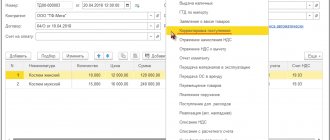

Setting up product accounting in 1C Accounting In the functionality settings (section “Main” – Settings –

Home / Taxes / What is VAT and when does it increase to 20 percent?

The concept and features of a budgetary organization Budgetary institutions are organizations that are financed by

Accounting and tax accounting of fixed assets in 2016 Accounting and tax accounting of fixed assets

How to correctly pay an advance in 2020-2021 according to the Labor Code The concept of “advance” by labor legislation

Transport tax for 2014 From this year, changes in legislation come into force,

The company was fined due to the submission of false information on the SZV-STAZH form in relation to those dismissed in the reporting period

Salaries accrued in 2015, but not paid The crisis has made adjustments: more and more individual entrepreneurs

Everyone has their own reasons for uncovered losses. An uncovered loss may result from: excess

If an organization acquires or produces a part of a mechanism, an element of equipment, a car, and then it goes somewhere