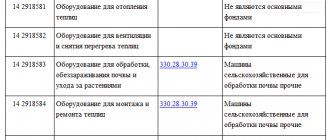

Property value limit in 2021 Until January 1, 2021, the residual value of fixed assets

Companies can sell goods either independently, on their own, or by involving intermediaries. This is enough

We kindly ask all our partners! The Profit-Liga company has changed the list of mandatory documents required

Account 16 in accounting When purchasing goods and materials as part of business activities of companies

Accounting entries for VAT when importing goods VAT entries when importing goods can be presented

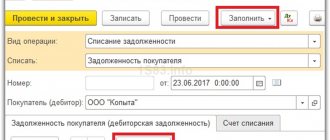

Very often, accountants in their work are faced with accounts payable and receivable. They can