Companies often enter into civil law agreements (CLA) with individuals: in this case, they succeed well

In the commercial activities of many manufacturing enterprises, there is such a thing as material costs. Not a secret,

The advance payment date in the organization is the 20th. After the 15th, but before the 20th

Objects for calculating tax duties Enterprises provide the fiscal service with reporting for objects compiled according to

Features of the return of money to the cash desk by an accountable person Organizations (IP) can issue cash on account

Without complicated formulations or fuss, we’ll tell you about the operating principle of cloud cash registers. When and where

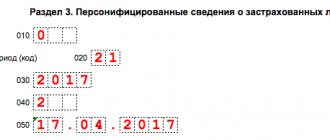

How to correctly fill out the RSV-2 PFR form for peasant farms. In column 2, write down your full name line by line.

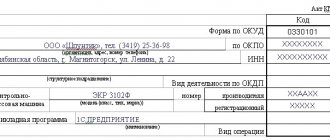

The standard unified form KM-1 is called “Act on transferring the readings of summing money meters to zeros

The article will discuss issues regarding personal income tax rates on dividends in 2021 for

Who is eligible for the child tax credit? By law, if you have