Is optimization always beneficial?

VAT is included in the cost of a product or service; it is an indirect tax. He comes to the company when purchasing and leaves when selling. If you, as a seller, added VAT to the cost of a product and sold it, you cannot keep this tax for yourself - it must be given to the state. But often companies find it difficult to part with revenue, and various schemes appear that help reduce VAT or pay it back later.

VAT is the second most difficult tax to calculate, so its optimization schemes are not simple and not always legal. But even if the scheme does not contradict the law, the tax authorities look at it with dissatisfaction and make claims for it.

Also, when working with VAT, you must take into account that other companies also calculate VAT. And if you optimize the tax, it may be unprofitable for your counterparties. For example, if you are a seller and do not charge value added tax, your buyer will not be able to recover the VAT - he may refuse the transaction or request a discount of around 20%. If your customers are a large business that mainly works with VAT, then without this tax they are of little interest to you.

If you pay VAT, it is also beneficial for you to work with suppliers who pay this tax. Working with non-payers will bring you less profit, unless they agree to give a discount in the VAT rate.

If you conduct different areas of your business - taxable and non-taxable - you will have to keep separate records, and this is not always profitable. If a preferential direction without VAT brings in relatively little income, then all the funds saved on VAT can be used to pay for the work of an accountant. With separate accounting, he will have more work.

Is it always necessary to optimize?

Exemption from VAT is not always a plus for a businessman. After all, if the seller does not charge VAT, then the buyer, accordingly, cannot submit the tax for reimbursement.

Therefore, if the main consumers of products or services are large companies, then working without VAT significantly reduces the competitiveness of a businessman. The loss of one or more key customers may result in losses that exceed the savings from the VAT exemption.

This approach also has a downside. Most businessmen act on the market not only as sellers, but also as buyers of goods or services.

Therefore, if you pay VAT, then you must also choose suppliers from among its payers. Purchasing from those who do not allocate VAT is advisable only if they provide a discount from the average market price comparable to the rate of this tax, i.e. 20%.

A situation is possible when a company sells both VAT-taxable and non-VAT-taxable goods and services. In this case, in order not to pay tax on “preferential” sales, you need to keep separate records. But if non-taxable sales constitute an insignificant share of revenue, then the costs of separating accounting may exceed the savings on VAT.

Accurate accounting to reduce VAT

The amount of VAT depends on proper accounting. To avoid an overestimated tax amount by the end of the quarter, follow these rules:

- add all incoming acts, invoices and invoices to your accounting system;

- request advance invoices from suppliers;

- issue invoices to customers;

- check that all invoices received from suppliers are posted in the system;

- check that the system has not calculated VAT twice: to do this, check the link to accounts and contracts in incoming payment orders and outgoing acts and invoices;

- check the same in outgoing payment orders and incoming acts and invoices.

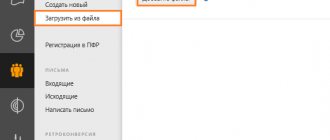

Web service for small and medium-sized businesses Kontur.Accounting will automatically check all VAT items in order to minimize the amount payable. The service will tell you what exactly needs to be done or checked in accounting.

Working in special mode

You don’t have to pay VAT at all, as well as property and profit taxes. To do this, switch to a special regime: simplified tax system, PSN (for individual entrepreneurs), unified agricultural tax or UTII (cancelled from 2021). Instead of paying multiple taxes, you'll pay one at a lower rate. Compare your tax burden across different tax regimes using our free calculator.

Each special regime has restrictions on revenue, participation of other companies in the authorized capital, type of activity, cost of fixed assets, number of employees, etc. Be careful when switching to a special regime: if it turns out that you do not have the right to use it, the tax office will transfer you to OSNO , will assess additional taxes and fines. Accounting will also have to be restored.

With the main system (on which you have to pay VAT), you can combine special modes: PSN, Unified Agricultural Tax, UTII (until it is closed). And some special modes can be combined with each other: simplified tax system + PSN, simplified tax system + UTII, simplified tax system + ESKHN. You will have to keep records and submit reports separately for each mode.

To also get rid of VAT, at least parts of the business are often divided into several legal entities or individual entrepreneurs: one of them works with VAT, the other does not. The risk of such optimization is that the tax authorities may consider this a fragmentation of the business. Then all directions will be combined into one, which by default will work on OSNO, additional taxes will be assessed, and fines will be imposed. And if at the same time the Federal Tax Service discovers a tax arrears of more than 5 million rubles, a criminal case may be initiated against you (Article 199 of the Criminal Code of the Russian Federation).

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

VAT exemption

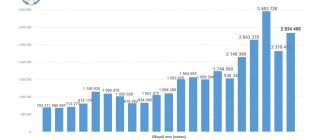

Companies without import operations and excisable goods can submit an application and be exempt from paying VAT on certain operations or activities (Article 145 of the Tax Code of the Russian Federation). To do this, a condition must be met: the company’s revenue excluding VAT should not exceed 2 million rubles for three consecutive calendar months. If this limit is exceeded, the right to the privilege “burns out.”

There is also an exemption from VAT for certain types of goods and services (Article 149 of the Tax Code of the Russian Federation). These include medical services, care for the disabled, child care, arts services, and research and development. Study the list of operations in Art. 149, you may find your products or services there.

Reduced VAT rates

In most cases, the VAT rate is 20%, but for some goods and services it is reduced to 10% and 0%.

- 10% VAT applies to food products, medications and other medical goods, school supplies, children's clothing (clause 2 of Article 164 of the Tax Code of the Russian Federation);

- 0% VAT is applied for international transportation services and export products (Clause 1, Article 164 of the Tax Code of the Russian Federation). The “zero” rate does not relieve you of the obligation to maintain documentation: issue invoices, fill out and submit VAT returns.

VAT on standard expenses

Chapter 25 of the Tax Code of the Russian Federation provides for standardized expenses.

VAT on them should be taken into account separately, since it is accepted for deduction in an amount corresponding to the established standards for such expenses (clause 7 of Article 171 of the Tax Code of the Russian Federation). VAT on excess expenses is not deductible. These tax amounts are written off from account 19 to the debit of account 91 as operating expenses. It is more convenient for an accountant to account for VAT on standardized expenses in separate subaccounts: for example, “VAT on entertainment expenses”, “VAT on advertising expenses”. At the same time, it is better not to write off VAT on excess expenses as a debit to account 91 until the end of the year. After all, the amount of entertainment and advertising expenses, calculated within the standard limits, may increase during the year. Consequently, the organization will be able to deduct an additional amount of tax.

EXAMPLE 1

LLC Charodeyka's advertising expenses in March 2004 amounted to 236,000 rubles. (including VAT - 36,000 rubles). Revenue for the first quarter is 15,000,000 rubles, and for the second quarter - 20,000,000 rubles.

For advertising expenses, the standard is 1% of sales revenue. This means that the company has the right to include 150,000 rubles in expenses for profit tax purposes. (RUB 15,000,000 x 1%).

For the first half of 2004, the amount of advertising expenses calculated according to the standard is equal to:

(15,000,000 rub. + 20,000,000 rub.) x 1% = 350,000 rub.

Consequently, for profit tax purposes, Charodeyka LLC will be able to take into account the remaining part of advertising expenses, that is, 50,000 rubles, as expenses. (RUB 236,000 – RUB 36,000 – RUB 150,000). In addition, VAT related to this part of advertising costs can be deducted.

The accountant will make the following entries:

in March 2004

DEBIT 19 subaccount “VAT on advertising expenses” CREDIT 60

— 36,000 rub. — VAT on advertising expenses is reflected;

DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 subaccount “VAT on advertising expenses”

— 27,000 rub. (RUB 150,000 x 18%) - part of the VAT on advertising expenses within the standard has been accepted for deduction;

in June 2004

DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 subaccount “VAT on advertising expenses”

— 9000 rub. (RUB 50,000 x 18%) - part of the VAT on advertising expenses taken into account when taxing profits for the half-year was accepted for deduction.

For some regulated expenses, the standards do not change during the year. For example, daily allowance for business trips. But it is still better to take into account value added tax on travel expenses in a separate subaccount. This will make it easier to fill out a VAT return, in which this tax amount is highlighted as a separate line.

Loans

With the help of loans, you can defer the payment of VAT for a quarter or more. To do this, the seller takes a loan from the buyer equal to the advance amount. After shipment, the debt for the goods sold and the loan are offset. Since loans are not subject to VAT, tax will only be charged on the sale of goods.

This scheme does not break the law, but it does have its risks. Firstly, the tax office is well aware of the scheme and is wary of it, so it will not be possible to use this technique regularly. Secondly, it is not profitable for the buyer to postpone the tax payment deadline or give a loan, so it is important to take into account the interests of the buyer.

Deferment of advances

As you know, VAT is also paid on advances received. Therefore, if, for example, a supply contract is concluded at the end of the quarter, the seller can agree with the buyer to transfer the advance payment to the beginning of the next tax period. The tax, of course, will still have to be paid, but at the end of the next quarter, i.e. - three months later.

You can “defer” the payment of VAT for a longer period if you use borrowed funds. In this case, the buyer issues a loan to the seller in the amount of the advance. Then, after shipment, the debts on the loan and for the sold products are offset.

Because the issuance of a loan is not subject to VAT, the tax is charged only at the time of sale.

Formally, this scheme complies with the law, but in practice there is a high risk of disputes with tax authorities. It is hardly suitable for use on an ongoing basis, because... inspectors can easily prove that numerous loans and offsets are sham transactions.

But for one-time shipments, you can try to use it if you correctly prepare all the documents justifying the business purpose of this particular calculation scheme.

In addition, with any options for deferring the advance payment, one should not forget about the balance of interests of the seller and the buyer. The fact is that the buyer, when transferring an advance payment, uses the amount of VAT from it for deduction. Therefore, he cannot always agree to postpone the payment deadline or issue a loan.

Including shipping amount in price

If you sell goods subject to a 10% VAT rate, it is beneficial for you not to allocate the delivery amount (where the tax rate will be 20%), but to include the costs of transporting the goods to the buyer's warehouse. Then you will pay 10% VAT on the entire cost of the goods, and for the services of transport companies you will deduct 20%. To apply this scheme, state in your accounting policy that the cost of goods includes delivery costs, and in the contract with the buyer indicate that delivery is included in the price of the goods.

Work with VAT in the Kontur.Accounting web service. The system makes it easy to keep records, pay salaries, and report online. The service will help you optimize VAT and tell you how to reduce your payment. The first two weeks are free for all new users

VAT on taxable and non-taxable transactions

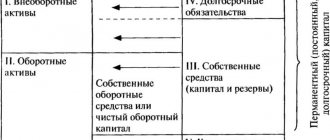

Many taxpayers simultaneously carry out transactions both taxable and not subject to VAT.

The amounts of “input” tax for such taxpayers are taken into account in the following order (clause 4 of Article 170 of the Tax Code of the Russian Federation): - “input” VAT is accepted for deduction if the purchased goods (work, services) are used for operations subject to VAT (if all conditions necessary for deduction);

— the tax is taken into account in the cost of goods (work, services) if they are used for transactions not subject to VAT;

— “input” VAT is distributed between transactions subject to and not subject to VAT, if the purchased goods (work, services) are used in both taxable and non-taxable transactions.

To comply with these requirements, the taxpayer must maintain separate accounting for “input” VAT. Otherwise, he will not be able not only to deduct VAT, but also to take it into account as expenses for profit tax purposes (paragraph 8, paragraph 4, article 170 of the Tax Code of the Russian Federation). This rule applies only to that part of the “input” tax that falls on transactions not subject to VAT.

Analytics on account 19 can be built based on the requirements of paragraph 4 of Article 170 of the Tax Code. An organization can open the following subaccounts for account 19:

— “VAT on taxable transactions”;

— “VAT on non-taxable transactions”;

— “VAT on taxable and non-taxable transactions.”

The Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, does not provide for such subaccounts. However, the analytics presented in the Chart of Accounts are advisory in nature. The organization must approve in its accounting policies an independently developed working chart of accounts. At the same time, she herself decides how to organize analytics on the accounting accounts.

The tax recorded in the subaccount “VAT on taxable transactions” is accepted for deduction in the generally established manner if all necessary conditions are met.

| NOTE |

| Conditions for accepting VAT deduction According to generally established rules, VAT recorded on account 19 can be deducted if: 1) the goods (work, services) to which this amount of VAT relates have been capitalized (paragraph 2, clause 1, article 172 of the Tax Code of the Russian Federation); 2) the supplier’s invoice is available (clause 1 of Article 169 and paragraph 1 of clause 1 of Article 172 of the Tax Code of the Russian Federation); 3) VAT was paid to the supplier (paragraph 1, paragraph 2, article 171 of the Tax Code of the Russian Federation); 4) VAT is highlighted as a separate line in payment documents (paragraph 1, clause 1, article 172 of the Tax Code of the Russian Federation); 5) goods (work, services) are used for transactions subject to VAT, or the goods were purchased for resale (subparagraphs 1 and 2 of paragraph 2 of Article 171 of the Tax Code of the Russian Federation). VAT on purchased goods (works, services) can be deducted if all these conditions are met simultaneously. |

Tax amounts recorded in the subaccount “VAT on non-taxable transactions” are included in the actual (initial) cost of purchased goods (work, services).

In this case, VAT is transferred from account 19 to the accounts of fixed assets (account 01), intangible assets (account 04), materials (account 10) or goods (account 41). If services (work) were purchased, the amount of “input” VAT is written off from account 19 to those cost accounts that reflect the cost of the relevant work or services (accounts 20, 25, 26, 29 and 44). The subaccount “VAT on taxable and non-taxable transactions” reflects tax amounts that are subject to distribution between taxable and non-taxable transactions. In this case, VAT is distributed in proportion to the share occupied by the cost of shipped goods (work performed, services rendered) used in taxable (non-taxable) transactions in the total cost of shipped goods (work, services).

The question arises: what shipping cost (including or excluding VAT) should be taken when calculating the specified proportion? Of course, without VAT. Otherwise, when calculating the proportion, unequal values will be compared: for taxable transactions - the cost of shipped goods (work, services) with VAT, and for non-taxable transactions - without VAT. As a result, the ratio of the cost of taxable and non-taxable shipments will be calculated incorrectly.

After the distribution of the “general” tax reflected in the subaccount “VAT on taxable and non-taxable transactions”, the part of the VAT related to non-taxable transactions is included in the cost of purchased goods (work, services). And the part of VAT attributable to taxable transactions is deductible. True, provided that all the conditions necessary for the deduction are met.

Please note: the entire amount of “input” VAT presented by suppliers in the current tax period and reflected in the debit of account 19, subaccount “VAT on taxable and non-taxable transactions” is subject to distribution. In this case, it does not matter in which tax period (current or future) the “input” VAT is accepted for deduction.

What to do with the amounts of “general” tax that are subject to deduction based on the results of distribution, but for which all the conditions necessary for deduction are not met? For example, there is no invoice. VAT cannot be deducted until the invoice is received. But it is not recommended to leave these tax amounts in the “VAT on taxable and non-taxable transactions” subaccount. After all, next month this subaccount will reflect the amounts of “general” VAT on new acquisitions. And therefore, there is a risk that the accountant will re-distribute the already distributed, but not accepted for deduction, VAT amounts for the previous period. To avoid this, tax amounts distributed based on the results of the tax period must be transferred by internal posting to other subaccounts of account 19. Let us show with an example how this is done.

EXAMPLE 2

In August 2004, the organization shipped products subject to and exempt from VAT. The cost of shipped taxable products amounted to 5,000,000 rubles, and non-taxable products - 2,000,000 rubles. In the same month, goods (work, services) used in both types of operations were purchased in the amount of RUB 1,180,000. (including VAT - 180,000 rubles).

At the end of the month, the accountant must distribute the “total” VAT by type of transaction. The tax is distributed in proportion to the cost of shipped products. The amount of “input” VAT that relates to taxable transactions is:

180,000 rub. x 5,000,000 rub. : (RUB 5,000,000 + RUB 2,000,000) = RUB 128,571.43

The amount of tax to be taken into account in the cost of purchased goods (work, services) is RUB 51,428.57. (RUB 180,000 – RUB 128,571.43).

In accounting, these transactions will be reflected as follows:

DEBIT 19 subaccount “VAT on taxable and non-taxable transactions” CREDIT 60

— 180,000 rub. — VAT is reflected on purchased goods (works, services) used in taxable and non-taxable transactions;

DEBIT 19 subaccount “VAT on taxable transactions” CREDIT 19 subaccount “VAT on taxable and non-taxable transactions”

— 128,571.43 rub. — reflects the part of VAT that is deductible after tax distribution;

DEBIT 19 subaccount “VAT on non-taxable transactions” CREDIT 19 subaccount “VAT on taxable and non-taxable transactions”

— 51,428.57 rub. — reflects the part of the VAT, which, after distribution, is taken into account in the cost of purchased goods (work, services).

When accounting for VAT on general business expenses, another problem arises. In accounting, general business expenses are written off to account 90 at the end of the month, and the amounts of “general” VAT are distributed at the end of the tax period. Difficulties arise for those organizations whose VAT tax period is a quarter. By the time the “input” VAT is distributed at the end of the quarter, the cost of goods (work, services), which include the amounts of the “general” tax, can already be written off. That is, it will no longer be possible to include VAT in the cost of these goods (works, services). In such a situation, “input” VAT can be written off to account 91 as operating expenses. This is permitted by paragraph 11 of PBU 10/99 “Expenses of organizations”.

EXAMPLE 3

LLC "Charodeyka" produces goods subject to and exempt from VAT. The tax period for VAT for the company is a quarter. Monthly data on the cost of shipped goods, as well as the amount of VAT on general business expenses for the second quarter are presented in the table. All conditions for accepting VAT for deduction have been met.

Table . Data for example 3

| Month | Cost of shipped goods subject to VAT, rub. | Cost of shipped goods not subject to VAT, rub. | Amount of VAT on general business expenses, rub. |

| April | 700 000 | 200 000 | 18 000 |

| May | 0 | 500 000 | 23 400 |

| June | 600 000 | 0 | 21 600 |

| Total | 1 300 000 | 700 000 | 63 000 |

The amount of VAT on general business expenses to be distributed between taxable and non-taxable transactions is RUB 63,000. Let's calculate the part of the tax that relates to transactions not subject to VAT:

63,000 rub. x 700,000 rub. : (RUB 1,300,000 + RUB 700,000) = RUB 22,050

This means that 40,950 rubles can be deducted from the “general” VAT amounts in the second quarter. (RUB 63,000 – RUB 22,050).

In accounting, after the distribution of VAT, the following entries were made:

DEBIT 19 subaccount “VAT on taxable transactions” CREDIT 19 subaccount “VAT on taxable and non-taxable transactions”

— 40,950 rub. — VAT is reflected on general business expenses, which, after distribution, is deducted;

DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 subaccount “VAT on taxable transactions”

— 40,950 rub. — accepted for deduction of VAT on general business expenses;

DEBIT 19 subaccount “VAT on non-taxable transactions” CREDIT 19 subaccount “VAT on taxable and non-taxable transactions”

— 22,050 rub. — VAT is reflected on general business expenses, which, after distribution, is taken into account in the cost of purchased goods (work, services);

DEBIT 91 CREDIT 19 subaccount “VAT on non-taxable transactions”

— 22,050 rub. — written off as operating expenses VAT on general business expenses.

VAT is written off to account 91, since it cannot be included in the cost of general business expenses. Indeed, by the time the tax is distributed between taxable and non-taxable transactions, some general business expenses in accounting have already been written off.

There is a similar problem in tax accounting. Clause 4 of Article 170 of the Tax Code of the Russian Federation obliges taxpayers to include amounts of “input” VAT in the cost of goods (work, services) used in non-taxable transactions. Consequently, having distributed VAT on general business expenses between taxable and non-taxable transactions, the taxpayer must reflect the VAT amounts along with the corresponding expenses when filling out the income tax return.

Distributing VAT by type of general business expenses is a very labor-intensive task. Some accountants believe that this need not be done. In their opinion, after the share of VAT on general business expenses related to non-taxable transactions has been determined, it can be attributed to “wholesale” expenses and reflected in the income tax return as a single indicator on line 070 of Appendix No. 2 to sheet 02. This is done reference to subparagraph 1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, according to which the amounts of taxes and fees accrued in accordance with tax legislation are included in other expenses associated with production and sales.

How legitimate is this position? According to the tax authorities, this accounting method contradicts the provisions of the Tax Code. Subclause 1 of clause 1 of Article 264 of the Tax Code of the Russian Federation deals with non-refundable taxes, and this norm does not apply to VAT. For tax accounting purposes, VAT is taken into account in the manner established by Chapter 21 of the Tax Code of the Russian Federation. Paragraph 4 of Article 170 of the Tax Code of the Russian Federation states unambiguously: VAT on goods (work, services) used to carry out non-taxable transactions is taken into account in the cost of these goods (work, services). Consequently, taxpayers have no reason, for profit tax purposes, to write off VAT on general business expenses related to VAT-exempt transactions in a single amount. This method of conducting tax accounting is illegal. It leads to incorrect formation of the cost of goods (works, services) in tax accounting.

Thus, despite the labor intensity, when distributing VAT, accountants must “work” not with the total amount of VAT for general business expenses, but with separate amounts of VAT for each type of expense. In other words, the accountant must determine the ratio of taxable and non-taxable shipments for the month, and then, using the resulting ratio, distribute the amount of VAT separately for each type of general business expenses (building rental, utilities, etc.). And after distribution, one part of the “input” VAT must be deducted, and the other must be included in the cost of exactly the service (work) to which it relates.

Some taxpayers may be freed from the painstaking work of distributing VAT on general business expenses if they meet the conditions provided for in the last paragraph of paragraph 4 of Article 170 of the Tax Code of the Russian Federation. If during the tax period the share of total costs for the production of goods (work, services), the sale of which is not subject to taxation, does not exceed 5% of all total costs for production, then taxpayers have the right to the entire amount of “input” VAT on goods (work, services), used in non-taxable transactions, be deducted in accordance with the generally established procedure.

In this case, the “general” tax amounts are not distributed. They can be deducted in full. In this case, VAT for which all conditions for deduction are met is written off to the debit of account 68. Those VAT amounts for which the conditions are not met are transferred from the corresponding sub-accounts to a separate sub-account “VAT subject to deduction”. As the conditions necessary for deduction are met, this VAT is accepted for deduction.

EXAMPLE 4

The total production costs for the organization as a whole for the tax period are 5,000,000 rubles. Of this, the cost of producing goods not subject to VAT is 150,000 rubles. The amount of VAT on the costs of producing these goods is 27,000 rubles, and VAT was paid only in the amount of 9,000 rubles.

Costs for the production of goods not subject to VAT are 3% (150,000 rubles: 5,000,000 rubles x 100%) of the total costs for the organization as a whole. This means that an organization can deduct all “input” VAT in a given tax period.

The accountant will make the following entries:

DEBIT 68 subaccount “Calculations for VAT” CREDIT 19 subaccount “VAT on non-taxable transactions”

— 9000 rub. — accepted for deduction of VAT on goods (works, services) used in non-taxable transactions;

DEBIT 19 subaccount “VAT subject to deduction” CREDIT 19 subaccount “VAT on non-taxable transactions”

— 27,000 rub. — part of the tax on goods (work, services) used in non-taxable transactions is reflected, for which all the necessary conditions for deduction are not met.